Global acts and independent artists recognised at ARIAs

Well-known music veterans and emerging independent stars were among the big winners at Australian music’s night of nights.

Melbourne-based global hard rockers Amyl and The Sniffers reaped four ARIAs at the annual ceremony in Sydney, bookending the night with the best group, best cover art, best rock album and album of the year gongs.

Up-and-coming indie producer Ninajirachi won three gongs, including best independent release, breakthrough artist and best solo artist for her inaugural album I Love My Computer.

The 26-year-old, whose stage name is a mash of her first name, Nina, and her favourite Pokémon, Jirachi, had released her first single eight years ago, and described her breakout award in 2025 as “really awesome and funny”.

“I guess a lot of people here probably have never heard of me before tonight or this year, but I put out my first album this year called I Love My Computer,” she said.

Australian house music producer and DJ Dom Dolla picked up two awards for best dance/electronic release and global impact.

“If (AC/DC lead guitarist) Angus Young’s anything to go by, I’ll have white hair ripping it out on the dance floor in like 50 years from now,” the 19-year veteran said.

The global superstar offered a tip to the next generation: show up every day and don’t worry about the destination.

Legendary Sydney rock band You Am I, which emerged in the 1990s with a distinctive garage grit and power pop hooks, entered the ARIA Hall Of Fame.

Frontman Tim Rogers urged audiences to take a punt on artists playing at small venues, not just huge international acts.

“By buying a ticket, going to those shows and taking a punt on something, something you’ve never heard of, you may be in a crowd of 12 people, but by doing that, you’re part of this great art experiment,” he said.

Indie popstar Missy Higgins won best adult contemporary for her album The Second Act, inspired by her divorce and becoming a single mum, adding to her 10 ARIAs.

“Being a 42-year-old woman and singing about divorce and single parenting isn’t like the sexiest thing you can do in this industry,” she said.

Higgins said the response to her album made her realise women her age don’t care about sexy.

“We just want to feel heard. We want to feel seen. I feel so grateful to be able to tell your stories.”

Song of the year went to Girls by The Kid Laroi, while Troye Sivan picked up best Australian live act.

Fashion-forward choices as stars walk ARIA red carpet

From graceful lace gowns to the bare-chested, musicians have strutted the red carpet with dazzling and daring fashion sense ahead of Australian music’s night of nights.

The biggest names and those emerging in Australia’s music scene arrived in style ahead of the ARIA Awards in Sydney.

Indie pop darling Missy Higgins, up for four gongs, stepped out in a colourful patchwork dress while indie producer Ninajriachi wore a black lace dress.

Tim Rogers, the frontman of legendary rock band You Am I, dazzled in a purple suit alongside band members Andy Kent, Davey Lane and Russell Hopkinson.

The Sydney band, which emerged in the 1990s with a distinctive garage grit and power pop hooks, is set to be inducted into the ARIA Hall Of Fame.

Indie techno pop duo 2charm, who also front pop group Cub Sport, turned up in black leather pants, baring their collection of tattoos on their upper body, where they did their red carpet dance to their single, boyfriend.

Cowboy hats were aplenty, with yellow Wiggle Tsehay Hawkins donning a denim and yellow country get-up, while fellow Wiggle Caterina Mete wore a red suit with patches stitched in, and original blue Wiggle Anthony Field sported chequered blue and red pants.

American country singer Kacey Musgraves walked the red carpet in a white bodice dress while in the country for her Australian tour.

Among the performers at this year’s ceremony are Baker Boy, G Flip, Missy Higgins, Thelma Plum, Alex Lahey, and British soul singer Olivia Dean.

Ninajriachi leads the contenders with eight nominations for her debut album, I Love My Computer.

The biggest prize of the night, Album of the Year, is led by an overwhelmingly female contingent.

‘Getting worse’: inquiry’s chilling child abuse warning

Horrific online sexual exploitation and physical abuse of children is getting worse as authorities concede they are struggling to protect vulnerable kids.

