Rethink on rules for everyday items could spur economy

Fixing rules for baby formula, carpeting, furniture packaging and other items could save Australians billions and stimulate the economy as the federal government seeks solutions to ailing productivity.

Australia has more than 7500 standards to ensure its products and services are safe.

But a Productivity Commission interim report has found more than three-quarters do not have an equivalent international standard, 40 per cent of those in legislation are obsolete or superseded and only one in four are consistently implemented by the states, territories and Commonwealth.

As a result, Australia’s labelling requirements for infant formula differ from those in Europe, the US and Hong Kong, which makes local manufacturers less competitive in those export markets.

Swedish furniture giant IKEA has also pointed to differences in packaging standards from overseas frameworks, and inconsistencies across states and territories impose unnecessary costs and undermine the efficiency and scalability of recycling efforts.

Differences in flooring standards between states and territories are the source of the flooring sector’s “greatest inefficiencies”, the Carpet Institute of Australia has found.

The consequences are so far-reaching aligning standards across Australia with overseas requirements could be worth almost $4 billion a year – potentially raising GDP by 0.2 per cent, the Productivity Commission found.

Harmonising standards would improve compatibility and increase competition by allowing more overseas-designed products to be sold in Australia, increasing competition, while reducing costs through economies of scale.

It would also pave the way for productivity gains by giving Australians earlier access to new technologies and improving public welfare by making it easier to acquire less expensive medical devices.

Treasurer Jim Chalmers welcomed the interim report and acknowledged standards reform could help Australians save and ease burdens on businesses.

“We’ve made good progress in some areas but there’s more to do,” he said.

The independent government advisory body also recommended states and territories join an automatic mutual recognition scheme for workers who require specific licenses for their jobs, allowing them to move freely across Australia to places where their skills are most needed.

These recommendations could be considered when Dr Chalmers convenes his economic roundtable later in August.

During the event, a range of experts are expected to discuss ways to lift living standards for Australians by boosting productivity, building resilience and strengthening the budget.

Proposals by other groups include increasing GST to 15 per cent, slashing property investor tax breaks and leaning on artificial intelligence.

Trump’s higher tariffs spark defiance and concern

US President Donald Trump’s higher tariffs on imports from dozens of countries have kicked in, raising the average US import duty to its highest in a century and leaving major trade partners such as Switzerland, Brazil and India hurriedly searching for a better deal.

The US Customs and Border Protection agency began collecting the higher tariffs of 10 per cent to 50 per cent on Thursday after weeks of suspense over Trump’s final tariff rates and frantic negotiations with countries seeking to lower them.

The leaders of Brazil and India vowed not to be cowed by Trump’s hardline bargaining position, even while their negotiators sought a reprieve from the highest tariff levels.

The new rates will test Trump’s strategy for shrinking US trade deficits without causing massive disruptions to global supply chains or provoking higher inflation and stiff retaliation from trading partners.

After unveiling his “Liberation Day” tariffs in April, Trump has frequently modified his plans, slapping much higher rates on imports from some countries.

These include 50 per cent for goods from Brazil, 39 per cent from Switzerland, 35 per cent from Canada and 25 per cent from India.

He announced on Wednesday a further 25 per cent tariff on Indian goods, to be implemented in 21 days over India’s purchases of Russian oil, on top of the 25 per cent already imposed.

Tariffs are ultimately paid by companies importing the goods and passed on in full or in part to consumers of end products.

Trump’s top trade negotiator, Jamieson Greer, said the US was working to reverse decades of policies that had weakened US manufacturing capacity and workforce, and that many other countries shared concerns about macroeconomic imbalances.

“The rules of international trade cannot be a suicide pact,” he wrote in a column published by the New York Times.

“By imposing tariffs to rebalance the trade deficit and negotiating significant reforms that form the basis of a new international system, the United States has shown bold leadership,” Greer said.

Eight major trading partners accounting for about 40 per cent of US trade flows have reached framework deals for trade and investment concessions to Trump, including the European Union, Japan and South Korea, reducing their base tariff rates to 15 per cent.

Britain won a 10 per cent rate, while Vietnam, Indonesia, Pakistan and the Philippines secured rate reductions to 19 per cent or 20 per cent.

Countries with punishingly high duties, such as India and Canada, “will continue to scramble around trying to fix this,” he added.

