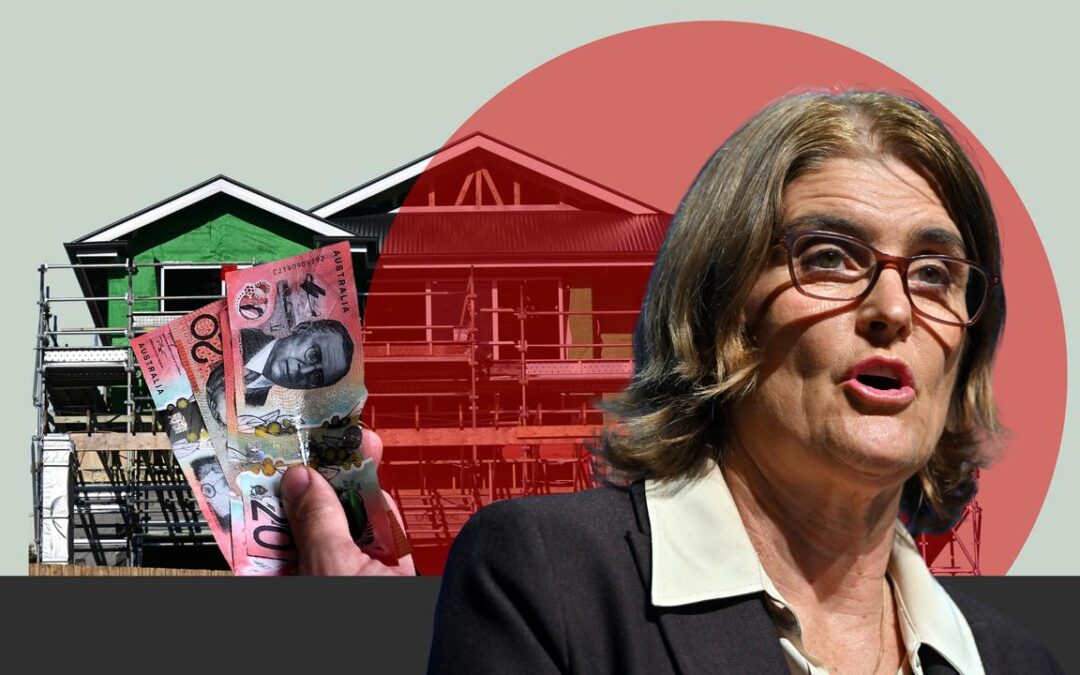

Rates cut but borrowers told not to bank on more relief

Borrowers have received welcome relief from the Reserve Bank of Australia, which delivered a widely expected interest rate cut but flagged the end to its easing cycle is getting closer.

The central bank opted not to shock markets for a second time in two months on Tuesday, cutting the cash rate by 25 basis points to 3.6 per cent.

In its accompanying statement, the RBA board said a further easing in monetary policy, following cuts in February and May, was appropriate because underlying inflation and the labour market had continued to ease.

“The board nevertheless remains cautious about the outlook, particularly given the heightened level of uncertainty about both aggregate demand and potential supply,” it said.

Absent from the board’s statement this time was a comment it felt monetary policy was still restrictive.

As the cash rate gets closer to the unobservable “neutral” rate, the board would have to work harder to justify crossing into stimulatory territory, EY chief economist Cherelle Murphy said.

“This will be a harder barrier for the Reserve Bank to cross but we think a likely one, with private consumption and investment still soft and risks persisting due to elevated global uncertainties,” she said.

RBA governor Michele Bullock said any further decisions would be taken “meeting-by-meeting” and based on economic data as it unfolds.

All nine board members voted in favour of a cut and there was no discussion of a jumbo 50 basis point cut, Ms Bullock said.

The RBA’s decision will save borrowers with a $600,000 mortgage almost $90 a month in repayments and a cumulative $272 per month since cuts began in February.

The move brings the cash rate to its lowest level since May 2023, with the average variable mortgage rate expected to fall to 5.5 per cent.

But for many borrowers, the financial boost was behind schedule.

Most economists had expected the RBA to deliver further rate relief in its July meeting.

In a shock 6-3 decision, the board kept rates on hold, citing a need to wait for more inflation data to ensure price growth was coming down sustainably to target.

The local share market lifted modestly and the Aussie dollar fell following the decision, while money markets were pricing in two more cuts by March.

Vanguard senior economist Grant Feng predicted one more cut by the end of 2025, as growth showed signs of recovery and the unemployment rate stabilising.

