NBN lifted by more people shifting to fibre from copper

Broadband wholesaler NBN Co has posted a rise in annual earnings as more Australians upgraded from aging copper technology to fibre in record numbers to connect to the internet.

The Australian government-owned entity’s earnings for 2024/25 jumped eight per cent to $4.2 billion, in line with guidance, as revenue rose four per cent to $5.7 billion.

More than 430,000 premises were upgraded from legacy copper connections to fibre, which was more than double from 2023/24, taking the total to over 805,000.

The shift to faster speeds and full fibre connections also drove demand for higher-speed internet tiers and lifted data usage across the country.

Average monthly data downloads per premise rose more than 10 per cent – from 460GB in June 2024 to 508GB in June 2025, NBN said on Tuesday.

As well, the number of homes and businesses connected via fibre to the premises grew by 23 per cent to 2.7 million – making it the dominant fixed-line technology on its network.

Almost nine million premises are now connected to the NBN network, including 31 per cent on fibre to the premises.

“Looking to the future, it is NBN’s aim that our 500 Mbps wholesale speed tier becomes Australia’s most popular NBNn plan,” CEO Ellie Sweeney said.

NBN was set up in 2009 as a government business enterprise to design, build and operate a wholesale broadband access network for the nation.

‘Best opportunity’ for peace: PM defends Palestine call

Palestinian statehood is the best chance for a long-term solution to the Middle East conflict, the prime minister says, despite concerns it could be counterproductive for peace.

Anthony Albanese on Monday confirmed Australia would back recognition of a state of Palestine at a United Nations General Assembly meeting in New York in September.

The move brings Australia into line with allies such as the United Kingdom, France and Canada, which have already outlined similar plans for recognition.

Mr Albanese deflected criticism that recognition would do little on the ground in Gaza, saying a different approach is needed to end the conflict.

“This is the best opportunity that there is out of a crisis to actually provide a long-term solution,” he told Seven’s Sunrise program on Tuesday.

“To continue to do the same thing is not enough.”

The prime minister said the international community was sending a message, in recognising a Palestinian state, that the status quo in the Middle East could not continue.

“The international community are saying we need to find a solution that provides security for the state of Israel but also recognises the legitimate aspirations of the Palestinian people for their own state,” he said.

Foreign Minister Penny Wong said statehood would give the Palestinian people a sense of hope for the future.

“We know this is a hard road to walk, but the alternative is to accept where we are, and I think the international community is saying to both the Israeli and Palestinian peoples we have to find a different path,” she told ABC radio.

“The practical steps for recognition will be tied to the commitments that the Palestinian Authority have made.”

The commitments include the assurance that Hamas, which has been designated a terrorist organisation and controls Gaza, will play no role in any future government.

Israel has criticised the move, saying it will be counterproductive to peace in the Gaza Strip and its demands for the release of Israeli hostages.

Israel’s Ambassador to Australia Amir Maimon said Palestinian recognition would “not change the reality on the ground”.

Liberal MP Tim Wilson, whose Victorian seat of Goldstein includes Jewish voters, says Mr Albanese’s decision is “actually immoral”.

“We can’t have a situation where we have a government that is kowtowing, literally, to the ambitions of … terrorists,” he told Nine’s Today show, referring to Hamas.

“They’re essentially handing over the keys to the kingdom.

“What they’ve done is actually immoral.”

French President Emmanuel Macron praised the decision by Australia on social media, saying it showed a commitment to a two-state solution, which includes the state of Israel.

More than two million Palestinians face severe food insecurity, based on United Nations projections.

At least 90,000 protesters marched across the Sydney Harbour Bridge earlier in August to call on the government to sanction Israel.

The crisis in Gaza began when Hamas attacked Israel on October 7, 2023, killing 1200 people and taking about 250 more hostage.

Israel’s military response has since killed more than 61,000 people, according to Gaza’s health authorities.

Israel has denied the population is suffering or dying from starvation, even though it has throttled the flow of aid to Gaza for months, international human rights groups have said.

Trump extends China tariff truce by 90 days

US President Donald Trump has signed an executive order extending a tariff truce with China by another 90 days, a White House official says with only hours to go before US tariffs on Chinese goods were due to snap back to triple-digit rates.