Switzerland’s President Karin Keller-Sutter said on Thursday that talks with the US would continue after she returned home empty-handed from an 11th-hour trip to Washington aimed at averting the crippling US import tariff on Swiss goods.

A last-minute attempt by South Africa to improve its offer in exchange for a lower tariff rate also failed.

The two countries’ trade negotiating teams would have more talks, South African President Cyril Ramaphosa’s office said.

Meanwhile, Brazil’s President Luis Inacio Lula da Silva told Reuters on Wednesday he would not humiliate himself by seeking a phone call with Trump even as he said his government would continue cabinet-level talks to lower a 50 per cent tariff rate.

Indian Prime Minister Narendra Modi was similarly defiant, saying he would not compromise the interests of the country’s farmers.

The pressure has also strengthened India’s commitment to a “strategic partnership” with Russia, with Russian President Vladimir Putin set to visit by the end of the year.

Some countries were also rallying together to confront Trump, with Brazil’s Lula saying he would call the leaders of India and China to discuss a joint BRICS response to tariffs.

Trump has repeatedly railed against BRICS members and recently threatened to subject their imports to an additional 10 per cent tariff.

Mushroom murderer returns to court as sentencing looms

Erin Patterson is due back before court a month after being convicted of killing three members of her estranged husband’s family by serving a death cap mushroom-laced lunch.

The 50-year-old mother has a mention hearing scheduled on Friday at the Supreme Court in Melbourne, where she is set to appear remotely via video link from prison.

Dates for her pre-sentence hearing, known as a plea, are expected to be set during her court appearance.

Plea hearings allow victims and their families to deliver statements to the court about how the crime has impacted them.

They also allow defence lawyers and prosecutors to argue matters for the judge to take into account in deciding Patterson’s sentence.

Patterson faces up to life in prison after being convicted of three murders and one attempted murder over a toxic beef Wellington meal she served in July 2023.

Her estranged husband Simon’s mother and father, Don and Gail Patterson, and aunt and uncle, Heather and Ian Wilkinson, all became sick and ended up in hospital after eating the lunch.

Mr Wilkinson was the only lunch guest to survive.

Patterson had pleaded not guilty and claimed not to have intentionally poisoned her lunch guests.

She spent eight days in the witness box during her regional Victorian trial, where she admitted a series of lies and said she may have accidentally included foraged mushrooms in the beef Wellington.

This included lies to police about her interest in wild mushrooms, and lies about owning a food dehydrator which she dumped at a local tip.

The trial became a media circus, involving 252 media outlets including 15 international, making it the biggest matter the Supreme Court has managed in recent history.

As the trial in Morwell reached its 11th week, jurors returned with guilty verdicts on all charges on July 7 after seven days of deliberations.

Patterson will have 28 days to lodge an appeal after she is sentenced.

US applications for jobless benefits up modestly

The number of Americans filing for unemployment benefits slightly increased last week, a sign that employers are still retaining workers despite economic uncertainty related to US trade policy.

Jobless claims for the week ending August 2 rose by 7000 to 226,000, the Labour Department reported on Thursday, slightly more than the 219,000 new applications that economists had forecast.

The report is the first government labour market data release since Friday’s grim July jobs report sent financial markets spiralling downward, spurring President Donald Trump to fire the head of the agency that tallies the monthly jobs numbers.

Weekly applications for jobless benefits are seen as a proxy for US layoffs and have mostly settled in a historically healthy range between 200,000 and 250,000 since COVID-19 throttled the economy in the spring of 2020.

It was just the second time in eight weeks that jobless benefit applications rose.

While layoffs remain low by historical standards, there has been a noticeable deterioration in the labour market this year.

Last week, the government reported that US employers added just 73,000 jobs in July, well short of the 115,000 expected.

Worse, revisions to the May and June jobs figures shaved a stunning 258,000 jobs off previous estimates and the unemployment rate ticked up to 4.2 per cent from 4.1 per cent.

Many economists contend that Trump’s erratic tariff rollout in April created uncertainty for employers, who have grown reluctant to expand their payrolls.

The grim jobs data raised the ire of Trump, who alleged that the data was manipulated for political reasons and ordered the firing of Erika McEntarfer, the head of the Bureau of Labour Statistics, which produces the monthly jobs figures.

