China extends visa-free policy to end of 2026

China will extend its visa-free entry policy for 45 countries including Australia and New Zealand to December 31, 2026 and expand the scheme to cover Sweden, effective November 10, the foreign ministry says.

The extension covers 32 European countries as well as Australia, New Zealand, Japan, South Korea and several states in South America and the Gulf region, a statement released by the foreign ministry’s consular affairs department showed.

The policy was scheduled to expire at the end of this year for many of the countries.

China has offered visa-free entry to citizens from dozens of countries in recent years as part of efforts to woo foreign visitors, revive a tourism sector battered by years of strict COVID-19 controls and boost foreign engagement.

The United States, Canada and the United Kingdom are not part of the scheme.

Under it, visitors from eligible countries can enter China for business, tourism, family visits, or transit for up to 30 days without a visa.

China is also expanding its outreach to the European Union, a key trading partner, at a time of fraught trade ties.

China confirmed that its one-year suspension of expanded rare earth export controls, announced after a meeting between President Xi Jinping and US President Donald Trump in South Korea last week, will also apply to the European Union, the bloc said after officials met in Brussels last week to alleviate tensions.

The two sides agreed to continue communication and exchanges to promote the stability and smooth operation of China-EU industrial and supply chains, China’s commerce ministry said on Monday.

Cup Day forecasts to bring intrigue, rate cut off cards

Analysts have largely written off the possibility of more mortgage relief on Melbourne Cup Day, but updated economic forecasts could hold the answer to where the bank will move next.

With inflation rising again, the majority of market economists and bond traders are predicting the Reserve Bank will leave the cash rate on hold at 3.6 per cent when the monetary policy board leaves its lock-up on Tuesday.

A surprise surge in inflation last week meant the RBA would “definitely” leave rates on hold, Chartered Accountants chief economist Richard Holden said.

Underlying or trimmed mean inflation, which is the Reserve Bank’s preferred measure, jumped one per cent in the September quarter, which was materially higher than the bank’s forecasts, governor Michele Bullock said.

After cutting rates as soon as underlying inflation returned to its two to three per cent target band, the RBA’s move now looked premature, Professor Holden said.

“I think they’re in a bind and the Australian economy is in a bind,” he told AAP.

“Unemployment is ticking up, but inflation is (also) ticking up, and if there was to be another increase in inflation … then they might have to start raising rates, which would really signal that they just misread the play terribly.”

With little chance the RBA takes financial markets massively off guard by cutting or hiking rates, the main source of interest from analysts will be the tone of Ms Bullock’s post-meeting media conference and the bank’s updated Statement on Monetary Policy.

The quarterly statement provides an update of RBA staff projections for key economic data.

Economic growth, unemployment and especially inflation forecasts will be closely scrutinised as major revisions are likely to provide some more clarity on when, or if, borrowers might expect another cut.

Ms Bullock is likely to indicate an ongoing concern over growth in unit labour costs, a key indicator of inflation that has been elevated by Australia’s sluggish productivity growth.

After the initial spike in inflation, which was mainly driven by overseas factors, the recent uptick in inflation appears more domestically driven and harder to abate.

“This looks like homegrown stuff, particularly in the services sector, which I think is reflecting lousy productivity outcomes and still reasonably robust wages increases,” Prof Holden said.

Coalition’s climate change policy fight ‘unavoidable’

A political divorce between the Liberal and National parties might be needed to save the coalition from “damaging” infighting over divisive climate policy, an analyst says.

Moderate Liberal MPs are discussing splitting from the Nationals after the rural party voted to dump their commitment to net-zero emissions by 2050 at a meeting on Sunday.

It places additional pressure on Sussan Ley’s leadership as her inner circle mulls ditching the climate target.

The opposition leader said the Nationals were entitled to take their own position on net zero.

While some within the Liberals are open to a relationship break, others hold a view the longer the two parties are separated the harder it will be to get back together, with the risk of greater divergence in other policy areas.

Monash University head of politics Zareh Ghazarian said a split would not be a bad idea as it would give the parties some time apart.

“They would be able to get their houses in order and they’d be able to consider whether they wanted to come back as a coalition before the next election,” he told AAP.

“It would be more damaging, politically, for the coalition to constantly be in conflict with each other.

“Resolving this question of climate change is unavoidable for the parties and if that means that they have to have a bit of a break, as they indicated, after the May election from each other, then this might be the opportunity to do so.”

