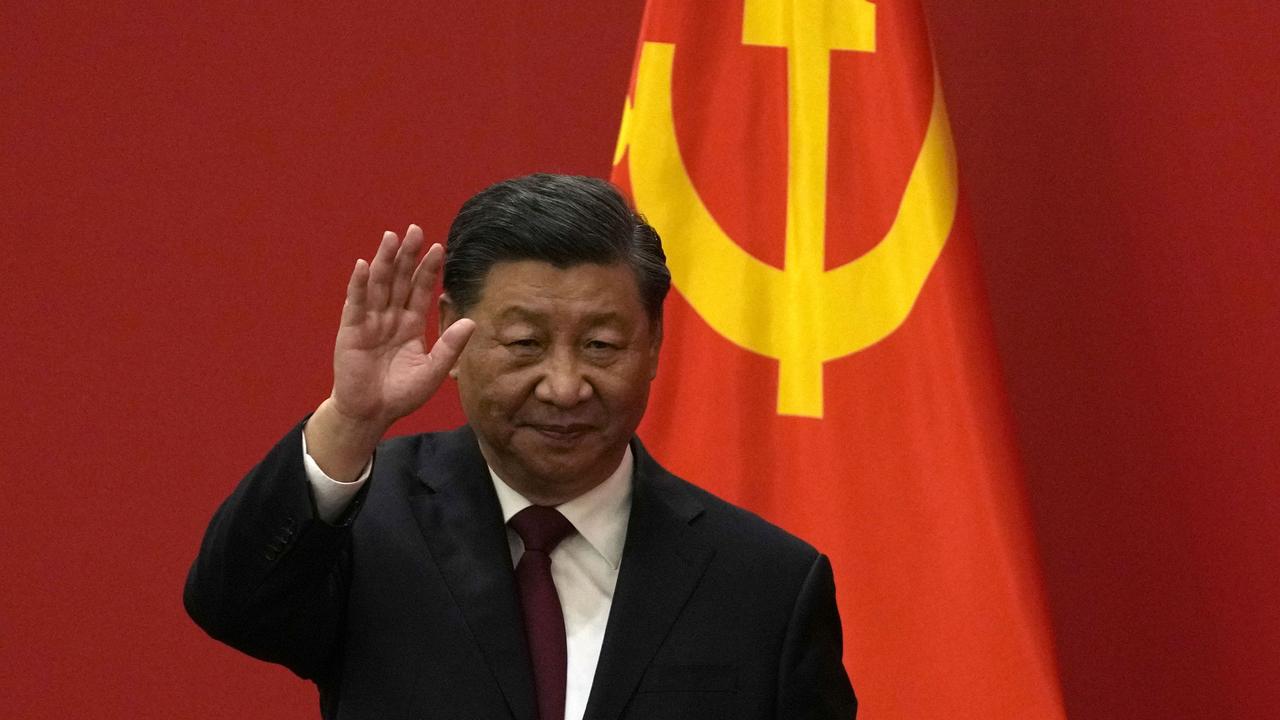

China’s leaders vow economy help as US talks in limbo

China’s top leaders have pledged to help companies slammed by higher US tariffs but are holding back on major moves after trade talks with the US kept businesses and planners in limbo.

At their summer economic planning meeting, the powerful politburo of the ruling Communist Party pledged to stabilise foreign trade and investment.

“We must assist foreign trade enterprises that have been severely impacted, strengthen financing support, and promote the integrated development of domestic and foreign trade,” the official Xinhua News Agency said in reporting the closed-door meeting on Wednesday.

It mentioned export tax rebates and free trade pilot zones but gave no other specifics.

The inconclusive outcome of two days of trade talks in Stockholm, Sweden, leaves open the question of higher tariffs on Chinese exports to the United States.

Chinese Vice-Premier He Lifeng said the two sides had agreed to work on extending a deadline for higher tariffs.

The US side said the extension was discussed, but not decided.

US Treasury Secretary Scott Bessent told reporters after the talks that President Donald Trump would decide whether to extend the August 12 deadline for an agreement or to let tariffs that have been paused for 90 days return to a higher level.