The firing was roundly criticised by economists, who, along with Wall Street investors, have long considered the job figures reliable.

Stock and bond markets often react sharply when they are released.

US markets recoiled at last week’s jobs report, with the Dow Jones Industrial Average tumbling more than 600 points on Friday.

The Bureau of Labour Statistics does not contribute to the weekly unemployment benefits report except to calculate the annual seasonal adjustments that account for changes in weather, holidays, and school schedules.

The Department of Labour’s Employment and Training Administration collects the weekly unemployment insurance claims reported by each state.

There was another indicator that the labour market is softening in a government report last week that revealed employers posted 7.4 million job vacancies in June, down from 7.7 million in May.

The number of people quitting their jobs — a sign of confidence in finding a better job — fell in June to the lowest level since December.

Hiring also fell from May.

Major companies have announced job cuts this year, including Procter & Gamble, Dow, CNN, Starbucks, Southwest Airlines, Microsoft, Google, and Facebook’s parent company, Meta. Most recently, Intel and The Walt Disney Co announced staff reductions.

The deadline on most of Trump’s stiff proposed taxes on imports kicked in on Thursday, though some deals have been made and other deadlines to negotiate have been extended.

Unless Trump reaches deals with countries to lower the tariffs, economists fear they could act as a drag on the economy and spark another rise in inflation.

Thursday’s report also showed that the four-week average of claims, which smooths out some of the week-to-week volatility, fell by 500 to 220,750.

The total number of Americans collecting unemployment benefits for the previous week of July 26 jumped by 38,000 to 1.97 million, the highest level since November 2021.

Activists arrested as students strike for Palestine

University students have walked out of classrooms across the country in solidarity with Palestinians as Australia considers its next diplomatic moves.

National student strikes were held in Melbourne, Sydney, Canberra, Adelaide, Brisbane and Wollongong on Thursday to highlight the humanitarian crisis in Gaza.

About 300 people gathered in central Melbourne, with one speaker accusing Prime Minister Anthony Albanese and Foreign Minister Penny Wong of having ‘”the blood of Gaza” on their hands.

“Thousands of children, hundreds of thousands of people are slowly starving to death in a man-made famine,” she told the crowd outside the State Library.

The demonstrators marched through the street holding signs and chanting “Israel out of Gaza” and “Israel out of West Bank”.

They staged a sit-in at the corner in front of Flinders Street Station, blocking the intersection to traffic.

Police tried to open the road and removed protesters who refused to move.

Five protesters were arrested and are expected to be charged on summons, police said.

A man with an Australian flag was also moved on for breaching the peace.

Tens of thousands of Australians took part in pro-Palestine protests at the weekend, including at least 90,000 who rallied at the Sydney Harbour Bridge.

Brisbane’s Story Bridge could be the next monument to host a historic march after Justice For Palestine told Queensland police of their intention to walk across it on August 24.

Australia has begun co-ordinating with other nations as France, Canada and the UK prepare to recognise the state of Palestine at a United Nations meeting in September.

The federal government has been hesitant to commit to a deadline for recognition and the coalition has raised concerns such an action could be seen as a reward for designated terrorist organisation Hamas.

But Australia’s former ambassador to Israel Peter Rodgers dismissed such arguments as “nonsensical”.

“Not recognising a Palestinian state rewards Israel,” he told ABC Radio.

“It rewards the government of Benjamin Netanyahu for ethnic cleansing and apartheid in the West Bank.”

A genocide case has been brought against Israel at the International Court of Justice, which is yet to rule on the matter.

Mr Netanyahu’s office called the allegations “false and outrageous”, with his government repeatedly claiming it only targets Hamas and not civilians.

Violence in Gaza reignited after Hamas killed 1200 people in Israel and took about 250 hostages on October 7, 2023.

Israel’s military response has since killed 60,000 people, according to local health authorities.

More than 50,000 children have been killed or injured by Israel since October 2023, UNICEF said.

Mr Rodgers was one of many former Australian diplomats who signed an open letter to Mr Albanese calling on Australia to urgently recognise Palestinian statehood.

More than 140 of the 193 United Nations member states already recognise the state of Palestine, including European Union member states Spain and Ireland.

Mr Albanese has said the recognition of Palestine would need to guarantee Hamas plays no role in the future nation.

