Treasurer blocks US takeover of Aussie pharma company

A big-money bid for an Australian medicine maker has been scuppered by Treasurer Jim Chalmers after the Foreign Investment Review Board found the deal was not in the national interest.

The sticking point for the $672 million acquisition of Mayne Pharma came after the bidder, US healthcare giant Cosette, threatened to sell or shut down the Australian company’s factory in Adelaide.

The treasurer said his decision to kill off the deal was “entirely consistent with the FIRB advice” that the proposal would be contrary to Australia’s national interest.

“Following broad consultation, I received unequivocal advice from Treasury and FIRB that no conditions could be put in place to adequately mitigate national interest risks, particularly unique risks to the supply of critical medicines,” Dr Chalmers said in a statement on Friday.

“This advice incorporated views from the Department of Health and Aged Care, the Therapeutic Goods Administration and the South Australian Government.”

The decision will come as good news for Cosette, a New Jersey-based private equity firm that has been trying for months to exit the $7.40-a-share deal struck in February, after Mayne’s financial performance soured and its share price tumbled below $5.

After a Supreme Court bid to extricate itself failed, Cosette’s final gambit ultimately proved successful – to force the FIRB’s hand by threatening to shut down the profitable Salisbury plant and shed its 200-odd jobs.

Dr Chalmers in late October told Cosette his preliminary view was not to allow the deal, because of the risk to jobs and Australia’s sovereign research and development capabilities if it went ahead with closing the factory.

Mayne went into a trading halt shortly after the ASX opened on Friday morning.

Shares in the company fell more than 20 per cent to $4.60.

The FIRB was initially due to make its final ruling on Thursday, but Mayne released a statement to the share market that day notifying that the review board had extended the approval deadline until Friday.

US posts solid jobs data in September, unemployment up

US employment growth accelerated in September, but the labour market remained sluggish and failed to keep pace with new job-seekers as employers dealt with fallout from import tariffs and integrated artificial intelligence into some positions.

The jobless rate rose to 4.4 per cent, its highest level in four years, from 4.3 per cent in August, the Labor Department said in its closely watched employment report on Thursday.

The August payrolls data was revised to show employers shedding jobs for the second time this year, underscoring the labour market softness.

Other data from the Labor Department showed layoffs stayed low in mid-November, suggesting the job market remained stuck in what economists and policymakers call a “no-hire, no-fire” state.

Some economists viewed the rise in the jobless rate as bolstering the argument for another Federal Reserve interest rate cut next month, while others said the better-than-expected job growth suggested the US central bank should stay pat, especially since policymakers would not get another employment report before the December 9-10 meeting.

“The upside surprise in this report is positive, but it likely dampens prospects for a rate cut in December,” said Olu Sonola, head of US economic research at Fitch Ratings.

“The slight uptick in the unemployment rate complicates the narrative – pick your poison, stronger job growth or rising unemployment, because the good news may not be as good after all.”

Non-farm payrolls increased by 119,000 jobs after a downwardly revised drop of 4000 in August, the Labor Department’s Bureau of Labor Statistics said.

Economists polled by Reuters had forecast 50,000 jobs would be added after a previously reported gain of 22,000 in August. The survey of establishments also showed job growth in July was downgraded by 7,000 to 72,000 positions.

The report was initially due on October 3, but was delayed by the shutdown of the federal government. The 43-day shutdown, the longest in US history, forced the BLS to cancel the release of October’s report as no data was collected for the household survey to calculate the unemployment rate for that month.

Job gains in September were partially flattered by difficulties adjusting for workers leaving their summer jobs, resulting in higher payroll counts in the leisure and hospitality industry as well as retail industry.

The healthcare sector continued to lead employment growth, adding 43,000 jobs in September, mostly in ambulatory services and at hospitals. Employment at restaurants and bars increased by 37,000 jobs, with overall leisure and hospitality payrolls rising by 47,000.

Retailers added 13,900 positions. But the transportation and warehousing industry lost more than 25,000 jobs, while manufacturing shed a further 6,000 positions. Professional and business services payrolls decreased, with temporary help services accounting for the bulk of the drop.

