Not so great value: Woolworths disappoints, shares drop

Woolworths has badly disappointed investors, just a day after its biggest rival delighted them.

Woolworths shares were on track for their worst performance in more than six years on Wednesday, plunging 13.9 per cent to a five-month low of $28.76 in early trading after Australia’s biggest private employer posted a big decline in full-year profit.

Coles shares, in contrast, were up 2.8 per cent to a fresh all-time high of $23.13, building on its stellar 8.5 per cent gains on Tuesday after the supermarket and liquor group beat earnings expectations almost across the board.

Woolworths’ losses on Wednesday came after it announced it would cut its dividend by 21.1 per cent after its net profit fell 17.1 per cent to $1.39 billion.

Sales were up 3.6 per cent to $69.1 billion, but earnings before interest, tax, depreciation and amortisation fell 3.5 per cent to $5.7 billion on a normalised basis.

Chief executive Amanda Bardwell said Woolworths’ financial performance was well below its expectations and those of shareholders, and it was taking action to reposition itself.

“You’re clearly lagging your major competitor by a fairly large margin, probably the largest margin we’ve seen in quite some time,” Jefferies deputy head of equity research Michael Simotas commented on an analyst call.

Woolworths said the drop in profit reflected higher finance costs and lower earnings, which were hit by a number of issues.

