Markets plummet as Trump issues more steep tariffs

US President Donald Trump’s latest wave of tariffs on exports from dozens of trading partners sent global stock markets tumbling and countries and companies scrambling to seek ways to strike better deals.

As Trump presses ahead with plans to reorder the global economy with the highest tariff rates since the early 1930s, Switzerland, “stunned” by 39 per cent tariffs, sought more talks, as did India, hit with a 25 per cent rate.

New tariffs announced on Friday also included a 35 per cent duty on many goods from Canada, 50 per cent for Brazil, 20 per cent for Taiwan, which said its rate was “temporary” and it expected to reach a lower figure.

The presidential order listed higher import duty rates of 10 per cent to 41 per cent starting in a week’s time for 69 trading partners, taking the US effective tariff rate to about 18 per cent, from 2.3 per cent last year, according to analysts at Capital Economics.

US stocks took a hit. By afternoon on Friday, the Dow Jones Industrial Average had dropped 1.46 per cent to 43,486.45, the S&P 500 1.8 per cent to 6,225.55 and the Nasdaq Composite 2.42 per cent to 20,610.91.

Markets were also reacting to a disappointing jobs report. Data showed US job growth slowed more than expected in July while the prior month’s data was revised sharply lower, pointing to a slowdown in the labour market.

Global shares stumbled, with Europe’s STOXX 600 tumbling 1.89 per cent on the day.

Trump’s new tariffs have created yet more uncertainty, with many details unclear. They are set to take effect on August 7, a White House official said.

Trump administration officials defended the president’s approach saying the uncertainty was “critical” for him to be able to leverage a better deal.

“The trade deals we’ve seen over the last few weeks… have been nothing short of monumental,” Council of Economic Advisers Chair Stephen Miran said on CNBC.

Trump’s tariff rollout also comes amid evidence they have begun driving up prices of home furnishings and household equipment.

Australian products could become more competitive in the US market, helping businesses boost exports, Trade Minister Don Farrell said, after Trump kept the minimum tariff rate of 10 per cent for Australia.

The European Union, which struck a framework deal with Trump on Sunday, is still awaiting more Trump orders to deliver on agreed carve-outs, including on cars and aircraft, EU officials said, saying the latest executive orders did not cover that.

Switzerland said it would push for a “negotiated solution” with the US, with industry insiders saying they were “stunned” by the 39 per cent tariffs.

South Africa’s Trade Minister Parks Tau said he was seeking “real, practical interventions” to defend jobs and the economy against the 30 per cent US tariff it faces.

Southeast Asian countries largely breathed a sigh of relief after the US tariffs on their exports that were lower than threatened and leveled the playing field with a rate of about 19 per cent across the region’s biggest economies.

Thailand’s finance minister said a reduction from 36 per cent to 19 per cent would help his country’s economy.

While India is in talks after being slapped with a 25 per cent tariff, which could impact about $US40 billion ($A62 billion) worth of its exports.

Trump issued a separate order for Canada that raises the rate on Canadian goods subject to fentanyl-related tariffs to 35 per cent, from 25 per cent previously, saying Canada had “failed to cooperate” in curbing illicit narcotics flows into the US.

This is contrast to his decision to allow Mexico a 90-day reprieve from higher tariffs to allow time to negotiate.

Businesses and analysts said the impact of Trump’s new trade regime would not be positive for economic growth.

“No real winners in trade conflicts,” said Thomas Rupf, co-head Singapore and CIO Asia at VP Bank.

“Despite some countries securing better terms, the overall impact is negative.”

SpaceX launches joint astronaut crew to ISS

An international crew of four astronauts has launched toward the International Space Station on Friday aboard a SpaceX rocket, embarking on a routine NASA mission that could be the first of many to last a couple months longer than usual.

The four-person crew – two NASA astronauts, a Russian cosmonaut and Japanese astronaut – boarded SpaceX’s Dragon capsule sitting atop its Falcon 9 rocket at NASA’s Kennedy Space Center on Friday and beat gloomy weather to blast off at 11.43am local time. After a roughly 16 hour flight, they will arrive at the ISS.

