Trade and skills under spotlight in ‘promising’ talks

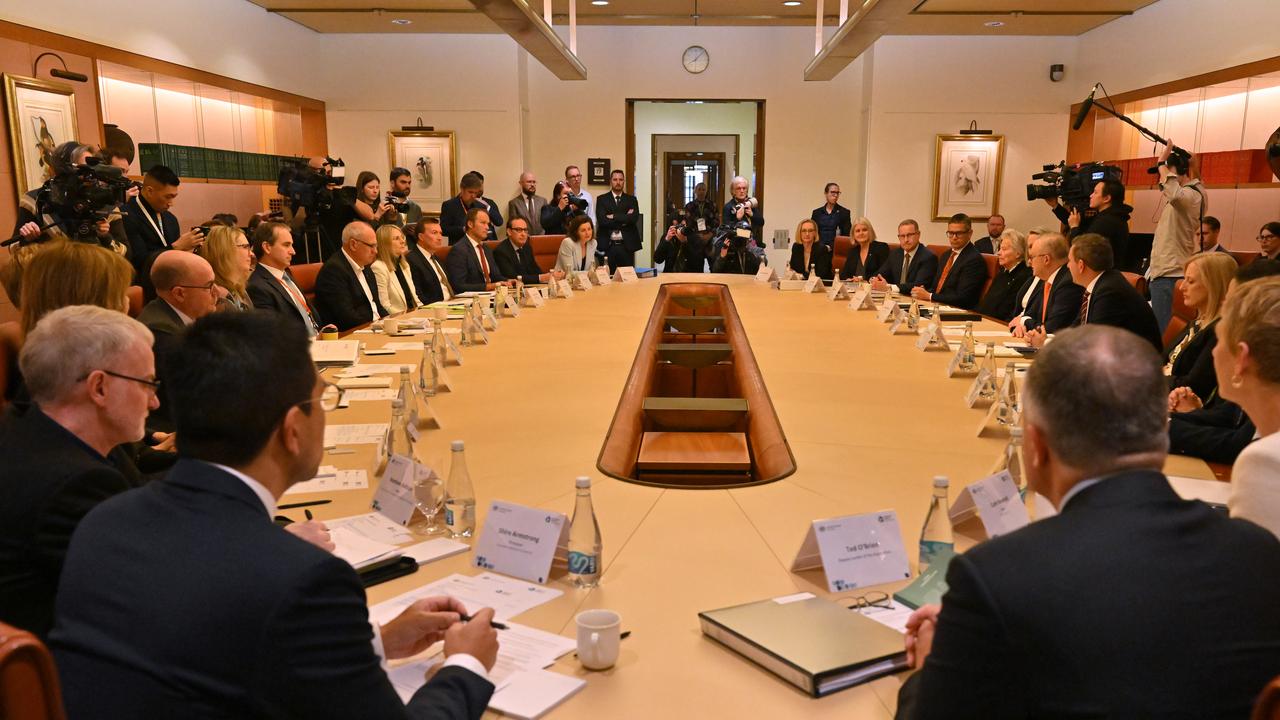

A hotly anticipated economic symposium has closed out a “promising and productive” first day as Australia’s top minds built consensus on skills, technology and trade.

Discussions around the federal government’s economic reform roundtable were shrouded in secrecy on Tuesday, with attendees not even allowed to bring mobile phones into the cabinet room at Parliament House.

But participants had risen to the occasion, Treasurer Jim Chalmers said.

“The quality and calibre of engagement in the room has been outstanding,” he said.

“It’s been a really promising and productive first day.

“I’m delighted at how specific people’s ideas have been and how constructively participants have worked together.”

During the lunch break, Business Council of Australia chief executive Bran Black reared his head to praise the proceedings.

“I thought that both conversations were really quite constructive and I think the treasurer did a good job in steering the conversation,” he told reporters.

The assessment would be music to the ears of Prime Minister Anthony Albanese, who earlier promised to strive for consensus to achieve long-lasting change.

