Business tax overhaul on wishlist of productivity tsar

Australia should cut taxes for small businesses and implement a new tax that allows immediate investment deductions, the Productivity Commission says, laying the groundwork for the government’s economic roundtable.

The proposal to cut the corporate income tax rate for business earning less than $1 billion to 20 per cent and introduce a five per cent cashflow tax would boost Australia’s economy by $14 billion without worsening budget sustainability, the commission said in a report.

This would help lift the nation’s floundering labour productivity by 0.4 per cent.

Combined, the measures would incentivise investment in the economy by $8 billion.

Declining business investment has caused productivity growth to fall to less than a quarter of its 60-year average over the past decade, the commission’s deputy chair Alex Robson said.

“If we don’t get our economy moving again, today’s children could be the first generation to not be better off than their parents,” he warned.

“We need to spark growth through investment and competition – the best way to do that is to reform our company tax system.”

Businesses with annual revenue under $50 million pay a 25 per cent corporate tax rate while larger firms pay the full 30 per cent tax rate.

Under the commission’s proposal, businesses over $1 billion in revenue would continue to be taxed at 30 per cent.

A net cashflow tax of five per cent would also allow companies to instantly depreciate the full value of investments, incentivising companies to invest in more productivity-boosting capital.

The commission said it could be expanded over time if successful.

A cashflow tax has previously been championed by Labor-aligned economists including Ross Garnaut and Craig Emerson.

At a tax roundtable hosted by Independent MP Allegra Spender last week, former Treasury secretary Ken Henry said Australia would eventually have to move to a cashflow tax, but it would be a very big step.

ANU tax policy expert Viva Hammer said implementing a comprehensive cash flow tax had one huge problem – transitioning from the current system.

“The people who are going to invest will have a completely different treatment for the people who’ve already invested. What do you do with the existing investments?” she told the roundtable.

“It’s a tremendous change in the way you tax the country. So any tremendous change is going to have tremendous winners and tremendous losers.”

The commission also urged Treasurer Jim Chalmers to make a clear commitment to reduce the regulatory burden on businesses, while forcing regulators to consider the impact of their actions on economic growth.

“You need so many licences and approvals from different levels of government to start a cafe in Brisbane that the City Council introduced a check list with up to 31 steps to guide people through the process,” commissioner Barry Sterland said.

The report’s release came as the treasurer released a schedule for his economic roundtable, which kicks off on August 19.

Day one of the three-day summit will open with addresses by Prime Minister Anthony Albanese, Dr Chalmers and Reserve Bank governor Michele Bullock.

Productivity Commission chair Danielle Wood, Treasury secretary Jenny Wilkinson and Grattan Institute chief executive Aruna Sathanapally will also present to the roundtable.

Among the topics to be discussed are better regulation, tax reform, artificial intelligence, boosting business investment and attracting skills.

US will set 15pc tariff on S.Korean imports in new deal

the US will charge a 15 per cent tariff on imports from South Korea, down from a threatened 25 per cent, President Donald Trump says, as part of a deal that eases tensions with a top-10 trading partner and key Asian ally.

South Korea also agreed to invest $US350 billion ($A544 billion) in the United States in projects selected by Trump and to purchase energy products worth $US100 billion.

The arrangement, announced after Trump met with Korean officials at the White House, came during a blizzard of trade policy announcements.

Many countries are rushing to cut deals before August 1, when Trump has promised higher tariffs will kick in.

“I am pleased to announce that the United States of America has agreed to a Full and Complete Trade Deal with the Republic of Korea,” Trump wrote on Truth Social.

The negotiations were an early test for South Korean President Lee Jae-myung, who took office in June after a snap election.

He said the deal eliminated uncertainty and set US tariffs lower than or at the same level as major competitors.

“We have crossed a big hurdle,” Lee said in a Facebook post.

Trump said Lee would visit the White House “within the next two weeks” for his first meeting with the US president.

South Korea would accept American products, including autos and agricultural goods into its markets and impose no import duties on them, Trump said.

South Korea’s top officials said the country’s rice and beef markets would not be opened further, and discussions over US demands on food regulations continued.

South Korea is one of three Asia-Pacific countries that had a comprehensive free trade agreement with the United States, but that did not spare it from new tariffs.

Pressure on negotiators increased after Japan clinched its deal earlier in July.

