Ley under pressure as Labor pushes environment reforms

Opposition Leader Sussan Ley faces a febrile party room during the final week of parliament for the year while the government races to pass major environment reforms.

Liberal insiders insist a leadership challenge against Ms Ley is unlikely until 2026, but fights over immigration and climate change are threatening to blow up internally.

There has also been speculation a poor result in the latest Newspoll could trigger a move against Ms Ley by leadership rivals Andrew Hastie or Angus Taylor.

The well-respected poll, conducted by The Australian, revealed a small deterioration in the coalition’s two-party preferred position to trail Labor 58 to 42 per cent.

Ms Ley’s net approval rating improved but remains toxic, up from minus 33 to minus 29.

The poll also asked respondents to list their preferred coalition leader.

The party’s first female leader was the top choice of 21 per cent of respondents, just ahead of Mr Hastie on 16 per cent, and Mr Taylor on nine per cent.

Mr Hastie edges Ms Ley for support among older voters and One Nation voters.

Speaking before the Newspoll, opposition finance spokesman and senior conservative James Paterson denied his colleagues were about to dump the 63-year-old.

“Politicians are reluctant to comment on polls at the best of times, but it would be particularly unwise to comment on a poll that hasn’t even yet been published,” he told Sky News on Sunday.

“Whatever the results are … I’m sure they will say that we’ve got more work to do,” Senator Paterson said.

Mr Hastie missed parliament’s last sitting bloc after surgery on his shoulder but the Perth-based MP is scheduled to attend this week.

As Labor mounts a last-ditch push to steer long-awaited environment reforms through parliament, Environment Minister Murray Watt said the coalition’s dysfunction had made talks tricky.

“It has been difficult to conduct negotiations with the coalition over the last couple of months when they’ve been completely distracted from these sorts of issues by their leadership struggles,” Senator Watt said.

Labor wants to pass a major overhaul of Australia’s environment regulations, arguing the changes will better protect natural sites and speed up approvals of key infrastructure, energy and housing projects.

But the government needs the support of either the coalition or the Greens to get the laws through.

After offering some concessions to win the minor party’s support, Senator Watt said he was still willing to strike a deal with either side.

“I’ve said all the way through this that no one’s going to get everything they want,” he told reporters in Brisbane on Sunday.

“We are prepared to make some changes, as long as they deliver to both the environment and to business.”

Vendor hack might have exposed major banks’ client data

Client data for JPMorgan Chase, Citi, Morgan Stanley and other major banks might have been accessed in a hack of a technology vendor, the New York Times reports.

SitusAMC said in a statement on its website on Saturday that it had been the subject of a cyber attack on November 12, compromising certain information from its systems and that “data relating to some of our clients’ customers may also have been impacted”.

The New York-based vendor for real estate lenders did not identify any of its affected clients.

JPMorgan Chase, Citi and Morgan Stanley did not immediately respond to Reuters’ requests for comment.

SitusAMC said the affected data included corporate information tied to some clients’ dealings with the company, including items such as accounting documents and legal contracts.

“We remain focused on analysing any potentially affected data,” SitusAMC chief executive Michael Franco said in a statement to the New York Times, adding the company had notified law enforcement.

FBI Director Kash Patel said in a statement to the newspaper: “While we are working closely with affected organisations and our partners to understand the extent of potential impact, we have identified no operational impact to banking services.”

Reuters could not immediately reach the FBI for comment.

The SitusAMC statement said the incident had been contained and services were fully operational, adding no encrypting malware was involved.