Federal government employment dropped by another 3000 jobs, bringing the total losses since January to 97,000. That number is expected to surge as tens of thousands of workers who took buyouts dropped off government payrolls at the end of September.

The labour market has lost significant momentum this year, as evidenced by sharp downward revisions to non-farm payroll counts. Economists and policymakers blame the slowdown on reduced supply and demand for workers.

Economists estimate the economy needs to create less than 100,000 jobs per month to keep up with growth in the working-age population, though the rise in the unemployment rate in August and September suggests the break-even rate could be higher.

“The unemployment rate has trended higher, but for the ‘right’ reasons because labour force participation is rising even faster than the solid gains in employment,” said Stephen Stanley, chief US economist at Santander US Capital Markets.

“This is very far from the results one would expect if the labour market were spiralling downward.”

Verizon cutting 13,000 jobs to ‘reorient’ company

Verizon is laying off more than 13,000 employees in mass job reductions that arrive as the US telecommunications giant says it must “reorient” its entire company.

The jobs cuts began on Thursday, according to a staff memo from Verizon CEO Dan Schulman.

In the letter, which was seen by the Associated Press, Schulman said Verizon’s current cost structure “limits” the company’s ability to invest -pointing particularly to customer experiences.

“We must reorient our entire company around delivering for and delighting our customers,” Schulman wrote.

He added that the company needed to simplify its operations “to address the complexity and friction that slow us down and frustrate our customers”.

Verizon had nearly 100,000 full-time employees as of the end of last year, according to securities filings.

A spokesperson confirmed that the lay-offs announced on Thursday account for about 20 per cent of the company’s management workforce, which is not unionised.

Verizon has faced rising competition in both the wireless phone and home internet space – particularly from AT&T, T-Mobile and other big market players.

New leadership at the company has stressed the need to right the company’s direction.

Schulman took the CEO seat just last month.

In the company’s most recent earnings, he stated that Verizon’s trajectory was at a “critical inflection point” – and said, rather than incremental changes, Verizon would “aggressively transform” its operations.

For its third quarter of 2025, Verizon posted earnings of $US4.95 billion ($A7.62 billion) and $US33.82 billion in revenue.

The carrier reported continued subscriber growth for its prepaid wireless services but it lost a net 7000 postpaid connections.

Fire disrupts negotiations at COP30 climate summit

A fire that forced an evacuation of the COP30 climate summit venue in the Brazilian city of Belem is under control, officials say, although it is unclear whether delegates will return immediately to continue negotiations.

Brazilian Tourism Minister Celso Sabino told reporters at the venue that the fire was under control and no one was hurt but that he did not know whether delegates would be able to return on Thursday or Friday to the part of the venue where the summit negotiations were taking place.

Summit organisers also confirmed the fire was under control, adding that Brazilian fire officials had ordered the evacuation of the summit’s entire premises.

The summit in the Amazon city was initially scheduled to wrap up on Friday but it missed a self-imposed Wednesday deadline to secure agreement among the nearly 200 countries present on issues including plans to phase out oil, gas and coal.

Developing countries are also pushing for a substantial increase in climate adaptation finance from industrialised countries, arguing that stronger support is essential as they face worsening storms, droughts, wildfires and floods.

The fire scare occurred in what is already a hive of activity during the summit’s two-week run, interrupting ongoing negotiations inside the venue.

A siren sent delegates, observers and journalists running for the exits with their belongings as police lined up as a barrier to prevent anyone from nearing the area where the fire was reported.

TV footage showed flames and smoke inside the venue, a conference centre on the site of a former airport.

Sabino told journalists that the fire started near the China Pavilion, which was among several pavilions set up for events on the sidelines of the climate talks.

The fire quickly spread to neighbouring pavilions, said Samuel Rubin, one of the people in charge of an entertainment and culture pavilion.

He said nearby pavilions include many of the Africa pavilions and one aimed at youth.

Para state governor Helder Barbalho told local news outlet G1 that a generator failure or a short circuit in a booth may have started the fire.

Since kicking off earlier this month, the summit has drawn multiple protests demanding action on climate change and forest protection, at times interrupting talks.

with AP and DPA

Coalition supports environmental reforms with changes

The coalition will support Labor’s long-awaited environmental reforms if a series of amendments are accepted.

