Pressure is growing for Labor to abandon the third stage of the tax cuts, due in 2024, because of pressure on the Budget. The tax cuts overwhelmingly favour high-income earning men and are a piece with the tilt against ordinary workers under the Morrison government, writes Alan Austin.

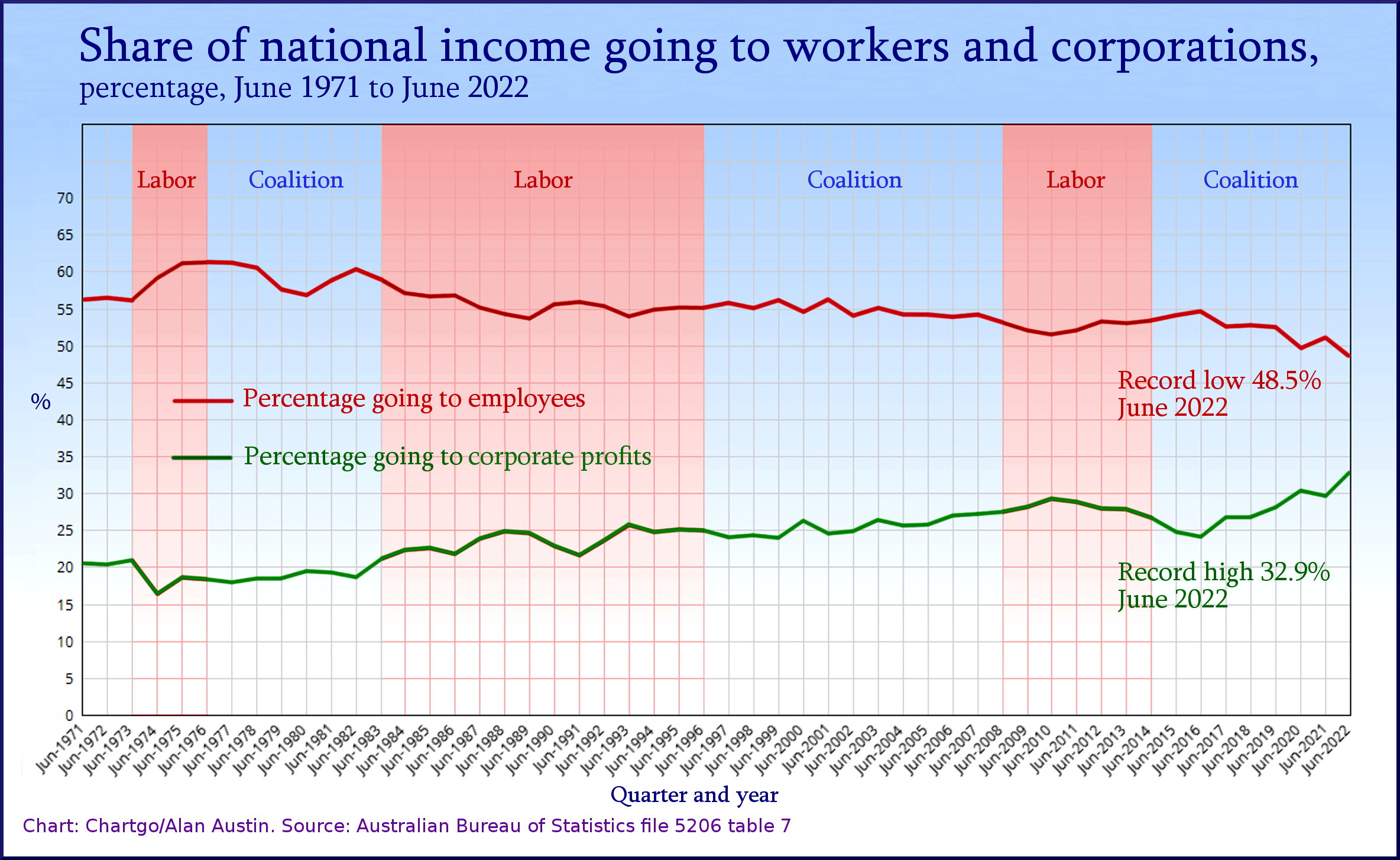

One dismal legacy of the Coalition’s time in government is the greatest disparity in income between workers and corporations in Australia’s postwar history.

