Superpower potential: advocates urge uranium rule redo

Australia is sinking billions of dollars into an uncertain bid to become the world’s leading green hydrogen exporter, but it already has the ingredients to become a renewable energy superpower, a Canadian physician turned nuclear evangelist says.

All that is needed is the stroke of a pen to banish one rule that stands in the way.

Australia already exports enough uranium to offset the emissions of the country’s entire coal fleet, but only South Australia and the Northern Territory allow the mining of uranium ore.

Despite Western Australia boasting vast reserves of the radioactive metal, the Labor state government has had a ban on new uranium projects since 2017.

Chris Keefer, a Canadian nuclear influencer headlining the annual Diggers and Dealers mining conference in Kalgoorlie, urged a rethink, arguing it would help global emissions and the Australian economy.

“There’s been a lot of talk, and I understand that it’s gone up in smoke now, about Australia becoming a hydrogen exporter, a green energy superpower, the Saudi Arabia of hydrogen, right?” Dr Keefer told a tentful of miners and investors in the WA gold mining town.

“And it’s ignoring the fact that you already are a clean energy superpower in terms of your exports.

“So one half of Australia’s emissions are offset by its uranium exports, which are used around the world instead of, you know, a mix of coal and gas. Your entire coal fleet’s emissions are essentially offset by the uranium that you export.

“So hopefully, God willing, sense will return and you’ll be able to contribute more.”

Dr Keefer, a self-proclaimed leftie who works as an emergency room doctor in his spare time, was speaking as part of a panel discussion alongside Centre for Independent Studies energy analyst Aidan Morrison and the free market think tank’s executive director Tom Switzer.

Lifting the ban was a “no-brainer” and the best hope to decarbonise the electricity sector globally, Mr Morrison said.

It’s the first time in the conference’s 34-year history its curtain-raiser keynote has taken the form of a panel discussion.

It was scheduled before the coalition’s catastrophic federal election meltdown in May, when its nuclear power ambitions went up in flames.

Instead, Australia has been locked into what Mr Morrison labelled an unachievable net-zero pipe dream pushed by the federal Labor government.

“There is no serious intellectual defence for the prospect that we would meet the net-zero targets in 2050,” he said.

“The characterisation of this energy transition meeting resistance, I don’t think it’s quite right.

“It stopped cold, stone dead, a year or two ago.”

The only thing keeping renewable energy projects viable was vast amounts of taxpayer subsidies, he said.

Dr Keefer, tapping into his background in medicine, said the government should view the energy transition like a triage ward.

Decarbonisation is a noble goal but policymakers need to make a sober analysis about how to mobilise limited resources of money, labour and time to have the biggest impact.

That means not throwing billions of dollars at unproven green hydrogen and putting it into things such as nuclear, he said.

Decarbonising global steel production by replacing coking coal with green hydrogen would take the equivalent of the entire electricity production of the United States.

That would require about 1.2 million wind turbines; each one requiring 500 to 1500 tonnes of steel.

“So we’re just chasing our tail around and around,” Dr Keefer said.

Australia needed to be clear-eyed about how quickly decarbonisation could be achieved, he said.

The world would eventually have to come to terms that its renewables targets won’t be reached and fossil fuels would have to be burned for longer to plug the gap.

That means discussing climate adaptation.

“You know, that’s taboo to talk about adaptation to climate change, to talk about geoengineering. And so we’re delaying doing the research on it, delaying doing the infrastructure building that we need,” Dr Keefer said.

“This isn’t an argument that we do nothing to reduce carbon emissions, but it is an argument for realism, because a shared collective delusion is not going to create ideal and best policy.”

