‘Brave’ plan to lift GST offers $3300 payment carrot

A bold proposal to give Australians an extra $3300 per year in exchange for a rise in the goods and services tax is being treated with caution by the major parties.

Independent MP Kate Chaney calls for the implementation of a “progressive GST model” as the federal government looks for ways to reinvigorate Australia’s languishing productivity and strengthen the budget at an economic roundtable.

Under the plan first proposed by economist Richard Holden, Australia would lift the rate of the consumption tax from 10 to 15 per cent and apply it to exempt items like food, education and health.

But to mitigate the impact on those with lower incomes, all Australians aged 18 and older would be given a $3300 rebate, meaning they would effectively pay no GST on the first $22,000 of their annual expenses.

While the GST-free threshold would cost Australia $68.8 billion, increasing the tax and removing exemptions for certain categories would raise $92.7 billion, adding $23.8 billion to the Commonwealth’s budget.

“The major parties like to talk about tax cuts and spending but they’re less willing to discuss where the money will come from,” Ms Chaney said.

“We have to have courageous conversations about other revenue sources to avoid handballing this problem to future generations.”

With the government’s economic roundtable to convene later in August, Prime Minister Anthony Albanese said he would not respond to every proposal in the meantime.

“Governments make government policy,” he told reporters in Melbourne on Thursday.

“Our tax policy – the only tax policy that we’re implementing – is the one that we took to the election … which is reducing income taxes.”

Opposition finance spokesman James Patterson said he was concerned two-thirds of revenue generated by Ms Chaney’s proposal would be used to compensate Australians for the tax it collects.

He warned against tax on spending in areas carved out of the GST when it was introduced more than two decades ago, such as education and health.

“The Howard government recognised that people who spend their money on private health or private education are actually taking a burden off the public purse, and therefore it would be unjust to tax them on top of that,” he told Sky News.

It would be an “incredibly brave government” that put a tax on top of insurance and private education fees, Senator Patterson said.

Meanwhile, the Australian Council of Social Service has called for a halving of the capital gains tax discount, a 15 per cent tax on superannuation retirement accounts and a commonwealth royalty payment for offshore gas.

It urges the government to strengthen the not-for-profit sector by supporting digital transformation and making service users the centrepiece of governance and program design.

All policies developed at the roundtable should be assessed on how they improve the wellbeing of people and the natural environment while taking gender and other factors into account, the council said.

“We must better prepare and train people for jobs and finally lift income support to levels that don’t trap people in poverty and destitution,” Dr Goldie said.

‘Not good enough’: electric vehicles fail range claims

Some of Australia’s best-selling electric vehicles fail to meet their advertised range and consume significantly more power than manufacturers promise, on-road tests reveal.

One popular SUV performed particularly poorly, stopping short of its advertised range by more than 100km, which one motoring group called “not good enough”.

The Australian Automobile Association released the results on Thursday after testing five electric vehicles as part of its $14 million Real-World Testing Program.

The findings come one week after the program revealed 25 out of 30 petrol and hybrid vehicles tested had consumed more fuel than their lab results showed and more than three in every four vehicles examined in the scheme failed to meet expectations.

The motoring body road-tested five electric vehicles in its first trial of the technology, using a 93km circuit around Geelong in Victoria in damp and dry conditions, and measuring the vehicles’ energy consumption.

BYD’s Atto 3 SUV produced the worst result of the models tested, falling short of its promised range by 111km or 23 per cent, and using 21 per cent more power than advertised.

Tesla’s entry-level electric car, the Model 3, also failed to meet its promised range by 14 per cent, or 72km, and used six per cent more electricity than lab results showed.

The Tesla Model Y and Kia EV6 SUVs also failed to meet their range by eight per cent, or just over 40km, while the Smart #3 electric car came the closest to its lab test results, falling within five per cent or 23km of the advertised range.

Significant differences between the advertised and actual range or fuel consumption of vehicles had the potential to mislead buyers, NRMA spokesman Peter Khoury said, and were not acceptable.

