Inflation ‘quirks’ unlikely to spook Reserve Bank board

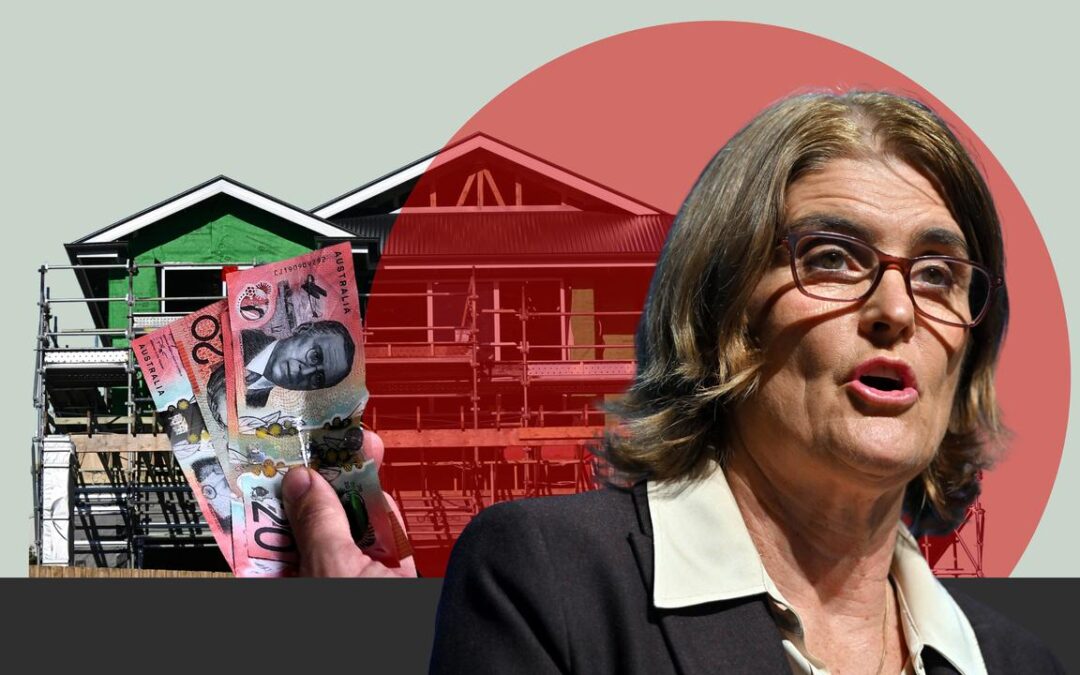

A surprise jump in inflation has dimmed the prospects of a back-to-back Reserve Bank rate cut, but it’s too early to write it off completely.

Traders lowered the odds of a rate cut at the central bank’s next meeting in late September after the Australian Bureau of Statistics on Wednesday reported the headline consumer price index surged from 1.9 per cent to 2.8 per cent in July.

While the news wouldn’t have been positively received at the central bank, CBA economist Harry Ottley warned against reading too much into the volatile data.

The inflation jump exceeded forecasts largely because payments for Commonwealth energy rebates that were expected to kick in in July will only start in August.

School holidays, which fell in July, also drove up travel costs.

“Much of the outsized surge in inflation can be explained by quirks regarding the timing of electricity rebates and holiday travel,” Mr Ottley said.

“These monthly movements will likely unwind in coming months.”

The less goods-heavy August monthly inflation print, which will be released in September ahead of the next RBA meeting, will provide important information about how transitory the price spikes were and whether services inflation is still tracking lower.

“(The RBA) has also been at pains to point out the volatility in the monthly figures. For this reason, the board is unlikely to be overly concerned about the surprisingly strong print,” Mr Ottley said.

Money markets had been pricing in the chance of a September rate cut at more than a third, but lowered the odds to less than a quarter following the data release.

But traders are still optimistic the Reserve Bank and governor Michele Bullock will deliver its fourth rate cut this year in November, with another one to follow by early 2026.

Sluggish economic growth could also boost the case for a rate cut.

The Westpac-Melbourne Institute leading index, which draws on a range of domestic and international data points to paint a picture of future economic growth, ticked up slightly in July but still points to sluggish growth in coming months.

“The recovery that started to take shape in last year continues to proceed slowly,” said Matt Hassan, Westpac Economics head of Australian macro-forecasting.

ANZ senior economist Adelaide Timbrell expects fresh data out on Thursday to show business spending on new private capital grew at just 0.2 per cent in the June quarter.

