Iron ore giant’s profit falls, green energy vow stays

One of Australia’s mining giants has reported its lowest annual profit in six years despite record shipments due to falling iron ore prices.

Despite the drop, Fortescue Metals pledged to invest in more research and development for renewable assets, with a particular focus on green iron that is in high demand from its international trading partners.

The world’s fourth largest iron ore firm reported a net profit after tax of $US3.4 billion ($A5.2 billion) for the 2025 financial year on Tuesday, down from $US5.68 billion a year earlier.

The company shipped 198.4 million tonnes of iron ore during the year but its revenue dropped by 15 per cent to $US15.5 billion due to reduced commodity prices.

The record shipments showed Fortescue had achieved a high level of productivity, chief executive Dino Otranto said, and remained the nation’s lowest cost iron ore producer.

“Our operations have never been stronger,” he told investors.

“We are well positioned for FY 2026, with shipment guidance of 195 to 205 million tonnes.”

During the year, Fortescue also acquired Red Hawk Mining for $254 million, began operations at its 100 megawatt solar farm at North Star Junction, and began construction on a 190MW solar farm at Cloudbreak.

The company’s newly appointed growth and energy chief executive Gus Pichot said Fortescue would continue to pursue renewable energy opportunities, both to meet its own decarbonisation goals and to sell solutions to other firms.

Decarbonisation projects would include technology to improve the performance of its battery electric trucks on mine sites, Mr Pichot said, as well as further investments in creating green metals.

Green iron, produced using renewable energy resources, has the potential to cut 90 per cent of emissions from the steelmaking process.

“We’re… investing in technologies that will drive down the cost of green hydrogen, launch a green iron industry, and deliver our own green metal projects,” Mr Pichot said.

“We’re also looking to what’s next for green iron and how we can strive to meet the demands from China and our customers.”

Fortescue’s Christmas Creek project is expected to begin green iron production this year, ramping up to produce 1500 tonnes.

But the company’s commitments come weeks after it announced its withdrawal from two green hydrogen projects – one in Gladstone, Queensland, and another in Arizona, US – citing higher than expected costs.

The price of producing green hydrogen would continue to fall, Mr Pichot said, although the firm was prepared for delays.

“Technology is improving at rapid speed, costs will come down and the market will come,” he said.

“We’re pushing to make that happen quickly but we’re also realistic.”

The Perth firm announced a dividend of 60 cents per share, bringing its full-year dividend to $1.10.

Ambassador expelled after Iran linked to firebombing

Iran’s ambassador to Australia has been expelled after intelligence revealed the Iranian government was behind two anti-Semitic attacks in Australia.

Prime Minister Anthony Albanese said ASIO intelligence revealed the Iranian government directed attacks on the Addas Israel synagogue in Melbourne in December, and an attack in Sydney in October 2024.

Iran’s ambassador Ahmad Sadeghi has been expelled from Australia over the security revelations, while operations at Australia’s embassy in Iran have been suspended.

“These were extraordinary and dangerous acts of aggression orchestrated by a foreign nation on Australian soil,” the prime minister told reporters in Canberra on Tuesday.

“They were attempts to undermine social cohesion and sow discord in our community.

“It is totally unacceptable.”