Opposition Leader Sussan Ley said the coalition was seeking “sensible” changes to the 1500-page bill, which proposes to rewrite the Environment Protection and Biodiversity Conservation Act.

“If they are adopted, then we will be supportive of legislation next week,” Ms Ley said in a statement.

“However, if the government rejects sensible suggestions and chooses to put jobs at risk, then we will vote against them with an open mind to revisit negotiations next year.”

The timing is crucial for Environment Minister Murray Watt, who has expressed confidence the reforms will pass the Senate before Christmas, with just four sitting days left for the parliamentary year before the summer break.

“”With our national environmental law reforms ready to pass the Senate next week, we really are on the precipice of something special,” Senator Watt said in a speech at the Queensland Press Club.

However, the Business Council of Australia and veteran conservationist Bob Brown were among those urging Labor to not rush the laws during a parliamentary committee hearing that examined the bill on Thursday.

Ms Ley echoed similar concerns, stating “Labor shouldn’t be rash, the parliament cannot rush to failure”.

The reforms aim to protect the environment while accelerating development approvals including housing, energy and critical minerals projects.

Senator Watt previously flagged he is open to negotiating elements of the legislation with the party that gives him most of what he has already put forward.

The coalition’s recommendations closely align with concerns held by the Business Council, which include a clarified definition of the minister’s power to reject projects because of their “unacceptable impact”.

It is also seeking to amend the powers of the proposed national Environment Protection Authority, arguing the power to assess and approve projects must remain with the minister.

Proposed penalties of up to $825 million for breaching the laws go too far, the coalition says, and further pathways to streamlined approvals must also be included.

Opposition environment spokeswoman Angie Bell said the amendments put forward reflect concerns raised by business and offer “reasonable solutions”.

“We are providing reasonable solutions and actively seeking a way forward that benefits jobs and the environment,” Ms Bell said.

Market darling brought to earth by sell-offs and exit

Just weeks ago defence technology innovator DroneShield was riding an artificial intelligence boom on the local share market after releasing new software.

Fast-forward to November and the Australian-based firm has haemorrhaged more than 70 per cent of its share value and seen executives either leave without notice or shed stakes in the company worth millions of dollars.

DroneShield calls itself the “only publicly listed company exclusively dedicated to the fast-growing counter-UAS (uncrewed aerial system) sector”, specialising in using AI to detect and destroy threats from drones.

Listed in 2016, the company traded steadily until early 2024 when conflicts in the Middle East and Ukraine sparked renewed interest in drone protection and the stock skyrocketed tenfold.

That demand continued into 2025 with shares peaking at $6.60 on October 9, but it has downhill since.

In the last two weeks, DroneShield has constantly hit the headlines after an alarming series of developments for investors and the ASX as a whole, with shares trading at $1.88 in early afternoon trading on Thursday.

On November 10, CEO Oleg Vornik told investors DroneShield had secured contracts totalling $7.6 million with the US government before issuing an embarrassing retraction hours later.

“DroneShield advises that the November contracts do not represent new orders,” Mr Vornik said in that announcement.

“The November contracts were inadvertently marked as new contracts rather than revised contracts due to an administrative error.”

Two days later, it was revealed Mr Vornik – along with chairman Peter James and director Jethro Marks – had sold $70 million in DroneShield shares, including more than $2 million before the incorrect contract information was withdrawn.

Queried by the exchange operator, DroneShield on Thursday rejected any suggestion that the trio had timed their sales or that they had even told the company they planned to sell.

The final dagger in the firm’s share price trajectory was the unexplained resignation of its US chief executive Matt McCrann on Wednesday, sparking a further 20 per cent drop in the share price.

The uncertainty spooked investors looking to downsize risk in their portfolios, a leading analyst says.

“We’ve been given so little reason why the US chief executive has stepped down suddenly, that’s never a good sign in a company,” Moomoo analyst Michael McCarthy told AAP.

“To some extent the market’s its own worst enemy here – perhaps it never deserved to run as high as it did but it’s certainly a highly volatile stock.”

DroneShield will be hoping it can regain some of that lost ground as the global AI revolution continues apace.

But investors might need a bit of reassurance the firm has its house in order before confidence is restored, according to observers.