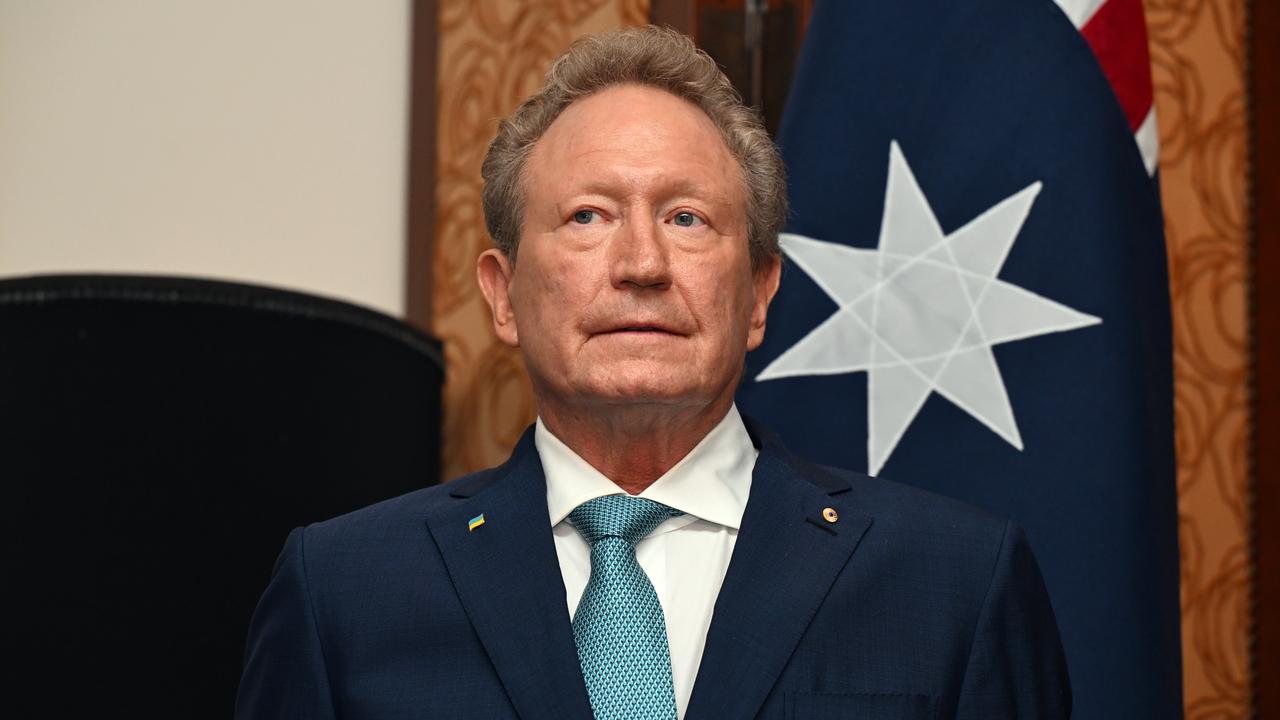

Green hydrogen true believer Andrew Forrest was recently forced to abandon two projects and asked by the government to return upfront funding grants.

His green hydrogen dream has never looked less likely.

Dr Forrest’s Fortescue Metals and the other iron ore majors are absent from the three-day conference.

Behemoths such as Fortescue, BHP and Rio Tinto have financing streams – the forum’s purpose is to connect small and mid-cap miners to funders as they look to get more speculative projects off the ground.

Uranium producers Paladin Energy and Boss Energy were hoping to attract some investor interest amid a trying time for the sector, even without the prospect of a domestic nuclear energy market evaporating.

Prices have slumped in 2025 after the emergence of Chinese AI disruptor DeepSeek challenged assumptions the technology would fuel a massive increase in global energy demand.

Uranium has rebounded slightly since but Paladin faced a further setback in late July when its Langer Heinrich mine in Namibia missed its output guidance.

Boss Energy, the second-most shorted stock on the ASX behind Paladin, suffered an even more brutal 40 per cent sell-off after it warned traders it would miss its projected output at its Honeymoon uranium mine in SA.

But chief executive Duncan Craib said the industry was at an inflection point, with rising government support globally driving renewed strength in the uranium market.

It’s not the first time the Diggers and Dealers forum has heard calls to overturn WA’s uranium ban.

The 2024 conference was gatecrashed by then-opposition leader Peter Dutton, who railed against the policy as he advocated for his ill-fated plan to build a government-owned fleet of nuclear reactors.

WA Mining Minister David Michael told AAP on Monday the government had no intention of changing the policy.

“Uranium mining is banned in Western Australia and the state government has no plans to change its existing policy,” he said.

“We know Western Australia will be a global renewable energy powerhouse into the future, and we must do everything we can to bring that industry alive.”

Democrats seek to block key vote by leaving Texas

Democratic lawmakers in Texas are leaving the state to deny Republicans the quorum needed to redraw the state’s 38 congressional districts.

Republicans are seeking to protect their narrow US House majority in next year’s midterm elections.

President Donald Trump has championed the redistricting plan, telling reporters he expects the effort to yield as many as five additional House Republicans.