World stocks mixed on weak data and upbeat earnings

World stocks are mixed, with markets mulling a raft of economic indicators including central bank rate decisions, inflation data and last-minute trade deal negotiations before US President Donald Trump’s August 1 deadline.

The most recent development came from the Bank of Japan, which held interest rates and increased its inflation forecast, casting cautious optimism on Japan’s economic prospects.

Japan’s shorter-dated bond yields at one point rose to their highest since early April, but walked that back after the BOJ’s policy statement led market participants to push out expectations for any future interest rate hike.

The yen also gave back early gains and was last steady on the day at 149.73 per US dollar, while the Nikkei index closed up just more than one per cent.

Earnings were also top of mind for investors, and Nasdaq futures gained 1.4 per cent after better than expected results from Microsoft and Meta Platforms.

S&P 500 futures advanced more than one per cent.

Earnings also underpinned stock indices in Europe.

The pan-European Stoxx 600 index was steady in Thursday morning trade.

The index is on track to end July 1.6 per cent higher as easing trade worries, better-than-expected US and European economic data and largely upbeat earnings reports bolstered sentiment.

The region’s banks rose more than 1.5 per cent on Thursday after positive results from Standard Chartered and France’s Societe Generale.

But MSCI’s broadest index of world shares was flat, weighed down by falls in Chinese stocks after official PMI gauges showed weaker-than-expected economic activity during July.

China’s blue chip CSI 300 ended 1.8 per cent lower, its biggest single-day drop since April 7, and Hong Kong’s index closed 1.6 per cent lower.

Investors in Asia also mulled the implications of a trade deal between the US and South Korea as well as whether Trump’s initial announcement of a 25 per cent tariff for India should be taken seriously, especially as it was announced in the middle of trade negotiations.

Shares in India recovered earlier losses, with the benchmark Nifty 50 just in positive territory.

The Korean won gained 0.3 per cent after Trump said the US would charge a 15 per cent tariff on imports from South Korea, which would in return invest $US350 billion in US projects and purchase $US100 billion in US energy products.

The announcement is the latest in a series of trade deals rushed out before Friday’s deadline to avert the imposition of Trump’s April 2 “Liberation Day” tariffs.

Copper futures plunged 19.4 per cent after Trump said the US would impose a 50 per cent tariff on copper pipes and wiring, falling short of the expectation of sweeping restrictions.

The Federal Reserve’s rate-setting committee voted on Wednesday to hold US rates steady for the fifth consecutive meeting.

Fed chair Jerome Powell’s comments after the decision undercut confidence that borrowing costs would fall in September.

The dollar index steadied at 98.718, knocked from the two-month high of 99.987 it touched on Wednesday.

The index is set for a 3.1 per cent gain for the month, its first in 2025.

US gross domestic product growth rebounded more than expected in the second quarter, but the details of the report painted a picture of an economy losing steam and plagued by uncertainty from Trump’s protectionist trade policies.

Brent crude futures for September delivery were down 26 cents to $US72.98 a barrel, while US West Texas Intermediate crude for September fell 25 cents to $US69.75 a barrel as traders exited positions set to expire on Thursday.

Trump ramps up trade war with Canada over Palestine

US President Donald Trump has intensified his trade war with Canada a day before his August 1 deadline for a tariff agreement, saying it will be “very hard” to make a deal with Canada after it gave its support to Palestinian statehood.

Trump is set to impose a 35 per cent tariff on all Canadian goods not covered by the US-Mexico-Canada trade agreement if the two countries do not reach an agreement by the deadline.

“Wow! Canada has just announced that it is backing statehood for Palestine. That will make it very hard for us to make a Trade Deal with them,” Trump said on Truth Social.

Canadian Prime Minister Mark Carney previously said tariff negotiations with Washington had been constructive, but the talks may not conclude by the deadline.

Talks between the two countries were at an intense phase, he added, but a deal that would remove all US tariffs was unlikely.

Canada is the second-largest US trading partner after Mexico, and the largest buyer of US exports. It bought $US349.4 billion ($A542.8 billion) of US goods last year and exported $US412.7 billion to the US, according to US Census Bureau data.

Canada is also the top supplier of steel and aluminium to the United States, and faces tariffs on both metals as well as on vehicle exports.

In June, Carney’s government scrapped a planned digital services tax targeting US technology firms after Trump abruptly called off trade talks saying the tax was a “blatant attack”.