The order followed a non-committal answer by Trump to reporters as to whether he would extend the lower tariff rates a day after he urged Beijing to quadruple its purchases of US soybeans.

A tariff truce between Beijing and Washington was set to expire on Tuesday.

The order prevents US tariffs on Chinese goods from shooting up to 145 per cent, with Chinese tariffs on US goods set to hit 125 per cent, rates that would have resulted in a virtual trade embargo.

“We’ll see what happens,” Trump told a press conference, when asked how he planned to extend the deadline.

“They’ve been dealing quite nicely. The relationship is very good with President Xi (Jinping) and myself.”

Imports from China are currently subject to 30 per cent tariffs, including a 10 per cent base rate and 20 per cent in fentanyl-related tariffs imposed by Washington in February and March.

China had matched the de-escalation, lowering its rate on US imports to 10 per cent.

The two sides in May announced a truce in their trade dispute after talks in Geneva, Switzerland, agreeing to a 90-day period to allow further talks.

They met again in Stockholm, Sweden in late July, but did not announce an agreement to further extend the deadline.

Kelly Ann Shaw, a senior White House trade official during Trump’s first term and now with Akin Gump Strauss Hauer & Feld, said she expected Trump to extend the 90-day “tariff détente” for another 90 days later on Monday.

“It wouldn’t be a Trump-style negotiation if it didn’t go right down to the wire,” she said, adding Trump could also announce progress in other aspects of the economic relationship as a backdrop for granting the extension.

“The whole reason for the 90-day pause in the first place was to lay the groundwork for broader negotiations and there’s been a lot of noise about everything from soybeans to export controls to excess capacity over the weekend.”

Ryan Majerus, a former US trade official now with the King & Spalding law firm, welcomed the news.

“This will undoubtedly lower anxiety on both sides as talks continue, and as the US and China work toward a framework deal in the fall. I’m certain investment commitments will factor into any potential deal, and the extension gives them more time to try and work through some of the longstanding trade concerns,” he said.

The White House declined to comment beyond Trump’s remarks.

The Treasury Department and US Trade Representative’s Office did not respond to requests for comment.

US Treasury Secretary Scott Bessent has said Washington has the makings of a deal with China and he was “optimistic” about the path forward.

Trump pushed for additional concessions on Sunday, urging China to quadruple its soybean purchases, although analysts questioned the feasibility of any such deal.

But Washington has also been pressing Beijing to stop buying Russian oil, with Trump threatening to impose secondary tariffs on China.

Go to school on AI to ease teacher load, treasurer told

Schools should use artificial intelligence to ease the load on teachers and tackle educational inequity, the government’s productivity adviser says.

The Productivity Commission also recommended financial incentives for businesses to train workers and to reduce barriers to occupational training in the fourth of five reports it is releasing ahead of the government’s economic reform roundtable.

Building the nation’s skills base is an important part of turning around Australia’s ailing productivity performance, the commission found.

“A thriving, adaptable workforce will give us the productivity growth we need to see higher wages and better living standards,” deputy chair Alex Robson said.

“As the pace of change in work and technology continues to accelerate, we need to ensure that workers can acquire the skills they’ll need to thrive.”