Republicans hold a narrow 220-212 majority in the House of Representatives, with three Democratic seats vacant after members’ deaths.

Democratic Representative James Talarico said the redistricting plan amounted to “rigging” the 2026 elections.

“My Democratic colleagues and I just left the state of Texas to break quorum and stop Trump’s redistricting power grab,” Talarico said in the video posted on X on Sunday.

Several other Texas Democrats said on X they were headed to Illinois, whose governor is Democrat JB Pritzker.

Republican Governor Greg Abbott said in a statement on Sunday that any Democrat House member who didn’t return would be removed from the Texas House.

“Democrats hatched a deliberate plan not to show up for work, for the specific purpose of abdicating the duties of their office and thwarting the chamber’s business”, the governor said in his statement, adding that leaving amounted to an abandonment of the office.

States are required to redistrict every 10 years based on the US Census but the Texas map was passed just four years ago by the Republican-dominated legislature.

While mid-cycle redistricting occasionally takes place, it is usually prompted by a change in power at the legislature.

Republicans have pursued redistricting in a special legislative session that will also address funding for flood prevention after the deadly July 4 flash flooding that killed more than 130.

Under the current lines, Republicans control 25 seats, nearly two-thirds of the districts in a state that went for Trump last year by a 56 per cent to 42 per cent margin.

Redistricting experts have said the plan could backfire if Republicans try to squeeze too many seats out of what is already considered a significantly skewed map.

First woman appointed to lead Australian Federal Police

Australia will have its first female Australian Federal Police commissioner after Krissy Barrett was appointed to the role.

Ms Barrett will become the ninth AFP commissioner after a 25-year career in law enforcement that has included involvement in the Solomon Islands and Bali bombings investigation.

Prime Minister Anthony Albanese announced her appointment on Monday.

“Today’s announcement is a historic appointment for the Australian government and for the AFP, with Ms Barrett becoming the first woman to hold the position of commissioner,” he told reporters in Canberra.

“The role of the AFP is critical to keeping our nation safe.

“There is no greater honour than wearing the uniform of those that serve and protect Australians.”

Ms Barrett began her career with the AFP as an administrative assistant in its Melbourne office before moving up the ranks.

“I never imagined that one day I would be leading this very fine organisation,” she said.

“I promise I will be your champion, I promise I will do this uniform proud for you and to every Australian – I will be devoted to protecting you and our way of life, and I commit to working as hard as I can every single day like every AFP commissioner before me.”

Currently a deputy commissioner, Ms Barrett will replace Reece Kershaw after October 4 when he steps down after six years in the top policing role.

Mr Kershaw was commended for his work wrangling organised crime and maintaining relationships with policing organisations throughout the Pacific.

But he said the job had taken its toll on family life.

“Being a grandfather has changed me dramatically and I need to be there for my family,” Mr Kershaw said.

“Policing is such a hard profession that we work in, and we sacrifice a lot, and in particular, our family.

“It’s time for me to give back.”

White House defends firing of jobs official

White House economic advisers have on defended President Donald Trump’s firing of the head of the Bureau of Labor Statistics, rejecting criticism it could undermine confidence in official US economic data.

Trump had BLS Commissioner Erika McEntarfer sacked on Friday, despite no evidence of any wrongdoing, after a report showed hiring slowed in July and was much weaker in May and June than previously reported.

Trump, in a post on his social media platform, alleged that the figures were “RIGGED in order to make the Republicans, and ME, look bad”.

Trump again criticised McEntarfer on Sunday, saying he would name a new commissioner in the next three or four days.

US Trade Representative Jamieson Greer told CBS that Trump had “real concerns” about the BLS data, while Kevin Hassett, director of the National Economic Council, said the president “is right to call for new leadership”.

Hassett said on Fox News Sunday the main concern was Friday’s BLS report of net downward revisions showing 258,000 fewer jobs had been created in May and June than previously reported.

Trump accused McEntarfer of faking the jobs numbers, without providing any evidence of data manipulation.

The BLS compiles the closely watched employment report as well as consumer and producer price data.

The BLS gave no reason for the revised data but noted “monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors”.

McEntarfer’s firing added to growing concerns about the quality of US economic data and came on the heels of a raft of new tariffs on dozens of trading partners, sending global stock markets tumbling as Trump presses ahead with plans to reorder the global economy.

Critics, including former leaders of the BLS, slammed Trump’s move and called on Congress to investigate McEntarfer’s removal, saying it would shake trust in a respected agency.