Carney followed France and Britain as he said on Wednesday that his country was planning to recognise the State of Palestine at a meeting of the United Nations in September.

In announcing the decision, Carney spoke of the reality on the ground, including starvation in Gaza.

“Canada condemns the fact that the Israeli government has allowed a catastrophe to unfold in Gaza,” he said.

Israel and the United States, Israel’s closest ally, both rejected Carney’s comments.

Carney’s office did not immediately respond to a request for comment on Trump’s post.

Lax Aussies making themselves easy spy targets: ASIO

Australia’s intelligence boss has warned that people who boast about their access to sensitive information are openly painting themselves as targets for foreign spying operations.

ASIO director-general Mike Burgess revealed details of multiple espionage operations as he used a keynote speech to warn officials, businesses and the general public about interference threats and the impact of lax security.

Russian spies were deported in 2022 after an ASIO investigation found they were “recruiting proxies and agents to obtain sensitive information, and employing sophisticated tradecraft to disguise their activities”, he said on Thursday.

Russia, China and Iran were singled out as adversaries but “you would be genuinely shocked by the number and names of countries trying to steal our secrets”, he said at the annual Hawke lecture at the University of South Australia.

ASIO, the nation’s domestic intelligence agency, disrupted 24 major espionage and foreign interference operations in the last three years, more than the previous eight years combined.

Mr Burgess said spies used a security clearance-holder to obtain information about trade negotiations and convinced one state bureaucrat to log into a database to obtain details of people a foreign regime considered dissidents.

The director-general also detailed how a foreign intelligence service ordered spies to apply for Australian government jobs, including at national security institutions, to access classified information.

Another example included a visiting academic linked to a foreign government breaking into a restricted lab with sensitive technology and filming inside, he said.

“They are just the tip of an espionage iceberg,” Mr Burgess said.

Foreign companies tied to intelligence services had also tried to access private data, buy land near military sites and collaborate with researchers developing sensitive technology.

“In recent years, for example, defence employees travelling overseas have been subjected to covert room searches, been approached at conferences by spies in disguise and given gifts containing surveillance devices,” Mr Burgess added.

Hackers had also broken into the network of a peak industry body to steal sensitive information about exports and foreign investment, as well as into a law firm to take information about government-related cases, he said.

The director-general chided people who held security clearances or who had access to classified information openly promoting themselves on social media, making it easier for them to be targeted by foreign agents.

More than 35,000 Australians indicated they had access to classified or private information on a single professional networking site, he said, adding 7000 referred to working in the defence sector and critical technologies.

Nearly 2500 boasted about having a security clearance, he said.

“All too often we make it all too easy,” he said.

Almost 400 people explicitly said they worked on the AUKUS project, under which Australia will acquire nuclear-powered submarines as the keystone of its military power.

Mr Burgess put the cost of espionage – including the theft of intellectual property resulting in lost revenue and responding to incidents – at $12.5 billion in 2023/24.

This included cyber spies stealing nearly $2 billion of trade secrets and intellectual property from Australian companies.

The number came from a conservative Australian Institute of Criminology analysis that took into account details for ASIO investigations, he said.

Hackers stealing commercially sensitive information from one Australian exporter gave a foreign country a leg up in a subsequent contract negotiation, “costing Australia hundreds of millions of dollars”, Mr Burgess said.

Nostalgia and political beef cap first sitting period

A sense of nostalgia has pervaded the nation’s capital as the 48th parliament’s first sitting fortnight drew to a close.

After two weeks of political beef over US cattle, battles between and within parties, and the passage of major election promises, Australia’s MPs and senators have patted themselves on the back as they jet out of Canberra.

Labor used the period to celebrate its post-election parliamentary dominance, with Prime Minister Anthony Albanese celebrating the plethora of first speeches from his party’s freshest faces and achievements of the previous fortnight.

But as his Question Time victory lap was interrupted by the coalition, Mr Albanese drew from the words of Joni Mitchell’s 1970 hit Big Yellow Taxi to lament the coalition’s departures from the previous government, specifically the former Liberal MP Paul Fletcher.

“Joni Mitchell was right, you don’t know what you’ve got ’til it’s gone,” he told the lower chamber on Thursday.

“We have a clear agenda of helping Australians, they have an agenda of fighting amongst themselves.”