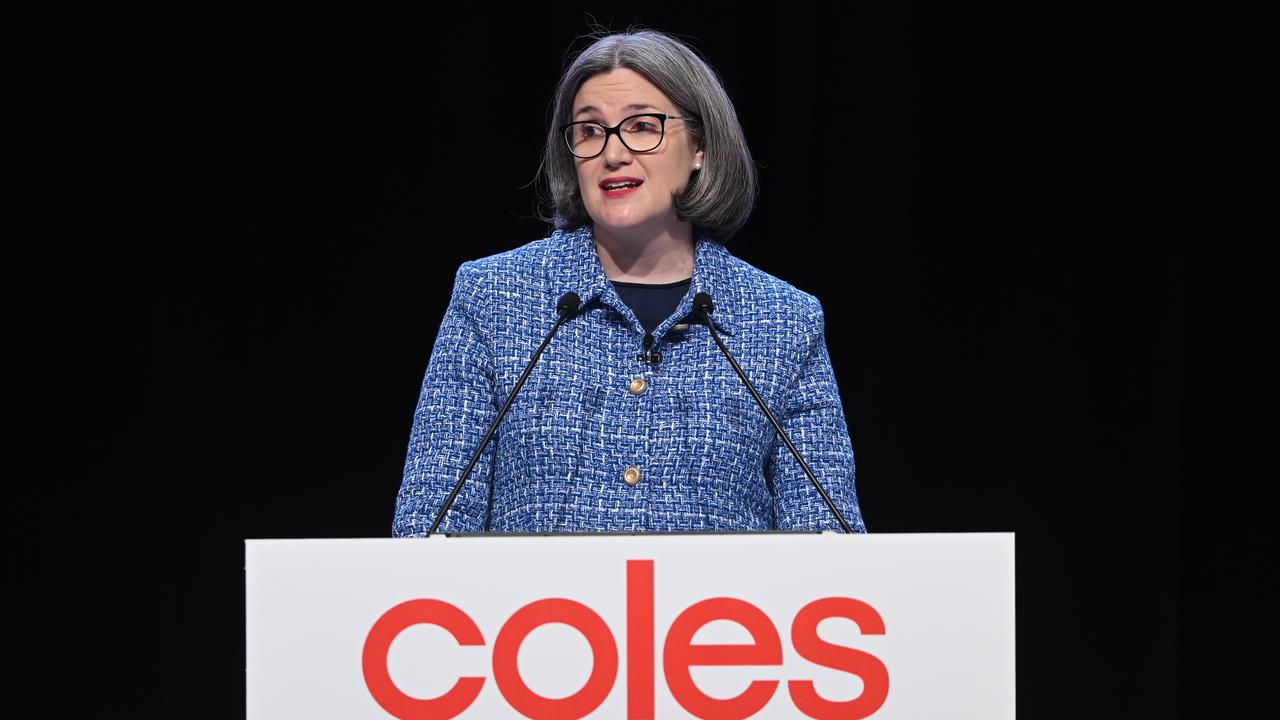

Super market rise for Coles as value focus bags results

Coles Group shares are soaring after the grocery and liquor company posted better-than-expected earnings underpinned by strong sales growth of its flagship supermarket division.

Its shares in early trading on Tuesday were on track for their best day in more than five years, rising 8.9 per cent to an all-time high of $22.58.

The gains came after the supermarket giant reported sales of $44.3 billion for the 52 weeks to June 29, up 3.6 per cent from Coles’ prior financial year after adjusting for the fact it was a week longer.

Supermarket sales grew 4.3 per cent to $40 billion – a 5.7 per cent increase when excluding tobacco products – while sales from its Liquorland stores were up 1.1 per cent to $3.7 billion.

Coles turned a $1.1 billion profit, up 2.4 per cent from 2024/25.

Chief executive Leah Weckert said the company had maintained a consistent focus on its strategic priorities during the financial year.

“There is no doubt that value has remained front of mind for our customers, and we have continued to work hard on providing a compelling offer with quality products across all price points,” she told analysts.

The “Great Value, Hands Down” seasonal value campaigns focused on fewer, deeper promotions with an expanded range of products, Coles said.

Customers had also responded favourably to its Curtis Stone Glassware and Harry Potter Magical Discs campaign.

Coles’ investment in its new state-of-the-art customer fulfilment centres in Sydney and Melbourne and an automated distribution centre in western Sydney were also paying dividends, although Coles incurred $103 million in dual-running costs as those warehouses get up and running.

Coles said its e-commerce supermarket sales rose 24.4 per cent to make up 11.2 per cent of all grocery sales, as the new customer fulfilment centres allowed it to offer next-day delivery to all customers in Sydney and Melbourne.

Coles’ momentum has continued in the new financial year, with supermarket sales rising 4.7 per cent in the first eight weeks of 2025/26.

Excluding tobacco products, sales are up 7.0 per cent.

Liquor sales have been flat so far in the new financial year, with the overall market subdued.

RBC Capital Markets analyst Michael Toner said Coles had announced positive results, with strong growth in supermarkets partially offset by a weaker performance for liquor.

Farhan Badami, eToro market analyst, described Coles’ earnings as “steady but unspectacular,” with profit coming in just shy of expectations but the supermarket division delivering a “real positive” with its sales growth.

Coles posted a final dividend of 32 cents, taking the total for the year to 69 cents, up from 68 cents last year.

Dollar, Treasuries slide on latest Trump attack on Fed

The dollar and US Treasuries slid in Asian trading on Tuesday after President Donald Trump announced he was removing a Federal Reserve governor, which undermined confidence in US assets.