IMF urges Australia to slash spending and reform taxes

The Reserve Bank of Australia and Albanese government have received the tick of approval from the International Monetary Fund, but it says bold tax reform is still needed.

In its annual assessment of the Australian economy on Thursday, the Washington-based body said the nation was successfully managing a soft landing amid global uncertainty.

Inflation was down, the labour market was strong and growth was proving resilient.

The IMF backed the RBA’s cautious stance on monetary policy, given uncertainty about the global economy, the strength of the jobs market and the current low cash rate.

It applauded the federal government’s nascent efforts to boost Australia’s particularly weak productivity, repair the budget bottom line and ensure economic resilience.

But deeper reforms were needed to improve living standards and mend intergenerational inequity, the fund said.

Suggestions included bringing back the mining tax and cutting personal income tax.

“An increase in indirect taxation, the reintroduction of a resource revenue tax, and removing income tax exemptions could offset lower corporate and labour taxes, thereby lowering the cost of capital and increasing incentives for investment and work,” it said.

Runaway spending in programs such as aged care and the $52 billion NDIS should be curtailed, while productive infrastructure investment should be maintained.

Budget disparities had widened between state and territories due to increased infrastructure, health and social protection spending, as well as uneven commodity revenues, heightening the need for the Commonwealth to co-ordinate areas such as climate governance and tax reform.

Shifting away from stamp duty to recurring property taxes would promote more efficient use of land, the IMF said.

Meanwhile, savings from tax arrangements that affect housing demand and investment, potentially by scaling back negative gearing, could be redirected toward building more homes.

The IMF urged the RBA to hold off on further rate cuts, if upcoming data continues to indicate tightness in the economy.

But if the data showed faster-than-expected softening, more cuts could be warranted, it said.

It also welcomed the central bank’s efforts to increase transparency since its recent review, and urged the government to repeal the treasurer’s power to override the RBA, which was recommended by the review but never implemented.

Treasurer Jim Chalmers called the IMF report a powerful endorsement of Labor’s responsible economic and fiscal management.

“We’ve made substantial progress on productivity reform since our roundtable in August, across housing, environmental approvals, better regulation, artificial intelligence, and simplifying trade, with more underway,” he said.

‘Racial profiling’ in Indigenous teen’s gunpoint arrest

The family of an Aboriginal teenager who was mistakenly pulled from a bus and arrested in the nation’s capital have labelled the incident a clear example of racial profiling and police brutality.

The 17-year-old had been travelling on the way to visit family when the bus was stopped by police cars on November 12.

His family said ACT police racially profiled the boy, removing him from the bus with guns drawn and handcuffing him before comparing a photo on a phone and realising they had the wrong person.

“That is not policing, that is abuse, a clear example of police brutality and racial profiling at its finest,” his family said on Thursday morning.

“A child who had never committed a crime was treated like a criminal, he was treated like a threat and he was treated as less than human.”

Reading a statement to the media, the boy’s aunties Mikaila McEwan and Kristie Peters said the incident was a gross violation of the child’s human rights.

“The officers pointed a gun … dragged him out, slammed him onto the ground … causing him pain and difficulty breathing,” they said.

“Even after admitting they had the wrong boy, the officer still searched him.”

ACT Police said they had been responding to reports of a person with a knife at a shopping centre in Woden.

They received information that a young person who matched the description of the offender was on a bus.

Officers arrested the teenager “for a short period” before realising he was not the person they were looking for, police said in a statement.

“We acknowledge this would have been a very distressing incident for the young person and the other passengers on the bus and we apologise for this.

“Given police were responding to multiple eyewitness reports of an active armed offender in a heavily populated part of Canberra, officers acted with the immediate aim of preventing a worst-case scenario from occurring – further harm to members of the public.”

The family wants the officers involved to be investigated and stood down while the inquiry process takes place.

They have also asked to see the body-worn camera footage of the incident, for a formal acknowledgement of the racial profiling by police and an apology.

Indigenous community advocates have labelled the incident outrageous and unacceptable.

“I’m appalled, it’s absolutely disgusting,” Winnunga Nimmityjah Aboriginal Health and Community Services chief executive Julie Tongs said.