“We haven’t given the sign-off,” Bessent said, though he emphasised that the talks had been “very constructive”.

China remains one of the biggest challenges for the Trump administration after it has struck deals over elevated tariff rates with other key trading partners, including Britain, Japan and the European Union.

Many analysts had expected the Stockholm talks to result in an extension of current tariff levels, which stand at a US tariff of 30 per cent on Chinese goods and a Chinese tariff of 10 per cent on US products, far lower than the triple-digit percentage rates raised in April.

The truce in the tariffs war to allow time for talks allowed exporters and other traders to ramp up shipments in hopes of beating any higher tariffs that might follow.

The meeting headed by Chinese leader Xi Jinping mostly reiterated Beijing’s priorities for the year, including a need to “unleash domestic demand”, which has lagged, leading to a surge of exports by industries unable to find growth at home.

It also stressed the need to promote jobs and prevent a “large-scale relapse into poverty”.

The economy “has demonstrated strong vitality and resilience”, the Xinhua report said, but it acknowledged many risks and challenges.

That includes reining in brutal competition that has led to damaging price wars among auto makers and some other manufacturers and managing excess capacity in some industries, it said.

China’s economy expanded at a 5.2 per cent annual pace in April-June, slowing slightly from the previous quarter.

Even with the hiatus in higher tariffs, companies are feeling a pinch.

Industrial profits in China fell 1.8 per cent in the first half of the year and 4.3 per cent in June, according to data released this week.

Aussie rocket carrying Vegemite lifts off, then crashes

Australia, we have lift-off.

An Australian-made rocket has been launched from home soil for the first time, only to crash moments later.

The 14-second maiden flight in Bowen, north Queensland, was hailed a “major step” toward Australia joining a potentially lucrative global space industry.

Gilmour Space Technologies on Wednesday made history with the first orbital launch attempt by a rocket designed and built in Australia.

To mark the milestone, a jar of Vegemite was the only occupant of the 23-metre, 35-tonne Eris rocket.

Spectators at the coastal town of Bowen near Townsville gathered while thousands around the world watched via YouTube channel Aussienaut when it launched about 8.30am.

The rocket took off with plumes of smoke erupting from underneath before hovering in the air briefly and then crashing into the ground nearby.

There were no injuries or environmental impacts, the Gold Coast-based company said.

“Off the pad, I am happy,” CEO Adam Gilmour posted on LinkedIn.

“Of course, I would have liked more flight time, but happy with this.”

He later posted on Facebook: “For a maiden test flight, especially after an extended 18-month wait on the pad for final approvals, this is a strong result and a major step forward for Australia’s sovereign space capability.”

The flight was brief but was still set to provide vital data.

“Space is hard. SpaceX, Rocket Lab and others needed multiple test flights to reach orbit,” Mr Gilmour said in a statement.

“We’ve learned a tremendous amount that will go directly into improving our next vehicle, which is already in production.

“This was the first real test of our rocket systems, our propulsion technology, and our spaceport – and it proved that much of what we’ve built works.”

Gilmour Space Technologies is looking to design and manufacture rockets to carry satellites into space, using new hybrid propulsion technology.

If successful, the company’s rockets are set to carry small satellites to orbit for business and government in a low cost service – one that is in growing demand globally.

“Satellites and communication are worth billions and billions in the global space economy,” Swinburne University of Technology’s Rebecca Allen told AAP.

“And it would mean huge benefits for the Australian economy and jobs if the rockets are to be manufactured here.

“In terms of a developed nation we are considered pretty far behind where we should be – this is definitely bringing us up closer to where we should be.”

The launch had been delayed for months because of weather conditions and technical issues.

It was set to take off on Tuesday afternoon and was 10 minutes out from launching, only to be halted because of high winds.

Australia’s attempt to enter the space race didn’t last long but Dr Allen agreed it was a success.

“The launch is a major milestone for the space industry here. It’s huge,” she said.

“Once this rocket is more reliable and fully able to undertake launches to lower orbit, it means we are not relying on another country to access space.”

