Price floor sends rare earths shares through the roof

Rare earths miners are backing in the government’s plan to underwrite supply, as talk of a potential price floor sends stocks soaring.

Setting a taxpayer-guaranteed minimum price for rare earths sold by Australian miners would be “well worth a look at”, Resources Minister Madeleine King said at the Diggers and Dealers mining forum at Kalgoorlie, raising hopes among producers of the critical minerals.

The weapons and electronics ingredients, with hard-to-pronounce names such as praseodymium and neodymium, have become the centre of a geopolitical tussle between China and the US.

To shore up Australian access to the minerals, the federal government in April announced it would set up a national reserve, which would include off-take agreements to buy agreed volumes of supply from producers and establish a stockpile of critical minerals.

But how that would work in practice was still being ironed out, Ms King said.

What was clear was the importance of securing supply, following China’s decision to restrict exports of rare earths in retaliation to Donald Trump’s tariffs.

“The floor price is but one means of how you establish a reserve,” Ms King told reporters on Tuesday.

“And we’ve always said this, there are many tools that can go into that … and stockpiles can take many forms, too. I think there’s sometimes a vision of it being some gargantuan pile and it’s not necessarily the case.”

Traders cheered reports of the government’s support for a price floor.

Lynas shares jumped more than five per cent, ASM surged more than fix per cent, while Arafura Rare Earths – whose Nolans project in the Northern Territory has already received more than $1 billion in government investment – rocketed more than eight per cent.

The US has grasped the importance of securing sovereign supplies of rare earths, given China controls almost the entire global market.

For aspiring vertically-integrated rare earths producer Australian Strategic Minerals, that presents an attractive opportunity.

The ASX-listed firm is busy working on getting its Dubbo mine online, but has already been inundated with orders for its South Korea processing plant.

“The Korean metals plant, particularly in recent months since those restrictions that we saw imposed by China, has had a huge influx of inquiry. So we’re busy ramping up our facility there,” ASM chief executive Rowena Smith said on Monday.

The plant is one of a few facilities outside of China capable of refining rare earths into the high-tech metals and alloys turned into magnets essential for making electronic devices.

In July, the US Department of Defence invested $US400 million in rare earths miner MP Materials, including a generous guaranteed price floor of $US110 per kilogram for neodymium and praseodymium.

The decision put a rocket under rare earth prices.

The US government had been “extremely supportive” about funding support to put an ASM facility in their jurisdiction, Ms Smith said.

Lynas, the biggest non-Chinese producer of rare earths, initially criticised the strategic reserve proposal, concerned the government would undercut it by buying at uneconomic prices.

The company’s general manager of development, Alex Logan, wouldn’t comment on the specific mechanisms floated, but said the company was “very enthusiastic about that consultation process”.

Arafura chief executive Darryl Cuzzubbo was supportive of Australia following the US lead in establishing a floor price.

“We have been advocating both with Canberra, but also publicly that the strategic reserve presents an incredible opportunity for Australia and the Australian government to show global leadership in a high-impact, low-risk way,” he said.

Despite Chinese rare earths selling for about half the $US130 per kilogram price Western producers were targeting, customers would be happy to pay the premium to avoid the risk of not having supply, Mr Cuzzubbo said.

“The downside of not having supply is massive,” he said.

“When you’ve invested billions in production lines and you’re running at below capacity, versus paying $70 extra, potentially for supply of rare earths.”

Smelter rescue bolsters nation’s critical metals future

Taxpayer rescue of two smelters avoids a “national catastrophe” but Australia must now develop a strategy to retain sovereign capability in manufacturing metals, a union urges.

Smelters in Hobart and South Australia’s Port Pirie will pivot to producing critical minerals in an ambitious modernisation supported by the bailout to protect jobs.

The federal, SA and Tasmanian governments on Tuesday announced contributions to the $135 million package for smelters operated by international producer Nyrstar.

As a result, entire communities “staring down the barrel of disaster” had been pulled from the brink, Australian Workers Union national secretary Paul Farrow said.

“To lose Nyrstar would have constituted a national catastrophe,” he said.

China was spending more on propping up its manufacturing sector than it spends on defence, he warned.