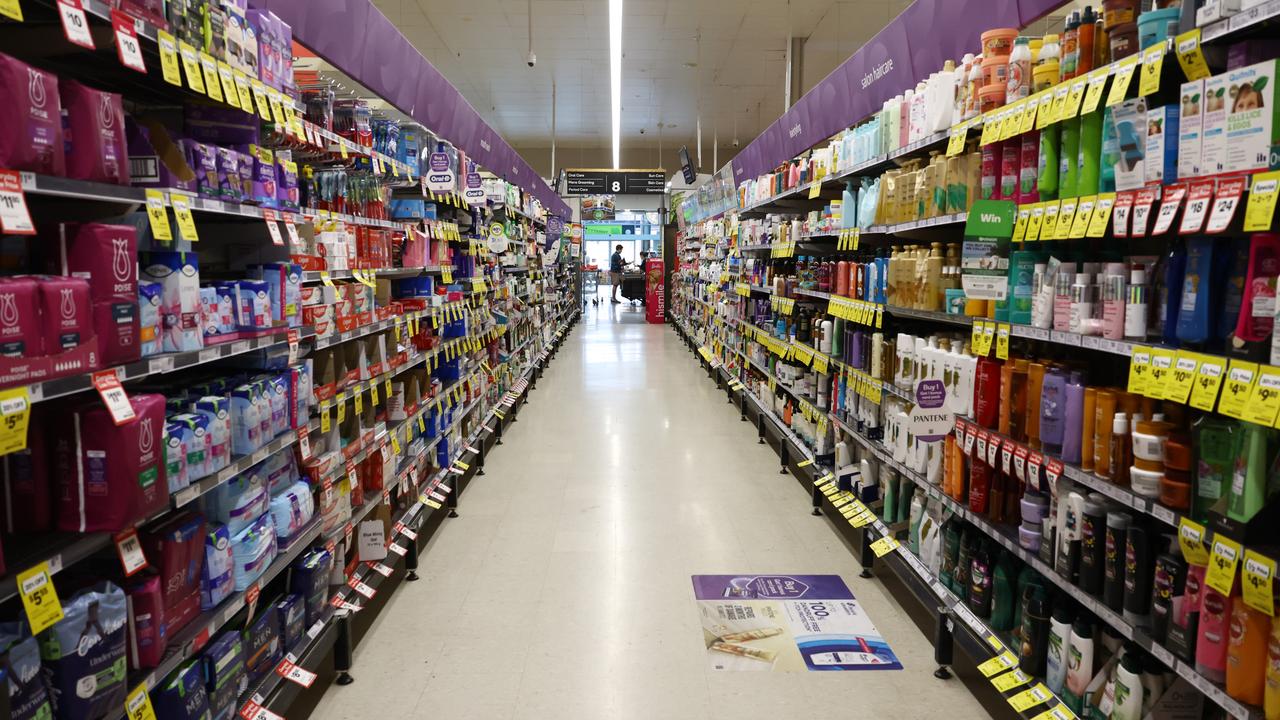

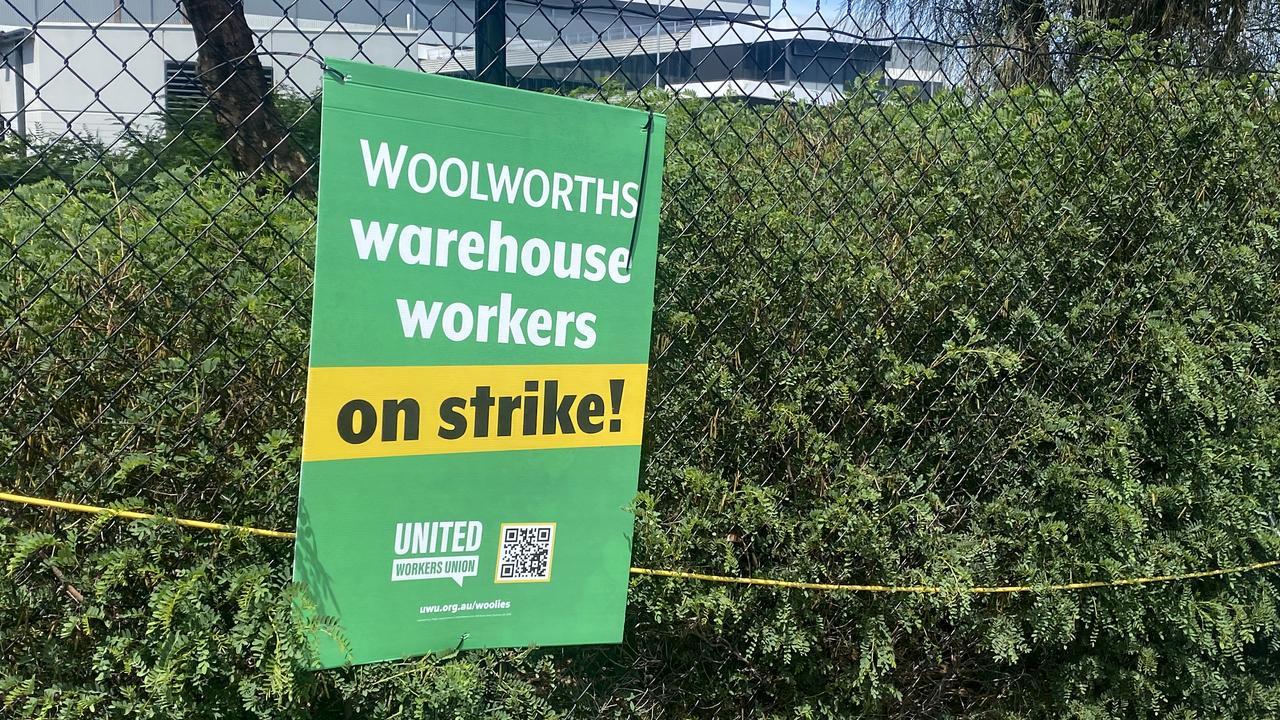

Industrial action in the first half cost the group $95 million, and it spent $73 million in dual-running costs as new high-tech warehouses get up and running.

Woolworths’ cost of doing business also rose, mostly because of a 4.25 per cent wage increase for Australian retail team members.

In addition, it posted $569 million in impairments, including writing off $346 million from the value of Big W after a financial performance below expectations.

A Disney Discs collectibles campaign had underperformed and theft and acts of aggression against Woolworths team members had increased during the second half, something the company has been taking steps to address.

Woolworths said that for the first eight weeks of 2025/26, Australian supermarket sales excluding tobacco were up four per cent compared with the same time last year.

RBC Capital Markets analyst Michael Toner pointed out that Coles on Tuesday reported supermarket sales excluding tobacco products were up 7.0 per cent over the same period.

That was a big difference, he said, adding Woolworths “appears to be losing market share to Coles”.

Woolworths will pay a 45c final dividend, down from last year’s 57c payout.

Unexpected inflation spike dampens rate cut hopes

Traders have scaled back their hopes for a second straight Reserve Bank rate cut after inflation unexpectedly surged in July.