Dr Ghazarian pointed to the issues climate change policy presented for previous prime ministers including Malcolm Turnbull.

Opposition energy spokesman Dan Tehan has said the party is likely to finalise its position by the end of 2025.

Liberal frontbencher Andrew Bragg called for the climate target to be retained in some form, stressing that Australia must maintain its international obligations.

“The Paris Accord requires you to get to net zero in the second half of this century,” Senator Bragg told Sky News.

“I don’t think it’s beyond the realm of possibility that Australia could achieve that.”

US company Kimberly-Clark buys Tylenol maker Kenvue

Kimberly-Clark is buying Tylenol maker Kenvue in a cash and stock deal, creating a massive consumer health goods company.

In the deal worth about $US48.7 billion ($A74.5 billion), Kimberly-Clark shareholders will own about 54 per cent of the combined company while Kenvue shareholders will own about 46 per cent.

The combined company will have a large stable of household brands under one roof, putting Kenvue’s Tylenol medicine, Listerine mouthwash and Band-Aid side-by-side with Kimberly-Clark’s Cottonelle toilet paper, Huggies and Kleenex tissues.

It will also generate about $US32 billion in annual revenue.

Kimberly-Clark and Kenvue said that they identified about $US1.9 billion in cost savings that are expected in the first three years after the transaction’s closing.

“With a shared commitment to developing science and technology to provide extraordinary care, we will serve billions of consumers across every stage of life,” Kimberly-Clark chairman and CEO Mike Hsu said in a statement.

Hsu will be chairman and CEO of the combined company.

Three members of the Kenvue’s board will join Kimberly-Clark’s board at closing.

The combined company will keep Kimberly-Clark’s headquarters in Irving, Texas and continue to have a significant presence in Kenvue’s locations.

The deal is expected to close in the second half of next year.

It still needs approval from shareholders of both both companies.

Shares of Kimberly-Clark slipped 11.8 per cent on Wall Street while Kenvue’s stock jumped more than 17 per cent.

Warning for Liberals on net zero as axing calls grow

The coalition is unlikely to be in power for another decade if the Liberals follow the Nationals in jettisoning their commitment to net zero emissions by 2050, an expert warns.

The Nationals voted unanimously over the weekend to drop the target from the party’s official platform, setting up a potential clash with the Liberals.

Moderate Liberal MPs have advocated for the party to maintain its support for the target, while conservatives have urged leader Sussan Ley to abandon the pledge.

Kos Samaras, founder of research firm Redbridge, said the coalition risked losing much-needed votes from younger Australians after its election drubbing in May if it dropped the climate commitment.

“Politically, at this rate, they won’t be in government in the next 10 years,” Mr Samaras told AAP.

“The coalition is only securing 15 to 16 per cent of Gen Z voters in this country.

“This entire saga is going to continue to basically put more nails on that coffin of theirs when it comes to talking to younger Australians.”

Ms Ley said the Nationals were entitled to take their own position on net zero.

“I always said that the Nationals would come to their decision in their party room and the Liberals would similarly come to our decision in our party room,” Ms Ley told reporters at Parliament House on Monday.

Liberal frontbencher Andrew Bragg called for the target to be retained in some form, stressing that Australia must maintain its international obligations.

“The Paris Accord requires you to get to net zero in the second half of this century,” Senator Bragg told Sky News.

“I don’t think it’s beyond the realm of possibility that Australia could achieve that.”

However, Liberal backbencher Sarah Henderson hopes her colleagues support the Nationals’ position and “turn our back entirely on Labor’s terrible net zero laws”.

Fellow backbencher Rick Wilson called for the opposition to get rid of the target, and said his vast electorate of O’Connor in southeast WA is “ground zero for net zero”.

Debating maverick Nationals MP Barnaby Joyce’s bill to scrap net zero in parliament on Monday, Mr Wilson said he was frustrated agricultural land was being converted into renewables projects.

Mr Joyce, who has flagged his intention to quit the Nationals amid frustration over net zero, said he had more to go through before making a decision on his political future, despite the target being dropped.

As division within the opposition reached a fever pitch, Prime Minister Anthony Albanese said he would “leave the coalition to their chaos and infighting”.

He acknowledged power prices and the cost of living are impacting households, but laid some of the blame on the former government.

“What has occurred on power prices is a product in part of the dysfunction and chaos that’s been there (in) the coalition – 24 out of 28 coal-fired power stations announced their closure,” the prime minister told reporters in Canberra.

