Hanson burqa stunt will lead to ‘abuse’ against women

Pauline Hanson’s “despicable” decision to wear a burqa in the Senate has been condemned by politicians across the divide, amid warnings the stunt will fuel abuse and harassment against Muslim girls and women.

The One Nation leader entered the upper house on Monday afternoon wearing the religious garment shortly after failing to move a bill banning the Islamic covering from public places.

Senator Hanson has been lashed by her parliamentary colleagues in the Greens, coalition and the crossbench.

Independent senator Fatima Payman, who quit Labor over its stance on Palestine, said the behaviour left others feeling unsafe.

“This is … an old trick that Pauline Hanson’s pulled out of the bag. Very disrespectful, very un-Australian,” she told ABC News

Senator Payman, a Muslim, said the stunt would most likely lead to school girls and women wearing hijabs to be abused or assaulted.

Cabinet minister Tanya Plibersek pointed to the issue of growing right-wing extremism in Australia.

“I don’t remember the last time someone in a burqa robbed a bank, but I do recall a couple of weeks ago that there was a queue of neo-Nazis standing outside NSW Parliament,” she told ABC radio.

“Senator Hanson’s stunt yesterday is simply a guarantee that some schoolgirl wearing a headscarf’s going to get bullied on the train on the way to school today. I don’t see how it helps anyone.”

Opposition Leader Sussan Ley said the stunt weakened the controversial senator’s case and cheapened the nation’s parliament.

“This is a reminded of how brittle One Nation’s politics are, they must resort to reheating desperate stunts,” she said.

“Australians deserve better and we will remain focused on fighting for them and holding the government to account.”

Senate President Sue Lines ordered Senator Hanson to leave the chamber for being disrespectful.

It’s the second time Senator Hanson has worn the burqa inside the parliament.

After first attempting the stunt in the upper house in 2017, Senator Hanson was slammed by then attorney-general George Brandis, who labelled it an “appalling thing to do”.

Speaking on the latest incident, Mr Brandis labelled it “despicable”.

“Every once in a while, she dreams up a new stunt to try and make herself the centre of political attention and discussion,” he told ABC radio.

“It reminds people both that the One Nation party has absolutely nothing to offer the Australian people, but also that the kind of politics they practice are ugly and divisive politics.”

Asked about the increase in One Nation’s popularity, Mr Brandis said he’s “not overly alarmed”.

Redbridge Group director and former Victorian Labor strategist Kos Samaras said the “permanent problem for right-wing populist outfits is that protest is easy.”

“That only grows the base so much,” he wrote on X.

“Sooner or later you have to project a serious alternative, not just a rolling stunt show.”

Floral tributes for teen allegedly murdered near school

Flowers are being laid at the scene of a teen’s stabbing death behind a high school as a 15-year-old boy faces court for the alleged murder.

The alleged victim, a boy aged 17, died from stab wounds to his thigh after a confrontation at a park in Sydney’s northwest about 4.20pm on Monday.

About three hours later, the younger boy arrived at a police station with a parent, police say.

He was later charged with murder and is due to face court on Tuesday.

The alleged stabbing occurred in a reserve area, close to several high schools and within sight of multiple people who were walking nearby.

Authorities remained at the scene on Tuesday.

Locals were seen in the area on Tuesday morning, with some laying flowers in honour of the deceased.

Police said those involved in Monday’s confrontation were not from the nearby school and officers believe it was not a random attack.

Several female witnesses who were in the park at the time rushed over to give aid to the victim.

Paramedics were called to the scene, but the teen died soon after.

“It would have been a horrifically confronting situation for those people and I can only praise them for their efforts,” Detective Superintendent Naomi Moore told reporters on Monday evening.

“It was a potentially dangerous situation they were walking into, but they thought nothing of themselves to go in and render aid.”

NSW Premier Chris Minns sent his condolences to the teenage boy’s family and friends.

“I am deeply saddened by the death of a teenage boy at Rouse Hill and extend my sincere condolences to his family and friends,” he said in a statement.

“It is an unimaginable loss, and the whole community will feel the impact.”