Treasurer Jim Chalmers said the decision was “very welcome relief for millions of Australians”.

“The three interest rate cuts we’ve seen this year would not have been possible without our collective efforts to get inflation down,” he said.

The RBA board in its statement noted uncertainty in the global economy was still high.

But markets had settled down in recent months with a little bit more clarity to the scale of Donald Trump’s tariffs and a fairly low amount of retaliation from other countries.

In quarterly forecasts produced by RBA staff and released alongside the cash rate decision, productivity growth was revised down by 0.3 per cent over the medium term.

That would flow through to lower GDP growth, lower living standards and make it harder to get inflation under control.

All four big banks and challenger lender Macquarie announced they would pass on the cut in full to variable home loan borrowers.

Untouched reefs cop record bleaching in intense heat

The longest, largest and most intense marine heatwave on record has triggered the worst coral bleaching off Australia’s western coastline, scientists say.

Researchers are still assessing the full extent of the damage after an unprecedented event that has prompted further calls for urgent action on climate change.

The Australian Institute of Marine Science has confirmed coral mortality rates of up to 90 per cent along 1500km of Western Australia’s coastline.

“The length and intensity of the heat stress and its footprint across multiple regions is something we’ve never seen before on most of the reefs in WA,” the institute’s senior research scientist James Gilmour said.

“Areas which had given us hope because they’d rarely or not bleached before, like the Rowley Shoals, north Kimberley and Ningaloo, have been hit hard this time.”

Sea surface temperatures around Australia in the past summer were the warmest since 1900, with the institute labelling it the “longest, largest and most intense” season on record for WA.

Conditions varied across the tropical reefs – from “extreme”, 90 per cent bleached or dead, to “medium”, somewhere between 11 and 30 per cent.

Mermaid and Clerke reefs in the Rowley Shoals, 300km west of Broome, recorded “very high” mortality levels between 61 and 90 per cent.

The World Heritage-listed Ningaloo Reef, known for its whale sharks, experienced “high” bleaching and mortality between 31 and 60 per cent.

Dr Gilmour said climate change was driving the increased frequency and severity of mass coral bleaching events and giving them little time to bounce back in between.

“They need 10 to 15 years to recover fully,” he said.

“The key to helping coral reefs survive under climate change is to reduce greenhouse gas emissions.”

The Great Barrier Reef has also been under pressure, experiencing the largest-ever annual decline in coral cover in two of its three regions in 2024.

Greens leader Larissa Waters said the WA event was a further warning about the impacts of climate change and accused the federal government of not taking the crisis seriously.

“Reefs that have never suffered bleaching before have now bleached – this is the face of the climate crisis,” she said.

“We’re not going to get too many more warnings, because we’ve seen mass coral bleaching and deaths, and you can’t come back from that.”

The Australian Marine Conservation Society called for urgent climate action and stronger protection for reefs.

“The vast scale of the impacts along WA’s coastline and offshore reefs is hard to comprehend – this is unprecedented harm and needs an unprecedented leadership response from WA and federal governments,” chief executive Paul Gamblin said.

The Conservation Council of WA said the bleaching was devastating but not surprising.

“Scientists have been telling us for many years now that at 1.5 degrees of warming we’re set to lose 80-90 per cent of our coral reefs and at two degrees we lose it all,” director Matt Roberts said.

Molecular ecologist Kate Quigley said the bleaching and coral deaths should be a “wake-up call” for the nation.

“We need strong emissions reductions to curb future marine heatwaves that we know are likely to be in our future,” the Minderoo Foundation principal research scientist said.

Dr Quigley also called for more research and monitoring of the “critical ecosystems”.

The coral health update comes ahead of the expected release of the federal government’s 2035 climate goals, due in September under Paris Agreement rules.

WA remains the only state without a 2030 emissions reduction target.

Israel’s Gaza occupation plan spurred Australia to act

Australia’s decision to recognise Palestine has been fuelled by Israel’s plans to take over Gaza City, but advocates say the government needs to go further to prevent civilian suffering.

Prime Minister Anthony Albanese on Monday confirmed Australia would join the UK, France and Canada in recognising a Palestinian state at a United Nations General Assembly meeting in September.

While the federal government previously insisted that the recognition of Palestine was a matter of “when, not if”, the announcement was a shift from comments made just weeks prior.

Australia’s decision was partially fuelled by the Israeli government’s decision to approve a plan to seize control of Gaza City, Mr Albanese said.