For the past two weeks, much of opposition’s schedule has been dominated by in-fighting instigated by a handful of Nationals MPs that have brought forward a private member’s bill to repeal Australia’s commitment to net-zero emissions by 2050.

The opposition’s leaders have kept the door open on the issue while others within the coalition support the target, but Nationals boss David Littleproud said the opposition would soon reach a position and maintained it had been a productive sitting period.

“I will never knock anybody from putting forward a private member’s bill – that would subvert our democratic principles and what this place is all about,” he told reporters in Canberra.

“(But) once you join the Labor team, you can’t have a voice outside of it.”

Labor has been forced to reckon with dissent as the prime minister stared down an internal push to recognise Palestinian statehood, and insisting Australia would not be rushed on the issue.

Instead, the government focused on implementing major commitments including a 20 per cent cut to student debt, which was promised at the election, and reforms to cut funding from childcare centres that fail to meet safety and quality standards.

Education Minister Jason Clare thanked the coalition for helping pass both bills.

“This is a different parliament and a different opposition leader,” he told reporters.

“Australians I think want us to work together on the big things that matter to help Australians.”

But both major parties maintained their disagreements, with Labor and the Greens opposing a coalition attempt to take US beef imports to an inquiry.

Eyebrows have been raised at Australia’s decision to lift restrictions on the product as the government attempts to negotiate a US tariff carve-out.

Point of starvation spurs statehood push for Palestine

Australia has the “opportune moment” to recognise a Palestinian state as the nation’s leaders say formal acknowledgement is now only a matter of time.

Canada has followed the UK and France in announcing plans to support statehood at a UN General Assembly meeting in September.

Canadian Prime Minister Mark Carney said recognition would be contingent on the demilitarisation and exclusion of Hamas, which is deemed a terrorist organisation by Australia and controls the Gaza Strip.

Treasurer Jim Chalmers said the government viewed Palestinian statehood as an important step toward a two-state solution and the “best pathway out of this enduring cycle of violence”.

“From an Australian point of view, recognition of the state of Palestine is a matter of when, not if,” he told Sky News on Thursday.

“This progress, this momentum that we’re seeing, is welcome but it’s also conditional … we need to make sure that there’s no role for Hamas in any future leadership.”

Despite indications Australia would follow the three G7 nations with Palestinian recognition, Prime Minister Anthony Albanese has declined to set a timeline.

Deakin University global Islamic politics professor Greg Barton said a “completely urgent moment” had come for the war to end in Gaza, with the population at a tipping point in the effects of starvation.

“It’s more a question of when is the opportune moment … what that means is a coming together of Western democracies in co-ordination with Arab states to announce a proposed peace process package, rebuilding of Gaza and beyond,” he told AAP.

“That’s what we’re waiting for … if this proves to be true, I think that would be one of the biggest breakthroughs we’ve had in decades.”

While consideration should be given to Hamas trying to spin statehood as a reward for its actions, which have included its deadly attack on Israel on October 7, 2023, that should not be a reason to avoid taking necessary steps, Prof Barton added.

The prime minister held talks overnight with his UK counterpart Keir Starmer on the situation in Gaza.

Mr Albanese reiterated Australia’s “long-standing and strong support for a two-state solution” and gave an update on the nation’s aid contributions.

The pair also spoke about the UK’s framework for recognising Palestine as a state.

“The leaders agreed on the importance of using the international momentum to secure a ceasefire, the release of all hostages and the acceleration of aid, as well as ensuring Hamas did not play a role in a future state,” according to a readout.

Executive Council of Australian Jewry co-chief executive Peter Wertheim said unless minimum pre-conditions were met, the future for both Palestinians and Israelis will be much the same as the past.

“It would be scandalous if Australia and other nations were to recognise a Palestinian state which, from day one, was internationally responsible for the holding of living and dead hostages and was impotent in the face of armed terrorist groups controlling large parts of its territory,” he said.

Opposition frontbencher James Paterson said he did not support the “premature” recognition of a Palestinian state before the conclusion of a peace process that also included Israel.

“I don’t think we should decide Australia’s foreign policy according to some artificial measure of momentum,” he said.

Greens senator Sarah Hanson-Young said Australia must formally recognise Palestine.

“It’s time to be recognising the state of Palestine …in line with comparable countries across the world,” she said.

Jigsaw coming together for further interest rate relief

Hopes of an impending interest rate cut have been bolstered by a top official who says fresh figures show inflation falling in line with predictions.