While normal crew rotation missions last roughly six months, the Crew-11 crew may be the first to settle into a new routine time of eight months, intended to better align US mission schedules with Russia’s missions, NASA said.

Over the next few months, NASA officials will monitor the health of SpaceX’s Dragon capsule, which remains docked to the ISS, before committing the mission to a full eight months.

Thursday’s mission, called Crew-11, includes NASA astronauts Zena Cardman and Michael Fincke, Russian cosmonaut Oleg Platonov, and Japanese astronaut Kimiya Yui.

A previous attempt to launch on Thursday was scratched at the last minute because of bad weather.

A delegation of senior Russian space officials, including the head of Russia’s space agency, Dmitry Bakanov, was in Florida for the launch attempt on Thursday, but it was unclear whether they stayed in town for Friday’s launch.

Their visit on Thursday included the first face-to-face meeting between the heads of NASA and Roscosmos, Russia’s space agency, since 2018. Roscosmos said Bakanov and acting NASA administrator Sean Duffy discussed continued ISS operations and cooperation on the moon.

The space cooperation is a bright spot in otherwise largely frosty US-Russia relations since Moscow’s full-scale invasion of Ukraine in 2022.

Depth of US-Australia ties on show in tariff reprieve

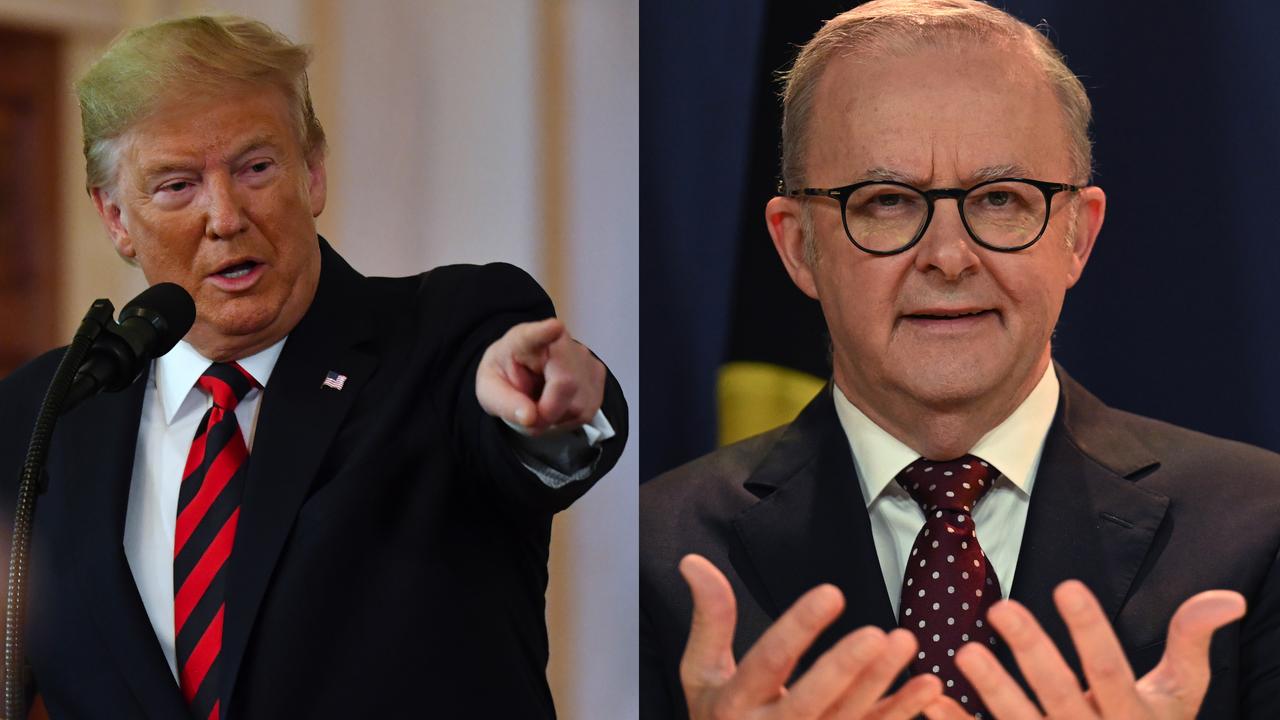

Donald Trump’s decision to spare Australia from increased tariffs shows the strength of the bilateral relationship, an expert says, and could give the nation an edge in global trade.