“Political change, whether it’s in the economy, social policy or the environment, is likely to be more successful and more entrenched and more lasting when people come with us on that journey,” he said in his opening address.

While Dr Chalmers identified reviving stagnant productivity as the roundtable’s main aim, day one of the three-day summit focused on improving Australia’s economic resilience amid increasing global challenges.

Shiro Armstrong, a professor of economics at ANU who addressed the roundtable on global uncertainty, said the mood was “extremely constructive”.

“I think the chairing was spectacular. Everyone had time to talk, nothing was rushed and really collegial between all the different interests,” he told Sky News.

Mr Black said there was consensus around removing more nuisance tariffs after the government abolished almost 500 import levies, including for toothbrushes, dishwashers and menstrual products, in its previous term.

About 300 different nuisance tariffs remained that raised about $15 million in revenue but cost the economy more than $150 million, he said.

Developing the skillset of Australia’s workforce was another focus of the roundtable.

Independent MP Allegra Spender said there was agreement around the need to train workers to adapt to the changing economy, including in using AI.

Participants recognised businesses needed to play a role in training their workers, but there was division on how to incentivise employers to do this.

Unions proposed charging employers a levy to provide skills, Mr Black said, but businesses preferred an incentive for employers to bring on more apprentices.

“We stressed the importance, instead of using the stick of a levy, of trying to incentivise employers with a carrot,” he said.

There were many points of agreement at a top level, but it was important to translate that into agreement on specifics over the three days, Mr Black said.

Reserve Bank governor Michele Bullock delivered a presentation outlining Australia’s declining productivity performance.

Productivity will feature more prominently on the second day, before budget sustainability and tax reform close out the roundtable on Thursday.

Shadow treasurer Ted O’Brien, who is also attending the roundtable, said it was Dr Chalmers’ biggest test since he entered parliament.

“He has made it very clear to the Australian people that he will turn the stats around on living standards,” Mr O’Brien said.

“Australia has experienced the biggest decline in living standards of all developed nations as a direct consequence of this government’s actions.”

Australia to probe $1b Chinese company deal with Nauru

Australia is working to confirm whether Nauru has breached a security treaty following a $1 billion announcement with a Chinese company.

Nauru must receive Australia’s sign-off on any partnership, arrangement or engagement with a third nation when it comes to security, including critical infrastructure such as banking and telecommunications.

Under the treaty, signed in December 2024, Australia would prop up Nauru’s banking sector, provide $100 million in budget support and $40 million for policing in exchange for an effective veto right over other security agreements.

Pacific Minister Pat Conroy said the Australian government was working with Nauru to determine whether a development deal with the China Rural Revitalisation and Development Corporation, signed on August 5, activated treaty obligations.

“That is a really important treaty for us, that helps position us as a security partner of choice with Nauru,” Mr Conroy said in Brisbane on Tuesday.

The first part of the three-phase deal with the Chinese corporation covers renewable energy, the phosphate industry, marine fisheries and sea infrastructure.

Mr Conroy said Australia wasn’t opposed to development and economic assistance from other nations in the Pacific.

“We think other countries should be doing their fair share and investing in the Pacific. That’s a good thing for the region,” he said.

“What we’ve been very clear is that every country in the world should respect the views of the Pacific Islands Forum, the leaders’ consensus, which is that security should be provided by countries within the PIF.”

Mr Conroy has stated China should play no security role in the Pacific.

The jostling for influence between China and traditional partners like Australia in the Pacific has also been on display ahead of the Pacific Islands Forum leaders meeting in the Solomon Islands in September.

Prime Minister Jeremiah Manele has banned all development partners from attending after pressure from China to exclude Taiwan from the forum.

The push to exclude Taiwan, which Beijing claims is part of its territory, split Pacific leaders, some of which still recognise Taiwan over China.

Some forum nations and development partners have expressed that any attendance of Chinese officials at forum events is a red line.

It followed an incident at the 2024 leaders meeting in Tonga where the leaders’ communique was altered after China’s Pacific envoy expressed anger at a provision referencing Taiwan.