“We make assessments based upon the totality of what is before us,” he told reporters in Melbourne on Tuesday, highlighting a decision by the Israeli government to “double down on its military solution”.

“We have seen too many innocent lives being lost.

“The international community is saying that we need to stop the cycle of violence.”

In late July, Mr Albanese stressed he would not be “driven by a time frame” on the recognition issue.

But less than a week later, Foreign Minister Penny Wong revealed Australia was co-ordinating with other countries on the issue amid concerns “there will be no Palestine left to recognise”.

She added recognition could be used to “isolate Hamas”, the designated terror group that ruled Gaza.

Senator Wong has since said practical steps for recognition will be tied to commitments made by the Palestinian Authority, which exercises partial civil control in the West Bank.

The commitments include assurances Hamas will play no role in any future government.

More than 140 of the 193 United Nations member states already recognise Palestine.

Australia’s decision helped to put further pressure on Israel, the former head of Human Rights Watch said.

“Israel is creating conditions that are so unsuitable for life and killing enough Palestinians with the aim of driving two million people to flee Gaza,” Kenneth Roth told AAP.

He accused Israeli Prime Minister Benjamin Netanyahu of systematic war crimes.

“Not only crimes against humanity, but also genocide, and he’s doing this heading one of the world’s most powerful militaries against a people who at this stage have no real capacity to fight back,” Mr Roth said.

Australia Palestine Advocacy Network president Nasser Mashni warned recognition was “a veneer that allows Israel to continue brutalising Palestinians”.

More than two million Palestinians face severe food insecurity, based on UN projections.

Israel has denied the civilian population is suffering or dying from starvation, even though it has throttled the flow of aid to Gaza for months, according to international human rights groups.

It has also dismissed allegations of genocide as “false and outrageous”.

Opposition Leader Sussan Ley said recognition “does not deliver a two-state solution, it does not improve the flow of aid, it doesn’t support the release of the hostages and it certainly doesn’t put an end to the terrorist group Hamas”.

The crisis in Gaza began when Hamas attacked Israel on October 7, 2023, killing 1200 people and taking about 250 hostage.

Israel’s military response has since killed more than 61,000 people, according to Gaza health authorities.

Unions push back on productivity plan for schools, jobs

Unions are challenging a productivity plan for the nation’s classrooms and workplaces, setting up another fault line before a much-vaunted reform roundtable.

Artificial intelligence in schools would help to ease the load on teachers and tackle educational inequity, the Productivity Commission said in the fourth of five reports ahead of the government’s economic summit.

The report, released on Tuesday, urged the government to create a single online platform of planning materials for teachers across all states and territories to access to reduce the time spent out of class preparing for lessons.

This would particularly help teachers in remote areas or who instruct classes outside of their field of expertise.

State and territory governments were told to provide professional development and support for teachers to adopt and use AI tools effectively.

But the Australian Education Union said the commission’s proposals were the wrong solutions to a real problem of high workloads.

“Governments need to listen to the profession and respect their experienced and informed views about what is needed to lift results,” AEU deputy president Meredith Peace said.

“Teachers know that off-the-shelf lesson plans aren’t what they need to meet the individual needs of students.”

Cutting administration loads so teachers could spend more time on lesson planning and working with colleagues would be a better fix, Ms Peace said.

The Productivity Commission also recommended financial incentives for businesses to train workers and for lower occupational entry rules for jobs such as car repairers, hairdressers and painters and decorators.

Building the nation’s skills base was an important part of turning around Australia’s ailing productivity growth, it said.

“A thriving, adaptable workforce will give us the productivity growth we need to see higher wages and better living standards,” deputy chair Alex Robson said.

Council of Small Business Organisations Australia chair Matthew Addison welcomed the proposed financial incentives for workplace training.

“Formalised training can be expensive and time consuming, and for small businesses that can be very hard to absorb,” he said.

Business Council of Australia chief executive Bran Black backed the push to reduce barriers for people working in certain industries, as well as the recommendations to integrate AI in schools.

“Removing excessive and inconsistent workforce entry regulations, expanding alternative entry pathways, and reviewing qualification requirements will boost participation and employment outcomes where we need it most,” he said.

But peak union body the ACTU rejected large parts of the proposals, describing them as prioritising “employer cost-cutting over effective solutions to address Australia’s skills and training challenges”.

Lower job entry requirements to address workplace shortages risked a “race to the bottom” on standards, while taxpayers shouldn’t be used to fund employers doing “what they should be doing anyway” by investing in training, it said.