While the US president has raised tariffs against dozens of nations, he showed mercy on Australia and kept levies against most products at 10 per cent.

This means Australia has secured the lowest tariff rate of any US trading partner, defying speculation it would be hit with a higher levy because Prime Minister Anthony Albanese had not yet met face-to-face with Mr Trump.

United States Studies Centre research director Jared Mondschein said the result was not surprising given Australia imports more from the US than vice versa and it has a free trade agreement with America.

He said the decision highlighted the strength of the US-Australia relationship.

“A lot of people put emphasis on the political leaders meeting, but the alliance is far deeper, wider and more expansive,” he told AAP.

“It’s worth getting a meeting, but I just don’t think it’s an existential threat to the alliance to be unable to secure one.

“Securing a 10 per cent tariff rate is definitely a win for Australia.”

The development has been celebrated by Trade Minister Don Farrell as a vindication of Australia’s “cool and calm” diplomatic approach.

Senator Farrell has predicted it could give Australia an advantage over other trading partners whose goods have been slugged with higher tariffs.

“Australian products are now more competitive in the American market,” he told reporters.

For example, Australia and Brazil are two of the biggest beef exporters to the US.

The tariff rate on the South American nation’s goods has been hiked from 10 to 50 per cent, meaning its beef will become more expensive for American consumers, which could push them towards Australian products.

Senator Farrell revealed American forces had pushed Mr Trump to increase tariffs on Australian goods, but the president resisted the calls.

Mr Mondschein warned Australia not to get too comfortable.

“The only certainty in the Trump administration is continued uncertainty when it comes to trade,” he said.

“In this administration, probably more than any other administration in modern history, there are a lot of folks who are pretty protectionist.”

The federal government has said it would continue calling for a complete tariff exemption, but no trading partner has been able to achieve this.

Opposition trade spokesman Kevin Hogan said the tariff decision was driven by the US having a trade surplus with Australia, “not because of any effort from the prime minister”.

Australians want action on Gaza as rally verdict looms

More than 60 per cent of Australians want tougher government measures to stop Israel’s military offensive in Gaza, a poll has found, as protesters await a court verdict to march across an iconic landmark.

The NSW Supreme Court is due to hand down a decision on Saturday morning after a bid by NSW Police to halt thousands of anticipated protesters marching across the Sydney Harbour Bridge.

The demonstrations slated for Sunday aim to highlight what the United Nations has described as “worsening famine conditions” in Gaza.

They have garnered support from activists nationwide, human rights and civil liberties groups as well as several MPs and public figures such as former Socceroo Craig Foster.

In solidarity with their interstate peers, protesters in Melbourne are gearing up to rally through the city’s CBD, aiming to reach the King Street Bridge.

A last-minute application on Friday was also lodged to police by a pro-Israel fringe group for a counter-protest in the tunnel under Sydney Harbour, the court heard.

Police confirmed to AAP the group withdrew the application soon after.

Respondents to a YouGov poll published on Friday and commissioned by the Australian Alliance for Peace and Human Rights believed Prime Minister Anthony Albanese’s condemnations of Israel had fallen short.

“While the government has recently signed a statement calling for an immediate ceasefire, 61 per cent of Australians believe this is not enough,” the alliance said.

“(Australians) want to see concrete economic, diplomatic and legal measures implemented.”

The alliance called for economic sanctions and the end of any arms trade with Israel, which the federal government has repeatedly said it has not engaged in directly.

