Trump deal a blueprint for Aussie minerals sales boost

Australia has what others want and is prepared to do deals on critical minerals with more than just the US, Anthony Albanese says.

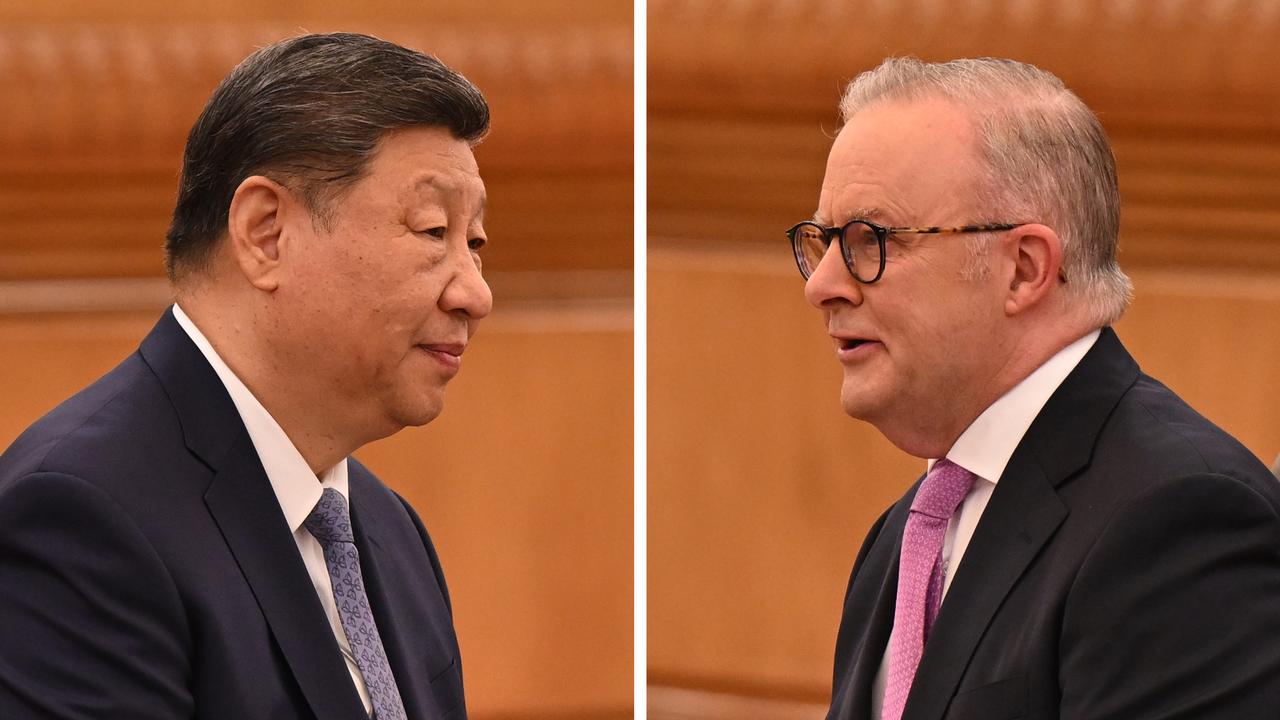

The prime minister also had another “informal” meeting with Xi Jinping, although he would not confirm whether defence tensions were raised with the Chinese president.

Leveraging Australia’s massive reserves of critical minerals and rare earths into deals with more countries in the region was one of Mr Albanese’s goals at the Asia-Pacific Economic Cooperation summit in South Korea.

Having signed a landmark $8.5 billion deal with US President Donald Trump last week, the prime minister wants to keep up the mineral momentum to boost the domestic economy.

“What we did with the United States was a framework,” Mr Albanese said on Friday.

“Australia has these products, critical minerals and rare earths that are in demand around the world.

“We see this as … not just an opportunity between Australia and the United States, this is an opportunity for Australian jobs and Australian economic growth.”

While confirming he did meet with President Xi, Mr Albanese would not divulge whether diplomatic incidents in the South China Sea were mentioned after they were raised in talks with Premier Li Qiang earlier in the week.

