Electric cars pull up short in road test of range claim

Some of Australia’s best-selling electric vehicles fail to meet their advertised range and consume significantly more power than manufacturers promise, on-road tests reveal.

One popular SUV performed particularly poorly, stopping short of its advertised range by more than 100km.

The Australian Automobile Association released the results on Thursday after testing five electric vehicles as part of its $14 million Real-World Testing Program.

The findings come one week after the program revealed 25 out of 30 petrol and hybrid vehicles tested had consumed more fuel than their lab results showed and more than three in every four vehicles examined had failed to meet expectations.

The motoring body road-tested five electric vehicles in its first trial of the technology, using a 93km circuit around Geelong in Victoria in damp and dry conditions, and measuring the vehicles’ energy consumption.

BYD’s Atto 3 SUV produced the worst result of the models tested, falling short of its promised range by 111km or 23 per cent, and using 21 per cent more power than advertised.

Tesla’s entry-level electric car, the Model 3, also failed to meet its promised range by 14 per cent, or 72km, and used six per cent more electricity than lab results showed.

The Tesla Model Y and Kia EV6 SUVs also failed to meet their range by eight per cent, or just over 40km, while the Smart #3 electric car came the closest to its lab test results, falling within five per cent or 23km of the advertised range.

The results could help families and fleet managers make choices about their next vehicle purchases, association managing director Michael Bradley said, as research showed range anxiety remained a significant concern for buyers.

“As more EVs enter our market, our testing will help consumers understand which new market entrants measure up on battery range,” he said.

An electric car’s range could be affected by a number of factors, Australian Electric Vehicle Association national president Chris Jones said.

These include high or low temperatures, headwinds, steep terrain, and the use of air conditioning and heating features.

Car makers should seek to “under-promise and over-deliver” when it comes to vehicle range, he said, to allow buyers to make informed choices about the models that will suit their needs.

“It is frustrating that manufacturers are inflating the values when they really ought to be a bit more conservative,” Mr Jones said.

“I would have thought a 10 per cent difference was reasonable but 20 per cent is pretty bad.”

Electric vehicle range is typically tested in Australia using the older New European Driving Cycle (NEDC) laboratory test, but this will be replaced by the more accurate Worldwide Harmonised Light Vehicle Test Procedure (WLTP) from December.

The Australian Automobile Association’s vehicle-testing program, funded by the federal government, has examined 114 fuel-powered vehicles since it began in 2023 and found 88 models, or 77 per cent, failed to meet their advertised energy consumption.

US memo urges countries to reject UN plastic caps

The United States has sent letters to at least a handful of countries urging them to reject the goal of a global pact that includes limits on plastic production and plastic chemical additives at the start of UN plastic treaty talks in Geneva.

In the communications dated July 25 and circulated to countries at the start of negotiations on Monday, seen by Reuters, the US laid out its red lines for negotiations that put it in direct opposition to over 100 countries that have supported the measures.

Hopes for a “last-chance” ambitious global treaty that tackles the full life cycle of plastic pollution from the production of polymers to the disposal of waste have dimmed as delegates gather for what was intended to be the final round of negotiations.

Significant divisions remain between oil-producing countries, who oppose caps on virgin plastic production fuelled by petroleum, coal, and gas, and parties such as the European Union and small island states, which advocate for limits, as well as stronger management of plastic products and hazardous chemicals.

The US delegation, led by career State Department officials who had represented the Biden administration, sent memos to countries laying out its position and saying it will not agree to a treaty that tackles the upstream of plastic pollution.

“We will not support impractical global approaches such as plastic production targets or bans and restrictions on plastic additives or plastic products – that will increase the costs of all plastic products that are used throughout our daily lives,” said the memo Reuters understands was sent to countries that could not be named due to sensitivities around the negotiations.

The US acknowledged in the memo that after attending a preliminary heads of delegation meeting in Nairobi from June 30 to July 2, “we plainly do not see convergence on provisions related to the supply of plastic, plastic production, plastic additives or global bans and restrictions on products and chemicals, also known as the global list”.

A State Department spokesperson told Reuters each party should take measures according to its national context.

“Some countries may choose to undertake bans, while others may want to focus on improved collection and recycling,” the spokesperson said.

John Hocevar, Oceans Campaign Director for Greenpeace USA, said the US delegation’s tactics under Trump marked a “return to old school bullying from the US government trying to use its financial prowess to convince governments to change their position in a way that benefits what the US wants”.