“The productivity commission has severely misunderstood the drivers of the lack of investment by large employers in training and then suggested the answer is to provide small and medium businesses with a tax break,” ACTU assistant secretary Liam O’Brien said.

“This is a missed opportunity.”

Treasurer Jim Chalmers welcomed the report, saying the government was grateful for the commission’s work “in helping us think through some of the big challenges in our economy”.

“The reason that our government is obsessed with productivity in our economy is because it’s the best way to lift living standards over time,” he said.

Business, union and civil society leaders will come together with experts and government representatives at the three-day economic reform roundtable, which begins on August 19.

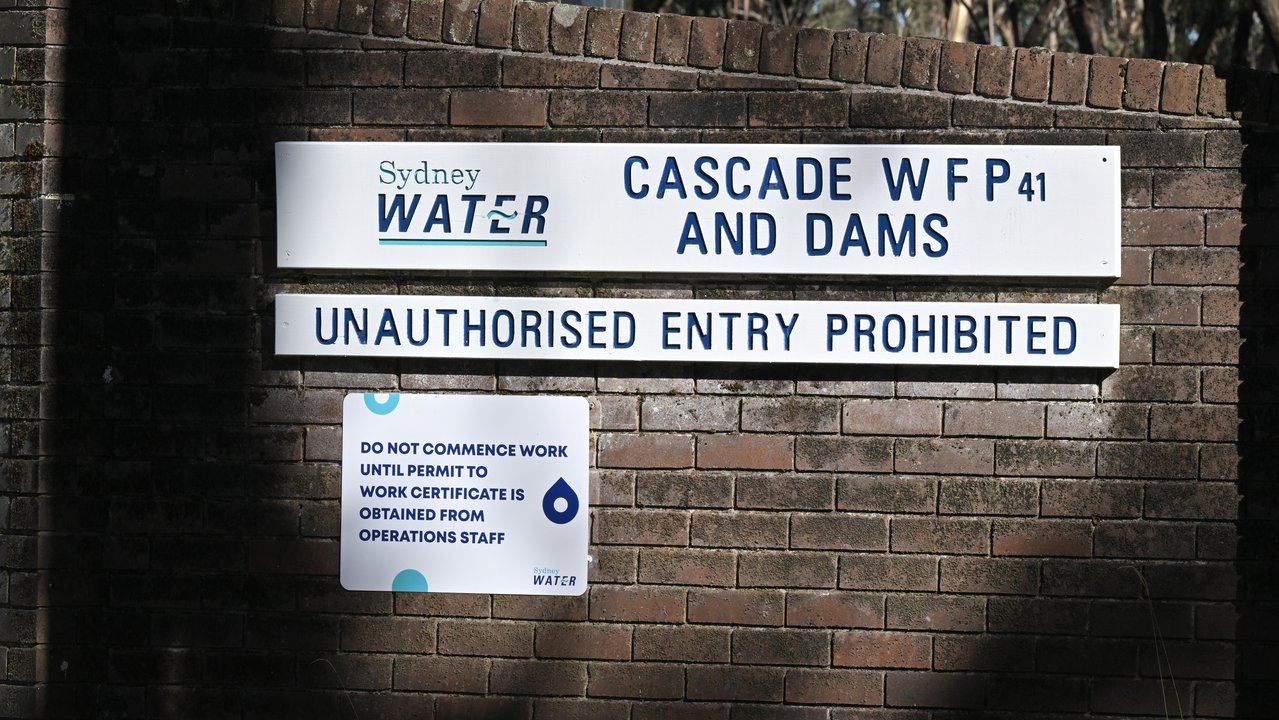

Cover-up claims over ‘forever chemicals’ in tap water

An expert panel’s report into contaminated drinking water has been labelled a cover-up by one community activist amid calls for broader monitoring and classification of so-called “forever chemicals”.

The increased detections in samples from Sydney drinking water coincides with concerns over the level of the contaminants considered safe as some readings exceed international guidelines.

“Sydney’s water meets current Australian standards, but when considering health benchmarks used in other countries, some samples were near or above safety limits,” University of NSW chemistry professor William Donald said.

He led a study published in environmental chemistry journal Chemosphere which reported analysis of 32 tap water and 10 bottled water samples from Sydney catchment areas in early 2024.

PFAS, or per- and polyfluoroalkyl substances, are a group of 15,000 toxic, synthetic chemicals used for their resistance to heat, stains and grease.