“If that had been a busload of black kids, would they have done what they did to the only white kid on that bus? I don’t think so.

“They need to take a long, serious look at themselves.”

Acting ACT Aboriginal and Torres Strait Islander Children and Young Peoples commissioner Barbara Causon said the incident would have a ripple effect in the community, influencing the way young people saw police.

“I understand that police have a very important role to play in keeping our community safe, but this innocent young boy was not safe,” she said.

“He was hurt, he was traumatised, he was not safe.”

Police said they had met with the teenager and his family to discuss the incident.

A complaint had been received and it would be reviewed through the Australian Federal Police’s professional standards command.

Australia U-turns and hands climate summit to Turkey

Australia will not host the UN’s annual climate summit in 2026, instead yielding to a rival bid from Turkey.

Three years of campaigning to bring the COP31 climate talks to Adelaide, in partnership with Pacific nations, have been dashed during last-gasp negotiations at the 2025 event in Brazil.

While Australia had the overwhelming backing of the “Western” grouping to stage the 2026 event, under UN rules hosting rights are decided by consensus and negotiation, not a vote.

In a stand-off where Turkey was unwilling to stand down, with the closure of the 2025 summit as a deadline looming, Australia all but relinquished its goal.

Climate Minister Chris Bowen, Australia’s representative at the COP talks, confirmed a compromise model after discussions with Turkey.

Antalya, a Mediterranean resort city popular with Russian tourists, will host the summit while Mr Bowen will take the role of COP negotiations president, with a lead-up event hosted in the Pacific.

The result is a diplomatic disaster for Prime Minister Anthony Albanese’s government, which has spent great energy and, most likely, tens of millions of dollars campaigning for the event.

Mr Bowen flew into Belem insisting Australia remained committed to the bid.

“We are in it and we are in it to win it,” he told attendees on Monday (AEDT).

At the same time back home, Mr Albanese appeared to grow cooler on the bid.

“If Australia is not chosen, if Turkiye (Turkey) is chosen, we wouldn’t seek to veto that,” he told reporters in WA on Tuesday.

As late as Thursday morning, Pacific Minister Pat Conroy insisted the government was still keen to host COP31, while conceding the diplomatic battle may not go Australia’s way.

The Turkish embassy in Australia said the Pacific would be taken into account.

“We will ensure that no one is left behind, particularly the regions that are most adversely affected by climate change including the Pacific,” the embassy said in a statement to AAP.

“The Mediterranean on the other hand, is a recognised climate hotspot warming 20 per cent faster than the global average, and facing growing threats from extreme heat, water scarcity and biodiversity loss.”

The embassy also argued Turkey was well-positioned to bridge the gap on climate policy between developed and developing nations.

Australia’s bid was first launched by Mr Bowen at the climate talks in 2022.

The ambition was lauded by climate advocacy organisations and by Pacific nations, who formally backed the bid and were promised a part of proceedings.

Mr Bowen said he kept Pacific hopes in his mind during the negotiations, with the compromise model including a “pre-COP” event in the Pacific which also acts as a pledging event for the Pacific Resilience Fund.

“Obviously, it would be great if Australia could have it all. But we can’t have it all,” he said on Thursday (AEDT).

Some critics of the bid, including Opposition Leader Sussan Ley, pointed at the likely cost of staging the summit, which had been estimated above $2 billion.

“I think Turkey is doing the Australian government a big favour,” she told the ABC on Thursday.

“We had a $12 billion deficit last year. We’re heading to a $42 billion deficit this coming year, and meanwhile, this prime minister wants to spend $2 billion on hosting a talkfest here in this country?”

Greens leader Larissa Waters suggested the government’s pursuit of hosting rights was “greenwashing” its climate record.

“The PM never really wanted to host a climate conference that needed him to be honest about the future of coal and gas while his mining corp mates are watching,” she wrote on social media.