“I don’t go out of private discussions and come in here and discuss them, because that way you won’t have diplomatic advancement,” the prime minister told reporters.

“It was an informal discussion with President Xi.”

Mr Albanese also would not be drawn on the controversy swirling around Australia’s head of state and whether the King made the right decision to strip Prince Andrew of his royal titles.

“I think His Majesty King Charles can make decisions without the benefit of my advice,” he said.

Asia shares poised for seventh straight month of gains

Asian shares are set for a seventh consecutive month of gains on Friday, after upbeat earnings from Amazon and Apple buoyed Wall Street futures and the dollar hovered near three-month highs on uncertainty over further Federal Reserve rate cuts.

Nasdaq futures jumped 1.2 per cent and S&P 500 futures gained 0.6 per cent as Amazon’s stellar earnings sent its shares up a staggering 13 per cent after the bell, which added more than $US300 billion ($A458 billion) to its market value. Apple also rose 2.3 per cent after its outlook on iPhone sales topped estimates.

That offset the drag from Meta and Microsoft overnight amid worries over their surging AI spending. Six of the “Magnificent Seven” US tech megacaps have now reported and the results have been mixed. Nvidia, the world’s first $US5 ($A7.6) trillion company, is due to report in three weeks.

“Things have gone in reverse, or at least slightly retraced, with earnings this morning from Apple and Amazon … improving sentiment going into Asian trade,” said Kyle Rodda, a senior analyst at Capital.com.

“The markets round out the week on still uncertain footing, although the big events of the week are now in the rear view mirror. The report card … isn’t categorically positive but it isn’t all that bad either.”

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.2 per cent on Friday, as gains elsewhere were offset by losses in Chinese stocks. The index was poised for a weekly gain of 1.8 per cent and a monthly rise of 4.7 per cent.

Japan’s Nikkei rallied 1.1 per cent on Friday, adding to its weekly and monthly gains to 5.2 per cent and 15.5 per cent, respectively.

Chinese stocks lagged after a dismal reading on China’s factory activity in October weighed on sentiment. The official purchasing managers’ index (PMI) dropped to a six-month low of 49, well below the forecast 49.6.

Chinese blue chips fell 0.4 per cent and Hong Kong’s Hang Seng index slipped 0.3 per cent.

The much-anticipated summit between US President Donald Trump and Chinese President Xi Jinping led to reduced US tariffs on Chinese goods, resumed US soybean purchases by Beijing and continued rare earth exports from China.

However, market reactions have been fairly muted as the meeting was viewed as just a tactical truce, rather than a major reset in bilateral relations.

This week, major central bank meetings have delivered decisions that are largely in line with expectations, with the biggest surprise coming from Federal Reserve Chair Jerome Powell who pushed back against the market’s sanguine view about a rate cut in December.

Treasuries were steady on Friday, but were set for weekly losses. Two-year Treasury yields were flat at 3.6021 per cent, having risen 12 basis points this week already, while the 10-year yield was steady at 4.0931 per cent and up 10 bps for the week.

The rise in yields offered support to the US dollar , which was holding near three-month highs at 99.459 against its major peers, although resistance seems heavy at 99.564 and 100.25.

The euro was last 0.1 per cent firmer at $US1.1572 ($A1.7650) after the European Central Bank kept interest rates unchanged at 2.0 per cent for the third meeting in a row on Thursday and repeated that policy was in a “good place” as economic risks recede.

Oil prices slipped and were headed for a third straight month of declines as a stronger dollar capped commodities gains and rising supply from major producers offset the impact of Western sanctions on Russian exports.

Brent crude futures slipped 0.5 per cent to $US64.67 ($A98.63) a barrel, while US West Texas Intermediate crude was at $US60.22 ($A91.85) a barrel, down 0.6 per cent.

Spot gold prices held a 2.4 per cent overnight gain at $US4,033.48 ($A6,151.88) per ounce but were still down almost 2.0 per cent for the week and well below its record high of $US4,381 ($A6,682) hit just last week.

Treasurer unveils next stage of investment reforms

Foreign entities will have access to automatic approvals for low-risk investments under a new proposal as the government looks to increase overseas capital flowing into Australia.

