Josh Frydenberg as treasurer and Scott Morrison as secret treasurer made a motza for foreign vulture funds in last year’s takeover boom and mega-sell-off of Australian assets. Who knew what when, and why are we flogging essential monopoly services to cuff-linked tax crooks? Callum Foote and Michael West report.

Two months after losing his seat at the federal election, former treasurer Josh Frydenberg landed on his feet with Wall Street investment bank Goldman Sachs.

Goldman Sachs was a banker to most of the large foreign takeovers that the Treasurer approved during his time. And there were some monsters: Afterpay, AusNet, Spark Infrastructure and Sydney Airport among them.

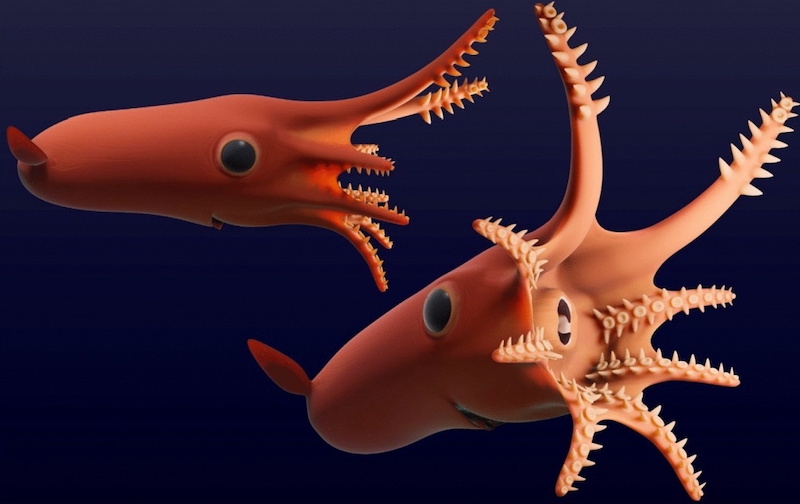

Once famously labeled the “Giant Vampire Squid wrapped around the face of humanity”, Goldman made a truckload of money from the decisions of Scott and Josh’s Treasury.

So, Australia’s reputation as an attractive destination for foreign capital was surely burnished during the Treasury stewardship of the dynamic duo. Burnished that is, as a destination for easy-pickings.

Sadly for Australians however – as opposed to Wall Street – we are too attractive; chumps and fools for foreign vulture funds with a penchant for snatching our assets on the cheap: things the public have already paid for, built, privatised and subsidised – and then plonking them in tax havens.

A swarm of Caribbean vultures

Look no further than Brookfield’s control of Australia’s private hospitals in the Cayman Islands and aged care homes in Bermuda. And now a large chunk of the electricity grid.

So slick is our own political leadership and the Department of Treasury at dudding ordinary Australians that they are about to do it again, but even bigger and more boof-headedly this time by approving Brookfield’s $18bn bid for Origin Energy, a deal which not only cements control of Victoria’s power industry somewhere in the Caribbean but with a big red bow on it and a card embellished with the gilt inscription Please Rob Us Now.

Treasury approval is required for big foreign takeovers on “national interest” grounds – and the Department is a patsy for foreign tax dodgers – but even the fact that Brookfield has the chutzpah to think it can slide this one by past the competition regulator, the ACCC, as well as Treasury shows what pushovers we have become to Wall Street’s cuff-linked buccaneers, indeed what pushovers they think we are.

Is there any other country which so cavalierly lets its services be pillaged by foreign tax cheats?

Cradle to grave

After all, Brookfield just nabbed electricity giant Ausnet for $20bn with all its poles and wires and pipelines (distribution and transmission) and now we are about to gift them our mines and shopfronts (generation and retail distribution). The game plan is “cradle-to-grave”: total control over the power industry on a plater: from mining, drilling and storing coal, gas and renewables and running power plants, “generation” that is, to “transmission” (big coat-hanger poles and wires) to “distribution” (the street poles and wires) to “would you like to save money on your electricity bill Madam?” (retailing the stuff) to millions of Australians.

Vertical integration post the Origin Energy takeover will deliver them greater power to charge what they like – a total regulatory surrender, an antitrust apocalypse, a license for another crew of tax haven merchants to stick it up millions of Australians.

The co-bidder with Brookfield for Origin is another American private equity mob EIG.

Scott Morrison and the pushover that is FIRB

The second half of last year featured the biggest takeover boom in Australia’s history. It was a fabulously profitable year for the Wall Street bank as these enormous assets fell to foreign buyers.

When he was Treasurer, Frydenberg had carriage of the Foreign Investment Review Board (FIRB), a small and secretive yet powerful division of the Department of Treasury. He signed off on the takeovers.

There was also another treasurer at the time, however, and that was Scott Morrison, who now we know had himself secretly appointed to a slew of senior ministries including as treasurer.

Goldman Sachs is renowned for its revolving door connection with governments and governmental bodies globally. The investment bank, once famously dubbed The Giant Vampire Squid by Rolling Stone magazine for having its greedy tentacles wrapped around so many transactions, has held much influence over successive US administrations spanning both sides of the aisle. The new Securities and Exchange Commission chair was a former Goldman banker.

As ultimate sign-off at FIRB, Frydenberg was the gatekeeper for bankers executing transactions for foreign buyers, and defending them too.

In 2020 and 2021 alone, FIRB made decisions on 6,651 proposals. According to the board’s annual report “6,650 were approved with a value of $233 billion, and one was rejected”.

Frydenberg is the classic case of “gamekeeper turned poacher”. His tenure as Treasurer endured from 2018, under the prime ministership of another former Goldman Sachs alumni, Malcolm Turnbull, until the end of the Liberal time in office under Morrison.