Reserve Bank of Australia deputy governor Andrew Hauser said the consumer price data released by the Australian Bureau of Statistics on Tuesday was “very welcome”.

The central bank’s preferred measure of inflation, the trimmed mean, fell from 2.9 per cent to 2.7 per cent in the June quarter.

Mr Hauser said the RBA had been looking for more evidence that inflation was moving sustainably back to the midpoint of its two to three per cent target band.

“And we’ve had another piece of that jigsaw yesterday,” he said in a fireside chat with Barrenjoey chief economist Jo Masters on Thursday.

The RBA wanted to make sure it brought down inflation to its 2.5 per cent target in a way that was “gradual, considered, measured … predictable,” Mr Hauser said.

His comments echoed minutes from its board’s July meeting, in which most members declared back-to-back rate cuts would not be consistent with a “cautious and gradual” monetary policy strategy.

The RBA’s decision to hold the cash rate at 3.85 per cent did not prove particularly predictable, blindsiding markets and the analyst consensus.

But money markets and economists widely expect the central bank board to lower the cash rate to 3.6 per cent at its meeting in August.

Another interest rate cut would be “welcome relief” for mortgage holders, Treasurer Jim Chalmers said.

“But it’s never mission accomplished because the global environment is uncertain – we’ve got some persistent structural issues in our economy, growth in our economy is soft, and people are under pressure,” Dr Chalmers told ABC TV.

Despite rising real incomes, falling interest rates and tax cuts, consumer spending had persistently undershot the RBA’s forecasts since the start of the year, Mr Hauser said.

The clue might lie in weak consumer confidence.

The amount of momentum in the economy was an area of debate among the RBA board, Mr Hauser added. Some who believed interest rates should be lower worried that consumer confidence could continue to lag, he said.

Retail data released shortly after Mr Hauser’s remarks suggest consumer spending may have turned a corner, with turnover jumping 1.2 per cent in June, tripling consensus estimates and solidly beating May’s upwardly revised 0.5 per cent rise.

“The strong June month rise in retail turnover was driven by discounts linked to sales and new product releases,” said ABS head of business statistics Robert Ewing.

“Turnover for electrical and gaming retailers was lifted further by the much-anticipated launch of the Nintendo Switch 2, which delivered record sales.”

While consumer confidence had been rattled by global trade tensions, Mr Hauser suggested three reasons why the impact of US President Donald Trump’s tariff threats had not been as bad as feared.

Firstly, the worst of the threatened tariff outcomes had not eventuated, especially retaliatory measures by other countries. Second was the Australian and global economies being more resilient than expected.

More worryingly, a third reason could be that the worst impacts are yet to come.

“You may remember when Brexit occurred, everyone rushed to the exit gate and nothing happened,” Mr Hauser said.

“But my goodness me, 10 years on, I think it’s fair to say things are happening.

“If those tariffs stick, there’s a real tax increase, and someone has to pay it.”