Mr Conroy said the decision to exclude dialogue partners by the Solomon Islands was “unfortunate”.

“We think that every dialogue partner should have been invited to the PIF … whether that’s China, Taiwan, the United States, United Kingdom, whoever, you name it,” he said.

“We think the 1992 status quo, the consensus around dialogue partner engagement should be maintained.”

The invitation of development partners began in 1992 and includes Taiwan.

Australia has been working to shore up its foothold in the Pacific by signing numerous security and defence co-operation treaties, some of which include exclusivity clauses.

The pact with Papua New Guinea precludes any security presence from China.

A defence pact allowing its citizens to serve in the Australian Defence Force is set to be inked at the celebrations for the 50th anniversary of its independence in Port Moresby in September.

But a treaty with Kiribati has been more elusive, with negotiations effectively put on ice by the Maamau government.

Mr Conroy declined to detail the status of the negotiations.

“We’re engaging with all Pacific island nations on their interests and we’ve made it very clear that we’re open to doing deals, negotiating beneficial arrangements for any Pacific nation that is interested in talking to us,” he said.

More teeth for uni watchdog as fears rise for 1500 jobs

A student-first approach and action on systemic issues could be on the menu of Australia’s hamstrung university watchdog, with concerns about $1 million pay packets and job cuts in the sector.

A review into the tertiary education regulator’s kit bag – whose limited powers have not changed in 15 years – has been foreshadowed by Federal Education Minister Jason Clare.

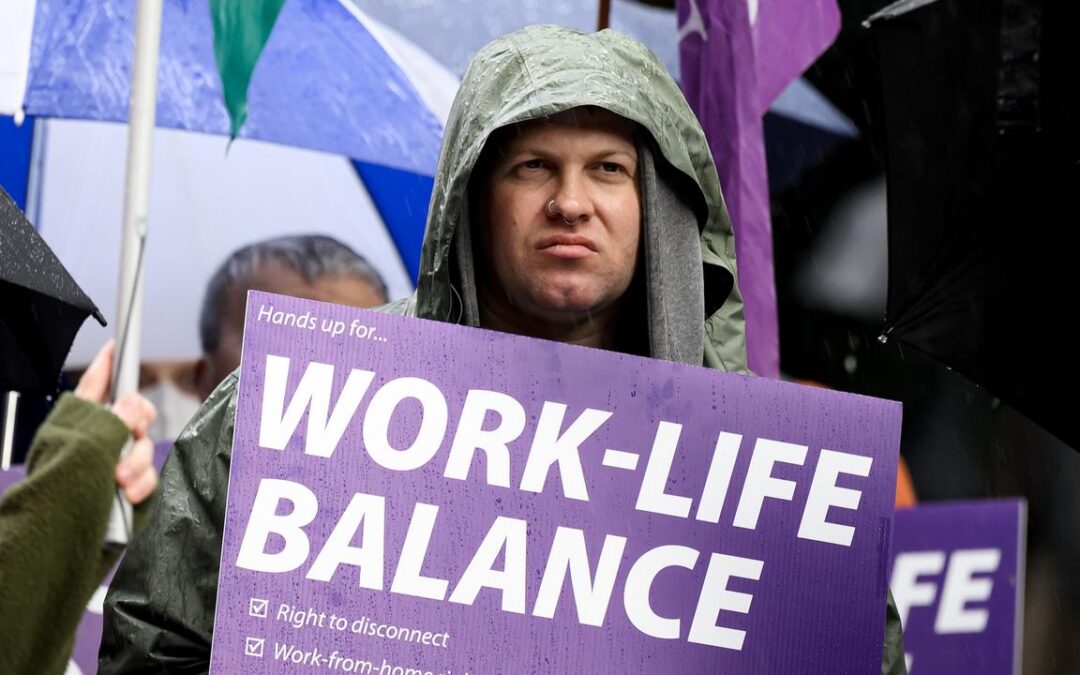

Dozens of academics demonstrated outside a higher education summit in Sydney on Tuesday over fears for 1500 jobs at six institutions and several major restructures.