“We expect to see sluggish growth in capex, as the uncertain global backdrop has led to weak investment appetite,” she said.

Aussie Iranian community under attack after expulsion

Australians of Iranian heritage face verbal abuse and intimidation over Tehran’s “insidious” direction of two anti-Semitic attacks in the nation’s largest cities.

The Albanese government has taken the extraordinary step of booting Iranian ambassador Ahmad Sadeghi from Australia, making him the first high-ranking diplomat to be expelled since World War II.

The nation’s spy agency said it had credible evidence the Iranian Revolutionary Guard had orchestrated at least two attacks on Jewish institutions in Sydney and Melbourne through criminals.

Mr Sadeghi was spotted leaving the Iranian embassy in Canberra on Wednesday morning.

Australian Iranian Society of Victoria vice president Kambiz Razmara said the local diaspora had been asking for the ambassador’s expulsion since 2022, following the regime’s crackdown on the women’s rights movement.

He said there had already been reports Australia’s Iranian community was being conflated with the actions of Iranian authorities.

“It is important for people to recognise that we, the Iranian diaspora, are opposed to what happens in Iran,” Mr Razmara said.

“The Iranian diaspora, by and large, are here because they’re seeking freedom and social cohesion and freedom of expression and democracy, so anything that tarnishes that we are resolutely against.”

Iran’s foreign ministry rejects the accusations made by Australia, instead linking them to the dispute Canberra faced with Israel after Labor announced it planned to recognise Palestine as a state.

The government had taken the right step after Iran’s “insidious, underhanded” work in destabilising Australian society, said David Andrews from the National Security College at the Australian National University.

On Australia’s relationship with Iran, Mr Andrews said Canberra had in the past been able to conduct diplomacy on behalf of its friends and allies who do not have a mission in Tehran.

“(The expulsion) potentially puts that role at some risk,” he said.

He said Australia should expect some retaliation.

“The risk of people being used as political pawns, or people who have either dual citizenship or Australians passing through Iran, could be used as a point of leverage or sort of in response to this action,” Mr Andrews said.

“There’s no one who will be rushing to try and repair those ties too actively.”