The researchers detected 31 chemicals, including 21 not previously recorded, as scientists grapple with removing the chemicals from the environment.

The task is made more difficult by tweaks in chemical structures to create new compounds, requiring fresh assessments for toxicity, environmental persistence and potential health impacts.

“We are stuck in a whack-a-mole situation with PFAS,” Prof Donald said.

Regulating the compounds as a class of chemicals rather than individually could ease the burden.

Lisa Hua, who along with Prof Donald also detected the chemicals in the “tar balls” that closed Sydney beaches in October, said broader monitoring could reveal more about contamination across Australia.

Monitoring and reporting also varies across the country.

Melbourne Water conducts “risk-based” monitoring, with fortnightly samples at seven sites in catchments across the city, while southeast Queensland water treatment plants are checked monthly.

Western Australia says it tests its water sources regularly.

“Expanding the current monitoring of PFAS could be beneficial to gain a greater understanding of seasonal variations of PFAS in drinking water supply,” Dr Hua said.

Australia’s drinking water guidelines were updated in June, reining in perfluorooctane sulfonic acid (PFOS) concentrations to eight nanograms per litre.

That was marginally above the levels researchers detected at North Richmond in Sydney’s northwest, while Sydney Water’s more recent sample from the filtration plant in July detected lower levels.

A NSW panel advising on potential health impacts of PFAS on Tuesday reported the effects “appear to be small”.

It said epidemiological studies would only positively contribute to understanding the clinical effect of the chemicals if there were well-characterised exposures, outliers were accounted for and the population was large enough to detect effects.

The panel said those characteristics were not met in any NSW population, including the Blue Mountains region where a dam was disconnected from drinking water supplies in 2024 due to high chemical levels.

Community group Stop PFAS’s convener, Jon Dee, said the panel’s report was “clearly a cover up”.

“It leaves the Blue Mountains population with no alternative but to undertake our class action against the NSW government and Sydney Water,” he told AAP.

Import, export, manufacture and use of some PFAS chemicals was banned nationwide in July.

Productivity a tough puzzle for central bank boffins

Australian living standards will recover slower than expected, the Reserve Bank has forecast, acknowledging it has consistently been wrong about a key economic assumption.

Economists at the central bank downgraded their estimate for Australia’s medium-term productivity performance in quarterly forecasts released simultaneously to the RBA board cutting interest rates to 3.6 per cent on Tuesday.

Because productivity is a key factor flowing through to growth in the economy and living standards, both were downgraded by around 0.3 percentage points.

That’s roughly in line with the assumption that trend productivity growth will fall from one to 0.7 per cent.

Labour productivity is expected to recover – increasing 0.7 per cent by the end of 2027, after declining 0.7 per cent over the past year.

The bank conceded it had consistently been proven wrong by productivity outcomes.

“For some time, our forecasts have implicitly assumed that productivity growth was temporarily weak and would gradually return to, and be sustained at, higher historical growth rates,” RBA staff wrote in the Statement on Monetary Policy.

“More often than not, this has not eventuated, resulting in the RBA’s implied productivity forecasts consistently overestimating the actual outcomes.”

The RBA’s new assumption aligns with the average growth rate for non-farm labour productivity – how much extra has been produced per each hour worked – over the past 20 years.

Productivity is closely correlated to real household disposable income, a crude measure of living standards.

It brings the RBA more in line with other Australian financial institutions, including NSW Treasury which recently revised its long-term growth assumption to 0.8 per cent.

The concession comes as RBA governor Michele Bullock prepares to address the government’s productivity roundtable next week.

Treasurer Jim Chalmers has assembled a range of experts, business leaders and unions to discuss how Australia’s tax and regulation frameworks can be reformed in a bid to revitalise the nation’s anaemic productivity growth.

The downgrade in the outlook was not a sign the bank was pessimistic about the summit’s prospects for success, the RBA said.

But any policy changes that might result in higher efficiency would take at least a couple of years to flow through to the economy, beyond the central bank’s forecast horizon.

Through its liaison with businesses, the RBA said firms told it regulation and labour availability were key barriers to lifting productivity.

“Firms said the complexity, cumulative volume and frequency of change in regulation has been hard to manage, particularly for smaller firms.”

Technology was viewed as important to driving productivity, though some businesses noted not all technology enhanced productivity.

While technology might initially drag down productivity as businesses require more staff for its adoption, most survey participants expected artificial intelligence to save labour in the future.