Federal police made the shock admission at a Senate inquiry on Wednesday, conceding they were “one step behind” pedophiles due to technology advancements.

A disturbing rise in exploitation cases was revealed as senior officers and child protection workers were grilled over incidents of abusers targeting childcare centres and kids in care.

Australian Federal Police Deputy Commissioner Ian McCartney said the complexity of online child sexual exploitation continued to grow virtually unchecked.

“I’m going to be honest … the crime of online child sexual exploitation is not getting better, it’s getting worse,” he said.

“I do not share this to scare the public, although I concede it may shock some caregivers and parents.”

The information might be confronting to hear, but people needed to be aware and ensure they were vigilant, Mr McCartney added.

“It used to take a village to raise a child,” he said.

“Because of advances in technology, it now takes a country to keep them safe.”

The Australian Centre to Counter Child Exploitation received an average of 226 reports every day, or 82,764 over the past financial year – up from 58,000 in the year prior.

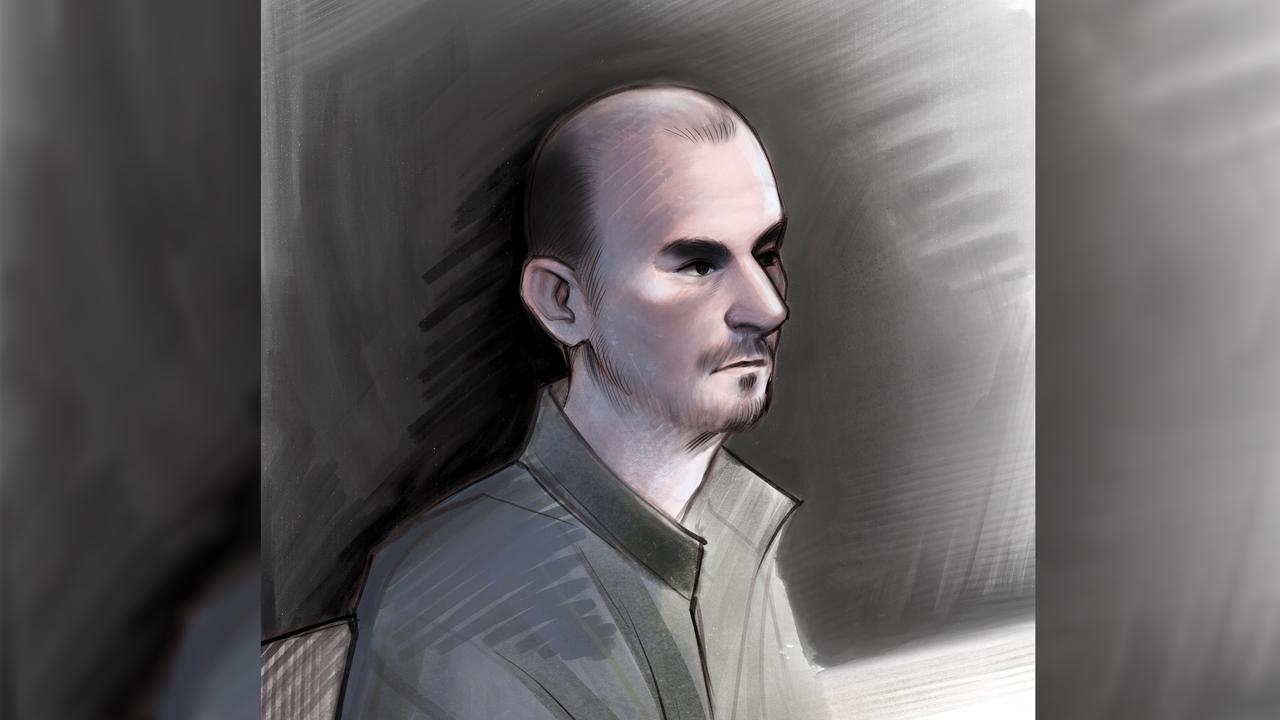

The parliamentary probe was launched after a series of vile reported incidents of abuse in childcare centres across the country, including by one of Australia’s worst pedophiles, Ashley Paul Griffith.