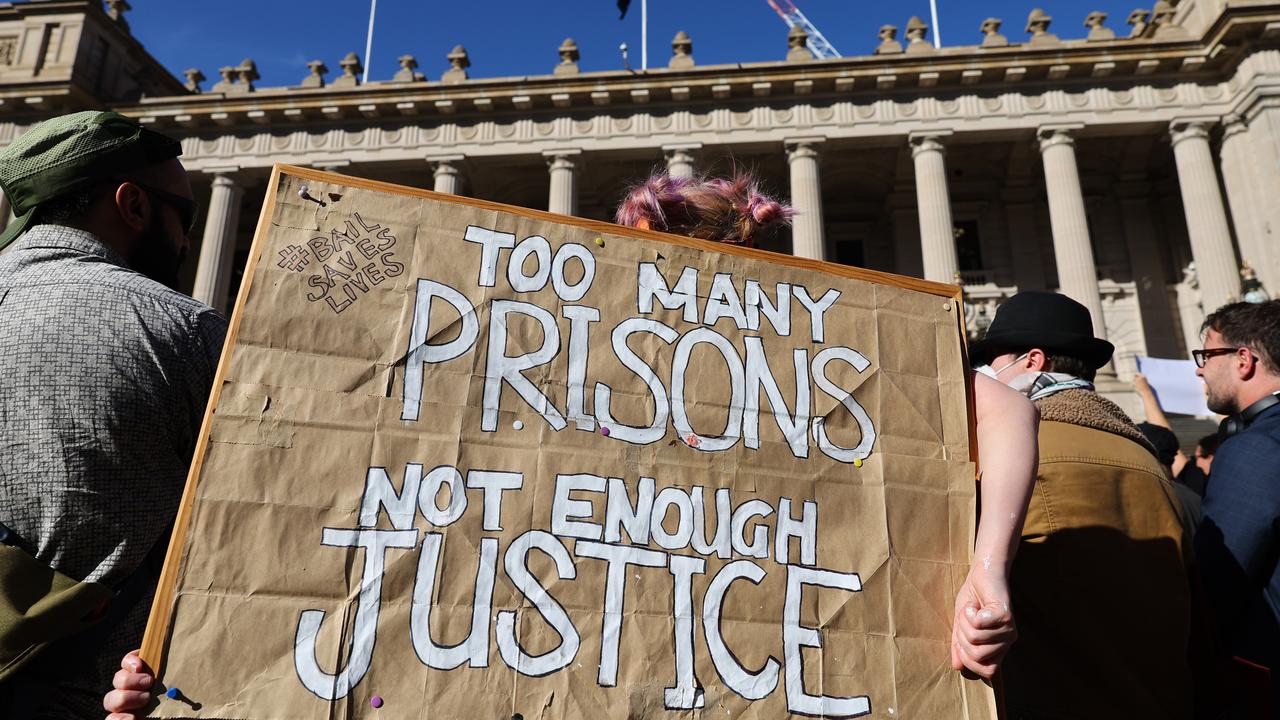

Australia paying lip service to Closing the Gap: Thorpe

Failure to bring Indigenous people’s outcomes up to par with the rest of the community has led one outspoken senator to question the point of Closing the Gap targets.

The latest update from the Productivity Commission found just four of the 19 targets were on track to be met by 2031.

Closing the Gap targets are part of a national agreement aimed at reducing First Nations peoples’ disadvantage.

But with progress towards several key targets going backwards, independent senator Lidia Thorpe said there appeared to be no consequences for not Closing the Gap.

Key targets, including adult imprisonment rates, children in out-of-home care, suicide rates and childhood development are continuing to worsen.

While there have been improvements in Year 12 attainment, tertiary education levels and housing access, the measures were not on track to meet deadlines in six years’ time.

Catherine Liddle, chief executive of SNAICC – National Voice for our Children, said there had been improvements in areas where there had been partnerships between communities and the government.

She said the Closing the Gap figures showed there was a lack of follow-through from the government to address issues, rather than a lack of solutions.

“The update shows that when governments work in true partnership with Aboriginal and Torres Strait Islander communities, we see real change,” Ms Liddle said.

“Progress in areas like land rights and employment shows what’s possible when communities are empowered and governments step up.”

Ms Liddle added the same commitments should be shown to worsening targets, such as child protection and youth justice.

Indigenous Australians Minister Malarndirri McCarthy said work continued to turn around the targets.

“It is very concerning that we are still seeing outcomes worsening for incarceration rates, children in out-of home care and suicide,” she said.

“It’s important that state and territory governments all back in their commitments under the national agreement with actions that will help improve outcomes for First Nations people.”

Senator Thorpe called for urgent action to address Indigenous deaths in custody following the death of 24-year-old Kumanjayi White in Alice Springs in May.

She said the government has been paying “lip service” rather than following through on First Nations deaths in custody, which affected Australia’s ability to close the gap.

“What are we doing to address a national crisis? (Deaths in custody) has been a national crisis for 34 years and more,” Senator Thorpe told reporters.

“If there’s no consequences to not Closing the Gap, then what’s the point of having it year after year?”

Pat Turner, from the Coalition of Peaks, said governments must hold themselves to account for the commitments they’d made under the national agreement.

“That requires smart investment, longer-term flexible funding, and full implementation of the four priority reforms – shifting power, not just policy,” the lead convener of the Indigenous representative body said.

“Without a real power shift, we’ll keep seeing the same patterns repeat, and our people will continue to pay the price.”

Queensland Aboriginal and Islander Health Council chief executive Paula Arnol said the latest Closing the Gap report card was disappointing.

“It’s 2025 and Aboriginal and Torres Strait Islander people are still not experiencing the health outcomes that non-Indigenous Australians enjoy,” she said.

“This is unacceptable.”