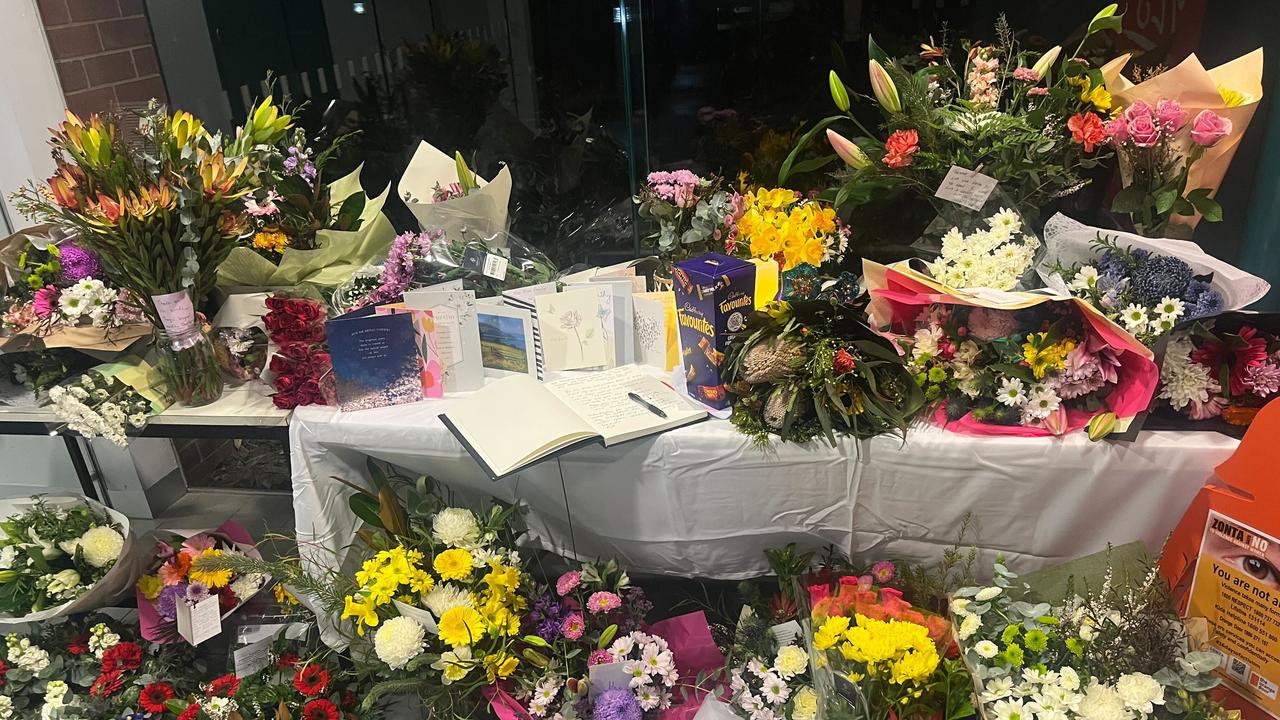

State mourns as manhunt continues for cop killer

A search for a fugitive who murdered two police officers in cold blood has entered a third day, as Victoria grieves for the fallen.

Monuments across the state lit up in blue in tribute to Detective Leading Senior Constable Neal Thompson, 59, and Senior Constable Vadim De Waart, 35, who were shot dead while attempting to serve a search warrant at a Porepunkah property on Tuesday.

Another wounded officer is expected to recover after undergoing surgery.

The accused gunman Dezi Freeman – also known as Desmond Filby – fled into bushland, plunging the town of about 1000 residents in Victoria’s high country into lockdown as police pursue the gunman.

Despite that, grieving community members have come out to decorate the foyer of nearby Wangaratta police station with colourful bouquets of flowers in memory of the fallen policemen.

The local primary school will re-open its doors on Thursday after it went into lockdown following the shooting.

The weather in the alpine region continued to deteriorate, as hundreds of police continued to scour the area by land and air.

Officers on Wednesday returned to the rural property, about 300km northeast of Melbourne, where two of their own were allegedly executed in cold blood, where onlookers described hearing loud bangs similar to gunshots.

Premier Jacinta Allan expressed her deepest sympathies to the the family, friends and colleagues of the two officers and announced prominent Melbourne buildings would be lit up in blue.

“It’s a very physical way that we can say to the men and women of Victoria Police, we stand with you, we support you, we care for you, we love you, particularly in this time of grief,” she said.

(Allanah Sciberras/AAP PHOTOS)

“We continue to provide every support necessary to the work of Victoria Police as they deal with this individual who perpetrated this most evil and awful of criminal act.”

Freeman was last seen wearing dark green tracksuit pants, a dark green rain jacket, brown Blundstone boots and reading glasses, police said.

He is believed to be a sovereign citizen, an ideology that questions government authority and whose followers believe the rule of law doesn’t apply to them and who disassociate from society.

Trump’s double down on Indian tariffs takes effect

US President Donald Trump’s doubling of tariffs on goods from India to as much as 50 per cent has taken effect as scheduled, escalating tensions between the world’s two largest democracies and strategic partners.

A punitive 25 per cent tariff imposed due to India’s purchases of Russian oil adds to Trump’s prior 25 per cent tariff on many products from India. It takes total duties to as high as 50 per cent for goods such as garments, gems and jewellery, footwear, sporting goods, furniture and chemicals – among the highest imposed by the US and on par with Brazil and China.

The new tariffs threaten thousands of small exporters and jobs, including in Prime Minister Narendra Modi’s home state of Gujarat.

India’s Commerce Ministry did not immediately respond to a request for comment. However, a Commerce Ministry official, speaking on condition of anonymity, said exporters hit by tariffs would receive financial assistance and be encouraged to diversify to markets such as China, Latin America and the Middle East.

A US Customs and Border Protection notice to shippers provides a three-week exemption for Indian goods that were loaded onto a vessel and in transit to the US before the midnight deadline. These goods can still enter the US at prior lower tariff rates before September 17.

Also exempted are steel, aluminium and derivative products, passenger vehicles, copper and other goods subject to separate tariffs of up to 50 per cent under the Section 232 national security trade law.

India trade ministry officials say the average tariff on US imports is around 7.5 per cent, while the US Trade Representative’s office has highlighted rates of up to 100 per cent on autos and an average applied tariff rate of 39 per cent on US farm goods.

Wednesday’s tariff move follows five rounds of failed talks, during which Indian officials had signalled optimism that US tariffs could be capped at 15 per cent, the rate granted to goods from some other major US trade partners including Japan, South Korea and the European Union.

Officials on both sides blamed political misjudgement and missed signals for the breakdown in talks between the world’s biggest and fifth-largest economies.