Griffith was jailed for a minimum of 27 years for more than 300 offences committed in daycares in Brisbane and Italy over a period spanning almost two decades.

More recently, Victorian childcare worker Joshua Dale Brown was charged with sexually abusing eight children under the age of two.

“There have been several investigations where the AFP has charged childcare workers or those who work with children with online exploitation offences,” Mr McCartney told the inquiry.

Law enforcement failed to keep pace with technology and fell behind the cyber capability of offenders, highlighted by the arrest of South Australia predator Shannon McCoole more than a decade ago, senators heard.

McCoole, a former child-protection worker, was unveiled as the head administrator of a highly sophisticated global child pornography website.

He preyed on boys and girls aged between 18 months and three years and ran an international abuse ring through the Dark Web.

While criminals and pedophiles exploited every loophole and technology advancement, Mr McCartney said investigators remained constrained by legislation and privacy guidelines.

“The environment has changed exponentially, in terms of the threat, but also tools that are out there … we’re always going to be, unfortunately, one step behind,” he said.

Authorities have been pursuing prevention campaigns by partnering with social media platforms like Snapchat, the inquiry was told.

Popular social media influencers have been recruited to deliver messaging on sextortion and online grooming.

“It was really aiming at young boys … using influencers that have strong followership with young girls and young boys, trying to be a bit more innovative there,” AFP’s Commander Helen Schneider said.

“Probably one of the most important partnerships we have is making sure, knowing this is a global crime, and we need to take a borderless approach.”

The inquiry continues.

Crowe toasts talkback titan for platforming ‘voiceless’

Russell Crowe has celebrated the life of influential broadcaster John Laws, declaring he “platformed the voiceless and let them be heard”.

Laws, one of Australia’s most influential and controversial broadcasters whose career spanned seven decades, was farewelled at a state funeral after dying peacefully on November 9, aged 90.

Prominent leaders including former prime minister John Howard, renegade MP Barnaby Joyce and NSW Premier Chris Minns packed into Sydney’s St Andrew’s Cathedral, along with fellow broadcasters Richard Wilkins and Ben Fordham.

Hollywood actor Crowe, who was a neighbour of Laws’ and delivered a eulogy at the funeral, said the broadcaster’s famous show-ending tagline – “be kind to each other” – summed up his true priorities.

“We hardly ever agreed on anything,” he told fellow mourners.

“From bike lanes to politics, we were quite often on opposite sides of any issues.

“However, we did agree that we liked each other’s company, and our different perspectives never stopped us from making each other laugh.”

Fellow neighbour Paul Warren noted Laws had interviewed a whopping 16 prime ministers on radio.

“All of them knew they were about to face one of the sharpest minds in Australia,” he said.

Laws’ famed golden microphone, given to him by 2UE management in an effort to woo the ratings juggernaut, held pride of place alongside his coffin in the cathedral.

Tributes have flowed since his death including from many past and present politicians, with Prime Minister Anthony Albanese labelling the broadcaster as “an iconic Australian”.

Along with Mr Albanese, former prime ministers Paul Keating and John Howard have spoken glowingly of Laws and his legendary career, with the former once calling him the “broadcaster of the century”.

“John Laws was a towering figure in Australian radio whose voice resonated across the nation for more than seven decades,” Premier Chris Minns said after his death.

“His legacy lies not only in the thousands of hours on air, but in the connection he forged with millions of Australians.”

Laws launched his radio career in Bendigo in 1953, before he joined 2UE and worked four separate stints at the Sydney station.

He also worked for 2GB, 2UW and 2SM and had short periods at Network Ten and Foxtel.

Laws’ career was not without scandal.

He and fellow radio star Alan Jones were found to have been taking cash for favourable coverage from certain brands.

The Australian Broadcasting Authority found Laws, Jones and 2UE breached the industry code 90 times and breached their station’s licence conditions five times.