Goldman refused to respond to questions for this story and rarely makes public statements, relying mostly on backgrounding finance journalists on transactions when it suits them. It did say something when it picked up the former treasurer though:

“We are fortunate to bring to Goldman Sachs a person of Josh’s deep public and private sector experience, connectivity, and insight,” Kevin Sneader, co-president of Goldman Sachs in Asia-Pacific ex-Japan, said in a statement.

The former treasurer, who in that role also had responsibility for giving the final approval on large foreign mergers or acquisitions of Australian firms, said was pleased to join the bank.

“I am pleased to join Goldman Sachs, which is the pre-eminent mergers and acquisitions and capital markets adviser to clients globally,” he said in a statement.

“I look forward to joining the team and contributing to the firm’s leadership, its global capability, and its strength of client franchise.”

M&A explodes

As pandemic lockdowns came off, and Australia’s ASX-listed assets were at bargain cheap prices, 2021 was open season for mergers and acquisitions – up from a 10-year average of $100 billion in deals by value to $308 billion in 2021 alone.

“None of us can remember a market where there has been so much volume at such a material scale,” said Marissa Freund, head of mergers and acquisitions for Goldman Sachs in Australia and New Zealand.

The second half of 2021 the treasurer was prolific on the takeover front, featuring 63% of all deals which added up to 78% of aggregate transaction value) for the year.

Foreign investors swooped in on the ASX which drove the value of corporate transactions from $33bn in 2020 to a record $131bn billion in 2021.

In December last year, FIRB ticked off on the sale of the essential monopoly and gateway to Australia Sydney Airport after a $24bn takeover bid by a consortium of super funds led by New York private equity firm Global Infrastructure Partners who were advised by Goldman Sachs.

The quid for the Squid

FIRB gave the green light to a consortium led by controversial US private equity giant Kohlberg Kravis Roberts (KKR) and the Ontario Teachers’ pension fund of Canada in 2021 to buy out energy provider Spark Infrastructure, paving the way for the $5.2 billion deal to be closed by year-end. Spark Infrastructure was advised by Goldman Sachs.

Then there was electricity juggernaut AusNet which fell to the tax dodgers from Brookfield in a $20bn takeover deal, signed off by FIRB. Goldman Sachs did not advise either party for the finalised deal, however, they did advise a rival bidder, the APA Group.

The $39bn takeover of Afterpay by Block Inc of the US, Australia’s largest ever takeover, was cleared by FIRB last November. Afterpay had Goldman Sachs as their advisor throughout the deal.

Frydenberg as treasurer also appointed Goldman Sachs’ executive director Marina Kelman as a member of the Takeovers Panel. The Takeovers Panel is the statutory body responsible for resolving disputes in a takeover bid during the period of the transaction, deciding whether bids are fair, properly executed and so forth.

Former Liberal Senator and ambassador to the United States Arthur Sinodinos is also among Goldman Sachs alumni in Australia.

All this is not to say that Goldman Sachs’ influence over Australia’s takeover market is in any way Frydenberg-related. The bank is ubiquitous in financial markets worldwide.

Globally, Goldman Sachs advised on over $1.5 trillion dollars worth of successful mergers and acquisitions in 2020-21 up 50% on the year before.

The total net earnings for the Goldman Sachs Group was $21.6 billion in 2021, with $2 billion of that coming from the Asia Pacific including Australia.

Secret treasurer Morrison

During last year’s takeover boom, when PM Scott Morrison secretly had himself sworn in as Treasurer, along with six other ministries, he had an interest in FIRB.

We know this because according to the Bell Report, an independent review produced by former High Court Judge Virginia Bell to investigate Morrison’s secret appointments, there is an email dated April 21, saying: “We are advised the Treasury swearing [appointment of the PM to Treasurer] relates to FIRB”.

It seems from the Bell Report however that Josh Frydenberg had no idea about Morrison’s appointments.

“Mr Frydenberg, the then Treasurer, was not informed of Mr Morrison’s appointment to administer the Department of the Treasury. Mr Frydenberg first became aware of this appointment, and Mr Morrison’s appointment to administer the Departments of Finance, Home Affairs and Industry, Science, Energy and Resources, in August 2022” the report reads.

The scandal over his multiple ministries only came to light in media articles in Murdoch’s The Australian newspaper after Scott Morrison had revealed it to two journalists writing a biography about him. (The very same media, along with Nine Entertainment, which sings the praises of the foreign takeover merchants and sells out the national interest.)

The Bell Report also notes that FIRB’s oversight was broadened under Josh Frydenberg in March 2020 when “the monetary threshold for all foreign investments subject to the Foreign Acquisitions and Takeovers Act was reduced to nil”.

This was enacted due to Covid and meant that there was a significant increase in the number of investments that were required to be notified to the Treasurer who could reject a proposal if he deemed it was against the national interest.

The threshold was reinstated for investments other than those in sensitive national security businesses on January 1, 2021.

To block the Chinese?

The AFR has reported that Morrison had wanted to control FIRB to block the Chinese from purchasing Australian assets.

It was the deputy secretary of the department of Prime Minister and Cabinet who revealed that the swearing-in related to FIRB in an email released under Freedom of Information.

“We are advised the Treasury swearing relates to FIRB, and the home affairs swearing relates to decisions on citizenship loss,” Reid wrote.

Frydenberg has been contacted by MWM with questions about whether, at any point, Morrison attempted to influence FIRB decisions, or whether the former treasurer had any dealings with Goldman Sachs executives outside of his usual role of treasurer.

FIRB has also been contacted to ask whether it was aware of Morrison’s appointments and to provide a list of approvals given during 2021.

A Royal Commission into Scott Morrison? He sold off the farm, in secret