“They had no plan to do anything other than fighting each other, and that’s continuing today.”

The Nationals’ position has put the party out of step with the Business Council of Australia and National Farmers’ Federation, but leader David Littleproud said he wouldn’t be taking “gratuitous advice” from others.

The party argued Australia is doing its fair share to reduce greenhouse gas emissions and the nation’s goals should be brought into line with an average among comparable nations.

Mr Littleproud said he would not be pressuring the Liberal Party to drop its commitment.

Illicit cigarettes surge clouds modest spending lift

Australia’s addiction to black-market tobacco has dragged down consumer spending figures, as the nation’s economic recovery stumbles along.

After two soft months of growth, household spending rose just 0.2 per cent in September, the Australian Bureau of Statistics reported on Monday.

But the data was muddied by a surge in illicit cigarette and vape sales, which are not included in the official statistics.

Excluding the sharp drop in supermarket cigarettes and tobacco sales, the indicator would have risen by 0.4 per cent over the quarter, double the reported figure.

The outcome undershot analyst expectations, with ANZ economists predicted spending growth to accelerate to 0.4 per cent while Commonwealth Bank’s economics team pencilled in a rise of 0.5 per cent.

The relatively subdued result for the month could also reflect consumers are holding out for November sales, which have become more significant in recent years, EY chief economist Cherelle Murphy said.

Household consumption had been steadily rising since the start of the year, as the Reserve Bank of Australia’s rate cuts boosted consumer sentiment.

But consumer confidence has since plateaued, as global uncertainty has risen and expectations for more rate cuts have fallen.

The moderate rise in spending followed a flat result in August and a 0.4 per cent rise in July, said ABS head of business statistics Tom Lay.

“Spending on non-discretionary items drove the overall rise, as households spent more on food, health, and petrol,” he said.

“Discretionary spending was flat for September, with higher spending on recreation and culture being offset by falls for air travel and accommodation.”

Health spending has been particularly strong, rising by 8.1 per cent over the past 12 months, as demand and costs for health services have increased, Ms Murphy said.

On an annual basis, household spending has risen 5.1 per cent – near a 22-month high – driven by higher real incomes, lower interest rates, and the wealth effect from rising property values, she said.

With consumption continuing to rise gradually and underlying inflation jumping to three per cent in the September quarter, the RBA is not expected to cut interest rates at its November meeting, which started on Monday and wraps up Tuesday afternoon.

As a result, the central bank has clearly turned more cautious over the past few weeks, said Domain chief economist Nicola Powell.

“Put simply, the RBA can’t move too quickly to cut rates, which will disappoint many hopeful buyers and mortgage holders,” Dr Powell said.

Reese Witherspoon admits anxiety is key to her success

Oscar-winning actress Reese Witherspoon puts her success down to anxiety, saying she’s been “rewarded” for perfectionism and stresses herself out “in service of my job”.

Reflecting on her acting and producing career, the Legally Blonde actress, 49, said she is “starting to relax into the idea that I’m enough”.

“Those at the beginning of my career were incredibly encouraging, but also gave me a lot of real-world advice about how to behave, how to carry myself, what not to do: not to move to Los Angeles,” she told Harper’s Bazaar UK.

“They said, ‘stay in Nashville, be a child for as long as you possibly can’. I was really friendly and bubbly and smiley. People thought I was faking it.

“The perception of being from the South was that I didn’t belong to the coastal-elite communities.

“I wasn’t part of the art world, or the cool-kid club. It was a culture clash. I didn’t understand the sharp elbows and competitive nature of what I did.”

The actress, who was born in Louisiana, is known for her roles in Cruel Intentions, American Psycho and Walk The Line which won her an Academy Award for best actress.

Witherspoon was a producer on thriller Gone Girl and adventure drama Wild, which also earned her an Oscar nomination, and she is producing a Legally Blonde prequel series through her media company Hello Sunshine.

“I was probably successful because I had so much anxiety – they go hand in hand,” she said.

“I had pressured myself to extreme levels to show up at work in a perfect way.

“We all now know – perfect is not attainable. It’s not sustainable.

“I stressed myself out in service of my job, and it got me really, really far.

“I’m rewarded for my anxiety and perfectionism, but I’m getting older and am starting to relax into the idea that I’m enough.

“I mean, I’ve had an abundance of good fortune, great work opportunities and worked with some of the greatest people on earth.”

