Talkfests can’t fix global tax evasion by multinationals and billionaires for one simple reason: the US will never agree to a plan where their billionaires and multinationals pay more tax in other countries like Australia. Callum Foote and Michael West report on the futility of G20 and OECD efforts to address the world’s biggest scam.

It is the biggest rort in the world, tax dodging by billionaires and multinational companies, that is. Something like $US30 trillion is parked in tax havens. Some $US450 billion is siphoned out to tax havens every year, most of it from wealthier, developed countries like Australia.

Among the biggest tax dodgers in Australia are foreign fossil fuel giants, yet amid the deepening cost-of-living crisis, record numbers of Australians are struggling to pay their energy bills. Clearly, it is an untenable situation. At some point, governments will have to tackle the might of the business lobby and fight corporate tax dodging.

But how do they do it? That is the question. Already, in its first year, and under pressure from the business lobby, the Albanese Labor government walked back its planned tax reforms.

The latest report out of Europe on multilateral moves to combat tax evasion – the Global Tax Evasion Report produced by the EU Tax Authority – estimates that billionaires globally pay personal effective tax levels of just 0% for 0.5% of their wealth. That compares with the 30% Australian company tax rate paid by small business with no offshore capability to park money in tax havens, and higher personal income tax rates.

They do it – not by paying dividends (these would incur tax) but via shell companies. Multinational tax avoidance relies on ‘changing the shape of money’ between different jurisdictions until that money can be accessed without paying tax.

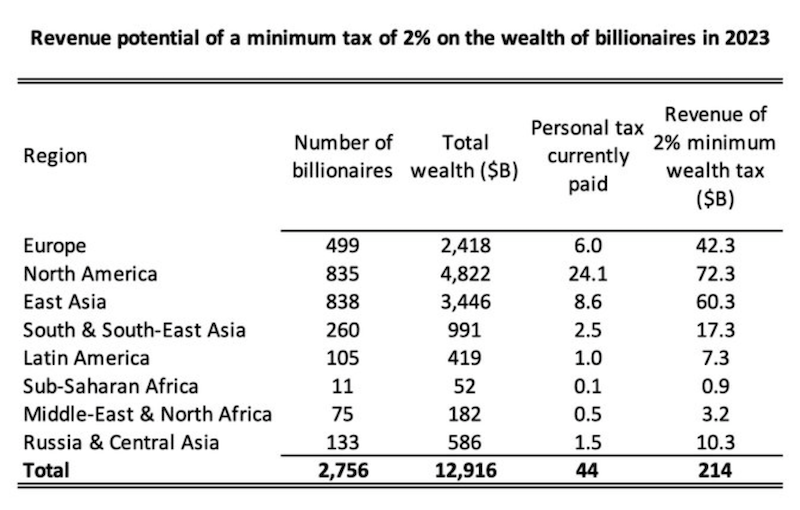

The first ever Global Tax Evasion Report produced by the EU Tax Authority recommended the introduction of an international anti-tax evasion body, similar to the IPCC for climate change, and found that a 2% tax on the world’s billionaires would raise $250 billion a year.

Yet the EU report, while a valuable bit of work, fails in one grand respect. It assumes that there is a multilateral solution to the world’s biggest rort. That is, the OECD members and the G20 can get together in their glitzy hotels for talkfests and sort it out. Yes, co-operation is part of the answer – sorting banking agreements and double tax treaties and the likes – but sovereign nations can move on their own – and indeed they have to move on their own, unilaterally, because the global talkfest approach is not working.

The problem with talkfests is that, not only are they infested with Big 4 types whose firms actually orchestrate the tax dodging along with tax lawyers, they rely on the co-operation of the US. And the US is home to the most billionaires and MNC which benefit from tax dodging. They will not act against their own interests. Full stop.

PwC scandal illustrates the problem

If this year’s PwC scandal was not enough to bring it home, it was made clear that the people involved in these sorts of talks, the Big 4 – Deloitte, EY, PwC and KPMG – and the global law firms are the problem, not the solution. PwC was busted favouring the interests of its multinational clients over Australians by selling them confidential government information.

This journal has long exposed the Big 4 and multinational evaders and avoiders. Yet we lost faith with the multilateral talkfest approach some ten years ago when we encountered a recently retired PwC head of global tax Rod Houng-Lee who made the simple point that it was not in the US’ interest to agree to global solutions as their companies and billionaires had most to lose.

“More taxes collected by foreign governments must mean less tax collected at home,” said Houng-Lee. “This means that the biggest loser from an effective multilateral crackdown on tax avoidance by MNCs [multinational corporations] would probably be the US – home to most of the world’s largest companies doing business globally,” Mr Houng-Lee said.

“Is it any wonder that actual action lags behind the political rhetoric on tax avoidance?”

Bank secrecy push working

Meanwhile, the recently published research produced by the EU Tax Authority recommends that governments develop an international body to tackle tax evasion, similar to the IPCC for climate change.

The EU Tax Observatory is a research laboratory created in 2021 with unique expertise on international tax issues.

The Observatory is funded by the European Union, Norway’s Agency for Development Cooperation, the Research Council of Norway, sustainable finance firm Mirova and the Willian and Flora Hewlett Foundation of IT giant HP.

According to Gabriel Zucman, director of the Observatory and professor of economics at UC Berkeley, “Thanks to the introduction of an automatic exchange of bank information between countries, offshore tax evasion by individuals has declined since 2016. A decade ago, hiding assets in tax havens was child’s play, due to complete bank secrecy.”