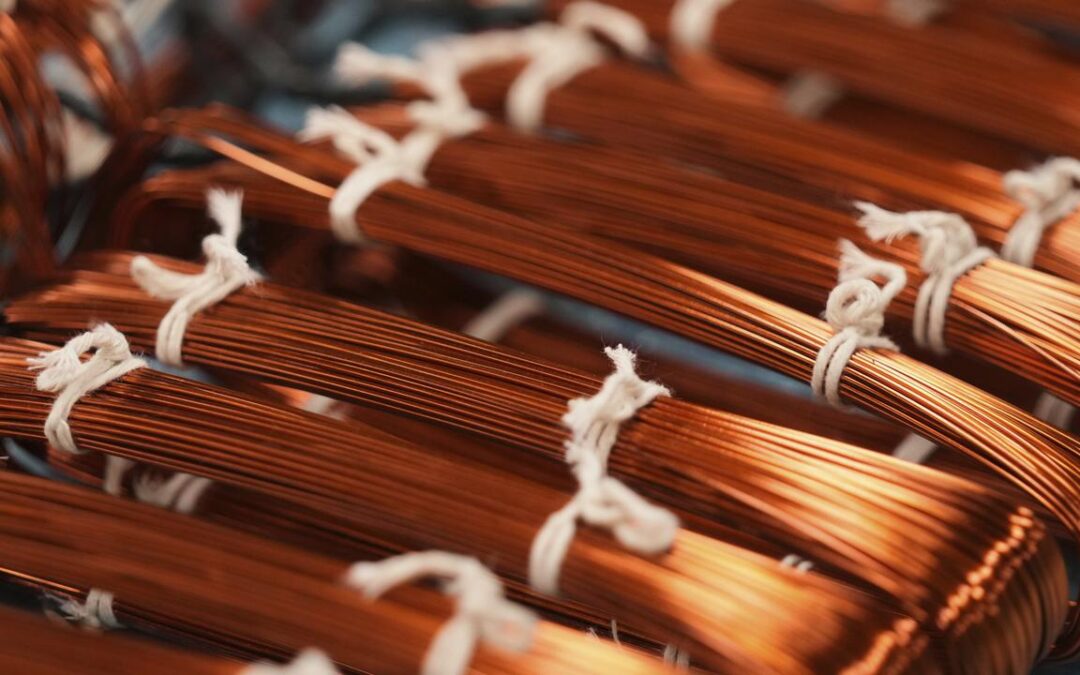

Britain unveils new critical minerals strategy

Britain has rolled out a critical minerals strategy designed to reduce dependence on foreign suppliers by 2035, with targets to source 10 per cent of domestic demand from UK production and 20 per cent from recycling.

The government announced the strategy as global competition for these essential resources intensifies.

Backed by up to Stg50 million ($A101 million) in new funding, the strategy seeks to ensure no more than 60 per cent of the UK’s supply of any one critical mineral comes from a single country by 2035, according to a statement on Saturday.

British Prime Minister Keir Starmer says critical minerals “are the backbone of modern life and our national security”, arguing that boosting domestic production and recycling will help shield the economy and support efforts to lower living costs.

The UK currently produces six per cent of its critical mineral needs domestically.

Under the plan, it wants to expand domestic extraction and processing, with a particular focus on lithium, nickel, tungsten and rare earths. It aims to produce at least 50,000 tonnes of lithium in the UK by 2035.

Britain faces an urgent need for a secure, long-term supply of critical minerals, including copper, lithium and nickel, which are essential for smartphones and electric vehicles and increasingly crucial for building data centres that power artificial intelligence.

British demand for essential materials is climbing sharply, with copper consumption projected to nearly double and lithium demand expected to surge by 1100 per cent by 2035.

The strategy underscores China’s grip on critical mineral supplies, leaving the sector exposed to price swings, geopolitical strains and sudden disruptions.

Britain noted China accounts for about 70 per cent of rare earth mining and 90 per cent of refining, a dominance that puts countries such as the UK at risk.

Earlier this year, Britain struck a minerals co-operation deal with Saudi Arabia aimed at bolstering supply chains, opening doors for British firms, and drawing fresh investment into the UK.

G20 summit adopts declaration despite US boycott

Group of 20 leaders adopted a declaration addressing the climate crisis and other global challenges over US objections, prompting the White House to accuse South Africa of weaponising its leadership of the group this year.

The declaration, which was drafted without input from the United States, “can’t be renegotiated” South African President Cyril Ramaphosa’s spokesperson told reporters, reflecting strains between Pretoria and US President Donald Trump’s administration, which boycotted the event.

“We had the entire year of working towards this adoption and the past week has been quite intense,” spokesperson Vincent Magwenya said.

Ramaphosa, host of this weekend’s gathering of Group of 20 leaders in Johannesburg, had earlier said there was “overwhelming consensus” for a summit declaration.

G20 envoys drew up a draft leaders’ declaration on Friday and hours later, the White House said Ramaphosa was “refusing to facilitate a smooth transition of the G20 presidency” after initially saying he would pass the gavel to ‘an empty chair.'”