Hamas has effectively governed Gaza since violently defeating the political party Fatah, which now controls the Palestinian Authority that exercises partial civil control in the West Bank.

Mr Albanese spoke with Palestinian Authority president Mahmoud Abbas on Tuesday, reiterating Australia’s commitment to a two-state solution in the Middle East that would allow Palestine and Israel to co-exist.

“The entire international community is distressed by what we’re seeing happening in Gaza,” he told reporters in Melbourne.

More than two million people in Gaza are now facing high levels of food insecurity, United Nations sources have found.

Israel denies there is starvation in the besieged strip despite international human rights groups decrying its offensive in Gaza and attributing deaths to starvation.

Labor opens door to PwC after tax scandal

Labor has opened the door to consultancy firm PwC being able to bid for government work following the damaging tax leak scandal.

Revelations emerged in 2023 that PwC had misused confidential information to help companies pay less tax.

It led to the firm selling off its government advisory arm and agreeing to a non-compete clause that it will not provide services to government until 2028.

But a review by the Department of Finance found “it is appropriate for Australian government entities to consider contracting with PwC Australia as they would any other supplier”.

Despite the decision, PwC maintains it cannot undertake government work, and may not start bidding for in three years’ time.

“We are proud of the progress we’ve made across the past two years and look forward to continuing to embed these important changes,” PwC Australia chief executive Kevin Burrowes said.

“There is more work to do as we strive to become the pre-eminent professional services firm, with a focus on delivering exceptional outcomes for our clients, using our deep industry sector expertise.”

Greens finance spokeswoman Barbara Pocock is one of three senators who led an inquiry into the scandal, and asked the finance department to reverse its draft decision to lift the restrictions.

She slammed the move as “gutless”.

“This government has betrayed the Australian people who had very rightly held the expectation that the rogue consulting firm PwC would be held to account for colluding with foreign multinationals to defraud our tax system,” Senator Pocock said.

“Very little has been done to put safeguards in place to ensure that the tax leak scandal does not happen again.”

PwC banned donations to political parties in the wake of the tax scandal, which led to thousands of staff leaving the firm.

PM backs working from home laws amid ‘stunt’ claims

Victoria has several ways to push ahead with legalising working from home, as the prime minister swings his support behind its potential.

The Victorian government has promised to introduce laws sometime in 2026 to allow private and public sector employees to work from home two days a week.

Much public discussion has focused on federal industrial relations laws potentially overriding proposed state laws, but employment law expert David Catanese said it was not that simple.

The Hall and Wilcox partner pointed to “carve outs” in the federal Fair Work Act that specified state laws that provided more beneficial, flexible entitlements to employees could co-exist with commonwealth laws.

“The devil will be in the detail and there will be limits on the extent of laws that can be made, but it is a potential pathway,” he told AAP.

Another would be adding “significant amendments” by increasing or creating new protections under equal opportunity laws, he said, so they covered a broader category of employees.

Premier Jacinta Allan has pushed back against suggestions the move could trigger challenges from the private sector, pointing to advice about an “explicit provision” in the Fair Work Act for state-based anti-discrimination laws.

The Fair Work Commission regulated commonwealth, not state law, so Mr Catanese warned it might be difficult for Victoria to enforce the new laws or penalties, depending on how the legislation was drafted.

“It’s possible we could have state laws without enforcement mechanisms – like a toothless tiger,” he said.

“That remains to be seen, as we haven’t seen the proposed laws.”

Even so, he said the laws could create change by setting a benchmark negotiated into agreements.

Prime Minister Anthony Albanese has backed the laws.

“I’ve got to say, it’s consistent with our views, which are that working from home is something that’s important, something that Australians voted for,” he told reporters in Melbourne on Thursday.

“Every time an (industrial relations) change is proposed, we hear suggestions that somehow this will undermine things.”

Property Council chief executive Mike Zorbas described the proposed laws as a “stunt”, adding to criticism from a growing number of business groups with concerns including how the policy would affect productivity or office attendance.

National office vacancy rates crept up slightly from 13.7 to 14.3 per cent in the six months to July 2025, which the council attributed to a rush of new supply.

Mr Zorbas said while working from home was an uncontested benefit for many roles, the proposed legislation would add red tape for businesses of all sizes.

Victorian minister Mary-Anne Thomas said the way people used the CBD had changed, although foot traffic had returned to pre-COVID-19 pandemic levels.