“A gap of 23 per cent or 26 per cent is obviously not good enough,” he told AAP.

“It is important that people are getting what they’re paying for.”

The results underlined the importance of independently testing vehicles, Mr Khoury said, as laboratory test results had proven unreliable for both fuel and electric cars.

An electric car’s range could be affected by a number of factors, Australian Electric Vehicle Association national president Chris Jones said.

These include high or low temperatures, headwinds, steep terrain, and the use of air conditioning and heating features.

Car makers should seek to “under-promise and over-deliver” when it comes to vehicle range, he said, to allow buyers to make informed choices about the models that will suit their needs.

“It is frustrating that manufacturers are inflating the values when they really ought to be a bit more conservative,” Mr Jones said.

“I would have thought a 10 per cent difference was reasonable but 20 per cent is pretty bad.”

Electric vehicle range is typically tested in Australia using the older New European Driving Cycle (NEDC) laboratory test, but this will be replaced by the more accurate Worldwide Harmonised Light Vehicle Test Procedure (WLTP) from December.

The Australian Automobile Association’s vehicle-testing program, funded by the federal government, has examined 114 fuel-powered vehicles since it began in 2023 and found 88 models, or 77 per cent, failed to meet their advertised energy consumption.

Failing to recognise Palestinian state ‘rewards’ Israel

Failing to recognise a Palestinian state would reward the Israeli government for its “campaign of genocidal violence”, a former ambassador to Israel has warned, as Australia considers its next diplomatic moves.

Australia has begun co-ordinating with other nations on the issue as France, Canada and the UK prepare to recognise the state of Palestine at a United Nations meeting in September amid a humanitarian crisis in Gaza.

Though the federal government has said recognition is a matter of “when, not if”, it has been hesitant to commit to a deadline and the coalition has raised concerns such an action could be seen as a reward for designated terrorist organisation Hamas.

But Australia’s former ambassador to Israel Peter Rodgers dismissed such arguments as “nonsensical”, noting there were “nasty people” on both the Israeli and Palestinian sides.

“Not recognising a Palestinian state rewards Israel,” he told ABC radio on Thursday.

“It rewards the government of Benjamin Netanyahu for ethnic cleansing and apartheid in the West Bank.

“We need to be very careful of pointing the finger in one direction and forgetting what’s going on, on the other side.”

A genocide case has been brought against Israel at the International Court of Justice, which is yet to rule on the matter, but Mr Netanyahu’s office called the allegations “false and outrageous” and his government has repeatedly claimed it only targets Hamas and not civilians.

More than 50,000 children have been killed or injured by Israel since October 2023, UNICEF said.

Prime Minister Anthony Albanese has said the recognition of Palestine would need to guarantee Hamas played no role in the future nation, and Foreign Minister Penny Wong has repeatedly emphasised the Palestinian Authority has condemned and sought to distance themselves from the terrorist group.

Hamas has effectively governed Gaza since violently defeating the political party Fatah, which now controls the Palestinian Authority that exercises partial civil control in the West Bank.

The Palestinian Authority is currently “pretty useless”, Mr Rodgers said, but recognition could provide an avenue for change.

“There is an opportunity to work with other Palestinians, to work towards reforming the Palestinian Authority … giving it meaningful power,” he said.

Mr Albanese spoke with Palestinian Authority President Mahmoud Abbas on Tuesday, when he reiterated Australia’s commitment to a two-state solution in the Middle East that would allow Palestine and Israel to co-exist, before discussing the two-state solution with French President Emmanuel Macron.

“The entire international community is distressed by what we’re seeing happening in Gaza,” he told reporters in Melbourne.

“We want to see commitments from the Palestinian Authority – commitments of their governance (and) reforms.”

More than two million people in Gaza are now facing high levels of food insecurity, United Nations sources have found.

Israel denies there is starvation in the besieged strip despite international human rights groups decrying its offensive in Gaza and attributing deaths to starvation.