The dollar fell against the yen and euro after Trump said on social media he was removing Lisa Cook from her position on the Fed’s board of directors, the latest in a series of attacks on the central bank’s independence.

Asian shares followed declines on Wall Street as prospects for a Fed rate cut in September became less certain. US stock futures retreated.

“All of this, tariffs included, is just another reason the US can’t be trusted,” said Bart Wakabayashi, the Tokyo Branch Manager of State Street. “There’s no credibility. That’s the basis of the US being the safest investment in the world. If you’re a responsible investor, it gives you pause.”

The dollar dropped 0.4 per cent to 147.24 yen. The euro was up 0.3 per cent on the day at $US1.165 ($A1.798).

The yield on benchmark 10-year Treasury notes rose to 4.2887 per cent compared with its US close of 4.275 per cent on Monday.

“I have determined that there is sufficient cause to remove you from your position,” Trump said in a letter to Cook posted on his Truth Social platform.

Trump said there was enough evidence that Cook had made false statements on mortgage applications.

Trump has regularly threatened to fire Fed Chair Jerome Powell, who was nominated by Trump during his first term in the White House and then nominated for a second term by Biden. Trump, who lacks the legal authority to fire the Fed chair except “for cause”, has backed away from that threat as Powell gets closer to the expiration of his term as Fed chief next May.

Cook’s exit from the Fed could speed up the president’s reshaping of the Fed. Her term had been due to end in 2038.

MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.2 per cent, after US stocks ended the previous session with mild losses. Japan’s Nikkei index sank 1.3 per cent.

Major brokerages, including Barclays, BNP Paribas and Deutsche Bank, now expect a 25-basis-point Fed rate cut in September. Fed funds futures traders are pricing in 84 per cent odds of a September cut, according to the CME Group’s FedWatch Tool.

Data for August due before the Fed’s September 16-17 meeting could still sway Fed policy. The US personal consumption prices reading, due on Friday, is considered the Fed’s preferred inflation gauge. Hotter-than-expected US producer price data last month raised some questions over the certainty of a cut.

US crude dipped 0.4 per cent to $US64.56 ($A99.62) a barrel. Gold was slightly higher, trading at $US3,378.09 ($A5,212.54) per ounce.

US stock futures, the S&P 500 e-minis, were down 0.17 per cent at 6,444.5.

‘Wake-up call’: the cohorts driving record drownings

Drowning deaths have reached record levels in Australia in what national lifesaving organisations say is a “wake-up call”.

An urgent warning has been issued after the 2025 National Drowning Report revealed the nation’s highest number of deaths in the water since records began.

Australia recorded 357 drowning deaths in the past year, 27 per cent higher than the 10-year average.

The report, released by Royal Life Saving Australia and Surf Life Saving Australia, also revealed alarming drowning rates for older adults and people born overseas, and for coastal locations and inland waterways.

“It’s a wake-up call, that’s for sure,” Surf Life Saving Australia chief executive Adam Weir told AAP.

One-third of all drowning deaths were adults aged 65 and older, the report said, and more than a third of total drownings involved people born overseas.

Coastal locations were the most dangerous with beaches, the ocean or rocks the sites of 154 fatalities, or 43 per cent of all drowning deaths.

Eighty-two people drowned at beaches alone, up 30 per cent on the 10-year average.

“Rip currents continue as Australia’s No.1 coastal hazard, claiming more lives than sharks, floods, or cyclones combined,” Mr Weir said.

More than a third of drowning deaths (122) occurred at inland waterways, mostly rivers (99).

There were 35 deaths in swimming pools, with 68 per cent of those fatalities in a backyard.

Disadvantaged areas of Australia had drowning rates double those of major cities, and regional and remote areas had almost triple the rate of deaths.

NSW recorded the most drowning fatalities -129 – ahead of Queensland’s 90 but South Australia had the highest increase with 24 deaths, up 71 per cent on the 10-year average.

The Northern Territory and Tasmania were the only jurisdictions to record decreases in drownings.

The data prompted an urgent call for action from Royal Life Saving Australia chief executive Justin Scarr ahead of summer.

“The decline in swimming skills, an ageing population and more people heading to remote and unfamiliar locations are causing concern,” he said.

“Half of all children leave primary school unable to swim 50 metres and float for two minutes, causing lifelong risk.

“Every Australian, regardless of postcode or background, must have access to swimming lessons, a great local pool or a safe place to swim.”