The regulator could do little more than publish statements of expectation, apply to courts for fines, impose conditions on a university’s registration or terminate a university’s registration, Mr Clare said on Tuesday.

“TEQSA has a sledgehammer and a feather and not much in between,” he said of the Tertiary Education Quality and Standards Agency.

It needed better tools to act on governance and leadership issues and matters of public interest, the minister said.

Mr Clare also took aim at the ballooning salaries of Australian vice-chancellors who are among the highest paid in the world.

Their average salary was more than $1 million in 2024.

“Can I just encourage everyone again, don’t be defensive about this,” he told leaders at Tuesday’s summit.

Salary comparisons were misleading because of scale and funding models, Universities Australia chief executive Luke Sheehy said.

He argued chronic government underfunding was contributing to the financial crunch universities faced.

“A decade of successive and consistent changes to policy and funding have stripped around $1 billion each year from teaching, driven investment in research to record lows and ended dedicated funding for infrastructure,” he told AAP.

“Universities are being asked to do more with less, at a time when demand for teaching, skills and research has never been higher.”

University of Technology Sydney on Thursday stopped enrolments for 120 courses for 2026 as the home of 50,000 students tried to plug a $100m financial hole.

The watchdog review coincides with a NSW parliamentary inquiry into university governance.

Former academic turned Labor MP Sarah Kaine will chair the inquiry and said it was focused on building a stronger, fairer university system.

“Universities are not just institutions of learning – they are public assets, civic anchors and engines of social progress,” Dr Kaine said on Tuesday.

Six of NSW’s 10 public universities have announced reviews into courses and staffing, putting an estimated 1500 jobs on the line, the National Tertiary Education Union said.

It attacked the higher education summit and key sponsor Nous, a global consulting firm linked to university restructures.

“There’s a clear picture of a sector in crisis due to corporate greed and poor leadership,” the union said.

“While staff are losing jobs and students are losing courses, senior executives and consultants are meeting inside the summit to discuss the sector’s future without staff or student voices at the table.”

Nous admitted the higher education sector faced challenges.

“That’s why we are called upon to provide insights and measures that enable universities to make long-term, evidence-based decisions,” a spokesperson said.

Retaliatory visa ban puts Australian diplomats in limbo

A trio of Australian representatives to the Palestinian Authority have had their visas revoked by Israel amid a diplomatic stoush.

The decision comes after Australia’s decision to recognise the state of Palestine and its refusal of entry to significant Israeli figures.

The diplomats were tasked with helping Australia engage with the Palestinian Authority as the federal government’s recognition of Palestine is tied to commitments made by the body, including an assurance that designated terror group Hamas play no role in a future state.

Though they have not been working in Gaza, the diplomats had liaised with humanitarian organisations which have been trying to get aid into the territory.

In a social media post on Monday, Israel’s Foreign Minister Gideon Sa’ar said he had also instructed the Israeli Embassy in Canberra to carefully examine any official Australian visa application for entry into Israel.

The move followed Australia denying far-right Israeli politician Simcha Rothman entry into the country for a speaking tour after provocative comments, including branding children in Gaza as enemies.

Foreign Minister Penny Wong said the government had a right to safeguard communities and protect “all Australians from hate and harm”.

“At a time when dialogue and diplomacy are needed more than ever, the Netanyahu government is isolating Israel and undermining international efforts towards peace and a two-state solution,” Senator Wong said on Tuesday.

“This is an unjustified reaction following Australia’s decision to recognise Palestine.”

She said Australia would continue to contribute to “international momentum to a two-state solution, a ceasefire in Gaza and release of the hostages” and would always take decisive action against anti-Semitism.

The Palestinian Authority’s Ministry of Foreign Affairs also condemned Israel’s “arbitrary” cancellations.

It stressed it would continue to deal with the Australian diplomats, saying Israel had no legal basis to block citizens of a third nation from entering Palestinian territory.