Mr Rodgers was one of many former Australian diplomats who signed an open letter to Prime Minister Anthony Albanese, which is being circulated on social media, calling on Australia to urgently recognise a state of Palestine.

More than 140 of the 193 UN member states already recognise the state of Palestine, including European Union member states Spain and Ireland.

Violence in Gaza reignited after Hamas killed 1200 people in Israel and took about 250 hostages on October 7, 2023.

Israel’s military response has since killed 60,000 people, according to local health authorities.

Tens of thousands of Australians took part in pro-Palestine protests over the weekend, including at least 90,000 who rallied at the Sydney Harbour Bridge, and both Students for Palestine and the National Union of Students have called for students to walk out of class on Thursday as part of a demonstration.

Opposition home affairs spokesman Andrew Hastie has taken issue with domestic protests.

“This is Australia. Not the Middle East,” he said in an interview with Sky News posted on his social media.

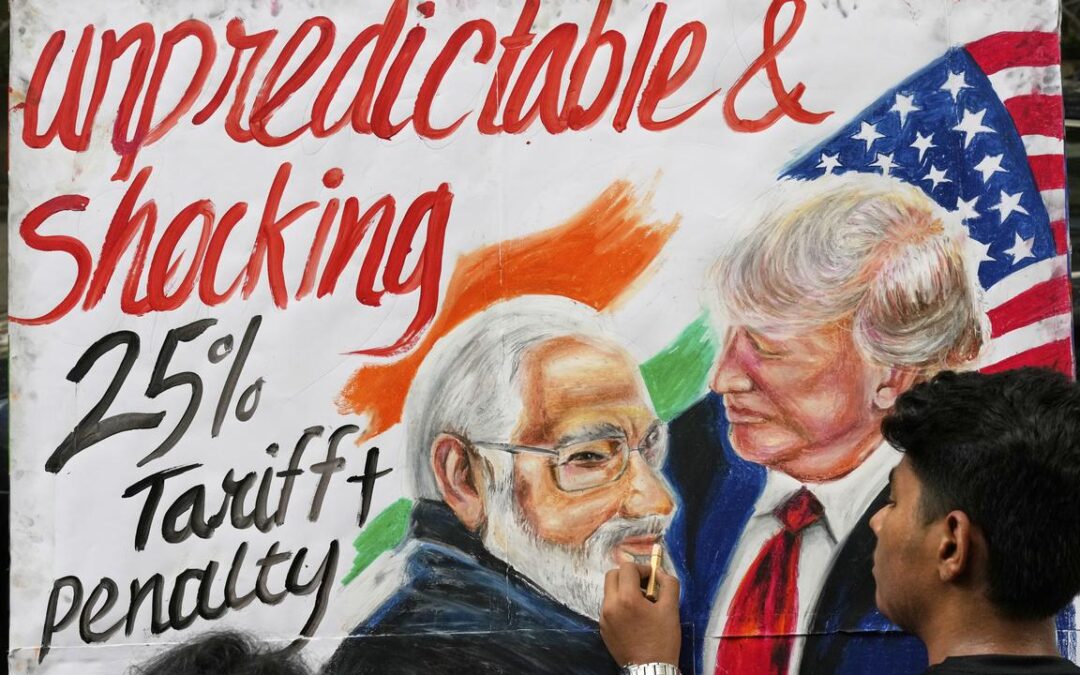

Trump to put additional 25pct import taxes on India

US President Donald Trump has signed an executive order to place an additional 25 per cent tariff on India for its purchases of Russian oil.

It brings the combined tariffs imposed by the United States on its ally to 50 per cent.

The tariffs would go into effect 21 days after the signing of the order, meaning both India and Russia might have time to negotiate with the administration on the import taxes.

Trump’s moves could scramble the economic trajectory of India, which until recently was seen as an alternative to China by American companies looking to relocate their manufacturing.

China also buys oil from Russia, but it was not included in the order signed by the Republican president.

As part of a negotiating period with Beijing, Trump has placed 30 per cent tariffs on goods from China, a rate that is smaller than the combined import taxes with which he has threatened New Delhi.