The lifesaving organisations urged people to learn swimming and water safety skills, wear a lifejacket when boating, fishing or paddling and swim at patrolled beaches between the flags.

They said children should always be supervised and adults must avoid alcohol and drugs around water, urging them to check conditions and forecasts.

Lifesavers and lifeguards made 2.4 million preventive actions and almost 9000 rescues last year.

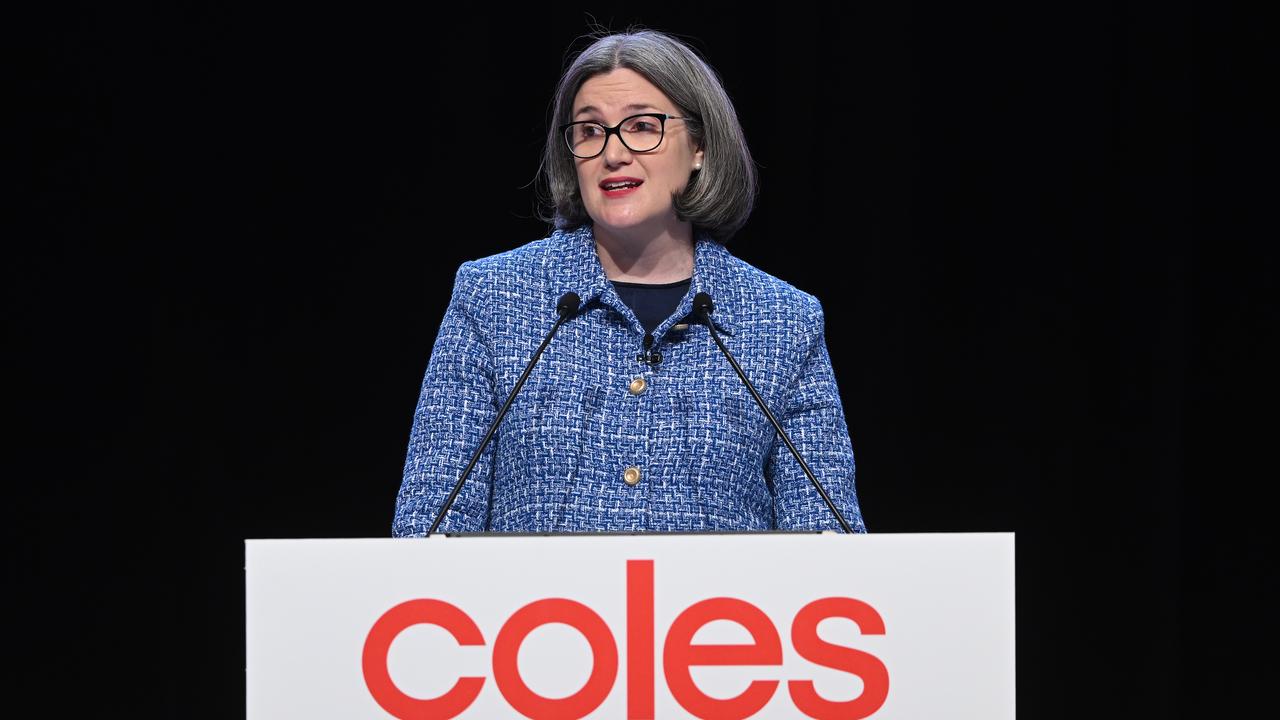

Coles says focus on value helped boost bottom line

Coles says customers have responded positively to its focus on fewer but deeper promotions, helping it grow both sales and profit.

The supermarket giant on Tuesday reported sales of $44.3 billion for the 52 weeks to June 29, up 3.6 per cent from Coles’ prior financial year after adjusting for the fact it was a week longer.

Supermarket sales grew 4.3 per cent to $40 billion – a 5.7 per cent increase when excluding tobacco products – while Liquorland sales were up 1.1 per cent to $3.7 billion.

Coles turned a $1.1 billion profit, up 2.4 per cent from 2024/25.

Chief executive Leah Weckert said that the company had maintained a consistent focus on its strategic priorities during the financial year.

“We were clear that value, quality and availability remained important to our customers,” she said.

Its “Great Value, Hands Down” value campaign focused on fewer, deeper promotions with an expanded range of products at low prices, Coles said.

Customers had also responded favourably to its Curtis Stone Glassware and Harry Potter Magical Discs campaign, which also underpinned the results.