“This, coupled with South Africa’s push to issue a G20 Leaders Declaration, despite consistent and robust US objections, underscores the fact that they have weaponised their G20 presidency to undermine the G20’s founding principles,” said White House spokeswoman Anna Kelly.

Trump looks forward to “restoring legitimacy” to the group next year, when the US holds the rotating presidency.

At the last minute Argentina, whose far-right President Javier Milei is a close ally of Trump, quit the negotiations right before the envoys were about to adopt the draft text, South African officials said.

“Argentina, although it cannot endorse the declaration … remains fully committed to the spirit of cooperation that has defined the G20 since its conception,” its foreign minister Pablo Quirno said at the summit.

In explanation, Quirno said Argentina was concerned about how the document referred to geopolitical issues.

“Specifically it addresses the longstanding Middle East conflict in a manner that fails to capture its full complexity,” he said.

The document mentions the conflict once, saying members agree to work for a just, comprehensive, and lasting peace in … the Occupied Palestinian Territory.”

Envoys from the G20 – which brings together the world’s major economies – drew up a draft leaders’ declaration on Friday without US involvement, four sources familiar with the matter said.

“It is a longstanding G20 tradition to issue only consensus deliverables, and it is shameful that the South African government is now trying to depart from this standard practice,” a senior Trump administration official said on Friday.

The declaration used the kind of language long disliked by the US administration: stressing the seriousness of climate change and the need to better adapt to it, praising ambitious targets to boost renewable energy and noting the punishing levels of debt service suffered by poor countries.

The mention of climate change was a snub to Trump, who doubts the scientific consensus that global warming is caused by human activities. US officials had indicated they would oppose any reference to it in the declaration.

In opening remarks to the summit, Ramaphosa said: “We should not allow anything to diminish the value, the stature and the impact of the first African G20 presidency.”

His bold tone was a striking contrast to his subdued decorum during his visit to the White House in May, in which he endured Trump repeating a false claim that there was a genocide of white farmers in South Africa, brushing aside Ramaphosa’s efforts to correct his facts.

Trump said US officials would not attend the summit because of allegations, widely discredited, that the host country’s Black majority government persecutes its white minority.

The US president had also rejected the host nation’s agenda of promoting solidarity and helping developing nations adapt to weather disasters, transition to clean energy and cut their excessive debt costs.

The South African presidency on Saturday reiterated its rejection of a US offer to send the US charge d’affaires for the G20 handover.

“The president will not hand over to a junior embassy official the presidency of the G20. It’s a breach of protocol that is not going to be accommodated,” Magwenya said.

Lamola later said that South Africa would assign a diplomat of the same rank as a charge d’affaires to hand over the G20 presidency at the foreign affairs department.

Early Christmas for RBA with landmark inflation print

Christmas has come early for data nerds.

In the coming week, the Australian Bureau of Statistics will unveil the first edition of its highly anticipated comprehensive monthly inflation report – at least long-awaited by the boffins at the Reserve Bank.

The new measure, to debut on Wednesday, will be the first time the consumer price index will track cost rises across the full breadth of the Australian economy.

It will provide the central bank with a more accurate and more timely picture of inflation as it makes decisions on the direction of interest rates.

While the Reserve Bank will be happy to get its hands on the new index, it might not like what it sees.

ANZ senior economist Adelaide Timbrell expects it to show inflation rose by 3.3 per cent on an annual basis in October, more than the Reserve Bank’s two to three per cent target band but less than the 3.5 per cent increase recorded in September.

The main drivers of the expected drop would be flat fuel prices, a sharp decrease in international holiday prices and little change in energy bills, offset by rental price rises re-accelerating, Ms Timbrell said.

The Reserve Bank board was unlikely to put much weight on the inflation result for October when considering interest rates at its December meeting, unless there was an “unambiguously material change”, she said.

A sharp rise in quarterly inflation figures cemented the board’s decision to keep rates on hold in November.

Central bank governor Michele Bullock has warned it will take a number of months for seasonal adjustments to bed in before the bank can fully transition away from the quarterly index.

“First of all, can I say, yay, ABS – very, very happy,” she said in July after the bureau said its complete monthly indicator was almost ready.

“It will bring us into line with most other advanced economies.”

The new index will replace the monthly CPI indicator, which was introduced in 2022 to provide an earlier read on inflation.