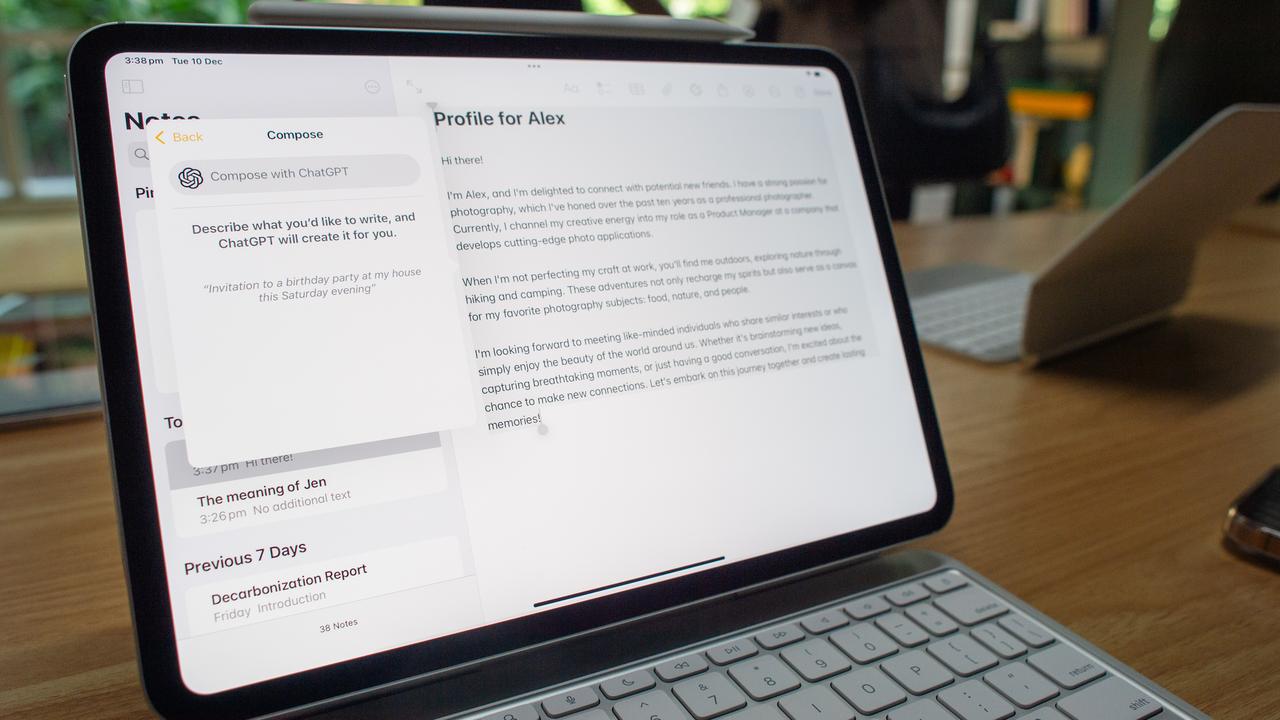

The federal government should provide “national leadership” on educational technology and AI in schools, the report recommended.

It is hoped the changes would arrest the decline in Australians’ foundational skills, which allow workers to learn new abilities and are essential to improving productivity.

National education bodies should establish a framework for assessing the quality of edtech tools, undertake a stocktake of what tools are being used and recommend tools for teachers across Australia to use, the commission said.

State and territory governments were told to provide professional development and support for teachers to adopt and use AI tools effectively.

The report urged the government to create a single nationwide online platform of planning materials for teachers across all states and territories to access.

This would particularly help teachers in remote areas or who instruct classes outside of their field of expertise.

Promoting the use of AI in schools was one of the recommendations put forward by ChatGPT owner OpenAI in an economic blueprint for Australia released by the Silicon Valley-based tech giant in June.

Treasurer Jim Chalmers welcomed the report, saying the government was grateful for the commission’s work “in helping us think through some of the big challenges in our economy”.

“The reason that our government is obsessed with productivity in our economy is because it’s the best way to lift living standards over time,” he said, as he prepared for his roundtable of business, unions, experts and civil society next week.

“Our investments and reforms to boost our human capital are a big part of that, helping workers around the country earn more and keep more of what they earn.

“As a Labor government, we’ll always back and invest in our workers to make sure we build the human capital and skills we need to grasp the opportunities of the defining decade ahead.”

While the summit provides a good opportunity for the government to tackle the challenges facing the nation’s economy, it came with risks as well, said Zareh Ghazarian, head of Monash University’s politics and international relations discipline.

“The challenge for the government will be how it manages the expectation that this event will make a real and positive impact on the community,” he said.

“Politically, entertaining questions on tax reform and productivity may be challenging for the Albanese government, especially as some arguments may go against its policy preferences.”

Norwegian fund sells shares in 11 Israeli companies

Norway’s sovereign wealth fund has sold its shares in 11 Israeli companies, its managers say, a move they said reduces its holdings in the country against the backdrop of the “serious humanitarian crisis” in Gaza.