The poll surveyed 1507 Australian voters in the last week of July, coinciding with a deteriorating starvation crisis and while diplomatic efforts from countries such as Canada have ramped up.

Some 42 per cent of polled coalition voters supported stronger measures and more than two thirds of Labor voters, 68 per cent, are pushing their party to be bolder in placing pressure on Israel.

An overwhelming number of Greens voters (91 per cent) wanted a more robust suite of measures as did 77 per cent of independent voters.

The results highlighted how the nearly two-year long war on Gaza had resonated with Australians, YouGov director of public data Paul Smith said.

“This poll shows there’s clearly across the board support for the Australian government to be doing much more in response to the situation in Gaza,” he told AAP.

“Sixty-one per cent shows the depth of feeling Australians have towards this issue.”

More than 60,000 Palestinians have been killed including more than 17,000 children, according to local health authorities, with reports of dozens of people dead in recent weeks due to starvation.

Israel’s campaign began after Hamas attacked Israel on October 7, 2023, reportedly killing 1200 people and taking 250 hostages.

PM to set sights on closing the gap in festival speech

Prime Minister Anthony Albanese will unveil an economic partnership with Indigenous organisations at the Garma Festival aimed at “a new way of doing business”.

Mr Albanese is expected to use his speech at the festival in Arnhem Land to announce the economic partnership with the Coalition of the Peaks, following the release of Closing the Gap data Indigenous organisations have labelled “unacceptable”.

“This builds on our commitment to the Closing the Gap Agreement, to its call for a new way of doing business and to the principle of shared decision-making,” Mr Albanese will say on Saturday.

The approach would allow Traditional Owners to advocate for infrastructure, housing and energy projects on their land and to build equity beyond the land itself.

It would empower Indigenous groups to engage with business and the private sector, encouraging partnerships with private capital and institutional investors from the outset.

“So companies and communities can come to government as partners, putting forward projects that are ready to go,” Mr Albanese will say.

Closing the Gap has been a topic of discussion at the Garma Festival, which has become a ground for political conversations and policy announcements while also focusing on culture and empowerment of the local Yolngu people.

The data, released on Thursday, revealed just four of 19 targets are on track to be met, with another four goals going backwards – adult incarceration, children in out-of-home care, suicide rates and child development.

When he delivers his keynote address on Saturday, Mr Albanese will say Closing the Gap data has underlined that a different, dedicated approach is required to address these issues.

“Reports and reviews have their place, but they are not a substitute for results,” he will say.

“Creating a process matters but it is not the same thing as making progress.”

Federal Opposition Leader Sussan Ley will not attend the four-day festival and will instead be in Western Australia’s Kimberley region.

Ms Ley will visit Indigenous and community organisations in Wyndham and Kununurra on Saturday.

She said Mr Albanese’s speech should be used to outline his plan for First Nations people.

“Anthony Albanese’s speech to Garma is an opportunity for him to provide some clarity,” she said.

“He has a personal obligation to explain to Indigenous Australians what his plan is to turn around the widening gap.”

13YARN 13 92 76

Lifeline 13 11 14

Swiss stunned by US tariff hike, seeks solution

Swiss manufacturers have warned that tens of thousands of jobs are at risk after US President Donald Trump hit them with one of the highest tariff rates in his global trade reset, even if there was some relief for now for the key drugs sector.

The government said it was “disappointed” and would decide how to proceed after Trump on Friday set a 39 per cent tariff on the export-reliant country – more than double the 15 per cent rate for most European Union imports into the United States.

The levy – up from an originally proposed 31 per cent tariff that Swiss officials had described as “incomprehensible” – is a body blow for the small Alpine nation, which counts the US as the top export market for its watches, jewellery and chocolates.

The White House said on Friday it had made the move because of what it called Switzerland’s refusal to make “meaningful concessions” by dropping trade barriers.

“Switzerland, being one of the wealthiest, highest income countries on earth, cannot expect the United States to tolerate a one-sided trade relationship,” a White House official said.