Gilmour Space Technologies was recently awarded a $5 million grant from the federal government to assist with the launch after receiving $52 million in Commonwealth funding to lead a space manufacturing network in Australia.

“Only six nations launch to orbit regularly and just a handful are working to join them – today brings Australia closer to that club,” Mr Gilmour said.

Cheers at last for Olympians who defied Moscow boycott

Death threats, spittle and bribes followed Peter Hadfield after he chose to represent Australia at the Moscow Olympics.

The decathlon competitor was one of 121 members of Australia’s Olympic team who defied calls to boycott the 1980 Games despite immense public pressure following the Soviet Union’s invasion of Afghanistan.

Mr Hadfield had previously won the Australian championship in 1976 but was not selected for that year’s Olympics in Montreal.

“When the boycott was called in 1980, it looked like I was going to miss out on my second Olympics in a row,” he told AAP.

“I was offered a bribe of almost my entire yearly salary not to go.

“There was death threats, we were called ‘traitors’ in the media, family members were spat on.”

Michelle Ford was just 17 when she won one of Australia’s two gold medals at the Moscow Olympics.

“We were told to sneak out of the country in case of threats on our team, on our lives – it’s quite hard for a teenager to take that,” the former swimmer told AAP.

“I wasn’t even voting age.”

But on Wednesday, almost 50 years after the games, the once-reviled Olympic team was recognised by the prime minister.

While this has brought some relief and vindication, for many it does not erase the past.

The boycott was the largest in Olympic history, with just 80 countries competing in the games after they were snubbed by 45.

Though many countries, including the United States, Japan and West Germany took part in a full boycott, Australia opted to support the action but allowed athletes to make the final call over whether they would participate.

Yet many of the young sports stars felt they had been forced to cop the backlash from Australia’s protest, while Malcolm Fraser’s Liberal government continued to trade with the Soviet Union.

After most Olympic Games, Australia has celebrated its triumphs and welcomed its athletes with open arms.

Prime Minister Anthony Albanese on Wednesday acknowledged their participation and their pain.

“When you choose to wear the green and gold, you should draw strength from knowing that the whole nation is with you,” he told parliament.

“Yet the returning athletes were met only by cold silence or cruel comments.

“Today, we fix that… you have earned your place in the history of the game and our nation.”

While Mr Albanese’s address was met with emotion, Opposition Leader Sussan Ley struck a different chord.

Though she acknowledged the athletes in the chamber and said they should not have been subject to personal attacks, she also gave credit to those who abided by the boycott including sprinter Raelene Boyle and swimmer Tracey Wickham.

“For many Afghan Australians who immigrated here and are now part of our Australian family … this boycott mattered,” she told the House of Representatives.

“The decision made by prime minister Malcolm Fraser to support the US-led boycott was the right one – and history has judged it so.

“That decision – correct as it was – takes nothing away from the Australians who did compete.”

The Olympians sitting in the public gallery appeared unimpressed, with some gasping during parts of the address.

None applauded at its conclusion.

Ron McKeon, the father of retired swimming superstar and Australia’s most decorated Olympian Emma McKeon, was also one of the 1980 competitors.

He and his family used the opportunity to celebrate his achievements as the source of inspiration for their own Olympic journeys.

“Dad coached me growing up but never really spoke much about his Olympic experiences,” Ms McKeon told AAP.

“I couldn’t imagine going through that – not having the ongoing support of the country – it would have been a huge struggle.

“I’m so proud of him.”

Rio Tinto posts modest profit as iron ore prices plunge

A weak iron ore price and extreme weather have weighed on Rio Tinto’s profits, but the mining giant is confident in the road ahead.

Rio posted a $US4.5 billion ($A6.9 billion) net profit in the half to June 30, a 22 per cent slip on the same period last year, after its Pilbara operations were impacted by four cyclones.

At the same time, iron ore prices grinded from US$107 per tonne to as low as US$93 per tonne.

Chief executive Jakob Stausholm, who will make way for incoming boss Simon Trott on August 25, called it a “resilient” result.