It only covered about two-thirds of the standard basket of goods and services each month and was not reliably used by the Reserve Bank to set interest rates.

Outside of inflation data, it will be a relatively quiet week domestically on the economic front.

On Wednesday, the statistics bureau will publish estimates of how much construction work was done in the September quarter, while updated business investment data is due out on Thursday.

Overseas, the Reserve Bank of New Zealand is expected to cut the cash rate to 2.25 per cent on Wednesday, while later that day, investors in the UK will be closely watching Chancellor Rachel Reeves’ second budget.

Both tax hikes and spending cuts are on the table as she tries to mend Britain’s parlous finances.

US stocks bounced on Friday on the hope of a December interest rate cut, but the three main indexes were down across the week as investors pulled back from previously buoyant tech companies.

The S&P 500 gained 64.23 points, or 0.98 per cent, to end at 6,603.65 points, while the tech-heavy Nasdaq Composite gained 195.03 points, or 0.88 per cent, to 22,273.08.

The Dow Jones Industrial Average closed 493.15 points higher, up 1.08 per cent at 46,245.41.

Australian share futures surged 92 points, or 1.09 per cent, to 8519.

Local markets tumbled to their fourth straight week of losses on Friday as concerns about stretched valuations met reduced chances of near-term interest rate cuts.

The benchmark S&P/ASX200 lost 136.2 points, down 1.59 per cent, to 8,416.5, as the broader All Ordinaries fell 147.7 points, or 1.67 per cent, to 8,686.3.

Titanic passenger’s watch sets record at UK auction

A gold pocket watch recovered from an elderly couple who drowned during the sinking of the Titanic has sold for a record-breaking Stg1.78 million ($A3.61 million) at auction.

It was the highest amount ever paid for Titanic memorabilia, the auctioneers said.

The previous record was set last year when another gold pocket watch presented to the captain of a boat which rescued more than 700 passengers from the liner sold for Stg1.56 million ($A3.16 million).

The 18-carat Jules Jurgensen engraved watch was owned by first class passenger Isidor Straus, who drowned when the ship sank on its maiden voyage from England to New York in April 1912, costing 1500 lives.

Isidor Straus and his wife Ida were portrayed in James Cameron’s 1997 blockbuster Titanic film as the couple cradling each other as the Titanic goes down.

The watch was recovered from the body of Isidor Straus along with other personal effects and returned to his family.

He had been given the watch in 1888 as a gift for his 43rd birthday – the same year he became a partner in New York department store Macy’s.

During the night of the sinking, the wealthy couple made their way to the Titanic’s boat deck.

When Isidor Straus was offered a seat on a lifeboat due to his age, he replied that he would not go before other men.

Ida Straus refused to leave her husband and they were last seen alive sitting on deckchairs, facing fate by each other’s side.

They were among very few first class passengers to perish in the disaster.

The watch, which had remained in the family, was sold at auctioneers Henry Aldridge & Son Auctioneers in Devizes, Wiltshire.

A letter written by Ida Straus on Titanic stationery and posted while onboard the ship fetched Stg100,000 ($A202,846).

A Titanic passenger list was bought for Stg104,000 ($A210,960) and a gold medal awarded to the crew of the RMS Carpathia by rescued survivors sold for Stg86,000 ($A174,448).

In total the auction of Titanic-related memorabilia reached Stg3 million ($A6.1 million) on Saturday.

Born into a Jewish family in Otterberg, Bavaria, in 1845, Isidor Straus emigrated to the US with his family in 1854.

In January 1912, he and his wife travelled on RMS Caronia to Jerusalem before returning to the US via Southampton on the Titanic.

“The world record price illustrates the enduring interest in the Titanic story,” Auctioneer Andrew Aldridge said.

“The Strauses were the ultimate love story, Ida refusing to leave her husband of 41 years as the Titanic sank, and this world record price is testament to the respect that they are held in.”

‘New hope’ for climate after COP summit wraps up

Australia has signed onto a global plan to eventually phase out fossil fuels and recommitted to the Paris climate accord in defiance of US President Donald Trump.

While the final agreement inked at the United Nations climate summit in Brazil did not mention the polluting fuels driving global warming, Australia joined a separate statement at the last minute, committing to the transition away from fossil fuels.

The federal government joined more than 80 other countries to sign up to the Belém Declaration, which calls for a roadmap to end the world’s use of fuels like coal and gas.