“Either we let them undercut our operations into oblivion, or we step up with a strategic national approach,” he said.

“We need to develop a better approach than playing whack-a-mole every time there’s a crisis (and) develop a long-term, national strategy to retain our smelters.”

Combined with investment by Nyrstar, the package allows the company to maintain operations while planning to potentially rebuild and modernise both its lead smelter in Port Pirie and zinc smelter in Hobart.

SA Premier Peter Malinauskas said it was an opportunity to transform the Port Pirie smelter and secure its long-term future.

“This town, this facility, has a potentially very bright and prosperous future indeed, but we know it’s going to be a journey to get there, which is why partnership is mission-critical,” he said.

“We know there is a journey in front of us to be able to tackle the challenges we see, particularly coming out of China, but we should be up-front and honest about them.”

The funding will also help fast-track feasibility studies into critical metals production.

Nyrstar will explore the potential production of essential critical minerals including antimony and bismuth at Port Pirie and germanium and indium at Hobart.

An immediate focus of the package is an antimony pilot plant in Port Pirie, which would make it the only producer of antimony metal in Australia and one of the few producers globally.

Antimony is an alloy hardener for other metals in ammunition and critical to manufacturing semiconductors found in electronics and defence applications.

Federal Industry Minister Tim Ayres said that within months, the facility should be upgraded and able to produce 15,000 tons of antimony, which is about 40 per cent of American antimony requirements.

As Australia’s only lead refiner and largest zinc refiner, Nyrstar contributes about $1.7 billion annually to Australia’s economy, supporting 1400 direct jobs and 6647 indirect jobs.

The support will also fund “asset integrity projects” including a major maintenance project in Port Pirie requiring 350 contractors and 90 suppliers, and major furnace and wharf investments in Hobart involving 200 contractors and suppliers.

The support demonstrates the strategic importance of Australian operations in “extremely challenging global market conditions”, Nyrstar global chief executive officer Guido Janssen said.

Independent Tasmanian MP Andrew Wilkie said the survival of the zinc works, along with other facilities like Liberty Bell Bay, Mt Isa and Whyalla, was “central to Australia’s economic future and national security”.

“When it comes to critical minerals and rare earth minerals in particular, Australia is remarkably well positioned to be a globally important supplier,” he said.

Mining giant Glencore faces similar challenges at its Mt Isa copper smelter and Townsville refinery, and warned it will be forced to put both facilities into care and maintenance mode – risking thousands of jobs – if it does not receive taxpayer assistance.

Households spending on non-essentials as pressures ease

Australians have been splashing out on new cars, food and electronics as price pressures ease.

Household spending rose 0.5 per cent in June on top of a one per cent increase in May as shoppers shelled out for new goods, official figures show.

Spending on furnishings and household equipment led the charge, growing by two per cent, while clothing and shoes rose by 1.6 per cent and food increased by 1.5 per cent in Australian Bureau of Statistics data released on Tuesday.

Australians spent less on alcohol and tobacco, health and eating out in June.

Compared to same month in 2024, Australians spent 7.9 per cent more on recreation and culture and 7.5 per cent more on food, with household spending overall sitting 4.8 per cent higher.

Data for the June quarter showed a third consecutive rise – of 0.7 per cent – in the volume of household spending to $217.8 billion, driven largely by non-essential purchases on things like recreation and culture, and hotels, cafes and restaurants.

The figures reflect “a steady improvement in consumer confidence as price pressures eased over the year”, the bureau’s head of business statistics Robert Ewing said.

Household spending grew in all but one Australian state or territory, with the NT experiencing the biggest rise. The only fall was in WA where it dropped 0.3 per cent.

The results were echoed by a lift in consumer confidence to its highest level in three years amid falling inflation and growing hopes of an interest rate cut.

Roy Morgan’s weekly consumer confidence index, also released on Tuesday, showed a rise of 3.9 to surpass 90 points for the first time since May 2022.

The Reserve Bank is widely tipped to cut interest rates at its August meeting after a surprise decision to leave the cash rate unchanged in July.

Australia to boost navy firepower with Japanese design

Australia will buy more than ten Japanese warships to prop up its navy as it enhances its combat fleet to project firepower deeper into the Pacific.