Earlier in August, Prime Minister Anthony Albanese confirmed Australia’s intention to recognise Palestinian statehood at the United Nations General Assembly meeting in September.

The decision came after more than 100,000 people marched across the Sydney Harbour Bridge to protest the war in Gaza.

Mr Sa’ar accused the Australian government of fuelling anti-Semitism as he announced the visa cancellations on social media on Monday.

“This follows Australia’s decisions to recognise a ‘Palestinian state’ and against the backdrop of Australia’s unjustified refusal to grant visas to a number of Israeli figures, including former minister Ayelet Shaked and … (Member of the Knesset) Simcha Rothman,” Mr Sa’ar posted on X.

Opposition Leader Sussan Ley said she regretted the way the relationship between the Australian and Israeli governments was deteriorating.

“That is something all Australians should be very sad about today,” she told reporters in Sydney.

Australia should be supporting Israel as a “liberal democracy” but had not demonstrated that in recent weeks, Ms Ley said, calling on Home Affairs Minister Tony Burke to explain his decision to reject Mr Rothman’s visa.

The Australia/Israel and Jewish Affairs Council also called the move “deeply troubling”.

“It is very disappointing that Australia and Israel have regressed from a close friendship to unproductive diplomatic jousting, which of course was started by unwarranted and hostile actions by the Australian Government,” the council said in a statement.

Australia has also denied entry to former Israeli minister Ayelet Shaked, based on anti-Palestinian comments, and Israeli advocate Hillel Fuld.

Canberra has further imposed sanctions on two far-right Israeli ministers, including travel bans.

The federal government has denied entry to people who have a history of anti-Semitism, including rapper Kanye West after he released a song praising Hitler, as well as Lebanese pro-Hezbollah influencer Hussain Makke.

Swatch apologies for ad showing gesture seen as racist

Swiss watchmaker Swatch has apologised for an ad campaign that upset consumers in China and elsewhere and says it has “immediately removed all related materials worldwide”.

In an image for the Swatch Essentials collection, an Asian male model is shown pulling the edges of his eyelids upward and backward with his fingers – a gesture seen as derogatory and racist, Swiss public broadcaster SRF reports.

The image triggered criticism on social media in China, with major influencers weighing in.

Swatch wrote on Instagram that “we sincerely apologise for any distress or misunderstanding this may have caused”.

It said it would “treat this matter with the utmost importance”.

SRF reported that the apology was also posted on the Chinese social network Weibo in Chinese and English.

China is a major market for luxury brands and watchmakers.

The founders of Dolce&Gabbana apologised on video in 2018 after a Chinese boycott of its products over what were seen as culturally insensitive videos promoting a runway show in Shanghai.

Swiss watch exporters are facing new tariffs in the US and a prolonged slowdown, with significant declines in the United States, Japan and Hong Kong, according to industry association figures.

Gas plant approval wait ‘frustrating’: Woodside boss

The head of gas giant Woodside has expressed frustration at delayed federal sign-off for its contentious North West Shelf project, while suggesting lengthy approvals are a productivity drag.

Speaking during the energy producer’s interim results calls, chief executive officer Meg O’Neill said it was “frustrating” not to have official go-ahead for the Western Australian gas plant extension beyond 2030.

Critics of the project warn the emissions produced by the plant will damage nearby ancient rock art, which recently secured World Heritage status, and contribute to climate change.

In late May, Woodside had been given 10 days to respond to Environment Minister Murray Watt’s provisional approval, a timeline that has since blown out and follows six years of waiting for state-level approval.

“It’s frustrating that we still don’t have the final federal approval,” Ms O’Neill said.

“Approval time frames are certainly something that needs to be considered when we’re thinking about lifting productivity in Australia.”

The remarks land as the government’s Economic Reform Roundtable kicks off in Canberra, where ramping up sluggish productivity growth is a desired outcome.

Woodside board member Ben Wyatt is among the attendees.

Senator Watt’s provisional approval for the North West Shelf extension is subject to conditions on air emission levels but the details have not been made public, a point of contention for conservation groups worried about negotiations behind close doors.