“Productivity has increased as a consequence of now nearly a third of the workforce being across Australia, working from home as part of hybrid work arrangements,” she said.

“We know that participation in the workforce continues to increase.”

Federal coalition frontbencher Tim Wilson labelled the policy “professional apartheid” in an opinion piece for the Australian Financial Review but the state opposition has demanded more details before deciding its stance.

Opposition frontbencher Georgie Crozier argued many workplaces already had a hybrid model while retailers and hospitality businesses were constantly talking about issues in the city.

“Anything we can do to improve the vibrancy and the areas around those concerns needs to be addressed, and I hope the government is listening to them,” she said.

Plan to lift GST must come with lower income tax burden

A push to lift the goods and services tax must form part of a broad reform package that reduces the burden on workers, a prominent economist says.

The Albanese government’s economic roundtable will be held later in August and has prompted calls for an overhaul to the nation’s tax system, including scaling back negative gearing and raising the GST.

AMP chief economist Shane Oliver said while he backed lifting the GST to 15 per cent, the change had to be implemented among other measures such as lowering income taxes to compensate lower income workers.

“It’s very important it all comes together as a package, because just changing tax concessions will disincentivise income workers,” he told AAP.

“I’m concerned it (roundtable) will morph from broad-base tax reform to more taxes.”

Negative gearing and capital gains concessions could be scaled back if the burden on workers was reduced through lower taxes, Mr Oliver said.

Independent MP Kate Chaney wants a “progressive GST model” as Labor looks for ways to reinvigorate Australia’s languishing productivity and strengthen the budget.

Under a plan proposed by economist Richard Holden, Australia would lift the rate of the consumption tax from 10 to 15 per cent and apply it to exempt items such as certain types of food, education and health.

But to mitigate the impact on those with lower incomes, all Australians aged 18 and older would be given a $3300 rebate, meaning they would effectively pay no GST on the first $22,000 of their annual expenses.

While the GST-free threshold would cost Australia $68.8 billion, increasing the tax and removing exemptions for certain categories would raise $92.7 billion, adding $23.9 billion to the Commonwealth’s budget.

“The major parties like to talk about tax cuts and spending but they’re less willing to discuss where the money will come from,” Ms Chaney said.

“We have to have courageous conversations about other revenue sources to avoid handballing this problem to future generations.”

Prime Minister Anthony Albanese said his government would determine its policy.

“Our tax policy – the only tax policy that we’re implementing – is the one that we took to the election … which is reducing income taxes,” he told reporters in Melbourne on Thursday.

Opposition finance spokesman James Patterson said he was concerned two-thirds of revenue generated by Ms Chaney’s proposal would be used to compensate Australians for the tax it collects.

He warned against tax on spending in areas carved out of the GST when it was introduced more than two decades ago, such as education and health.

“The Howard government recognised that people who spend their money on private health or private education are actually taking a burden off the public purse, and therefore it would be unjust to tax them on top of that,” he told Sky News.

It would be an “incredibly brave government” that put a tax on top of insurance and private education fees, Senator Patterson said.

The Australian Council of Social Service has called for a halving of the capital gains tax discount, a 15 per cent tax on superannuation retirement accounts and a commonwealth royalty payment for offshore gas.

It urges the government to strengthen the not-for-profit sector by supporting digital transformation and making service users the centrepiece of governance and program design.

All policies developed at the roundtable should be assessed on how they improve the wellbeing of people and the natural environment while taking gender and other factors into account, the council said.

