Barnes opens Logies as host roasts TV’s biggest stars

Australian television’s night of nights opened in true working-class style with a powerhouse performance from iconic rocker Jimmy Barnes.

The star-studded crowd was on its feet early, fired up by Barnes’ performance of his hit Working Class Man, before settling in for opening remarks from returning host Sam Pang.

Pang, hosting Australian television’s night of nights for the third consecutive year, didn’t miss a beat.

“It’s inspiring that with the world in as much turmoil as it is right now, that we as an industry have not wavered in our commitment and bravery in coming together tonight to honour ourselves,” he said.

He went on to congratulate and roast each nominee for the coveted Gold Logie and some of the commercial networks’ biggest stars – from The Voice host Sonia Kruger to 20-year Today Show veteran Karl Stefanovic and former talk show queen Kerri-Anne Kennerley.

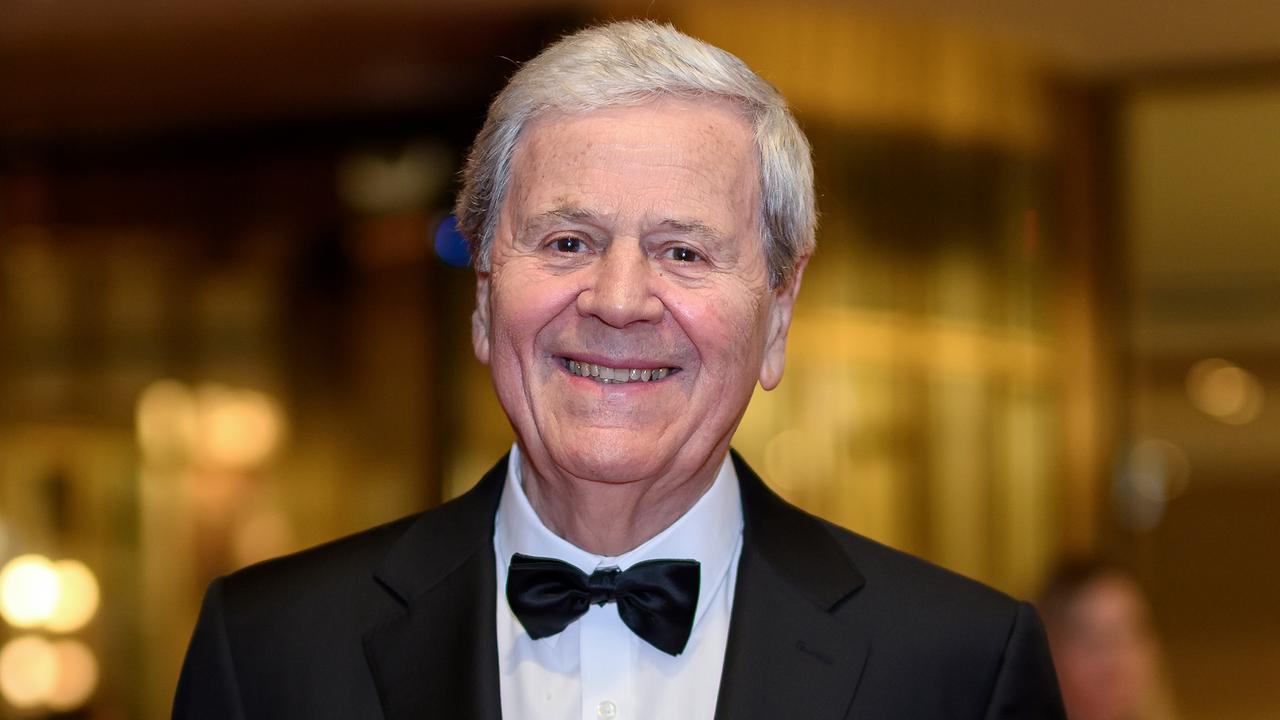

Larry Emdur, who won the Gold Logie in 2024, wasn’t spared either, with Pang cheekily noting the presenter’s absence from this year’s nominee list.

Seven’s The Voice took out the first award of the night, winning Best Entertainment Program.

Seven TV personalities are vying for the Gold Logie – 2023 winner Sonia Kruger, Ten’s I’m A Celebrity … Get Me Out Of Here! host Julia Morris, ABC’s Lisa Millar, Lynne McGranger from Home and Away, MasterChef Australia’s Poh Ling Yeow, A Current Affair host Ally Langdon and two-time Gold Logie winner Hamish Blake, host of Lego Masters.

Pang jokingly said he was eager to hear Blake’s acceptance speech if he took out the win, predicting it would be the most “awkward speech ever”.

Presenting the award for Best Children’s Program, Blake admitted he was hoping not to win, with his wife captured shaking her head when asked if she had voted for him.

“What a unique position to be in – to fear the win,” he said.

