Fight goes on as defence suicide reforms slowly kick in

A mother who successfully lobbied for a royal commission into defence and veteran suicide says people are still fighting for justice and accountability as reforms are introduced.

Nine recommendations had been fully implemented, with a further 110 under way almost a year after the inquiry’s final report was handed down, Veterans’ Affairs Minister Matt Keogh told parliament on Thursday.

Julie-Ann Finney’s son, Royal Australian Navy petty officer David Finney, took his own life in 2019.

Carrying photos of her son, Ms Finney said she was a “little scared” as the progress gave her hope.

But there was still a long way to go with reforming defence culture, she said, standing by the call “don’t enlist until it’s fixed”.

“There’s still so much bullying going on and people are still fighting for justice and accountability,” Ms Finney said.

Mr Keogh said the government wanted Australians to join the military and know they and their families would be looked after.

“We will continue to do what’s right to take action on the royal commission as quickly as we can,” he said.

“It’s the least we can do.”

Labor provided its response in December, accepting the overwhelming majority of the commission’s 122 recommendations.

A task force set up in 2024 to guide reform found four priority areas, such as establishing a Defence and Veterans’ Service Commission and addressing military sexual misconduct.

The commission, legislated within three months of the government’s response, will receive $44.5 million across four years and lead implementation of other recommendations.

It will be operational by the end of September, as the government recruits a commissioner to head the body.

Sexual misconduct remained a “systemic” issue for the Australian Defence Force, with the government agreeing to a standalone inquiry into the issue.

Measures that will allow defence force personnel convicted of sexual crimes to be booted from the military would be in place by the end of 2025, Mr Keogh said.

Work continues to ensure troops convicted of serious crimes during their military service get a civilian record of their offending.

This involves co-operation between civil agencies and government departments to feed records into the national police reference system.

Opposition veterans’ affairs spokesman Darren Chester accused Mr Keogh of “putting lipstick on a pig”.

“It was extraordinary that the minister came in here and endeavoured to pretend this is a good reform when it actually disenfranchises our veterans and their families,” he said.

Mr Chester told parliament he agreed with the broad themes in the royal commission, but was concerned its findings risked a false narrative of “despondency, desperation and helplessness”.

Greens defence spokesman David Shoebridge said he did not think anyone could be confident cultural changes had taken place.

“My office continues to hear from current and former members of the ADF who are being bullied, who have been belittled, who are not being heard when they’re making complaints about sexual violence in the ADF,” he said.

“But I think it’d be wrong to say no progress has been made.”

Following the royal commission, an independent inquiry by the Inspector-General of the Australian Defence Force began in 2024 into claims the military justice system had been “weaponised” to cause harm to some personnel.

The royal commission found 1677 serving and former serving defence personnel had died by suicide between 1997 and 2021 – more than 20 times the number killed in active duty during the same period.

