Calls to power up energy workforce as shortfall looms

As the sun sets on the Eraring Power Station’s operating life, Brett Harvey is one of several employees keen on staying in the energy industry.

Nearly all workers at Origin’s power station in NSW, due to shutter in two years as the nation weens itself off fossil fuels, have been eligible for retraining in whatever they choose.

Some have pursued careers outside the energy industry but more than 80 per cent have decided to stay, taking up the opportunity to train up as electricians or other occupations better suited to a low emissions economy.

It’s a welcome trend at a time when Australia faces a 42,000 shortfall of energy, gas and renewables workers by 2030 that the Powering Skills Organisation warns could blow out further without concerted effort to keep people moving through the training system.

An extra 22,000 apprentices should have been on the tools last year to meet the workforce needs of the transition, according to the government-backed independent jobs and skills council.

A failure to keep a healthy pipeline of electricians and other essential occupations progressing through training risks further slowing a clean energy transition already feeling the weight of cumbersome planning processes, community opposition and other roadblocks.

Mr Harvey, currently an instrumentation technician, is looking at a number of upskilling opportunities in the energy space, including a training and assessing certification.

A shortage of educators and training infrastructure has proven a stubborn problem and a top priority for Powering Skills Organisation chief executive officer Anthea Middleton.

Getting employers to take on apprentices was a perennial issue, she explained, exacerbated by an eight-fold increase in the value of major energy projects over the past 10 years.

“What is often misunderstood in the system is that everyone wants to hire a trained electrician, but no one wants to train the electrician,” she told AAP.

Training is a costly exercise dominated by small businesses that often do not reap the rewards of an extra pair of hands because their apprentices are snapped up by bigger outfits in their third or fourth years.

Enforcing early-stage apprentice quotas on major projects, namely large businesses, was flagged by the organisation as a way to incentivise the big end of town to bring on fresh trainees.

Ms Middleton was “urgently optimistic” Australia’s workforce hurdles could be overcome to clear the way for a fast, efficient energy transition but it was important to be ambitious.

“We really do need a collective view from the states and territories and the federal government on things like energy policy, on things like system reform,” she said.

Federal Skills and Training Minister Andrew Giles said meeting the energy workforce needs of the nation represented both a “huge challenge” and “equally huge opportunity”.

“Achieving our net zero targets, powering Australia with cheaper, cleaner, more reliable energy will, of course, require a large, indeed, a larger and a highly skilled workforce.”

Mr Giles outlined a number of existing federally-funded programs aimed at solving problems in the trainee pipeline, including a $30 million commitment towards turbo-charging the teacher, trainer and assessor workforce.

“We need to continue to work together – governments, industry, unions and other stakeholders – to get more apprentices into Australia’s energy sector.”

Qantas profit soars, reputation repairs ‘on schedule’

Qantas shares have taken flight after Australia’s largest airline delivered one of its biggest profits, raised its dividend and splashed out on another 20 mid-range aircraft.

Qantas on Thursday posted a $1.6 billion full-year statutory net profit after tax, up 28.3 per cent from a year ago, while its underlying pre-tax profit rose 15 per cent to $2.4 billion.

Citing customer loyalty surveys, Qantas said its reputation and brand was “rebuilding at a strong and steady pace,” an allusion to the battering the airline took at the end of Alan Joyce’s tenure as CEO in 2023.

Replacement chief executive Vanessa Hudson deserved credit for turning things around, EToro analyst Josh Gilbert said.

“(Ms) Hudson inherited a mammoth challenge in balancing shareholder returns, rebuilding trust with consumers, and satisfying regulators,” he said.

“Just under two years in the job, and the results speak for themselves.

“The airline has stabilised, costs are being managed effectively, and customer sentiment is slowly being rebuilt.”

The latest blow to the airline’s reputation was a record $90 million fine earlier in August for illegally sacking 1820 staff.

It added to a $100 million fine it received for selling tickets to flights that were already cancelled between 2021 and 2023, against the backdrop of executives pocketing seven-figure bonuses.

Revenue for the year ended June 30 grew 8.6 per cent to $23.8 billion, thanks to growth in its international operations and strong demand for domestic business and leisure travel.

In early afternoon trading, Qantas shares were on track for their best performance in over two years, rising 9.1 per cent to an all-time high of $12.12.