The Gold Logie nominees hit the red carpet in Sydney before the show opened, with Yeow and Morris seen sharing a laugh as they posed for photographs ahead of the ceremony.

Home and Away favourite McGranger is widely tipped to take out the top honour, as women dominated the nominations for the coveted Gold Logie.

This year marks a milestone for the actress, who stepped away from her legacy role as Irene Roberts in March.

The star glowed as she walked the carpet, hand-in-hand with her daughter Clancy.

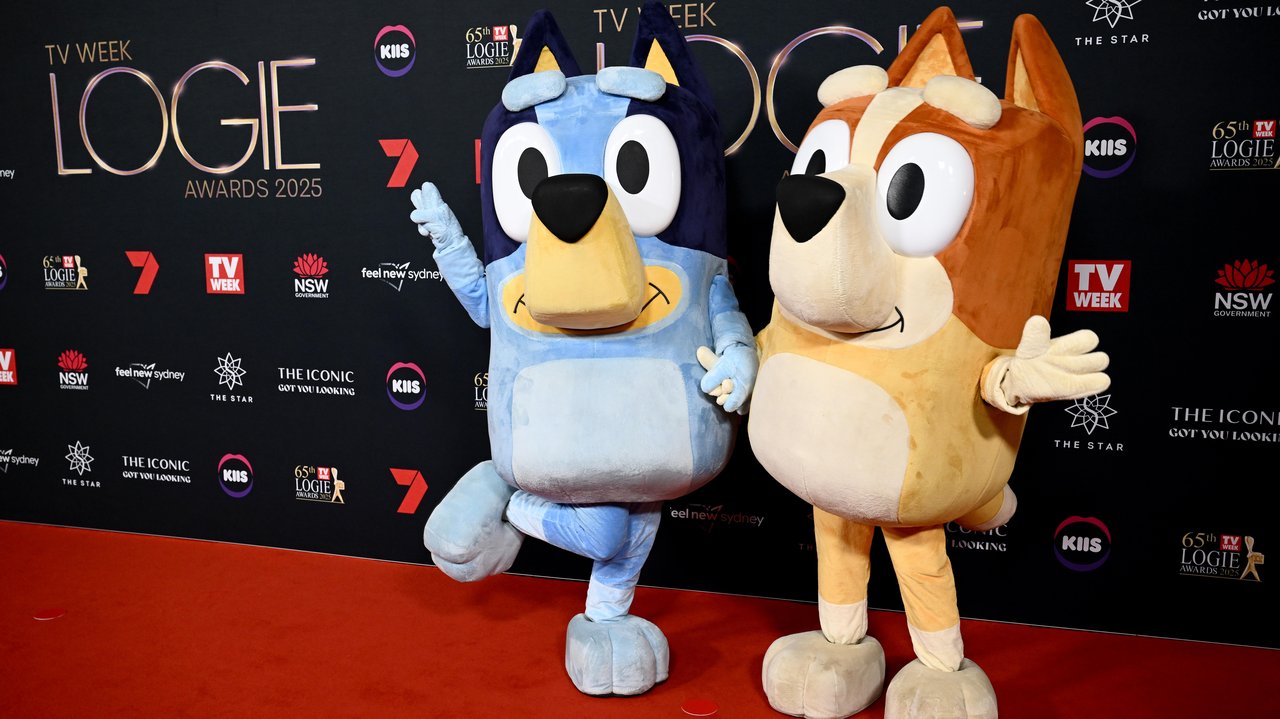

The red carpet was graced by Bandit and Chilli, stars of the beloved children’s cartoon Bluey.

The two-time Logie-winning series was an early winner, taking the Logie for the Best Children’s Program.

The awards will honour star Magda Szubanski with an induction into the Logies Hall of Fame, recognising almost 40 years of contributions to the industry.

The announcement comes just months after the Kath & Kim star revealed her stage four blood cancer diagnosis.

This year’s ceremony will also debut a brand-new gong, the Ray Martin Award for Most Popular News or Public Affairs Reporter.

The inaugural nominees are Nine’s Ally Langdon, Tara Brown, and Peter Overton, the ABC’s David Speers and Sarah Ferguson, and Seven’s Michael Usher.

In terms of other awards, eyes will surely be on the limited Netflix series Apple Cider Vinegar, which tells the story of wellness influencer and con-woman Belle Gibson.

The series received a massive eight nominations, including Best Supporting Actor, Best Supporting Actress and Best Lead Actress in a Drama.

The 65th Logie Awards are being broadcast on the Seven Network.

Stars shine on red carpet ahead of Logies

The brightest stars of Australian television are lighting up the red carpet, unfazed by torrential rain and ongoing protests that show no signs of letting up.