Lower skilled jobs were especially at risk as the workforce transitioned to higher skilled roles.

While GDP growth was revised down as a result of the productivity downgrade, the inflation outlook was largely unchanged, with both the trimmed mean and headline inflation expected to hit the midpoint of the RBA’s 2-3 per cent target band by the end of 2027.

That’s because the RBA assumed the economy would quickly adjust to the lower growth in supply capacity.

The unemployment rate is expected to hold at 4.3 per cent over the duration of the RBA’s forecast horizon.

The bank noted its forecast was “close to full employment”, reiterating that its estimate of the non-accelerating inflation rate of unemployment is still above that of many market economists, who have posited it is actually closer to four per cent.

Delayed gratification for borrowers as RBA cuts again

Borrowers have received welcome relief from the Reserve Bank of Australia, which has delivered a widely expected interest rate cut.

The central bank opted not to shock markets for a second time in two months on Tuesday.

Its decision to cut the cash rate by 25 basis points to 3.6 per cent – the third reduction in six months – will save borrowers with a $600,000 mortgage almost $90 a month in repayments and a cumulative $272 per month since cuts began in February.

The move brings the cash rate to its lowest level since May 2023, with the average variable mortgage rate expected to fall to 5.5 per cent.

But for many borrowers, the financial boost is behind schedule.

Most economists had expected the RBA to deliver further rate relief in its July meeting.

In a shock 6-3 decision, the board kept rates on hold, citing a need to wait for more inflation data to ensure price growth was coming down sustainably to target.

A benign consumer price index in late July and weaker jobs figures gave the bank the green light to deliver the cut that most saw as a matter of when, not if.

With money markets predicting more cuts coming down the pike, rising buyer confidence and borrowing capacity was set to support housing demand and price growth, REA senior economist Eleanor Creagh said.

According to Domain, the cut will lift borrowing power for households earning $50,000 a year by $4000 annually, while double-income households on $400,000 will be able to lift their loan limit by an extra $49,000.

“With more money chasing too few homes, prices are set to rise again,” said Domain chief economist Nicola Powell, who predicts house prices to climb six per cent and units to lift five per cent by mid-2026.

Traders will be glued to governor Michele Bullock’s post-meeting press conference for any signs of where the bank will move next.

Ahead of the decision, the market was pricing in another one-and-a-half cuts by Christmas.

All nine board members voted in favour of a cut.

Plan to seize Gaza City pushed Australia to recognition

Israel’s plan to take over Gaza City helped spur Australia’s decision to recognise a Palestinian state, the prime minister has revealed.

Anthony Albanese on Monday confirmed Australia would join the UK, France and Canada in recognising Palestine at a United Nations General Assembly meeting in New York in September, following mounting pressure to take action to support the suffering people of Gaza.

While the federal government had previously insisted that the recognition of Palestine was a matter of “when, not if”, the announcement was a shift from those comments made less than two weeks prior.

This was because Australia’s decision was partially fuelled by the Israeli government’s decision on Friday to approve a plan to seize Gaza City, Mr Albanese said.

“We make assessments based upon the totality of what is before us,” he told reporters in Melbourne on Tuesday.

“The other thing that is occurring is … the decision by the Israeli government to double down on its military solution … with the decision that they’ve made to go in and to occupy Gaza City.

“We have seen too many innocent lives being lost.

“The international community is saying that we need to stop the cycle of violence.”

In late July, Mr Albanese stressed he would not be “driven by a time frame” on the recognition issue.

But less than a week later, Foreign Minister Penny Wong revealed Australia was co-ordinating with other countries on the issue amid concerns “there will be no Palestine left to recognise”.

Recognition could be used to “isolate Hamas” – a line the government has continued to lean on – she added, referring to the designated terrorist group that controls Gaza and is in a fight to the death with Israel.

Senator Wong has said practical steps for recognition will be tied to commitments made by the Palestinian Authority, which exercises partial civil control in the West Bank.

The commitments include assurances Hamas will play no role in any future government.

More than 140 of the 193 United Nations member states already recognise Palestine.

Australia Palestine Advocacy Network president Nasser Mashni has warned recognition is “nothing but a veneer that allows Israel to continue brutalising Palestinians”.

Opposition Leader Sussan Ley said the decision “does not deliver a two-state solution, it does not improve the flow of aid, it doesn’t support the release of the hostages and it certainly doesn’t put an end to the terrorist group Hamas”.