Treasurer Jim Chalmers will on Friday reveal a second tranche of reforms to the nation’s foreign investment review scheme at a speech in Sydney.

The government has already introduced changes to the way foreign investments are determined by the Foreign Investment Review Board, including streamlined assessments for investors with a proven track record and more resources for the board.

“Our vision is for Australia to be the destination where global investment flows first and grows fastest,” Dr Chalmers will tell investors at the Citi A50 Australian Economic Forum.

“When you reconsider and redeploy the capital you manage, our objective is for Australia to be the most obvious and most compelling place to put it to work.”

Boosting foreign investment is seen as a key way to fix Australia’s ailing productivity performance, which has fallen in the past decades in line with lower investment in capital such as tools and manufacturing equipment.

Dr Chalmers has previously called for more investment to boost capital deepening – increasing the amount of equipment available to each worker – which he called one of the big challenges to productivity.

Following its economic reform roundtable in August, the government has begun rolling back red tape, put in place an Investor Front Door pilot and begun consultation on changing the super performance test to encourage extra investment.

“We’re open to going further, which is why I’m releasing a new consultation paper for a second tranche of foreign investment reforms today,” Dr Chalmers will say.

“Our goal is a FIRB regime that is much stronger where risks are high, and much faster where risks are low.”

The government will consult on a new automatic approvals process that would allow low-risk actions from trusted investors to require notification but not sign-off.

The FIRB would retain the power to review cases and call them in if needed.

Additional measures include reducing reporting requirements, better managing approved investments and making sure more decisions are made by the statutory deadline.

“We’re also looking to tighten our scrutiny of investments in sensitive sectors, strengthen enforcement powers and ensure non-compliance is penalised,” Dr Chalmers will say.

“And we’ll be consulting on a new enforceable undertakings power and conditions to make sure investment is in the national interest.

“This will make the FIRB regime stronger and faster.”

Lifetime impact of gender pay gap costs women millions

The gender pay gap accelerates across a woman’s working life, peaking in her late-50s and leaving female workers millions of dollars short of men over their careers.

Women entering the workforce in their late teens earn slightly more than men – $376 on average equalling a gender pay gap of two per cent in favour of women – a Workplace Gender Equality Agency (WGEA) report has found.

But between 20 to 24 years, the gender pay gap switches to 1.1 per cent in favour of men and then rises significantly to a peak of 31.4 per cent between the ages of 55 and 59.

This is equivalent to a difference of nearly $53,000 between the average total remuneration of women and men.

The report – Ages and Wages – used information reported by more than 7000 employers to WGEA in 2024 and represents the experience of more than 5.1 million employees in 19 industries across Australia.

It is the first time WGEA has produced the report, which identified a key turning point for female employees occurs around 30, when the gender pay gap rapidly accelerates.

This is driven by a lack of availability of part-time manager roles as well as bonus and overtime systems that favour men.

Women would continue to experience a dramatic lifetime financial impact if further action was not taken to address fairness at work, WGEA chief executive Mary Wooldridge said.

“Our report shows how key employer interventions at critical times could reduce the gender pay gap and improve women’s ability to earn and save for retirement,” she said.

“It also provides insight into how those same actions can help address men’s concerns including lack of flexibility, long-hours work culture and fair and equal access to parental leave.”

The cumulative financial impact, adding the earnings difference for every age from 15 to 67, women earn, on average, about $1.5 million less than men.

“We’re asking employers to change the story and shape the future,” Ms Wooldridge said.

“Closing the gender pay gap enhances women’s capacity to invest for their retirement, provide for their family, afford housing and have financial independence.”