The monthly consumer price index skyrocketed from 1.9 per cent to 2.8 per cent, wrong-footing economists who had predicted the annualised rate to climb to 2.3 per cent in figures released by the Australian Bureau of Statistics on Wednesday.

“This is the highest annual inflation rate since July 2024, following several months of easing inflation,” ABS head of prices statistics Michelle Marquardt said.

The surge was driven by a 13 per cent rise in electricity prices over the month, due to government energy rebates for NSW and the ACT not kicking in until August.

The timing of energy rebates has made the headline inflation figure especially volatile of late.

But worryingly for the RBA, less volatile figures that exclude items like electricity that tend to jump around more also rose above expectations.

The annual trimmed mean rose from 2.1 per cent to 2.7 per cent, while the CPI excluding volatile items and holiday travel measure rose to 3.2 per cent, above the central bank’s two to three per cent target band.

While the jump in the monthly data will be unwelcome news to the RBA ahead of its upcoming meeting in late September, the board places greater emphasis on quarterly figures, which are not due to be released until October.

Sean Langcake, head of macroeconomic forecasting for Oxford Economics Australia, said excluding electricity costs, inflation was still relatively well contained.

“The RBA is likely to wait until they have full information on inflation in Q3 before changing policy settings,” he said.

“Despite some upside in these data, we expect a fairly benign print for core inflation in Q3 overall, which will pave the way for a November rate cut.”

In its latest meeting minutes released on Tuesday, the RBA board expected the unwinding of energy rebates would boost the headline inflation rate over 2025 and 2026.

Money markets were pricing in the chance of a September rate cut at slightly above one-third, but following the ABS release, odds were cut back to less than three-10ths.

Food, alcohol and tobacco also drove prices higher, while growth in rents slowed to 3.9 per cent annually – the slowest rate since November 2022.

Holiday travel and accommodation prices also rose strongly.

The Westpac-Melbourne Institute leading index, which draws on a range of domestic and international data points to paint a picture of future economic growth, ticked up slightly in July but still indicates growth will remain sluggish in coming months.

“The recovery that started to take shape in last year continues to proceed slowly,” said Matt Hassan, Westpac Economics head of Australian macro-forecasting.

Asia stocks steady, investors wary on Fed independence

Asian stocks were steady on Wednesday ahead of an earnings report from AI leader Nvidia that will shape near-term risk sentiment, while the US dollar was frail as investors remained nervous about attacks on Federal Reserve autonomy.

The US Treasury yield curve has been steepening since President Donald Trump on Monday ordered the firing of Federal Reserve Governor Lisa Cook, an unprecedented move that could lead to a legal tussle after a lawyer for Cook said she will file a lawsuit to prevent it.

“The Fed has said it will abide by any decision the court makes on Lisa Cook but the reality is the Fed is in a bind,” said Prashant Newnaha, senior Asia-Pacific rates strategist at TD Securities.

“If the court ends up ruling in favour of Trump, this potentially puts Chair (Jerome) Powell in line to be fired for permitting a non-Fed employee to make decisions on behalf of the Fed Board” should Cook continue to serve between Trump’s firing and the court’s decision.

Shorter-dated yields fell more than longer-dated ones, causing the yield curve to steepen. The yield on the two-year note, which typically moves in step with interest rate expectations, hit its lowest since May at 3.654 per cent in early Asian hours, while the yield on the 30-year note was 1.5 basis point higher at 4.923 per cent.

Trump has repeatedly criticised Powell and policymakers for not cutting interest rates. Market watchers interpreted Powell comments last week as indicating cuts could be on the way.

That has led to investors wagering a cut next month, with traders pricing in an 84 per cent chance of the Fed moving in September and expecting more than 100 bps of easing by June.

“Markets are anticipating a scenario where Trump holds the majority on the Board of Governors setting the stage for cuts to come sooner and potentially faster,” said Newnaha.

After an initial sharp drop in the dollar after Trump’s comment, the greenback remained near those lows. The euro last fetched $US1.1636 ($A1.7907), while the yen was steady at 147.6 a dollar.

“I think investors are focused more on the upcoming payroll print and what that means for a September rate move. The hope is that a rate cut is still on the cards without a sharp deterioration in the labour market,” said Ben Bennett, APAC investment strategist at Legal and General Investment Management.