“It undermines credibility,” said William Beach, a former BLS commissioner and co-chair of the group Friends of the BLS.

“There is no way for a commissioner to rig the jobs numbers,” he said on CNN’s State of the Union.

Former Treasury Secretary Larry Summers also criticised McEntarfer’s firing.

“This is a preposterous charge. These numbers are put together by teams of literally hundreds of people following detailed procedures that are in manuals,” Summers said on ABC’s This Week.

Global consortium has Whyalla steelworks in its sights

A huge international consortium has the Whyalla steelworks in its sights with a string of bidders lining up to take over the ailing manufacturing plant.

Australia’s largest steelmaker BlueScope has formed a consortium with companies from Japan, South Korea and India to bid for the plant.

Earlier in 2025 the South Australian steelworks received a $2.4 billion government bailout package to help keep it afloat and save jobs.

BlueScope on Monday announced it had entered into a collaboration agreement with South Korean steelmaker POSCO, Japan’s Nippon Steel and India’s JSW Steel conglomerate to take part in the sale process.

“The consortium has identified Whyalla as a prospective location for future production of lower emissions iron in Australia for both domestic and export markets, with the potential to play an important role in the decarbonisation of the global steelmaking industry,” BlueScope said.

SA Premier Peter Malinauskas said on Monday more than 15 national and international parties had passed the final expression-of-interest phase in a positive sign for the steelmaker’s transition to new ownership.

Sales advisor 333 Capital reported interest from credible parties around the world and would now move to solicit indicative bids from shortlisted parties that expressed interest, with no preferred bidder at this stage.

“The state government’s objective has been to transition the ownership of the steelworks to a new credible owner who can invest in Whyalla’s future,” Mr Malinauskas said in a statement.

“This strong interest is a positive sign for the future of the Whyalla Steelworks and for the future of sovereign steelmaking capability in Australia.”

Together, the consortium represents a market capitalisation – or total trading value – of $115 billion, giving it deep pockets for any successfully completed transaction.

Emissions reduction ‘central’ to boosting productivity

An answer to Australia’s languishing productivity lies in its response to the threat of climate change, an independent government advisory body has found.

Adapting to growing climate-related risks while also reducing emissions and transitioning to clean energy will enable higher productivity growth and living standards, according to an interim report by the Productivity Commission.

The findings come as Treasurer Jim Chalmers prepares to convene a roundtable in search of a solution to the nation’s lagging productivity.

“Australia’s net zero transformation is well under way,” commissioner Barry Sterland said.

“Getting the rest of the way at the lowest possible cost is central to our productivity challenge.”

By minimising the costs of reducing emissions through careful policy design, resources would be freed up for more productive activities, the interim report found.

It recommended ensuring incentives to invest in technology that can achieve reductions.

The Renewable Energy Target and the Capacity Investment Scheme, for example, will not support new investment in renewables after 2030, which means new market-based incentives should be implemented to eventually replace them.

The report also recommends incentivising heavy vehicle operators to reduce emissions.

Long-overdue reforms to Australia’s main environment law would also better protect the natural world by introducing national standards and improving regional planning, while speeding up approvals for infrastructure to make energy cheaper.

Though Australia has already set targets to cut greenhouse gas emissions 43 per cent by 2030 and achieve net zero emissions by 2050, the interim report found Australia will face significant climate-related risks regardless of emissions reductions.

This means adapting to climate change is integral to growing productivity.

The government has been urged to boost resilience to climate perils, which would lower the cost of disaster recovery and help maintain quality of life while Australia grapples with the impacts of climate change.

Australians’ homes in particular must become better adapted to climate risks, prompting the Productivity Commission to call for a housing resilience rating system and resources to help households, builders and insurers more easily identify upgrades.

Dr Chalmers’ roundtable will convene later in August and some invited to attend have already called for similar reforms.

Former Treasury secretary Ken Henry in July urged the government to overhaul the nation’s environment laws or risk Australia missing its most important economic goals.

Electric expectations as mining conference goes nuclear

The Diggers and Dealers mining forum will take on a radioactive yellow hue as uranium miners take centre stage on opening day.

While goldminers dominate the speaking program of the three-day mining industry networking fest, uranium will be the focus of the curtain-raiser keynote on Monday morning.

For the first time in the conference’s 34-year history, the keynote will take the form of a panel discussion.