The management of the fund, which invests Norway’s profits from oil and gas, said in a statement that it had investments in 61 Israeli companies at the end of this year’s first half.

It said it decided last week to sell all its investments in 11 firms that are not in the Norwegian Finance Ministry’s equity benchmark index, and has spent recent days completing those sales.

It did not identify the companies concerned.

The fund also said it will move all investments in Israeli companies that have been run by external managers in-house and is terminating contracts with external managers in Israel.

“These measures were taken in response to extraordinary circumstances. The situation in Gaza is a serious humanitarian crisis,” said Nicolai Tangen, the chief executive of Norges Bank Investment Management, which manages what is widely known as the Oil Fund.

“We are invested in companies that operate in a country at war, and conditions in the West Bank and Gaza have recently worsened. In response, we will further strengthen our due diligence.”

Tangen added in a statement that the latest move “will simplify the management of our investments in this market” and reduce the number of companies that the fund’s council on ethics monitors.

The fund’s management noted that it intensified its monitoring of investments in Israeli companies last fall and sold its holdings in “several” firms as a result.

Officially known as the Government Pension Fund Global, the Oil Fund owns nearly 1.5 per cent of all shares in the world’s listed companies, with holdings in about 9000 firms, according to its management’s website.

Repayment warning in countdown to interest rate cut

Mortgage holders are being urged to keep an eye on their repayments as the Reserve Bank of Australia’s prepares to hand down its cash rate decision.

With RBA Governor Michele Bullock widely expected to announce an interest rate drop for a third time in six months on Tuesday, the cumulative effect of 75 basis points of cuts could save the average borrower almost $300 a month in repayments since February.

But not all mortgage holders will be eligible for an automatic reduction.

Of the big four banks, only Westpac automatically lowers a customer’s payments if they have it set to the minimum.

CBA, NAB and ANZ customers must contact the bank if they want their direct debit amounts reduced.

Regardless of who they were with, Canstar data insights director Sally Tindall urged mortgage holders to weigh up what was best for them.

“For those managing to hold their budgets together, consider keeping your repayments exactly the same,” she said.

“Every rate cut is another opportunity to invest back into your mortgage and potentially be debt-free months, if not years early.”

If a mortgage holder who was sitting on a $600,000 loan in February kept their repayments steady, they would be paying $272 more per month in repayments than if they had lowered them to the minimum rate.

But it would also mean shaving off three years and three months off the length of their mortgage.

While money markets and the majority of economics expect the RBA to cut the cash rate to 3.6 per cent, the rates offered to consumers will still be substantially higher than the central bank’s benchmark figure.

The average variable rate for owner-occupiers would fall to 5.54 per cent, assuming a cut is delivered and lenders pass it on in full, Ms Tindall said.

But that shouldn’t stop customers shopping around for an even lower rate.

“Your mortgage rate is one number where you want to be aiming for well below average,” she said.

“After this next cash rate cut, ambitious owner-occupiers should be able to set themselves a stretch target of 5.25 per cent.”

Recognition not enough: calls for more action on Gaza

Australia has been urged to go further than recognising a Palestinian state by following up with sanctions and an arms embargo on Israel.

The calls from pro-Palestine groups follow Prime Minister Anthony Albanese’s confirmation of Australia’s intention to recognise the state at the United Nations General Assembly meeting in September.

The move, which has been criticised by the Israeli ambassador as counterproductive to peace and the release of hostages, puts Australia in alignment with allies such as France, the UK and Canada.

But statehood recognition could be serving as a “political fig leaf” for western states, warned Australian Palestine Advocacy Network president Nasser Mashni.

“Recognition is completely meaningless while Australia continues to arms-trade with, diplomatically protect and encourage other states to normalise relations with the very state perpetrating these atrocities,” he said.

“Palestinian rights are not a gift to be granted by Western states.”

Labor Friends of Palestine welcomed the move but also urged the federal government to go further on sanctions and an arms embargo, citing “a groundswell” of member support.

The federal government has maintained Australia is not exporting weapons to Israel but there has been scrutiny over the contribution of Australian companies to the supply chain for fighter jets used by the Israeli military.