Trump had previewed for reporters that the tariffs would be coming.

During an event in the Oval Office on Wednesday, local time, with Apple chief executive Tim Cook, Trump affirmed the 50 per cent tariff number, not giving a specific answer as to whether additional tariffs on India would be dropped if there were a deal between Russia and Ukraine.

“We’ll determine that later,” Trump said. “But right now they’re paying a 50 per cent tariff.”

The White House said on Wednesday that Trump could meet in person with Russian President Vladimir Putin as soon as next week as he seeks to broker an end to the war.

The Indian government called the additional tariffs “unfortunate”.

“We reiterate that these actions are unfair, unjustified and unreasonable,” Foreign Ministry spokesman Randhir Jaiswal said in a statement, adding that India would take all actions necessary to protect its interests.

Jaiswal said India has already made its stand clear that the country’s imports were based on market factors and were part of an overall objective of ensuring energy security for its 1.4 billion people.

Ajay Srivastava, a former Indian trade official, said the latest tariff places the country among the most heavily taxed US trading partners and far above rivals such as China, Vietnam and Bangladesh.

“The tariffs are expected to make Indian goods far costlier with the potential to cut exports by around 40-50 per cent to the US,” he said.

Srivastava said Trump’s decision was “hypocritical” because China bought more Russian oil than India did in 2024.

“Washington avoids targeting Beijing because of China’s leverage over critical minerals which are vital for US defence and technology,” he said.

In 2024, the US ran a $US45.8 billion ($A70.4 billion) trade deficit in goods with India, meaning America imported more from India than it exported, according to the US Census Bureau.

American consumers and businesses buy pharmaceutical drugs, precious stones and textiles and apparel from India, among other goods.

As the world’s largest nation, India represented a way for the US to counter China’s influence in Asia.

But India has not supported the Ukraine-related sanctions by the US and its allies on Moscow even as India’s leaders have maintained that they want peace.

The US and China are currently in negotiations on trade, with Washington imposing a 30 per cent tariff on Chinese goods and facing a 10 per cent retaliatory tax from Beijing on American products.

The planned tariffs on India contradict past efforts by the Biden administration and other nations in the Group of Seven leading industrialised nations that encouraged India to buy cheap Russian oil through a price cap imposed in 2022.

Trump says he plans 100pct tariff on computer chips

The United States will impose a tariff of about 100 per cent on semiconductor chips imported into the nation, President Donald Trump says.

“We’ll be putting a tariff on of approximately 100 per cent on chips and semiconductors,” Trump said in the Oval Office while meeting with Apple chief executive Tim Cook.

“But if you’re building in the United States of America, there’s no charge.”

The Republican president said companies that make computer chips in the US would be spared the import tax.

During the COVID-19 pandemic, a shortage of computer chips increased the price of autos and contributed to an overall uptick in inflation.

Inquiries sent to chip makers Nvidia and Intel were not immediately answered.

Demand for computer chips has been climbing worldwide, with sales increasing 19.6 per cent in the year-ended in June, according to the World Semiconductor Trade Statistics organisation.

Trump’s tariff threats mark a significant break from existing plans to revive computer chip production in the United States.

He is choosing an approach that favours the proverbial stick over carrots in order to incentivise more production.

Essentially, the president is betting that higher chip costs would force most companies to open factories in the US, despite the risk that tariffs could squeeze corporate profits and push up prices for mobile phones, TVs and refrigerators.

By contrast, the bipartisan CHIPS and Science Act signed into law in 2022 by then-president Joe Biden provided more than $US50 billion ($A77 billion) to support new computer chip plants, fund research and train workers for the industry.

The mix of funding support, tax credits and other financial incentives was meant to draw in private investment, a strategy that Trump has vocally opposed.

Nationalist Nawrocki sworn in as Polish president

Karol Nawrocki, a conservative historian and supporter of Donald Trump’s MAGA movement, has been sworn in as Poland’s president, setting the stage for conflict with the centrist government and potentially cooler relations with Ukraine.