Exporter groups estimate hikes could affect nearly 55 per cent of India’s $US87 billion ($A134 billion) in merchandise exports to the US, while benefiting competitors such as Vietnam, Bangladesh and China.

Rate cut hopes dim as power bill shock sparks inflation

A shock jump in inflation has wrong-footed economists while diminishing hopes of more Reserve Bank interest rate cuts.

The monthly consumer price index rose from 1.9 per cent to 2.8 per cent as electricity prices surged 13 per cent in one month, the Australian Bureau of Statistics reported on Wednesday.

Analysts had only predicted the annualised rate to climb to 2.3 per cent.

“This is the highest annual inflation rate since July 2024, following several months of easing inflation,” the bureau’s head of prices statistics Michelle Marquardt said.

The jump in electricity prices, due to government energy rebates for NSW and the ACT not kicking in until August and annual price reviews coming into effect, contributed 0.3 percentage points to the headline figure.

The timing of energy rebates has made the headline inflation figure especially volatile of late and will drag electricity prices lower in September.

Also rising above expectations were other price figures that exclude items like electricity that tend to jump around, which could prove a worry for the RBA.

The annual trimmed mean rose from 2.1 per cent to 2.7 per cent, while the CPI excluding volatile items and holiday travel measure rose to 3.2 per cent, above the central bank’s two to three per cent target band.

While the jump in the monthly data will be unwelcome news to the central bank ahead of its upcoming meeting in late September, the RBA board places greater emphasis on quarterly trimmed mean figures, which are not due until October.

In its latest meeting minutes released on Tuesday, the board expected the unwinding of energy rebates would boost the headline inflation rate over 2025 and 2026.

But it was unclear what could make core inflation fall further, said HSBC chief economist Paul Bloxham.

Unemployment was low and steady, capacity utilisation was above its historical average and the economy was still being hamstrung by weak productivity.

Meanwhile, economic growth is in an upswing and construction work figures also released on Wednesday were higher than expected, causing Mr Bloxham to raise his prediction for next week’s GDP growth print to 0.5 per cent in the June quarter.

“Our central case is that the RBA will only be able to cut by a further 50 basis points in this easing phase (in November 2025 and February 2026), but we see the risks as clearly weighted to less easing than this, rather than more,” he said.

“Today’s figures increase the risk that the RBA is close to the end of its easing phase. An upside surprise in next week’s GDP figures could further increase that risk.”

Holiday travel and accommodation prices also rose strongly, given school holidays fell during July.

NAB senior markets economist Taylor Nugent said the release would tell the RBA little about the underlying pulse of inflation.

“The surprise was strength in travel and timing of electricity subsidy payments and so is not as material as it looks at face value.”

Even so, it raises the risk that the all-important trimmed mean for the September quarter comes in above the central bank’s forecast, he said.

Money markets repriced the chance of a September rate cut following Wednesday’s data release, from slightly above one-third to less than three-in-ten.

Treasurer Jim Chalmers emphasised the volatile nature of the monthly figures, reiterating that quarterly headline and trimmed mean inflation were at their lowest rates in almost four years.

“Today’s figures show the Albanese government’s responsible cost-of-living relief measures are making a meaningful difference in easing pressure on Australians,” he said.

“Rents rose 3.9 per cent through the year but would have risen 5.1 per cent without the recent increases to commonwealth rent assistance.”

Workers, union line up for share of $90m Qantas fine

A fight to divide the spoils of a $90 million fine could make former Qantas staffers $22,000 richer if the airline is not ordered to further fill union coffers.

Qantas outsourced 1820 baggage handling, cleaning and ground staff roles during the COVID-19 pandemic in 2020, a move the Federal Court ruled was designed to curb union bargaining power in wage negotiations.

Justice Michael Lee has ordered Australia’s flagship airline to pay the largest employer fine in Australia’s industrial history, citing the “sheer scale of the contraventions, being the largest of their type”.

He directed $50 million be paid to the Transport Workers’ Union for highlighting and prosecuting the illegal conduct but remains unsure where the remaining $40 million should end up.

The union on Wednesday argued for an even larger cut of the penalty pie, suggesting its share should be $60 million.

Affected workers could then split “an adequate sum” of $30 million, the court was told.

“Obviously, the vast bulk of (the remaining $40 million) should go to the employees,” the union’s barrister, Noel Hutley SC, told Justice Lee.

