The Salteri family made their wealth through defence contracts, infrastructure and engineering projects including the Sydney Harbour Tunnel. They represent one-half of the founding families of the Transfield Group alongside the Belgiorno-Nettis family. The Salteris are major political donors and are linked to an intricate web of Dark Companies on the Secret Rich List.

| Top 200 Rich List (2020) | No. of Dark Companies: 4 | Political Donations since FY 1998-99 |

|---|---|---|

| Rank: 57 | Olbia Pty Limited | Labor Party: $748,118 |

| Wealth: $1.69b | Tenix Holdings International Pty Limited | Coalition: $1,012,953 |

| Wealth (2019): $1.57b | Transtunnel (Nominees) Pty Ltd | Independent: $5,000 |

| YoY wealth change: 7.6% | Transtunnel (Finance) Pty Ltd | Total: $1,766,071 |

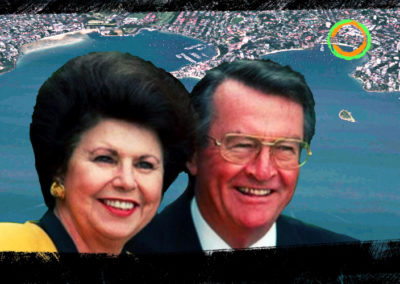

Carlo Salteri co-founded Transfield – a Dark Company – with fellow Italian-born mechanical engineer Franco Belgiorno-Nettis in 1956. The company operated large scale engineering projects ranging from bridges, tunnels and dams to coal power stations, oil rigs, power lines and major mining projects.

It also built defence infrastructure, becoming the largest defence company in Australia after landing a $6 billion contract to build ten Anzac Class Frigates in 1989.

In less than 30 years, Transfield had grown to 3,000 employees and an annual turnover of $350 million. Their success landed them the job of constructing the Sydney Harbour Tunnel in 1988 which was completed and opened to the public in 1992.

During the project in 1989, the founding fathers stood down from their executive roles and handed the reins to their eldest sons, Paul Salteri and Franco Belgiorno-Nettis.

In 1994, a feud between the already fractured families eventually led to the demerger of Transfield Group. The terms would see the Salteris retain control of the defence sector under their rebranded organisation Tenix founded in 1997.

Paul Salteri is on the board of all four of the family’s Dark Companies, joined by his brother Robert on two occasions. He owns extensive property in the Southern Highlands and sold his Wagyu cattle station to Gina Rinehart for $31.5 million in 2014. In 2017, Robert purchased a $27 million penthouse in Circular Quay overlooking Sydney Harbour.

Together, Paul and his wife Sandra established the Cages Foundation which “funds organisations working to improve the lives of Aboriginal people and create an environment that enables every Aboriginal child to reach their potential.” The family’s other philanthropic achievements include support for the Aukland Rescue Helicopter Trust via Tenix.

In 2008, the Salteri’s sold Tenix Defence to BAE Systems for $775 million. This was followed by the family selling their remaining assets in Tenix to Downer EDI in 2014 for $300 million.

Despite selling their remaining stake to Downer EDI, the Salteri family still operates several private companies under the Tenix banner. One of which is their Dark Company Tenix Holdings International Pty Limited whose parent company is Olbia Pty Limited, another grandfathered entity.

ATO tax transparency data shows Olbia’s tax record for financial years 2013/14, 2014/15 and 2016/17. For these three years, Olbia generated a total income just shy of $1.5 billion and paid $0 in tax.

Olbia is a joint-venture owner of the Sydney Harbour Tunnel alongside Transfield Holdings, a Dark Company owned by the Belgiorno-Nettis empire. The tunnel’s ownership is determined by a 30-year contract with the NSW government which ends in 2022. Despite the animosity between the Italian patriarchs, they still manage to see eye to eye in generating profits from the harbour tunnel tolls using two Dark Companies.

Staff writers who have worked on one or more of our special investigative projects include Zacharias Zsumer (War Powers), Stephanie Tran, Tasha May and Luke Stacey.