All eyes are on the seven TV personalities vying for the Gold Logie, including 2023 winner Sonia Kruger, Ten’s I’m A Celebrity … Get Me Out Of Here! host Julia Morris, ABC’s Lisa Millar, Lynne McGranger from Home and Away, MasterChef Australia’s Poh Ling Yeow, A Current Affair host Ally Langdon and two-time Gold Logie winner Hamish Blake, host of Lego Masters.

Most nominees have hit the red carpet in Sydney, including Yeow and Morris, who were dressed to impress and seen sharing a laugh as they posed for photographs ahead of the 65th Logie Awards.

Home and Away favourite McGranger is widely tipped to take out the top honour, as women dominated the nominations for the coveted Gold Logie.

This year marks a milestone for the actress, who stepped away from her legacy role as Irene Roberts in March.

The star glowed as she walked the carpet, hand-in-hand with her daughter Clancy.

Blake, the only man among the Gold Logie nominees, stepped onto the red carpet in a sharply tailored suit with his wife Zoe Foster Blake.

One of Australia’s favourite celebrities, Sophie Monk, turned heads in a show-stopping Hollywood-inspired gown reminiscent of Marilyn Monroe’s iconic style.

The red carpet was graced by Bandit and Chilli, stars of the beloved children’s cartoon Bluey.

The two-time Logie-winning series is once again in the running, nominated for Best Children’s Program.

There will be no shortage of entertainment as comedian Sam Pang returns to host for the third consecutive year, supported by performances from rock legend Jimmy Barnes, singer-songwriter Richard Marx, and Guy Sebastian.

Marx looked sharp as he walked the red carpet, with wife Daisy Fuentes and Aussie singer Kate Miller-Heidke.

The awards will honour star Magda Szubanski with an induction into the Logies Hall of Fame, recognising almost 40 years of contributions to the industry.

The announcement comes just months after the Kath & Kim star revealed her stage four blood cancer diagnosis.

This year’s ceremony will also debut a brand-new gong, the Ray Martin Award for Most Popular News or Public Affairs Reporter.

The inaugural nominees are Nine’s Ally Langdon, Tara Brown, and Peter Overton, the ABC’s David Speers and Sarah Ferguson, and Seven’s Michael Usher.

In terms of other awards, eyes will surely be on the limited Netflix series Apple Cider Vinegar, which tells the story of wellness influencer and con-woman Belle Gibson.

The series received a massive eight nominations, including Best Supporting Actor, Best Supporting Actress and Best Lead Actress in a Drama.

The 65th Logie Awards will begin at 7pm, broadcast on the Seven Network.

Australia due for ‘massive reckoning’ with its history

Australia needs a “massive reckoning” with the injustices of its own colonial past, human rights advocates say.

Speaking at the Garma Festival at Gulkula in northeast Arnhem Land, Aboriginal and Torres Strait Islander Social Justice Commissioner Katie Kiss said people must be mindful about political leaders favouring “practical measures” over truth-telling.

“What people don’t understand is that it’s the practical measures that got us to the situation that we’re currently in,” she said.

“We’ve got to be really mindful about that fact when we hear this narrative about truth-telling is symbolism.”

The importance of truth-telling was also highlighted by Human Rights Commission president Hugh De Kretser.

“In mainstream Australia there is a need for a massive reckoning around the injustice,” he said.

“That’s why truth-telling is so important.”

Ms Kiss pointed to youth justice legislation in the Northern Territory and Queensland, saying those jurisdictions have been wilfully opposing their human rights obligations.

“If we do not exercise our rights, they are not held accountable to them,” she said.

“If we do not challenge governments on the fact they have obligations to our rights, they will continue to violate them.”

Her comments come after Warlpiri Elder Ned Jampijinpa Hargraves called out the Northern Territory government and the NT Police at the Garma Festival.

Mr Hargraves said his community of Yuendumu had lost trust in the police after the deaths of his grandson Kumanjayi White in May, and Kumanjayi Walker in 2019.

Kumanjayi Walker was 19 when he was shot by then-constable Zachary Rolfe at close range at a home in Yuendumu.

A coronial inquest found Mr Walker’s death was preventable, and coroner Elisabeth Armitage said she could not rule out that racism may have played a part in the teenager’s death.

The Northern Territory government is yet to commit to any of the coroner’s recommendations, handed down in Yuendumu in July.

In May, the community was left reeling after the death of Kumanjayi White at a supermarket in Alice Springs.

The 24-year-old, who had a disability, died after being forcibly restrained by two plain-clothes officers.

“Kumanjayi Walker was murdered in broad daylight,” Mr Hargraves said.

“In the same way my jaja, my grandson, was done, he was killed by the law.

“The police has done enough. Enough is enough. We have to put a stop to it somewhere.”

Reading from a letter he penned to the prime minister, Mr Hargraves said Anthony Albanese had the power to turn around the outcomes for his community.