“That could keep investor sentiment very strong. Tonight’s Nvidia results will also be important for the near-term direction of markets.”

Data showed options traders are pricing in about a $US260 billion ($A400 billion) swing in Nvidia’s market value after the firm reports earnings, where its business in China will be in focus following an unusual profit-sharing deal with the Trump administration.

Caught in the crossfire of a Sino-US trade war, the fate of Nvidia’s China business hangs on where the world’s two largest economies land on tariff talks and chip trade curbs.

That has left traders hesitant in placing major bets. MSCI’s broadest index of Asia-Pacific shares outside Japan up just 0.2 per cent, Japan’s Nikkei was little changed and share prices in Taiwan were up 0.6 per cent.

China’s blue-chip stocks gained 0.3 per cent, hovering near a three-year high touched earlier in the week. Stocks in China have been on a tear recently, buoyed by tech sector.

In commodities, spot gold was 0.23 per cent lower after hitting a two-week high in the previous session.

Oil prices were little changed after falling in the previous session, as the market awaits massive new US tariffs on imports from India, the world’s third-largest crude consumer, in response to India’s purchases of Russian oil.

Iranian ambassador on the way out after shock expulsion

Iran’s ambassador to Australia has left the embassy after he was expelled over revelations that the regime had directed two anti-Semitic attacks in Sydney and Melbourne.

Ahmad Sadeghi was spotted departing from the Canberra embassy on Wednesday after becoming the first ambassador to be booted by the federal government since World War II.

Prime Minister Anthony Albanese announced the expulsion after Australia’s spy agency said it had “credible evidence” that the Iranian government directed at least two attacks on Jewish premises and was suspected of involvement in others.

“It’s clearly aimed at disharmony in Australia,” he told ABC radio.

“It’s an attack on our social fabric and on who we are.”

While he would not go into detail about the Australian Security Intelligence Organisation’s evidence – citing ongoing investigation – agencies had been able to trace connections between domestic criminal elements and the Iranian Revolutionary Guard.

The government is now drafting laws to list Iran’s Revolutionary Guard as a terrorist organisation.

It was not previously listed under terrorism laws because it was a government entity.

Iran has denied the allegations through its Foreign Ministry spokesman Esmail Baghaei, who tried to link it to the challenges Australia faced with Israel after the government announced it was preparing to recognise a Palestinian state.

“It looks like that the action, which is against Iran, diplomacy and the relations between the two nations, is a compensation for the criticism that the Australians had against the Zionist regime,” Mr Baghaei said.

An Iranian foreign ministry spokesperson reportedly said Iran would take an “appropriate decision” in response to Australia’s action.

Foreign Minister Penny Wong urged any Australians in Iran to leave immediately and warned travellers not to go to the country as the government no longer has an embassy there.

“The Iranian regime is an unpredictable regime, a regime which we have seen is capable of aggression and violence,” Senator Wong told ABC radio.

Australia’s travel advice has been updated to warn of a “high risk” of arbitrary detention or arrest.

The Adass Israel Synagogue was one of the sites firebombed by criminal proxies in December 2024, badly damaging the building and injuring a worshipper.

Synagogue board member Benjamin Klein said he received a call from a senior official in Prime Minister Anthony Albanese’s office telling him the government would announce “dangerous acts of aggression” were directed by Iran.

“It is quite shocking and traumatic to think that a peaceful, loving shule (synagogue) in Melbourne is targeted and attacked by terrorists from overseas,” Mr Klein told AAP.

He said Victorian and federal authorities had been supportive with increased security arrangements at a temporary location where the congregation now gathered.

Police arrested a second man over the firebombing earlier in August.

The other site targeted was the Lewis’ Continental Kitchen in Sydney, a kosher deli and a mainstay of Bondi in the city’s eastern suburbs, which was firebombed in October.

Executive Council of Australian Jewry Alex Ryvchin said the owner of the popular shop, Judith Lewis, was still processing revelations that the Revolutionary Guard had been linked to the attack.

“The fact that a business is targeted makes every Jewish Australian fearful that they could be next,” he said.

The deli arson attack was allegedly committed by Wayne Dean Ogden, 41, who remains behind bars ahead of a court appearance on October 21.

Sayed Mohammed Moosawi, 32, was released on bail three weeks ago after pleading not guilty to commissioning the attack and directing a criminal group. His case is back in court on the same day.