In 2016 Witherspoon co-founded Hello Sunshine, now part of Candle Media, which aims “to shine a light on where women are now and help them chart a new path forward”, according to its website.

“I advocate for storytelling that is inclusive and more reflective of the entire female experience, because it’s been shrouded for hundreds of years,” she said.

Her company also produced Apple TV drama The Morning Show, which has won three Emmys and stars Witherspoon and Jennifer Aniston as co-anchors of a news program.

Reflecting on her 50th birthday next year, Witherspoon said she wasn’t worried about the milestone.

“I like getting older. I think it’s great to be wiser and understand your place in a business.

“I’ve worked really hard to get to that place … I feel like I’m living my purpose, for sure. I love my job. I love my fans. I’m the captain of my own destiny.”

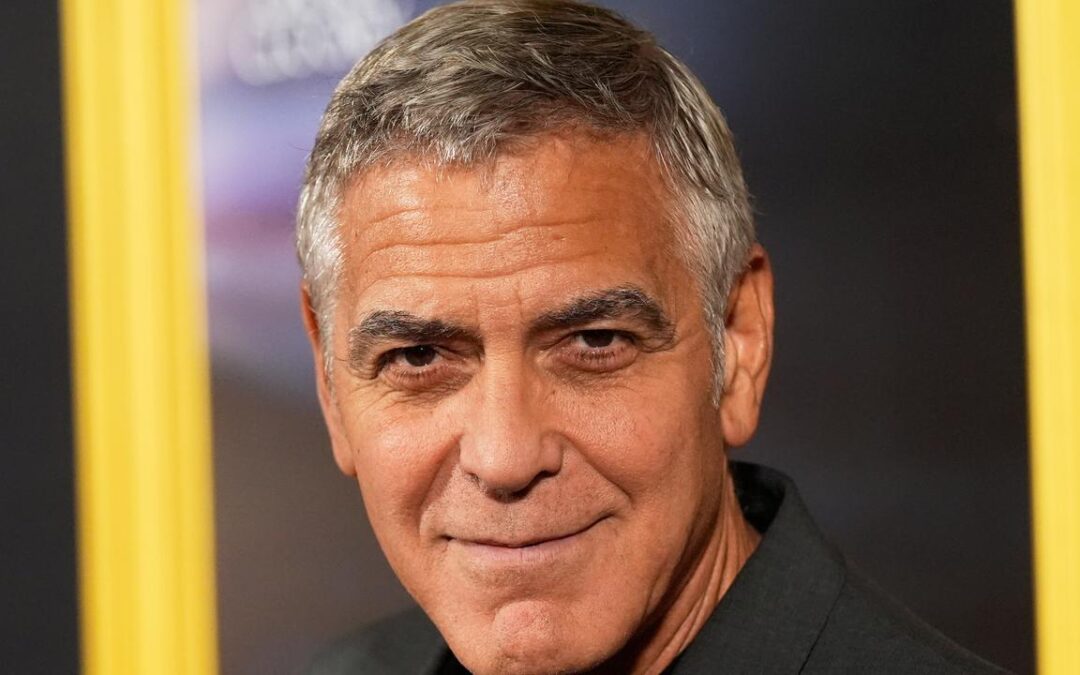

It was a mistake to replace Biden with Harris: Clooney

Hollywood actor George Clooney says it was a mistake to replace Joe Biden with Kamala Harris during the 2024 US presidential election.

The outspoken Democrat, also said he was “saddened” by the “real attack” on US institutions that “hold truth to power”.

Clooney called for Biden to quit the race in a New York Times opinion piece and argued the party should pick a new nominee at its August 2024 convention, saying the process would be “messy” but “wake up” voters in the party’s favour.

Asked if he would write this again, he told US show CBS News Sunday Morning: “Yes, we had a chance. I wanted there to be, as I wrote in the op-ed, a primary.

“Let’s battle test this quickly and get it up and going. I think the mistake with it being Kamala is that she had to run against her own record, and it’s very hard to do if the point of running is to say, ‘I’m not that person’. It’s hard to do,” he said.

“And so she was given a very tough task. I think it was a mistake, quite honestly.

“But we are where we are. We were going to lose more house seats, they say.

“To not do it would be to say, ‘I’m not going to tell the truth’.”

Biden ended his bid for re-election in July 2024 following mounting pressure to step aside after a faltering debate with Republican rival Donald Trump a month earlier.