Nearly 40,000 people also demanded he undergo training in 2013 as he defended an interview in which he asked a 44-year-old victim of child sex abuse whether it was “in any way your fault”.

Elon Musk back in the fold at Saudi crown prince dinner

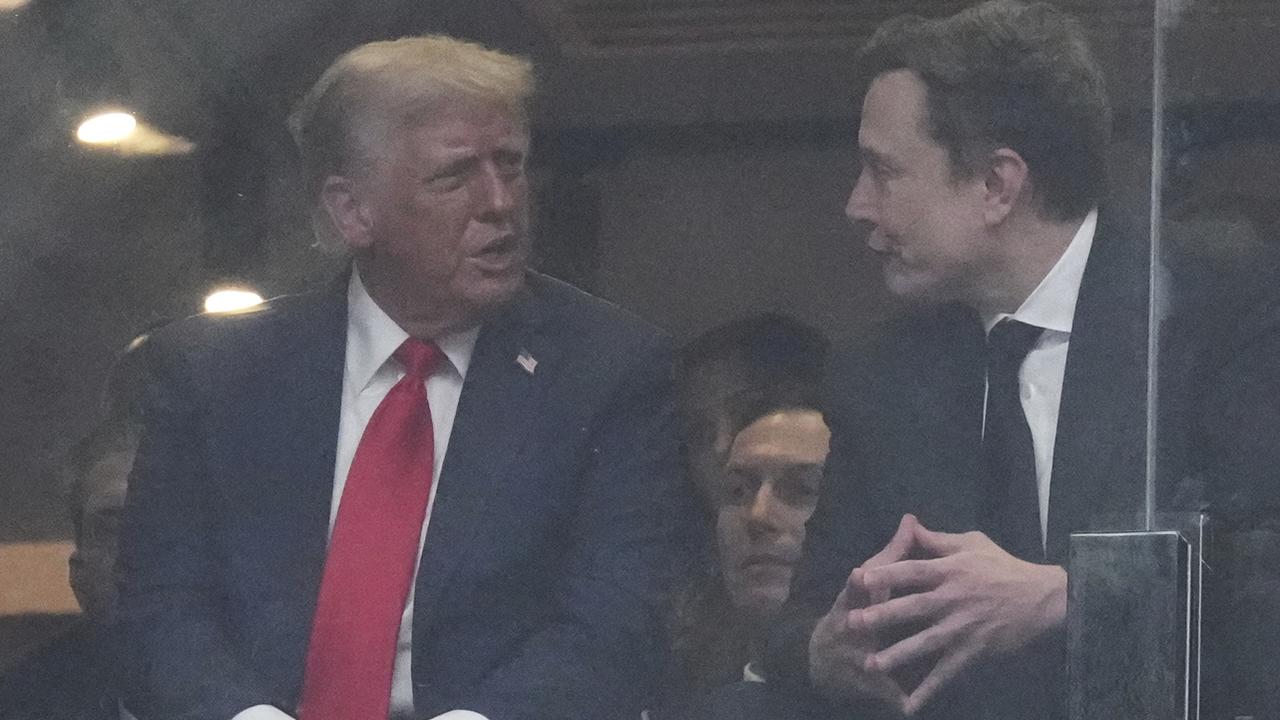

Elon Musk has joined Donald Trump and Saudi Crown Prince Mohammed bin Salman for a formal White House dinner, the second joint public appearance since a bitter public feud earlier this year.

Musk’s attendance could be a sign of reconciliation in a turbulent relationship between the Tesla CEO and the US president.

Musk supported and funded Trump’s election last year and became a close adviser to his administration early this year, leading the Department of Government Efficiency (DOGE) and overseeing cuts to federal funding and jobs.

But the two soon had a spectacular falling out.

The billionaire businessman took to social media to attack Trump’s sweeping tax and spending bill as fiscally reckless, and said he planned to create a new political party.