Canadian physician turned nuclear evangelist Chris Keefer has been flown into the Western Australian gold-mining town of Kalgoorlie, alongside Centre for Independent Studies energy analyst Aidan Morrison and the free market think tank’s executive director Tom Switzer.

The panel was scheduled before the coalition’s catastrophic federal election meltdown in May, when their nuclear power ambitions went up in flames.

But Diggers chairman Jim Walker says the setback doesn’t dim the importance of the topic.

As Australia grapples with the question of how to power its energy transition, it’s worth listening to an international perspective, he says.

“Look, we’ve seen a change going from diesel-powered submarines to nuclear-powered submarines,” he told AAP.

“We are non-political, all right. We are definitely non-political. We just thought, from the interest we’ve had from miners around the place asking the question about where we’re going to get our power from, let’s grab hold of these people and let them give their presentation.”

Paul Hemburrow, chief operating officer of the ASX’s largest dedicated uranium miner, Paladin Energy, will try to drum up investor interest as he follows up the keynote with the first presentation of the forum.

Even without the evaporated prospect of a domestic nuclear market, it’s been a tricky time for the uranium sector.

Prices have slumped in 2025 after the emergence of Chinese AI disruptor DeepSeek challenged assumptions that the technology would fuel a massive increase in energy demand globally.

Uranium has rebounded slightly since but Paladin faced a further setback in late July when its Langer Heinrich mine in Namibia missed its output guidance.

Traders dumped shares in the Perth-based miner, which is down nearly 21 per cent since the start of 2025.

Paladin has taken the title of the most shorted stock on the ASX, while second-placed Boss Energy suffered an even more brutal 40 per cent sell-off after it warned traders it would miss its projected output at its Honeymoon uranium mine in South Australia.

Boss Energy chief executive Duncan Craib will be second cab off the rank to deliver a presentation at Diggers.

The previous prime target for short sellers – lithium miners – will be feeling slightly more bullish as they look to revive interest in the industry at the forum.

There is increasing optimism that prices for the battery ingredient may have bottomed out following a dire three-year bear market, as China looks to stamp out oversupply.

Lynne McGranger wins Gold Logie

Australian television royalty Lynne McGranger has claimed the coveted Gold Logie.

It marks a milestone year for the 72-year-old, who stepped away from her iconic role as Irene Roberts on the cult-hit Home and Away in March, ending a decades-long chapter in Australian TV history.

“I am thrilled and honoured,” she said moments after accepting the award, beaming with emotion.

Six other TV personalities were vying for the Gold Logie – 2023 winner Sonia Kruger, Ten’s I’m A Celebrity … Get Me Out Of Here! host Julia Morris, ABC’s Lisa Millar, MasterChef Australia’s Poh Ling Yeow, A Current Affair host Ally Langdon and two-time Gold Logie winner Hamish Blake, host of Lego Masters.

Magda Szubanski earlier took centre stage – via video – as she was inducted into the Logies Hall of Fame.

The beloved comedian and actor recently revealed her diagnosis of stage four blood cancer and was unable to attend the awards.

True to form, Szubanski worked her audience with tears and laughs as she accepted her honour in a pre-recorded speech, adding her award was in no way due to her cancer.

“I am getting this because of 40 years of hard work. Lobbying, bribing, threatening, whatever it took, whatever it took. Finally it has all paid off,” she said.

She ended her speech by removing her beanie to reveal a clean-shaven head and joking she had her “hair done specifically so it would match” her Gold Logie.

“The Australian TV industry is a terrific industry to work in and it is chock-a-block full of really good people, a few rogues but mostly really good people,” she said.

Szubanski, best known for her beloved role as Sharon Strzelecki in the comedy series Kath & Kim, received a standing ovation.

Fisk was one of the night’s biggest winners, taking home five Logie Awards, including Best Scripted Comedy Program.

Kitty Flanagan clenched the Silver Logie for Best Lead Actress in a Comedy, while Glenn Butcher claimed Best Supporting Actor, and Aaron Chen won the Silver Logie for Best Lead Actor in a Comedy.

Julia Zemiro rounded out the sweep with the Silver Logie for Best Supporting Actress.

Tennis star Jelena Dokic also delivered an emotional acceptance speech after winning the Logie for Best Factual or Documentary Program for Unbreakable: The Jelena Dokic Story.

Based on her book of the same name, the powerful documentary traces Dokic’s journey from refugee to tennis champion, while confronting the trauma of her abusive relationship with her father.