“But if Your Honour takes the position it should all go (to affected workers), the union is perfectly content with that course.”

Any interest generated by the $40 million while it awaits distribution should go to workers, the union said.

Mr Hutley said the union’s main concern was ensuring the debate did not delay payments to workers or incur further legal costs.

Qantas did not address the court on the $40 million issue.

Justice Lee, who was scathing of the federal government for not investigating Qantas despite the “array of powers” at its disposal, confirmed no outside party would receive a dollar.

“I don’t want any part of the penalty going to anyone except the affected workers … or the union,” Justice Lee said.

He will deliver his decision at a later date.

The workers are in line to receive about $65,900 each for economic loss, pain and suffering after Qantas agreed to establish a $120 million compensation fund.

Legal costs associated with the administration of the fund will be deducted from interest accrued on it.

General damages of $9000 have been paid out to 1759 former employees, which amounts to more than $15.8 million, the court was told on Wednesday.

The economic and non-economic loss suffered by the sacked workers is now under assessment for an award of further compensation.

“This was an egregious wrong that had to be righted,” TWU national secretary Michael Kaine said after the decision.

In his judgment, Justice Lee said some Qantas executives appeared to be more concerned about the damage done to the company than the affected workers or the illegal conduct.

“I accept Qantas is sorry, but I am unconvinced that this measure of regret is not … ‘the wrong kind of sorry’,” he said.

Chief executive Vanessa Hudson accepted the decision and apologised for the airline causing “genuine hardship for many of our former team”.

Qantas saved about $125 million in the year after the outsourcing and stood to save that amount annually, the court was told in 2021.

Australia ‘had to act’ on Iran’s hand in Jewish attacks

Australia was left with “no choice” but to take action over revelations the Iranian regime had directed two anti-Semitic attacks in Sydney and Melbourne.

The federal government has expelled Iranian ambassador Ahmad Sadeghi, making him the first high-ranking diplomat to be booted from Australia since World War II.

Australia’s spy agency said it had “credible evidence” the Iranian Revolutionary Guard directed at least two attacks on Jewish premises through connections with domestic criminal elements.

Iran’s ambassador to Australia was spotted leaving the embassy in Canberra on Wednesday morning as the government begins drafting laws to list the Revolutionary Guard as a terrorist organisation.

While the government has been hesitant to divulge details as other investigations continue, Australian National University Arab and Islamic Studies scholar Ian Parmeter believes the move must be grounded in “utterly compelling” evidence.

“If you’ve got evidence of that happening at the behest of a foreign country, you have to take action,” the former ambassador to Lebanon told AAP.

“I don’t think we really had any choice.”

Iran has denied the allegations, but Mr Parmeter believes such moves were “part of their playbook”.

In recent months, Iran has lost power in the Middle East.

The US bombed Iranian nuclear sites in June as part of Israel’s 12-day war with Tehran, and the fall of Syria’s Assad regime in December has taken down one of Iran’s closest allies.

“Iran feels very isolated,” Mr Parmeter said.

“The Islamic Revolutionary Guard Corps were, in a sense, thrashing about and trying to make themselves relevant again.”

Prime Minister Anthony Albanese said the anti-Semitic incidents were “an attack on our social fabric and who we are”.

Iran’s foreign ministry spokesman Esmail Baghaei denied the allegations and linked them to challenges Australia faced with Israel after the government announced it was preparing to recognise a Palestinian state.

A government spokesperson was quoted by state media as saying Iran would take an “appropriate decision” in response to Australia’s action.

Australians in Iran have been urged to leave immediately as the government no longer has an embassy there.

“The Iranian regime is an unpredictable regime, a regime which we have seen is capable of aggression and violence,” Foreign Minister Penny Wong told ABC Radio.

The government’s travel advice has also been updated to warn of a “high risk” of arbitrary detention or arrest.

The Iran-Australia relationship has never been particularly close but is now “as low as it’s been”, Mr Parmeter said.

Australia has previously expelled lower-level diplomats, booting Russian spies in 2018 over a nerve-agent attack and ousting an Israeli representative in 2010 after forged Australian passports were used in the assassination of a Hamas operative.

But these expulsions were carried out “fairly quietly” compared to Tuesday’s Iranian announcement.

Coalition home affairs spokesman Andrew Hastie welcomed the move, saying “any foreign power who conducts violent operations through proxies on our shores is not welcome here”.

The Adass Israel Synagogue was one of the sites firebombed by criminal proxies in December 2024, badly damaging the building and injuring a worshipper.

