Sorry, that’s old news…

You’ve found an older news story. We delete stories from our AAP News Feed after two months. But fear not, here’s today’s news!

The war in the Middle East is escalating, with nearly 800 killed in Iran as explosions rock Lebanon, where Israel ...

Kyiv is pitching economic opportunities for Australian businesses during a mammoth reconstruction task, as the war ...

Dennis Cometti is being remembered as a broadcasting legend whose memorable phrases became part of the sporting ...

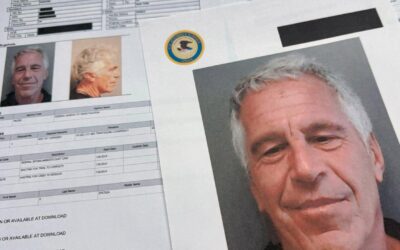

The US government committee probing the Jeffrey Epstein files will question Commerce Secretary Howard Lutnick and ...

Pubs and bottle-shop owner Endeavour says the outlook for consumer spending is uncertain given a higher inflation ...

A whopping $34 billion is expected to flow to the biggest economy in the nation with renewable energy in the ...

Small business owners are concerned an Australian-first right to work from home could unfairly disrupt their ...

Despite Jim Chalmers' claims that public demand isn't fuelling inflation, official figures show federal spending ...

No results found.

Background image courtesy victoriancollections.net.au