More than two million Palestinians face severe food insecurity, based on United Nations projections.

At least 90,000 protesters marched across the Sydney Harbour Bridge earlier in August to call on the government to sanction Israel.

Israeli Ambassador to Australia Amir Maimon said Palestinian recognition would “not change the reality on the ground”.

“Peace is not achieved through declarations; it is achieved when those who have chosen terror abandon it and when violence and incitement end,” he said in a statement.

Mr Albanese said formal recognition was part of a co-ordinated global effort.

“A two-state solution is humanity’s best hope to break the cycle of violence in the Middle East and to bring an end to the conflict, suffering and starvation in Gaza,” he said.

Mr Albanese said recognition would need to guarantee designated terror group Hamas, which de facto governs Gaza, would play no role in its future government.

Coalition foreign affairs spokeswoman Michaelia Cash said Labor’s decision risked “delivering Hamas one of its strategic objectives of the horrific terrorism of October 7” and put Australia at odds with its most important ally in the US.

The crisis in Gaza began when Hamas attacked Israel on October 7, 2023, killing 1200 people and taking about 250 more hostage.

Israel’s military response has since killed more than 61,000 people, according to Gaza’s health authorities.

Israel has denied that the population is suffering or dying from starvation, even though it has throttled the flow of aid to Gaza for months, international human rights groups have said.

Fugitive Moldovan offers cash to anti-govt protesters

Fugitive pro-Russian businessman Ilan Shor has offered Moldovans monthly payments worth thousands of dollars to join anti-government protests, in a bid to undermine Moldova’s pro-European government ahead of parliamentary elections next month.

The payments are worth $US3,000 ($A4,612).

Moldovan officials have regularly accused Moscow of meddling in their domestic politics by stoking pro-Russian sentiments in a subversive campaign to topple the government as it bolsters ties with the West, accusations Moscow denies.

Shor, under Western sanctions for efforts to destabilise Moldova on Russia’s behalf, said he would make daily payments to each protester totalling a monthly $US3,000 ($A4,612) if they began protesting in the capital Chisinau starting on Saturday.

“Yes, I am…compensating you in such a way that already from Saturday you’ll feel the effects of the victory that we will soon achieve,” he said in a video posted to social media.

He added that accounts for payment would be opened up directly at the protest site.

Moldova’s National Police said in a statement that Shor’s message was “criminal incitement” and warned Moldovans they risked investigation if they engaged with the offer.

“Law enforcement will not allow criminal groups to organise illegal protests aimed at causing disorder and violence. Any attempt will be firmly rejected within the legal framework,” the police statement said.

Moldova says Shor, who was convicted of helping steal $US1 billion ($A1.5 billion) from the country’s banking system in 2014, is Moscow’s primary agent of influence.

Officials have barred his party from standing in elections and banned media assets linked to him.

Earlier this month, a Moldovan court jailed a pro-Kremlin regional leader for channelling money from Russia between 2019 and 2022 to finance Shor’s party.

A small former Soviet republic situated between Ukraine and EU and NATO member Romania, Moldova will hold parliamentary elections on September 28.

The ruling party is aiming to hold on to its majority to keep the country’s pro-European trajectory intact.

Trump tariffs prompt calls to boycott US goods in India

From McDonald’s and Coca-Cola to Amazon and Apple, US-based multinationals are facing calls for a boycott in India as business executives and Prime Minister Narendra Modi’s supporters stoke anti-American sentiment to protest tariffs.

India, the world’s most populous nation, is a key market for American brands that have rapidly expanded to target a growing base of affluent consumers, many of whom remain infatuated with international labels seen as symbols of moving up in life.

India, for example, is the biggest market by users for Meta’s WhatsApp, and Domino’s has more restaurants than any other brand in the nation.

Drinks such as Pepsi and Coca-Cola often dominate store shelves, and people still queue up when a new Apple store opens or a Starbucks cafe doles out discounts.

Although there was no immediate indication of sales being hit, there’s a growing chorus both on social media and offline to buy local and ditch American products after US President Donald Trump imposed a 50 per cent tariff on goods from India, rattling exporters and damaging ties between New Delhi and Washington.

