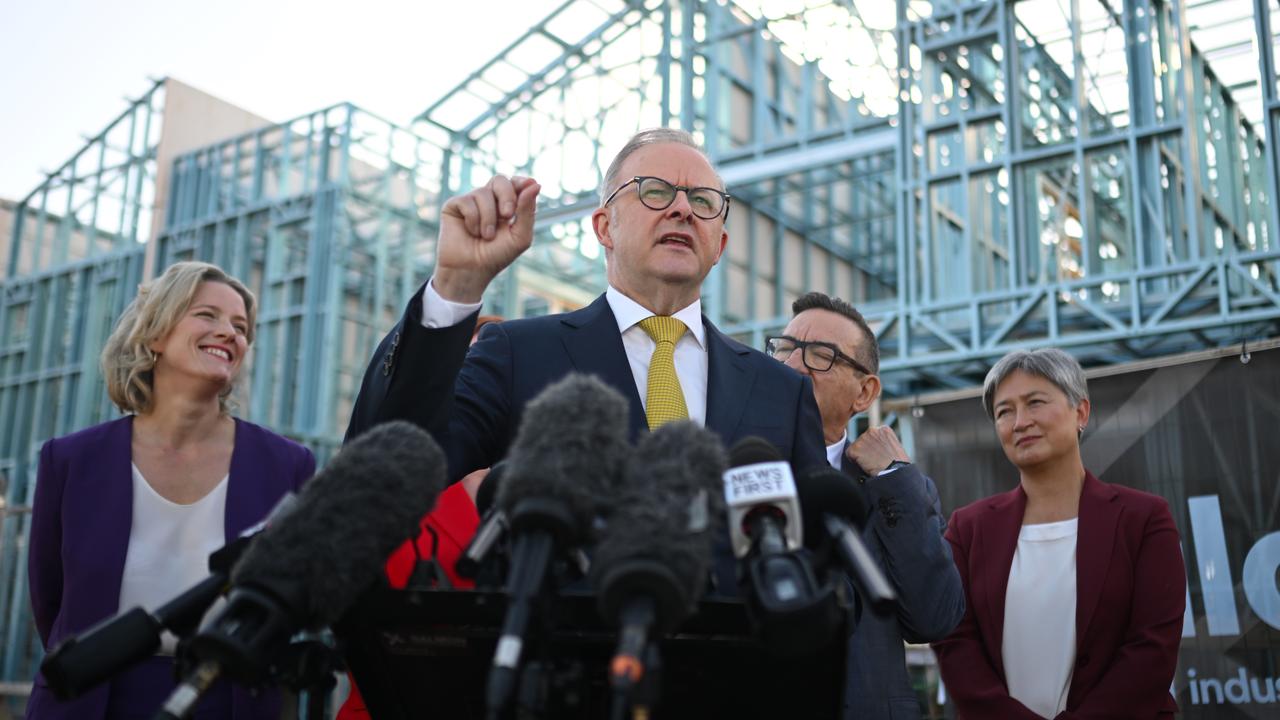

Fast approvals only add to housing construction logjam

Adding new housing projects to Australia’s already swollen pipeline has been likened to turning the “tap on a bath that is already full”, as analysis shows faster approvals are no silver bullet in fixing the nation’s crisis.

Data from property research firm Cotality shows approvals could move higher in the coming months due to rezoning reforms and incentives for new builds coinciding with falling interest rates.

But rather than fix the shortage of homes, it could cause a problem for the construction industry by adding new projects to an already long list.

“It’s like turning up the tap on a bath that is already full,” said the analysis from head of research Eliza Owen.

It found delivery to be the problem, not approvals, with 219,000 homes under construction and completion times ballooning.

“The real bottleneck lies in the build phase, not planning reform,” the analysis said.

The federal government’s goal to build 1.2 million new homes in five years, adopted in August 2023, is thought of as unachievable by the industry.

“With completion times already above average, and construction costs elevated, it seems an odd time to be incentivising more dwelling approvals and commencements to the backlog of work to be done,” the report stated.