Coles posted a final dividend of 32 cents, taking the total for the year to 69 cents, up from 68 cents last year.

AusPost halts many US services due to tariff rules

Australia’s postal service will stop sending many items to the United States until further notice, due to recent changes to import tariffs and customs rules.

Australia Post announced the temporary ban on Tuesday, saying it was effective immediately.

The government-owned entity’s decision is in response to recent significant changes made by the US government to customs and import tariff rules for parcels sent to America.

Those changes include the US suspending the “De Minimis” exemption for inbound goods valued below $US800 (about $A1200) and requiring the pre-payment of tariffs prior to items arriving.

The temporary suspension will impact business contracts, MyPost business and retail customers sending goods through the postal network to the US.

Gifts under $US100 (about $A150), letters and documents are unaffected.

Australia Post is not the only postal operator to pause operations to the United States.

Postal services across Europe have already suspended most parcel shipments to the US, including France’s La Poste, Germany’s Deutsche Post, Spain’s Correos, Poste Italiane and the Belgian, Swedish and Danish postal service.

Austria’s Österreichische Post and the UK’s Royal Mail are expected to stop sending parcels to the US by the end of August.

In the meantime, Australia Post is working with Zonos, an authorised US Customs and Border Protection third-party provider, on a solution for business customers.

Australia Post executive general manager for Parcel, Post and eCommerce Services, Gary Starr, said it was working on a quick solution.

“We are disappointed we have had to take this action,” he said.

“However, due to the complex and rapidly evolving situation, a temporary partial suspension has been necessary to allow us to develop and implement a workable solution for our customers.

“Australia Post continues to work with US and Australian authorities and international postal partners to resume postal service to the US as a priority.”

It’s believed Australian businesses will still be able to send parcels to the US through more expensive commercial models like DHL and FedEx.

Australia Post’s temporary partial suspension also includes parcels to Puerto Rico, as it is a US Customs territory and has also been impacted by tariff changes.

Postal goods sent to the US and Puerto Rico lodged on or after Tuesday, August 26, will not be accepted by Australia Post until further notice.

It comes just a day after Australia Post announced it would hire 3500 seasonal team members ahead of the busy Christmas period.

Customers seeking an update can check the Australia Post website or call 13 POST (13 7678).

Aust Post halts US service due to customs, tariffs rule

Australia’s postal service will stop sending many items to the United States until further notice, due to recent changes to import tariffs and customs rules.

Australia Post announced the temporary ban on Tuesday, saying it was effective immediately.

The government-owned entity’s decision is in response to recent significant changes made by the US government to customs and import tariff rules for parcels sent to America.

Those changes include the US suspending the “De Minimis” exemption for inbound goods, valued below $US800 (about $A1,200), and requiring the pre-payment of tariffs prior to items arriving.

The temporary suspension will impact business contract, MyPost business and retail customers sending goods through the postal network to the US.

Gifts under $US100 (about $A150), letters and documents are unaffected by this change.

Australia Post is not the only postal operator to suspend operations to the United States.

In the meantime, Australia Post is working with Zonos, an authorised US Customs and Border Protection third-party provider, on a solution for business customers.

Australia Post Executive General Manager, Parcel, Post & eCommerce Services, Gary Starr, said it was working on a quick solution.

“We are disappointed we have had to take this action,” he said.

“However, due to the complex and rapidly evolving situation, a temporary partial suspension has been necessary to allow us to develop and implement a workable solution for our customers.

“Australia Post continues to work with US and Australian authorities and international postal partners to resume postal service to the US as a priority.”

The temporary partial suspension also includes postal sending to Puerto Rico, as it is a US Customs territory and has also been impacted by these tariff changes.

Postal goods sent to the US and Puerto Rico lodged on or after Tuesday, August 26, will not be accepted by Australia Post until further notice.

It comes just a day after Australia Post announced it would hire 3,500 seasonal team members ahead of the busy Christmas period.

Customers seeking an update can check the Australia Post website or call 13 POST (13 7678).

French govt risks collapse with budget confidence vote

France’s minority government looks increasingly likely to be ousted next month after three main opposition parties indicated they would not back a confidence vote, which Prime Minister Francois Bayrou has announced.

Bayrou has flagged the September 8 vote over his plans for sweeping budget cuts.

The far-right National Rally, the Greens and later the Socialists, on whose vote Bayrou’s fate largely lies, said they did not see how they could back him.