The federal opposition has backed the government’s action.

“Any foreign power who conducts violent operations through proxies on our shores is not welcome here,” coalition home affairs spokesman Andrew Hastie told ABC radio.

The Israeli embassy in Australia welcomed the government’s decision as a “strong and important move”.

Australian minister comes face-to-face with JD Vance

Australia is deepening its defence relationship with the US, Defence Minister Richard Marles says, despite ongoing uncertainty about America’s commitment to the AUKUS alliance.

Mr Marles met with US Secretary of Defence Pete Hegseth, as well as Vice President JD Vance, Secretary of State Marco Rubio and White House Deputy Chief of Staff Stephen Miller, in Washington on Tuesday, local time.

His visit to the US came as a Pentagon review into the AUKUS pact hung over the future of the alliance and a fleet of nuclear submarines Australia is set to acquire.

Mr Marles reiterated Australia’s importance to the US as competition in the region is ramping up with an increasingly assertive China in the Indo-Pacific.

“I was pleased to have the opportunity today to meet with some of the most senior members of the US Administration, including Vice President Vance and Secretary Rubio to reaffirm our commitment to the alliance and advance our strong partnership,” he said.

“It was fantastic to see Secretary Hegseth again, following our most recent meeting at the Shangri-La Dialogue in May.

“Australia’s defence relationship with the United States continues to grow and deepen.”

With Prime Minister Anthony Albanese yet to secure a face-to-face meeting with the president, Mr Marles’ meetings with Mr Vance and Mr Miller are the highest-ranking face-to-face engagement between the two nations since Donald Trump’s election win.

But the relationship between the two nations’ defence officials has been strained amid US perceptions that Australia is not lifting its weight as America urges allies to increase their capabilities to ward off China.

US officials have been leaning on Australia to increase defence spending from about two per cent to 3.5 per cent of gross domestic product.

The Albanese government has resisted the calls, insisting Australia is pulling its weight under a plan to lift spending to 2.3 per cent by 2033.

Mr Marles’ visit also included meetings with a procession of defence contractors, including Northrop Grumman, Boeing and Palantir, which have been expanding their footprint in Australia as part of the AUKUS agreement.

Opposition defence spokesman Angus Taylor said Australia does not have the right level of defence spending for “dangerous times”.

“They are living in this sort of La La Land of rhetoric, not readiness,” he told Sky News on Wednesday.

“We need to have the readiness, we need to have the agility, we need to have the sovereign capability that (we) need to underpin our alliances.

“These are the things that are necessary at the most dangerous time for us since the Second World War.”

Mr Marles reiterated Australia’s strategic advantages in critical minerals production, as the home to some of the largest deposits of the resources on earth.

Critical minerals, such as rare earth metals, are integral to the manufacturing of advanced weapons systems and the US is increasingly looking to shore up access to supplies.

China currently commands near-monopoly control of several critical minerals.

Australia stands as a trusted and valuable investment partner, Mr Marles said, reiterating that the US remains the largest investor in Australia.

Despite the ongoing trade links between the two nations, the relationship has been strained by President Donald Trump’s tariffs, which have hurt Australian companies exporting to the US.

Australia Post on Tuesday suspended a range of deliveries to the US because of changes to customs and import tariff rules, leaving retailers who ship products to America scrambling to find ways to fulfil orders.

Big profit fall at Woolworths leaves investors wanting

Woolworths has cut its dividend after posting a big decline in full-year profit.

The supermarket group delivered a $1.39 billion net profit in the 52 weeks to June 29, down 17.1 per cent from Woolworth’s the previous financial year after normalising the reporting period.

Woolworths will pay a 45c final dividend, down 21.1 per cent from last year’s 57c payout.

Sales were up 3.6 per cent to $69.1 billion, while earnings before interest, tax, depreciation and amortisation fell 3.5 per cent to $5.7 billion on a normalised basis.

Woolworths said the drop in profit reflected higher finance costs and lower earnings, which were hit by a number of issues.

Industrial action in the first half cost the group $95 million, and the group spent $73 million in dual-running costs as new high-tech warehouses get up and running.

Woolworths’ cost of doing business also rose, mostly because of a 4.25 per cent wage increase for Australian retail team members.