Ahead of the Albanese government’s national productivity summit later this month, the report calls for a move away from demand stimulation to sustainable delivery.

“Making homes faster and cheaper to build, while still maintaining quality, resilient homes is the key challenge for policymakers to focus on right now,” the report reads.

Labor’s massive election win has prompted union bosses to call for the government to revisit potential changes to negative gearing and capital gains tax concessions.

But proposals to scale back the tax deduction is tricky for the government, after Labor took reforms for negative gearing to the 2019 federal election and lost.

Negative gearing allows investors to claim deductions on losses and the capital gains tax discount halves the tax paid by Australians who sell assets owned for 12 months or more.

The analysis says if governments are serious about delivering on the housing target, they “must focus on building capacity, lifting productivity, and ensuring every approved home actually gets built”.

Coral coverage crashes after ‘unheard of’ heat events

Coral cover on parts of the Great Barrier Reef has crashed by as much as a third from record high levels following a global mass bleaching event.

The heat-vulnerable tropical ecosystem off the coast of Queensland has experienced its sharpest decline in hard coral prevalence in four decades, with a 2024 spike in ocean temperatures largely to blame.

The Australian Institute of Marine Science’s latest survey does not capture the most recent bleaching event confirmed earlier in 2025 that struck the Great Barrier Reef as well as ecosystems off the Western Australian coastline.

Report co-author Daniela Ceccarelli was concerned about the growing prevalence of bleaching events.

“These back-to-back events were previously completely unheard of,” Dr Ceccarelli told AAP.

Heat stress events in quick succession were worrying given the emerging dominance of “fast to grow and first to go” Acropora coral species.

Capable of bouncing back quickly after a destructive event when given more space to expand, the fast-growing varieties were largely responsible for the previous survey’s record-high coral coverage rates.

Dr Ceccarelli likened the fast-growing corals to grasses and bushes that shoot up first after a bushfire.

“And if you were to fly over, you’d go ‘it’s nice and green, it’s great’,” she explained.

“But the trees are not there yet.”

With heat stress events coming too often for hardier, slow-growing corals to get a foothold, Dr Ceccarelli warned such cycles of crash and rapid recovery were becoming more common.

“The question is, how long can this go on before we reach a low from which recovery is not possible?

“We don’t know that, but it’s worrying we aren’t getting a lot of time between heatwaves anymore.”

Particularly sensitive to heat stress, corals expel the algae living in their tissues when water is too warm, causing the coral to turn completely white.

Coral can recover from bleaching but it is a sign of stress and can kill the organisms if severe enough.

Cyclones and crown-of-thorn starfish outbreaks also contribute to reef damage, but AIMS said climate change-fuelled ocean warming drove much of the 2024 coral coverage decline.

The entire tropical ecosystem recorded falls in coral coverage – an internationally-recognised indicator of reef health – but declines were sharpest in the south.

Coverage fell by nearly a third in the southern region, from 38.9 per cent to 26.9 per cent.

North of Cooktown, coverage fell by roughly a quarter.

In the central region, hard corals shrunk nearly 14 per cent.

Even with those sharp declines, when coming from such a high base, overall coverage is now hovering around long-run averages.

AIMS chief executive officer Selina Stead said ocean warming caused by climate change was clearly impacting coral reefs.

“The future of the world’s coral reefs relies on strong greenhouse gas emissions reduction, management of local and regional pressures, and development of approaches to help reefs adapt to and recover from the impacts of climate,” Professor Stead said.

Flesh-eating parasite rattles Mexican cattle producers

The United States’ suspension of live cattle imports from Mexico hit at the worst possible time for rancher Martín Ibarra Vargas, who after two years of severe drought had hoped to put his family on better footing selling his calves across the northern border.

Like his father and grandfather before him, Ibarra Vargas has raised cattle on the parched soil of Sonora, the state in northwestern Mexico that shares a long border with the US.

His family has faced punishing droughts before,, but is now facing a new scourge: the New World Screwworm, a flesh-eating parasite.