Journalist Ally Langdon was all smiles as she accepted the inaugural Ray Martin Award for Most Popular News or Public Affairs Presenter.

The award was presented by Martin, who said he was honoured to be recognised with the tribute, adding he had never seen journalism more under siege than it is today.

Gold Logie nominee Langdon, who hosts Nine’s A Current Affair, thanked the media veteran for his service to news in Australia.

Langdon was also part of the Channel Nine team that won the Logie for Best Sports Coverage for the 2024 Paris Olympics.

Travel Guides claimed its fourth Logie, taking out the award for Best Lifestyle Program, while LEGO Masters was named Best Competition Reality Program.

New Zealand comedian and Guy Mont Spelling Bee host Guy Montgomery won the coveted Graham Kennedy Award for Most Popular New Talent.

Iconic rocker Jimmy Barnes earlier kicked off the night in true style with a powerhouse performance of his hit Working Class Man, before settling in for opening remarks from returning host Sam Pang.

Pang, hosting for the third consecutive year, didn’t miss a beat.

“It’s inspiring that with the world in as much turmoil as it is right now, that we as an industry have not wavered in our commitment and bravery in coming together tonight to honour ourselves,” he said.

He went on to congratulate and roast each nominee for the coveted Gold Logie and some of the commercial networks’ biggest stars – from The Voice host Sonia Kruger to 20-year Today Show veteran Karl Stefanovic and former talk show queen Kerri-Anne Kennerley.

Bluey was an early winner, taking the Logie for the Best Children’s Program.

The 65th Logie Awards are being broadcast on the Seven Network.

Standing ovation as Magda enters Logies Hall of Fame

Magda Szubanski has taken centre stage at television’s night of nights – via video – as she was inducted into the Logies Hall of Fame.

The beloved comedian and actor recently revealed her diagnosis of stage four blood cancer and was unable to attend the awards.

True to form, Szubanski worked her audience with tears and laughs as she accepted her honour in a pre-recorded speech.

Szubanski joked her award was in no way due to her cancer.

“I am getting this because of 40 years of hard work. Lobbying, bribing, threatening, whatever it took, whatever it took. Finally it has all paid off,” she said.

She ended her speech by removing her beanie to reveal a clean-shaven head and joking she had her “hair done specifically so it would match” her Gold Logie.

“The Australian TV industry is a terrific industry to work in and it is chock-a-block full of really good people, a few rogues but mostly really good people,” she said.

Szubanski, best known for her beloved role as Sharon Strzelecki in the comedy series Kath & Kim, received a standing ovation.

Tennis star Jelena Dokic also delivered an emotional acceptance speech after winning the Logie for Best Factual or Documentary Program for Unbreakable: The Jelena Dokic Story.

Based on her book of the same name, the powerful documentary traces Dokic’s journey from refugee to tennis champion, while confronting the trauma of her abusive relationship with her father.

“This is not about winning. This is about a win for victims and survivors, especially of domestic violence and mental health,” she said.

Journalist Ally Langdon was all smiles as she accepted the inaugural Ray Martin Award for Most Popular News or Public Affairs Presenter.

The award was presented by Martin, who said he was honoured to be recognised with the tribute, adding he had never seen journalism more under siege than it is today.

Gold Logie nominee Langdon, who hosts Nine’s A Current Affair, thanked the media veteran for his service to news in Australia.

Langdon was also part of the CHannel Nine team that won the Logie for Best Sports Coverage for the 2024 Paris Olympics.

Travel Guides claimed its fourth Logie, taking out the award for Best Lifestyle Program, while LEGO Masters was named Best Competition Reality Program.

New Zealand comedian and Guy Mont Spelling Bee host Guy Montgomery won the coveted Graham Kennedy Award for Most Popular New Talent.

Iconic rocker Jimmy Barnes earlier kicked off the night in true working-class style with a powerhouse performance of his hit Working Class Man, before settling in for opening remarks from returning host Sam Pang.

Pang, hosting for the third consecutive year, didn’t miss a beat.

“It’s inspiring that with the world in as much turmoil as it is right now, that we as an industry have not wavered in our commitment and bravery in coming together tonight to honour ourselves,” he said.

He went on to congratulate and roast each nominee for the coveted Gold Logie and some of the commercial networks’ biggest stars – from The Voice host Sonia Kruger to 20-year Today Show veteran Karl Stefanovic and former talk show queen Kerri-Anne Kennerley.

