Contrary to mainstream media’s China fear-mongering, Australia should perhaps be more worried about the lack of Chinese investment in Australia. Jude Manning with the story.

Albanese and Dutton’s pre-election stoush over the Port of Darwin made one thing clear – Australia remains deeply ambivalent about Chinese investment. Each promising to end the lease if elected, the major parties clearly believed a billion-dollar national security stunt would play well with the electorate. This, despite Dutton taking no issue with the lease as a cabinet minister in 2015, and multiple reviews by Australian security agencies finding insufficient grounds to terminate it.

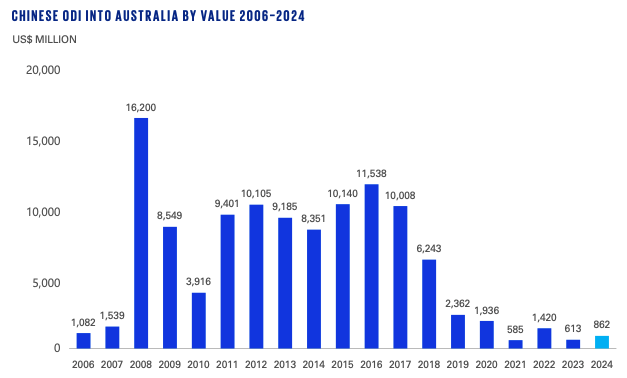

Politicians and commentators who want to be hawkish about Chinese investment might breathe a sigh of relief if they looked at the figures—Chinese investment in Australia is near a twenty-year low, despite China investing more than ever elsewhere. With Australia falling short of capital requirements for its energy transition and housing targets,

a better question than whether we should be attracting foreign investment might be whether we can.

In the midst of a cost-of-living and housing crisis, Australians are right to be concerned about foreign investment. This is especially true given a marked increase in secrecy at the top end, where wealthy buyers, many of them from China, have increasingly hidden their identity from public view. With weak anti-money laundering powers and legislation, and Labor’s promised land benefits registry nowhere in sight, there is little doubt that the property market is being dragged higher by shady domestic and foreign buyers.

High-end secrecy and money-laundering is dragging the property market higher

China’s real estate investment

China accounts for $2.2 billion of the $6.4 billion in foreign residential real estate investment approvals given in the year to October 2024 (most recent quarterly report for Treasury figures), making it the largest overseas investor.

However, this type of investment is already subject to strong restrictions, which have recently tightened further. Foreign citizens were already prevented from buying existing homes, being restricted to new builds, and only if working or studying in Australia. Labor has removed this exception as of April 1, almost entirely banning foreign citizens from buying Australian residential property.

Where foreign citizens and companies can still buy residential property today is when they propose to develop land to increase housing supply.

With all sides of the political aisle agreeing on the need for more housing stock, the economic imperatives for this kind of investment are obvious, and begin to couch Chinese investment more as a gain than a threat. While land banking practices remain an issue, the government has announced more powers and funding for the ATO to compel investors to build, so we will see if see if there is any meaningful change.

It might be a concern, then, that the value of Chinese real estate proposals has fallen consistently over three quarters ending October 2024, from $800 million at the end of 2023 to $400 million most recently.

Mining investments

According to the latest joint study on Chinese investment between the University of Sydney and KPMG, the same trend is evident in retail and agriculture, with Chinese investment in Australia retreating to the mining sector.

China is increasingly favouring developing nations that are part of its Belt and Road Initiative (BRI) over developed ones. Even Chinese resources investment, where Australia was once undisputed, is moving overseas. This year saw modest growth in Chinese investment in Australia on last year. The joint report, however, states:

Much of the recorded growth, similar to that in 2022, reflects Chinese acquisitions of Australian companies with mining assets abroad rather than increased investment within Australia.

This shift generates much less tax revenue for Australia and creates many fewer, if any, jobs. The one sector where Australia bucks this trend is China’s Port Investment, being the second largest recipient, despite not signing the BRI. Cancelling Landbridge’s lease on Darwin will certainly change that.

Economic sovereignty

There is a genuine threat to economic sovereignty that comes from excessive foreign ownership of local assets. Australia’s apparent inability to tax its own resource wealth has made this abundantly clear. ‘Our’ biggest companies are majority foreign-owned, and heavily lobby the government to resist legislation that may increase tax revenue from foreign owned entities. The result is that we are handing out resource profits to foreign shareholders for free. But here’s the catch, they’re mostly American, not Chinese.

Worried about agents of foreign influence? Just look at who owns Australia’s biggest companies

According to the Department of Foreign Affairs and Trade (DFAT), China is only the tenth largest source of foreign investment in Australia, making up 1.9% of the $4.7 trillion Australia received in the year ending 2023 (the latest for which DFAT has collated figures). Hong Kong is fifth (3.1%), but if you combine the two, they still don’t surpass Japan at fourth (5.7%), in turn just a fraction of the UK (18.9%) and the US (25.1%).

Source: KPMG, University of Sydney

As the Trump administration has upended global markets with multiple rounds of tariffs, and recently cancelled funding to joint research projects with Australian Universities, perhaps we should be more concerned by Australia’s vulnerability to its largest investor, rather than the tenth largest.

Labor’s Future Made In Australia plan aims to make Australia a renewable superpower. Perhaps we should be interested in the world’s largest investor in renewable energy to date. Climate Energy Finance Director Tim Buckley told the AFR ($) that Chinese investment is critical to reach our net-zero goals,

If Australia doesn’t welcome foreign capital here with clear and transparent rules of engagement, the capital will simply flow elsewhere.

‘We need to collaborate with them because they have got the world’s best technology in solar panels, polysilicon, batteries, wind turbines and electric vehicles … Getting them to collaborate and invest in Australia in partnership with us will be critically important’.