The Mitsubishi Heavy Industries’ Mogami-class frigate has undersea warfare and air defence capabilities, including 32 vertical launch missile slots to fire long-range missiles.

The upgraded Mogami ship will be able to carry 128 air defence missiles, four times more than the current Anzac-class frigates Australia operates and has a range of 10,000 nautical miles (18,500km), compared with the Anzac’s 6000 nautical miles (11,000km).

The ships can also be crewed by 90 sailors, significantly fewer than the 170 required to operate the Anzac-class.

“It’s a much bigger ship which is able to operate with a much smaller crew and that’s a reflection of how modern this ship is,” Defence Minister Richard Marles told reporters in Canberra on Tuesday.

It beat the German Meko-class frigate to become the biggest defence industry agreement ever struck between Japan and Australia, the minister said.

Advice from the Defence Department recommended the Japanese design due to its cost, capability and build schedule.

“The Mogami is absolutely the best ship and that was very clear in all the advice that we received,” Mr Marles said.

The Japanese ship has a life span of 40 years and can be used at sea 300 days a year, both of which outperformed the Meko.

The Mogami was also described as more compatible with Australia as it uses a US-designed weapons system compatible with missiles already in the navy’s arsenal.

Three frigates will be built in Japan, with the first arriving in Australia in 2029 before entering service in 2030.

The remaining two will be handed over by 2034.

They are part of an 11-frigate fleet, with the last eight to be built in Western Australia’s Henderson precinct.

“We want to do that as soon as possible, and we see that as occurring after the third ship,” Mr Marles said.

“It is contingent on the Henderson defence precinct being ready, but we’re confident that it will be ready.”

The frigates will utilise the Japanese design with limited modifications to facilitate a speedier transfer and mitigate any cost blowouts through customisation, Defence Industry Minister Pat Conroy said.

The expedited timeline means Australia will be able to phase out its ageing Anzac-class fleet sooner and upgrade its firepower with more reliable ships.

“This is a lesson we’ve learned from previous acquisitions and guarantees speed to capability,” Mr Conroy said.

Naval expert Jennifer Parker said the Mogami was a capable and modern warship and Japan’s industrial base had a good production rate.

But the risk of Japan exporting a major ship like this for the first time shouldn’t be underestimated, she warned, noting that the advanced ship wasn’t in production yet.

“We have to have our eyes open to the risks and ensure we have mitigations in place,” she said.

“They’ve exported coastguard ships before, but this is another level, so we need to be more involved with them in the building of the ships.”

The exact price hasn’t been announced as the Commonwealth enters contract negotiations, but $10 billion has been set aside for the project over the next decade.

A contract outlining specific timelines and costs is set to be inked in 2026.

However, the $10 billion isn’t purely for the acquisition of the three ships.

Some of the money will go toward scaling up Australian industry and components that can be used in the future frigates when they roll off the production line.

It’s part of $55 billion allocated by the government to upgrade Australia’s combat fleet over the next decade, following a landmark defence review that recommended the Navy focus on increasing its firepower and long-range strike capability.