He focused on positive earnings and cash flow results, buoyed by aluminium and copper.

“We remain on track to deliver strong mid-term production growth, with solid foundations in place and a diverse pipeline of options for the future,” Mr Stausholm said.

The company will pay an interim ordinary dividend of $US1.48 ($A2.27) per share, worth $US2.4 billion, delivering its promised 50 per cent payout ratio.

Rio Tinto’s production guidance remained largely unchanged, but Pilbara shipments were tipped to fall to the lower end of the expected range because of cyclones in the first quarter.

Bauxite and copper production was forecast to come in at the higher end of expectations thanks to better-than-expected mine performances and a successful ramp up at an underground mine in Mongolia.

Rio’s takeover of Arcadium Lithium came to $US7.6 billion ($A11.7 billion) which, along with property and equipment purchases, $US3.8b billion in dividends and other outgoings took its net debt to $US14.6 billion, swelling from US$5.5 billion at the end of 2024.

“We are well positioned to generate value from our best-in-class project execution, together with growing demand for our products, now and over the coming decades,” Mr Stausholm said.

RBC Capital Markets analysts Kaan Peker and Ben Davis said sentiment on the result would be positive.

“Rio Tinto produced a good set of operational results across key divisions that was a six per cent beat at the product group level,” the analysts wrote.

“But this was dragged down by other items including restructuring costs at Arcadium.”

Looking further afield, the miner said the global economy appeared resilient with continued commodity demand growth supported by the energy transition.

It was likewise optimistic about China’s growth prospects, supported by ongoing domestic stimulus and a government committed to infrastructure investment in the face of its beleaguered property sector, the report said.

The US economy was holding up despite tariff impacts still feeding through to inflation and consumer sentiment, but the housing sector remained weak with building hampered by high mortgage rates, construction costs and poor labour supply.

Rate cut looms as inflation result brings RBA ‘comfort’

Mortgage holders can all but lock in a rate cut in less than two weeks after the central bank’s preferred measure of inflation fell to its lowest level in three-and-a-half years.

Trimmed mean inflation – which omits volatile items to measure underlying growth in prices – was 0.6 per cent in the June quarter, the Australian Bureau of Statistics reported on Wednesday.

The result was in line with economists’ expectations and brought the annual figure down to 2.7 per cent from 2.9 in March.

The last time the trimmed mean was that low was in December 2021.

After the Reserve Bank of Australia shocked the market by holding the cash interest rate steady at 3.85 per cent in its July meeting, the board should have “all the comfort it needs” to cut rates in August, said KPMG chief economist Brendan Rynne.

“Since the RBA’s last board meeting, it seems the arguments for lowering the cash rate have now materialised more than the arguments put forward to maintain the more restrictive monetary policy settings,” he said.

“Consumer and business confidence has continued to remain in the doldrums, with households and investors looking for continued rate relief before they open their wallets further.”

After the RBA’s last meeting, Governor Michele Bullock said the board was waiting for June quarter figures to confirm whether or not inflation was still on track to sustainably reach 2.5 per cent.

Although the result was slightly above the central bank’s 2.6 per cent forecast from May, it reflects ongoing progress toward the midpoint of the RBA’s two to three per cent target band.

A recent uptick in unemployment and weaker-than-expected household spending further supported the case for a cut.

A delighted Treasurer Jim Chalmers cycled through the superlatives as he heralded the result.

“These numbers represent remarkable, outstanding progress when you consider that when we came to office, headline inflation was three times higher than what it is in these numbers today,” he told reporters.

“These are very pleasing, very welcome, absolutely outstanding inflation numbers.”

Economists from all four big banks, as well as accounting firms EY, KPMG and Deloitte, confirmed their rate cut calls.

Money markets firmed their odds of an August 12 rate cut to 100 per cent, having assigned a 95 per cent chance ahead of the release.

Traders were pricing in at least one further cut before Christmas.

CBA economist Harry Ottley predicted the RBA would follow an August rate cut with another 25 basis point reduction in November.

He said there appeared to be more risk that inflation would fall below target than remain too high.

