A rise in secrecy by property owners can only exacerbate the housing crisis. Michael West checks out how secrecy, money-laundering and tax breaks have shot housing affordability.

The Nine Entertainment titles are known more for their goggle-eyed adulation of upmarket property than their analysis but the AFR broke ranks over the weekend and published a commendable investigation into the rise in secrecy surrounding wealthy property buyers.

“From STM 123 No 11 to Lavender Pty Ltd and Sirgrey Pty Ltd, the wealthy are increasingly hiding behind corporate entities and trusts as they snap up high-end properties. Of the 50 most expensive properties sold last year, almost a quarter were acquired in this way. In 2018, this figure was only 12 per cent.”

That is a sharp rise in secrecy at the top end, but why? The story says firstly that rich people like their privacy. That may be true; yet many like to flaunt their wealth too. But then they did get to what is probably the key reason for the rise in secrecy – money laundering.

As mainstream media, particularly Nine, is funded by property ads, we don’t see many stories about money laundering. But money-laundering – often wealthy foreign buyers parking money in Australian property – has been booming for years. That is despite promises made 17 years ago that accountants, lawyers and property developers would become subject to Anti Money Laundering-Counter Terrorism Financial (AML-CTF) laws as banks and casinos are.

Here is the crunch, and this is definitely a field which the corporate media deliberately fails to plough: capital gains tax relief.

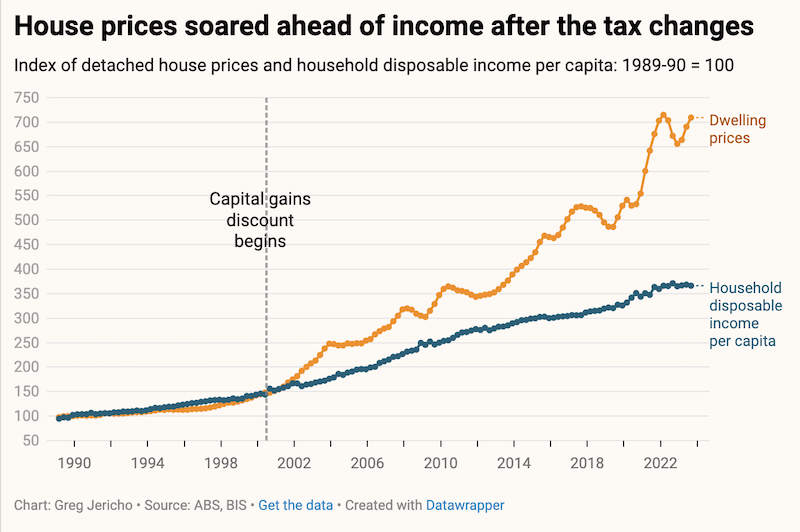

You can see from the chart blow that when the government of John Howard introduced CGT relief 25 years ago, the price of residential property began to detach from disposable income. We now have a full blown housing crisis.

There are other reasons for the relentless rise in property to be sure – and the rise in rents: supply, failure to deliver social housing, high immigration, AirBNB and negative gearing to identify the main ones. But there is no doubt that the flood of foreign money, much of it from China, largely unchecked, into Australian property is a significant factor.

Aspiring Australian property owners are forced to compete at auction against shell companies owned by secretive foreign buyers.

CGT relief is a significant factor too because the wealthy of Sydney and Melbourne have been ‘mansion-flipping’ for 15 years, making massive tax-free profits on the sale of their “family home”. Some have done it two or three times.

As younger Australians, and indeed older Australians with no property struggle, the ramp up in property prices has been a boon for foreign property owners too. And yes, the high end drags up the whole market. It affects all of us.

And it is successive government policies, or the failure thereof, which has got us here.

Crackdowns and Crickets: money-laundering to keep firing up real estate … for now

So this secrecy caper identified by the AFR is toxic. Secrecy goes hand in hand with money-laundering.

“Along Sydney Harbour, from Circular Quay to Barangaroo, a slew of apartments in the Crown Residences, Bennelong Apartments, Macquarie Apartments and Opera Residences are held by shell companies – vehicles that lawfully hide the identity of their owners.”

The story makes the important point that it is often lawyers and accountants which are the directors of the companies which own these properties. The owner does not have to be a director but can appoint the directors. And the shareholders may entail more layers of companies or trusts to hide the beneficial owner – trusts do not have to disclose their beneficiaries.

So the buyer can hide.

AUSTRAC confirms Australia is a haven for white collar criminals

The government did promise to institute a ‘beneficial ownership’ register when it was in campaign phase but has yet to do so … and one would not be crossing one’s figures in expectation.

Nor in respects of the much promised money laundering reforms now 17 years delayed. Attorney-General Mark Dreyfus has pledged to introduce Tranche II of the AML-CTF reforms but is yet to unveil the legislation, and he has foreshadowed that it may be watered down from fully capturing lawyers, accountants and property types.

A secrecy and money-laundering are helping to drive the whole market up and as politicians tend to own properties and be pestered relentlessly by property lobbyists to boot, and as the media is in hoc to the property sector advertising, don’t expect anything soon.

So it is that we have a property crisis … but it’s only a crisis for those who don’t have property. For those who do, it’s great, unless of course you take the view that the Land of the Fair Go is becoming the Land of the Fairly Gone when it comes to equality; that two Australia’s are emerging: the haves and the have nots.

Songbirds and snakes. How to end the ‘Hunger Games’ of housing affordability

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.