Synagogue board member Benjamin Klein said he received a call from a senior official in Mr Albanese’s office telling him the government would announce “dangerous acts of aggression” were directed by Iran.

“It is quite shocking and traumatic to think that a peaceful, loving shule (synagogue) in Melbourne is targeted and attacked by terrorists from overseas,” Mr Klein told AAP.

The other site targeted was the Lewis’ Continental Kitchen in Sydney, a kosher deli and a mainstay of Bondi in the city’s eastern suburbs, which was firebombed in October.

Executive Council of Australian Jewry co-CEO Alex Ryvchin said the owner of the popular shop, Judith Lewis, was still processing revelations that the Revolutionary Guard had been linked to the attack.

“The fact that a business is targeted makes every Jewish Australian fearful that they could be next,” he said.

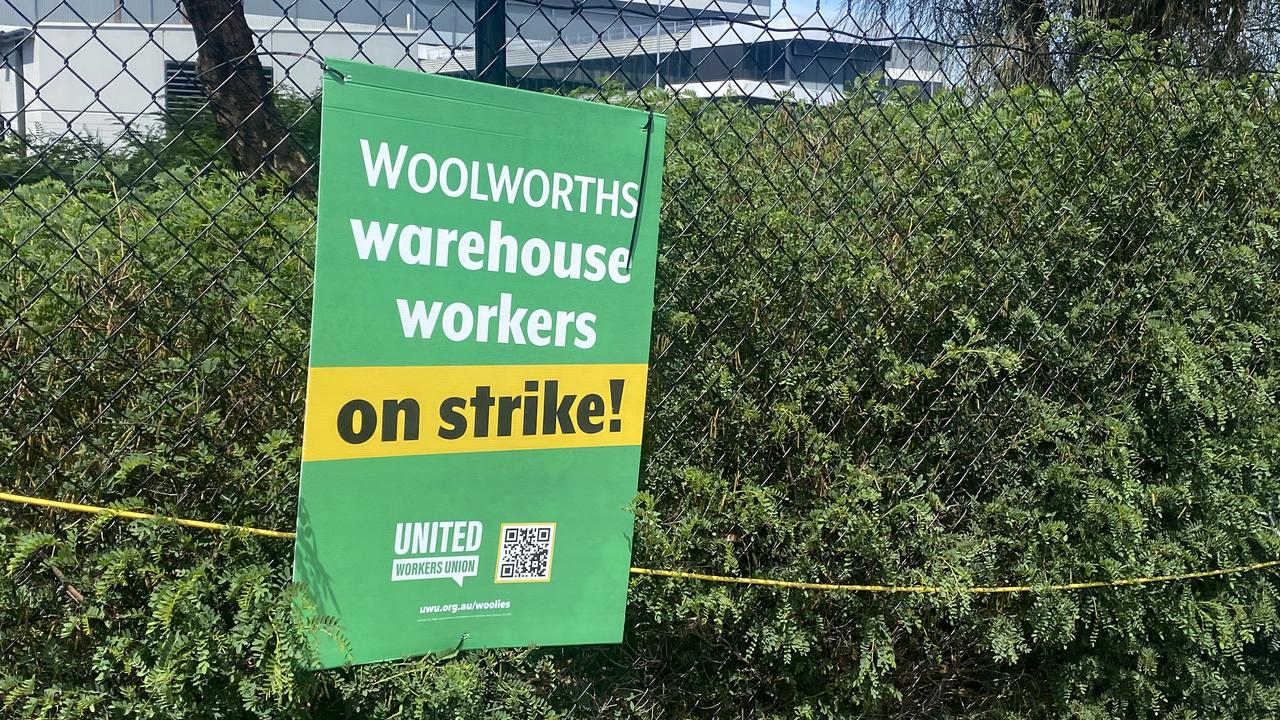

Shoppers check out of Woolies as Coles registers gains

Australians are swapping their shopping allegiances, with Woolworths losing ground to smaller supermarket rival Coles after years of market dominance.

And investors are losing patience.

Woolworth’s shares on Wednesday afternoon were on track for their biggest decline in many years, falling 13 per cent after posting a financial performance CEO Amanda Bardwell said was well below its expectations.

It’s a stark contrast with Coles, whose shares have climbed more than 11 per cent since Tuesday morning, when the supermarket and liquor group beat earnings expectations almost across the board.