The airline said it had ordered 20 Airbus A321XLR aircraft that will begin arriving in 2028, taking its total order for the next-generation planes to 48.

The jets have a range of 8700km, about 3000km more than the Boeing 737s they will replace.

The aircraft will allow Qantas to launch flights to destinations across Southeast Asia and Pacific islands that are not currently viable.

Qantas flagged Perth-India and Adelaide-Singapore as two possibilities for new routes and said more updates would follow.

Sixteen of the jets will have lie-flat business seats and seat-back entertainment screens for longer routes, such as flights between Perth and the east coast as well as short- and medium-haul international routes.

Qantas’ first two A321XLRs, configured for domestic and short-haul international trips, are expected to begin flying mid-September on the busy Sydney-Melbourne and Sydney-Perth routes.

“Investing in new aircraft is one of the most significant ways that we can provide our customers with a better flying experience,” Ms Hudson said.

“These billion dollar investments are possible because of our continued strong financial performance.”

Ms Hudson said direct flights to London and New York from Australia’s east coast were a step closer to reality, with the first Project Sunrise A350-1000ULR set to move to Airbus’ final assembly line in France in October.

Qantas expects to take delivery in October 2026 and to make its first Project Sunrise flights in the June quarter of 2027.

Qantas will pay investors a final dividend of 16.5 cent per share as well as a special dividend of 9.9 cents per share.

The airline also announced it would pay about 25,000 of its non-executive employees $1000 in Qantas shares each year.

Business boost as more nuisance tariffs get the chop

Hundreds of “nuisance” tariffs on imports including tyres, televisions and wine glasses will be slashed in a move that will save businesses millions of dollars.

Abolishing an extra 500 imposts, which increase prices consumers pay for goods and cost more in compliance than they raise in revenue, was a recommendation of Treasurer Jim Chalmers’ economic roundtable earlier in August.

“It’s a bit mad, frankly, that in some of these areas where we’re importing a lot of goods, we spend a lot of time and money – we being business and governments – complying with a regime that nets us almost no income and just adds a bigger compliance burden,” Dr Chalmers told reporters on Thursday.

In its first term, the Albanese government slashed 457 tariffs on goods ranging from toothbrushes to washing machines.

The latest tranche of cuts will spare businesses more than $32 million each year complying with tariffs on tyre imports, which raise less than $80,000.

Another $13 million in compliance costs will be saved for tariffs on televisions, which raise less than $43,000. Wine glass importers will be saved $375,000 while cutting air conditioner tariffs will save more than $504,000 each year.

“We are doing this for a very simple reason. These nuisance tariffs often do more harm than good,” Dr Chalmers said.

The Business Council of Australia called the move a “smart and sensible decision”, clearing away outdated barriers and making the economy more efficient.

“Removing low-value, high-cost tariffs is a great start and now we need to look at further reform to address productivity so we can increase real wages and lift living standards,” said BCA chief executive Bran Black.

While there was broad support during the roundtable to abolish more nuisance tariffs, Australian Council of Trade Unions assistant secretary Liam O’Brien was more cautious, urging the government to consult unions and workers in affected industries beforehand.

Treasury will consult on the 500 tariffs before a final list is agreed on and published in next year’s budget.

The government emphasised it was also strengthening protections for Australian businesses from unfair trade practices, modernising the nation’s anti-dumping regime by bringing responsibility for safeguard measures under the one roof.

Show us your ‘cojones’: cricket star tests PM on Israel

Cricket great Usman Khawaja has urged the prime minister to act with courage and sanction Israel.

Mr Khawaja spoke with Prime Minister Anthony Albanese in Parliament House about the deteriorating situation in Gaza and gambling reform.

Although their meeting was initially cancelled due to scheduling conflicts, they found a new time on Thursday, according to Treasurer Jim Chalmers.

Prior to the face-to-face, the Australian batsman revealed he had voted for Labor at the May federal election and had faith in Mr Albanese.

“I actually have a lot of love and a lot of respect for the prime minister …. at times he’s 100 per cent shown courage,” Mr Khawaja told reporters in Canberra.

“It takes a little bit more courage to go for the next step and have sanctions, and I genuinely believe Prime Minister Albanese is the man to have the courage and do that.

“He’s shown that he’s got, (for lack of) better words, the cojones to go out there and do it.”

