The Baiada family owns one of the largest poultry empires in Australia, supplying to retailers and fast-food conglomerates including Coles, Woolworths, KFC, Subway and McDonald’s. The Group, with 9 controlling entities on the Secret Rich List, processes and supplies its chicken products under the Steggles and Lilydale brands.

| Top 200 Rich List (2020) | No. of Dark Companies: 9 | Political Donations since FY 1998-99 |

|---|---|---|

| Rank: 143 | Baiada Pty Ltd (SGE) | Labor Party: $0 |

| Wealth: $724m | Baiada (Tamworth) Pty Ltd (SGE) | Coalition: $0 |

| Wealth (2019): $816m | Baiada Poulty Pty Limited (SGE) | Independent: $0 |

| YoY wealth change: -11.3% | Tangaratta Stockfeeds Pty. Limited (SGE) | Total: $0 |

| Bartter Enterprises Pty. Limited | ||

| Bartter Farms Pty. Limited | ||

| Bartter Poultry Pty. Limited | ||

| Bartter Hatcheries Pty. Limited | ||

| Bartter Stockfeeds Pty. Limited |

The Baiada empire is second only to Inghams (another Dark Group) in size after they purchased the Bartter Group in 2009, which at the time was the second-largest poultry manufacturer and supplier in Australia. Four of the family’s nine grandfathered companies are significant globals entities (see explainer below).

The Bartter acquisition brought the Steggles brand to the Baiada Group, significantly expanding its market share in the industry. For this reason, the acquisition was initially opposed by consumer watchdog the ACCC as it “would be likely to substantially lessen competition in the markets for the supply of processed chicken meat”.

However, the ACCC overturned its original decision and approved the deal on the primary condition that Baiada, upon acquiring Bartter, divested all assets currently owned by Bartter in Victoria to La Ionica Poultry Pty Ltd. The merger not only increased the family’s influence and market share but earned them an additional five Dark Companies.

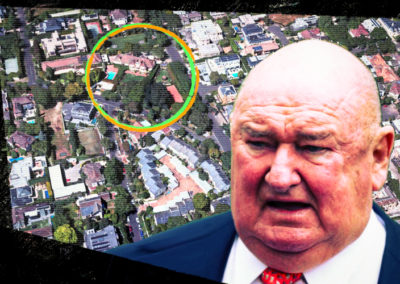

The Baiada story dates back to 1916 when Celestino ‘Charlie’ Baiada emigrated to Australia from Malta when he was 14 years old. He initially worked as a kitchen hand for 15 shillings a week. By 1928, he had saved enough money to buy his first property in Pendle Hill, Western Sydney for 400 pounds. This house, which sits directly on the Great Western Highway, now operates as the empire’s innocuous head office.

Celestino continued to invest in land as he established his poultry business. The turning point came in 1940 when he won a contract with the Australian military to supply chicken products to the army. The subsequent growth saw Celestino processing 20-30 birds per week conducted in the sink at his family home. Baiada Pty Ltd was eventually established in 1963 as operating as a sole trader was no longer viable.

The Baiada Group was again investigated by the ACCC in 2011 for false advertising regarding the treatment of their chickens. A decision by the Federal Court in 2013 saw the business fined $400,000 for engaging in “false, misleading and deceptive conduct … when it described on product packaging and in advertising that its meat chickens were ‘free to roam in large barns’.” The ACCC determined that the population density of Baiada’s chickens raised in their barns and hatcheries did not allow for such movement.

In 2014, Baiada was questioned by the NSW Environmental Protection Agency, demanding an environmental audit of its chicken abattoir in Tamworth regarding an effluent spill. Baiada has also been the subject of mistreating and underpaying foreign workers and questionable development proposal strategies.

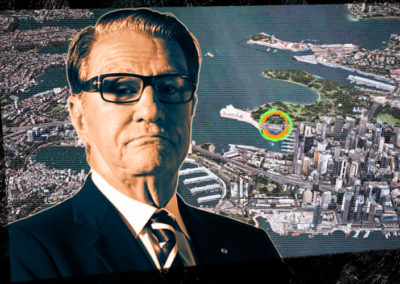

The poultry conglomerate also runs a property development operation called ‘Celestino’ which is currently developing the Sydney Science Park in Western Sydney valued at $5 billion. The family’s property development wing is controlled by one or more of their companies on the Secret Rich List. Their developments also include ‘The Gables’, “a $4 billion master-planned housing estate in Box Hill [in Sydney’s north-west]”.

Both businesses are now held by Celestino’s six children and primarily run by his daughter Mary’s two sons John and Simon Camilleri. Another of Celestino’s daughters Therese Cordina married into the Cordina poultry empire. The Cordina family own three Dark Companies themselves, of which Therese is a director and shareholder.

According to the Australian Electoral Commission (AEC) database (dating back to 1998), the Baiada family and its extensive group of related entities, as well as prevalent board members such as George Tsekouras have not made any political donations.

ATO tax transparency data shows Baiada Poultry Pty Ltd declared an income of $10.9 billion between financial years 2013/14 to 2018/19. Over this time, their tax payable was $83.5 million, representing 29% of their taxable income.

Staff writers who have worked on one or more of our special investigative projects include Zacharias Zsumer (War Powers), Stephanie Tran, Tasha May and Luke Stacey.