In addition it posted $569 million in impairments, including writing off $346 million from the value of Big W after a financial performance below expectations.

CEO Amanda Bardwell described the 2024/25 results as disappointing, but said the group expected to return to profit growth in this financial year.

“We will continue to rebuild customer trust through compelling value and retail execution excellence, simplify the way we work and become a more focused, lower-cost retailer with a differentiated Food offer at our core,” she said on Wednesday.

“Some of this will take time, but I am confident that the strength of our brands, assets and team can see us deliver a much-improved performance.”

Woolworths also said for the first eight weeks of 2025/26, Australian supermarket sales were up 2.1 per cent compared to the previous year, or up four per cent excluding tobacco sales.

Iran’s regime ‘crossed a line’ in attacks on Australia

Iran has been accused of “crossing a line” after Australia’s spy agency revealed it directed two anti-Semitic attacks on Jewish premises in Sydney and Melbourne.

The federal government’s response has been swift, with Canberra moving to expel the Iranian ambassador – which is the first time Australia has booted such a high-ranking diplomat since World War II.

As well, the government is urgently drafting laws to list Iran’s Revolutionary Guard as a terrorist organisation.

While Foreign Minister Penny Wong acknowledged these were unprecedented moves, she said it was the “right time” to take such measures.

“When you have a regime that is behaving in Australia in a way that is inciting violent crime against Australians with the threat of harm, this is clearly a line that has been crossed,” she told the Today show on Wednesday.

“This was so beyond anything that we could accept.”

She also urged any Australians in Iran to leave immediately and warned travellers not to go to the country as the government no longer has an embassy there.

“The Iranian regime is an unpredictable regime, a regime which we have seen is capable of aggression and violence,” Senator Wong told ABC radio.

Australia’s travel advice has been updated to warn of a “high risk” of arbitrary detention or arrest.

Iran has denied the allegations through its Foreign Ministry spokesman Esmail Baghaei, who tried to link it to the challenges Australia faced with Israel after the government announced it was preparing to recognise a Palestinian state.

“It looks like that the action, which is against Iran, diplomacy and the relations between the two nations, is a compensation for the criticism that the Australians had against the Zionist regime,” Mr Baghaei said.

An Iranian foreign ministry spokesperson reportedly said Iran would take an “appropriate decision” in response to Australia’s action.

The Adass Israel Synagogue was one of the sites firebombed by criminal proxies in December 2024, badly damaging the building and injuring a worshipper.

Synagogue board member Benjamin Klein said he received a call from a senior official in Prime Minister Anthony Albanese’s office telling him the government would announce “dangerous acts of aggression” were directed by Iran.

“It is quite shocking and traumatic to think that a peaceful, loving shule (synagogue) in Melbourne is targeted and attacked by terrorists from overseas,” Mr Klein told AAP.

He said Victorian and federal authorities had been supportive with increased security arrangements at a temporary location where the congregation now gathered.

“We’re a bit more anxious, a bit more stressed and scared, but we don’t change our way.”

Police arrested a second man over the firebombing earlier in August.

The other site targeted was the Lewis’ Continental Kitchen in Sydney, a kosher deli and a mainstay of Bondi in the city’s eastern suburbs, which was firebombed in the early hours of October 20 last year.

Executive Council of Australian Jewry Alex Ryvchin said the owner of the popular shop, Judith Lewis, was still processing revelations the Revolutionary Guard had been linked to the attack.

“The fact that a business is targeted makes every Jewish Australian fearful that they could be next,” he said.

The deli arson attack was allegedly committed by Wayne Dean Ogden, 41, who remains behind bars ahead of a court appearance on October 21.

Sayed Mohammed Moosawi, 32, was released on bail three weeks ago after pleading not guilty to commissioning the attack and directing a criminal group. His case is back in court on the same day.

ASIO director-general Mike Burgess said on Tuesday that more anti-Semitic attacks could be linked to Iran,

Opposition has backed the government’s action.

“Any foreign power who conducts violent operations through proxies on our shores is not welcome here,” coalition home affairs spokesman Andrew Hastie told ABC radio.

The Israeli embassy in Australia welcomed the government’s decision as a “strong and important move”.