US agriculture officials halted live cattle crossing the border in July – the third suspension of the past eight months — due to concerns about the flesh-eating maggot which has been found in southern Mexico and is creeping north.

The screwworm is a larva of the Cochliomyia hominivorax fly that can invade the tissues of any warm-blooded animal, including humans.

The parasite enters animals’ skin, causing severe damage and lesions that can be fatal.

Infected animals are a serious threat to herds.

The US Department of Agriculture calls it a “devastating pest” and said in June that it poses a threat to “our livestock industry, our economy, and our food supply chain”.

It has embarked on other steps to keep it out of the United States, which eradicated it decades ago.

As part of its strategy, the US is preparing to breed billions of sterile flies and release them in Mexico and southern Texas.

The aim is for the sterile males to mate with females in the wild who then produce no offspring.

The US ban on live cattle also applies to horses and bison imports.

It hit a ranching sector already weakened by drought and specifically a cattle export business that generated $US1.2 billion ($A1.9 billion) for Mexico last year.

This year, Mexican ranchers have exported fewer than 200,000 head of cattle, which is less than half what they historically send in the same period.

For Ibarra Vargas, considered a comparatively small rancher by Sonora’s beef-centric standards, the inability to send his calves across the border has made him rethink everything.

The repeated bans on Mexican cows by US authorities have pushed his family to branch into beekeeping, raising sheep and selling cow milk.

What he earns is just a fraction of what he earned by exporting live cattle, but he is trying to hold on through the lean times.

“Tiempos de vacas flacas” — times of the lean cows — as he calls them.

At least it lets us continue ranching, the 57-year-old said with a white cowboy hat perched on his head.

Even as ranchers in Sonora intensify their efforts to make sure the parasitic fly never makes it into their state, they’ve had to seek new markets.

In the past two months, they’ve sold more than 35,000 mature cows within Mexico at a significant loss.

“We couldn’t wait any longer,” said Juan Carlos Ochoa, president of the Sonora Regional Cattle Union.

Those sales, he said, came at a “35 per cent lower price difference compared with the export value of a cow”.

That’s hard to stomach when beef prices in the US are rising.

The US first suspended cattle imports last November.

Since then, more than 2258 cases of screwworm have been identified in Mexico.

Treatment requires a mix of manually removing the maggots, healing the lesions on the cows and using anti-parasite medicine.

Some ranchers have also started retail beef sales through luxury butcher shops referred to as “meat boutiques”.

There are other foreign markets, for example, Japan, but selling vacuum-sealed steaks across the Pacific is a dramatically different business than driving calves to US feedlots. The switch is not easy.

With his calves mooing as they ran from one end of a small corral to the other, waiting to be fed, Ibarra Vargas said he still hasn’t figured out how he will survive an extended period of not being able to send them to the US.

The recent two-year drought reduced his cattle stocks and forced him to take on debt to save the small family ranch that has survived for three generations.

Juan Carlos Anaya, director of Agricultural Markets Consulting Group, attributed a two per cent drop in Mexico’s cattle inventory last year to the drought.

Anaya said Mexican ranchers who export are trying to get the US to separate what happens in southern Mexico from the cattle exporting states in the north, where stricter health and sanitation measures are taken, “but the damage is already done”.

“We’re running out of time,” said Ibarra Vargas, who laments that his children are not interested in carrying on the family business.

For a rancher who “doesn’t have a market or money to continue feeding his calves, it’s a question of time before he says: “you know what, this is as far as I go”.