Swiss President Karin Keller-Sutter earlier told Reuters the government would keep talking to Washington, but there were only limited concessions it could offer, as US imports already enjoyed 99.3 per cent free market access.

“We have companies that have made very important direct investments (in the US). It’s really difficult to give more,” she said on the sidelines of a Swiss National Day event in Ruetli.

Switzerland’s main export to the US is pharmaceutical products – worth $US35 billion ($A54 billion) last year – though officials said big pharma should not be affected by the higher rate for now.

Swissmem, a group representing the mechanical and electrical engineering industries, said it was “really stunned” by the US move.

“It’s a massive shock for the export industry and for the whole country,” said its deputy director Jean-Philippe Kohl.

“The tariffs are not based on any rational basis and are totally arbitrary … This tariff will hit Swiss industry very hard, especially as our competitors in the European Union, Britain and Japan have much lower tariffs.”

The US is Switzerland’s top foreign watch market, accounting for 16.8 per cent of exports, or about 4.4 billion francs ($A8.4 billion), according to the Federation of the Swiss Watch Industry.

Shahzaib Khan, who runs two businesses selling Swiss luxury watches abroad, said the tariffs were “hard to digest”.

“This is getting out of hand a little bit… I don’t think brands can absorb 39 per cent,” Khan told Reuters.

The new rate is set to take effect on August 7, and a Swiss source familiar with the matter said negotiations would continue.

India engaged in further trade talks with US

India is engaged in trade talks with the United States, an Indian government source with knowledge of the discussions says, a day after US President Donald Trump signed an order imposing a 25 per cent tariff on New Delhi’s exports.

Trump set steep import duties on dozens of trading partners, including a 35 per cent tariff on many goods from Canada, 50 per cent for Brazil, 20 per cent for Taiwan and 39 per cent for Switzerland, according to a presidential executive order.

A US delegation is expected to visit New Delhi later in August, the government source said.

“We remain focused on the substantive agenda that our two countries have committed to and are confident that the relationship will continue to move forward,” India’s foreign ministry said on Friday.

Trade talks between Washington and New Delhi have been bogged down by issues including access to India’s highly protected agriculture and dairy sector.

Nearly $US40 billion ($A62 billion) worth of exports from the South Asian nation – the world’s fifth-largest economy – could be affected by Trump’s tariff salvo, according to the source.

Without a deal, the rate singles out India for harsher trade conditions than its major peers, potentially damaging the economy of a strategic US partner in Asia that is seen as a counterbalance to Chinese influence.

The source said there was no question of compromising on India’s agriculture and dairy sectors, especially not allowing import of dairy products due to religiously based opposition to animal feed in these products.

On Wednesday, Trump also threatened additional penalties on India for its commercial dealings with Russia and membership in the BRICS group of major emerging and developing economies.

There is no clarity yet on the penalty. Trump accuses BRICS of pursuing “anti-American policies”.

Differences between the US and India could not be resolved overnight to arrive at a trade deal, a senior US official said on Thursday.

The US has a trade deficit of $US46 billion with India.

Global stocks tumble after Trump tariff blitz

Global shares have tumbled after the US slapped dozens of trading partners with steep tariffs, while investors anxiously await US jobs data that could make or break the case for a Fed rate cut in September.

The Stoxx 600 fell about one per cent in the first hour of trading on Friday.

It was 1.7 per cent lower on the week, on track for its biggest weekly drop since early April.

Both Nasdaq futures and S&P 500 futures were down about one per cent.

Late on Thursday, President Donald Trump signed an executive order imposing tariffs ranging from 10 per cent to 41 per cent on US imports from foreign countries.

Rates were set at 25 per cent for India’s US-bound exports, 20 per cent for Taiwan’s, 19 per cent for Thailand’s and 15 per cent for South Korea’s.

He also increased duties on Canadian goods to 35 per cent from 25 per cent for all products not covered by the US-Mexico-Canada trade agreement, but gave Mexico a 90-day reprieve from higher tariffs to negotiate a broader trade deal.