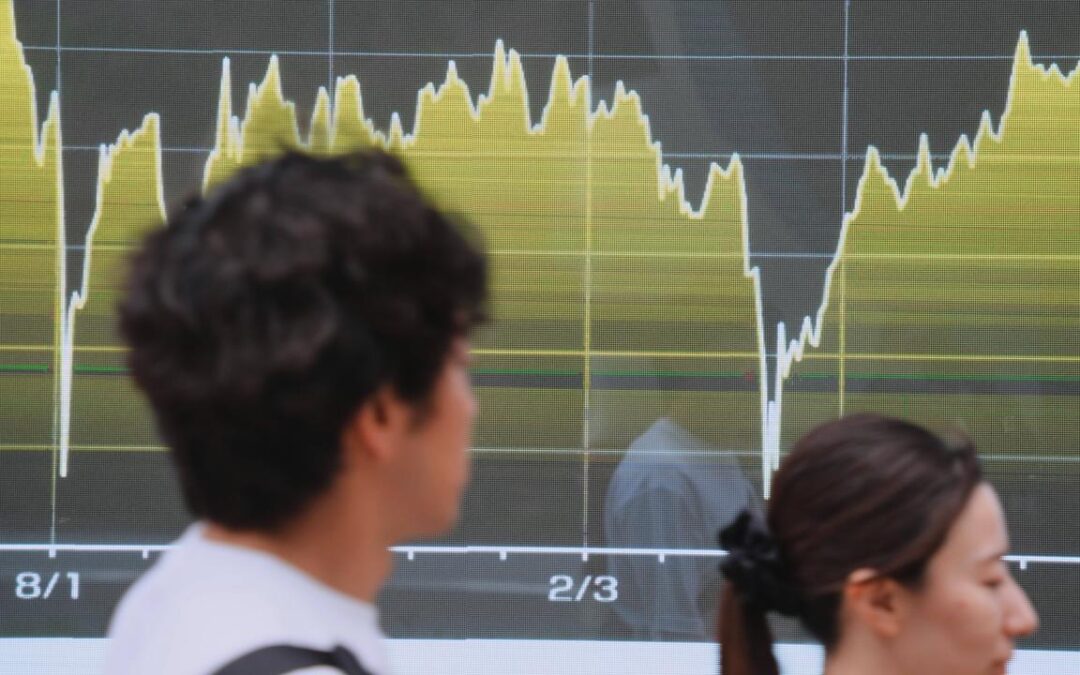

Shares in Asia rally, dollar lower against yen

Shares in Asia rose for a second consecutive session and the US dollar held most of its losses on Tuesday as investors increased bets the Federal Reserve will act to prop up the world’s largest economy.

US shares rallied on Monday on generally positive earnings reports and increasing bets for a September rate cut from the Fed after disappointing jobs data on Friday.

Oil remained lower after output increases by OPEC+ and threats by US President Donald Trump to raise tariffs on India over its Russian petroleum purchases. Japan’s Nikkei rallied, with data showing a jump in the nation’s service sector activity in July.

“There are signs of weakness in parts of the US economy, that plays to the view that maybe not in September, but certainly this year that the Fed’s still on course to ease potentially twice,” said Rodrigo Catril, senior currency strategist at National Australia Bank.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.6 per cent in early trade. The Nikkei climbed 0.5 per cent after falling by the most in two months on Monday.

The dollar dropped 0.1 per cent to 146.96 yen. The euro was unchanged at $US1.1572 ($A1.7904), while the dollar index, which tracks the greenback against a basket of major peers, edged up 0.1 per cent after a two-day slide.

Odds for a September rate cut now stand at about 94 per cent, according to CME Fedwatch, from a 63 per cent chance seen on July 28. Market participants see at least two quarter-point cuts by the end of this year.

The disappointing nonfarm payrolls data on Friday added to the case for a cut by the Fed, and took on another layer of drama with Trump’s decision to fire the head of labour statistics responsible for the figures.

News that Trump would get to fill a governorship position at the Fed early also added to worries about politicisation of interest rate policy.

Trump again threatened to raise tariffs on goods from India from the 25 per cent level announced last month, over its Russian oil purchases, while New Delhi called his attack “unjustified” and vowed to protect its economic interests.

Second-quarter US earnings season is winding down, but investors are still looking forward to reports this week from companies including Walt Disney and Caterpillar.

Tech heavyweights Nvidia, Alphabet and Meta surged overnight, and Palantir Technologies raised its revenue forecast for the second time this year on expectations of sustained demand for its artificial intelligence services.

“Company earnings announcements continue to spur market moves,” Moomoo Australia market strategist Michael McCarthy said in a note.

In Japan, the S&P Global final services purchasing managers’ index climbed to 53.6 in July from 51.7 in June, marking the strongest expansion since February.

Oil prices were little changed after three days of declines on mounting oversupply concerns, with the potential for more Russian supply disruptions providing support.

Brent crude futures were flat at $US68.76 ($A106.38) per barrel, while US crude futures dipped 0.02 per cent to $US66.28 ($A102.55) a barrel. Spot gold was slightly higher at $US3,381.4 ($A5,231.6) per ounce.