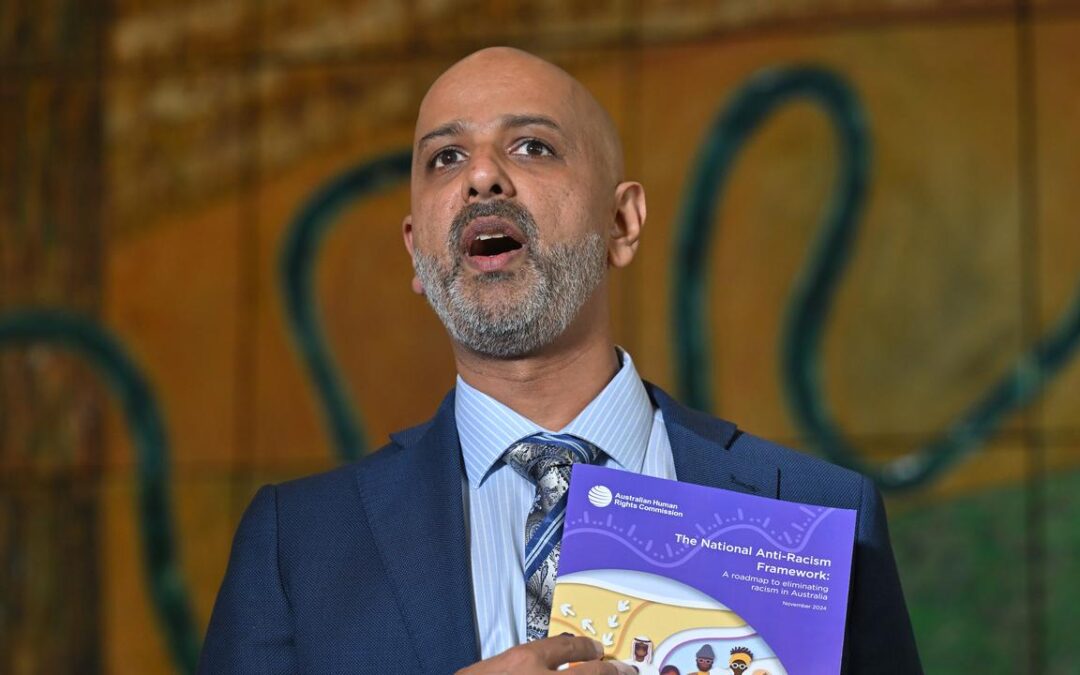

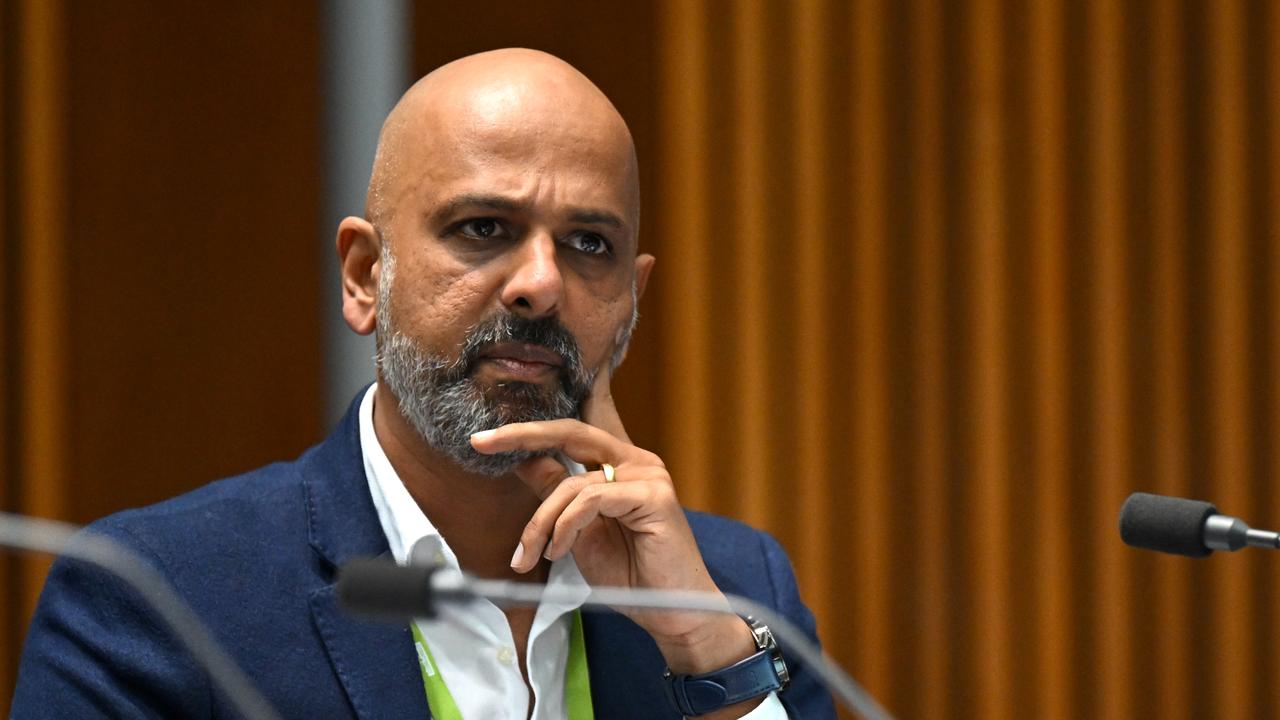

Australia urged to take key step to stamp out racism

Australia’s race discrimination commissioner rejects the notion of “casual racism”, warning prejudice is having a significant cost on the economy.

“It’s much more than skin deep, it can really scar you in on your soul,” Giridharan Sivaraman told AAP.

“It’s in every aspect of our society.”

The commissioner said one way this manifested was in the workplace, with job hunters with Anglo-friendly names more likely to get a call back for a gig.

People with qualifications from non-English speaking countries were more likely to be employed in jobs below their levels of experience, or in roles in entirely different fields.

In an address to the National Press Club in Canberra on Wednesday, Mr Sivaraman will say Australia is at a “critical time” where a whole-of-government approach is needed to tackle racism.

He will call on Labor to commit to the national anti-racism framework, handed down by the Australian Human Rights Commission last November.

“It’s the racism that’s in our systems and institutions, it’s stopping people from being able to thrive or simply be safe,” he said ahead of his address.

“Taking action against racism doesn’t take anything from any person. It actually improves society for everyone.”

The commissioner said Australia needed to face the issue with “courage and honesty” as to why this keeps happening.

“There needs to be fundamental change … that’s the real conversation that we should all be having,” he said.

Mr Sivaraman said the issue needed investment as opposed to the ad hoc and disjointed approaches from past governments.

The voice to parliament referendum, held in October 2023, had led to an increase in discrimination and prejudice against Indigenous people, he added.

“There can be no racial justice in this country without justice for Aboriginal and Torres Strait Islanders, and that is abundantly clear,” Mr Sivaraman said.

The commissioner said different ethnic groups could also be targeted in Australia during points of rupture in society.