One of the world’s leading producers of plastics, the US has also proposed revising the draft objective of the treaty to reduce plastic pollution by eliminating a reference to an agreed “approach that addresses the full life cycle of plastics”, in a proposed resolution seen by Reuters.

A source familiar with the negotiations told Reuters it indicated that the US is seeking to roll back language that had been agreed in 2022 to renegotiate the mandate for the treaty.

The US stance broadly aligns with the positions laid out by the global petrochemicals industry, which stated similar positions ahead of the talks, and several powerful oil and petrochemical producer countries that have held this position throughout the negotiations.

Over 100 countries have backed a cap on global plastic production.

In the US, the Trump administration has numerous measures to roll back climate and environmental policies that it says place too many burdens on industry.

Plastic production is set to triple by 2060 without intervention, choking oceans, harming human health and accelerating climate change, according to the OECD.

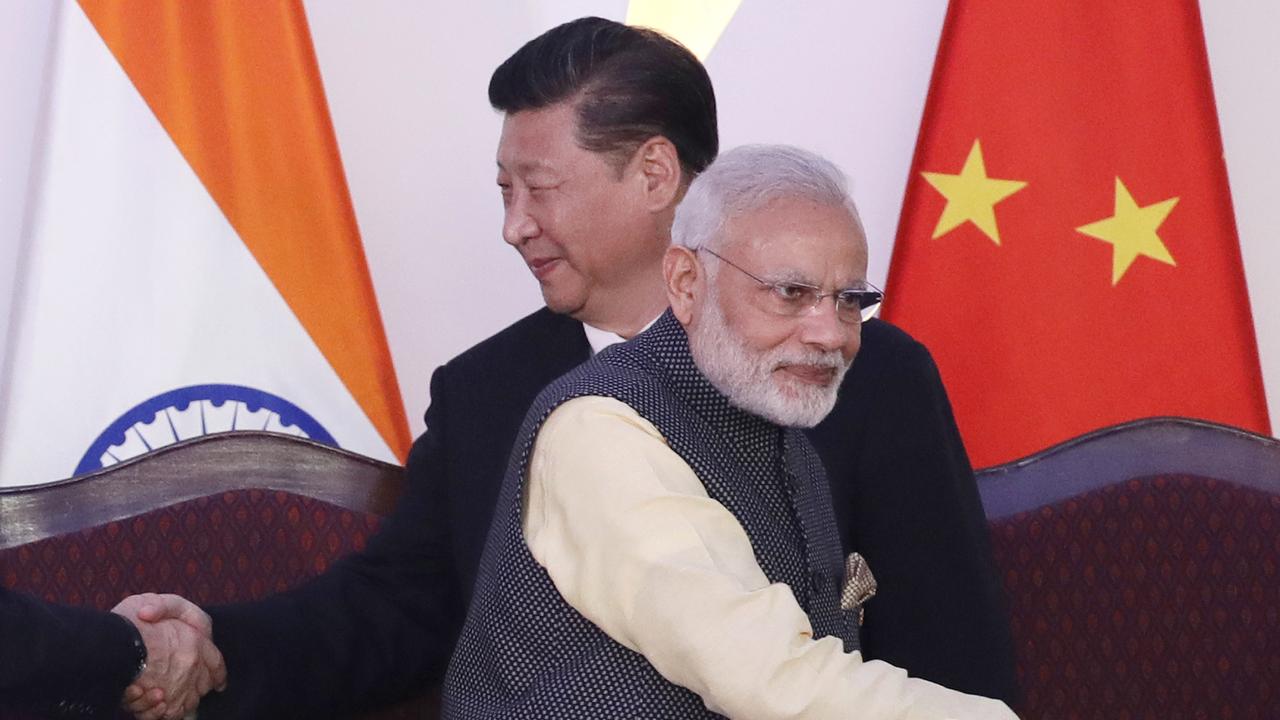

Modi to visit China for first time in seven years

Indian Prime Minister Narendra Modi will visit China for the first time in more than seven years, in a further sign of a diplomatic thaw with Beijing as tensions with the United States rise.

Modi will go to China for a summit of the multilateral Shanghai Cooperation Organisation which begins on August 31, a government source, with direct knowledge of the matter, told Reuters.

India’s foreign ministry did not immediately respond to a request for comment.