Seven TV personalities are vying for the Gold Logie – 2023 winner Sonia Kruger, Ten’s I’m A Celebrity … Get Me Out Of Here! host Julia Morris, ABC’s Lisa Millar, Lynne McGranger from Home and Away, MasterChef Australia’s Poh Ling Yeow, A Current Affair host Ally Langdon and two-time Gold Logie winner Hamish Blake, host of Lego Masters.

Home and Away favourite McGranger is widely tipped to take out the top honour, as women dominated the nominations for the coveted Gold Logie.

Bluey was an early winner, taking the Logie for the Best Children’s Program.

The 65th Logie Awards are being broadcast on the Seven Network.

Ally Langdon wins inaugural Ray Martin news Logie award

Acclaimed Australian journalist Ally Langdon was all smiles at the Logies as she accepted the inaugural Ray Martin Award for Most Popular News or Public Affairs Presenter.

The award was presented by Martin, who said he was honoured to be recognised with the tribute, adding he had never seen journalism more under siege than it is today.

Gold Logie nominee Langdon, who hosts Nine’s A Current Affair, thanked the media veteran for his service to news in Australia.

“I think for a lot of us in this industry, you are a big part of why we got into it. Thank you so much for just showing and being that guiding light,” Langdon said.

Tennis star Jelena Dokic earlier delivered an emotional acceptance speech after winning the Logie for Best Factual or Documentary Program for Unbreakable: The Jelena Dokic Story.

Based on her book of the same name, the powerful documentary traces Dokic’s journey from refugee to tennis champion, while confronting the trauma of her abusive relationship with her father.

“This is not about winning. This is about a win for victims and survivors, especially of domestic violence and mental health,” she said.

“To not just to have heard but for them to reclaim their life, to find their voice and not just survive but to thrive.”

Travel Guides claimed its fourth Logie, taking out the award for Best Lifestyle Program and solidifying its place as a fan favourite.

Family favourite LEGO Masters was named Best Competition Reality Program.

Host and reluctant Gold Logie nominee Hamish Blake was elated by the win, joking that this one was “OK to win”.

“This is fine because it is a team effort, team show,” he said.

New Zealand comedian and Guy Mont Spelling Bee host Guy Montgomery won the coveted Graham Kennedy Award for Most Popular New Talent.

Comedian and actor Magda Szubanski is being inducted into the Logies Hall of Fame, recognising almost 40 years of contributions to the industry.

The announcement comes just months after the Kath & Kim star revealed her stage four blood cancer diagnosis.

Iconic rocker Jimmy Barnes earlier kicked off the night in true working-class style with a powerhouse performance.

The star-studded crowd was on its feet early, fired up by Barnes’ performance of his hit Working Class Man, before settling in for opening remarks from returning host Sam Pang.

Pang, hosting for the third consecutive year, didn’t miss a beat.

“It’s inspiring that with the world in as much turmoil as it is right now, that we as an industry have not wavered in our commitment and bravery in coming together tonight to honour ourselves,” he said.

He went on to congratulate and roast each nominee for the coveted Gold Logie and some of the commercial networks’ biggest stars – from The Voice host Sonia Kruger to 20-year Today Show veteran Karl Stefanovic and former talk show queen Kerri-Anne Kennerley.

Larry Emdur, who won the Gold Logie in 2024, wasn’t spared either, with Pang cheekily noting the presenter’s absence from this year’s nominee list.

Seven’s The Voice took out the first award of the night, winning Best Entertainment Program.

Seven TV personalities are vying for the Gold Logie – 2023 winner Sonia Kruger, Ten’s I’m A Celebrity … Get Me Out Of Here! host Julia Morris, ABC’s Lisa Millar, Lynne McGranger from Home and Away, MasterChef Australia’s Poh Ling Yeow, A Current Affair host Ally Langdon and two-time Gold Logie winner Hamish Blake, host of Lego Masters.

Home and Away favourite McGranger is widely tipped to take out the top honour, as women dominated the nominations for the coveted Gold Logie.

This year marks a milestone for the actress, who stepped away from her legacy role as Irene Roberts in March.

The star glowed as she walked the carpet, hand-in-hand with her daughter Clancy.

The red carpet was graced by Bandit and Chilli, stars of the beloved children’s cartoon Bluey.

The two-time Logie-winning series was an early winner, taking the Logie for the Best Children’s Program.

The 65th Logie Awards are being broadcast on the Seven Network.