While Rupert Murdoch’s pundits at News Corporation decry welfare bludgers and ‘Their ABC’, Foxtel gets a free ride on tax. Michael West consults the (actually independent) experts.

Sky News presenters regularly fulminate about Australian taxpayers funding the “Their ABC”, that taxpayer-funded hotbed of woke “leftists”.

“What a hide!” thundered prominent Sky News commentator Prue MacSween at the government’s move last month to reinstate $83m in funding to the ABC which had been cut by the previous Coalition government.

“Middle class welfare!” thundered another who demanded the national broadcaster be sold off (while ignoring the rather obvious truth that privatising the ABC would crush the commercial broadcasters who are already struggling).

When it comes to the ABC, Rupert Murdoch’s desk-pounding pundits are all on the same page – they sing with one shrill voice about Their ABC and its lack of diversity of opinion.

Well, here is one for their “News you can trust, opinions you can’t ignore” band of pundits to debate. Their own organisation is publicly funded by income tax evasion.

NXE level tax dodging

There are two things that Rupert Murdoch is renowned for not doing in Australia. One is delivering unbiased news; the other is paying corporate income tax.

In consultation with accounting and tax experts, MWM has peered into the shonky financial world of just one of media properties in this country controlled by the American billionaire. That is Foxtel, which is a related party of Sky News Australia and which Rupert recently sold for $3.4B to British sports network DAZN.

On December 23, 2024, just as Santa Claus was conducting his last minute logistics for Christmas, News Corporation announced the DAZN transaction to sell Foxtel for an enterprise value which equated to more than 7x Foxtel’s earnings (EBITDA). The “T” for tax in this EBITDA calculation is … not really a thing.

The corporate entity which holds Foxtel, NXE Australia Pty Ltd (NXE), has been Foxtel’s head company since a corporate reorganisation during 2018 that folded in all Foxtel-related companies, including Foxtel Sports Australia Pty Ltd. The sports rights is where the proverbial gold is in the Foxtel asset suite.

The financial statements of NXE for fiscal 2024 disclose a loss after tax of $96.3 million and net cash flow provided by operating activities of $247.7 million. The net cash flow was after interest and other costs of finance paid of $176 million.

Five years, zero tax

Foxtel appears to be good at generating operating cash flow and paying interest but not so good at making profit a taxable profit that is, a profit which is subject to income tax in Australia.

This may seem odd to the audiences of News Corporation in Australia, who are subject to daily haranguing as to the ‘taxpayer-funded ABC’ and assorted welfare bludging as it is not the income taxes of Sky or other Murdoch properties which fund these apparent legions of welfare bludgers.

According to Corporate Tax Transparency Data published by the Australian Taxation Office (ATO), NXE, or Foxtel, has paid no income tax in any of the five years from 2019 to 2023.

An analysis of the accounts of Foxtel prepared for MWM (which is unlikely to be covered by the learned pundits of Sky News despite their avid sermonising about Australia’s national interest) shows that NXE has generated $14B of total income across this five-year period.

The total tax payable across this period, however, is $0. The average total income is $2.8B per year for this government mandated monopoly media asset, while the average tax payable is $0 per year. For 2023 the numbers are: total income $2.8 billion and tax payable $0.

My, my.

They have form. They managed to cream off $4.5B a few years ago by creating a soufflé of ‘goodwill’ (which is not cash) which magically transmogrified into cash they siphoned overseas.

Rupert Murdoch’s US empire siphons $4.5b from Australian business virtually tax-free

Although unable to find it within themselves to pay tax, they were sufficiently liquid to be able to take on a lot of debt. A key plank of the sale deal to DAZN is the repayment of News Corp’s interest-bearing loans to Foxtel of $578 million.

Interest on loans, including shareholder loans, is a big-ticket item for how Their Foxtel manages to avoid, or evade, income tax. The financial statements of NXE show that Foxtel paid interest of $328.9 million for fiscal 2023, and presumably, all that amount was claimed as an income tax deduction.

Foxtel’s claims for interest tax deductions appear to have ratcheted up significantly after the corporate reorganisation of 2018, a transaction by this country’s biggest media operator which regulator ACMA (Australian Communications and Media Authority) was apparently not told about.

“On the face of it, the dominant purpose of the corporate reorganisation of 2018 was to shield Foxtel’s income from tax by increasing Foxtel’s deductions for interest, including the interest on loans from News Corp,” said one expert who is familiar with the accounting.

Foxtel has previous form for manipulating interest tax deductions on loans from News Corp. Back in 2015, Foxtel was paying interest at the rate of 12% p.a. to News Corp when debt experts were suggesting that an interest rate approaching 4% p.a. would have been more appropriate.

A ‘multinational’s wet dream’

“Foxtel is a multinational’s (News Corp’s) wet dream,” one accounting expert told MWM. “It generates billions in income and cash receipts each year that can be, and have been, routinely funnelled overseas to low tax jurisdictions using interest on loans and other charges.

“Australia is the place where Foxtel is invoicing millions of Australians for subscription television services, but the Australian income tax base receives nothing from this inglorious arm of Rupert Murdoch’s business empire that is responsible for Sky News.”