The pan-region Euro Stoxx 50 futures were up 0.2 per cent, while German DAX futures were up 0.3 per cent and FTSE futures rose 0.4 per cent. US stock futures, the S&P 500 e-minis , were up 0.2 per cent.

Bitcoin was little changed at $US114,866.06 ($A177,716.35) after a two-day rally.

Biggest ever: Japan wins Australian navy warships deal

Australia has chosen a Japanese company to build a new $10 billion frigate fleet for the navy.

Mitsubishi Heavy Industries’ Mogami-class frigate is the federal government’s preferred vessel for its future fleet over the German Meko-class frigate.

The deal is the biggest defence industry agreement ever been struck between Japan and Australia, Defence Minister Richard Marles said on Tuesday.

“There is no country in the world with whom we have a greater strategic alignment, and that is being reflected in a blossoming defence relationship,” he told reporters in Canberra.

“This decision is entirely based on the capability of the respective ships.

“This does represent a very significant moment in the bilateral relationship between Australia and Japan.”

The Mogami-class warships had a comparable cost to its competitors at acquisition but over the whole of life, the Japanese ships were cheaper, the minister added.

The frigate is also already in production, making it the only option to meet the government’s timeline.

Australia hopes to acquire its first ship in 2029 for service in 2030, according to Defence Industry Minister Pat Conroy.

It can fire more missiles at longer distances and is more inter-operable with other Australian defence assets.

The new ships will replace Australia’s older ANZAC-class frigates.

The federal government has also secured a pipeline of shipbuilding work in Western Australia, with some of the new ships to be built domestically.

It has a new agreement with Australia’s newly established strategic shipbuilder, Austal Defence Shipbuilding Australia Pty Ltd.

Australia co-ordinating on recognition of Palestine

Australia is one step closer to recognising Palestinian statehood and is co-ordinating with other nations on the issue, as the foreign minister warns there might soon be “no Palestine left”.

Canada, the UK and France have announced plans to recognise the state of Palestine at a United Nations meeting in September, amid a humanitarian crisis in Gaza.

Although the federal government has said statehood is a matter of “when, not if”, it has been hesitant to set a timeline, with the prime minister previously saying any UN resolution would need to guarantee the designated terror group Hamas played no role in the future nation.

Now, Foreign Minister Penny Wong has revealed Australia is working with other countries on recognition to ensure its concerns are met.

“We understand the urgency, we also understand the importance of having impact, we are obviously discussing and co-ordinating these issues with many countries,” she told Nine’s Today show on Tuesday.

“Everybody understands that there is a risk that there will be no Palestine left to recognise unless the international community work together towards two states.

“We want to ensure work with others to ensure that Hamas has no role in a future Palestinian state, and we do have a unique opportunity at this time with the international community to isolate Hamas.”

Prime Minister Anthony Albanese spoke with Palestinian Authority President Mahmoud Abbas on Tuesday morning, when he reiterated Australia’s commitment to a two-state solution in the Middle East that would allow Palestine and Israel to co-exist.

He also stressed the need for the immediate delivery of aid to Gaza, a permanent ceasefire and the release of all hostages.

Mr Abbas thanked Australia for its economic and humanitarian support for Gaza and agreed to meet on the sidelines of the UN General Assembly meeting starting on September 9.

More than 140 of the 193 UN member states already recognise the state of Palestine, including European Union member states Spain and Ireland.

The Australian development comes after significant pro-Palestine protests in capital cities over the weekend, including a 90,000-strong march on the Sydney Harbour Bridge on Sunday.

Australia on Monday also committed another $20 million to humanitarian aid for Gaza, as UN sources found more than two million people in the enclave were facing high levels of food insecurity.

Mr Albanese has also requested a call with his Israeli counterpart, Benjamin Netanyahu.

The crisis in Gaza began after Hamas attacked Israel on October 7, 2023, killing 1200 people and taking about 250 more hostage.

Israel’s retaliatory response has since killed more than 60,000 people, according to Gaza’s health authorities.

Israel has denied the population is facing, or succumbing to, starvation despite international human rights groups branding its offensive a genocide.

Overnight, Gaza’s health ministry said the number of people who have died from hunger since the war began has risen to 180, including 93 children.

The Australian government has taken issue with the Israeli position.