Productivity commissioner Selwyn Button said the review showed the outcomes of the agreement were falling well short of what governments had committed to.

“What the outcomes in the agreement reflect most of all is the limited progress of governments in collectively acting on the priority reforms: sharing decision making and data with communities; strengthening the Aboriginal community controlled-sector and changing the way governments operate,” he said.

The findings come as Prime Minister Anthony Albanese is set travel to the Garma Festival in East Arnhem Land.

The four-day festival, the country’s largest Indigenous gathering, will begin on Friday.

13YARN 13 92 76

Lifeline 13 11 14

1800 RESPECT (1800 737 732)

Men’s Referral Service 1300 766 491

Asia stocks slide on weak China data as copper plunges

Asian equities slipped on Thursday after weaker-than-expected Chinese activity data and a plunge in copper prices, while investors weighed a trade deal between South Korea and the United States.

The dollar held near a two-month high as investors weighed a Federal Reserve decision to hold rates steady and strong earnings from megacap tech firms.

Nasdaq futures surged 1.2 per cent higher after better-than-expected earnings from Microsoft and Meta Platforms. S&P 500 futures advanced 0.8 per cent, while the US dollar held steady after hitting a two-month high.

Both companies’ earnings reports “have shot the lights out”, reporting higher revenue from cloud computing and AI-enabled ad targeting respectively, said Tony Sycamore, a market analyst at IG in Sydney.

MSCI’s broadest index of Asia-Pacific shares outside Japan eased 0.7 per cent, though still on track for its fourth consecutive monthly gain in July.

Stocks in Hong Kong and China led declines after official PMI gauges showed weaker-than-expected economic activity during July.

Markets are now awaiting the Bank of Japan’s monthly policy decision later in the day, with traders looking for any hints that Governor Kazuo Ueda may offer on the likelihood of another rate hike this year.

The Federal Reserve’s rate-setting committee voted 9-2 on Wednesday to hold interest rates steady for the fifth consecutive meeting, with two Fed governors dissenting for the first time in more than three decades.

Fed Chair Jerome Powell’s comments after the decision undercut confidence that borrowing costs would begin to fall in September.

“It will take the next two months of data to convince Fed officials that tariff effects will only lead to modest, one-time price increases and that policy rates should head toward neutral,” analysts from Citi said in a note.

The dollar index was at 98.812, just shy of the two month high of 99.987 it touched on Wednesday. The index is set to clock a 3.1 per cent gain for the month, its first in 2025.

“Although the Federal Reserve decided to keep rates steady at its recent rate setting decision, the chance of rate cuts at upcoming meetings remain live as they balance softening economic data with the potential for persistent inflation,” said Manusha Samaraweera, fixed income investment director at Capital Group.

US gross domestic product growth rebounded more than expected in the second quarter, but the details of the report painted a picture of an economy that was losing steam plagued by uncertainty from Trump’s protectionist trade policy.

The Korean won appreciated 0.3 per cent after Trump said the US will charge a 15 per cent tariff on imports from South Korea, which will in return invest $US350 billion ($A544 billion) in US projects and purchase $US100 billion ($A155 billion) in US energy products.

The announcement is the latest in a series of trade policy deals rushed out before an August 1 deadline to avert the imposition of the April 2 “Liberation Day” tariffs. These deals continue to cast a shadow on global markets.

Copper futures plunged 19.4 per cent after Trump said the US will impose a 50 per cent tariff on copper pipes and wiring, as the details of the levy fell short of the sweeping restrictions expected and left out copper input materials such as ores, concentrates and cathodes.

Trump said on Wednesday negotiations on trade with India are still under way after announcing earlier the US will impose a 25 per cent tariff on goods imported from the country.

Meanwhile, the US will also suspend its “de minimis” exemption that allowed low-value commercial shipments to be shipped to the United States without facing tariffs. The tax break is a mainstay of China’s low-cost e-commerce platforms such as Shein and PDD’s Temu.

In commodities, oil prices rose for a fourth straight day on Thursday, as investors worried about supply shortages amid Trump’s push for a swift resolution to the war in Ukraine and threats of tariffs on countries buying Russian oil.

Brent crude futures for September delivery, which are set to expire on Thursday, rose 0.33 per cent, to $US73.48 ($A114.18) a barrel, while US West Texas Intermediate crude for September gained 0.21 per cent to $US70.15 ($A109.01) a barrel.