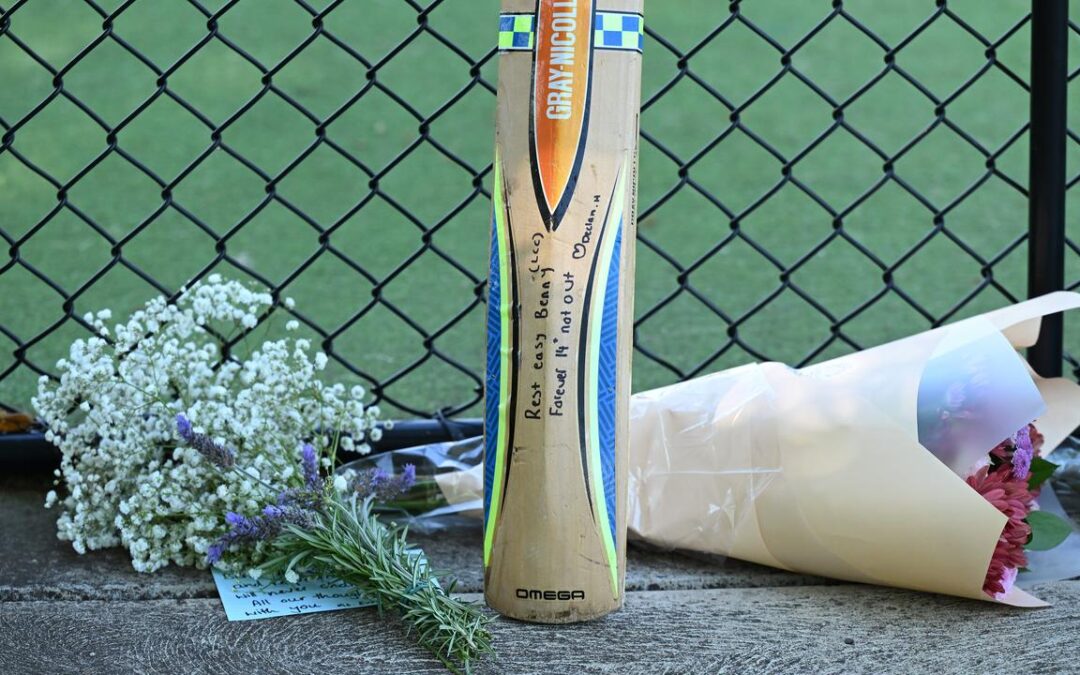

Tributes to cricketer who died after warm-up accident

Clutching flowers instead of bats and bags, dozens of heartbroken young cricketers arrived at a suburban ground to pay tribute to their teammate who never came home.

The tragic scene unfolded after Ben Austin, 17, was struck by a ball while practising in the nets on Tuesday afternoon in Ferntree Gully in Melbourne’s east.

His teammates rushed to help before paramedics transported him to hospital in a critical condition, where he died on Thursday morning.

Within hours, dozens of flower bouquets, sweet treats and a handful of cricket bats left by grieving friends had turned into a memorial for the teen.

A friend told AAP he understood Ben was wearing a helmet at the time of the accident and the bowler was using a “wanger” – a plastic instrument used to sling a ball.

Devastated young people sat nearby discussing the tragedy, while a woman placed a helmet on her head and demonstrated where the ball had hit his neck.

Friend and teammate Liam Vertigan said Ferntree Gully Cricket Club was in a state of shock over the death of such an energetic young man.

“He lived and breathed his cricket,” Mr Vertigan told AAP.

“He was just well loved by us all, very, very polite, always with a smile on his face.”

Ben’s father Jace revealed a teammate was bowling in the nets at the time, describing what happened as an accident that impacted two young men.

Mr Austin said he and his wife Tracey were devastated and would forever cherish their son.

“Ben was an adored son, deeply loved brother to Cooper and Zach and a shining light in the lives of our family and friends,” he said in a statement.

“This tragedy has taken Ben from us, but we find some comfort that he was doing something he did for so many summers – going down to the nets with mates to play cricket.”

Cricket Australia chief executive Mike Baird said the cricket world would come together to support the club and the Austin family.

Ben was involved in multiple football and cricket clubs, while earlier this year he received an award recognising him as a player who demonstrated dedication and the right attitude.

Australian cricketing great Merv Hughes said the young athlete’s death had been felt far beyond his community.

“It doesn’t matter what level of cricket you play, there’s always a chance that something like this happens,” he told reporters on Thursday.

“Right across Australia and throughout the world, no doubt people will be thinking of him.”

The use of helmets and neck guards is mandated across all Cricket Australia-sanctioned competitions but only “strongly recommended” at the community level.