His trip will come at a time when India’s relationship with the US faces its most serious crisis in years after US President Donald Trump imposed the highest tariffs among Asian peers on goods imported from India.

Trump issued an executive order on Wednesday, imposing an additional 25 per cent tariff on goods from India, saying the country directly or indirectly imported Russian oil.

The penalties for buying Russian oil are part of US efforts to seek a last-minute breakthrough that will bring about a ceasefire in the war in Ukraine.

Trump’s top diplomatic envoy, Steve Witkoff, is in Moscow, two days before the expiry of a deadline the president set for Russia to agree to peace in Ukraine or face new sanctions.

Modi’s visit to the Chinese city of Tianjin for the summit, a Eurasian political and security grouping that includes Russia, will be his first since June 2018.

Subsequently, Sino-Indian ties deteriorated sharply after a military clash along their disputed Himalayan border in 2020.

Modi and Chinese President Xi Jinping held talks on the sidelines of a BRICS summit in Russia in October that led to a thaw.

The giant Asian neighbours are now slowly defusing tensions that have hampered business relations and travel between the two countries.

Trump has threatened to charge an additional 10 per cent tariff on imports from members of the BRICS group of major emerging economies for “aligning themselves with Anti-American policies”.

Meanwhile, India’s National Security Adviser Ajit Doval is in Russia on a scheduled visit and is expected to discuss India’s purchases of Russian oil in the wake of Trump’s pressure on India to stop buying Russian crude, according to another government source, who also did not want to be named.

Doval is likely to address India’s defence cooperation with Russia, including obtaining faster access to pending exports to India of Moscow’s S400 air defence system, and a possible visit by President Vladimir Putin to India.

Doval’s trip will be followed by Foreign Minister Subrahmanyam Jaishankar in the weeks to come.

US and Indian officials told Reuters a mix of political misjudgement, missed signals and bitterness scuttled trade deal negotiations between the world’s biggest and fifth-largest economies, whose bilateral trade is worth over $US190 billion ($A293 billion).

India expects Trump’s crackdown could cost it a competitive advantage in about $US64 billion ($A99 billion) worth of goods sent to the US that account for 80 per cent of its total exports, four separate sources told Reuters, citing an internal government assessment.

However, the relatively low share of exports in India’s $US4 trillion ($ A$6.2 trillion) economy is expected to limit the direct impact on economic growth.

On Wednesday, the Reserve Bank of India left its GDP growth forecast for the current April-March financial year unchanged at 6.5 per cent and held rates steady despite the tariff uncertainties.

Union alarm as mining giant mulls sick leave overhaul

Thousands of iron ore workers could have their sick leave entitlements slashed, a union claims.

Rio Tinto has proposed a slew of changes to its sick leave policy, including reducing workers’ entitlement of 90 days per year to 12 days, the Australian Manufacturing Workers’ Union said.

The proposals raised serious concerns for workers and the mining giant needed to provide more information, AMWU state secretary Steve McCartney said.

“Rio Tinto is starting with workers’ sick leave entitlements — but who’s to say wages and broader conditions aren’t next on the chopping block?” he said.

“The union will be standing firm in defence of our members’ rights.”

The union said workers had told them Rio Tinto had not provided enough detail about the proposed changes.

“That’s not good enough,” Mr McCartney said.

“We’ll support them every step of the way to ensure they’re protected throughout this process.”

According to the union, the revised policy includes 10 days of sick leave and two additional days per year, which do not accrue year-on-year

Workers will be eligible for a $1000 annual payment for wellness programs, it said.

“This is a warning to all employees and contractors — if a company like Rio Tinto can unilaterally alter leave, it could just as easily move on pay and other conditions,” Mr McCartney said.

Rio Tinto said it was consulting with its employees over proposed changes to its sick and carer’s leave policy for its iron ore business.

“Safety and wellbeing of our people is our top priority,” a spokeswoman said.

“Prompted by feedback from our people survey, we are conducting a review of the sick and carer’s leave policy for Rio Tinto Iron Ore.”

The company said the proposed changes were designed to ensure fairness for all employees.

“This includes up to 12 months of sick and carer’s leave at full pay, including allowances, in the event of serious illness or injury, which we believe would be industry leading,” the spokeswoman said.

Rio Tinto Iron Ore employs about 16,000 people.

Under the National Employment Standards, full-time employees are entitled to 10 days of sick leave each year.