Greenpeace Chief Executive David Ritter, who attended the conference in the city of Belém, said the deal presented a “great new hope”.

“In signing the Belém Declaration, a critical mass of nations have acknowledged that the legally binding international commitment to limit warming to 1.5C means no new fossil fuels,” he said in a statement.

At the end of the COP30 conference, more details were revealed about how Australia would jointly host next year’s COP31 with Turkey.

After a months-long diplomatic stalemate, Australia last week ceded hosting rights to the Turkish resort town of Antalya, but Energy Minister Chris Bowen will serve as the president of negotiations.

A memo reveals Mr Bowen will be responsible with organising consultations and meetings over the next year and producing draft agreements in the lead-up to the fortnight-long summit.

In a joint statement, the prime minister, foreign minister and energy minister said Mr Bowen would have “exclusive authority” over the negotiations.

Australia’s opposition has criticised Mr Bowen’s joint roles as energy minister and president of negotiations but Trade Minister Don Farrell said he was the “perfect candidate” for the COP position.

“Having Chris at the helm of the international consideration of how we get to net zero is a good thing for Australia,” he told Sky News on Sunday.

The federal opposition – which has shifted its policy away from supporting renewables and is campaigning on cheaper energy – has lashed the appointment, claiming it makes Mr Bowen a part-time minister.

“He wants to be on the international circuit, he wants to be hobnobbing and negotiating at climate conferences,” Senator James Paterson told Sky News.

“If that’s Chris Bowen’s priority, then let’s get a real energy minister who’s actually focused on Australians and getting energy prices down.”

As world leaders meet in South Africa for the G20 summit, Anthony Albanese also signed a declaration recommitting Australia to the Paris climate agreement, which includes a pledge to reach net zero carbon emissions by 2050.

US President Donald Trump has walked away from the landmark accord, and a senior White House official described the G20 declaration as “shameful”, according to Reuters.

Mr Trump boycotted the gathering over debunked claims about the persecution of white South African farmers.

Attendees also agreed wealthy countries will need to do more to help developing nations transition away from fossil fuels, and backed a push to triple the world’s renewable energy capacity.

Mr Albanese said it was a good thing the conference had landed on a final statement.

“There is overwhelming support for action on climate change,” he told reporters in Johannesburg.

“People are very conscious of the fact that the increase in extreme weather events, the impact of climate change, is here right now.”

Labor’s last-ditch olive branch on stalled nature laws

Labor has been dangling concessions on its environmental laws in a last-ditch bid to get the stalled changes over the line.

A controversial provision that would allow coal and gas projects to be approved if they were in the national interest could be scrapped as the government courts crucial Greens votes in the Senate.

Environment Minister Murray Watt has been negotiating with the minor party and the coalition in an attempt to get one side to provide the support needed for the reforms.

The government is looking to streamline approvals for key housing and energy projects, while bolstering nature protections.

To get the Greens on board, Senator Watt has offered to strip amendments that would allow a national-interest test to be used to approve fossil fuel projects.

But the minor party is demanding better native forest protection, and for the environmental impact of a project to be considered during the approval process, before signing up to the proposed reforms.

Labor has a week to pass environmental and conservation reforms before parliament rises for the year, but it needs a deal to get the legislation through a hostile Senate.

Independent senator David Pocock also called for the exclusion of fossil fuel projects from the national interest test and for safeguards around streamlined approvals.

“Without significant amendments to the bills, I can’t back these reforms,” Senator Pocock said on Saturday.

“We have a once-in-a-generation chance to get these reforms right, and I urge the government to listen to the feedback and take the time to ensure that these laws actually do what is promised.”

The coalition has released proposed amendments and will pass the laws if the conditions are met, but some red lines for Labor persist.

They include how emissions are reported and the introduction of an independent Environmental Protection Agency.

The coalition wants to axe reporting, reduce fines and keep decision-making powers within the government’s environment department.

But that has raised concerns a future minister could use their powers to tick and flick environmentally damaging projects – a possibility the Greens have leveraged in their attack on the proposals.

Labor’s laws would allow the agency to halt projects if it believed environmental destruction was imminent, but the coalition warned this would create too much doubt.

Liberal leaders try to repair party image after turmoil

Liberal leaders are working to repair damage to the party’s brand after a series of fractious debates and turmoil at state and national level.