Ms O’Neill said Woodside was seeking similar conditions on approval in its talks with the federal government as those outlined by the state government.

The tentative federal approval faces fresh legal action, including a case brought by Murujuga traditional custodian Raelene Cooper due to be heard in Federal Court on Wednesday.

On Tuesday, the company posted an underlying net profit of $US1.24 billion (A$1.91 billion) for the first half, down from $US1.63 billion (A$2.51 billion) previously but a touch higher than market estimates.

The bottom line result was $US1.32 billion ($A2.03 billion), down 32 per cent.

Weaker commodity prices and other factors weighed on the bottom line and more than offset a major boost in production, which was buoyed by the Sangomar oil project.

Woodside’s operating revenue increased 10 per cent in the six months ended June 30 to US$6.59 billion ($A10.14 billion).

The company also recorded an 11 per cent rise in half-year production to 99.2 million barrels of oil equivalent.

Woodside will pay an interim dividend of 53 US cents per share, which is lower than the 69 US cents paid out in the corresponding half.

Woodside’s share price was tracking lower before the market close, down 1.7 per cent at $26.43.

BHP mulls mothballing coal mines over royalty regime

Weak commodity prices have weighed on the profit of one of the world’s biggest miners, prompting BHP to slash its dividend and consider shuttering some of its coal mines.

While BHP posted a 14 per cent lift in full-year net profit to $US9 billion ($A13.9 billion), underlying net profit fell more than a quarter to $US10.6 billion, shrinking the final shareholder to 60 US cents ($A0.92) per share, down from 74 US cents the year before.

Chief executive Mike Henry said the result reflected the resilience of the Melbourne-headquartered group, which is a leading producer of iron ore, copper and coal.

“We delivered on our full-year guidance across our suite of businesses and achieved record iron ore and copper production,” he said on Tuesday.

“Our operational results have underpinned another year of sector-leading margins and strong cash flows.”

Despite record iron ore and copper production, revenue slipped by $US4.4 billion because of coal and iron ore price weakness, but this was partially offset by stronger copper prices.

Weaker revenues translated to softer earnings before interest, tax, depreciation and amortisation.

Those earnings were down 10 per cent to $US29 billion, but underlying earnings from copper swelled to 45 per cent of group earnings to a record $US12.3 billion.

Apart from sluggish commodity prices, BHP’s financial report took aim at Queensland’s royalty regime – introduced in 2022 by the state Labor government – and flagged some of the state’s five coal mines operated under the BHP Mitsubishi Alliance (BMA) could be mothballed.

“With no change to the ongoing negative impacts of extreme royalty rates, we will maintain our existing position of not investing in any further growth at BMA,” the report stated.

“If low coal prices persist, options to pause lower margin areas of our operational footprint will be considered.”

The alliance, which owns and operates the Hay Point Coal Terminal near Mackay, employs more than 10,000 full-time equivalent employees and contractors, according to Mitsubishi.

Iron ore prices have been under pressure from weaker ore demand and steel oversupply and the outlook for global economic growth was mixed, BHP’s boss said.

“While economies around the world continue to navigate policy uncertainty, China and India again demonstrated resilient economic and commodity demand growth in the first half of this year,” Mr Henry said.

“Our commodities have large markets, resilient demand and steep cost curves.

“The world is going to need a lot more steelmaking materials, a lot more copper and a lot more potash.”

As for the shrunken dividend, the CEO noted it was “well above” BHP’s minimum payout ratio and represented a full-year payout of $US5.6 billion.

“This is backed by a strong balance sheet, lower than expected capital spend and confidence in the long-term trajectory of our business,” Mr Henry said.

“This year, we contributed almost $US47 billion globally through wages, taxes, royalties, community contributions and payments to suppliers and shareholders.”

BHP held its capital guidance for exploration expenditure unchanged at $US11 billion.

It also invested $US2.1 billion for a 50 per cent interest in the Vicuna joint venture, which includes one of the largest copper deposit discoveries of the past 30 years.