Lifeline 13 11 14

Open Arms 1800 011 046

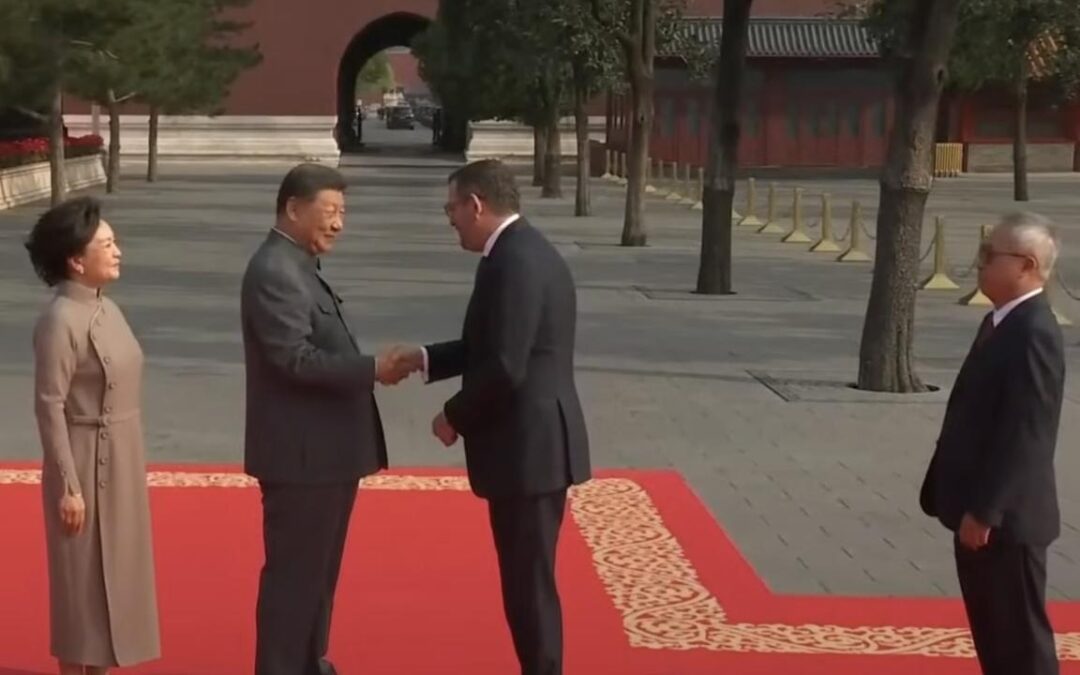

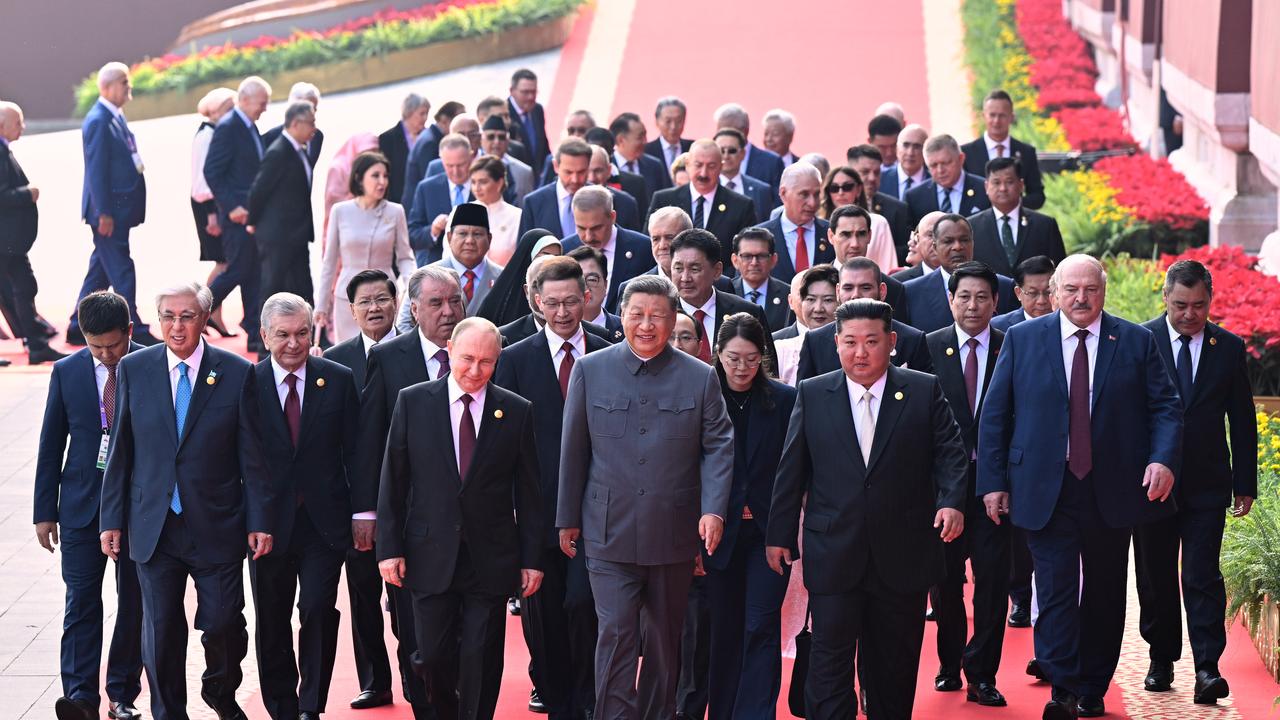

Daniel Andrews breaks silence on China parade outing

Former premier Daniel Andrews has defended a controversial visit to China to attend a military parade alongside dictators despite criticism from both sides of politics on the optics of his attendance.