Balance key as government reviews anti-Semitism report

Politicians are being implored to balance free speech against racial vilification protections amid moves to curb rising anti-Semitism.

A report handed down by anti-Semitism special envoy Jillian Segal has recommended scrapping funding for universities that fail to tackle the issue adequately.

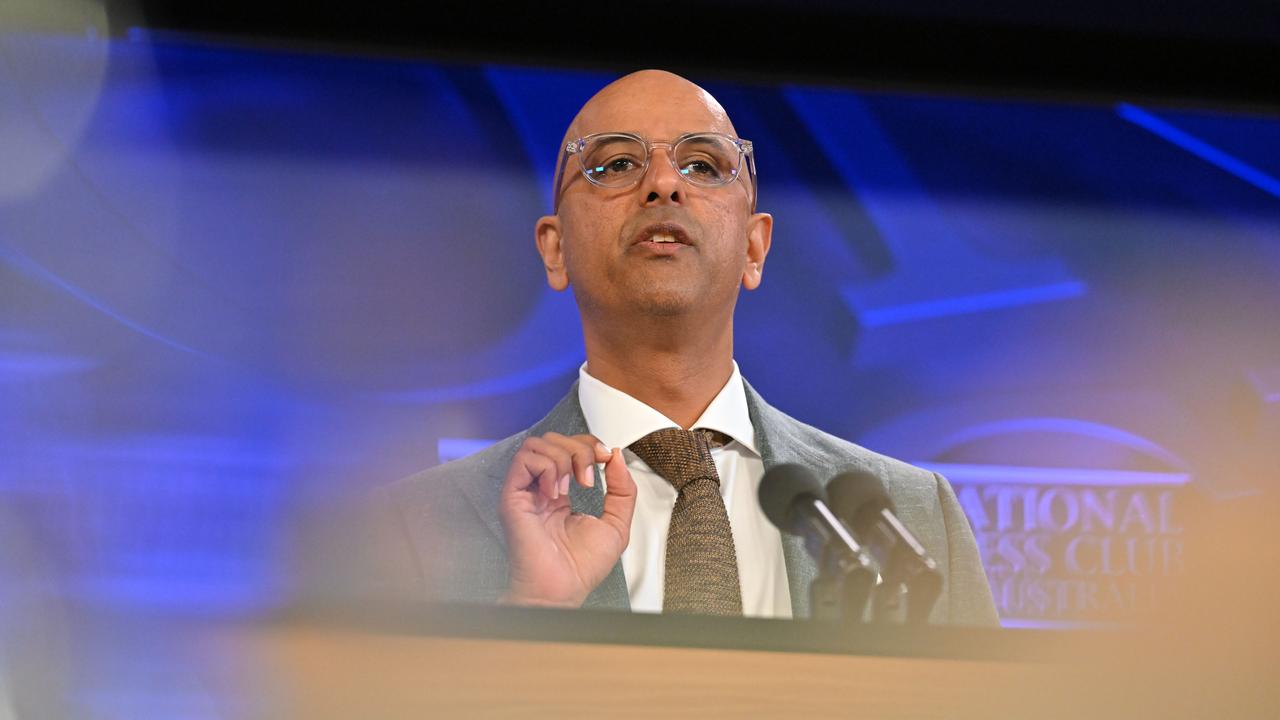

Race Discrimination Commissioner Giridharan Sivaraman said there needed to be “appropriate balancing” of the two priorities and he didn’t think that detail had been explored in Ms Segal’s report.

“Of course there needs to be protection against racial vilification and hate speech, but there also has to be protection of the independence of institutions,” he told the National Press Club in Canberra on Wednesday.

“We are having discussions with (Ms Segal) to try and flesh it out, but it is really important to get that right.”

Ms Segal’s report urges politicians to cut funding to universities, programs or academics that enable or fail to act against anti-Semitism.

The Albanese government is considering its response.

Mr Sivaraman called on Labor to commit to the “first of its kind” national anti-racism framework, handed down by the Australian Human Rights Commission in November.

The “road map” contained 63 recommendations for proposed reforms across justice, health and media sectors.

As the nation’s leaders call for conflicts abroad not to be “brought” to Australia amid the Israel-Gaza war, Mr Sivaraman said to ignore global conflicts dehumanised people affected at home.

“Sometimes it’s because their family, friends and relatives that have been killed or hurt, or it’s because they can identify with the people that are being killed or hurt,” he said.