“I don’t want to sound dismissive at all – it’s just tragic – but probably the records show there’s more chance of being hit by lightning than there is of dying through an incident at cricket,” Hughes said.

“So let’s not be too hasty in judging what should and shouldn’t be done.”

The accident came more than a decade after the death of Test cricketer Phillip Hughes, who was struck in the neck with a ball while batting in a Sheffield Shield game at the Sydney Cricket Ground.

Phillip Hughes’ family were among those sending condolences to Ben’s loved ones, expressing hope that they would be comforted by cherished memories of the teenager.

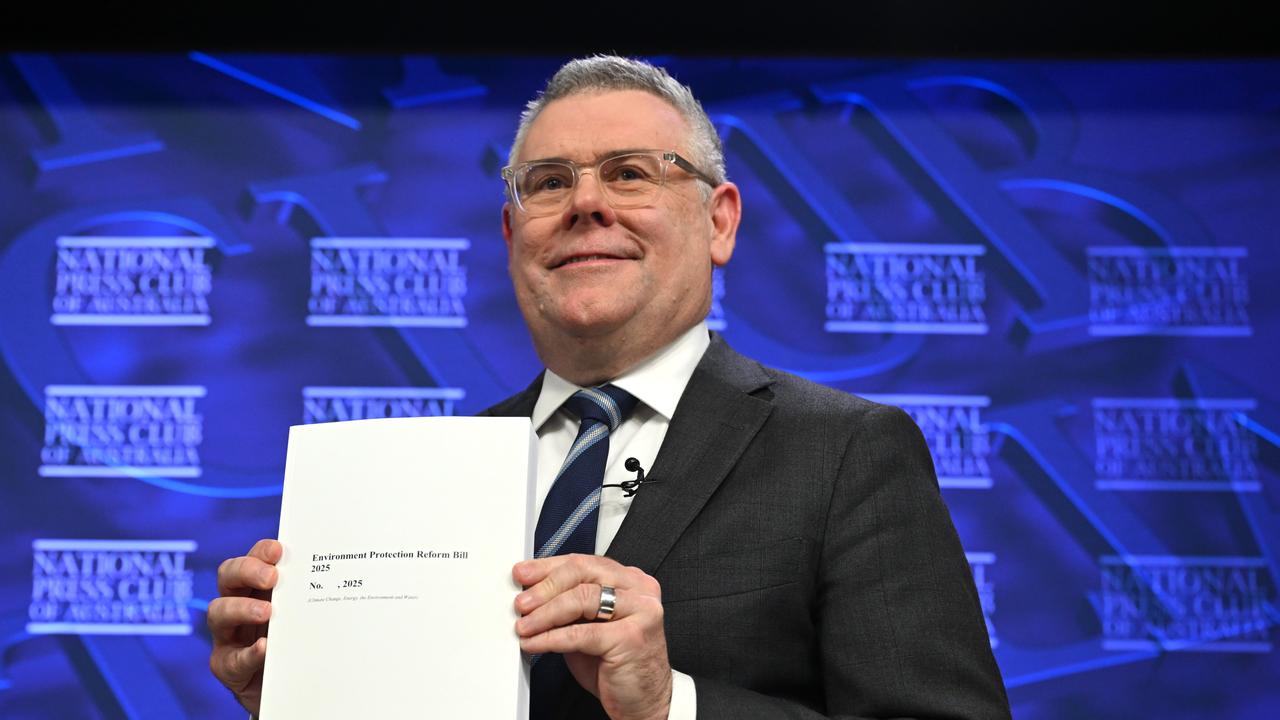

Warning law reforms too ‘weak’ to protect environment

Conservation groups are warning Labor’s latest attempt to refresh nature protections will fail to protect the environment from climate change and other threats.

Federal Environment Minister Murray Watt on Thursday introduced to parliament 1500 pages of changes to the laws protecting threatened species, ecosystems and other matters of national significance.

Environmental groups have welcomed some aspects of the bill, including the commitment to protection standards, but argue the package is not strong enough to protect nature.

“Weak laws will put more valuable forests under a bulldozer, pollution into the atmosphere and destroy Australia’s natural wealth,” Australian Conservation Foundation acting chief executive officer Paul Sinclair said.