“This genocide must stop,” he said.

“We are asking you, the prime minister, to do something about it.”

Mr Albanese visited Garma for a few hours on Saturday, making a speech and meeting with senior Yolngu leaders.

He announced an economic partnership with Indigenous organisations, which he said would allow Traditional Owners to advocate for infrastructure, housing and energy projects on their land, with millions promised for First Nations clean energy projects and for native title reform.

During his speech Mr Albanese also acknowledged the work of Victoria’s truth-telling process, the Yoorrook Justice Commission, which Mr De Kretser said was good to see, and could “open the door a little” to truth-telling on a national level.

13YARN 13 92 76

Lifeline 13 11 14

Thousands pour onto iconic bridge for Gaza

One of Australia’s most iconic landmarks has become the centrepoint of public resistance to Israel’s military action in Gaza, with tens of thousands of protesters spilling onto the Sydney Harbour Bridge.

On a wet and windy Sunday, hundreds of Palestinian flags could be seen fluttering in the breeze as protesters marched to spotlight suffering in Gaza.

Rally organiser Palestine Action Group intends to draw attention to what the United Nations has described as worsening famine conditions in Gaza, as police flagged concerns of crowd crush.

Police sought an order to prohibit the protest but Supreme Court Justice Belinda Rigg rejected the application on Saturday.

With increasing concerns for public safety, the force has since permitted protesters to walk back southbound across the bridge to the Sydney CBD after the march was initially proposed to end in North Sydney’s Bradfield Park.

The bridge will remain closed to motorists for most of Sunday and the metro is out of commission with scheduled repairs.

Several Labor MPs including former NSW Labor premier and former federal foreign minister Bob Carr joined the march in defiance of Premier Chris Minns alongside multiple Greens and independent colleagues.

The premier previously warned the city would “descend into chaos” if the protest went ahead.

In a statement, Mr Carr said Australians “want the Netanyahu government’s humanitarian blockade to stop, the starvation and the killing to end”.

WikiLeaks founder Julian Assange joined Mr Carr at the rally.

First time protesters and friends Ian Robertson, 74, and Greg Mullins, 66, said they hoped their attendance could make a difference.

“The world’s gone mad,” Mr Mullins told AAP.

“I came today because I don’t want my kids telling me what were you doing when this mass murder and genocide was going on,” Mr Robertson added.

“It’s horrific and awful, we can’t bear watching it.”

Acting Police Assistant Commissioner Adam Johnson earlier warned police would take swift action against anyone who sought to hijack the peaceful protest.

“That’s our message all the time, whether it’s a public assembly or not.

“I’m talking about anyone, I’m not talking about the actual protesters specifically, but anyone, that people are expected to obey the law.”

Mr Johnson also raised safety concerns, citing the rainy conditions and the number of demonstrators.

“Crowd crush is a real thing … but in this case, the risk is the numbers are unknown,” he said.

An estimated 25,000 are believed to be on the ground in Sydney, NSW Police told AAP.

Federal Opposition leader Sussan Ley questioned the shutting down of a “critical piece of infrastructure” in Sydney.

Formerly a pro-Palestinian MP in parliament before shifting her position, Ms Ley took aim at the protest organisers and suggested the rally be moved to another location.

“I respect the right of free speech and protest, but this is taking it to another level … the protest could happen elsewhere,” Ms Ley told Sky News.

Labor backbencher Ed Husic, who has been more outspoken on ending the war on Gaza, emphasised unity.

“What we are seeing is that Australians are deeply affected by the images they are seeing out of Gaza,” he told ABC TV.

“They want to send a strong message through peaceful protests to governments, both here and abroad, that the killing has got to stop, the starvation has got to end.”

Several thousand protesters also marched through Melbourne to block a major CBD thoroughfare with many in the crowd banging pots and pans in a nod to mounting concerns about mass starvation in Gaza.

More than 60,000 Palestinians have been killed in the war in Gaza, according to local health authorities, while the United Nations says dozens of people have died in recent weeks due to starvation.

Israel’s military campaign began after militant group Hamas attacked Israel on October 7, 2023, killing 1200 people and taking more than 251 hostages.

‘Not right’: Australia urged to wind back tax breaks

Australian workers could be locked out of home ownership unless property concessions are reined in, but any reform would require careful manoeuvring from the government.

As the federal government seeks ways to reinvigorate the nation’s languishing productivity, the Australian Council of Trade Unions has urged it to reform the tax system and make housing affordable.

Tax concessions like negative gearing, which allows investors to claim deductions on losses, and the capital gains tax discount, which halves the amount of tax paid by those who sell assets owned for a year or more, have incentivised property investment and tied up capital that could otherwise be invested more productively, according to the union.

“Working people can no longer afford to live near where they work and young people are locked out of the housing market and locked into high rents,” ACTU secretary Sally McManus said.