“The issue is people say ‘don’t bring that with you … you can come here as long as you fit in’ and that’s how racism operates.”

One way racism in Australia manifested was in the workplace, with job hunters with Anglo surnames more likely to get a call back for a gig, the commissioner said.

People with qualifications from non-English speaking countries were more likely to be employed in jobs below their levels of experience, or in roles in different fields.

Mr Sivaraman said Australia needed to confront the issue with “courage and honesty” and examine why racism keeps happening.

The issue needed investment as opposed to the ad hoc and disjointed approaches from past governments.

The voice to parliament referendum in October 2023 had led to an increase in discrimination and prejudice against Indigenous people, he said.

“There can be no racial justice in this country without justice for Aboriginal and Torres Strait Islanders and that is abundantly clear.”

The commissioner said different ethnic groups were targeted in Australia during points of rupture in society.

He pointed to the “bile” directed towards people of Asian heritage during the COVID-19 pandemic and, most recently, soaring levels of anti-Semitism and anti-Palestinian sentiment fuelled by the war in Gaza.

The Australian Human Rights Commission will next week launch an online national survey asking university students and staff about their experiences of racism.

The survey aimed to get a “baseline” of prejudice at the nation’s higher education institutions, Mr Sivaraman said.

The questions would be distributed via email by universities and participants would remain anonymous.

Banks, miners lead Australian share market to new highs

Australia’s share market has topped 8800 points for the first time, as inflows into global miners and continued banking sector strength wiped investor worries about global growth.

The S&P/ASX200 hit a record intraday peak of 8,848.8 points before settling at its highest-ever close of 8,841, up 71 points, or 0.81 per cent for the day.

The broader All Ordinaries rose 78.3 points, or 0.87 per cent, also to a record-high close of 9,107.1, after hitting a peak of 9,115.4 during the session.

Materials, energy and consumer discretionary stocks led 10 of 11 local sectors higher, while interest rate-sensitive segments such as financials, real estate and IT stocks surged on expectations of cheaper incoming borrowing costs in Australia and the United States.

The Australian dollar is higher against most major currencies, buying 64.88 US cents, up from 64.60 US cents on Tuesday at 5pm.

Australia to take ‘sensible, middle path’ on AI control

Australia will chart a “sensible, middle path” on regulating artificial intelligence, the treasurer says, as concerns grow over its impact on the future of work and the arts.

Treasurer Jim Chalmers is hoping to use AI as a weapon in Labor’s second-term battle against languishing productivity after the Productivity Commission’s interim report determined it could transform the global economy and add more than $116 billion to Australia’s economic activity over the next decade.

Aspirations for AI have long been dogged by concerns it could replace human jobs and draws data from dubious or potentially stolen sources.

But Dr Chalmers insists Australia can both wrangle the risks and reap the benefits of AI.

“Our approach is a sensible, middle path,” he told reporters in Canberra on Wednesday.

“I’m very conscious and attentive to the genuine concerns that workers can have about big changes in technology and it’s hard to imagine a bigger change in technology than this one.

“Technological change typically creates more opportunities than it discards, but the nature of work is always evolving and always changing

“We don’t want to see people necessarily put out of work – our job is to make sure that people have the skills they need to adapt and adopt this kind of technology.”

The Productivity Commission urged Australia to hold off from imposing guardrails on high-risk AI and only introduce technology-specific regulations after amending the rules and frameworks already in place.

“Poorly designed” regulation could stifle the adoption and development of AI, “limiting a potentially enormous growth opportunity”, Commissioner Stephen King said.

But the ACTU has accused the commission of taking a “knee-jerk” stance and selling out workers and industries.

“The Productivity Commission’s only ambition for Australia’s digital future seems to be that we turn ourselves into a mini version of the United States where tech bros get all the benefits of the new technology, and productivity benefits are not fairly shared,” ACTU assistant secretary Joseph Mitchell said.

A united front of Australian screen industry bodies including the Australian Writers’ Guild and the Australian Directors’ Guild has pushed back on the report, specifically its considerations on copyright.

“A remuneration scheme is essential to maintaining the livelihoods of creators and authors to ensure they are fairly compensated for the exploitation of their work on AI platforms,” Australian Screen Directors Authorship Collection Society executive director Deb Jackson said.

“Without this there is a significant threat to Australian creative innovation and economic growth in the creative sectors.”