“They’re not good enough.”

The package does not include a “climate trigger” to stop coal and gas projects, a mechanism ruled out by Senator Watt, who says the safeguard mechanism already curbs the emissions of Australia’s biggest polluters.

Environmental Defenders Office managing lawyer Revel Pointon said the failure to assess the climate impacts of projects runs counter to international law as laid out in a recent advisory opinion from the World Court.

In the landmark opinion from the International Court of Justice delivered earlier in 2025, the judges specified fossil fuel production could constitute an “internationally wrongful act”.

“Requiring only partial disclosure of greenhouse gas emissions – and not assessing them – is not environmental protection,” Ms Pointon said.

“It’s a free pass for fossil fuel expansion.”

Under the reforms, major emitting project proponents will need to disclose estimates of scope one and two greenhouse gas emissions.

Industry have welcomed efforts to streamline approvals and remove duplication but have taken issue with some elements of the reforms.

Business Council of Australia chief executive Bran Black called for an “appropriately focused” Environmental Protection Agency and the timely accreditation of states and territories to start delivering assessments and approvals to new federal standards.

“Without reforms that strike the right balance, we won’t get the homes, the renewable energy or the critical minerals projects that are vital to Australia’s future prosperity,” he said.

Project approval timelines have blown out by 70 weeks since nature laws were first introduced 25 years ago, Department of Climate Change, Energy, the Environment and Water analysis suggests.

Labor has been rushing to pass legislation before the end of 2025.

The timeline could be in trouble, however, with either the Greens or the coalition needed to pass the laws but both unhappy with the package as it stands.

Greens leader Larissa Waters described it as “gift-wrapped for big business”, while opposition environment spokeswoman Angie Bell was not convinced the changes would give certainty to business.

Workers threatened with weapons as retail crime spikes

Retail workers at Bunnings and Kmart are being threatened by customers more than 1000 times a month, with many incidents involving weapons.

Parent company Wesfarmers, which also owns Target and Priceline Pharmacy, has revealed the extent of worsening rates of retail crime.

Incidents involving threats of serious harm at Bunnings rose by 66 per cent while threatening incidents at Kmart increased 29 per cent, chief executive Rob Scott said.

The company recorded 13,500 instances of customers threatening workers in retail stores across 12 months, he told shareholders at the company’s annual general meeting on Thursday.

More than 1000 of those instances involved physical assault and several hundred threats of serious harm, often with a weapon.

The company has increased security at high-risk locations, trained workers in de-escalation tactics and deployed body-worn cameras.

Data showed one-in-three retail crimes across Australia took place in Victoria – 60 per cent more than any other state.

Research from the Australian Retailers Association and National Retail Association found 79 per cent of Victorians were concerned about rising crime levels, compared to 66 per cent in other states and territories.

“These are not issues just focused on Wesfarmers. These are broader societal community issues,” Mr Scott said.

The conglomerate shared information with retail peers, governments and police because they played important roles in addressing the growing hazard.

“We support sensible reform, including tougher, nationally consistent penalties for violent retail crime and a national conversation to enable controlled, responsible use of technology to exclude known violent offenders from retail environments,” Mr Scott said.

The ACT has laws that allow judges to impose workplace protection orders that prohibit individuals engaging in violence towards workers from attending particular shops for up to 12 months.

South Australia has introduced similar legislation to its parliament.

The NSW government has launched a police retail crime strategy that allows prosecutors to apply to prevent recidivist and violent offenders from re-entering retail premises with a place restriction order after a conviction.

The Victorian government said laws to crack down on the assault and abuse of retail workers were imminent.

Wesfarmers delivered a record net profit after tax of $2.7 billion excluding significant items, up 3.8 per cent on the previous year, and a revenue of $46 billion.

Despite this, chairman Michael Chaney warned of an exodus of business investment if a Productivity Commission recommendation to add a five per cent cash flow tax on big businesses was accepted.

Mr Chaney said $43 billion (93 per cent) of Wesfarmers’ revenue went to other parties such as suppliers, team members, governments and the community.