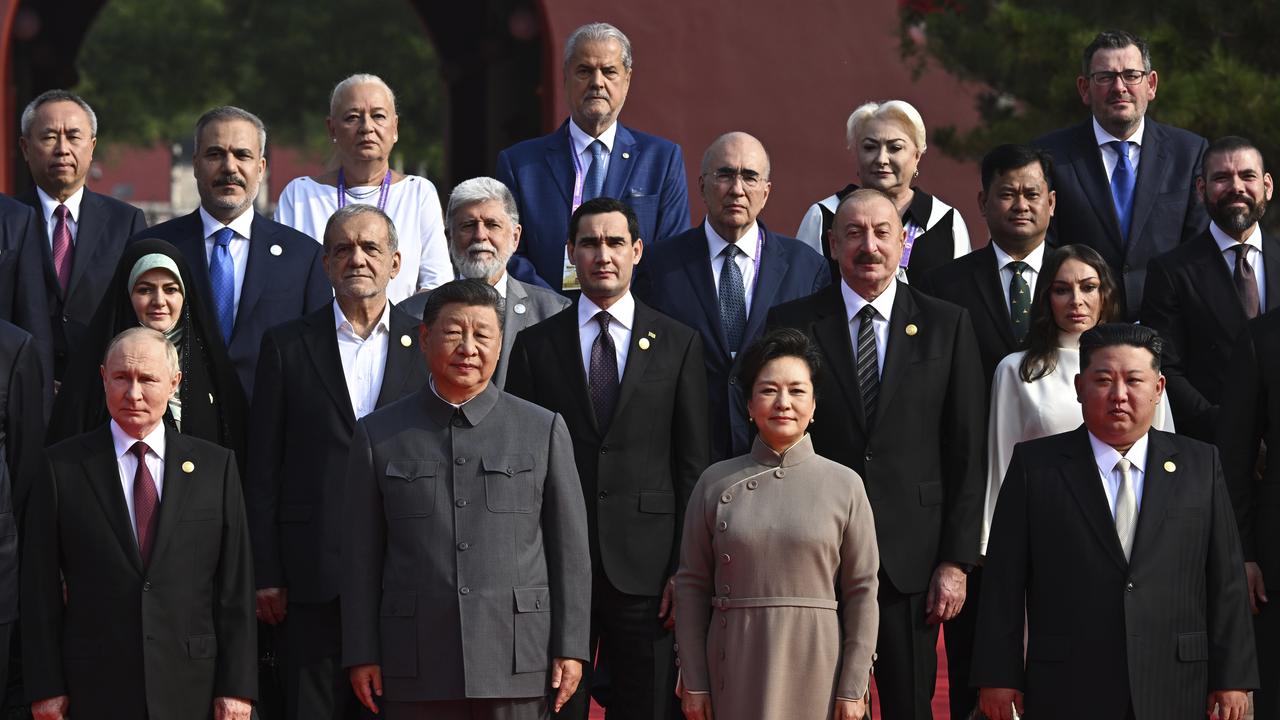

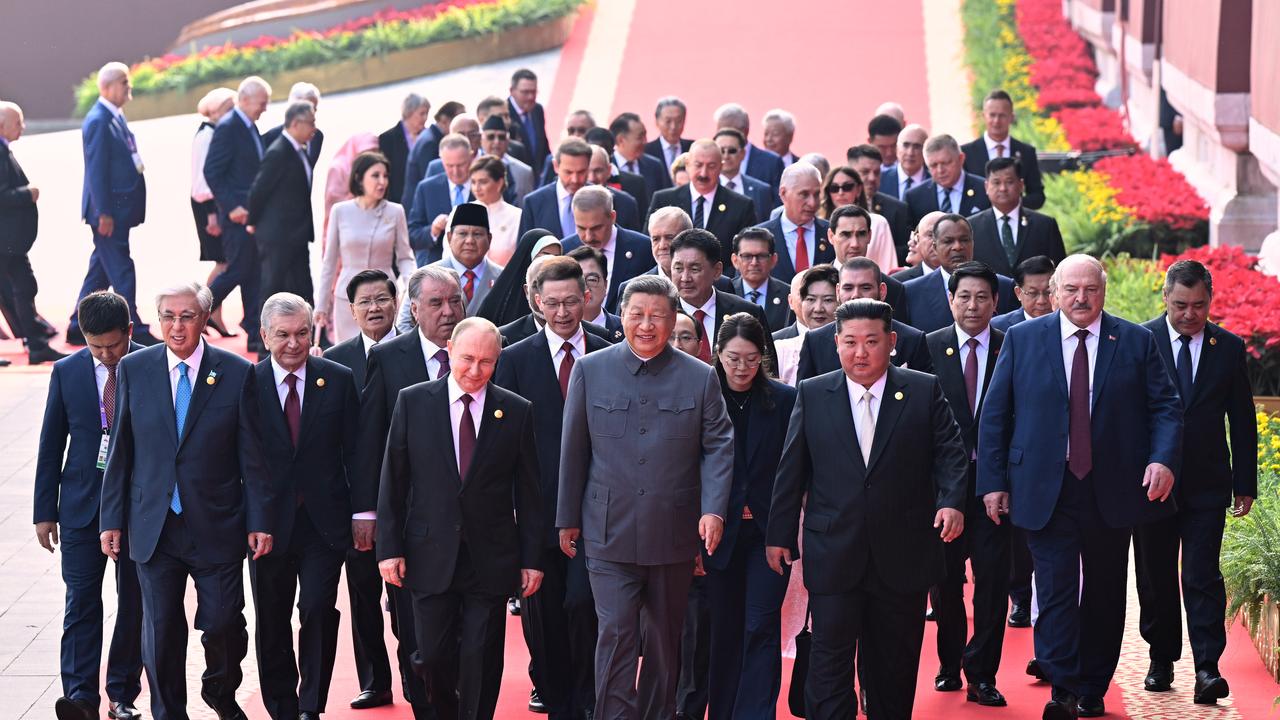

The former Victorian leader attended a parade in Beijing on Wednesday to mark the 80th anniversary of the end of the Second Sino-Japanese War and World War II, alongside Russian President Vladimir Putin and North Korean dictator Kim Jong-un.

Mr Andrews said his visit followed a formal invitation to the event.

He said while maintaining ties with China was important, he condemned the actions of other leaders who attended the parade.

“I’ve said for years that a constructive relationship with China – our largest trading partner – is in Australia’s national interest and hundreds of thousands of Australian jobs depend on it. That hasn’t changed,” he said in a statement.

“Just so there’s no conclusion – I have condemned Putin and his illegal war in Ukraine from day one. That’s why he banned me from Russia last year.”

Mr Andrews criticised Iran in the statement, after the Middle East nation’s leader attended the event.

“My support for Israel and Australia’s Jewish community has been outspoken and unwavering and I unequivocally condemn Iran for its attacks on Australia, Israel and elsewhere around the world,” he said.

He said the event was a chance to meet with leaders in the region, such as former New Zealand prime ministers John Key and Helen Clark.

The visit to China attracted criticism in federal parliament, with the opposition urging Prime Minister Anthony Albanese to condemn Mr Andrews for his appearance.

Mr Albanese said he was not responsible for Mr Andrews’ actions.

He said the coalition was “delulu” (slang for delusional) for questioning why he had not condemned the former premier.

“I am not responsible for what every Australian citizen does,” he told parliament on Thursday.

“What I am responsible for is what our government does.”