Investors took the predominantly in-line report as a positive for BHP, pushing its shares 1.5 per cent higher to $42.07 in early afternoon trading.

BHP’s strong set of results highlighted the consistency of the business, RBC Capital Markets analyst Kaan Peker said.

“The company is balancing its shift toward growth (namely in copper), and is continuing to pay compelling dividends.”

Intel getting $3 billion lifeline from SoftBank

Intel is getting a $US2 billion ($A3.1 billion) capital injection from SoftBank Group, in a major boost of confidence for the troubled US chipmaker that’s in the middle of a turnaround effort.

The equity investment, announced by the two companies on Monday, is a lifeline for the once-iconic US chipmaker which has struggled to compete after years of management blunders that left it with virtually no foothold in the booming artificial intelligence chip industry.

The deal follows media reports last week that the US government may buy a stake in Intel, after a meeting between new CEO Lip-Bu Tan and President Donald Trump that was sparked by the president’s demand for Tan’s resignation over his ties to Chinese firms.

SoftBank’s decision to invest in Intel is not connected to Trump, a person familiar with the matter told Reuters. The White House did not immediately respond to a request for comment.

The investment will make SoftBank a top-10 shareholder of Intel and add to the Japanese tech investor’s ambitious bet on AI that includes the $US500 billion ($A771 billion) Stargate US data centre project.

“This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States, with Intel playing a critical role,” SoftBank CEO Masayoshi Son said in a statement.

It will pay $US23 ($A35) per share for the Intel common stock. SoftBank would become the sixth largest investor in Intel, according to LSEG data.

SoftBank’s investment will come via a primary issuance of common stock by Intel, and, based on the US company’s market capitalisation at close of trading on Monday, represent an equity stake of just under two per cent, an Intel spokesperson said.

SoftBank’s shares dropped more than five per cent on Tuesday following the announcement, while Intel surged 5.6 per cent in after-market hours trading.

The Japanese company will only take an equity stake in Intel and will neither seek a board seat nor commit to buying Intel’s chips, the person familiar with the matter said.

Intel has struggled financially and recorded an annual loss of $US18.8 billion ($A29.0 billion) in 2024, its first such loss since 1986.

Bloomberg News reported earlier on Monday that the US government is in talks to take a 10 per cent stake in Intel.

SoftBank declined to provide more details on the Intel investment when asked to comment by Reuters.

The Intel funding is the latest in the Japanese company’s run of mammoth investment announcements in 2025, which include committing $US30 billion ($A46 billion) to ChatGPT maker OpenAI as well as leading the financing for Stargate.

Biotech giant to slash 3000 jobs, spin-off vaccine arm

Australian pharmaceutical giant CSL will cut as many as 3000 jobs and spin-off its flu vaccine arm into a separate business in a bid to shave $500 million from its bottom line.

The biotechnology firm announced the shake-up at its annual financial results call on Tuesday, where its chief executive dismissed concerns about US tariffs, but warned about the impact of falling vaccination levels.

The company, which is the third largest in Australia, also revealed its revenue rose by five per cent during the last financial year and its profit after tax grew by 14 per cent to reach $US3 billion ($A4.6 billion).

Despite its rising profit, CSL chief executive Paul McKenzie told investors the global pharmaceutical market had become a volatile environment and the company would need to adapt to meet its financial goals and simplify operations.

Cost reductions would include cutting up to 15 per cent of its workforce worldwide over the next three years, and closing 22 US plasma centres over the next 12 months.

“We are pleased with this performance but we know we must rapidly adapt to position ourselves well into the next decade in a constantly evolving operating environment,” Mr McKenzie said.

“We will target more than half a billion US dollars in savings by the end of fiscal year ’28.”

The company would also seek to “de-merge” its flu vaccination arm, Seqirus, as part of the shake-up, to become a separate ASX-listed company chaired by former CSL Seqirus president Gordon Naylor.

The move would come at a challenging time for flu vaccinations worldwide after low rates of take-up in some countries, Mr McKenzie said, but with signs that could improve.