Manish Chowdhary, co-founder of India’s Wow Skin Science, took to LinkedIn with a video message urging support for farmers and startups to make “Made in India” a “global obsession,” and to learn from South Korea, whose food and beauty products are famous worldwide.

“We have lined up for products from thousands of miles away. We have proudly spent on brands that we don’t own, while our own makers fight for attention in their own country,” he said.

On Sunday, Modi made a “special appeal” for becoming self-reliant, telling a gathering in Bengaluru that Indian technology companies made products for the world but “now is the time for us to give more priority to India’s needs”.

Even as anti-American protests simmer, Tesla launched its second showroom in India in New Delhi, with Monday’s opening attended by Indian commerce ministry officials and US embassy officials.

The Swadeshi Jagran Manch group, which is linked to Modi’s Bharatiya Janata Party, took out small public rallies across India on Sunday, urging people to boycott American brands.

“People are now looking at Indian products. It will take some time to fructify,” Ashwani Mahajan, the group’s co-convenor, told Reuters. “This is a call for nationalism, patriotism.”

‘Don’t slam brakes on EVs’: sparks fly over fee push

Motorists could face distance-based fees to drive on Australian roads as part of a proposed tax change expected to be on the menu of Treasurer Jim Chalmers’ economic roundtable.

Momentum is building for a road user charge, seen by one federal frontbencher as a “sensible” solution to fund road maintenance as more people switch to electric vehicles.

But EV owners are urging the government not to slow the transition from internal combustion.

The tax change was flagged by the treasurer during a speech in June, saying he was working with the states and territories “on the future of road-user charging” for EVs.

A group of transport industry leaders, convened by Infrastructure Partnerships Australia, met on Monday to discuss a preferred model for a road user charge.

Roads Australia chief executive Ehssan Veiszadeh attended the meeting and said without changes, Australia risked falling short on the infrastructure needed to support its growing population and economy.

Money collected as part of the fuel excise is allocated for fixing roads, but concerns have been raised there will be less set aside in coming years as the number of EVs increases.

“Without reform, we risk a future where our roads are underfunded, unsafe, and unable to support the demands of a growing population,” Mr Veiszadeh said.

No public recommendations were released from the meeting but the infrastructure partnerships group will use the discussion as the basis for a briefing to Treasury before next week’s roundtable.

The government had an opportunity to promote EV uptake by using the revenue generated from a road user charge to roll out charging infrastructure, Infrastructure Partnerships Australia chief executive Adrian Dwyer said.

“The primary impediment to the greater uptake of electric vehicles is range anxiety – we can kill two birds with one stone by future-proofing our funding system and paying for the charging network that will drive EV uptake,” he said.

While the federal government has maintained the issue is for states and territories, frontbencher Tanya Plibersek said the idea of a tax for EV users made sense.

“I don’t think anything’s happening tomorrow, but I do think it’s sensible … for the states and territories, to look long term at what they do, to make sure that there’s enough money to build the roads that people want to drive on,” she told Seven’s Sunrise program.

Victoria tried to put in place a two cent per kilometre charge on EV users in 2023, but the proposal was overruled by the High Court, effectively banning states from implementing a road user charge and leaving the issue in the lap of the Commonwealth.

NSW has assumed one will eventually be implemented regardless. In its latest budget, the state’s treasurer, Daniel Mookhey, forecast a road user charge kicking in by 2027/28, which is estimated to bring in $73 million.

New Zealand has a road user charge scheme for EVs based on vehicle weight and distance driven.

Last week the NZ government announced petrol cars would also have to pay the charge, while its fuel excise would be scrapped.

EV owners group the Australian Electric Vehicle Association said any road user charge must be universal and not incentivise internal combustion vehicles over EVs.

The introduction of road user charges should not slam the brakes on Australia’s shift to clean transport, Electric Vehicle Council chief executive Julie Delvecchio said.

“Reforms should only apply once electric vehicles reach 30 per cent of new vehicle sales.”

EVs accounted for about 12 per cent of new car sales in the first half of 2025.

Coalition senator Jane Hume said more needed to be done to fix ailing roads, which a broader road tax could achieve.