Last week’s national accounts reveal that the share of the nation’s income going to employees fell in this year’s June quarter from 51% in June last year to an all-time low 48.5% per cent. That is a decline just in the last six years of 6.1 percentage points, down from 54.6% in June 2016 to 48.5% in the June quarter this year. (Back in the Whitlam and Fraser years this was above 60%.)

This data was released last week by the Australian Bureau of Statistics (ABS) in file 5206, table 7 of its quarterly national accounts.

Correspondingly, the share of national income going to corporate profits increased from 24.1% in June 2016 to 32.9% in June this year, up a thumping 8.8 percentage points. See blue chart, below.

We can measure in dollar terms the shift in income from workers to corporate profits as a result of recent policy settings which have suppressed wages and boosted profits.

Total factor income – the measure the ABS uses in this series – was $2,098.5 billion in the year to June. When the Coalition took office in 2013, workers collected 53.1% of this. That would have been $1,113.9 billion. Now workers only collect 48.5%, which is just $1017 billion, a difference of $96.9 billion.

With 11,407,300 Australians employed, that’s an average of $8495 per worker. That is the extra annual salary workers would be receiving now, on average, had the distribution of income remained unchanged over the last nine years.

Profits pocketed in Australia or sent abroad are now correspondingly higher in dollars by $112.5 billion each year.

Future trajectories

The red line in the graph above shows a steady decline in workers’ remuneration over the ;past six years, with just one significant reversal. The green line shows a corresponding rise in profits. This suggests the entire economy is now structurally geared to keep shifting income in this direction.

The next national accounts, due in early December, will therefore be illuminating. Will they show a continuation of this baked-in transfer of income, or will the Albanese government’s early policies effect a reversal? We shall see.

It will, of course, take some years before the full impacts of any substantial policy shifts are observed.

Treasurer Jim Chalmers is well aware real wages are going backwards and that working families are looking to him for help. He told commercial radio last Thursday that: “the core of our economic plan is to get wages moving again, which is a big part of the story when it comes to the cost-of-living.”

Chalmers is currently sifting through the suggestions offered at the recent jobs and skills summit and is already publicly canvassing some:

“There are lots of good ideas that are pitched up to us to make it easier for people, whether it’s a different start date for childcare, whether it’s different arrangements for paid parental leave, or different arrangements for JobSeeker.”

When pressed on the possibility of cancelling the promised stage three tax cuts for the top end scheduled to take effect in July 2024, Chalmers remained obdurate:

We haven’t changed our view on that, as you know … But also, they [the tax cuts] come in in a couple of years’ time and we’ve got some far more pressing issues to deal with

Tax reform essential

The stark reality is that the dramatic shift in wealth and income from working families to corporate profits is largely the result of the tax regime. Income tax and company tax rates combined with the various indirect taxes have served over recent decades, and particularly the past six years, to enrich the top end at the expense of low-income citizens. Company tax evasion, as shown by the ATO’s annual tax transparency reports, further advantages corporations, particularly those with head offices in offshore tax havens.

The force of the argument for Albanese and Chalmers to break their election promise and scrap the stage three tax cuts is increasing. Those now urging this include Professor Steven Hamilton, The Guardian, The Monthly, the ACTU, the Greens, independent senator David Pocock and nine of the 18 parliamentary cross benchers.

Most of these are pretty adamant. The Guardian headed its analysis: “The stage three tax cuts are a pile of garbage, and everybody knows it”. The Monthly went with: “A terrible, horrible, no good, very bad policy”.

One creative alternative is to proceed with the stage three tax cuts, but before doing so, impose a temporary tax surcharge on the higher brackets of income earners and also on company tax.

These can be presented to the community as transitory measures necessitated by the multiple rorts over the past nine years – taxation and other – which have plunged the economy into record debt.

After two or three years, this surcharge can be abandoned. Or, depending on observed results, could be extended, increased, reduced or made permanent.

Fortunately, although the Albanese Opposition promised to retain the stage three tax cuts, it also signalled intent to reform tax avoidance and evasion.

Chalmers is now working on an October budget which will set out the government’s economic program in detail. Its taxation components will be critical. Especially for the 11 million workers dudded by $8495 a year.

Better than Buckleys: a real plan to tackle energy prices, climate and the Budget to boot

Alan Austin is a freelance journalist with interests in news media, religious affairs and economic and social issues.