He pointed to the “bile” that was directed towards people of Asian heritage during the COVID-19 pandemic, and most recently, soaring levels of anti-Semitism and anti-Palestinian sentiment fuelled by the war in Gaza.

The Australian Human Rights Commission will next week launch an online survey to ask university students and staff across the nation about experiences of racism.

Mr Sivaraman said this would be done to get a “baseline” of prejudice at the nation’s higher education institutions.

The survey will be distributed via email by universities and participants will remain anonymous.

Clamps on AI could mire Australia in productivity mud

Australia is urged to hold off imposing guardrails on high-risk artificial intelligence as the technology could offer a solution to the nation’s withered productivity.

AI has been touted as a tool that could transform the global economy and is expected to add more than $116 billion to Australia’s economic activity over the next decade, according to the Productivity Commission’s interim report.

While the independent advisory body to the federal government acknowledged the risks that accompany AI, it also warns “poorly designed” regulation could stifle its adoption and development as well as limit its benefits, fuelling calls for the government to only introduce technology-specific regulations as a last resort.

“Adding economy-wide regulations that specifically target AI could see Australia fall behind the curve, limiting a potentially enormous growth opportunity,” Commissioner Stephen King said.

“Like any new technology, AI comes with risks, but we can address many of these risks by refining and amending the rules and frameworks we already have in place.”

The federal government’s consultations on AI found Australia’s regulatory system was not fit to respond to the risks it posed, prompting the Commonwealth to seek responses on 10 proposed, mandatory guardrails for high-risk AI, which are aimed at reducing the likelihood of harms from its development and deployment.