Greens senator David Shoebridge warned a hands-off approach to AI would “continue to rip off creators and spy on individuals” and Opposition Leader Sussan Ley echoed those concerns, calling on the government to protect Australian content.

“We need a government that backs in our artists, our writers, our musicians and our unique and special Australian content,” Ms Ley told reporters.

“We should embrace the technology with respect to AI, but we have to get the balance right.”

The federal government’s report published in September found AI can amplify biases, contribute to misinformation and disinformation, spread extremist content and create other new risks.

Some business groups have supported the cautious recommendations on regulation, with the professional accounting body, CPA Australia, urging the government to help businesses adopt AI through incentives and educational programs.

Dr Chalmers promised to listen to workers before an August economic roundtable on improving productivity to lift living standards.

Shadows of robodebt as welfare unlawfully cancelled

Advocates call for the scrapping of an “unlawful, harsh and unfair” welfare scheme that wrongly cancelled income support payments to almost 1000 jobseekers.

Payments were automatically terminated for 964 people under the federal government’s Targeted Compliance Framework between April 2022 and July 2024, despite laws introduced in the aftermath of the Robodebt Royal Commission.

Decision-makers were previously forced to cancel or reduce payments when jobseekers persistently failed to meet obligations such as completing job applications and attending interviews.

The legislation passed in 2022 required a human decision-maker to consider a welfare recipient’s circumstances before deciding if their income support payments should be altered.

But the Commonwealth Ombudsman found the Department of Employment and Workplace Relations and Services Australia failed to take adequate steps to ensure the Targeted Compliance Framework worked in accordance with the amendments.

It came as nothing of a shock to the Australian Council of Social Service, whose CEO Cassandra Goldie said had been calling for its scrapping due to such fears since 2018.

“(We said) if it was implemented it would be harsh, it would be brutal, and it would crush people who were subjected to it,” she said.

“The ombudsman report finds exactly that is what has happened.”

The federal government watchdog said failure to exercise a discretion about cancelling an income support posed “significant, if not catastrophic” consequences for vulnerable jobseekers.

It also found government agencies had failed to take every step required to safeguard jobseekers and were aware of the risks involved in automating income support decision-making.

The Employment and Workplace Relations department was also deemed to have taken “too long to act”.

It was made aware of the issue in September 2023, but the department secretary did not pause decisions to cancel income support until ten months later in July 2024.

Even after the decision to halt payment cancellations, a further 45 jobseekers received automatic terminations when they should not have.

The ombudsman made seven recommendations, including processes to ensure lawful decisions and addressing the inappropriate use of automated decision-making.

The Department of Employment and Workplace Relations accepted the ombudsman’s recommendation not to resume cancellations until the errors have been rectified and fix decision-making issues.

“We are actively working to improve our governance processes, ensuring legal, policy and operational considerations are integrated into our system,” department secretary Natalie James said in a letter to the ombudsman.

Services Australia has also accepted many of the recommendations and has committed to staff training and strengthening procedures to ensure cancellations are lawful.

The Antipoverty Centre has called on the government to immediately stop all Centrelink payment penalties and permanently remove the Targeted Compliance Framework, while welcoming the report as a “step towards justice”.

Asia shares track Wall Street lower, dollar struggling

Asian shares slipped along with Wall Street on Wednesday, after weak US data highlighted the damage tariffs were having on economic activity and earnings, while the dollar struggled with the drag from lower bond yields.

US services sector activity unexpectedly flatlined in July, data showed on Tuesday. Employment further weakened and input costs climbed by the most in nearly three years, underscoring the impact from President Donald Trump’s tariff policy.

Second-quarter earnings results also revealed pressure from Trump’s tariff wars. Taco Bell parent Yum Brands missed expectations as steep trade duties dent consumer spending, while Caterpillar warned that US tariffs would cost it up to $US1.5 billion ($A2.3 billion) this year.

“It paints a picture of a stagflationary dynamic, which although still far from truly coming to fruition, raises the risk of a toxic mix of rising joblessness and prices as tariffs filter through the US economy,” said Kyle Rodda, senior analyst at Capital.com.

MSCI’s broadest index of Asia-Pacific shares outside Japan slipped 0.2 per cent, while Japan’s Nikkei eked out a small 0.2 per cent gain.

Both Chinese blue chips and Hong Kong’s Hang Seng index were flat.