“It’s just not right and has to change.”

The union has proposed limiting negative gearing and capital gains tax discounts to a single investment property, though those tax breaks would be grandfathered for five years on properties that already benefit, giving investors time to adjust.

Independent economist Saul Eslake, who has spent decades advocating for the abolition of negative gearing and the capital gains discount, said the ACTU’s proposal was “good policy”.

“One of the things about our tax system is it provides enormous incentives for people to invest in residential property – not so much in building more of it but in speculating that its price will go up,” he told AAP.

But reforms to property tax concessions have historically been political kryptonite for Labor.

A previous proposal to limit negative gearing contributed to the party’s narrow defeat at the 2019 election, which may not come as a surprise given about one in five taxpayers have at least one investment property and about half of them are negatively geared, Australian Taxation Office statistics have found.

While Labor won the May election in a landslide victory, Australian political orthodoxy would suggest the government may not do much with its margin and instead seek to argue for an expansive mandate at the 2028 contest when it will be prepared to take some flack.

“There’s a lot of votes at risk,” Mr Eslake said.

“But what’s the point of having political capital, if you’re not prepared to spend it?”

Treasurer Jim Chalmers appears keen to break from the political orthodoxy in pursuit of major tax reforms.

However, this will come at a cost, Mr Eslake said.

Australia’s last big tax reform – the introduction of the GST – came during a time when the Howard government had maintained a significant surplus that could be drawn down on to ensure everyone was better off.

The current government is staring down a decade of deficit, which means some people will have to be worse off.

“(But) the government can afford to alienate people who would never vote for it in the first place,” Mr Eslake said.

He says this is the implicit attitude behind such Labor policies as its proposal to lift taxes on super balances above $3 million from 15 per cent to 30 per cent, which will impact about 0.5 per cent of savers.

Dr Chalmers will convene a roundtable later in August that will focus on lifting living standards by improving productivity, building resilience and strengthening the budget.

The union has also urged the government to implement a minimum 25 per cent tax rate for individuals who earn more than $1 million and a cap on the Fuel Tax Credit Scheme for big business to ensure companies cannot claim more than $20 million in those credits.

But the Business Council of Australia has hit back, calling the proposals “ad hoc tax grabs”.

“You don’t fix Australia’s lagging productivity and investment by taxing businesses more and making Australia less competitive,” chief executive Bran Black said.

