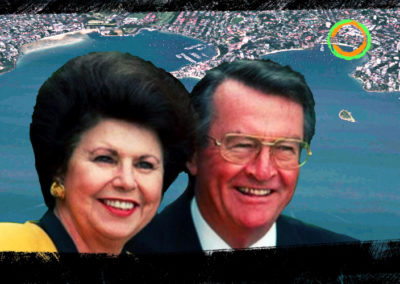

The Belgiorno-Nettis family co-founded Transfield Group which most notably built the Sydney Harbour Tunnel and now operates it in a Dark Company. They are large political donors with no less than eight companies on the Secret Rich List.

| Top 200 Rich List (2020) | No. of Dark Companies: 8 | Political Donations since FY 1998-99 |

|---|---|---|

| Rank: N/A | Transfield Pty Limited | Labor Party: $895,298 |

| Wealth: | Transfield Holdings Pty. Limited | Coalition: $451,138 |

| Wealth (2019): | Transfield Corporate Pty. Limited | Independent: $2,000 |

| YoY wealth change: | Transfield Construction Pty Limited | Total: $1,348,436 |

| Transfield International Pty Limited | ||

| Transfield Holdings Overseas Pty Limited | ||

| Transtunnel (Finance) Pty Ltd | ||

| Transtunnel (Nominees) Pty Ltd |

Transfield Pty Limited – now a Dark Company – was co-founded by fellow Italian-born mechanical engineers Franco Belgiorno-Nettis and Carlo Salteri in 1956. The Salteris also own several Dark Companies and despite a falling out between the founding families in the 1990s, they still share executive roles in the grandfathered entities Transtunnel (Finance) Pty Ltd and Transtunnel (Nominees) Pty Ltd.

This fallout led to a demerger of the Transfield Group in 1996. The restructure saw the Belgiorno-Nettis’ retain the Transfield name and the engineering, investment, transport and infrastructure industries, while the Salteri’s kept the defence arm under a new organisation called Tenix.

These days, the Transfield Group is run by Franco’s sons Luca and Guido. Projects linked to the family outside the industry include the newDemocracy Foundation which was founded by Luca in 2004, touted as “a not-for-profit research organisation focused on political reform.” In 2016, the family sold more than $30 million worth of Sydney real estate including a property built by Franco in the 1960s.

Prior to the fracture between the founding families, the Transfield enterprise won the bid from the NSW government to construct and operate the Sydney Harbour Tunnel. The project commenced in 1988 and was completed and opened to the public in 1992.

The deal was legislated by a 30-year contract with the State government which gave Transfield ownership of the harbour tunnel by overseeing its operation and maintenance until 2022. The company would generate profits from the tolls to pay off construction costs.

Despite the separation between the families and the Salteri’s alleged dissociation from the Transfield Group, both patriarchs continue to own the harbour tunnel in a joint-venture including two Dark Companies: Transfield Holdings Pty. Limited for the Belgiorno-Nettis family, and Olbia Pty Limited for the Salteris.

Interestingly, both joint-venture companies are parents of Transtunnel (Finance) and Transtunnel (Nominees) where both families sit on the board.

In 2001, Transfield Group consolidated its maintenance contracting division including power, transportation and hydro assets into a new operation which they listed on the ASX as Transfield Services. Transfield Holdings, the same Dark Company operating the harbour tunnel, owned an initial 45% stake in the listed company.

Since that time, Transfield Services has made several acquisitions in various industries such as operating offshore detention centres including Manus Island and Nauru. Their maintenance of the immigration facilities came into question in 2015 for their prevalence of “violent riots, child sexual abuse allegations, assaults and other human rights breaches, and have been consistently condemned by the United Nations”.

Amid the controversy, the Belgiorno-Nettis’ – who had sold their 11.3% stake in Transfield Services for over $90 million – “withdrew its permission to use their Transfield brand.”

The company was subsequently rebranded under the ‘Broadspectrum’ name and logo. However, the shift in identity does not change the fact that Transfield Services/Broadspectrum are serial tax dodgers, including when the Belgiorno-Nettis’ held a controlling stake in the company using their private entity on the Secret Rich List.

Staff writers who have worked on one or more of our special investigative projects include Zacharias Zsumer (War Powers), Stephanie Tran, Tasha May and Luke Stacey.