“There appears very little in the inflation basket that suggests inflation risks will re‑accelerate and become a material problem over the forecast horizon,” he said

Equities traders cheered the data, with the Australian share market jumping about half a percentage point.

The headline consumer price index rose 2.1 per cent over the 12 months to June.

“This is the lowest annual inflation rate since the March 2021 quarter,” ABS head of prices statistics Michelle Marquardt said.

Housing, food and health costs drove inflation higher, while falling petrol prices took some steam out of the index, reflecting lower global oil prices.

Shadow treasurer Ted O’Brien said the data offered hope to struggling mortgage holders, who had suffered as a result of interest rates being too high for too long under Labor.

“Comparable jurisdictions saw interest rates cut far sooner than in Australia, with Labor’s addiction to spending keeping rates higher for longer locally,” he said.

A 25 basis point cut would shave $90 a month in repayments off a $600,000 mortgage.

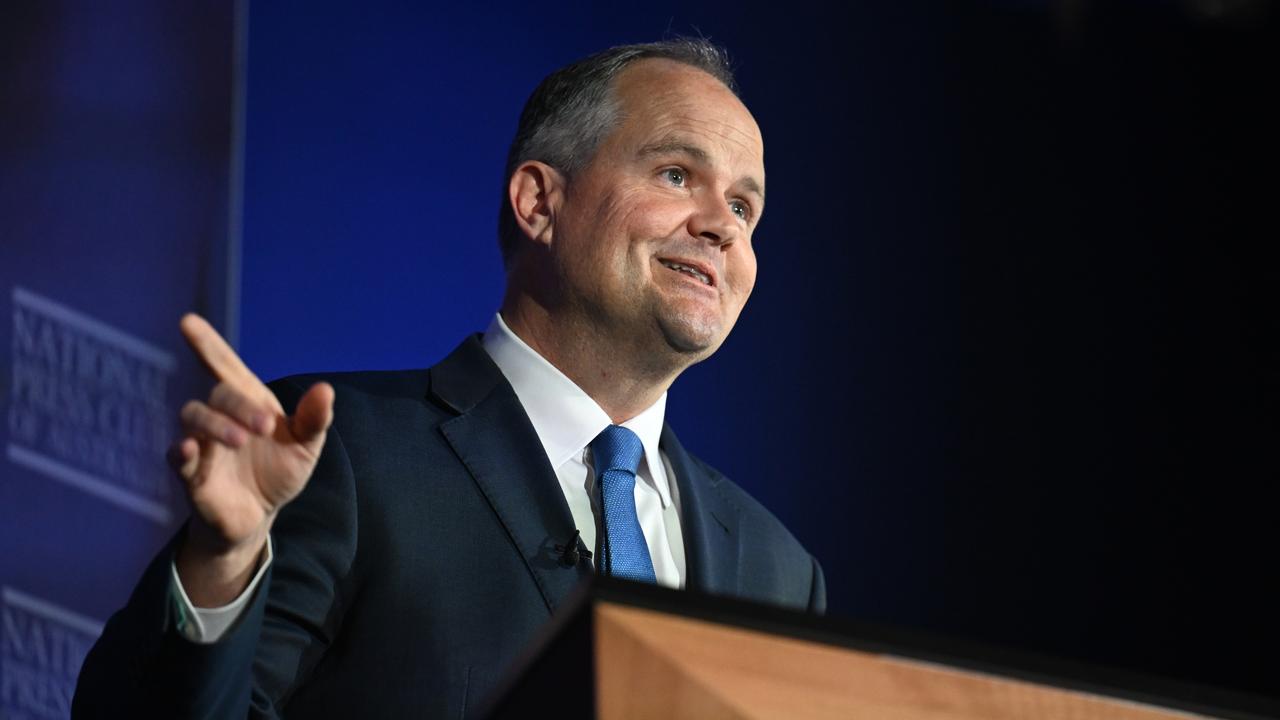

Embrace AI or suffer: Atlassian billionaire’s warning

Australia has a big opportunity to develop artificial intelligence, but the technology could have major economic ramifications if firms and governments don’t adapt, a billionaire entrepreneur has warned.