‘Genocide must stop’: Elder’s message to the PM

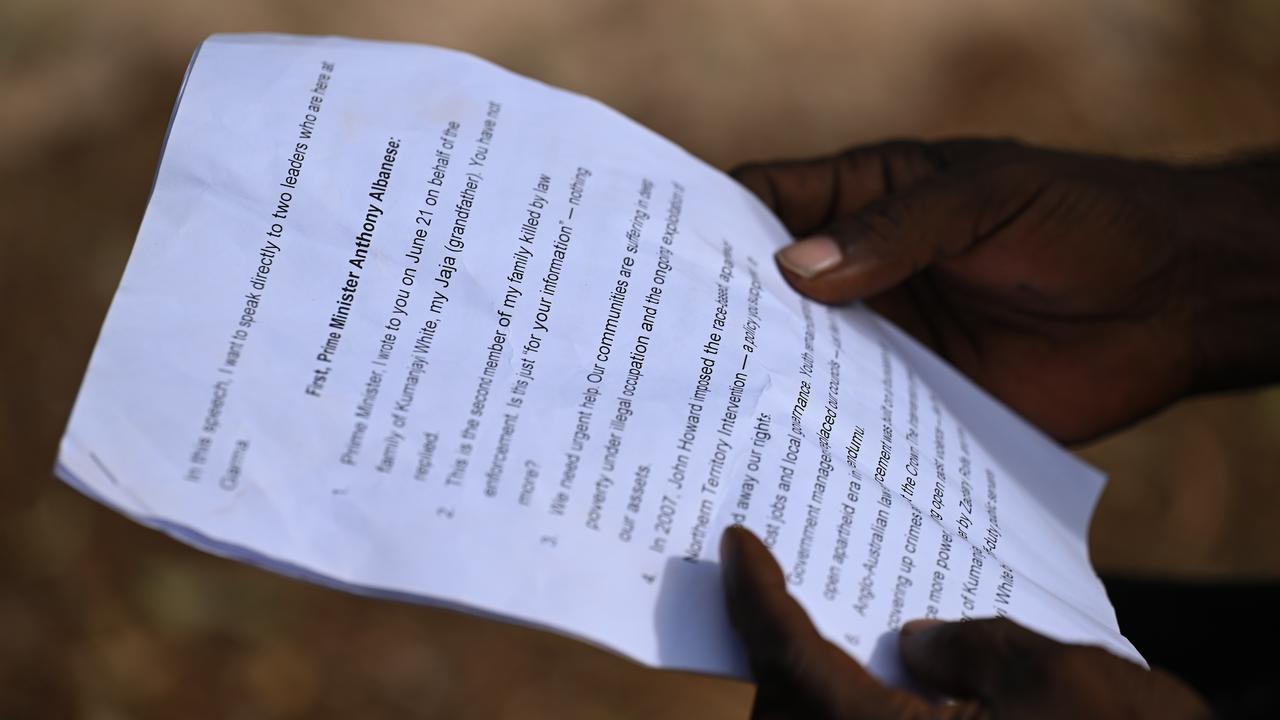

A Warlpiri Elder has delivered a powerful message for the prime minister following the deaths of two young men from his remote community.

Visiting the annual Garma Festival at Gulkula in northeast Arnhem Land, Ned Hargraves said his community of Yuendumu had lost trust in the police after the deaths of his grandson Kumanjayi White in May, and Kumanjayi Walker in 2019.

Kumanjayi Walker was 19 when he was shot by then-constable Zachary Rolfe at close range at a home in Yuendumu.

A coronial inquest found Mr Walker’s death was preventable, and coroner Elisabeth Armitage said she could not rule out that racism may have played a part in the teenager’s death.

The Northern Territory government is yet to commit to any of the coroner’s recommendations, handed down in Yuendumu in July.

In May, the community was left reeling after the death of Kumanjayi White at a supermarket in Alice Springs.

The 24-year-old, who had a disability, died after being forcibly restrained by two plainclothes officers.

“Kumanjayi Walker was murdered in broad daylight,” Mr Hargraves said.

“In the same way my jaja, my grandson, was done, he was killed by the law.

“The police has done enough. Enough is enough. We have to put a stop to it somewhere.”

Reading from a letter he penned to the prime minister Mr Hargraves said Anthony Albanese had the power to turn around the outcomes for his community.

“This genocide must stop,” he said.

“We are asking you, the prime minister, to do something about it.”

Mr Albanese visited Garma for a few hours on Saturday, making a speech and meeting with senior Yolngu leaders.

He announced an economic partnership with Indigenous organisations, which he said would allow Traditional Owners to advocate for infrastructure, housing and energy projects on their land, with millions promised for First Nations clean energy projects and for native title reform.

While Opposition Leader Sussan Ley did not attend Garma, she continued the Liberal Party’s post-election defeat listening tour through engagements with First Nations community groups in Western Australia.

“The first thing we have to do is listen, be present in regional communities, and talk to Indigenous Australians,” she told ABC Weekend Breakfast on Sunday.

“I don’t think it is good enough for the prime minister to stand there, deliver a speech with nice words, but not followed with any demonstration of real action.”

Since the death of Kumanjayi White in May, the community of Yuendumu has maintained calls for CCTV footage of the incident to be released, and an independent investigation into what occurred.

Mr Hargraves reiterated those calls when he spoke to media on Sunday.

“We cannot trust them because they, the government and the police, deny what we ask for, they don’t help us,” he said.

“All they want to do is destroy, kill our lives, kill our children, kill our people. It’s not right.”

13YARN 13 92 76

Lifeline 13 11 14

Upward spending trend unlikely to shift needle on rates

Australian spending habits will help the Reserve Bank fill in its picture of the nation’s economy, with another rate cut expected at its next board meeting amid global tariff woes.

All eyes will be on the monthly spending indicator for June as it becomes the main measure of retail trade when published by the Australian Bureau of Statistics on Tuesday.

Household spending rose 0.9 per cent in May when consumers splashed out on clothes, shoes and new vehicles with borrowing easier since the RBA began cutting rates in February.

This trend is expected to have continued in June, with Commonwealth Bank economists predicting a rise of one per cent.

The data could seal the deal for the central bank’s August interest rate decision following a rise in unemployment in June and a fall in inflation for the quarter, with the trimmed mean figure dropping from 2.9 per cent to 2.7 per cent.

RBA deputy governor Andrew Hauser on Thursday hailed the “very welcome” data, as the central bank had been searching for more evidence of inflation returning to the midpoint of its two to three per cent target band.

A host of new and increased US tariffs are expected to come into effect later in the week after nations scrambled to try lock down trade negotiations with President Donald Trump ahead of his August 1 deadline.

Australia has been spared a higher tariff and though most of its goods will continue to face a 10 per cent levy, no US trading partner has a lower rate.

This continuation is a “relief” according to AMP chief economist Shane Oliver, who noted Mr Trump has previously foreshadowed further tariffs on pharmaceuticals – one of Australia’s biggest exports to the US.

Increased tariffs on Australia’s trading partners could also have indirect impacts for the domestic financial markets.

“The surge in US tariffs still poses a significant threat to the global economy, which will likely become more evident in the months ahead,” Mr Oliver said.