Although the federal government has introduced broad sanctions on countries like Russia and Myanmar, it is yet to do so for Israel.

Dr Chalmers, who joined the discussions between Mr Khawaja and the prime minister, said they had a great deal of respect for the cricketer.

“He’s a leader of real substance,” he told reporters.

“So I take his contribution very seriously.”

Standing alongside independents, outspoken Labor MP Ed Husic and human rights activists, the sportsman laid bare the suffering of Palestinian civilians in Gaza.

The United Nations-backed Integrated Food Security Phase Classification has officially declared widespread famine in area.

More than 470,000 people now face catastrophic levels of food insecurity as Israel continues throttling aid into the territory.

More than 62,000 Palestinians have been killed in the latest conflict, including more than 18,000 children, according to local health authorities.

“It’s been 22 months of absolute horror in Gaza,” Médecins Sans Frontières humanitarian affairs lead Arunn Jegan told reporters.

“Food and medicine sit at Gaza’s borders blocked by Israel and when Palestinians try to reach what little is allowed through, they are killed.

“This is a genocide, this is not just a crime against Palestinians, this is a crime against humanity.”

In direct contradiction to this and reports from more than 100 humanitarian groups, Israel has denied starvation in Gaza and allegations of genocide.

A genocide case against Israel has been brought to the International Court of Justice, and the International Criminal Court has issued arrest warrants for Israeli Prime Minister Benjamin Netanyahu for his alleged responsibility for war crimes of starvation as a method of warfare.

Israel’s military campaign in Gaza began after the designated terror group Hamas killed 1200 Israelis and took about 250 more hostage on October 7, 2023.

The International Criminal Court has also issued an arrest warrant for former Hamas commander Mohammad Deif over alleged crimes against humanity and war crimes, though he was assassinated by an Israeli air strike in 2024.

As the humanitarian situation continues to deteriorate, Australia has issued stronger condemnations of Israel and announced its intention to recognise the state of Palestine at the United Nations General Assembly in September.

Mr Khawaja praised that move but urged the PM to go further.

“The prime minister has an opportunity right now to cement his legacy, to say ‘I fight for the people, I’m fighting for humanity’,” he said.

During Australia’s Test series in December 2023, the International Cricket Council barred the opener from wearing boots sporting the words “all lives are equal” and “freedom is a human right” and using a bat with an image of a dove.

What cost of living crisis? Kmart owner profit soars

The owner of some of Australia’s best-known chain stores has reported a double-digit profit jump after successfully navigating a cost of living crisis and rising costs.

Wesfarmers on Thursday posted a bottom-line net profit of $2.9 billion for the 12 months to June 30, up 14.4 per cent on the prior year.

Revenue rose 3.4 per cent to $45.7 billion, while earnings before interest and tax grew 11.9 per cent to $4.47 billion.

Wesfarmers owns Kmart, Target, Bunnings and Officeworks and has interests in chemical, fertiliser and safety products.

“Wesfarmers’ earnings growth in challenging trading conditions is a credit to our team members, who continued to find ways to support customers and create shareholder value,” managing director Rob Scott said.

Earnings for Kmart Group, which includes Target, grew 9.2 per cent to $1 billion, while Bunnings’ earnings rose 3.8 per cent to $2.3 billion. Officeworks’ earnings climbed 1.9 per cent to $212 million.

EToro market analyst Farhan Badami said Wesfarmers had delivered a strong set of numbers and that the results showed off its pricing power and supply chain strength.

“It has a unique competitive advantage of offering low prices that allow it to expand margins even as consumers hunt for value,” Mr Badami said.

“At nearly 40x forward earnings, Wesfarmers is priced for perfection following a 28 per cent rally this year, but these results show it has earned that premium.”

Wesfarmers plans to upgrade more of its Kmart stores to a new “Plan C+” format, with improved design and layout and a full store refresh, after seeing improved trading in the five that have already been transformed.

Wesfarmers will pay a final dividend of $1.11 per share, for a total dividend for 2024/25 of $2.06 per share, an increase of four per cent.

In early Thursday trading, Wesfarmers shares were 0.1 per cent higher at $91.78.

Qantas orders another 20 jets as profit takes off

Australia’s biggest airline has posted a strong full-year result and ordered another 20 mid-range aircraft.