Scott Farquhar, the co-founder of tech giant Atlassian, said Australia was on the edge of a “great industrial revolution” with AI in a speech to the National Press Club on Wednesday.

He said taking advantage of existing AI infrastructure could contribute up to $115 billion per year to Australia’s economy by 2030.

It comes as the government prepares to host an economic roundtable in August, where development of AI to enhance productivity is on its agenda.

“The scoreboard of the AI era is blank,” Mr Farquhar said.

“The race is still on, and Australia has everything to play for.”

Mr Farquhar said the place to kickstart Australia’s productivity with AI was in data centres.

Data centres are massive facilities that process data from cloud servers, with complex operations serving millions of customers.

Mr Farquhar said Australia’s strategic location near southeast Asia, as well as having lots of land, could lead the country to become a world leader in AI storage.

He called for the government to change copyright laws to give exceptions for text and data mining to boost AI’s capacity.

The US and Europe have exceptions for text and data mining, which means AI can learn and make informed decisions when tasked to complete an action effectively.

“There’s huge opportunities for people that are great at what they do, at creating content to sell in a totally new way,” Mr Farquhar said.

Atlassian cut 150 jobs on Wednesday, saying that they were going to be replaced by AI.

When asked about the impact of AI taking away jobs, Mr Farquhar said it was inevitable.

He compared the arrival of AI to the introduction of electric trains following the era of steam locomotives, noting while people at the time were concerned they would lose jobs, it advanced the country in the long run.

Mr Farquhar added big businesses needed to increase its part in contributing to AI’s research and development in Australia, with small firms and technology companies leading the way.

“The amount we spend is an early canary into how productive and innovative we are going to be in the next decade or two,” Mr Farquhar said.

“Big businesses in Australia are falling behind their (research and development) investments.”

Australian Council of Trade Unions president Michele O’Neil said improving productivity was important, but not at the expense of AI taking jobs.

Star’s sale of Queens Wharf entertainment hub stalled

Star Entertainment Group’s bid to sell its half-stake in the money-losing Queens Wharf Brisbane entertainment complex for $53 million is faltering.

In a statement to the ASX on Wednesday, the embattled casino operator said that based on the current status of discussions, it was “unlikely” the parties would be in a position to finalise sale documents by Thursday’s deadline.

That deadline was already extended early this month as Star negotiated with its Hong Kong partners, Chow Tai Fook and Far East Consortium.

Each hold a quarter-stake in the $3.6 billion mixed-use megaproject that opened late last year.

Unless the parties agree to another extension, Star would have until next Wednesday to pay back a $10 million advance on the sale it received in March, and until September 5 to send them another $26.5 million.

Star’s financial position improved considerably in the last quarter, however, after it received a total of $233 million from US gaming giant Bally’s and billionaire pub baron Bruce Mathieson as part of a $300 million rescue deal.

Star had $234 million in available cash as of June 30, compared to just $44 million on March 31, and is set to receive another $67 million from Bally’s and Mathieson by October 7.

But the company kept burning through cash during the fourth quarter, losing $27 million in earnings before interest, tax, depreciation and amortisation, up from a $24 million loss it incurred in the third quarter.

Star blamed the loss on an “ongoing challenging operating environment” including the impact of mandatory carded play and cash limits in NSW and stricter regulatory requirements across all its properties.

Star says the $5,000 cash limit and mandatory carded play that NSW regulators imposed on the Star Sydney casino last October have led to a 17 per cent drop in revenue there, and the cash limit is set to reduce further on August 19, to $1,000.

“The Group’s ability to continue as a going concern remains dependent on several key matters,” Star said, pointing to a list from April of 13 different issues it needs to resolve if it is to remain able to pay its debts on time.

A major issue is the $400 million fine the Australian Transaction Reports and Analysis Centre is seeking to impose on Star for years of allowing VIP clients to launder dirty money at its casinos.

Star says $100 million is all it can afford and a $400 million penalty would send it into insolvency.