“This breakdown of our financial performance highlights the importance of large companies in our economy, and that’s a fact that is not well enough recognised,” he said.

A cash flow tax would make Australia’s tax regime “one of the most onerous in the world” and drive investment offshore, Mr Chaney said.

He warned this would threaten Australia’s productivity performance and said corporate and income tax levels were too high.

“Our political leaders seem unwilling to address this. It’s time to think about the long-term needs of Australia and stop worrying about near-term political risks,” he said.

Rudd hails Australia’s ‘first-class’ ties with Trump

Riding high from a successful bilateral meeting with United States President Donald Trump, Australia’s ambassador Kevin Rudd has heaped praise on Anthony Albanese for managing the alliance while repairing ties with China.

Shrugging off the tongue-in-cheek personal jabs he received from Mr Trump during a press spray, Mr Rudd told high-powered financial executives at the Citi A50 Sydney Investment Summit Canberra was viewed positively in Washington DC.

“Australia … is enjoying a first-class working relationship with the Trump administration … and you’ve seen some of the practical fruit of that from what the PM agreed to in recent days,” he said on Thursday in a gilded room at the Opera House.

Mr Rudd was referring to the multibillion-dollar deal inked earlier in October that gives the US greater access to Australia’s critical mineral reserves.

Mr Trump heaped praise on Mr Albanese at an exclusive dinner with other world leaders on Thursday on the sidelines of the APEC summit in South Korea, talking up co-operation between the US and Australia.

“You’ve done a fantastic job … we’re working together on rare earths, but we’re working on a lot of things together and it’s working out very well,” he said.

In a fireside chat with NSW Treasurer Daniel Mookhey at the Sydney summit, former prime minister Mr Rudd said Mr Albanese was pivotal in restoring ties with China after “there were many disruptions to the trade relationship”.

Ties strained to near breaking point under Scott Morrison’s tenure before being steadied, but jockeying for political and military influence in the Asia-Pacific has required careful management of links with the US and China.

“The underlying strategic tensions in the region will remain and the practical challenge for statecraft will be how those rolling operational tensions are navigated,” Mr Rudd said.

Both Australia and China recently traded barbs over an encounter between their militaries in the South China Sea, most of which is claimed by Beijing as part of its territory.

The government said a Chinese fighter jet dropped flares near one of its patrol planes, prompting Beijing to complain that Canberra was trying to cover up an “intrusion” into Chinese airspace.

Mr Albanese has sidestepped the hiccups and said he hoped trade tensions between the US and China would ease.

“The United States and China have an important role as the two major economic powers that exist in our region,” he said.

“These are important relationships for Australia.”

The talks between Mr Trump and Chinese President Xi Jinping, which Mr Rudd said were “of foundational importance”, follow months of friction over tariffs and security.

“We have been able to manage, not only a stable, productive and expansive relationship with the US … we’ve also restabilised the China relationship as well,” Mr Rudd said.

Coles puts heat on Woolworths with strong sales growth

Coles has kept gaining on Woolworths in the supermarket wars, eclipsing its distracted arch-rival’s quarterly sales growth.

Coles Group’s supermarket sales revenue grew twice as fast as that of Woolworths in the first quarter of the financial year, although Woolworths remains the larger player.

Coles said on Thursday its supermarket sales were up 4.8 per cent to $9.97 billion in the 13 weeks to September 28.

In comparison, Woolworths’ Australian retail sales grew by just 2.1 per cent to $13.9 billion in the 14 weeks to October 5.

Coles also took market share from Woolworths in 2024/25, with seven per cent sales growth compared to Woolworths’ four per cent.

“The really pleasing feeling for us at the moment is that we’ve got strength in sales across the board,” Coles Group chief executive Leah Weckert told reporters on Thursday.

She cited in particular the performance of non-food products such as its own-brand nappies and baby wipes.

“These represent really great value for customers, as well as being fantastic quality,” Ms Weckert said.

E-commerce supermarket sales grew 27.9 per cent to $1.3 billion, making up a record 13.3 per cent of Coles’ overall supermarket sales.

RBC Capital Markets analyst Michael Toner said Coles was continuing to outperform Woolworths.

