Amid fossil fuel corporate fury at any move to tax them or cap their soaring price rises, the tax reform moves of the Albanese government have been yet modest. The country-by-country reporting initiative however has drawn international plaudits. Callum Foote and Michael West report on the progress and the challenges in funding Australia’s future.

In the gas sector’s version of a Miss Universe speech the other day, the chief executive of Japanese juggernaut Inpex, Takayuki Ueda, declared Australia’s gas policies were a threat to world peace. No kidding.

Ueda’s world peace schtick trumped even Kevin Gallagher’s hissy fit earlier this year when the Santos boss pronounced Australia was headed the way of Venezuela and Nigeria due to Albo’s “Soviet-style” move to cap gas prices In reality, it is tinkering about the edges of a grave challenge for government.

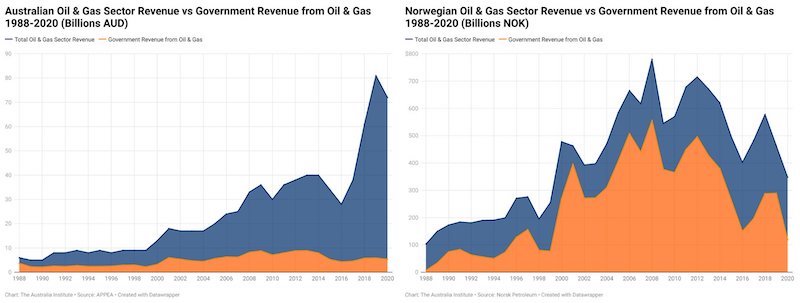

The biggest corporations, indeed the wealthiest institutions in this country, are taxed proportionately the least. And the wealthiest and most profitable of these are foreign-owned fossil fuel corporations. Santos had failed to pay corporate income tax for years and, as for Inpex, the gas giant continues to tip in zilch – despite racking up $3.6 billion in total income in the last set of Tax Office transparency figures.

Meanwhile, ordinary workers bear the brunt of funding government services; and as they are about to be silently hit by the removal of LAMITO tax offsets, and the Stage 2 tax cuts for higher income workers are yet on the legislative table, the fossil multinationals merrily export Australia’s resources – the resources which we own – for the benefit of foreign shareholders.

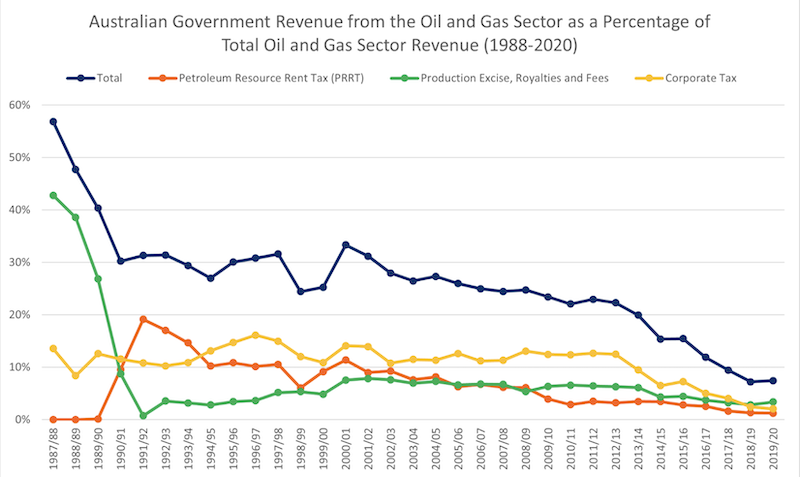

It is fair to say, Inpex is yet in the project development phase but Australia’s corporate tax regime is a failure. The likes of Chevron, ExxonMobil and a raft of other foreign players have paid nothing for years and the Petroleum Resource Rent Tax (PRRT) is utterly hopeless.

Buckle up for fear-mongering

The collective heads of Takayuki and his fossil peers will be madly spinning in days to come. Greens leader Adam Bandt is about to ramp up demands for a tax overhaul this week to apply the PRRT to onshore gas projects and apply a 10% royalty on offshore projects to raise an extra $30bn in revenue.

If the recent hysterics are any guide then, we can expect rhetoric from the gas lobby and its PR peons in the fossil media about Bandt and the Greens taking Australia back to the Ice Age. Especially if Labor were to embrace Adam Bandt’s plan to wipe out the gas giants’ carried forward tax credits.