Indeed, Foxtel seems to enjoy doing things back to front. Instead of engaging in the provision of news and the reporting of facts, Foxtel promotes thought bubbles and opinions. Instead of making an income tax contribution for using Australia as its place of business, Foxtel takes money from ordinary Australians by holding out its needy corporate hands for government grants then failing to be accountable in a disclosure sense for how the public funds are used.

Foxtel can afford to pay more for the likes of sporting rights – to keep national sports locked behind its paywalls – because it is absolved from paying Australian income tax.

Effectively, its honchos at News Corp require the Australian taxpayer to pick up the tab for various monetary transfers to their friends and associates. Borrowing from the lingo of some presenters on Sky News (but absent the arm-waving and unnatural eyeball/eyebrow movements), Foxtel has the corporate mindset of a bludger. It is a corporate welfare freeloader sucking on the public teat.

ATO … where are you?

But what can be done about Foxtel’s income tax chicanery? Surely, it is time for the ATO to take a deep dive into Foxtel’s income tax affairs over the last decade or so, and ASIC its accounting affairs?

This may mean diverting a fraction of the Tax Office’s resources that have been committed to punishing ex-employee Richard Boyle for blowing the whistle on maladministration at the ATO. Yet a reallocation of resources might prove to be worth it.

The Australian tax base would likely receive a significant boost if the ATO investigated and acted against Foxtel for income tax evasion.

Page 84 of the Senate Report into Corporate Tax Avoidance, Part 1, August 2015, refers to allegations that Rupert Murdoch’s News Corp is the ATO’s top-tax risk. There is no evidence, however, that the ATO has acted to immunise Australia against this risk.

On the contrary, the non-payment of income tax by NXE Australia over the period 2019 to 2023 indicates that nothing has been done.

Foxtel has a clear legal advantage over someone like Richard Boyle. Foxtel doesn’t act in the public interest or disclose inconvenient truths that ATO management and Attorney-General Mark Dreyfus might find annoying.

In Australia, snitches get stitches when they embarrass a government department or agency. It is much safer from a legal perspective to be a partner in a big accounting firm monetising the ATO’s confidential information by selling it to multinational clients than being a whistleblower who exposes the ATO’s egregious debt recovery practices against small businesses – the ‘mums and dads’.

The Sky News experts are big on ‘mums and dads’, yet sadly, their indignation over the treatment of mums and dads does not extend to championing the cause of Richard Boyle.

Corporate reorganisation with a dominant tax purpose

Paper shuffling to create new head companies that result in multinationals reducing their payment of income tax to zero, or near zero, should not sit right with the ATO. After all, the ATO does have at its disposal the general anti-avoidance rules and multinational anti-avoidance laws (Part 4A).

News Corp has a propensity to engage in corporate reorganisations that involve the issue of billions of dollars or new shares that, on the face of it, have a dominant tax purpose.

After a 2004 corporate reorganisation with paper shuffling and paying off a few tax advisors, Rupert Murdoch’s US empire siphoned $4.5b from its Australian business virtually tax-free.

In 2018, News Corp went back to its ‘multinational well of corporate reorganisations and new head companies to avoid income tax’ schtick and created NXE Australia to hold its interests in Foxtel-related companies. Rupert’s tax and accounting advisers were back for another round of the share capital creation game using internally generated goodwill.

NXE Australia issued 100 million new shares in exchange for shares in Foxtel related companies and recognised share capital of $3.4B in the process (funny how this was the sale price to DAZN). These new billions of dollars in share capital provided increased capacity for Foxtel to siphon interest on loans overseas while still claiming all the interest as a tax deduction.

Foxtel’s journey to paying no income tax

Paying no income tax was the dominant purpose of the corporate reorganisation of 2018.