Nawrocki took the presidential oath in a ceremony in the Polish parliament on Wednesday.

The election victory of Nawrocki, who was backed by the nationalist opposition party Law and Justice (PiS), dealt a blow to Prime Minister Donald Tusk’s hopes of cementing the pro-European Union course he has set for the bloc’s largest eastern member and left his government floundering in the polls.

Poland is now bracing for a continuation of the deadlock seen under nationalist outgoing President Andrzej Duda, with Nawrocki able to use his veto powers to stymie a government agenda that includes rolling back judicial reforms implemented by PiS, which critics said undermined the independence of the courts.

Nawrocki also looks set to pose a headache for the government by proposing measures such as tax cuts that are likely to be popular with many voters but hard to implement for an administration with a stretched budget.

“As prime minister, I have so far worked with three presidents,” Tusk, who was also prime minister from 2007 to 2014, wrote in a post on X.

“What will it be like with the fourth? We’ll manage.”

The incoming president has said he does not currently see a place for Ukraine in NATO or the EU, a marked shift in tone compared to Duda.

As president, Nawrocki would be required to sign off on Poland’s ratification of a new member joining NATO.

While Tusk has said that the European Union should play a bigger role in defence matters alongside NATO, PiS and Nawrocki have argued this would undermine Poland’s alliance with the United States.

“The United States is undoubtedly our priority partner,” said Nawrocki’s spokesman Rafal Leskiewicz.

However, the fact he is a political newcomer who was little known to the public before PiS threw its weight behind him means there is much uncertainty about how his presidency will pan out, political observers say.

“I don’t know if he will, in short, fully implement the policies of Law and Justice … or if he will try to come up with his own initiatives,” said Andrzej Rychard, a sociologist from the Polish Academy of Science.

Nawrocki emerged victorious from a tumultuous campaign in which allegations regarding his past, including that he acquired a second property from an elderly man in return for a promise of care that he did not provide, frequently dominated the headlines.

Nawrocki denied accusations of wrongdoing, although he admitted to taking part in an organised fight between football hooligans, adding to the tough-guy image the amateur boxer had already sought to cultivate.

After the election, supporters of defeated liberal candidate Rafal Trzaskowski filed thousands of protests to the Supreme Court over irregularities at some polling stations.

However, the irregularities were not enough to materially alter the result.

Telcos still failing to support struggling customers

Telecommunication companies have been put on notice for consistently failing to support customers facing financial hardship.

Although new financial hardship standards came into effect in 2024, customers are still reporting that simple requests for help are being rejected.

A Telecommunications Industry Ombudsman report published on Thursday, based on a review of more than 900 customer complaints, found some telcos were causing or adding to the financial stress of their customers.

Ombudsman Cynthia Gebert said the report confirmed that more needed to be done by companies to meet their obligations and support people struggling financially.

“We are seeing that telcos aren’t consistently supporting consumers and that has a real impact on people’s lives and their ability to stay afloat,” she told AAP.

The report found some telcos even refused to help customers who proactively sought support, including a woman who fell into hardship after experiencing family violence and health complications.

She had purchased a device at a store and was talked into additional products but wasn’t informed about any of the extra costs.

The woman was unable to pay for the extra services and was not offered any help from her telco.

The telco ended up selling her debt to a debt collection agency and listed a default on her credit file, which totalled $7000.

The cost was waived after she contacted the communications watchdog.

“We want people to feel confident that when they reach out to their telco for the help they are entitled to, they’ll get the support they need that is right for their circumstances,” Ms Gebert said.

About three-in-five Australians have experienced some form of financial difficulty, with 41 per cent experiencing high or chronic financial difficulty.

Telcos contacted by the communications watchdog indicated increased numbers of customers seeking financial support over the past year, due to ongoing cost-of-living pressures.

The report also found that customers prioritising their phone and internet bills over essentials like food or rent, fearing disconnection.

Many consumers also reported finding it difficult to initiate a conversation with their telco about financial hardship, with some feeling their telco was unsympathetic.