Trump hit back threatening to cut off the billions of dollars in subsidies that Musk’s companies received from the federal government.

The feud, along with Musk’s far-right political rhetoric, hurt Tesla’s brand image, sales and stock price, analysts have said.

Musk and Trump have rarely come together publicly since. Musk was last spotted shaking hands with Trump at a memorial for conservative activist Charlie Kirk in September.

Trump is hosting the Saudi de facto ruler as the latter seeks to rehabilitate his global image and deepen ties with Washington.

Others at the dinner included Portugal’s soccer star Cristiano Ronaldo and Nvidia CEO Jensen Huang.

Culture issues to blame for customer ripoffs: bank boss

The boss of ANZ has offered an unreserved apology for widespread misconduct including the bungling of a multibillion dollar bond sale and ripping off customers.

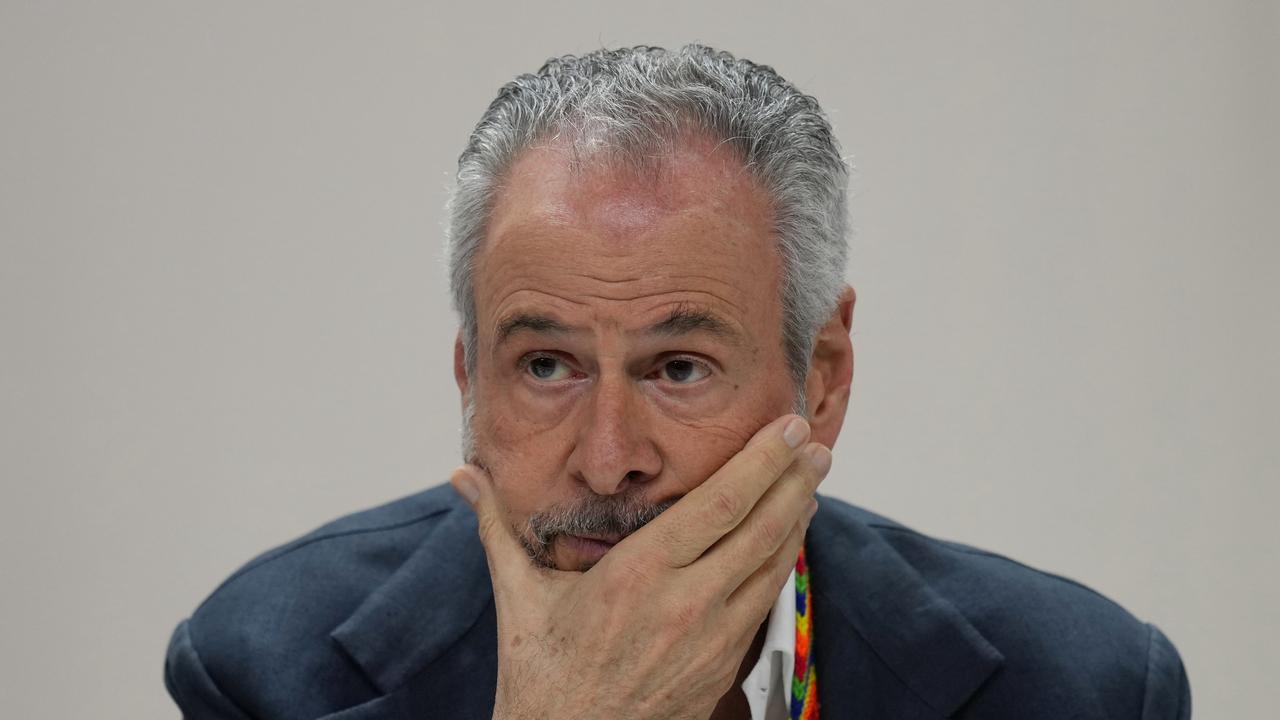

Chief executive Nuno Matos said the failures, which led to the bank being slapped with a $240 million penalty, were the result of a lack of self-awareness and a “good news culture”.