Federal Opposition Leader Sussan Ley continued the coalition attack on Mr Andrews.

“Today I once again unequivocally express the coalition’s utter condemnation of former premier Dan Andrews’s attendance at the CCP military parade, where he stood with dictators, despots and war criminals like Vladimir Putin and Kim Jong-un,” she told parliament.

Mr Andrews’ successor, Jacinta Allan, who will travel to China for trade talks later in September, backed him.

“It is good for Victoria that Daniel Andrews is held in such high regard by the people of China,” she said on Thursday.

“Victoria is an old friend of China and these connections are so valuable for our state.

“I’m looking forward to building on this connection by leading a trade mission to China this month where I’ll meet with business, government, educators, and communities and launch Victoria’s new China strategy.”

Victoria has a sister state relationship with China’s Sichuan province. A number of councils have sister city relationships with other centres.

Ms Allan, who faces a state election in 2026, did not directly address the television footage and agency photographs of Mr Andrews with Mr Putin and Mr Kim and other leaders.

Deputy Premier Ben Carroll was far more critical, questioning if it was worth standing behind the Russian and North Korean leaders for “self-interested business purposes”.

“I think for the vast majority, myself included, the value judgement (is) it’s not worth that photo,” he told the Nine Network.

“It’s not something I would have done.”

Former Queensland Labor premier Annastacia Palaszczuk said on Wednesday Mr Andrews’ parade appearance was “a bridge too far”.

Rudd-era foreign minister Bob Carr was in Beijing for the commemorations but decided not to attend the parade because he thought it would be “extremely boring”.