Former Liberal prime minister Scott Morrison, whose government controversially recognised West Jerusalem as Israel’s capital before Labor reversed the decision, branded any recognition of Palestine as a “hollow gesture”.

The crisis in Gaza began when Hamas attacked Israel on October 7, 2023, killing 1200 people and taking about 250 hostage.

Israel’s military response has since killed more than 61,000 people, according to Gaza’s health authorities.

French President Emmanuel Macron praised Australia’s decision.

But Israel said recognition would be counterproductive to peace in the Gaza Strip and its demands for the release of the remaining hostages.

More than two million Palestinians face severe food insecurity, based on UN projections.

Israel has denied the Gazan population is suffering or dying from starvation, even though it has throttled the flow of aid to Gaza for months, international human rights groups have said.

NBN users gorge on fibre for healthier download speeds

More Australians are ditching ageing copper internet connections for faster fibre optic technology in a move that has increased download speeds across the nation, NBN Co has revealed.

More than 430,000 Australian homes and businesses upgraded their connections from older, slower technology over the past year, the broadband wholesaler disclosed in its annual results on Tuesday, which increased the firm’s revenue.

The government-owned entity’s earnings for 2024/25 jumped eight per cent to $4.2 billion, in line with guidance, and its revenue rose four per cent to $5.7 billion.

The results were helped by growing demand for higher internet speeds on its network, with 2.7 million premises (32 per cent) connected to plans offering 100 megabit-per-second downloads or more, and average spending up by $3 a month to $50.

The shift to faster download speeds and fibre connections also drove higher data usage across the nation.

Average monthly data downloads per premise rose more than 10 per cent, from 460 gigabytes in June 2024 to 508 in June 2025.

Fibre upgrades had driven demand for both faster plans and greater downloads, NBN Co chief executive Ellie Sweeney said.

“Customers transitioning from copper to fibre-based connections are taking advantage of faster speeds and using their internet in more dynamic and data-intensive ways,” she said.

“For the first time ever, fibre is the dominant connection technology in our network.”

The fibre-to-the-node upgrades have been largely funded by a $3 billion commitment from the federal government, announced in January.

While NBN Co upgraded 806,000 premises to fibre in the last financial year, Ms Sweeney said the firm had a plan in place to upgrade the remaining 622,000 properties connected with copper, though warned it would take years.

“We’ll continue to work with (retail service providers) and with industry around how we can accelerate that movement to fibre,” she told AAP.

“At the moment, we’re anticipating it will be the early part of 2030.”

Almost nine million premises are now connected to the National Broadband Network, the company revealed, including 31 per cent using fibre-to-the-premises technology.

Further enhancements for some users were planned for September, Ms Sweeney said, with speed boosts to three wholesale tiers offered over HFC and fibre connections, as well as a more efficient terminating device.

“Looking to the future, it is NBN’s aim that our 500Mbps wholesale speed tier becomes Australia’s most popular NBN plan,” she said.

NBN Co was established in 2009 as a government business enterprise to design, build and operate a wholesale broadband access network for the nation.