“The bank fell short of what is expected of us, and for that, I offer an unreserved apology,” he told a parliamentary inquiry into the big four banks on Wednesday.

The corporate regulator whacked ANZ with the record fine for a number of breaches, including incorrectly reporting bond trading data while managing a major government deal, which potentially cost the commonwealth $26 million.

The Australian Securities and Investments Commission (ASIC) also accused the bank of failing to respond to customer hardship notices, making false statements about savings interest rates and failing to refund fees charged to dead customers.

The company maintained the government lost nothing in the bond sale and said while ANZ breached some of its licensing obligations, it was not accused of market manipulation or over-hedging.

Despite that fine being the highest in ASIC’s history, committee chair Ed Husic said the bank got off lightly.

“It should have been higher,” the Labor MP told AAP.

ANZ also announced in 2025 it is slashing its workforce by eight per cent across its institutional and retail divisions.

Mr Matos, who only joined the bank in May, said cultural change was needed to prevent the saga happening again.

“We need to be more decisive and taking decisions today and not postpone it for tomorrow,” he said.

“We need to be more self-aware of the things we don’t do well.

“We need to execute on time and be accountable.”

National Australia Bank chief executive Andrew Irvine will also appear before the committee after Commonwealth and Westpac bosses were grilled.

Surcharges on card payments and the government’s five per cent deposit home loan scheme were on the agenda in Canberra on Tuesday.

The inquiry heard the Reserve Bank was reviewing the nation’s payment system and suggested removing surcharges on eftpos, Mastercard and Visa cards, which would save consumers more than $1 billion a year.

Commonwealth Bank chief executive Matt Comyn said he supported the proposal “in essence” but urged the RBA not to be too hasty with the changes.

Host Brazil pushes for progress on big issues at COP30

As United Nations climate talks bubble to a critical point, negotiators are being pressured to ensure that oil – along with fossil fuels coal and natural gas – won’t be burned in the future.

Although the COP30 conference is scheduled to run until Friday, the Brazilian presidency is pushing for an interconnected decision sooner on four issues that weren’t originally on the agenda.

Meanwhile, dozens of nations – rich and poor – banded together on Tuesday in a concerted call to deliver a detailed road map for the world to phase out or transition away from fossil fuels.

Former Ireland President Mary Robinson compared the talks in Belem, on the edge of the Amazon, to the climate talks that produced the landmark 2015 Paris climate agreement that set a target for limiting earth’s warming.

“This COP reminds me of Paris very much,” Robinson told The Associated Press,

“I’m hoping for as good an outcome out of this difficult environment as possible. We can get it, you know, we can get it.”

Much of it will come to a head on Wednesday, the deadline set by COP30 President André Corrêa do Lago for a decision on four issues that were initially excluded from the official agenda: whether countries should be told to toughen their new climate plans; details on handing out $US300 billion ($A461 billion) in pledged climate aid; dealing with trade barriers over climate and improving reporting on transparency and climate progress.

The issue that’s getting talked about by more than 80 nations is weaning the world from fossil fuels. Two years ago, after much debate, the UN climate talks in Dubai agreed on language for a “transition away from fossil fuels”.

But the following year the issue disappeared from view. Now, many countries are pushing for a detailed road map that would essentially give directions on how to phase out fossil fuels.

“People around the world are mobilising on a massive scale, demanding concrete action for climate justice, particularly against the expansion of fossil fuel,” said Colombia’s Environment Minister Irene Vélez Torres.

“Our categorical decision backed by science and by people has been to phase out fossil fuels. Despite being a producer country of oil and coal, we have chosen not to grant any new oil exploration contracts, nor any new coal mining titles.”

“We have to leave here with a call for a road map, there’s no other way,” she said.

Ed Miliband, the United Kingdom’s top official for energy and climate change, said the issue has united the Global South and North, “saying with one voice that this is an issue that cannot be ignored, cannot be swept under the carpet, and this is where the momentum is”.