Qantas posted a bottom line net profit of $1.6 billion in for the year ended June 30, up 28.3 per cent from a year ago.

Its underlying pre-tax profit rose 15 per cent to $2.4 billion.

Revenue grew 8.6 per cent to $23.8 billion, thanks to growth in its international operations and strong demand for domestic business and leisure travel.

The airline will order another 20 Airbus A321XLR aircraft which will begin arriving in 2028, taking its total order for the next-generation planes to 48 aircraft.

The jets have a range of 8700km, around 3000km more than the Boeing 737 it replaces, and will allow Qantas to launch flights to destinations across Southeast Asia and the Pacific islands that aren’t currently viable.

Qantas’ first two A321XLRs, configured for domestic and short-haul international trips, are expected to begin flying in mid-September on the Sydney-Melbourne and Sydney-Perth routes.

“Investing in new aircraft is one of the most significant ways that we can provide our customers with a better flying experience and these billion-dollar investments are possible because of our continued strong financial performance,” said CEO Vanessa Hudson.

Qantas will pay investors a final dividend of 16.5 cent per share as well as a special dividend of 9.9 cents per share.

Politicians accused of inflaming fears over crime rates

Rising fears among most Australians of spiralling crime rates do not match reality and politicians are often to blame for stoking alarm, experts say.

A Roy Morgan survey of about 500,000 people found 66 per cent said crime was a growing problem in their community.

Queensland recorded the highest level of concern about crime at 77 per cent, spiking from 60 per cent five years ago, followed by Victoria at 72 per cent.

Crime rates become topical during election cycles and can increase community fears, Roy Morgan CEO Michele Levine says.

“Although the trend of rising concern about crime is seen nationally, there are clearly some states in which the issue is set to play an outsized role over the next 12-18 months,” she said.

Queensland Premier David Crisafulli swept into power in 2024 on the back of pledges to crack down on youth crime.

His government passed the much-criticised Making Queensland Safer Act in December and expanded the “adult crime, adult time” legislation in May, with sentences of young offenders increased drastically.

But the level of concern about crime varied greatly and was triggered by disruptive events, said Griffith University Institute of Criminology director Rebecca Wickes, who has studied people’s perceptions of crime for two decades.

“When a really serious, violent incident occurs, like homicide, people get very concerned,” she told AAP.

“They see that as a signal or a symbol that something’s gone wrong.

“But when you actually look at homicide in in the Australian context, one, we have phenomenally low rates, compared to other advanced Western economies.”

Professor Wickes said the focus on scapegoating young people by politicians and sections of the media was nothing new because “law and order has always been a politicised platform”.

She said decades of research showed that locking up people did not reduce crime and Australia is a less violent country.

“One of the things we know for certain is that the more involvement a young person has with the criminal justice system, the more likely are they are to re-offend in the future,” Dr Wickes said.

The Human Rights Law Centre slammed the Victorian government for passing harsh bail laws on Wednesday it argues will put more First Nations people behind bars.

“These laws are a disaster waiting to happen, and are part of a disturbing trend across the country towards regressive policies … driving up the number of untried and unsentenced people in prison,” the centre’s First Nations justice director Maggie Munn said.

Earlier in August, the Justice Reform Initiative criticised NSW Premier Chris Minns for introducing tough bail laws that do not necessarily prevent crime and it says were passed for short-term political gain.

The latest Bureau of Crime Statistics and Research data released in August shows the number of youth detained in the state had grown by almost 35 per cent in two years, with 60 per cent of them Aboriginal.

Tradie trouble: Australia lags in energy upskilling job

An extra 22,000 apprentices should have been on the tools last year to meet the workforce needs of the renewables transition and green manufacturing boom.

Australia has made inroads on its net zero labour shortages, a government-backed independent industry body says, but warns trainee numbers are still off-track.

A failure to keep a healthy pipeline of electricians and other essential occupations progressing through training risks further slowing a clean energy transition already feeling the weight of cumbersome planning processes, community opposition and other roadblocks.

Powering Skills Organisation said 42,000 extra workers would be needed for energy, gas and renewables industries by 2030 in its latest update on workforce dynamics in the industry.

It’s a figure previously at the upper end of estimates but now looking increasingly likely as Australia leans into its green metals and broader clean manufacturing opportunity.