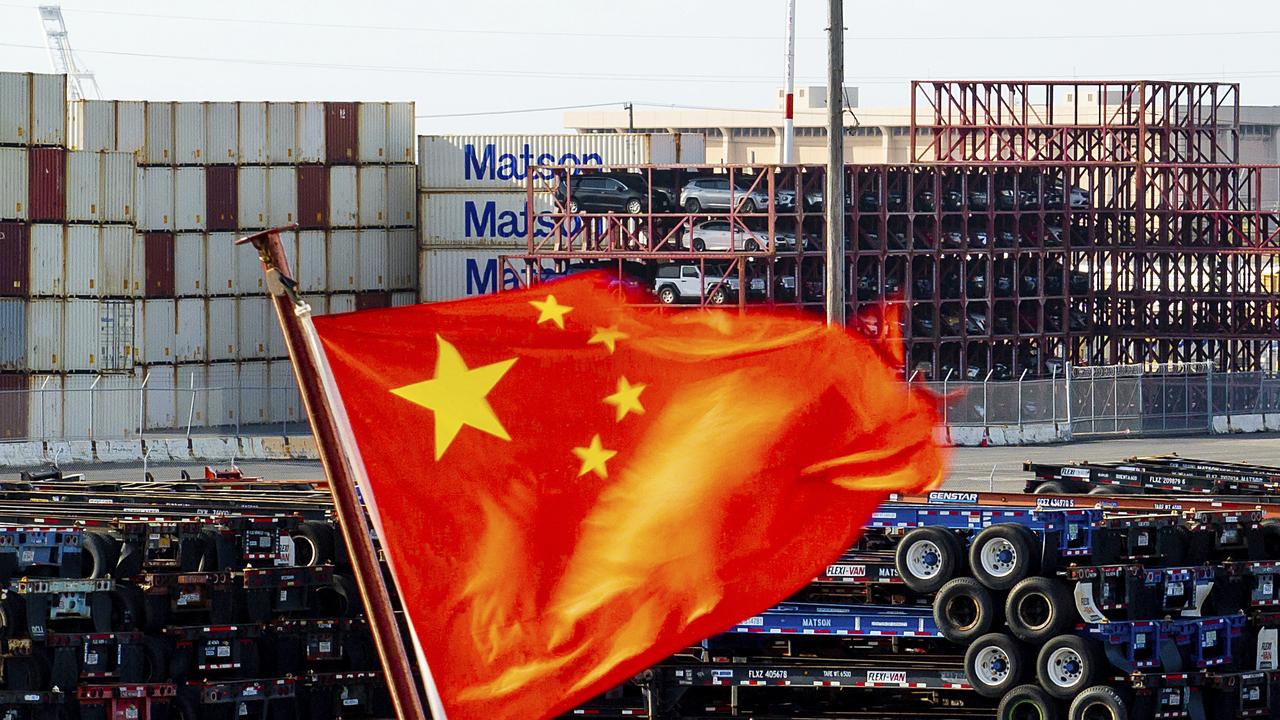

China’s exports up 7.2 per cent amid US trade tensions

China’s exports beat forecasts in July, as manufacturers made the most of a fragile tariff truce between Beijing and Washington to ship goods before tougher US duties targeting transhipments take effect.

Global traders and investors are waiting to see whether the world’s two largest economies can agree on a durable trade deal by August 12 or if global supply chains will again be upended by the return of import levies exceeding 100 per cent.

US President Donald Trump has raised the prospect of further tariffs, including a 40 per cent duty on goods rerouted to the US via transit hubs, that took effect on Thursday, as well as a 100 per cent levy on chips and pharmaceutical products, and an additional 25 per cent tax on goods from countries that buy Russian oil.

China’s outbound shipments rose 7.2 per cent year-on-year in July, customs data showed on Thursday, beating a forecast 5.4 per cent increase in a Reuters poll of economists and accelerating from June’s 5.8 per cent growth.

China’s trade war truce with the US – the world’s top consumer market – ends next week, although Trump hinted further tariffs may come Beijing’s way due to its continuing purchases of Russian hydrocarbons.

Imports grew 4.1 per cent, defying economists’ expectations for a 1.0 per cent fall and climbing from a 1.1 per cent rise in June, pointing to improving domestic demand as policymakers step up efforts to encourage households to boost spending.

“The trade data suggests that the Southeast Asian markets play an ever more important role in US-China trade,” said Xu Tianchen, senior economist at the Economist Intelligence Unit.

“But it’s not all about the transhipments that Trump seeks to stop, ASEAN countries are also importing raw materials and components from China before exporting finished products to the US,” he added.

China’s exports to the US fell 21.67 per cent last month from a year earlier, the data showed, while shipments to ASEAN rose 16.59 per cent over the same period.

Trump said on Tuesday the US was close to a trade deal with China and that he would meet his Chinese counterpart Xi Jinping before the end of the year if the world’s two largest economies could come to an agreement.

China’s July trade surplus narrowed to $US98.24 billion ($A151.02 billion) from $US114.77 billion in June.