If he loses the confidence vote in the National Assembly, Bayrou’s government will fall.

The uncertainty spooked investors, pushing the risk premium on French bonds over their German equivalents up 5.0 basis points to their highest level since mid-June.

The CAC-40 index of leading French shares ended the day down 1.6 per cent.

If the government falls, President Emmanuel Macron could name a new prime minister immediately or ask Bayrou to stay on as head of a caretaker government, or he could call a snap election.

Macron lost his last prime minister, Michel Barnier, to a no-confidence vote over the budget in late 2024, after just three months in office following another snap election in July that year.

Bayrou acknowledged seeking the confidence of a very fragmented parliament was a risky bet.

“Yes, it’s risky, but it’s even riskier not to do anything,” he told a press conference, referring to what he said was the major danger the country faced due to its huge debt pile.

The confidence vote, he said, would gauge whether he had enough support in parliament for his 44 billion euro ($A79.39 billion) budget squeeze, as he tries to tame a deficit that hit 5.8 per cent of gross domestic product last year, nearly double the official EU limit of 3.0 per cent.

Even if the government wins the confidence vote, it would only mean he has support for his views on France’s fiscal woes, with a vote on the actual budget itself due later in the year.

Bayrou has proposed scrapping two public holidays and freezing welfare spending and tax brackets in 2026 at 2025 levels, not adjusting them for inflation.

He said his proposal to scrap the bank holidays could be tweaked.

Far-right party chief Jordan Bardella said Bayrou had de facto announced “the end of his government” by calling for the vote.

“The RN will never vote in favour of a government whose decisions are making the French people suffer,” he said on X.

Leader Marine Le Pen said the RN would vote against Bayrou – as did the Greens.

The hard left France Unbowed also said the vote would mark the end of the government.

The votes of Socialist politicians will be decisive for Bayrou’s fate because if they join other left-wing parties and the far right in voting against the government, there will likely be enough votes to oust it.

Socialist party leader Olivier Faure told TF1 television that French Socialists would not vote in favour of a confidence motion for Bayrou.

The confidence vote will take place just two days before planned protests, which have been called for on social media and backed by leftist parties and some unions.

The September 10 call for general protests has drawn comparisons to the Yellow Vest protests that erupted in 2018 over fuel price hikes and the high cost of living.

The “gilets jaunes” protests spiralled into a broader movement against Macron and his efforts at economic reform.

Starring role for households in least-cost transition

Australians’ embrace of rooftop solar and batteries is saving households but the energy regulator warns better co-ordination with the grid is essential to avoid bill shock for all.

The latest update on the state of electricity and gas markets from the Australian Energy Regulator identifies so-called “consumer energy resources” as an increasingly important player in the energy system.

Rooftop solar contributed 14.7 per cent of the national energy market’s total generation in the first quarter of 2025, surpassing the role of wind turbines, 13.7 per cent, and large-scale solar, at 9.3 per cent.

Households are increasingly pairing their solar systems with batteries to store more of their cheap energy for when the sun goes down, with installations accelerating thanks, in part, to federal subsidies.

Rooftop solar, batteries and electric cars have the potential to lower energy costs for consumers who invest in them, the regulator’s 2025 State of the Energy Market Report said.

“The broader system and economic benefits for all consumers will depend on the extent to which consumer energy resources can be orchestrated,” the report said, echoing the position of other regulatory and operational energy bodies.

Orchestration using virtual power plants, vehicle-to-grid and other measures can keep down costs for all consumers by smoothing out peak demand for energy, meaning less money needs to be spent on large-scale solar and wind, and poles and wires.

The energy regulator said the projected savings on network costs are not a given and rely on the right policy settings and market incentives, as well as consumer trust to make effective orchestration a success.

Alongside the ascendance of household energy resources, strong inroads are being made into large-scale clean energy delivery in the pursuit of climate targets.

The regulator’s chair Clare Savage flagged 2024 as a “notable” year for the energy system’s transition away from coal.

“By the end of the year, renewable technologies including rooftop solar, solar farms, wind, hydro and batteries made up 60 per cent of the National Electricity Market’s generation capacity and contributed 39 per cent of generation output, representing a significant increase over the past decade,” she said.

But the rollout of big renewables projects and the infrastructure needed to transport it around the country has hit some speed bumps, with lengthy planning and environmental approvals and social licence hurdles all slowing progress.