Woolworths said that for the first eight weeks of 2025/26, Australian supermarket sales excluding tobacco were up four per cent compared with the same time last year.

RBC Capital Markets analyst Michael Toner pointed out Coles on Tuesday reported supermarket sales excluding tobacco products were up 7.0 per cent over the same period.

That was a big difference, he said, adding Woolworths “appears to be losing market share to Coles”.

The results show Woolworths falling behind Coles, Jefferies deputy head of equity research Michael Simotas said.

“You’re clearly lagging your major competitor by a fairly large margin, probably the largest margin we’ve seen in quite some time,” he commented on an analyst call.

Sales were up 3.6 per cent to $69.1 billion, but earnings before interest, tax, depreciation and amortisation fell 3.5 per cent to $5.7 billion on a normalised basis.

Coles shares were set to close at their highest level on Wednesday, while Woolworths’ WOW shares were on pace to finish at a five-month low.

Adding insult to injury for its shareholders, Woolworths announced it would cut its dividend by 21.1 per cent after its net profit fell 17.1 per cent to $1.39 billion.

Woolworths said the drop in profit reflected higher finance costs and lower earnings, which were hit by a number of issues.

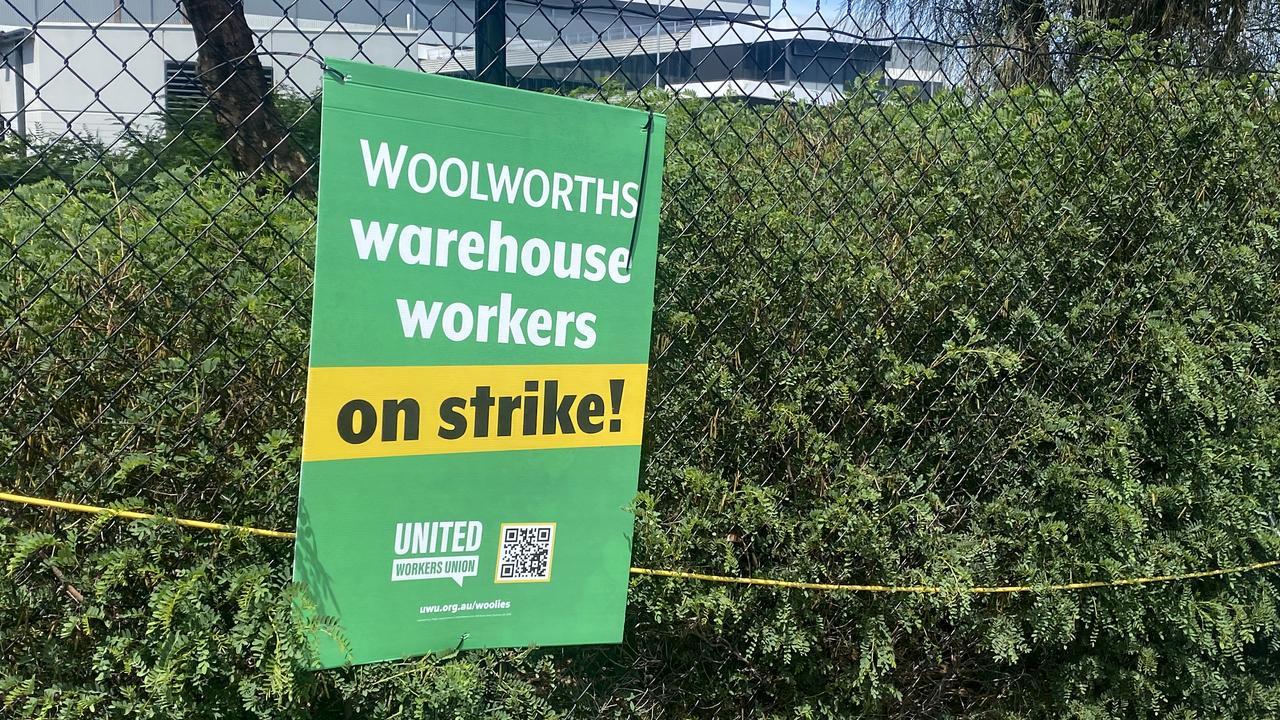

Industrial action in the first half cost the group $95 million, and it spent $73 million in dual-running costs as new high-tech warehouses get up and running.

Woolworths’ cost of doing business also rose, mostly because of a 4.25 per cent wage increase for Australian retail team members.

In addition, it posted $569 million in impairments, including writing off $346 million from the value of Big W after a financial performance below expectations.