“The August 1 announcement on reciprocal tariffs are somewhat worse than expected,” said Wei Yao, research head and chief economist in Asia at Societe Generale.

Market reaction was not as volatile as April’s global asset declines, she said.

“We are all getting much more used to the idea of 15-20 per cent tariffs being manageable and acceptable, thanks to the worse threats earlier.”

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.5 per cent, bringing the total loss this week to roughly 2.7 per cent.

Japan’s Nikkei closed 0.6 per cent lower, Chinese blue chips ended 0.5 per cent down and Hong Kong’s Hang Seng index lost more than one per cent.

Overnight, Wall Street failed to hold on to an earlier rally.

Data showed inflation picked up in June, with new tariffs pushing prices higher and stoking expectations that price pressures could intensify, while weekly jobless claims signalled the labour market remained on a stable footing.

Fed funds futures imply just a 39 per cent chance of a rate cut in September, compared with 65 per cent before the Federal Reserve held rates steady on Wednesday, according to the CME’s FedWatch.

Much now will depend on the US jobs data due later on Fridayand any upside surprise could price out the chance for a cut in September.

Forecasts are centred on a rise of 110,000 in July, while the jobless rate likely ticked up to 4.2 per cent from 4.1 per cent.

The greenback found support from fading prospects of imminent US rate cuts, with the dollar index up 1.5 per cent this week against its peers to 100, in the biggest weekly rise since late 2022.

The tariff news appeared to have little impact on the Canadian dollar, which was last up 0.15 per cent.

The yen was the biggest loser overnight, but recovered 0.2 per cent to 170.5 yen.

The Bank of Japan held interest rates steady on Thursday and revised up its near-term inflation expectations, but Governor Kazuo Ueda sounded a little dovish in the news conference.

Two-year Treasury yields fell one basis point to 3.9428 per cent, while benchmark 10-year yields ticked up two basis points to 4.382 per cent, after slipping 2 bps overnight.

Oil prices continued to fall after a one per cent overnight plunge.

Brent fell 24 cents to $US71.46 per barrel, while US crude fell 27 cents to $US68.99 a barrel.

Spot gold prices were up 0.1 per cent to $US3,294 an ounce.

Decision left up in the air over pro-Palestine march

It is “inevitable” thousands of people will march over an Australian landmark for Palestine rights.

But whether police will be able to bar protesters from blocking public roads and infrastructure on Sunday is yet to be determined, after a Supreme Court judge ruled she would sleep on her decision.

Aimed at shining a spotlight on starvation in Gaza as a result of Israel’s offensive, the rally at the Sydney Harbour Bridge has been hyped by organisers as a “March for Humanity”.

Similar demonstrations are planned in Melbourne and Adelaide and an online petition to allow the Sydney march has attracted more than 15,000 signatures.

NSW Police on Friday took the demonstration’s organisers, Palestine Action Group, to the Supreme Court in Sydney to request the rally be deemed unauthorised.

NSW has a permit system that allows protesters to block public roads and infrastructure but a court can revoke those immunities if police challenge the permit.

Representing state police, Lachlan Gyles SC argued they would not be able to maintain a safe environment if the protest was authorised and closing the bridge was not reasonable with less than a week’s notice.

Under cross-examination, acting Assistant Police Commissioner Adam Johnson raised the possibility of a crowd crush.

“I’m personally concerned about that,” he said on Friday.

But Palestine Action Group barrister Felicity Graham told the court it would be safer for police to authorise the protest, as people would march regardless of Justice Belinda Rigg’s decision.

“A prohibition order may well increase the number of people who attend the protest and exacerbate the potential for unrest and violence,” she said.

The group had vowed to rally regardless of the judge’s decision, with spokesman Josh Lees saying the groundswell of support was unstoppable.

A last-minute application on Friday was lodged to police by a pro-Israel fringe group to also protest in the tunnel under Sydney Harbour, the court heard.