AI can amplify biases, contribute to misinformation and disinformation, spread extremist content and create other new risks, the government’s report found.

Others have also raised concerns about the significant amount of water and energy needed to run generative AI.

But the Productivity Commission believes the suggested guardrails should only be applied when harms cannot be mitigated by existing regulatory frameworks or in cases where “technology-neutral” regulation is not possible.

Until the government has completed reviews into the gaps posed by AI to existing regulatory structures, “steps to mandate the guardrails should be paused”.

AI is expected to be a key concern at Treasurer Jim Chalmers’ economic roundtable on productivity, which convenes later in August.

“The impact of AI on our economy is uncertain, but there are good reasons to be optimistic,” he said.

“We can deploy artificial intelligence in a way consistent with our values if we treat it as an enabler not an enemy, by listening to and empowering workers to adapt and augment their work.”

US trade deficit narrows amid drop in consumer imports

The US trade deficit narrowed in June on a sharp drop in consumer goods imports, the latest evidence of the imprint on global commerce that President Donald Trump is making with sweeping tariffs on imported goods.

The overall trade gap narrowed 16.0 per cent in June to $US60.2 billion ($A93.1 billion), the Commerce Department’s Bureau of Economic Analysis said on Tuesday.

Days after reporting that the goods trade deficit tumbled 10.8 per cent to its lowest since September 2023, the government said the full deficit including services also was its narrowest since September 2023.

Exports of goods and services totalled $US277.3 billion ($A429.0 billion), down from more than $US278 billion ($A430 billion) in May, while total imports were $US337.5 billion ($A522.1 billion), down from $US350.3 billion ($A541.9 billion).

The diminished trade deficit contributed heavily to the rebound in US gross domestic product during the second quarter, reported last week, reversing a drag in the first quarter when imports had surged as consumers and businesses front-loaded purchases to beat the imposition of Trump’s tariffs.

The economy in the second quarter expanded at a 3.0 per cent annualised rate after contracting at a 0.5 per cent rate in the first three months of the year, but the headline figure masked underlying indications that activity was weakening.

Last week, Trump, ahead of a self-imposed deadline of August 1, issued a barrage of notices informing scores of trading partners of higher import taxes set to be imposed on their goods exports to the US.

With tariff rates ranging from 10 per cent to 41 per cent on imports to the US set to kick in on August 7, the Budget Lab at Yale now estimates the average overall US tariff rate has shot up to 18.3 per cent, the highest since 1934, from between two per cent and three per cent before Trump returned to the White House in January.

Titan submersible disaster was preventable: Coast Guard

The tour operator responsible for the Titan submersible, which fatally imploded near the wreckage of the Titanic, “leveraged intimidation tactics” to “evade regulatory scrutiny,” a US Coast Guard investigation report concludes.

The disappearance of the Titan off Canada in June 2023 led to a search that grabbed worldwide attention.

The incident resulted in the deaths of five people – including British adventurer Hamish Harding and father and son Shahzada and Suleman Dawood.

The chief executive of tour operator OceanGate Expeditions, Stockton Rush, and French national Paul-Henri Nargeolet, were also killed in the incident.

On Tuesday, the US Coast Guard published a 335-page report in which it identified eight “primary causal factors” that led to the fatal implosion.

The report said the implosion was “preventable”.

The report said OceanGate had a “toxic workplace environment” and used the “looming threat of being fired” to prevent staff from coming forward with safety concerns.

It added that analysis revealed a “disturbing pattern of misrepresentation and reckless disregard for safety”.

The report criticised OceanGate’s design and testing processes and the continued use of the Titan submersible despite “a series of incidents that compromised the integrity of the hull and other critical components”.

The tour operator’s former director of engineering was reported by the US Coast Guard to have said the first hull used on the Titan submersible was akin to a “high school project”.

According to the report, a contractor hired by OceanGate in 2022 voiced “numerous safety concerns” to a company director, before being told: “You have a bad attitude, you don’t have an explorer mindset, you know, we’re innovative and we’re cowboys, and a lot of people can’t handle that”.