Local federal MP Michelle Rowland said she was deeply saddened by the incident.

“There is no place in our community for these acts of senseless violence, and I know this news will be particularly distressing for local families,” she said.

The 15-year-old boy has been refused bail to appear in a children’s court on Tuesday.

Trump, Xi talk on phone about trade, Taiwan and Ukraine

US President Donald Trump and Chinese President Xi Jinping have spoken by phone to discuss trade, Taiwan and Ukraine, according to the White House and Chinese officials, nearly a month after the two men met in person in the South Korean city of Busan.

Xi told Trump in the phone call on Monday that Taiwan’s return to mainland China is “an integral part of the post-war international order,” according to the Chinese foreign ministry.

A White House official confirmed that the call happened on Monday morning but offered no details of the call.

The conversation came after Japanese Prime Minister Sanae Takaichi recently said Japan’s military could get involved if China were to take action against Taiwan, the self-governing island that officials in Beijing say must come under its rule.

Japan is an important ally of the US in the region.

China has since rebuked Takaichi’s remarks, and China-Japan relations have plunged.

Xi in the phone call said China and the US, which fought together during the war against fascism and militarism, should “jointly safeguard the victory of World War II”.

The US has taken no side on the sovereignty of the self-governed island but is opposed to the use of force to seize Taiwan.

It is obligated by a domestic law to provide sufficient hardware to the island to deter any armed attack.

Trump has maintained strategic ambiguity about whether he would send US troops in case of a war in the Taiwan Strait.

His administration has urged Taiwan to increase its military budget.

Dire housing affordability widening the wealth divide

Housing affordability has sunk to record lows, exacerbating the divide between Australia’s haves and have nots.

Since March 2020, home values have climbed by 47.3 per cent, lifting the median dwelling value $280,000 to $872,500, property data firm Cotality found in its annual Housing Affordability Report on Tuesday.

Over the same period, the median annual household income increased just 15 per cent to $104,390.

Three out of four of Cotality’s affordability metrics – the price-to-income ratio, years to save a deposit, and the share of income needed for rent – have hit record highs.

The portion of income required to service a new mortgage has come down slightly from a record high to 45 per cent of household income, as a result of the Reserve Bank’s three interest rate cuts since February.

“For first home buyers, the metrics are pretty disappointing,” said Cotality head of research Eliza Owen.

“There’s this real disparity between where incomes are and where property prices are that show a kind of structural shift in who can access the market.”

The five-year price surge was driven by a mix of factors boosting demand, including pandemic-era stimulus, low interest rates, government incentives for first home buyers and a rapid bounce-back in net overseas migration after border closures were lifted.

Meanwhile, housing supply lagged behind. Construction sector insolvencies, rising material costs and changing preferences for larger homes and smaller household size didn’t help.

The result was a mismatch of more than one million new households formed in the past five years compared with 880,000 new dwellings completed, according to the report.

As property prices have gone up, homeowners and investors have been able to reinvest their massive capital gains windfalls back into the housing market, creating a larger gap for first home buyers and those without parental assistance to enter the market.

“There’s been this extraordinary separation between property prices and income,” Ms Owen said.

“It definitely speaks to a widening in the divide of the haves and have nots when it comes to the property market.”

In Sydney’s eastern suburbs, it would take 35 years for an average wage earner to save up a 20 per cent deposit on a median house.

Even if they somehow cleared that hurdle, servicing the mortgage would take up one-and-a-half times their income.

Canberra, Hobart and Melbourne have shown pockets of relief.

Canberra’s relatively high rate of new apartments entering the market, along with a slower rate of internal migration, have eased rental affordability in the ACT.

Meanwhile, increased taxes on investment properties in Melbourne have kept home values structurally lower across the city, with the median dwelling value 7.1 times higher than income, compared with a multiple of 10 in Sydney.

Melbourne could serve as a good example of how to target housing demand and bring down prices at a time when supply is challenged, Ms Owen said.

“It might take some time to tease out exactly what kind of impact the increased investment taxation has had, but I think it’s fair to say it has at least helped to take some heat out of the market, and many people look to Melbourne now as a relatively affordable buying option.”