However, he said the comparison would get tougher towards the end of the year, with the benefit Coles received a year ago from industrial action in Woolworths’ distribution centres last December.

Coles’ Liquorland business did not do as well, with sales falling 1.4 per cent to $842 million.

“The liquor market is still challenging,” Ms Weckert said.

“Customers are still seeking out value, and they’re limiting consumption as they’re managing the overall family budget, but we are really pleased with the results that we’ve seen from the Simply Liquorland rollout.”

The rollout involves converting all of Coles’ liquor stores into Liquorlands.

“We think that is putting us in good shape from a future perspective, when cost of living becomes less of a focus for families and they start doing a bit more entertaining, and some of the behaviours reverse back.”

Coles converted another 60 of its Vintage Cellars and First Choice Liquor Market stores to Liquorlands during the quarter, taking the total number of conversions to 112.

It plans to have all 160 such stores converted by the end of the year.

New tobacco laws and the growth in the black market meant Coles’ tobacco sales fell by 57 per cent, compared to the same period a year ago.

Supermarket price inflation moderated, with food prices climbing by 1.2 per cent compared to 1.5 per cent in the previous quarter.

Coles said an abundant supply of fruit and vegetables including avocados, tomatoes and capsicum helped bring down prices, while beef and lamb prices rose.

‘Eye off the ball’: Woolies lays blame for limp results

Cost-of-living pressures, price cuts and worker strikes have led to “disappointing” earnings for the nation’s largest supermarket chain.

Woolworths recorded falling earnings in the 2024/25 financial year, while sales were up 3.6 per cent to $69.1 billion but well short of expectations.

The results reflected the result of a series of challenges, the supermarket giant’s chair Scott Perkins said.

“I want to make it very clear to all shareholders that neither your board nor … the management team is satisfied with recent performance,” he told shareholders at the company’s annual general meeting on Thursday.

“We have put behind us a period where our teams were distracted by external factors, including a raft of regulatory inquiries, industrial action and CEO succession.”

Woolworths had also adjusted to the “new normal of intensified competition”, Mr Perkins added, on the same day chief rival Coles reported faster sales growth in the first quarter of the new financial year.

The supermarket giant also faced a more than $100 million hit after distribution centre workers went on strike for 17 days at the end of 2024.

Mr Perkins acknowledged the focus on the various external events impacted on customers’ trust of the grocery giant’s pricing.

“(We) took our eye off the ball at a period of quite dramatic change … and the customer changed their purchasing patterns quite significantly during the period,” he said.

Amanda Bardwell, who appeared at her first general meeting as chief executive, said cost-of-living pressures continued to weigh on household budgets, causing people to focus on hunting for bargains.

The supermarket posted a 2.7 per cent increase in sales to $18.5 billion for the first quarter of the 2025/26 financial year.

Its growth lagged that of its chief rival Coles, where sales grew 3.9 per cent to $10.5 billion.

“I want to acknowledge that this performance was disappointing and well below our expectations,” Ms Bardwell said.

“We want to be the first choice for customers for the freshest Australian food.”

The issue of salmon farming reared its head at the meeting for the second year running as executives faced a barrage of questions about the supermarket’s decision to continue selling farmed salmon.

Fish-farming practices in Tasmania’s Macquarie Harbour have been blamed for threatening the endangered Maugean skate, whose remaining wild populations live exclusively in the body of water.

The supermarket was lashed by several shareholders for continuing to label its salmon products from Macquarie Harbour as “responsibly sourced” despite rival Coles removing the description from its packaging.

More than a third of shareholders voted in favour of Woolworths identifying and reporting the impacts of farmed seafood it sells, while 14 per cent supported a motion for the company to align itself with a global best practice standard.

Ethical share trading platform SIX’s Phoebe Rountree said the vote sent a strong message that Woolworths needed to take nature risks more seriously.

“This is a message from shareholders today and investors will be watching them very closely to see how they respond to this vote,” she told AAP.

Mr Perkins said the company relied on information from the University of Tasmania that indicated skate populations had recovered to decade-long highs.

“However, if the evidence changes, so too will our position,” he said.

“This is not a crusade by Woolworths.”