Authored by lead investigator Thomas Whalen and marine board chairman Jason Neubauer, the report said that for several years preceding the incident, OceanGate “leveraged intimidation tactics,” allowances for scientific operations, and “the company’s favourable reputation to evade regulatory scrutiny”.

“By strategically creating and exploiting regulatory confusion and oversight challenges, OceanGate was ultimately able to operate Titan completely outside of the established deep-sea protocols, which had historically contributed to a strong safety record for commercial submersibles,” the report said.

“The lack of both third-party oversight and experienced OceanGate employees on staff during their 2023 Titan operations allowed OceanGate’s chief executive officer to completely ignore vital inspections, data analyses, and preventative maintenance procedures, culminating in a catastrophic event.”

The submersible disaster has led to lawsuits and calls for tighter regulation of the developing private deep-sea expedition industry.

with AP

NZ to charge tourists for entry into national parks

New Zealand will begin charging tourists up to $NZ40 ($A37) to visit its most popular tourist destinations such as Milford Track and Mount Cook, as the government seeks ways to help spur economic growth.

Prime Minister Chris Luxon presented a plan to reform the 1987 Conservation Act, with which the government aims to establish a new system of concessions to boost the tourism sector while establishing fees at popular sites.

“Unleashing economic growth on one third of New Zealand’s land will create jobs and increase wages across the country,” Luxon said in a statement.

In 2024, New Zealand welcomed around three million tourists, a 13 per cent increase from the previous year.

In October, NZ tripled the tourist entry fee to $NZ100 to help offset the cost of maintaining public services and conserving the national heritage.

The government will initially consider introducing the fee at Cathedral Cove, Tongariro Crossing, Milford Track and Mount Cook – sites where foreigners often make up 80 per cent of visitors, Luxon said.

“Tourists make a massive contribution to our economy, and no one wants that to change. But I have heard many times from friends visiting from overseas their shock that they can visit some of the most beautiful places in the world for free,” NZ Conservation Minister Tama Potaka said.

The government has not yet specified when it will start charging admission, although NZ media outlets are speculating that it will be in 2027.

According to official figures, tourism accounts for 7.5 per cent of New Zealand’s gross domestic product.

Snowtown murderer granted parole after decades in jail

The youngest of the four men convicted over South Australia’s “bodies in the barrels” serial killings has been granted parole.

James Vlassakis has spent 26 years behind bars after being found guilty of being involved in four of the 11 murders between 1992 and 1999.

At its monthly meeting on Tuesday, SA’s parole board approved his application to serve the remainder of his life sentence under conditions in the community.

Parole Board chief Frances Nelson told AAP that Vlassakis “does not represent a risk to the community” and would be sent to the Adelaide pre-release centre for up to 12 months and undergo a resocialisation process.

Vlassakis was 19 when he committed the crimes and was sentenced to life with a minimum term of 26 years, which expires in August 2025.

Ms Nelson said she was “sure that the victims feel he has been insufficiently punished”.

“That’s quite common for victims to feel that way, but that’s not our role,” she said.

“Sentencing and punishment is a matter for a judge, not for a parole board, and the legislation prevents us from imposing our own view on sentence, so our role is simply to assess whether he fulfils the legislative criteria for parole.”

Snowtown murders accomplice Mark Ray Haydon, 66, was released on parole in May 2024 to live in the community under strict supervision.

Vlassakis was also a key prosecution witness against John Bunting and Robert Wagner, who were found guilty of 11 and 10 murders respectively.

Both are serving life sentences with no chance of parole.

Vlassakis would be moved to the pre-release centre “provided there is no request to review our decision”, Ms Nelson said.

“There is a 60-day period which would enable either the attorney general or the commissioner for victims rights or the police commissioner to apply for a review,” she said.

Commissioner for Victims Rights Sarah Quick told AAP the decision would “understandably bring fresh pain and anger to those who have already suffered beyond measure”.

“These individuals are not only worn down by their trauma, but also by the ongoing criminal justice processes,” she said.