“We view the softness in the US seasonal category as highly irrational based on the vaccine risk-reward profiles and the scale of disease burdens which this year reached a 15-year high,” he said.

“In the US… we are encouraged by the recent positive universal recommendation by (the Advisory Committee on Immunisation Practices), a clear sign that influenza is not going away and it still has severe impact on public health.”

Potential pharmaceutical tariffs floated by US President Donald Trump were also unlikely to affect CSL, Mr McKenzie told investors, due to its operations in the US.

Mr Trump threatened to impose tariffs of up to 250 per cent on drug imports from Australia earlier this month, though has yet to confirm details or a timeline for the plan.

Total revenue for CSL rose to $US15.5 billion during the 2025 financial year, and the company forecasts revenue to grow between four and five per cent over the 2026 financial year.

The company will pay a final dividend of $US1.62 to shareholders, up by 12 per cent.

Qantas sackings ‘betrayed Spirit of Australia’ values

Long coasting on being the “Spirit of Australia”, Qantas has been told to act with a conscience, not just a balance sheet, as its reputation takes a battering.

Experts have warned the flag carrier risks losing its place in the national psyche as a result of its recent indiscretions, including a $210 million hit for illegally sacking nearly 10 per cent of its workforce.

In delivering the largest ever fine for industrial law breaches, Justice Michael Lee on Monday noted the airline purported to be emblematic of Australia and of such national importance, it could inject itself into political and cultural debates.

RMIT associate professor of finance Angel Zhong said the positioning invited scrutiny of the airline’s ethics, not only its performance.

“Illegally sacking workers is seen as a betrayal of the very values Qantas claims to represent: fairness, mateship and respect,” she told AAP.

“If Qantas is the ‘Spirit of Australia’, then the public expects it to act with a conscience, not just a balance sheet.”

The $90 million fine was on top of an order to pay $120 million in compensation to the 1820 sacked workers and a $100 million fine for separately selling tickets to flights that had been cancelled between 2021 and 2023.

Don Dixon, one of the illegally sacked workers, said the company meant everything to Australians, but it needed to behave with that in mind.

“It’s an Australian company. You go overseas and see that red kangaroo, you know ‘that’s my country and I’m going home, I feel safe’ … that’s been lost,” he told AAP.

The embattled airline, which employs more than 21,000 people, long argued it was right to outsource ground staff roles during the pandemic, taking appeals all the way to the High Court.

But failures to overturn the findings paved the way to Justice Lee ordering Qantas to pay $90 million in penalties.

He cited the “sheer scale of the contraventions, being the largest of their type” as a reason to impose a penalty that would deter other businesses from similar conduct.

Justice Lee ordered $50 million of the fine be paid to the union that brought the proceedings and highlighted the illegal conduct.

Employer groups said that step would embolden other unions to commence litigation, regardless of the merits.

“It seems to be a direct encouragement,” Australian Chamber of Commerce and Industry chief executive Andrew McKellar told the ABC on Tuesday.

But the message large corporations should take is “don’t illegally sack your workers,” federal cabinet minister Katy Gallagher said on Tuesday.

The minister was less forthright about whether the union had exposed a gap in enforcement that would usually be the work of government watchdogs.

“We have various dispute mechanisms but this ultimately found its way into the courts,” she said.

Qantas will have to pay the hefty bill on top of the $120 million compensation payment it has made to the affected ground staff for their economic loss, pain and suffering following the outsourcing.

Chief executive Vanessa Hudson apologised for the airline causing “real harm to our employees.”

“Over the past 18 months, we’ve worked hard to change the way we operate as part of our efforts to rebuild trust with our people and our customers. This remains our highest priority as we work to earn back the trust we lost,” she said.

Public frustration and disappointment with Qantas might have increased, Dr Zhong said, but it wouldn’t necessarily change consumer behaviour with price, route availability and loyalty programs outweighing ethical concerns.

“That said, sustained reputational damage can have long-term effects,” she said.

“If trust continues to decline, Qantas risks losing not just customers, but its privileged position in the national psyche.”