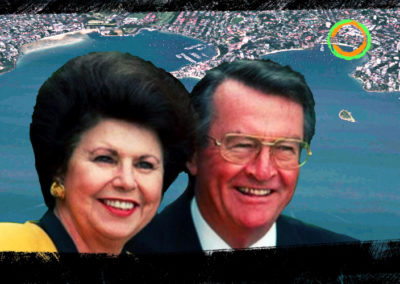

Ervin and Charlotte Vidor are pioneers in the Australian hotel and property development industries. Through their Toga Group empire, which includes two Dark Companies, the pair control over 10,000 hotel rooms across Australia, New Zealand and parts of Europe.

| Top 200 Rich List (2020) | No. of Dark Companies: 2 | Political Donations since FY 1998-99 |

|---|---|---|

| Rank: 115 | Toga Pty. Ltd. | Labor Party: $546,658 |

| Wealth: $866m | Toga Development No 36 Pty Ltd | Coalition: $531,927 |

| Wealth (2019): $973m | Independent: $0 | |

| YoY wealth change: -11.0% | Total: $1,078,585 |

Considering their commanding presence in the hospitality sector, the Vidor couple does well to keep a low profile. Both Ervin and Charlotte escaped post-war Europe from Hungary and Poland respectively, emigrating to Australia in the 1950s. Charlotte and her parents were some of the few survivors of the Jewish community of Lviv (now part of Ukraine) which after the outbreak of war had swollen to about 200,000.

In 1950, Ervin established his own business making metal shoe tips allegedly weeks after arriving in Australia. The start-up eventually led to his own factory selling jewellery to suppliers including Coles and Woolworths. His girlfriend, and pharmacist at the time, Charlotte would dye the perspex stones of the jewellery. While operating the business, Ervin studied accounting at UNSW. Charlotte would later complete a master’s degree in Town Planning.

Vidor founded Toga in 1963, with his wife joining the business four years later. The group’s activities include the acquisition, construction, and management of commercial real estate, servicing the housing, property management, hospitality and retail sectors.

The company almost went broke in the early 1970s after a poor decision to list on the stock exchange. The move saw them pressured by merchant bankers to value fast profits over strengthening their property portfolio, resulting in halted constructions and a debt surpassing $100 million. However, their bank at the time backed them, funding Toga for two years to finish its projects.

In 2013, the Toga Group formed a joint venture with Singapore’s largest private property developer Far East Organization via their hospitality wing Far East Orchard. The partnership operates under Toga Far East (TFE) Hotels and owns upwards of 70 hotels including the Adina serviced apartments, Vibe, Medina and Travelodge hotel brands. The Adina business is recognised as the first Australian hotel operation of its time to enter Europe.

ATO tax transparency data shows Toga declared an income of $2.4 billion between financial years 2013/14 to 2017/18. Over this time, their tax payable was $54.3 million, representing 26% of their taxable income. However, taxable income and tax payable for three out of these five years were $0.

The Toga Group was also linked to the Australian government’s controversial $1 billion-plus visa privatisation project proposed in 2019.

The proposed deal – which was terminated in April last year following the Covid outbreak – saw a convergence of some of the Liberal Party’s closest friends and largest political donors (contributed handsomely by the Vidors) including “friend and political advisor to Scott Morrison Scott Briggs … fruit and veggie moguls the Tripodina Family, executives and companies associated with James Packer, Qantas and NAB, and an opaque Sydney property group, Toga Investments”.

Toga Investments’ parent company is Toga Pty Ltd, a Dark Company exempt from lodging financial accounts.

Staff writers who have worked on one or more of our special investigative projects include Zacharias Zsumer (War Powers), Stephanie Tran, Tasha May and Luke Stacey.