That’s doubtful. Powerful oil-producing countries have opposed moving on a phaseout, and the United States – with President Donald Trump frequently calling climate change a “scam” – is skipping the talks.

COP30 President do Lago kicked off Tuesday’s action with a proposal that had 21 options for negotiators on four sticky and interrelated issues.

While the options in the draft text “are a first step, what’s required now is to eliminate the options that add to delay and ignore the urgency of action,” said Jasper Inventor, deputy program director of Greenpeace International.

The documents ask leaders to hash out many aspects of a potential agreement by Wednesday so that much is out of the way before the final set of decisions Friday, when the conference is scheduled to end. Climate summits routinely go past their last day as nations have to balance domestic concerns with the major shifts needed to cut greenhouse gas emissions.

Brazil President Luiz Inácio Lula da Silva was scheduled to return to Belem on Wednesday and the deadline may be timed for him to push parties together or celebrate some kind of draft.

‘Texas racially gerrymandered’ map, US court rules

A US federal court has blocked Texas from using a new congressional map intended to flip several Democratic-held US House of Representatives seats to Republicans in the 2026 midterm elections.

The court faulted Governor Greg Abbott for directing the legislature to draw it based on race.

The 2-1 ruling by a three-judge panel dealt a major blow to Texas Republicans who had been urged by President Donald Trump to redraw the boundaries of the state’s congressional districts to maximise the number of Republicans who could be elected in order to protect his party’s narrow US House majority.

The El Paso-based panel ruled in favour of civil rights groups that had challenged the map, finding that “substantial evidence shows that Texas racially gerrymandered” it.

The map was passed by the Republican-led state legislature and signed by Abbott, a Republican, in August.

The ruling criticised Abbott’s actions to meet the Trump administration’s demands, stating “the Governor explicitly directed the Legislature to redistrict based on race”.

Democrats and civil rights groups in Texas had argued the new map further diluted the voting power of racial minorities in violation of federal law.

The court ordered that the 2026 congressional elections be carried out under a previous map, approved in 2021. Republicans control 25 of 38 US House seats in Texas under that 2021 map.

Abbott said the state will appeal the decision to the US Supreme Court.

Gerrymandering involves redrawing electoral district boundaries to marginalise a certain set of voters and increase the influence of others.

The US Supreme Court in 2019 forbade federal courts from intervening in cases involving gerrymandering done for partisan advantage. Gerrymandering predominantly driven by race remains illegal.

The NAACP civil rights group noted in a statement that “the state of Texas is only 40 per cent white, but white voters control over 73 per cent of the state’s congressional seats”.

Trump has demanded that Republican-led states redraw their congressional maps to help his party retain House control. Texas was at the forefront of the push, with Abbott signing the new Republican-backed map into law on August 29 with the aim of flipping as many as five Democratic-held seats.

“Any claim that these maps are discriminatory is absurd and unsupported by the testimony offered during ten days of hearings,” Abbott said..

“This ruling is clearly erroneous and undermines the authority the US Constitution assigns to the Texas Legislature by imposing a different map by judicial edict.”

“It’s quite obvious that Texas’s effort to redistrict mid-decade, before next year’s midterm elections, is racially motivated,” the NAACP said.

“The state’s intent here is to reduce the members of Congress who represent Black communities, and that, in and of itself, is unconstitutional.”

Right to disconnect laws slashing unpaid overtime hours

Labour laws protecting workers’ free time appear to be paying dividends, with research showing employees are working less unpaid overtime.

The average full-time worker would have worked an extra $4500 per year in unpaid overtime if rates remained the same as they were before Labor’s right to disconnect laws were introduced, according to a report from the Australian Institute’s Centre for Future Work on Wednesday.

While there could be other factors at play in the reduction in unpaid overtime, report author Fiona Macdonald said the legislation appeared to be having the intended impact.

In 2023, the survey found full-time employees were working on average 6.2 hours of unpaid overtime each week.

Following the law’s implementation in 2024, that number dipped to 4.1 hours. In this year’s poll of 1001 workers, it slid further to 3.8 hours per week.