Nasdaq futures fell 0.3 per cent and S&P 500 futures eased 0.1 per cent.

Trump on Tuesday said it would announce tariffs on semiconductors and chips in the next week or so, while the US would initially impose a “small tariff” on pharmaceutical imports before increasing it substantially in a year or two.

He also said the US was close to a trade deal with China and that he would meet his Chinese counterpart Xi Jinping before the end of the year if an agreement was struck. However, he threatened to further raise tariffs on goods from India over its Russian oil purchases.

In currency markets, the dollar consolidated after sliding from two-month highs last Friday on a weak jobs report that had markets price in a near-certain chance of a Federal Reserve interest rate cut in September.

The dollar index, which measures the US currency against six counterparts, was flat at 98.821 and was up 0.1 per cent this week after Friday’s 1.4 per cent fall.

Fed funds futures imply a 94 per cent chance of a rate cut next month, with at least two cuts priced in for this year, according to the CME’s FedWatch.

Investors are waiting for Trump’s pick to fill a coming vacancy on the Federal Reserve’s Board of Governors. Trump said the decision will be made soon, while ruling out Treasury Secretary Scott Bessent as a contender to replace current chief Jerome Powell, whose term ends in May 2026.

Treasury yields edged up overnight after a $US58 billion ($A90 billion) auction of three-year notes went poorly, but still hovered near multi-month lows. More supply will hit the market this week with $US42 billion ($A65 billion) in 10-year notes on Wednesday and $US25 billion ($A39 billion) in 30-year bonds on Thursday.

Two-year Treasury yields rose 1 basis point to 3.7284 per cent, having risen 3.5 bps overnight, while benchmark 10-year yields ticked up 2 bps to 4.2198 per cent, after holding steady overnight.

In commodity markets, oil prices edged up after four straight sessions of declines. US crude rose 0.2 per cent to $US65.3 ($A100.8) per barrel, while Brent was at a one-month low of $US67.78 ($A104.63) per barrel, up 0.1 per cent.

Trump said on Tuesday he will decide on whether to sanction countries who purchase Russian oil after a meeting with Russian officials scheduled for Wednesday.

Spot gold prices were flat at $US3,381 ($A5,219) an ounce.

Let’s work together: miners look for price stability

Lithium heavy hitters Liontown and PLS have talked up the potential of working together to solve the price volatility that has smashed miners in recent years.

Liontown managing director Tony Ottaviano and PLS chief Dale Henderson both expressed support for a joint effort to come up with a more mature price mechanism that would shield them from Chinese market manipulation of the price of the battery metal.

Speaking at the annual Diggers and Dealers mining forum in Kalgoorlie on Tuesday, Mr Henderson said the lithium industry was still nascent and lacked the market trading structures in more mature sectors like iron in coal.

“So where that ultimately goes, I think, is probably the major participants of the industry pulling together to help resolve that,” he said.

The lithium market lacks a well-developed futures trading market, meaning prices are mainly determined via opaque private contracts.

Developing a spot trading platform would increase liquidity and price transparency, helping iron out the wild price swings the market has suffered in recent years, Mr Henderson hoped.

Fellow lithium giant Mineral Resources has previously called for a spot trading market to boost transparency.

Mr Ottaviano said he was in favour of whatever it took to see a transparent and stable lithium price.

“I’m very much encouraged by what Dale says,” he said.

“You cannot have a price like lithium on Friday go up $60 a ton, on Monday drop $60 a ton, or in the last three months drop 30 per cent.

“How do you respond? It’s very difficult to turn a ship in such a rapid time.”

The rapid market turnaround had driven Liontown down 70 per cent in two years, while PLS was two-thirds lower over the same period.

But after oversupply caused the price of lithium-rich spodumene to plummet about 90 per cent from its 2023 peak, the commodity has recently stabilised.

China was beginning to crack down on its supply glut to protect the sustainability of its own industry, Mr Ottaviano posited.

“We’re starting to see government policy to move private enterprise and state-owned enterprises away from this maniacal push for capacity at the detriment of economics,” he said.

Mr Henderson said it was hard to determine whether the lithium price had bottomed out.

“It’s hard to call given what we’ve seen in the market historically, with a disconnect to the fundamentals,” he said.

The pair saw further upside for demand, through a pick-up in the use of robots and home batteries, with Mr Ottaviano predicting demand could catch up with supply in as little as one year.