But something has to be done. Not only are the immense profits from gas been ripped offshore but households and businesses are being smashed by price gouging while these corporations pay less per dollar of tax than any other sector.

Poles and wires super-profits causing energy price spikes, and foreign takeovers

Country by country a winner

While the elephant in the tax room is yet ignored, Treasurer Jim Chalmers has been making the right noises on Budget repair and Assistant Minister Andrew Leigh has overseen the push to introduce greater tax transparency.

Just before the easter long weekend, Albanese government released a draft of first of its kind legislation for greater tax transparency for any significant global entity operating in Australia.

The introduction of country-by-country reporting will require large multinationals operating in Australia to report key information about basic finances such as earnings, profits, losses, number of staff and taxes paid (or not) for every country where it operates across the globe.

The legislation follows the reporting requirements in the Global Reporting Initiative (GRI) Tax Standard, which will ensure that the information revealed is complete, meaningful and standardised. GRI reporting on other topics is already used by a majority of large corporations and supported by global investors and other stakeholders.

Jason Ward, Principal Analyst, CICTAR (Centre for International Corporate Tax Accountability & Research), says: “The Australian government is showing global leadership by introducing public country-by-country reporting for multinationals. This move will increase transparency and accountability and shine a bright light on where and how multinationals shift profits to avoid the obligation to help fund essential public services and infrastructure around the world.”

According to experts, this means that everyone, everywhere, will have access to the same information on how multinationals arrange tax affairs, including governments in low-income countries, shareholders, journalists, workers and campaigners.

“Exposure of current practices will encourage an end to abusive tax schemes everywhere. We are confident that the government has the votes to easily pass this landmark legislation, for implementation beginning 1 July, which will begin to level the playing field for all businesses that already pay a fair share and contribute to the communities where profits are generated,” Ward says.

“Gound-breaking” is the way US tax reform advocates have framed it.

“The introduction of this legislation in Australia is a game-changer in the fight for a fairer, more transparent international tax system,” said Ian Gary, executive director of the FACT Coalition. “Understanding where multinational corporations are doing business and paying – or not paying – taxes is a vital step towards ending the era of corporate tax avoidance that has robbed governments worldwide of much-needed revenues and exacerbated global inequality. FACT applauds the Australian government for its leadership on this important initiative.”

According to Daniel Bertossa, Assistant General Secretary for the Public Service International, the new laws will be “particularly important for government revenue in low income countries that rely more heavily on corporate taxes for revenue. Importantly it will now set a precedent for other countries to introduce robust standards and paves the way to normalise the practice.

As the new reporting regime, if it is introduced, would cover foreign-headquartered entities with “permanent establishment” in Australia, it is hoped that many U.S.-based multinationals would be captured by the new reporting requirements.

The new legislation puts Australia at the forefront of calls from transparency advocates which have thus far already convinced large multinationals to introduce the reporting standards independently.

Just last year, investors advanced shareholder resolutions calling on Amazon, Microsoft, and Cisco to begin publishing tax and operational data on a country-by-country basis, garnering the support of independent shareholders collectively representing hundreds of billions of dollars.

This year, oil giants Exxon, Chevron, and ConocoPhillips will face similar resolutions introduced by FACT member Oxfam America.

Foreign fossil fuel juggernauts dominate the annual MWM Top 40 Tax Dodgers chart

The new legislation, is slated to be introduced from July 1 but we can expect a mighty backlash from the corporate tax lobby whose tax avoidance thrives in the darkness of non-disclosure.

Since the previous government’s Tax Transparency measures were introduced in 2016, billions in extra income has flowed to the national coffers as the debate about tax fairness became mainstream in the community and Australia’s most egregious dodgers and their facilitators from the Big Four audit firms were outed.

This alone is by no means enough however. It stands to reason that those who profit most from Australia are taxed fairly in Australia, indeed that all necessary measures are pursued to capture Australia’s wealth for Australians. The answers are clear: we need a domestic gas reservation policy on the East Coast – as they have in WA where energy prices are far lower. We need a windfall profit tax on fossil fuel corporations, or better a fossil exports levy.

When the profits and tax of these companies are revealed at the end of this month (December year financial statements), it will show, thanks to transparency and reputation issues, the likes of Exxon beginning to pay corporate income tax for the first time in many years. But it will be small cheese compared with their size and profitability.

Better than Buckleys: a real plan to tackle energy prices, climate and the Budget to boot