Robodebt payout could take years to flow to victims

Robodebt victims may have to wait years to get a payout despite reaching a record-breaking class-action settlement with the federal government.

Labor has agreed to pay an additional $475 million to people affected by the unlawful debt collection scheme, which pursued welfare recipients for money they didn’t owe.

It’s the largest settlement in Australian legal history and, if approved by the federal court, will mean the bungled program has cost the government more than $2.4 billion.

The government will also pay tens of millions of dollars in legal and administrative costs.

Settling the claim was the “just and fair thing to do”, Attorney-General Michelle Rowland said.

“The most significant cost of robodebt cannot be measured in dollars and cents. It can only be measured in human terms because the robodebt scheme destroyed lives,” she told parliament on Thursday.

The latest settlement is on top of $1.76 billion in forgiven debts and $112 million in compensation from the original robodebt class action.

Gordon Legal lodged an appeal after the robodebt royal commission found the automated debt collection scheme was “crude and cruel” and “neither fair nor legal”.

The law firm expects tens of thousands of people to register for a slice of the settlement, but is flagging it will likely take years to pay everyone who signs up.

Former government services minister Bill Shorten, who led the charge to establish the royal commission into the scheme, said the agreement “closes a dark and shameful chapter in Australian public administration”.

“This settlement cannot bring back those lives lost, nor can it erase the years of stress suffered by so many. But it can serve as a line in the sand,” he said.

Robodebt operated between 2015 and 2019 and used automated data from the tax office to calculate welfare recipients’ average earnings and issued debt notices with little to no human oversight.

The royal commission found it contributed to at least three suicides.

The Greens have welcomed the settlement but say the political leaders and public servants responsible must still be held accountable for the scheme.

“People who were subject to robodebt, people who lost family members to robodebt, have still not seen justice,” Greens senator Penny Allman-Payne said.

Lifeline 13 11 14

beyondblue 1300 22 4636

Hot economic growth may place further rate cuts on ice

Australian borrowers have been warned the end of interest rate cuts may be near as a surge in household spending heats up the economy.

A surprise jump in economic growth, revealed by the Australian Bureau of Statistics on Wednesday, was followed by strong household spending data, indicating tax cuts, falling interest rates and rising real wages were helping consumers.

Reserve Bank of Australia governor Michele Bullock insisted she did not know “at this stage” what the uplift in economic growth could mean for interest rates.

“But it does mean that it’s possible that if it keeps going, then there may not be many interest rate declines left to come,” she said.

Ms Bullock issued her warning following an address on the impact new technology would have on the economy she delivered to the Shann Memorial Lecture in Perth on Wednesday evening.

EY chief economist Cherelle Murphy said the RBA previously noted there was a risk rising household spending could reignite inflation pressures as real incomes and wealth rose.

Household spending was 5.1 per cent higher over the year to July – the largest increase since November 2023 – the ABS revealed on Thursday.

A 0.5 per cent jump over the month was driven by strong growth in spending on services, including on health, hotels, air travel and dining out, although spending on goods fell after mid-year discounting boosted June sales.

“Today’s strong result and the solid consumer data in the June quarter National Accounts will be reason for the Reserve Bank to reconsider how quickly the consumer is adding demand back into the economy,” Ms Murphy said.

The solid rebound in consumption growth put Australia in good stead for the global uncertainty and big economic challenges ahead, Treasurer Jim Chalmers said in question time.

The monthly spending data reinforced market expectations the RBA would hold rates in September, after the nation’s economic growth rate jumped from 1.4 to 1.8 per cent on an annual basis in June, said CommSec chief economist Ryan Felsman.

Money markets had been fully pricing in a November cut before the GDP release, but lowered the odds to 80 per cent following Ms Bullock’s speech.

In welcome news, productivity as measured by GDP per hour worked climbed 0.3 per cent over the quarter to be 0.2 per cent higher over the year.

That is still below Australia’s historical average, limiting the nation’s maximum growth potential.

The RBA in August downgraded its assumption for medium-term productivity growth to 0.7 per cent, which mechanically lowered Australia’s GDP growth potential to two per cent a year.

Without an increase in productivity growth to about 1.5 per cent, inflation would struggle to stay in the RBA’s two-to-three per cent target band over time, Mr Felsman said.

Business investment fell 0.4 per cent over the quarter, although that was partly explained by the completion of some large mining and renewable energy construction projects.