“Phone and internet are so critical to our ability to function in day-to-day society,” Ms Gebert said.

“It’s (how) you access government services, banking services … If you are disconnected, the wide ranging impacts on your ability to function are huge and it can compound.”

The report’s findings come after the introduction of new industry rules aimed at improving financial hardship support in March 2024.

The new rules require telcos to provide a minimum of six different options for assistance to customers, and to only disconnect consumers as a measure of last resort.

More gold jackpots lurking in WA dirt, top miner says

The man who helped unearth one of Australia’s biggest recent gold finds says there’s plenty more motherlodes in them thar hills.

Former De Grey Mining chairman Simon Lill hit the jackpot when his exploration team discovered the Hemi deposit in the Pilbara region of Western Australia in 2020.

Despite the region being better known for its rich iron ore reserves, the discovery gave De Grey one of the most valuable gold assets in development in Australia, estimated at more than 11 million ounces of ore.

The timing could not have been better, with bullion prices soaring to record highs in the years since, leaving the company sitting on top of more than $55 billion worth of gold at current prices.

So De Grey cashed in, with Australia’s largest goldminer Northern Star snapping the company and its Hemi project up for $5 billion.

The deal earned De Grey and Mr Lill the coveted Dealer of the Year award at the glitzy closing night ceremony of this year’s Diggers and Dealers mining forum.

“De Grey Mining exemplifies all that makes our industry great,” the conference’s organisers said.

“Exceptional market validation driven by resource expansion and investor anticipation.”

Now chair of Ballard Mining, an ASX newbie spun out of Gina Rinehart-backed Delta Lithium along with its high-grade Mount Ida gold project, Mr Lill said there was plenty more gold to be found in the red WA dirt.

“I used to work with a crusty old metallurgist,” he said on Wednesday.

“He said, if it’s under-explored, there ain’t nothing there, i.e. the old timers have found it all. I think the gold industry in recent years has proven that that is wrong.”

Ballard already claims more than one million ounces of gold in its deposit, but with more exploration underway at the site, Mr Lill is confident that figure is just scratching the surface.

“The geologists from De Grey were convinced that there’ll be another Hemi somewhere,” he said.

Right next door to Ballard’s Mount Ida project is a processing plant owned by privately-held gold producer Aurenne Group.

It was only logical at some stage to hold discussions with Aurenne about potentially acquiring the facility, Mr Lill said.

Flush with cash from the surge in gold prices to more than $5200 an ounce, mergers and acquisitions was a hot topic among delegates at the three-day mining forum in Kalgoorlie.

Another recent M&A participant, Ramelius Resources, scooped the Digger of the Year award.

The mid-tier miner, which a week earlier completed its $2.4 billion takeover of gold play Spartan Resources, achieved a record 301,664 ounces of gold production last financial year, demonstrating “outstanding operational and financial performance”.

West African explorer Turaco Gold won the emerging company award while the GJ Stokes Memorial Award went to Peter Cook, recognised for more than 40 years in the industry.

A plane-load of workers was flown into Kalgoorlie to staff the gala dinner under the giant Diggers marquee on Wednesday night, before being flown back to Perth in the early hours of Thursday morning when the festivities had wrapped up.

Novo Nordisk warns of layoffs as pressure mounts

Novo Nordisk expects continued competition from copycat versions of its blockbuster Wegovy obesity drug this year and could face layoffs as it battles rising pressure from main US rival Eli Lilly, the Danish drugmaker warns.

Novo, which became Europe’s most valuable company worth $US650 billion ($A1.0 trillion) last year on booming sales of Wegovy, is facing a pivotal moment as the medicine loses market share and sees sales growth slow, especially in the United States.

It has warned of far slower growth this year – in part due to compounders who have been allowed to make copycat medicines based on the same ingredients as Wegovy due to shortages.

Novo cut its full-year sales and profit forecasts last week, wiping $US95 billion ($A146 billion) off its market value since.