Labor path to pass nature laws in last week narrows

Labor is facing an uphill battle as it tries to strike a deal in the Senate to pass major environmental law reforms.

Resistance from the Greens and the coalition suggests the proposed changes are unlikely to be adopted this week, the final sitting week of the year, despite Environment Minister Murray Watt expressing confidence it will.

The coalition is understood to have poured cold water on the prospect of an imminent deal while the Greens say the government’s offers to change the legislation have fallen short.

Meanwhile, conservationists have urged Labor to not side with the coalition to pass the reforms.

Australian Conservation Foundation chief executive Kelly O’Shanassy said negotiations were at a critical stage and a deal with the coalition would weaken “already bad legislation”.

“(Labor) should only negotiate with the parties that want to protect nature,” she said.

“The bare minimum they could do is make sure that coal and gas projects that are put out for assessment are actually assessed through climate impacts.”

The ACF says the new legislation would take Australia backwards by expanding the minister’s discretion over contentious projects like coal and gas, if deemed in the national interest.

But siding with the coalition would be a “catastrophe” for nature, as that would amount to weakening the already bad legislation, Ms O’Shanassy said.

Labor has extended an olive branch to the Greens, proposing to prevent a contentious “national interest” exemption being used to approve coal and gas projects if the party agreed to support its nature laws.

Greens leader Larissa Waters said the changes were “welcome” but weren’t enough to win her support.

The coalition has been offered changes to limit “stop work” orders, and wants a requirement for a project to report its carbon dioxide emissions to be dumped.

Liberal MP Leon Rebello said the legislation shouldn’t be rushed, admitting he hadn’t read the whole 1500-page bill.

“The fact they’re trying to rush it through the last two sitting weeks is just indicative of the fact they’re not prepared to front up and have a debate,” Mr Rebello told Sky News.

Senator Watt said based off discussions at the weekend, he was “very confident” an agreement would be landed within his desired time-frame.

Veteran conservationist and Greens co-founder Bob Brown criticised the proposed laws and said proposed amendments didn’t go far enough.

He used logging in Tasmania as an example of destruction that Labor could “stop tomorrow”.

“It’s the biggest cause of extinction of everything from koalas to greater gliders to critically endangered swift parrots and Tasmanian devils,” Mr Brown said.

“But the industry is being financed and subsidised by Canberra.”

Labor wants to pass the laws before the end of the year, but the senate committee reviewing it is not due to report back until March 2026.

The government says the reforms – which would set up an Environment Protection Agency – would provide stronger environmental protections, more efficient assessments and approvals, and greater accountability.

The environment minister would have the final say on rejecting project developments if they are deemed to seriously damage nature, or approve projects in the “national interest”.

Japan wages push bolsters case for rate hike

Early signs on Japan’s annual wage negotiations for next year point to another round of solid pay hikes despite profit pressure from US tariffs, bolstering the case for the Bank of Japan to raise interest rates further.

The wage outlook has drawn renewed attention after BOJ Governor Kazuo Ueda said he wanted “a bit more data” on the initial momentum of next year’s wage talks – notably whether firms hit by US tariffs would keep lifting pay.

Labour unions have already made clear they will again demand bumper pay hikes.

Sustained wage growth would underpin private consumption, giving the BOJ confidence to raise rates without derailing Japan’s economic recovery.

Despite hefty increases in recent years, real wage growth has remained negative as core consumer inflation has held above the BOJ’s two per cent target.

Rengo, Japan’s largest labour union umbrella group, with seven million members, is seeking wage hikes of five per cent or more in 2026. That is what Rengo asked for in 2025, resulting in the biggest pay hike in 34 years.

The top union for automakers, among the industries hit hardest by US tariffs, also has no plans to scale back its wage demands at labour talks for next year despite profit squeezes, its chief told Reuters this month.

Japan’s annual wage negotiations typically start with unions drafting demands late in the closing year, followed by formal talks early the next year, with settlements announced in March.