“We believe it is a breach of international law to stop food being delivered, which is the decision Israel made in March,” Senator Wong told ABC Radio.

Pro-Palestine Australians have called on the government to impose sanctions on Israel similar to those placed on Myanmar and Russia.

Senator Wong noted that Australia had sanctioned individuals for human rights abuses against Palestinians.

The government would not speculate on sanctions “for the obvious reason they have more effect if they are not flagged”.

The coalition has reiterated its support for a two-state solution, but Liberal MP Julian Leeser said recognition can only come “at the end of a process”.

“It’s wrong that we’re putting recognition on the table at this point because it removes pressure on Hamas, and I think it sends a bad signal to other areas of conflict,” he told ABC Radio.

“It’s very important that we do nothing that encourages Hamas in its activities.”

Trump threatens steeper India tariffs over Russian oil

Donald Trump says he will substantially raise tariffs on goods from India over its Russian oil purchases, while New Delhi says it will take measures to safeguard its interests and calls its targeting by the US president “unjustified.”

Trump said last week Washington was still negotiating with India on trade after announcing the US would impose a 25 per cent tariff on goods imported from the country starting last Friday.

India has faced pressure from the West, including the US, to distance itself from Moscow after Russia invaded Ukraine in early 2022. New Delhi has resisted that pressure, citing its longstanding ties with Russia and economic needs.

“India is not only buying massive amounts of Russian Oil, they are then, for much of the Oil purchased, selling it on the Open Market for big profits. They don’t care how many people in Ukraine are being killed by the Russian War Machine,” Trump said in a post on Truth Social.

“Because of this, I will be substantially raising the Tariff paid by India to the USA.”

He did not elaborate on what the tariff would be.

Over the weekend, two Indian government sources told Reuters that India will keep purchasing oil from Russia despite Trump’s threats. The sources did not wish to be identified due to the sensitivity of the matter.

Washington has cited geopolitical disagreements with India to explain why it has not yet been able to reach a trade deal with New Delhi.

Other than India’s ties with Russia, Trump has cast the BRICS group of developing nations – of which India is a key part – as hostile to the US Those nations have dismissed that accusation, saying the group promotes the interests of its members and of developing countries at large.

A spokesperson for India’s foreign ministry said India will “take all necessary measures to safeguard its national interests and economic security.”

“In this background, the targeting of India is unjustified and unreasonable,” the spokesperson added.

India began importing oil from Russia because traditional supplies were diverted to Europe after the outbreak of the Ukraine conflict, the Indian statement said.

The spokesperson said India’s imports were meant to ensure affordable energy costs for Indian consumers and were a “necessity compelled by global market situation.”

The statement also noted the West’s, particularly the European Union’s, bilateral trade with Russia: “It is revealing that the very nations criticising India are themselves indulging in trade with Russia.”

India also has been frustrated by Trump repeatedly taking credit for an India-Pakistan ceasefire that he announced on social media on May 10. The ceasefire halted days of hostilities between the nuclear-armed Asian neighbours.

India’s position has been that New Delhi and Islamabad must resolve their issues directly without outside involvement.

Trump has reached a trade deal with Pakistan.

Elsewhere, Switzerland is ready to make a “more attractive offer” in trade talks with Washington, its government said on Monday, following a crisis meeting aimed at averting a 39 per cent tariff on Swiss goods that threatens to hammer its export-driven economy.

The Federal Council – the country’s governing cabinet – said it was determined to pursue discussions with the United States, if necessary beyond the August 7 deadline that President Trump has set for the tariff to come into effect.

“Switzerland enters this new phase ready to present a more attractive offer, taking US concerns into account and seeking to ease the current tariff situation,” it said in a statement.

Switzerland counts the US as its top export market for pharmaceuticals, watches, machinery and chocolates.

States boycotting Israel to go without US federal funds

US states and cities that boycott Israeli companies will be denied federal aid for natural disaster preparedness, the Trump administration has announced, tying routine federal funding to its political stance.

The Federal Emergency Management Agency stated in grant notices posted on Friday that states must follow its “terms and conditions.” Those conditions require they certify they will not sever “commercial relations specifically with Israeli companies” to qualify for funding.