Federal Opposition Leader Sussan Ley continues to focus on power prices after her Liberal colleagues agreed to scrap their commitment to a net-zero emissions reduction target by 2050.

The party’s energy plan further embraces fossil fuels in a major policy pivot to focus on lowering power bills.

She linked rising power prices to struggling manufacturing businesses in Victoria.

“Victorians are really hurting, they really are and a lot of this comes down to manufacturing,” she told Sydney radio station 2GB.

Ms Ley faces the difficult task of selling the Liberals’ reneging of their emissions reduction policy in metropolitan seats, where climate change is a major issue among voters.

The party was all but wiped out in inner-city electorates around the country at May’s election.

But MPs think lower power bills, which would then have a flow-on effect to other productions as manufacturers have reduced overhead costs, can cut through to people struggling to make ends meet.

The Liberals’ electoral fortunes are looking up in Victoria, with a poll revealing new state leader Jess Wilson already leads as preferred premier.

Almost half of respondents believe she would make a stronger leader, compared with 33 per cent who back Premier Jacinta Allan, according to the poll in The Australian on Saturday.

The coalition holds a 51-49 lead in the two-party-preferred vote.

NSW Opposition Leader Kellie Sloane, who took over the top job on Friday, faces a bigger challenge to turn her party’s fortunes around.

She will also have to contend with selling the Liberal brand among federal dysfunction after the climate debate tore at the seams of the national party room.

This includes fighting with the state Nationals and federal colleagues over abandoning a net-zero emissions target after her party agreed to retain the commitment.

Pollster Kos Samaras said the Liberals would continue to lose inner city votes if it failed to have a strong climate policy as only 10 per cent of Gen Z – “the generation most animated by climate” – supported the party.

That compares with a 51 per cent primary vote for Labor within the cohort.

The Liberals also needed to win over more multicultural voters, with only 17 per cent of diverse Australians supporting the Liberals compared with 46 per cent backing Labor, according to his polling.

The numbers are even more dire in Sydney and Melbourne.

Ms Ley is expected to unveil a migration plan in the coming weeks after months of fractious infighting between moderates and conservative MPs on energy policy, undermining her leadership.

While the party pushes to cut Australia’s immigration intake, negative rhetoric about migrants resulted in diverse communities abandoning the party in droves.

Ms Sloane used her first day trip as NSW Liberal leader to tour Little India in western Sydney’s Harris Park, across the city from her well-heeled electorate of Vaucluse.

She met with local businesses and community members as the Liberals work to embrace multicultural communities and win back seats in the city’s diverse suburbs.

COP30 talks in Brazil reach tentative deal, sources say

The COP30 climate talks in Brazil have reached a tentative deal, sources say, after negotiators resolved a protracted stand-off over action to cut greenhouse gas emissions and climate finance.

The two-week conference, billed as a chance to show that countries can still join forces to tackle climate change despite the absence of the United States, had been scheduled to end on Friday but dragged into overtime on Saturday as negotiators struggled to resolve the deadlock.

Sources said the impasse was resolved after all-night negotiations led by host Brazil although a final deal text had not yet been published and details of the compromise were not immediately clear.

The European Union agreed not to stand in the way of a deal, two sources familiar with the matter told Reuters on Saturday morning.

Any deal needs a consensus to be approved.

The talks had been deadlocked over the balance between advancing the implementation of a 2023 promise to move away from fossil fuels, and wording around the flow of climate finance – to adapt to the effects of global warming – from developed countries to poorer ones.

The European Union had been pressing for language on the move away from fossil fuels but had come up against stiff resistance from the Arab Group of countries including Saudi Arabia.

COP30 President Andre Correa do Lago said on Saturday the presidency would publish a side text on fossil fuels, as well as on protecting forests, as there had been no consensus on these issues at the global climate talks.

“I will announce that the Brazilian presidency will do the two ‘roadmaps’ because visibly we did not have maturity to reach consensus. I believe if we do it under the presidency we will have results,” he said.

Delegates also agreed that rich countries must triple adaptation finance for developing countries by 2035, building on a 2025 doubling target, according to one source familiar with the negotiations.

The decision, which would be part of the COP30 agreement, would urge wealthy countries to increase funding to help poorer ones cope with the effects of climate change.