Companies, to be sure, may not heed union demands on 2026 wages as the hit from higher US levies on shipments of Japanese goods is likely to intensify in coming months, clouding the outlook for the export-reliant economy.

But so far manufacturers are holding up, with a Reuters poll this month showing sentiment hit a nearly four-year high in November, buoyed by softness in the yen and solid orders.

A tight labour market is also likely to pressure companies to stick with generous pay hikes.

A separate Reuters survey this month showed 72 per cent of respondents intend to raise wages next year at about the same rate as in 2025.

A November survey by the Japan Center for Economic Research showed economists projecting that wage hikes would average 4.88 per cent next year.

That is higher than the 4.74 per cent estimated in January for this year’s wage talks, which resulted in a 5.52 per cent increase.

“Companies have plenty of scope to raise wages,” with profits remaining elevated, said Yoshiki Shinke, senior executive economist at Dai-ichi Life Research Institute.

He expects hikes averaging 5.2 per cent in next year’s wage talks, slower than this year’s but exceeding five per cent for three straight years.

Companies may also face pressure for wage hikes from the new administration of Prime Minister Sanae Takaichi, who has vowed to build a strong economy in which wage gains outpace inflation.

Domestic media have reported that Japan’s biggest business lobby, Keidanren, will stress the need to maintain “strong wage momentum” in guidelines due in January to member companies for next year’s wage talks.

BOJ Governor Ueda told parliament on Friday the central bank was still in the midst of gathering data and information on the wage outlook, including from its branches nationwide.

“The BOJ will discuss the feasibility and timing of an interest rate hike at upcoming meetings looking closely at various data and information,” he said.

Former UK PM David Cameron’s reveals cancer diagnosis

Former British prime minister David Cameron has revealed he had prostate cancer.

His diagnosis has motivated him to speak out in favour of a targeted screening program for the UK’s most common cancer in men.

Cameron was urged to get tested by his wife, Samantha, after the pair heard the founder of Soho House, Nick Jones, speaking about his experience with the cancer on the radio a year ago, the Times reported.

He had a prostate specific antigen (PSA) test, an MRI scan and then a biopsy which confirmed the diagnosis.

“You always dread hearing those words,” he told the Times.

“And then literally as they’re coming out of the doctor’s mouth you’re thinking, ‘Oh, no, he’s going to say it. He’s going to say it. Oh God, he said it’.”

“This is something we’ve really got to think about, talk about, and if necessary, act on.”

Cameron is advocating for screening to be offered to high-risk men.

“I want to add my name to the long list of people calling for a targeted screening program,” he said.

“I don’t particularly like discussing my personal intimate health issues, but I feel I ought to.

“Let’s be honest. Men are not very good at talking about their health. We tend to put things off.

“We’re embarrassed to talk about something like the prostate, because it’s so intricately connected with sexual health and everything else,” he said.

He received focal therapy for treatment, in which electrical pulses target and destroy cancer cells.

Prostate cancer is the most common cancer in males in the UK, with around 55,000 new cases every year.

There’s no screening program for prostate cancer in the UK because of concerns about the accuracy of PSA tests.

“There are respectable arguments against a screening program,” Cameron admitted.

“You’ve always got to think how many cases do we discover and how many misdiagnoses are there and how many people will be treated unnecessarily.

“But … the circumstances are changing. The arguments are changing, and so it’s a really good moment to have another look at this.”

Cameron’s announcement comes days after the first eligible men in the UK were invited to join a major trial testing the most promising screening techniques for the disease.

Cameron served as prime minister from 2010 to 2016 and resigned after advocating for a ‘No’ vote in the the Brexit referendum when the country voted to leave the European Union

‘No illusions’ Labor’s environmental reforms will pass

Labor insists its environmental reforms, aimed at speeding up project approvals while balancing nature protections, will get over the line with the minister flagging further concessions to strike a deal.

As the federal parliament returns for the final sitting week of the year, the Albanese government is yet to secure the numbers it needs in the Senate to pass the bill.

“Under no illusions, we are going to pass these laws this week, and it’s going to happen with either the coalition or the Greens,” Murray Watt told reporters in Canberra on Monday.