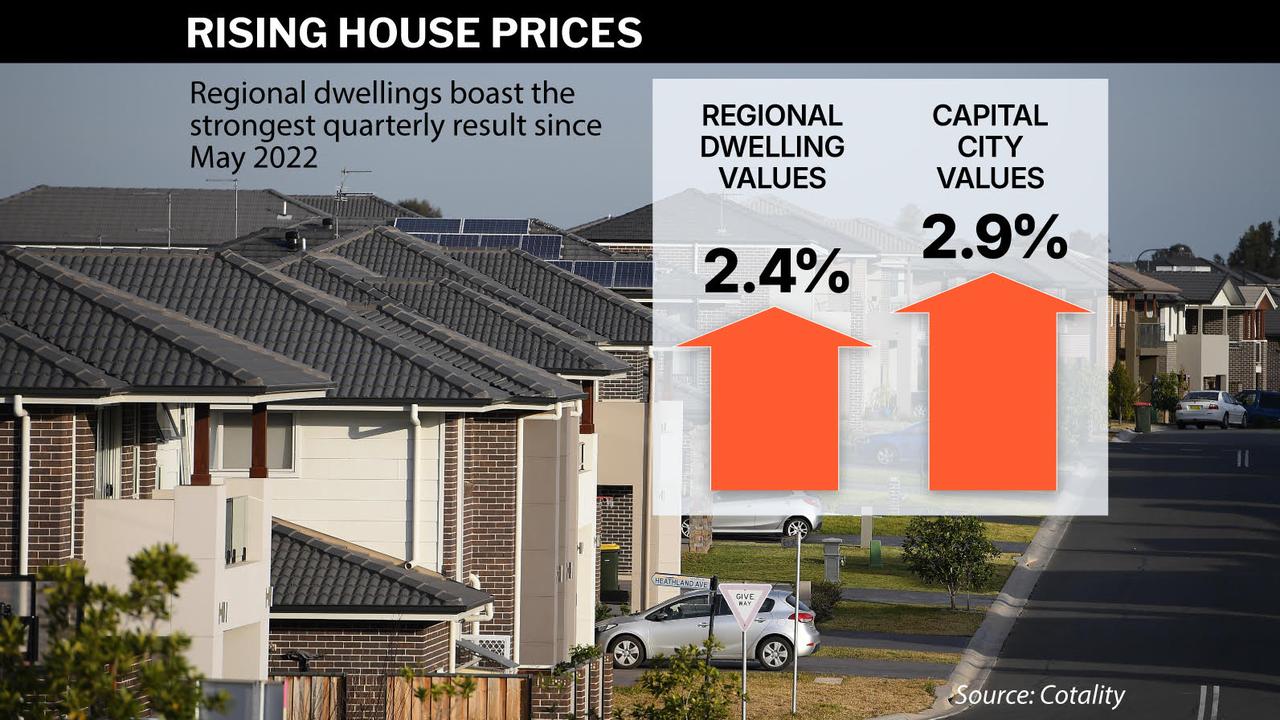

House prices surge as city-dwellers flee to the regions

Home buyers are being pushed out to the regions as falling interest rates and a lack of supply put a rocket under inner-city house prices.

The median house price in Sydney is set to approach the dizzying $2 million barrier in 2026, according to forecasts released by property sales portal Domain on Thursday.

House prices across the capital cities are expected to grow by six per cent in 2026.

That is on top of the nine per cent growth forecast for 2025, as three Reserve Bank interest rate cuts and stronger income growth boost demand.

“We’ve seen momentum building across our housing markets, and particularly in our largest markets Sydney and Melbourne,” Domain chief economist Nicola Powell told AAP.

“We’re expecting that momentum to continue to build in the first half of 2026.”

After falling in recent years, the median Melbourne house price is expected to grow six per cent to a record of $1,170,168 in 2026.

The median Sydney house price is forecast to rise seven per cent to $1,924,439, putting it on track to eclipse $2 million in 2027.

“I would describe a million-dollar median house price as a psychological hurdle for a buyer. And I think with Sydney approaching $2 million, this is like Mount Everest,” Dr Powell said.