A Disney Discs collectibles campaign had also underperformed, Ms Bardwell said, blaming collectibles fatigue among consumers.

Coles CEO Leah Weckert in contrast a day previously had credited its Harry Potter Magical Discs campaign with helping lift sales.

Coles said theft declined in 2024/25, while Woolworths said it had increased during the second half, along with acts of aggression against staff.

Woolworths will pay a 45c final dividend, down from last year’s 57c payout, while Coles kept its final dividend steady.

Etoro analyst Josh Gilbert said Woolworths’ dividend cut would be “a kick in the teeth for loyal shareholders who’ve endured zero growth from shares in the last five years, and that won’t do much for confidence”.

Flight Centre expects travel turbulence to continue

Flight Centre isn’t expecting a quick rebound after having to twice downgrade its earnings forecasts in the past few months, but hopes interest rate cuts will spur travel momentum in 2026.

The online travel agency on Wednesday delivered a $289.1 million underlying profit before tax, in line with revised expectations but far less than the $365 million to $405 million it had forecast in November and reaffirmed in February.

Flight Centre said its peak fourth-quarter trading had been impacted by escalating Middle East tensions and a global downturn in leisure travel to the US, where there have been a number of high-profile incidents of tourists encountering problems with border authorities.

“After two years of strong recovery post-COVID, FY25 proved to be a more challenging trading period,” said managing director Graham Turner.

Flight Centre said it expected the cyclical challenges that affected its 2024/25 results would continue to impact booking and travel patterns in 2025/26, forecasting its first-half profit would be “reasonably flat”.

But the travel group expects accelerated profit growth in the second half as the trading cycle improves, with the prospects of further rate cuts in some nations helping to alleviate cost-of-living pressures and boosting consumer confidence.

There’s been early signs of stabilisation including improvement in some key consumer confidence metrics, Flight Centre said.

The company has high hopes for a new leisure loyalty program it will unveil later in 2025.

Flight Centre said the program will also span Travel Associated and Cruiseabout in Australia, and will reward customers across the entire travel journey with the most accessible and diverse redemption options in the market.

In early afternoon trading FLT shares were down 2.8 per cent to $12.57.

Not so great value: Woolworths disappoints, shares drop

Woolworths has badly disappointed investors, just a day after its biggest rival delighted them.

Woolworths shares were on track for their worst performance in more than six years on Wednesday, plunging 13.9 per cent to a five-month low of $28.76 in early trading after Australia’s biggest private employer posted a big decline in full-year profit.

Coles shares, in contrast, were up 2.8 per cent to a fresh all-time high of $23.13, building on its stellar 8.5 per cent gains on Tuesday after the supermarket and liquor group beat earnings expectations almost across the board.

Woolworths’ losses on Wednesday came after it announced it would cut its dividend by 21.1 per cent after its net profit fell 17.1 per cent to $1.39 billion.

Sales were up 3.6 per cent to $69.1 billion, but earnings before interest, tax, depreciation and amortisation fell 3.5 per cent to $5.7 billion on a normalised basis.

Chief executive Amanda Bardwell said Woolworths’ financial performance was well below its expectations and those of shareholders, and it was taking action to reposition itself.

“You’re clearly lagging your major competitor by a fairly large margin, probably the largest margin we’ve seen in quite some time,” Jefferies deputy head of equity research Michael Simotas commented on an analyst call.

Woolworths said the drop in profit reflected higher finance costs and lower earnings, which were hit by a number of issues.

Industrial action in the first half cost the group $95 million, and it spent $73 million in dual-running costs as new high-tech warehouses get up and running.

Woolworths’ cost of doing business also rose, mostly because of a 4.25 per cent wage increase for Australian retail team members.

In addition, it posted $569 million in impairments, including writing off $346 million from the value of Big W after a financial performance below expectations.

A Disney Discs collectibles campaign had underperformed and theft and acts of aggression against Woolworths team members had increased during the second half, something the company has been taking steps to address.

Woolworths said that for the first eight weeks of 2025/26, Australian supermarket sales excluding tobacco were up four per cent compared with the same time last year.

RBC Capital Markets analyst Michael Toner pointed out that Coles on Tuesday reported supermarket sales excluding tobacco products were up 7.0 per cent over the same period.

That was a big difference, he said, adding Woolworths “appears to be losing market share to Coles”.

Woolworths will pay a 45c final dividend, down from last year’s 57c payout.