Wall Street investors were feeling the pinch on Friday as new tariffs on dozens of trading partners and a surprisingly weak jobs report spurred selling pressure.

The S&P suffered its biggest daily percentage decline in more than two months, with an 8.3 per cent tumble in Amazon.com shares after it posted quarterly results but failed to meet lofty expectations for its cloud computing unit also weighing on equities.

Australian share futures dropped 32 points, or 0.37 per cent, to 16,231.

The benchmark S&P/ASX200 index on Friday dropped 80.8 points, or 0.92 per cent, to 8,662.0, while the broader All Ordinaries fell 81.9 points, or 0.91 per cent, to 8,917.1.

Profit reporting season also begins this week, with major companies such as News Corp, AMP and QBE Insurance set to reveal earnings results.

Australia urged to ‘bite the bullet’ on tax breaks

Working Australians will be locked out of home ownership unless the government winds back property tax breaks, a major union body has warned.

As the federal government seeks ways to reinvigorate the nation’s languishing productivity, the Australian Council of Trade Unions has urged the government to reform the tax system and make housing affordable.

Tax concessions like negative gearing, which allows investors to claim deductions on losses, and the capital gains tax discount, which halves the amount of tax paid by those who sell assets owned for a year or more, have incentivised property investment and tied up capital that could otherwise be invested more productively, according to the union.

“Working people can no longer afford to live near where they work and young people are locked out of the housing market and locked into high rents,” ACTU secretary Sally McManus said.

“It’s just not right and has to change.”

The union has proposed limiting negative gearing and capital gains tax discounts to a single investment property, though those tax breaks would be grandfathered for five years on properties that already benefit, giving investors time to adjust.

But such reforms have historically been political kryptonite for Labor, with a proposal to limit negative gearing contributing to its narrow defeat at the 2019 election.

Even in the aftermath of its significant election win in May, the party has largely avoided the topic and attempts at tax reform in recent years have been met with vocal opposition.

The government’s bill to lift taxes on super balances above $3 million from 15 per cent to 30 per cent has proved controversial among industry giants and the coalition.

But Ms McManus insisted the system needs to change.

“We’ve got to bite the bullet,” Ms McManus told ABC’s Insiders on Sunday.

“Otherwise we’re just saying, ‘too bad young people, you’re not going to be able to ever own a home’.”

The union has also urged the government to implement a minimum 25 per cent tax rate for individuals who earn more than $1 million and for family trusts.

Labor is preparing to host an economic roundtable later in August that will focus on lifting living standards by improving productivity, building resilience and strengthening the budget.

Unions, business representatives and a host of government and economic figures have been invited to offer their answers.

Younger Australia is facing a loneliness ‘epidemic’

A silent crisis is taking root among young Australians, with nearly half those aged 15 to 25 reporting they regularly feel lonely.

One in seven experience persistent loneliness that lasts more than two years.

The findings, from a new national report by Ending Loneliness Together, have prompted warnings loneliness is becoming endemic, exacerbated by digital isolation, rising living costs and a lack of community spaces to connect face-to-face.

“There’s a lot of misconceptions that just because young people are so much embedded within the structures of society that they shouldn’t feel lonely,” says Michelle Lim, scientific chair of Ending Loneliness Together and co-lead author of the A Call for Connection report.

“This is a huge misconception because the way we define loneliness is very much a subjective feeling of the stress that comes up to you when you feel your relationships do not meet your current social needs.”

Naoka Cheah was just settling into student life at the University of Melbourne aged 19 when COVID-19 hit, forcing her to return to Malaysia and complete much of her degree remotely.

“I went back thinking it’s probably just going to be a few months at most … not a huge impact. But I was stuck back in Malaysia for more than a year,” she says.

“It was a very unreal experience, being apart from your other students, being apart from friends … and also trying to ace those exams and not fail. I think that’s something we were all struggling with.”

Now 25 and working as a data analyst in Melbourne, Ms Cheah reflects on how her forced isolation also came with unexpected benefits.

“Initially it is a very scary experience but it pushes you to kind of face yourself,” she says.

“There’s a stigma of loneliness but it’s actually very important to then also have that time by yourself … to figure out what you actually love, what you actually hate.”

Like many young professionals in a post-COVID world, Ms Cheah now works mostly from home and makes a conscious effort to stay socially connected.

“I’m very lucky to have a team that’s very much inclusive and sociable but I will assume not everyone is lucky enough to have that environment,” she says.

“It can be very difficult to reach out. That first obstacle could be the hardest thing for people to overcome.”

Associate Professor Lim agrees that being alone is not the same as being lonely.

“By definition, young people are not often socially isolated … they’re not actually physically alone … but they are feeling very lonely,” she says.

Digital technology, while offering new ways to connect, is also part of the problem.