Adoption of productivity-boosting AI technology surged, with investment in intellectual property up 1.9 per cent.

HSBC chief economist Paul Bloxham said the economy was operating near full capacity and it was not clear where further disinflation would come from without an upswing in business investment and productivity.

CBA is only expecting one more cut in November before the central bank calls an end to its easing cycle.

Roberts-Smith to fork out lump sum for legal bills

Ben Roberts-Smith has received another judicial roasting over his failed appeal against war criminal findings, as he was ordered to pay a lump sum to Nine Newspapers.

The decorated soldier had appealed his 2023 Federal Court loss after he sued the publisher for defamation over reports claiming he was complicit in the murder of four unarmed civilians in Afghanistan.

Roberts-Smith disputed Justice Anthony Besanko’s findings that the allegations were substantially true, arguing that was not backed up by sufficient evidence for such serious claims.

While losing his appeal, his conduct differed from his protests of innocence at trial, appeal court Justices Nye Perram and Geoffrey Kennett said.

That therefore did not open the former special forces soldier to again paying Nine’s legal costs on an indemnity basis, as ordered after the defamation trial.

The costs of the 110-day trial and the 10-day appeal are estimated to exceed $30 million.

But the appeal judges firmly rejected the former SAS corporal’s claim he did not know allegations of murder at a compound known as Whiskey 108 were true.

One of the allegations taken to be proven on the balance of probabilities was that Roberts-Smith ordered the execution of an elderly prisoner to “blood the rookie” during a raid of that compound with a junior Australian soldier.

The court contrasted Roberts-Smith’s behaviour with that of a doctor with an honest but misguided perception of historical injustice regarding their professional incompetence.

“Ordering another soldier to execute an old man kneeling on the ground is not an ambiguous situation,” they wrote in their judgment on Thursday.

“So too, we do not see how the finding that the appellant executed the man with the prosthetic leg with a burst of machine gun fire after frogmarching him to a place outside the compound is susceptible to any ambiguity which might make it plausible that the appellant did not know that what he was doing was murder.”

When dismissing his appeal in May, the judges noted there were three eyewitnesses to the murder, which they said was a “problem” for Roberts-Smith.

The alleged war criminal has maintained his innocence after the appeal loss and has taken the case to the High Court.

The Victoria Cross recipient has not been charged with criminal wrongdoing.

He will have to pay Nine a lump sum to cover some of their appeal costs, but will not be forced to pay indemnity costs after the judges found there was no impropriety in his appeal.

Indemnity costs are those beyond what the court would normally impose, generally allowing the applicant to recoup a larger proportion of their legal fees.

“The appellant was seeking an ultimate outcome predicated on the falsity of imputations which he must have known were substantially true,” the appeal justices said.

“(But) he did not advance a positive and dishonest case against those imputations in the appeal.”

The parties have been asked to negotiate the legal costs sum over the next fortnight.

If no agreement can be reached, a registrar will determine the lump sum in the coming months after considering both sides’ arguments.

Roberts-Smith’s High Court bid will claim the Full Court of the Federal Court made an error in assuming he had accepted some allegations which were not re-contested during the appeal.

‘Dictator Dan’ silent, but Labor comrades have his back

A former state premier is yet to break his silence after being criticised for appearing alongside controversial world leaders at a Chinese military parade.

But his Labor comrades continue to defend him, after the man branded ‘Dictator Dan’ by his detractors raised eyebrows by appearing in photographs with dictators and alleged war criminals.

North Korean dictator Kim Jong-un and Russian President Vladimir Putin were among high-profile leaders in Beijing for the parade on Wednesday to mark the 80th anniversary of the end of the Second Sino-Japanese War and World War II.

Ex-Victorian Labor premier Daniel Andrews was shown shaking hands with Chinese leader Xi Jinping and joining world leaders for group photographs.

He’s yet to officially respond to criticism of his attendance at the commemoration.

But his successor, Jacinta Allan, who will travel to China for trade talks later this month, has backed the Labor icon following the backlash.

“It is good for Victoria that Daniel Andrews is held in such high regard by the people of China,” she said in a statement on Thursday.

“Victoria is an old friend of China and these connections are so valuable for our state.

“I’m looking forward to building on this connection by leading a trade mission to China this month where I’ll meet with business, government, educators, and communities and launch Victoria’s new China strategy.”

Victoria has a sister state relationship with China’s Sichuan province. A number of councils have sister city relationships with other centres.