At midday Star shares were flat at 11.5 cents.

‘Worrying’: fresh NAPLAN results trend revealed

Student literacy and numeracy appears to be stagnating in Australia, with the latest NAPLAN test results fuelling concern about ongoing trends.

About 10 per cent of students need more help to meet basic education standards, leading federal Education Minister Jason Clare to acknowledge that “there’s more work to do”.

However, Mr Clare noted the results released on Wednesday showed “encouraging signs of improvement” in numeracy and literacy.

Two-thirds of students performed strongly or exceeded expectations on the NAPLAN testing, but geographic location, parent education levels and family background continue to be major factors impacting results.

Almost one-in-three Indigenous students fell below minimum standards and needed extra support, compared to less than one-in-ten non-Indigenous students.

Amy Haywood, Deputy Program Director of Grattan’s Education Program, says the results are worrying, although she noted the results haven’t differed much over the past three years.

“It’s worrying that one in three school students are still falling short of that proficiency benchmark in literacy and numeracy,” she told AAP.

“We should note this isn’t a one-off.”

There was also a regional divide, with just one-in-five students in very remote areas considered strong or exceeding expectations – far below 70 per cent of students in major cities.

Girls again outperformed boys in literacy but boys did better in numeracy, with the gaps emerging in early secondary and late primary school.

Some 71.1 per cent of year 7 girls achieved strong or “exceeding” – the highest proficiency level – in writing results, compared to 57 per cent of boys.

In numeracy, by year 3 there were 6.1 per cent fewer girls achieving “exceeding” results than boys, which increased to eight per cent by year 5.

Children from higher socio-economic backgrounds in urban areas also tended to score better.

The Centre for Independent Studies Education research fellow Trisha Jha believes improvement in results is on the horizon, although it will take time.

“We’ve got instructional models and approaches to teaching and curriculum that are becoming more aligned with evidence,” Ms Jha told AAP.

“Those are really positive changes but the biggest problem is that it’s going to take a long time for the impact of those policies to be felt on students at a classroom level.”

Results in all subjects were relatively stable across the board but Australian Curriculum Assessment and Reporting Authority chief executive Stephen Gniel called for “collective action” to help those left behind.

“Such as supporting students from our regional and remote areas, those from a disadvantaged background, and Indigenous students,” he said.

The curriculum boss was buoyed by more Indigenous students in years 7 and 9 achieving “exceeding” results in writing and numeracy, as well as an overall better maths results.

“It’s encouraging to see higher NAPLAN scores on average across years 5, 7 and 9 in numeracy, particularly among the stronger students,” he said.

“These may be small percentage changes, but the increases represent an additional 20,000 Australian students performing at the highest proficiency level – exceeding – in 2025 compared to 2024”.

Year 3 and year 5 students recorded better reading and numeracy results compared to last year, however there was a jump in year 7 and 9 students classified as needing extra support in both subject areas.

NAPLAN results released on Wednesday did not give reasons behind the trends and a school-by-school breakdown will be released later in the year.

Participation rates have rebounded to pre-pandemic levels as some 1.3 million students in years 3, 5, 7 and 9 sat the tests in early March – equivalent to 93.8 per cent of students.

That includes students in Queensland, who did their exams in the days after Cyclone Alfred struck and still managed the highest participation rates since 2019.

Door opens on rate cut as inflation continues to fall

Mortgage holders could see more rate relief within weeks after the Reserve Bank’s preferred measure of inflation fell to 2.7 per cent annually.

Trimmed mean inflation, which omits volatile items to measure underlying growth in prices, came in at 0.6 per cent in the June quarter, the the Australian Bureau of Statistics reported on Wednesday.

The figure was in line with consensus expectations.

It represented a 0.2 per cent drop in the annual trimmed mean from the March quarter and continued progress towards the midpoint of the RBA’s two to three per cent target band.

But the result was slightly above the central bank’s forecast in its latest statement on monetary policy in May.

Nevertheless, alongside a recent uptick in unemployment and weaker-than-expected household spending, it should be enough to secure another 25 basis point cut.