“We haven’t really introduced good digital literacy, not just for our children but even for us as parents. As parents we model behaviours and with the increases of digital communication, we’re not doing a great job ourselves.

“We know we have to be able to get young people to have healthy social relationships in that digital world.”

She adds that for some young Australians – particularly those from the LGBTQI community or in regional areas- digital spaces can be essential.

“They say ‘I need that digital community because I don’t have people around me that are like me’.

So there is a place for it but we haven’t quite taught young people how to navigate this very tricky social media world and digital world and how to use it for their benefit.”

Darcy Gilmour, a 25-year-old graduate from Canberra, understands this complexity all too well. Hospitalised at age 10 for two years due to rare blood disorders, he says the loneliness he experienced during and after was profound.

“That obviously created a big feeling of isolation,” he says.

“It was pretty tough.

“When I went to high school, I was just trying to reintegrate … it was a big adjustment and I also experienced a lot of loneliness there. It was like being thrown in the deep end.”

Despite being constantly surrounded by nurses, classmates and family, he still felt isolated.

“I’d never spend any time actually alone but still had that incredible feeling of loneliness,” he explains.

Mr Gilmour says those experiences have given him a deeper understanding of what true connection means.

“If I notice someone else is struggling to make friends, that’s also when I can tend to reach out a bit more because I’m able to recognise that pretty easily,” he says.

His advice is to be proactive – even when it’s hard.

“I’ve had a lot of times where you’re leading up to going to hang out with your friends and you’re, like: ‘oh, I don’t know if I’ll enjoy this. I’d rather just stay at home and just relax a bit alone and not stress’,” he says.

“But then you go out and you actually have a really good time.”

Loneliness isn’t just an emotional issue, according to Prof Lim. It has measurable impacts on mental and physical health, especially for those under financial strain or from lower socio-economic backgrounds.

“We are paying costs in other ways,” she says.

“We are very good at interventions. We’re very good at dealing with problems. We’re very good at throwing money at mental health and suicide.

“But we’re not very good at preventing these things.”

What’s needed, Prof Lim says, is systemic change: from digital education in schools to more inclusive public spaces, and support that doesn’t fall entirely on individuals or parents.

“This should be a policy that we introduce on that systems level, where we’re teaching that very actively in school, and what healthy social interaction can look like,” she says.

“We need something more than just relying on parents.”

While large-scale solutions are being debated, Prof Lim believes even small moments of connection can make a difference.

“A quick hello, a chance encounter, an act of kindness, a compliment, a shared experience or interest, a new hobby or even a funny story – these small but meaningful interactions matter,” she says.

“They spark conversation and help us feel seen and valued.”

Going for gold: female stars vie for Logies glory

Women are set to dominate television’s most glamorous night after securing all but one of the nominations for the coveted Gold Logie award.

The 65th Logie Awards will take place on Sunday, uniting the brightest stars in front of the camera and the dedicated teams behind the scenes.

Comedian Sam Pang will return as host for the third consecutive year.

Seven TV personalities are vying for the Gold Logie, including 2023 winner Sonia Kruger, Ten’s I’m A Celebrity … Get Me Out Of Here! host Julia Morris, ABC’s Lisa Millar, Lynne McGranger from Home and Away, MasterChef Australia’s Poh Ling Yeow and A Current Affair host Ally Langdon.

Two-time Gold Logie winner Hamish Blake, host of Lego Masters, is the only man in the line for TV glory.

Rock legend Jimmy Barnes, singer-songwriter Richard Marx and Guy Sebastian are among those scheduled to perform at the event.

The 65th anniversary of the Logie Awards will also see a new gong introduced, the Ray Martin Award for Most Popular News or Public Affairs Reporter.

The inaugural nominees are Nine’s Ally Langdon, Tara Brown, and Peter Overton, the ABC’s David Speers and Sarah Ferguson, and Seven’s Michael Usher.

The limited Netflix series Apple Cider Vinegar, which tells the story of wellness influencer and conwoman Belle Gibson, received a massive eight nominations, including Best Supporting Actor, Best Supporting Actress and Best Lead Actress in a Drama.

ABC’s Fisk also earned a raft of nods, including for Best Comedy and Best Actress for Kitty Flanagan.

Nominations for Best Drama Program have been dominated by Netflix and the ABC, with standout titles including the rebooted Heartbreak High on the streaming service and The Newsreader from the national broadcaster.

In the Best Comedy Entertainment Program category, the ABC and Network 10 have split the nominations, with popular shows like Hard Quiz and Have You Been Paying Attention? leading the charge.

Two-time Logie winner Bluey, the beloved children’s cartoon, is also up for another award for Best Children’s Program.

The 65th TV WEEK Logie Awards will be held in Sydney on Sunday night and broadcast on the Seven Network.