The requirement applies to at least $US1.9 billion ($A2.9 billion) that states rely on to cover search-and-rescue equipment, emergency manager salaries and backup power systems among other expenses, according to 11 agency grant notices reviewed by Reuters.

The requirement is the Trump administration’s latest effort to use federal funding to promote its views on Israel.

The Department of Homeland Security, the agency that oversees FEMA, in April said that boycotting Israel is prohibited for states and cities receiving its grant funds.

FEMA separately said in July that US states will be required to spend part of their federal terrorism prevention funds on helping the government arrest migrants, an administration priority.

The Israel requirement takes aim at BDS, the Boycott, Divestment, and Sanctions movement designed to put economic pressure on Israel to end its occupation of Palestinian territories. The campaign’s supporters grew more vocal in 2023, after Hamas attacked southern Israel and Israel invaded Gaza in response.

“DHS will enforce all antidiscrimination laws and policies, including as it relates to the BDS movement, which is expressly grounded in antisemitism,” a spokesperson for Secretary of Homeland Security Kristi Noem said in a statement.

The requirement is largely symbolic. At least 34 states already have anti-BDS laws or policies, according to a University of Pennsylvania law journal.

FEMA’s Israel requirement is “shameful,” said Mahmoud Nawajaa of the BDS Movement in a statement on Monday.

The American Jewish Committee supports the Trump administration’s policy, said Holly Huffnagle, the group’s director of antisemitism policy. The AJC is an advocacy group that supports Israel.

Under one of the grant notices posted on Friday, FEMA will require major cities to agree to the Israel policy to receive a cut of $US553.5 million ($A856.4 million) set aside to prevent terrorism in dense areas.

New York is due to receive $US92.2 million ($A142.6 million) from the program, the most of all the recipients. Allocations are based on the agency’s analysis of “relative risk of terrorism”, according to the notice.

Millions struggle to afford personal hygiene products

Millions of Australians could be living in hygiene poverty, with many struggling to afford basic items such as soap, toothpaste and deodorant.

About one in eight people recently skipped buying personal hygiene or cleaning products to afford other essentials, according to research conducted on behalf of charity Good360 Australia.

“Our research has uncovered the heartbreaking reality that millions of Australians are struggling to afford everyday basics,” managing director Alison Covington said.

Hygiene poverty occurs when people are unable to afford everyday essential products such as soap, shampoo, toothpaste, deodorant, household cleaning products and feminine hygiene products.

“Hygiene poverty can cause feelings of low self-esteem, embarrassment and shame, and make it difficult for people to maintain their health,” Ms Covington said.

“It takes a devastating toll on people’s mental and physical wellbeing.”

People unable to afford basic needs often avoid social events or commitments such as work and school, Ms Covington added.

“There should not be millions of Australians, including children, going without the basics they need to thrive,” she said.

The survey, involving a nationally representative sample of 1000 people, also found that one in seven respondents struggled to afford cleaning products in the last six months, while one in eight experienced hygiene poverty for the first time.

A further 19 per cent feared they would soon be unable to afford hygiene or cleaning products and 12 per cent of people were experiencing hygiene poverty for the first time.

Women and young people were more likely to be impacted by the issue, with almost a third of young people and 21 per cent of women concerned about affording essential hygiene and cleaning products, compared to 16 per cent of men.

Liverpool Women’s Health Centre, in Sydney’s southwest, helps more than 5000 women per year and has found personal items such as soap, deodorant and feminine hygiene products to be in high demand.

“Everyday women that you wouldn’t necessarily expect to need a deodorant or a packet of soap are taking it,” chief executive Kate Meyer told AAP.

“They’re thrilled. They come and they check our freebie table that we have set up in the reception area and their eyes light up.

“They’re so grateful to have these things that they thought that they were going to have to make do without.”

Ms Meyer said one of the centre’s elderly clients was “over the moon with gratitude” when she was given incontinence products.

“That’s horrifying for us because these are things that she needs for her everyday living,” she said.

“They shouldn’t be something that gives her such joy.

“They should be things that she’s able to get in her groceries every week.”

Good360 channels unsold consumer goods to charities and disadvantaged schools to help people in need, preventing the surplus goods from going to landfill.