Ms Allan, who faces a state election next year, did not directly address the television footage and agency photographs of Mr Andrews with Mr Putin and Mr Kim and other leaders.

But ex-Queensland Labor premier Annastacia Palaszczuk on Wednesday ticked off Mr Andrews, saying his attendance at the parade was “a bridge too far”.

Victorian government minister Gabrielle Williams also declined to criticise Mr Andrews, reiterating that his attendance at the parade was as a private citizen.

“I’m not here to speak for Dan Andrews,” she told reporters on Thursday morning.

Rudd-era foreign minister Bob Carr was in Beijing for the commemorations but decided not to attend the parade because he thought it would be “extremely boring”.

“I’m not criticising Dan Andrews,” he told ABC Radio Melbourne.

“He’s vigorous enough to defend himself, which he’s demonstrated in a remarkably successful political career.”

The federal coalition has raised questions about the presence of both Mr Andrews and Mr Carr. While Australia’s ambassador to China did not take part, the government did send a junior official.

Liberal Senator Jane Hume took aim at Mr Andrews, suggesting he displayed a “lack of judgment”.

“It was clearly a sign of military might, a display of military might quite threatening in its intentions,” she told Nine’s Today program.

“And there he was, standing alongside some of the most unsavoury characters from right around the world.”

Prime Minister Anthony Albanese batted away concerns on Wednesday, pointing out that the Abbott Liberal government sent senior Victorian senator Michael Ronaldson to the 70th anniversary in 2015.

Mr Albanese has repeatedly described Mr Andrews as a friend, with the pair having previously lived together.

Federal Opposition Leader Sussan Ley heaped fresh pressure on the prime minister to rebuke his former flatmate on Thursday.

“Anthony Albanese needs to demonstrate some moral clarity here and actually call out Daniel Andrews for being just a few feet away from dictators and despots,” she told Sky News.

AAP has approached Mr Andrews for a response.

Record-breaking settlement for robodebt victims

Hundreds of thousands of robodebt victims will share in the largest class-action settlement in Australian history after appealing their case against the federal government.

Labor has agreed to pay an additional $475 million in compensation to victims of the debt-collection scheme, which was declared unlawful in 2019.

Including legal fees and administration costs, the settlement is expected to reach nearly $550 million, but the final amount is still subject to court approval.

“Everyday Australians should now know that they can stand up and demand respect and fairness, especially from their government,” robodebt victim Nathan Knox said after bringing the case forward.

Fellow applicant Felicity Button said people affected by the program had been treated as “second-class citizens”.

“I feel as though myself and all the other victims of robodebt have been heard and finally have our voice back,” she said.

Legal firm Gordon Legal lodged the appeal after the release of the robodebt royal commission’s scathing final report in 2024, which found the automated debt-collection scheme was “crude and cruel” and “neither fair nor legal”.

It recommended a raft of policy changes, corruption investigations and potential civil and criminal prosecutions for some of the officials involved.

In total, about 450,000 people signed on to the class action.

The payout is on top of $1.76 billion in forgiven debts and $112 million in compensation from the original robodebt class action, bringing the total cost to the government to well over $2 billion.

“Without the bravery and persistence of so many victims that came forward to tell their story, and the impact that Robodebt had on their lives, this day would never have come,” Gordon Legal partner Andrew Grech said.

“I am very pleased that our legal challenge has been so successful and that group members can finally begin to put this terrible chapter behind them.”

Attorney-General Michelle Rowland acknowledged the settlement, saying the government was committed to addressing the harms caused by robodebt, a scheme established under the former coalition government.

“Settling this claim is the just and fair thing to do,” she said in a statement.

India cuts consumption tax to spur domestic demand

Indian Finance Minister Nirmala Sitharaman has decided to cut taxes on hundreds of consumer items ranging from soaps to small cars to spur domestic demand in the face of economic headwinds from US tariffs.

The goods and services tax (GST) panel approved lowering taxes on the so-called common man items and simplifying their structure, Sitharaman, who heads the panel that includes ministers from all states, told a late night press conference.

The GST was criticised for its complicated structure and numerous tax categories.

To simplify this, the panel approved the two-rate structure of 5 per cent and 18 per cent, instead of four currently that also include tax bands of 12 per cent and 28 per cent.

Sitharaman said the panel approved cuts in consumer items such as toothpaste and shampoo to 5 per cent from 18 per cent, and on small cars, air conditioners and televisions to 18 per cent from 28 per cent.