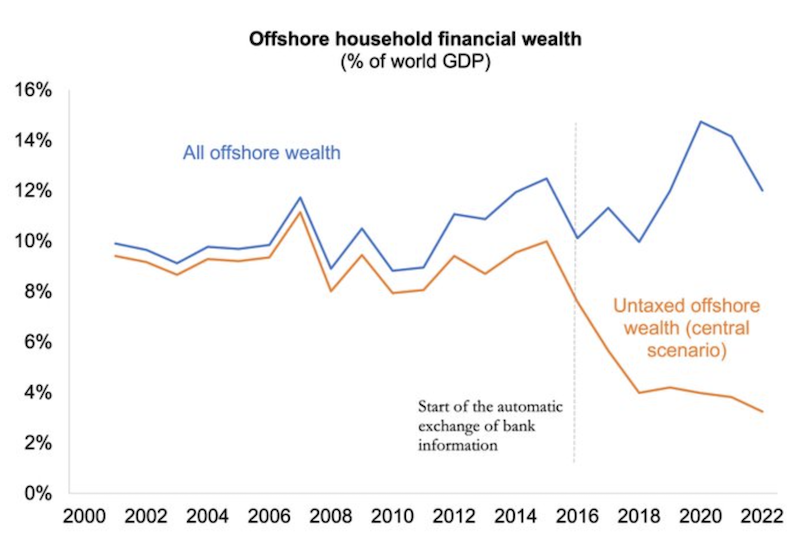

Over the last 10 years, there has been a concerted international push against tax evasion with the creation of an automatic multilateral exchange of bank information in 2017 and applied by more than 100 countries as of 2023.

Until 2015 the equivalent of 9% of world GDP was held untaxed in tax havens. Today, thanks to the automatic exchange of bank information, this is down to 3% – 4%

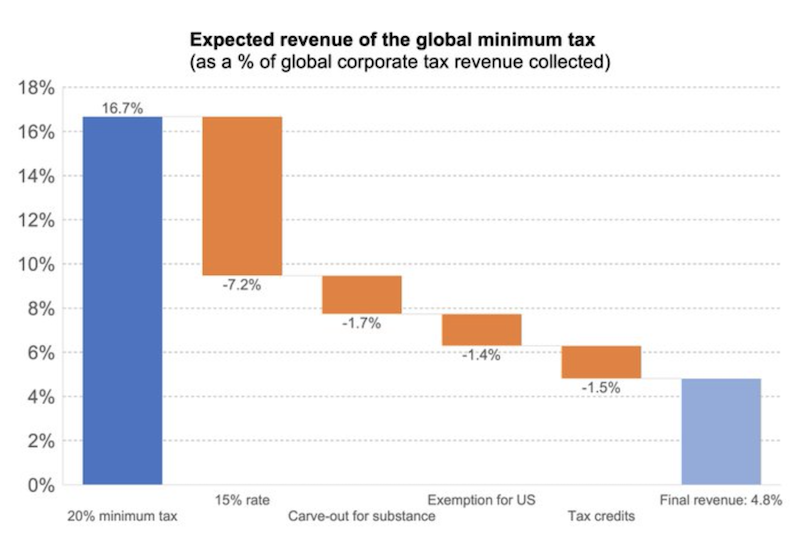

In 2021, 140 countries agreed on a 15% minimum tax for multinationals. Unfortunately, the report has found that loopholes permit a great deal of wealth to go untaxed. “Some assets are excluded, some banks do not properly comply” says Zucman.

These loopholes have cut the expected revenues of the global minimum tax by a factor of 2 And by a factor of 3 relative to a comprehensive minimum tax of 20%.

“These loopholes not only reduce revenues, they risk fuelling new forms of harmful tax competition Consider the dreadful “substance carve-out” The more production a multinational moves to tax havens, the less it will be allowed to pay in tax: 10%, 5%, 0% – any rate is acceptable” Zucman says.

Renowned American economist Joseph Stiglitz says that billionaire tax evasion is bad for society and democracy.

“Glaring tax disparity undermines the proper functioning of our democracy; it deepens inequality, weakens trust in our institutions, and erodes the social contract” he wrote in a foreword to the report. “What we asked of corporations we now must ask of billionaires. It is time to establish a global tax on the very rich.”

The report estimates that billionaires globally pay personal effective tax levels of just 0% for 0.5% of their wealth. Setting a minimum effective tax rate of just 2% on the world’s 2750 billionaires would add between $214 and $244 billion to the tax bills of the ultrarich.

How do they do this? Billionaires primarily use shell companies to avoid income tax. Instead of earnings, dividends and interest themselves, they earn it through shell companies, free of the individual income tax.

Zucman says that contrary to arguments that this is perfectly legal “this is not so clear: the tax laws of most countries have anti-abuse provisions according to which structures created with the sole goal of avoiding taxes are illegal. And these shell companies often have no clear other goal.”

The answer then? Progress has been made multilaterally via bank secrecy reform. But still, the world’s biggest corporations and richest people pay proportionately the least tax as ordinary workers are battling inflation and a cost-of-living crisis.

Sovereign governments, like Australia, have the ability to make laws to combat tax avoidance on their own, without kowtowing to global authorities and forums. We did this successfully by introducing the MAAL laws and transparency reforms of 2016. They worked, delivering billions to the national coffers.

And there were expectations the reform process would combat tax dodging in this present term of government, before the embarrassing backflip on country-by-country reporting.

These hopes were dashed, alongside the failure to introduce a domestic gas reservation policy on the East Coast (they have one in WA) and the as yet failure to walk back the Stage 3 tax cuts.

Still, the answers are there. It is just the political will which is lacking.

Better than Buckleys: a real plan to tackle energy prices, climate and the Budget to boot