The shares were down 3.4 per cent on Wednesday afternoon.

The slide is a huge and abrupt turnaround for the firm that has been one of the world’s hottest investment stories, which led to a rapid expansion of manufacturing and sales capacity.

Now the firm is eyeing potential cost-cutting measures.

“We probably won’t be able to avoid layoffs,” outgoing CEO Lars Fruergaard Jorgensen told Danish broadcaster DR.

“When you have to adjust a company, there are some areas where you have to have fewer people, some (areas) where you have to be smaller.”

He added, though, that any decision on layoffs would be in the hands of the incoming CEO, company veteran Maziar Mike Doustdar, who takes over on Thursday.

On a media call, Jorgensen said the market for copycat versions of Wegovy’s class of drugs – known as GLP-1 receptor agonists – was of “equal size to our business” and compounded versions of Wegovy were sold at a “much lower price point”.

In May, the company said it expected many of the roughly one million US patients using compounded GLP-1 drugs to switch to branded treatments after a US Food and Drug Administration ban on compounded copies of Wegovy took effect on May 22, and it expected compounding to wind down in the third quarter.

However, finance chief Karsten Munk Knudsen said on Wednesday that more than one million US patients were still using compounded GLP-1s and that Novo’s lowered outlook has “not assumed a reduction in compounding” this year.

“The obesity market is volatile,” Knudsen told analysts when asked under what circumstances the company could see negative growth in the last six months of the year.

Knudsen reiterated that the company was pursuing multiple strategies, including lawsuits against compounding pharmacies, to halt unlawful mass compounding.

Jorgensen said the company was encouraged by the latest US prescription data for Wegovy.

While the drug was overtaken earlier this year by rival Lilly’s Zepbound in terms of US prescriptions, that lead has narrowed in the past month.

Second-quarter sales of Wegovy rose by 36 per cent in the US and more than quadrupled in markets outside the US compared to a year ago, Novo said.

While Wegovy’s US pricing held steady in the quarter, the company expected deeper erosion in the key US market in the second half, due to a greater portion of sales expected from the direct-to-consumer or cash-pay channel, as well as higher rebates and discounts to insurers, Knudsen said.

Productivity spruikers urged to keep battlers in mind

Tackling financial inequality is being touted as a productivity boost ahead of an economic think-fest designed to plot Australia’s future.

Raising revenue via tax reform and rethinking how community services are funded are on the wishlist of the Australian Council of Social Service ahead of the three-day Economic Reform Roundtable later in August.

Lifting GST levels to reduce reliance on income tax would “undermine fairness” and do nothing to improve economic efficiency, the council’s chief executive Cassandra Goldie said.

“The extra revenue we need to fund care and community services, schools, and an income support system that protects people from poverty must come from those with the most capacity to pay – not those doing it toughest,” she said.

“The government must not waste this historic chance to put Australia on a fairer, more productive and more sustainable financial footing.”

The council’s submission calls for a halving of the capital gains tax discount, a 15 per cent tax on superannuation retirement accounts and a commonwealth royalty payment for offshore gas.

It urges the government to strengthen the not-for-profit sector by supporting digital transformation and making service users the centrepiece of governance and program design.

All policies developed at the roundtable should be assessed on how they improve the wellbeing of people and the natural environment while taking gender and other factors into account, the council said.

“We must better prepare and train people for jobs and finally lift income support to levels that don’t trap people in poverty and destitution,” Dr Goldie said.

The Productivity Commission has proposed cutting the income tax rate to 20 per cent for firms earning less than $1 billion while introducing a five per cent tax on cashflow, which it says would reap $14 billion without worsening budget sustainability.

But business groups argue productivity will not be fixed by taxing companies and making Australia less competitive.

Treasurer Jim Chalmers said finding ways to afford tax reform was crucial.

“Some people have embraced that challenge. Others haven’t,” he said.

“It’s a good thing (the commission) is testing some of these difficult ideas and trade-offs … I’m not surprised not everybody forms an orderly queue, but it’s an important input.”