After the RBA’s last meeting, where it shocked the market by holding rates steady, Governor Michele Bullock said the board was waiting to confirm whether inflation is still on track to sustainably reach 2.5 per cent.

Ahead of the ABS data release, money markets were pricing in a 95 per cent chance the RBA would lower the cash rate to 3.6 per cent on August 12.

The headline consumer price index rose 2.1 per cent over the 12 months to June.

Housing, food and health costs drove inflation higher, said ABS head of prices statistics Michelle Marquardt.

“This is the lowest annual inflation rate since the March 2021 quarter,” she said.

Meanwhile falling petrol prices took some steam out of the index.

‘Moral momentum’ to recognise Palestine after UK move

Prime Minister Anthony Albanese is being urged to help build “moral momentum” to recognise a Palestinian state and end starvation in Gaza.

The United Kingdom government released a statement overnight announcing it was prepared to join France in recognising Palestinian statehood in September.

Australia could increase that momentum to help innocent civilians caught up in Israel’s war against Hamas in the Gaza Strip, federal Labor MP Ed Husic said.

“There is a moral momentum now that we are all witnessing,” he told reporters on Wednesday.

“Australia can lend its great weight to that momentum in making the decision to recognise.”

Mr Husic, who was the first Muslim federal minister before being moved to the backbench after the May election, has led a caucus push to pressure the prime minister to recognise Palestine.

Mr Albanese has in recent days stepped up his criticism of Israel for denying food to Gazans, leading to what aid agencies say is a humanitarian crisis, with the UN saying on X “the worst-case scenario of famine is now unfolding in Gaza”.

On Tuesday, Mr Albanese said it was “beyond comprehension” that Israel could claim there was no starvation in Gaza.

But he would not commit to recognising Palestine while it remained under the de facto leadership of Hamas, which is listed as a terrorist organisation by Australia.

Mr Husic said he understood the prime minister’s position but said the government could still join the international push to recognise Gaza without legitimising Hamas.

“We can still maintain that we have conditions that we believe need to be satisfied, not the least of which is the build up of democratic institutions within the state of Palestine, the demilitarisation of Hamas, for example,” he said.

“But we can flag our preparedness to join with both France and the UK, to signal our commitment to recognise Palestine.”

Two more developments in the past 24 hours also added to the urgency for Australia to act, Mr Husic said.

Gaza’s health ministry says 60,000 people have been killed by Israel since October 7, while a number of Israeli human rights groups have called Israel’s offensive in Gaza a genocide.

Australia joined 14 other countries, including France, the UK and Canada in a statement backing the recognition of Palestine “as an essential step towards the two-state solution and invite all countries that have not done so to join this call”.

It comes ahead of a leader’s level meeting during the 80th United Nations General Assembly scheduled for September, where Palestinian statehood is set to be a major topic of discussion.

The statement, signed by the 15 foreign ministers, also condemned terrorist group Hamas for its attack against Israel on October 7, 2023 and called for the release of all hostages and an immediate ceasefire.

It also called for further humanitarian aid as people starve to death in Gaza as Israel chokes food and medical supplies entering the besieged strip to put pressure on Hamas.

The foreign ministers added they “express grave concern over the high number of civilian casualties and humanitarian situation in Gaza”.

They further welcomed reform within the Palestinian Authority, which Australia has said needs to undergo significant reform as part of the process for recognition and a two-state solution, because Hamas could play no role in governing the strip.

This included a commitment by the authority’s president to schooling reform and to hold elections within a year, as well as accepting the principle of a demilitarised Palestinian state.

Opposition frontbencher James Paterson would not say whether he thought a starvation crisis was occurring in Gaza but said reports of starvation were “certainly credible”.

“I’m not in a position to independently assess the evidence that’s coming out of Gaza. I’m not there on the ground,” he told ABC Radio National.

“While we can all observe the very serious humanitarian situation, we should be careful not to endorse claims that are made by Hamas.”

Israel says Hamas is to blame for food not getting into Gaza and contests Gazan health officials’ casualty figures.