Police confirmed to AAP the group withdrew the application soon after.

Five NSW Labor MPs and Greens senator David Shoebridge are among 16 politicians planning to join the march.

They had urged the government to facilitate a safe and orderly event on Sunday or “some other agreed date”.

Outspoken upper house government MP Stephen Lawrence went a step further.

He predicted Premier Chris Minns’ perceived interference in police negotiations with protesters would hamper the court’s ability to thwart the bridge plans.

“The circumstances of this protest are not ideal, but the event is now absolutely inevitable, largely because of the way it has been mishandled,” he said on Friday morning.

Mr Minns softened his largely anti-protest stance on Friday and said he hoped organisers would work with police to find an alternative route.

“There are thousands of people that want to be part of the protest. It’s not deniable and many people have been struck by images that have come out of Gaza,” he said.

Mr Minns had earlier suggested the Harbour Bridge protest would bring “chaos” to Sydney.

Mr Lawrence and fellow MP Sarah Kaine said the premier’s position ran counter to Labor Party values.

The number of Palestinians killed during the war in Gaza is now more than 60,000 according to local health authorities, while the United Nations says dozens of people have died in recent weeks because of starvation.

Israel’s campaign began after Hamas, which Australia has designated as terror group, attacked Israel on October 7, 2023, killing 1200 people and taking 250 hostage.

Justice Riggs has reserved her decision until 10am on Saturday.

Relief in Southeast Asia as Trump’s tariffs level field

Southeast Asian countries are breathing a sigh of relief after the US announced tariffs on their exports that were far lower than threatened and levelled the playing field with a rate of about 19 per cent across the region’s biggest economies.

US President Donald Trump’s global tariffs offensive has shaken Southeast Asia, a region heavily reliant on exports and manufacturing and in many areas boosted by supply chain shifts from China.

Thailand, Malaysia and Cambodia joined Indonesia and the Philippines with a 19 per cent US tariff, a month after Washington imposed a 20 per cent levy on regional manufacturing powerhouse Vietnam.

Southeast Asia – with economies collectively worth more than $US3.8 trillion ($A5.9 trillion) – had raced to offer concessions and secure deals with the United States, the top export market for much of the region.

Malaysia’s trade ministry said its rate, down from a threatened 25 per cent, was a positive outcome without compromising on what it called “red line” items.

Thailand’s finance minister said the reduction from 36 per cent to 19 per cent would help his country’s struggling economy face global challenges ahead.

“It helps maintain Thailand’s competitiveness on the global stage, boosts investor confidence and opens the door to economic growth, increased income and new opportunities,” Pichai Chunhavajira said on Friday.

The extent of progress on bilateral trade deals with the United States was not immediately clear, with Washington so far reaching broad “framework agreements” with Indonesia and Vietnam, with scope to negotiate further.

Thailand was about a third of the way there, Pichai said.

The United States on Friday slashed the tariff rate for Cambodia to 19 per cent from earlier levies of 36 per cent and 49 per cent, a major boost for its crucial garments sector.

“If the US maintained 49 per cent or 36 per cent, that industry would collapse in my opinion,” Cambodia’s Deputy Prime Minister and top trade negotiator Sun Chanthol said.

In Thailand and Malaysia, business groups cheered a tariff rate that could signal a maintenance of the status quo between rival markets, among them beneficiaries of so-called “China plus one” trade.

Much remains to be worked out by the Trump administration, including non-tariff barriers, rules of origin and what constitutes trans-shipment for the purposes of evading duties, a measure targeting goods originating from China with no or limited value added, where a 40 per cent tariff would apply.

Vietnam has one of the world’s largest trade surpluses with the United States, worth more than $US120 billion in 2024, and has been often singled out as a hub for the illegal rerouting of Chinese goods to America.

It reached an agreement in July that slashed a levy from a threatened 46 per cent to 20 per cent, but concerns remain among some businesses that its heavy reliance on raw materials and components imported from China could lead to a wider application of the 40 per cent rate.