To have enough energy workers by the end of the decade, the Powering Skills Organisation would have liked to have seen 40 per cent more apprentices in training in 2024, representing an increase to 77,000 from 55,000.

Chief executive officer of the organisation, Anthea Middleton, said getting employers to take on apprentices was a perennial issue exacerbated by an eight-fold increase in the value of major energy projects over the past 10 years.

“What is often misunderstood in the system is that everyone wants to hire a trained electrician, but no one wants to train the electrician,” she told AAP.

Training is a costly exercise dominated by small businesses that often do not reap the rewards of an extra pair of hands because their apprentices are snapped up by bigger outfits in their third or fourth years.

Long waits for the in-classroom component of learning and a shortage of trainers are other issues gumming up the pipeline.

The PSO has outlined a number of solutions to training bottlenecks, including a national register for hopefuls seeking apprentice spots and boosting training infrastructure and trainer numbers.

Enforcing early-stage apprentice quotas on major projects, namely large businesses, was billed as a way to incentivise the big end of town to bring on fresh trainees.

Ms Middleton was “urgently optimistic” Australia’s workforce hurdles could be overcome to clear the way for a fast, efficient energy transition but it was important to be ambitious.

“We really do need a collective view from the states and territories and the federal government on things like energy policy, on things like system reform,” she said.

The workforce report will be released at a Parliament House event with federal Skills and Training Minister Andrew Giles on Thursday.

The minister said up to $10,000 in financial support for apprentices and other federal schemes in skills and training were helping.

“We need to continue to work together – governments, industry, unions and other stakeholders – to get more apprentices into Australia’s energy sector,” he said.

Jail risk as judge rules on tax office whistleblower

Whistleblower Richard Boyle is set to learn his fate after exposing unethical debt-collection practices at the Australian Taxation Office.

Judge Liesl Kudelka will sentence Boyle, 49, in the South Australian District Court, seven years after the former debt collection officer went public with allegations that led to reforms within the ATO.

In a plea deal with prosecutors, the Adelaide man has admitted four criminal charges, reduced from the original 66 laid after he appeared on the ABC’s Four Corners program.

Boyle has admitted disclosing protected information to another entity, making a record of protected information, using a listening device to record a private conversation and recording other people’s tax file numbers.

Each charge carries a maximum penalty of two years’ jail.

Whistleblower Justice Fund founder Rex Patrick said a custodial sentence was unlikely because there had been a plea deal and the government’s lawyers didn’t seek a jail term “but ultimately that’s a decision for the judge”.

Another potential outcome was a conviction with a non-custodial sentence such as a good behaviour bond.

“The third option – which is what a number of people, including myself, wrote to the court urging – was no conviction, basically saying he didn’t operate with malice,” Mr Patrick said.

“He actually thought he was protected. It’s taken four judges, and silks and lawyers to work out whether or not he was protected.

“He went in thinking he was but it turns out that he wasn’t. All he did was press a record button, he took a photograph, he sent an encrypted email to his lawyer.”

In a speech in 2024, Boyle said the experience had left him “broken, physically, mentally and financially”.

The Human Rights Law Centre’s Kieran Pender said prosecuting whistleblowers had “a chilling effect on people speaking up”.

“The sentencing of Richard Boyle concludes a long and sorry saga that significantly undermined whistleblower protections in Australia,” he said.

“It is critical that the Albanese government and Attorney-General Michelle Rowland now act to better protect whistleblowers and ensure cases like this never happen again.”

Mr Patrick said Boyle’s treatment was “disgraceful” and there was no public interest in prosecuting him.

“The federal government knew whistleblower laws were broken and had made a commitment to change them,” he said.

“The attorney-general (Mark Dreyfus) could have, in the public interest, stopped the prosecution, and he didn’t do that.”

Independent senators David Pocock and Jacqui Lambie have tabled the Whistleblower Protection Authority bill in parliament “but that’s only a start”, Mr Patrick said.

“We also need to change the laws so that people are protected when they do reasonable things in the context of preparing a public interest disclosure … the government knows that bit’s broken, and yet they did nothing.”