Australia, other countries face US anti-dumping duties

The US Department of Commerce has issued affirmative determinations of anti-dumping and countervailing duties against 10 countries after investigations into corrosion-resistant steel products.

The determinations cover $US2.9 billion ($A4.5 billion) in imports from Australia, Brazil, Canada, Mexico, the Netherlands, South Africa, Taiwan, Turkey, the United Arab Emirates and Vietnam, the US Commerce Department said in a statement.

“Commerce made its final determinations that imports of CORE into the United States from ten trading partners were being dumped and/or subsidised,” the department said.

Corrosion-resistant steel is used to build cars, appliances and buildings, the department said.

“American steel companies and workers deserve to compete on a level playing field,” Under Secretary of Commerce for International Trade William Kimmitt said in a statement.

The International Trade Commission – a US federal agency – will now make its own determination of injury to the domestic steel industry, the department said.

“If the ITC makes an affirmative, trading partner-specific injury determination, Commerce will issue AD and CVD orders,” the Commerce Department said.

UN postal agency says 25 countries suspend US shipments

A United Nations agency responsible for the postal sector says 25 of its member states have suspended goods consignments to the United States amid uncertainty after US President Donald Trump’s administration scrapped a customs tax rule that exempted small packages from duty.

The Universal Postal Union, a Switzerland-based agency promoting co-operation between postal services of its 192 member countries, said it conveyed their concerns about disruption in a letter to US Secretary of State Marco Rubio on August 25.

It did not name the countries although Australia, Norway, Switzerland and others have already announced suspensions publicly.

The news comes after the US administration said last month it would suspend the global “de minimis” exemption, which also allows minimal paperwork, for international shipments under $US800 ($A1,230), effective August 29.

Low-value imports are losing their duty-free status in the United States as part of Trump’s agenda for making the country less dependent on foreign goods and resetting global trade with tariffs.

Purchases that previously entered the US without needing to clear customs will require vetting and be subject to their origin country’s applicable tariff rate, which can range from 10 per cent to 50 per cent.

For the next six months, US carriers handling orders sent through the global mail network also can choose a flat duty of $US80 to $US200 per package instead of the value-based rate.

with AP

Watchdog sets sights on protecting retirees’ pensions

Protecting hard-earned investments from roll-of-the-dice funds will receive more attention as three million Australians approach retirement age in the next decade.

Australia’s corporate watchdog on Tuesday revealed superannuation trustees would be in the sights of its investigators in the coming year as it unveiled its 2025/26 corporate plan.

Peoples’ faith in superannuation trustees had been stretched to the limit, Australian Securities and Investments Commission chair Joe Longo said.

“With around three million Australians reaching superannuation preservation age in the next 10 years, and at least $750 billion in funds shifting from the accumulation phase to the retirement phase, superannuation trustees must do better,” he wrote in the plan.

“(We have) acted swiftly and dedicated considerable resources to investigate the high-pressure sales tactics, clickbait advertising and other dubious tactics that resulted in thousands of investors switching their superannuation into high-risk funds with the potential for significant losses.”

The release coincided with the watchdog formally accusing a superannuation firm of steering thousands of members into investing in a master fund with no track record.

ASIC’s Federal Court action against ASX-listed Equity Trustees alleges it failed to exercise caution when it allowed members to invest in the Shield Master Fund and did not act in the best financial interests of said members.

Equity Trustees, which oversees approximately $88 billion in funds owned by about 800,000 members, said it fully co-operated with the commission’s investigation and was reviewing the claim.

The commission says it has launched 50 per cent more investigations in the past year, up to 252.

Lawsuits seeking court penalties increased 20 per cent.

Being seen to be a tougher cop on the beat by bringing more legal action would let people feel their money was in safer hands, Mr Longo said.

“‘That transformation is key to ensuring ASIC can continue to serve the Australian community,” he said.

“The operating environment for our financial ecosystem is increasingly complicated and that requires a well-calibrated response … we direct our efforts and finite resources to areas where we see the greatest risks and potential harms.”

The watchdog is also looking at how it can simplify regulation so people can better understand rights and obligations under financial law.

ASIC’s push to cut red tape includes simplifying forms, processes and digital interactions and law reform proposals to reduce unnecessary reporting and paperwork.

“This plan demonstrates our commitment to being a modern, confident and ambitious regulator,” Mr Longo said.