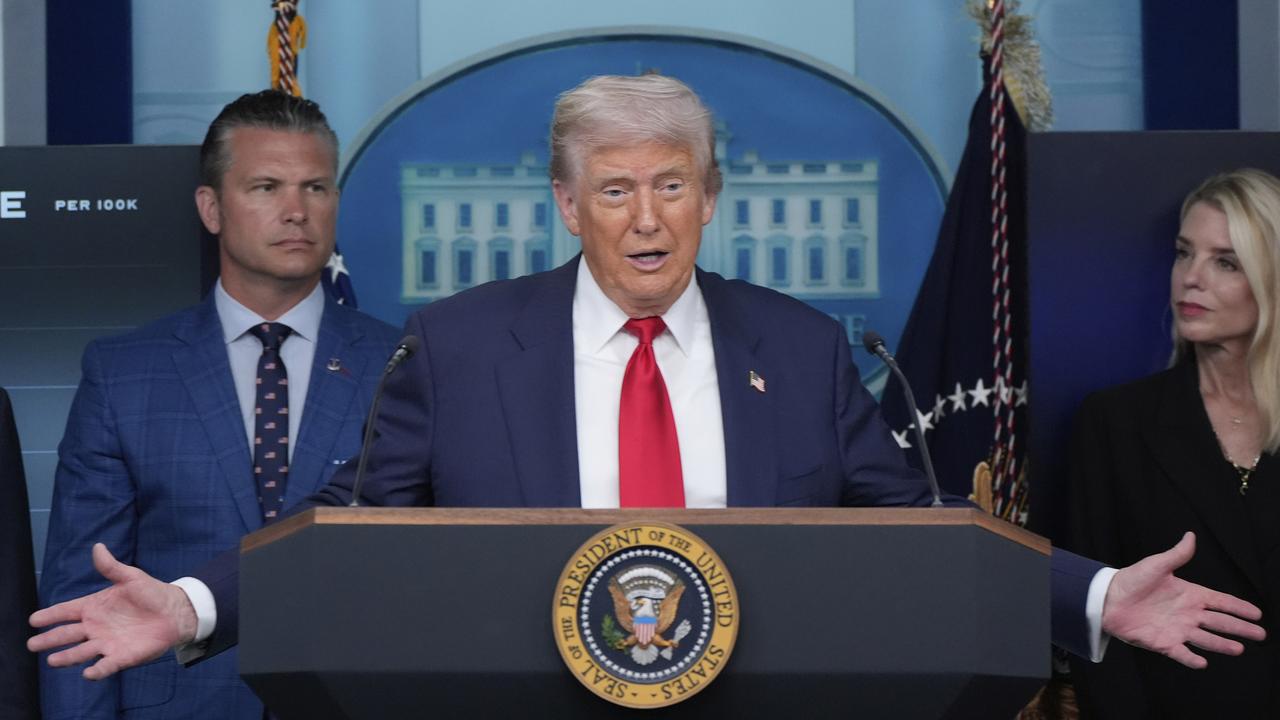

US and China extend tariff truce by 90 days to November

The United States and China have extended a tariff truce for another 90 days, staving off triple-digit duties on Chinese goods as US retailers get ready to ramp up inventories ahead of the critical end-of-year holiday season.

US President Donald Trump announced on his Truth Social platform that he had signed an executive order suspending the imposition of higher tariffs until November 10, with all other elements of the truce to remain in place.

China’s Commerce Ministry issued parallel moves on Tuesday, saying it would adopt and maintain all necessary measures to suspend or remove non-tariff measures.

Trump on Sunday had demanded China quadruple its purchases of US soybeans, but the order included no mention of any additional purchases.

“The United States continues to have discussions with the PRC to address the lack of trade reciprocity in our economic relationship and our resulting national and economic security concerns,” Trump’s executive order stated.

“Through these discussions, (China) continues to take significant steps toward remedying non-reciprocal trade arrangements and addressing the concerns of the United States relating to economic and national security matters.”

The tariff truce between Beijing and Washington had been due to expire on Tuesday. The extension until early November buys crucial time for the seasonal autumn surge of imports for the Christmas season, including electronics, apparel and toys at lower tariff rates.

The new order prevents US tariffs on Chinese goods from shooting up to 145 per cent, while Chinese tariffs on US goods were set to hit 125 per cent – rates that would have resulted in a virtual trade embargo between the two countries. It locks in place – at least for now – a 30 per cent tariff on Chinese imports, with Chinese duties on US imports at 10 per cent.

“We’ll see what happens,” Trump told a news conference, highlighting what he called his good relationship with Chinese President Xi Jinping.

Trump told CNBC last week that the US and China were getting very close to a trade agreement and he would meet with Xi before the end of the year if a deal was struck.

The two sides in May announced a truce in their trade dispute after talks in Geneva, Switzerland, agreeing to a 90-day period to allow further talks. They met again in Stockholm in late July, and US negotiators returned to Washington with a recommendation that Trump extend the deadline.

Treasury Secretary Scott Bessent has said repeatedly the triple-digit import duties both sides slapped on each other’s goods were untenable and had essentially imposed a trade embargo between the world’s two largest economies.

“It wouldn’t be a Trump-style negotiation if it didn’t go right down to the wire,” said Kelly Ann Shaw, a senior White House trade official during Trump’s first term and now with law firm Akin Gump Strauss Hauer & Feld.

Imports from China early this year had surged to beat Trump’s tariffs, but dropped steeply in June, Commerce Department data showed last week.

The US trade deficit with China tumbled by roughly a third in June to $US9.5 billion, its narrowest since February 2004. Over five consecutive months of declines, the US trade gap with China has narrowed by $US22.2 billion – a 70 per cent reduction from a year earlier.

Washington has also been pressing Beijing to stop buying Russian oil, with Trump threatening to impose secondary tariffs on China.