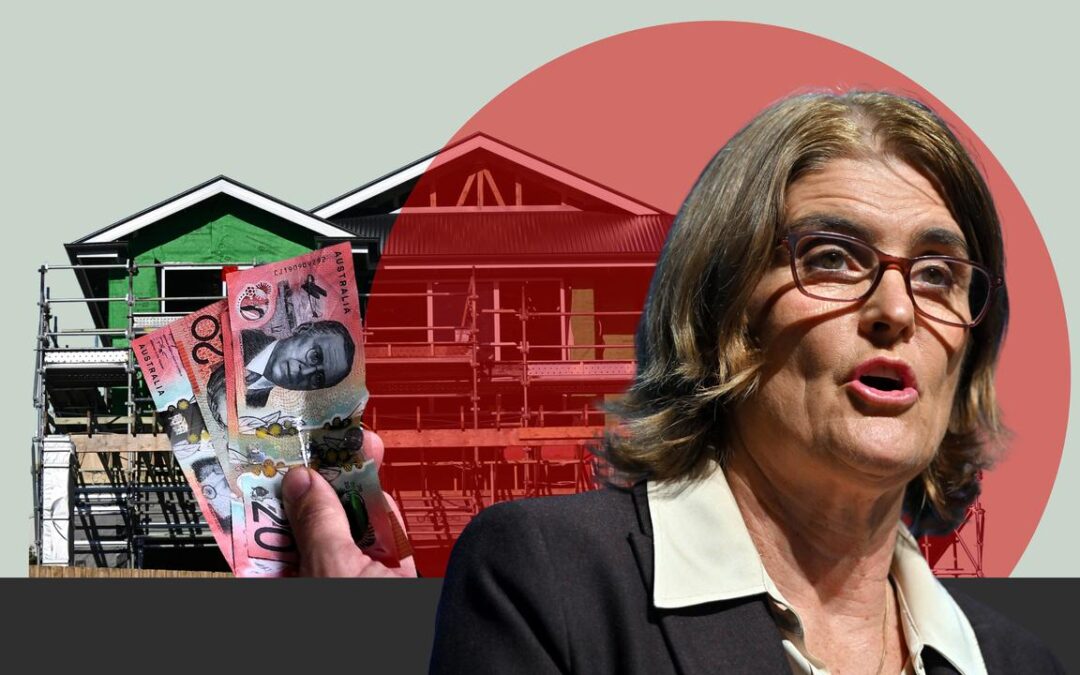

Inflation ‘quirks’ unlikely to spook Reserve Bank board

A surprise jump in inflation has dimmed the prospects of a back-to-back Reserve Bank rate cut, but it’s too early to write it off completely.

Traders lowered the odds of a rate cut at the central bank’s next meeting in late September after the Australian Bureau of Statistics on Wednesday reported the headline consumer price index surged from 1.9 per cent to 2.8 per cent in July.

While the news wouldn’t have been positively received at the central bank, CBA economist Harry Ottley warned against reading too much into the volatile data.

The inflation jump exceeded forecasts largely because payments for Commonwealth energy rebates that were expected to kick in in July will only start in August.

School holidays, which fell in July, also drove up travel costs.

“Much of the outsized surge in inflation can be explained by quirks regarding the timing of electricity rebates and holiday travel,” Mr Ottley said.

“These monthly movements will likely unwind in coming months.”

The less goods-heavy August monthly inflation print, which will be released in September ahead of the next RBA meeting, will provide important information about how transitory the price spikes were and whether services inflation is still tracking lower.

“(The RBA) has also been at pains to point out the volatility in the monthly figures. For this reason, the board is unlikely to be overly concerned about the surprisingly strong print,” Mr Ottley said.

Money markets had been pricing in the chance of a September rate cut at more than a third, but lowered the odds to less than a quarter following the data release.

But traders are still optimistic the Reserve Bank and governor Michele Bullock will deliver its fourth rate cut this year in November, with another one to follow by early 2026.

Sluggish economic growth could also boost the case for a rate cut.

The Westpac-Melbourne Institute leading index, which draws on a range of domestic and international data points to paint a picture of future economic growth, ticked up slightly in July but still points to sluggish growth in coming months.

“The recovery that started to take shape in last year continues to proceed slowly,” said Matt Hassan, Westpac Economics head of Australian macro-forecasting.

ANZ senior economist Adelaide Timbrell expects fresh data out on Thursday to show business spending on new private capital grew at just 0.2 per cent in the June quarter.

“We expect to see sluggish growth in capex, as the uncertain global backdrop has led to weak investment appetite,” she said.