“The prospect of Mr Vlassakis re-entering the community is a difficult reality for the victims and will require a significant emotional adjustment, adding to an already unbearable burden.

“We must never forget that – for the friends, family and loved ones of murder victims – the impact of the killing does not end simply because a prison term has ended. It is something they live with every day for the rest of their lives.”

A suppression order on images of Vlassakis remains in effect, and there has been a high level of secrecy regarding his imprisonment.

In July, Haydon appeared in the SA Supreme Court, where an application for an extended supervision order for a high-risk offender was approved, and most of the conditions of an interim order imposed in 2024 were confirmed.

He spent 25 years in jail for his role as an accessory in the murder spree.

Sea of green as Aussie shares notch highest-ever close

Australia’s share market has posted its best-ever close as confidence around company earnings and future interest rate cuts washed out global growth concerns.

The S&P/ASX200 surged 106.7 points higher, up 1.23 per cent, to 8,770.4, while the broader All Ordinaries shot 106.8 points higher, or 1.20 per cent, to 9,028.8.

The result pipped the top-200’s previous record close of 8,757.2, but finished just six points shy of its intraday best of 8,776.4 set in mid-July.

The prospect of cheaper US and Australian borrowing costs helped interest rate-sensitive sectors like financials, real estate, technology and consumer discretionary stocks lead all 11 segments higher.

On top of this, Australia’s prospect as a market where investors could weather uncertainty elsewhere was likely growing, Pepperstone head of research Chris Weston said.

“We’ve got a very, very stable banking sector with excellent liquidity, so you’re looking for a safe harbour in this kind of area, I think Australia ticks the right boxes” he told AAP.

“Now, you’re not going to get a huge amount of foreign investments looking at Australia, because you do have a scarcity of incredibly liquid assets.”

Tuesday’s performance showed investors weren’t worried about taking on risk heading into earnings season, Mr Weston said.

Consumer discretionary stocks led the gains with a 1.8 per cent surge, as Bunnings owner Wesfarmers jumped 2.83 per cent to $87.52 per share and JB Hi-Fi lifted 1.8 per cent to $115.80.

The financial sector surged 1.5 per cent as all big four banks’ respective market caps sailed 1.4 per cent or more higher on a sea of green. NAB was the best performer, rallying 1.6 per cent to $38.80.

Australia’s IT sector wiped out Monday’s losses with a 1.3 per cent gain, tracking with an overnight rally in US tech stocks.

Hopes of cheaper borrowing costs helped real estate stocks push 1.4 per cent higher, with strong performances by Dexus, GPT Group and Charter Hall.

Miners rallied for a second straight day, as continued strength in iron ore prices helped push large caps BHP, Rio Tinto and Fortescue 0.4 per cent to 0.5 per cent higher.

Gold producers also pushed higher despite a slight downtick in the gold prices during the session, with Newmont Corporation (+4.1 per cent) and Ramelius Resources (+3.9 per cent) standing out.

Rare earths miner Iluka Resources was the top-200’s best performer with a 8.7 per cent surge after federal resources minister Madeleine King flagged setting a price floor for the commodity group to shore up investment.

Also with some help from government was second-best performer Austal, the shipbuilder’s shares pushing 7.9 per cent higher after securing billions in defence contracts and winning strategic asset designation by the federal government, which will make it a tough takeover target for overseas buyers.

The Australian dollar is buying 64.60 US cents, edging higher than 64.41 US cents on Monday at 5pm.

ON THE ASX:

* The benchmark S&P/ASX200 index on Tuesday gained 106.7 points, or 1.23 per cent, to 8,770.4

* The broader All Ordinaries rose 106.8 points, or 1.20 per cent, to 9,028.8

CURRENCY SNAPSHOT:

One Australian dollar buys:

* 64.60 US cents, from 64.81 US cents on Monday .

* 95.17 Japanese yen, from 95.68 Japanese yen

* 55.93 euro cents, from 65.02 euro cents

* 48.65 British pence, from 48.80 British pence

* 109.68 NZ cents, from 109.60 NZ cents