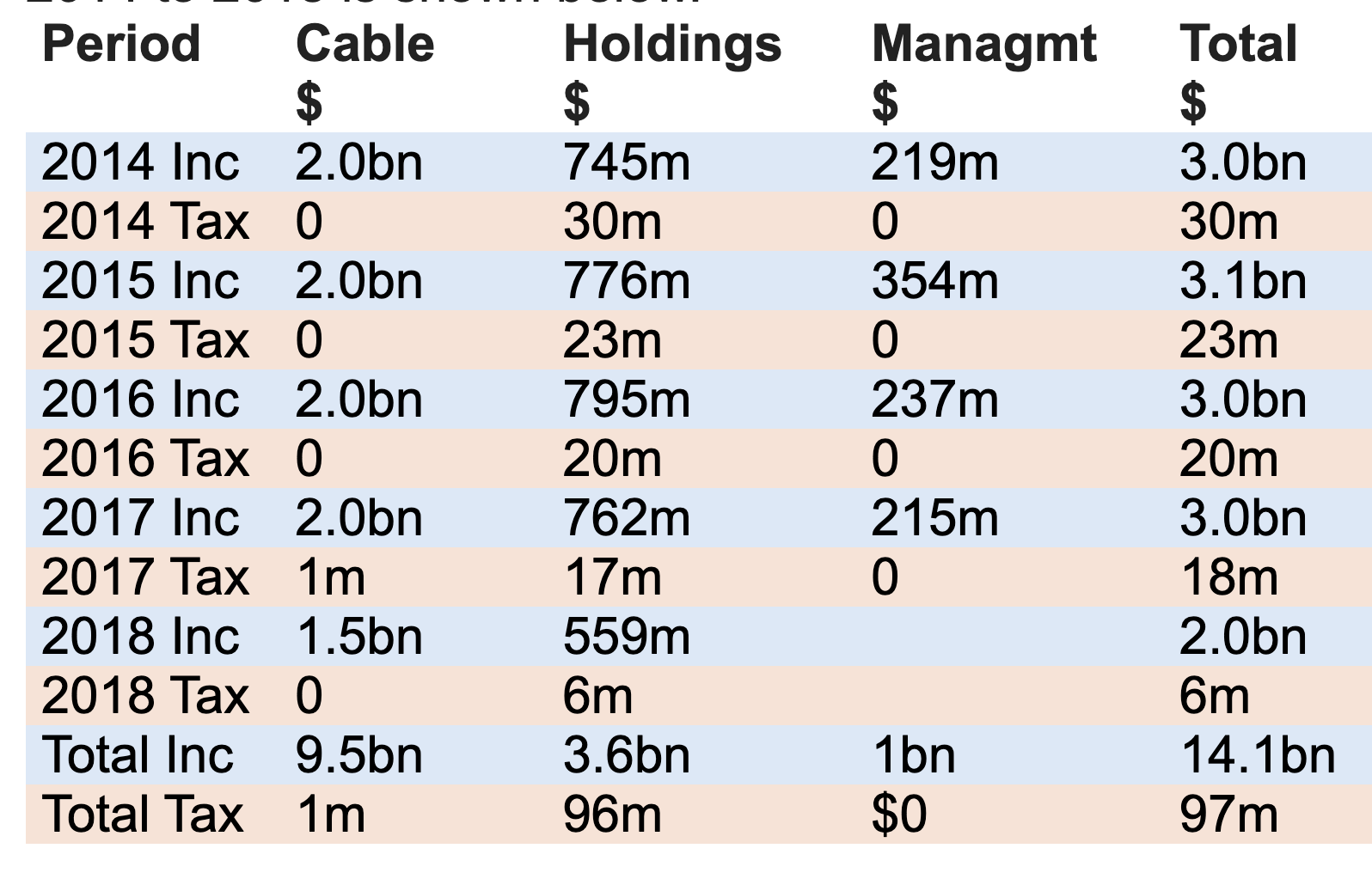

The restructure meant that Foxtel’s subscription television business went from paying income tax of $97m on total income of $14.1B across 2014 to 2018 to paying no income tax on total income of $14B across 2019 to 2023, the analysis shows.

Prior to the Foxtel reorganisation in 2018, there were three Foxtel companies included in the corporate tax information published by the ATO: (1) Foxtel Cable Television Pty Limited; (2) Foxtel Holdings Pty Limited; and (3) Foxtel Management Pty Ltd.

The total income and income tax payable of these three companies over the five-year period from 2014 to 2018 is shown below.

Income tax of $97m on total income of $14.1bn is equivalent to 0.7%. But the creed of Rupert Murdoch is why pay any income tax in Australia if you can get away with paying 0%.

There is an awful lot not to like about how Foxtel goes about its financial and tax affairs in Australia. It is almost as if Foxtel is beyond Australian laws and beyond the scrutiny of regulators that are supposed to enforce those laws.

Where is the ATO action on dealing with Foxtel’s dodgy tax deductions for interest?

And what of Foxtel’s financial reports lodged with the Australian Securities and Investments Commission (ASIC)? Check out the statement of cash flows shown here.

This how a billion-dollar multinational company can disclose its cash flows in Australia, that is, not at all. When a multinational enterprise fails to disclose its cash flows the obvious question is what have they got to hide? What are they hiding?

The $3.4B company with no bank account

Foxtel Cable Television generated $1.9B of revenue from sending out invoices to millions of Australian customers during 2018 but claims it didn’t receive cash, or pay cash, for anything because “The company has no bank accounts”.

It provides the services. It sends out the invoices. Yet it doesn’t receive any cash.

Using this Foxtel logic, an employee in Australia should be allowed to inform the Tax Office that they don’t need to pay income tax on their salary and wages because they don’t have a bank account, and they didn’t receive anything.

The ATO would never accept that silly argument from a salary and wage earner, but it seems they may be prepared to accept the paper-shuffling that News Corp uses to avoid paying income taxes in Australia.

No bank accounts is one thing, another is no employees. Yes, here it is, the filing which shows that this $6B company has no employees. Maybe NXE’s auditors EY know the answer to this mystery.

Surely this is one for the Sky expert pundits. You know it makes sense. Andrew Bolt, Paul Murray, Rita Panahi and Sharri Markson could get together with their experts Prue MacSween and Rowan Dean and discuss how having employees, a bank account and paying tax are woke.

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.