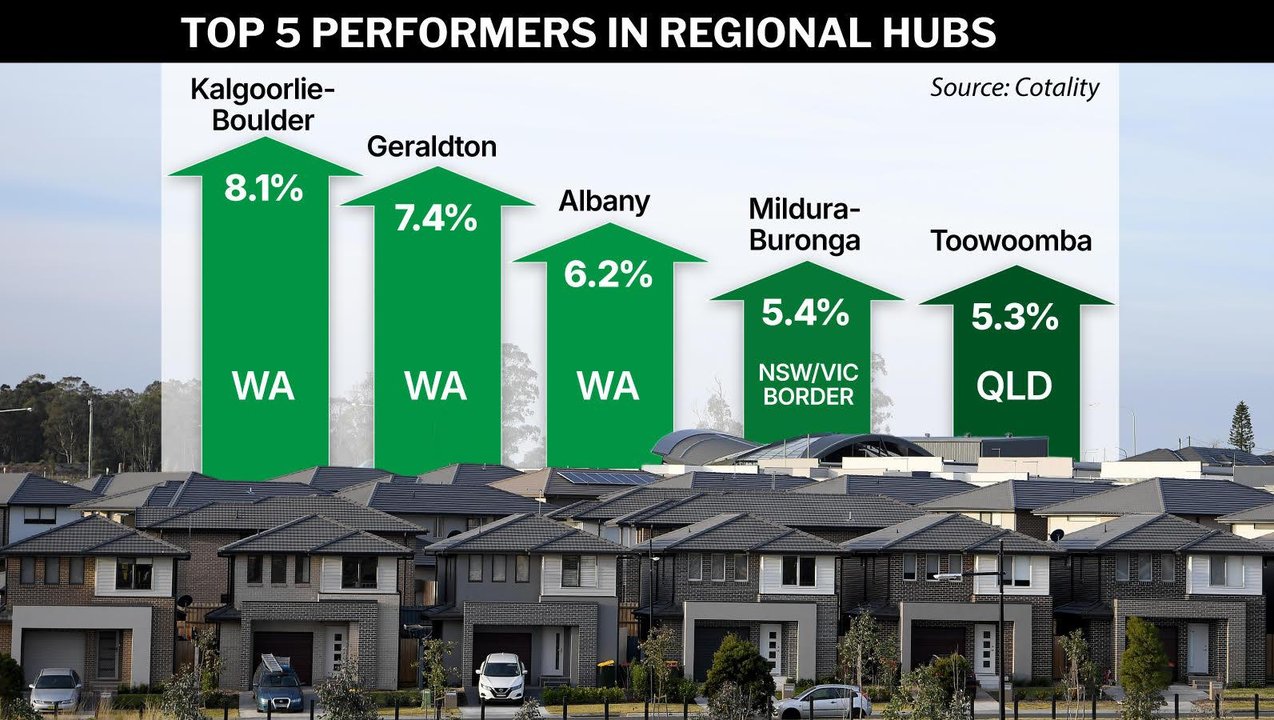

As prices surge in the cities, buyers in the regions have been feeling the spillover effects.

Regional dwelling values rose 2.4 per cent in the three months to October 31, the highest growth rate in more than three years, property analytics firm Cotality found.

While the spike in regional property prices at the height of the COVID-19 pandemic was driven by pull factors such as remote work and a desire for more space, the current growth phase is down to prospective buyers being priced out of the cities.

Communications professional Rowena Sturn and her partner, a public servant, bought a house in Newcastle in 2024 after realising Sydney was well out of their price range.

“Blocks of land in the suburb we were living in in the inner west were selling for like $2.5 million, $3 million, and we’re like we’re never going to be able to afford that, so we’re out,” she said.

With starting a family on their mind, the couple returned to their home town of Newcastle.

But they were not ready for how hard it would be to break into the market or how rife underquoting by real estate agents would be.

“The competition was fierce. It took us like nine, 10 months of active house hunting, coming up from Sydney almost every weekend, going to inspections, to look at properties,” Ms Sturn said.

“I don’t think enough is being done to make it easier and more accessible to purchase.”

Governments have in recent years worked to improve housing affordability by increasing supply, such as NSW recently passing planning and zoning reforms.

While it would take time for such changes to bear fruit, Australia’s chronic undersupply would start to improve from late 2026, Dr Powell said.

Units are expected to grow by a more modest five per cent nationwide in 2026.

For those for whom buying a house is not an option, rents are expected to start rising after a period of near-stagnant growth in 2025.

Falling overseas migration and increased investor activity should at least keep rental growth under control, at a relatively subdued three per cent.