In today’s wages, that’s a drop from $13,392 in unpaid overtime per worker in 2023 to $8892 in 2025.

“Cost-of-living pressures are still impacting on people’s desire for work. So you wouldn’t expect it to be particularly dropping otherwise,” Dr Macdonald told AAP.

She speculated a rise in collective bargaining might have resulted in workers negotiating for more flexibility arrangements, which could also have contributed to reduced unpaid overtime for full-time workers.

But the opposite was true for part-time and casual workers.

Part-time workers’ unpaid overtime rose from 2.8 hours per week in 2024 to 3.7 hours per week in 2025.

Dr Macdonald said there were a number of reasons why right to disconnect laws would have been less effective for part-time workers.

For one, they have a higher tendency to work in sectors such as hospitality and retail with a higher proportion of small businesses, which have only had to comply with right to disconnect laws since August 2025.

“So I think so we might see some further reductions. But I also think there’s some systemic, structural issues with part-time work,” she said.

Part-time employees are more likely to work in precarious, insecure employment and may be less aware of their rights, for example.

Adding clauses into collective agreements to ensure overtime kicked in automatically or employers had to transparently record hours worked against hours paid could help address the issue, Dr Macdonald said.

Employment Minister Amanda Rishworth said no significant disputes were raised with the Fair Work Commission about the right to disconnect laws in their first 12 months.

She pointed to an Australian HR Institute survey showing 58 per cent of employers said the right to disconnect had improved employee engagement and productivity

Trump hosts Saudi crown prince for deal-making visit

US President Donald Trump has hosted Crown Prince Mohammed bin Salman at the White House, with the Saudi de facto ruler seeking to further deepen ties with the United States.

Making his first White House visit in more than seven years, the crown prince was greeted with a lavish display of pomp and ceremony presided over by Trump on the South Lawn, complete with a military honour guard, a cannon salute and a flyover by US warplanes.

Talks between the two leaders are expected to advance security ties, civil nuclear co-operation and multibillion-dollar business deals with the kingdom.

But there will likely be no major breakthrough on Saudi Arabia normalising ties with Israel, despite pressure from Trump for such a landmark move.

The meeting underscores a key relationship – between the world’s biggest economy and the top oil exporter – that Trump has made a high priority in his second term as the Saudi leader seeks to further rehabilitate his global image after the 2018 killing of US-based journalist Jamal Khashoggi.

The international uproar around the killing of Khashoggi, a Saudi insider-turned-critic, has gradually faded.

US intelligence concluded that bin Salman approved the capture or killing of Khashoggi at the Saudi consulate in Istanbul.

The crown prince denied ordering the operation but acknowledged responsibility as the kingdom’s de facto ruler.

The warm welcome for bin Salman in Washington DC is the latest sign that relations have recovered from the deep strain caused by Khashoggi’s murder.

Trump greeted bin Salman with a smile and a handshake on the red carpet, while dozens of military personnel lined the perimeter.

The limousine was escorted up the South Drive by a US Army mounted honour guard.

The two leaders then looked skyward as fighter jets roared overhead, before Trump led his guest inside.

Before sitting down for talks, the two leaders chatted amiably as Trump gave bin Salman a tour of presidential portraits lining the wall outside the Oval Office.

During a day of White House diplomacy, bin Salman will hold talks with Trump in the Oval Office, have lunch in the Cabinet Room and attend a formal black-tie dinner in the evening, giving it many of the trappings of a state visit.

US and Saudi flags festooned lamp posts in front of the White House.

Trump expects to build on a $US600 billion ($A922 billion) Saudi investment pledge made during his visit to the kingdom in May, which will include the announcement of dozens of targeted projects, a senior US administration official said

The US and Saudi Arabia were ready to strike deals on Tuesday for military sales, enhanced co-operation on civil nuclear energy and a multibillion-dollar investment in US artificial intelligence infrastructure, the official said on condition of anonymity.