She said GST will be exempted on all individual life insurance policies and health insurance.

The panel also approved a higher tax of 40 per cent on “super luxury” and “sin” goods such as cigarettes, cars with engine capacity exceeding 1500 cc and carbonated beverages, the minister said.

The move to reduce the consumption tax was first announced by Prime Minister Narendra Modi in his Independence Day speech on August 15.

After the cuts were approved on Wednesday, Modi said “the wide ranging reforms will improve lives of our citizens and ensure ease of doing business for all, especially small traders and businesses”.

The new rates will come into effect on September 22, the first day of the Hindu festival of Navratri.

Defence reform update reveals suicide inquiry progress

Only a fraction of more than 100 recommendations made by a defence and veteran suicide royal commission have been delivered.

The federal government will on Thursday lay out its progress on implementing the damning inquiry’s final report almost a year after it was handed down.

Nine recommendations had been completed, with work under way on a further 110, Veterans’ Affairs and Defence Personnel Minister Matt Keogh will tell parliament.

“We want Australians to be attracted to serving our nation in our Australian Defence Force, and confident that they and their families will be well supported by their leaders, their mates and the broader Defence organisation,” he will say.

Labor provided its response in December, accepting the overwhelming majority of the 122 recommendations.

A task force set up in 2024 to guide reform found four priority areas, such as the establishment of the Defence and Veterans’ Service Commission and addressing military sexual misconduct.

The commission, legislated within three months of the government’s response, will receive $44.5 million in funding over four years and will help lead the delivery of other recommendations.

It will be operational by the end of September, as the government recruits a commissioner to head the body.

Sexual misconduct remained a “systemic” issue for the Australian Defence Force, with the government agreeing to a standalone inquiry into the issue.

While progress is being made to get the inquiry up and running, no time frame has been set for its start.

Chief of the Defence Force Admiral David Johnston issued an interim directive last November that serious misconduct be taken into account when deciding to suspend or kick out troops.

The government is expected to bring on legislation that will allow defence force personnel convicted of sexual crimes to be booted from the military.

Work is also continuing to ensure troops convicted of serious crimes during their military service get a civilian record of their offending.

This involves co-operation between civil agencies and government departments to feed records into the national police reference system.

Following the royal commission, an independent inquiry by the Inspector-General of the Australian Defence Force began in 2024 into claims the military justice system had been “weaponised” to cause harm to some personnel.

Mr Keogh will say the inquiry uncovered systems that were “frankly broken, of culture that was toxic, and that simply not enough was being done to support our Aussie personnel in and following service”.

The royal commission found 1677 serving and former serving defence personnel had died by suicide between 1997 and 2021 – more than 20 times the number killed in active duty during the same period.

Lifeline 13 11 14

Open Arms 1800 011 046

Putin says China to benefit from new gas pipeline

Russian President Vladimir Putin says a planned new Power of Siberia 2 gas pipeline will give a competitive advantage to China because the world’s biggest energy consumer would get gas at a price lower than Europe’s.

Russia and China gave their blessing to the vast pipeline project with a binding memorandum signed during Putin’s visit to China but little is known about the key details of the pipeline and Gazprom said that pricing was yet to be agreed.

“Finally, the negotiating parties found a consensus,” Putin told reporters in Beijing when asked about the Power of Siberia 2 agreement.

“There is no charity on either side – these are mutually beneficial arrangements.

“And, by the way, the price of this product is also formulated not based on current prices but according to a certain formula, and this formula is purely objective – and market-based,” Putin said.

The pipeline, which could one day deliver an additional 50 billion cubic metres (bcm) of gas per year to China through Mongolia from the Arctic gas fields of Yamal, gives China greater options to hedge against any future reliance on US liquefied natural gas.

After the pipeline is built, Russia would supply a total of more than 100 billion cubic metres (bcm) of gas per year to China, Putin said.

The so-called “no limits” partnership between China and Russia, the world’s biggest producer of natural resources, has strengthened since the US and its allies imposed sanctions to punish Russia for the war in Ukraine.

“The growing Chinese economy has needs, and we have the opportunity to supply these raw materials,” Putin said, adding that talks had gone on for years.

“Of course, this will create competitive advantages for our Chinese friends because, I repeat, they will receive the product at balanced market prices, not at the inflated prices that we are currently seeing in the euro zone,” Putin said.

“Everyone is satisfied, everyone is happy with this result, to be honest, and so am I.”