Separate data from the US Commerce Department’s Bureau of Economic Analysis on Tuesday showed the US trade gap with China shrank to its lowest in more than 21 years in June.

Chinese government advisers are stepping up calls to make the household sector’s contribution to broader economic growth a top priority at Beijing’s upcoming five-year policy plan, as trade tensions and deflation threaten the outlook.

And top leaders have vowed to step up regulation of aggressive price-cutting by Chinese companies that is pushing prices ever lower.

But economists warn that reversing the current deflationary slump will be far more difficult than during the last round of supply-side reforms a decade ago, as the downturn now poses a broader threat to employment, which Chinese leaders have emphasised is a core component of social stability.

Reaching an agreement with the United States – and with the European Union, which has accused China of producing and selling goods too cheaply – would give Chinese officials more room to advance their reform agenda.

with DPA

Trump’s higher tariffs hit goods from trading partners

US President Donald Trump’s higher tariff rates of 10 to 50 per cent on dozens of trading partners have kicked in, testing his strategy for shrinking US trade deficits without massive disruptions to global supply chains.

US Customs and Border Protection agency began collecting the higher tariffs at 12.01am EST (2.01pm AEST) on Thursday after weeks of suspense over Trump’s final tariff rates and frantic negotiations with major trading partners that sought to lower them.

Goods loaded onto US-bound vessels and in transit before the midnight deadline can enter at lower prior tariff rates before October 5, according to a customs notice to shippers issued this week.

Imports from many nations had previously been subject to a baseline 10 per cent import duty after Trump paused higher rates announced in early April.

But since then, Trump has frequently modified his tariff plan, slapping some nations with much higher rates, including 50 per cent for goods from Brazil, 39 per cent from Switzerland, 35 per cent from Canada and 25 per cent from India.

He announced on Wednesday a separate, 25 per cent tariff on Indian goods to be imposed in 21 days over the South Asian country’s purchases of Russian oil.

“RECIPROCAL TARIFFS TAKE EFFECT AT MIDNIGHT TONIGHT!,” Trump said on Truth Social just ahead of the deadline.

“BILLIONS OF DOLLARS, LARGELY FROM COUNTRIES THAT HAVE TAKEN ADVANTAGE OF THE UNITED STATES FOR MANY YEARS, LAUGHING ALL THE WAY, WILL START FLOWING INTO THE USA. THE ONLY THING THAT CAN STOP AMERICA’S GREATNESS WOULD BE A RADICAL LEFT COURT THAT WANTS TO SEE OUR COUNTRY FAIL!”

Eight major trading partners accounting for about 40 per cent of US trade flows have reached framework deals for trade and investment concessions to Trump, including the European Union, Japan and South Korea, reducing their base tariff rates to 15 per cent.

Britain and Australia won a 10 per cent rate, while Vietnam, Indonesia, Pakistan and the Philippines secured rate reductions to 19 per cent or 20 per cent.

“For those countries, it’s less-bad news,” said William Reinsch, a senior fellow and trade expert at the Center for Strategic and International Studies in Washington.

“There’ll be some supply chain rearrangement. There’ll be a new equilibrium. Prices here will go up, but it’ll take a while for that to show up in a major way,” Reinsch said.

Nations with punishingly high duties, such as India and Canada, “will continue to scramble around trying to fix this”, he added.

Trump’s order has specified that any goods determined to have been transshipped from a third country to evade higher US tariffs will be subject to an additional 40 per cent import duty, but his administration has released few details on how these goods would be identified or the provision enforced.

Trump’s July 31 tariff order imposed duties above 10 per cent on 67 trading partners, while the rate was kept at 10 per cent for those not listed.

These import taxes are one part of a multilayered tariff strategy that includes national security-based sectoral tariffs on semiconductors, pharmaceuticals, autos, steel, aluminium, copper, lumber and other goods.

Trump said on Wednesday the microchip duties could reach 100 per cent.

China is on a separate tariff track and will face a potential tariff increase on August 12 unless Trump approves an extension of a prior truce after talks last week in Sweden.

He has said he may impose additional tariffs over China’s purchases of Russian oil as he seeks to pressure Moscow into ending its war in Ukraine.

Trump has touted the vast increase in federal revenues from his import tax collections, which are ultimately paid by companies importing the goods and consumers of end products.