“They have an important choice to make about whether they want to be part of this process and work with us cooperatively, or whether they want to sit on the sidelines complaining and see us do a deal with the opposite party.”

In a bid to win over the Greens, Labor has promised tougher rules on native forest logging which would still go ahead under the new legislation, in addition to scrapping a provision to allow coal and gas projects to bypass the main approval process.

The coalition has been offered changes to limit “stop work” orders, and wants a requirement for a project to report its carbon emissions to be dumped.

Senator Watt said based off negotiations at the weekend, he was “very confident” in landing an agreement.

“We are prepared to make some further concessions in order to pass these laws, because it’s not in anyone’s interests for us to hang on to the current laws that we’ve got at the moment, which are completely broken,” he said.

Opposition environment spokeswoman Angie Bell said the coalition was “not in a rush to fail” and was seeking to work constructively with the government.

“The ball is in the minister’s court,” she told ABC radio.

“I would need to see the amendments in terms of those substantive issues, and there’s a list of seven, but there are more than that that I presented to the minister.”

Wicked: For Good opening weekend beats first film

Universal Pictures’ two-part Wicked gamble continues to defy gravity at the box office.

Just a year after part one brought droves of audiences to movie theatres around the country, even more people bought opening weekend tickets to see the epic conclusion, Wicked: For Good.

According to studio estimates on Sunday, Wicked: For Good earned $US150 million ($A233 million) from North American theatres in its first days in theatres and $US226 million ($A350 million) globally.

Not only is it the biggest opening ever for a Broadway musical adaptation, unseating the record set by the first film’s $US112 million ($A174 million) launch, it’s also the second biggest debut of the year behind A Minecraft Movie’s $US162 million ($A251 million).

As with the first film, women powered opening weekend, making up around 71 per cent of ticket buyers according to PostTrak exit polls. Critics were somewhat mixed on the final chapter, but audiences weren’t: An overwhelming 83 per cent of audiences said it was one they would “definitely recommend” to friends.

Jon M Chu directed both Wicked films, starring Cynthia Ervio and Ariana Grande. The first film made over $US758.7 million ($A1.2 billion) worldwide and received 10 Oscar nominations (winning two, for costume and production design).

The question is how high Wicked: For Good can soar. Combined, the two films cost around $US300 million ($A465 million) to produce, not including marketing and promotion costs.

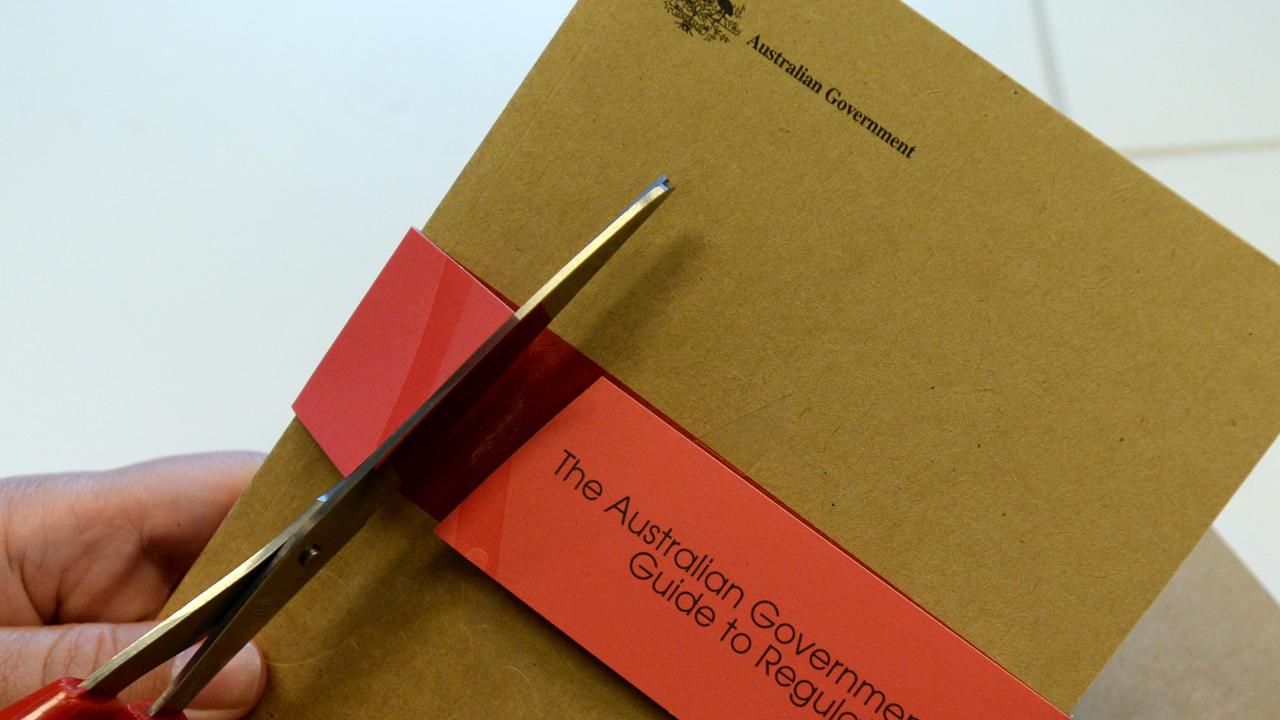

Red tape setting back businesses billions and counting

Red tape in Australia has gotten so thick, compliance has become a major industry in its own right.

In 2024, businesses employed 52,000 dedicated workers just to comply with regulation, a report released by the Australian Institute of Company Directors on Monday claims.

That’s more staff than are employed by the entire coal mining sector – Australia’s second-largest export industry.

The paper, written by economics consultancy Mandala Partners, estimates the thickets of federal red tape, that have grown like topsy in the past decade, are costing Australian businesses and the economy $160 billion, or 5.8 per cent of GDP.

That’s up from 4.2 per cent of GDP in 2013, when the last economy-wide regulatory stocktake was compiled.

The analysis lays out the scope of the challenge facing Treasurer Jim Chalmers, as he attempts to boost productivity and cut unnecessary red tape in the economy.

Australia has become a hard place to do business and, without change, would lose its international competitiveness, warned AICD chief executive Mark Rigotti.

The amount of pages of federal regulation has tripled since 2000, while the time boards spend on complying with red tape has grown from 23 to 55 per cent in the past 10 years, the report found.

“This isn’t about weakening protections or cutting corners. It’s about making our regulatory system fit for purpose,” Mr Rigotti said.

“When more than half of board time is consumed by compliance and regulatory oversight, we know we have got the balance wrong.”

The issue is not the fact that governments seek to regulate risky or destructive activities, but in the unwieldy way that laws have been layered on top of one another over time.

In a report earlier this year, independent advisory body the Productivity Commission found poorly conceived individual regulations or a “pile-up” of multiple regulations hindered business investment and dynamism.

That has contributed to Australia’s productivity growth – the main determiner of rising living standards in the long run – sinking to its lowest level in more than 60 years.

Dr Chalmers said he was determined to make in-roads on the blockages.

“Whether it’s slashing tariffs, streamlining and strengthening our foreign investment regime, our merger reforms, or our environmental reforms in the Parliament this week, we’re doing a lot to responsibly improve regulation and speed up approvals,” he said.

“We’ve already got a big agenda to ease the burden on businesses, cut red tape and build more homes but we’re keen to do more where we can.”

The institute called on the treasurer to reduce the regulatory burden by a quarter by 2030 and implement a process to better assess the impacts of new pieces of regulation on compliance costs.

Other recommendations in the report included lifting the threshold at which companies are required to lodge audited financial reports with the corporate regulator from $50 million in revenue and $25 million in assets to $100 million in revenue and $50 million in assets.

According to the report, that alone would yield around $1.7bn in compliance savings over four years, whilst removing the climate reporting burden for around 1500 firms.

“We must abandon a set and forget approach that allows regulatory accumulation by default,” Mr Rigotti said.