His son, Hunter Biden, accused Clooney of exaggerating the former president’s frailty.

“I could spend a lot of time debunking many of the things he said, because many things he said were just outright lies,” Clooney said.

Speaking about the importance of a free press, Clooney said: “I want our government to reflect us at our best and to step in when needed and I am watching a real attack on all the basic institutions, and I’m saddened by that.

“And I’ve seen this pendulum swing so many times. People will talk about this being the worst time in the country for a lot of people, and it’s bad,” he said.

However, he pointed out “1968 was pretty rough, too”.

“Every city in the United States was on fire. They killed Martin Luther King and Bobby Kennedy. The Tet Offensive. Vietnam War still raging. The capital was surrounded by armed guards to protect them,” he said.

“We’ve been in tricky situations. We’ve had a civil war. We’ll get through it, but I am saddened by it, and I think that we must protect the institutions that hold truth to power.”

Westpac touts ‘solid’ year as profits near $7b

Westpac has delivered a $6.9 billion full-year net profit, up slightly on its result for the previous year.

The big four bank on Monday said its net interest margin, a key metric that contributes to a lender’s profitability, slipped slightly over the year amid persistent competition in loans and deposits.

Westpac’s loan book increased by six per cent to $851.9 billion and its customer deposits climbed seven per cent to $723 billion.

The bank had a market share of 21 per cent of Australian household deposits and mortgages, and 16 per cent of Australian business lending.

Operating expenses rose nine per cent to $11.9 billion, reflecting salary and wage growth and the cost of rolling out the Unite program to simplify its banking systems.

“This has been a solid year at Westpac and I’m pleased with the result we are delivering today,” chief executive Anthony Miller said.

“With a very strong balance sheet and momentum in our target segments, the opportunity to deliver more for our customers, people and shareholders is exciting.”

Mr Miller said he was pleased with Westpac’s growth in deposits and loans, and 22 per cent growth in its agribusiness portfolio, mostly from existing customers.

“This reflects our focus and investment in regional Australia,” he said.

Westpac has opened a service centre in the NSW town of Moree with more locations to be added.

The bank announced it would pay shareholders a final ordinary dividend of 77 cents per share, taking its total dividends for the 2024/25 financial year to $1.53 per share, up one per cent from the previous year.

World Economic Forum head warns of AI, crypto bubbles

Large investments in artificial intelligence and cryptocurrencies could lead to the development of bubbles, according to World Economic Forum president Børge Brende.

“There is definitely a geopolitical disorder … But even in the situation of geopolitical disorder, the global economy has been incredibly resilient – not necessarily in Europe but in India, China and the USA,” Brende said in Berlin.

He noted that this was being fuelled by investments in new technologies like AI.

“This year has seen $US500 billion ($A762 billion) of investments in AI alone. So, what we can be worried about is that there may be bubbles developing, be it a bubble on crypto or an AI bubble,” Brende said.

The WEF head said investors need to be patient with these investments.

But he also said that frontier technologies would be the new drivers of growth.

“We will also need to make sure that the new technologies and the benefits trickle down. We could even see productivity gains of 10 per cent in the coming decade. And productivity is prosperity,” Brende said.

He described the new technologies as “a big paradigm shift” and predicted breakthroughs in medicine, synthetical biology, space and energy.

“AI can accelerate processes so quickly,” he said.

The Norwegian has taken over from WEF founder Klaus Schwab.

The forum holds an annual conference in Davos in the Swiss Alps attended by world political and economic leaders.

The 56th conference is scheduled for January 19-23, 2026.

Brende also expressed concern about global crises and conflicts.

“There is definitely a geopolitical disorder: the world order we had is not there anymore. What is the next world order? Hopefully not the law of the jungle,” he said.

And, in a reference to current US tariff policy, he said that uncertainty was the highest tariff.

“One of my worries is that global investments are going down. We need to re-establish an environment for investments,” he said.

Brende said the current competition between the United States and China was “basically a competition for hegemony or dominance in technology. The country that leads in new technologies – be it quantum, superintelligence, AI, autonomous vehicles or synthetical biology – will also be the most powerful nation coming out of this century,” he predicted.

And he called for multilateral action to deal with “problems that don’t travel with a passport,” including pandemics and cybercrime.

The world is becoming more complicated with different groups forming, Brende said.

He pointed to a G4 of the US, China, Europe and India, followed by fast-growing economies like Indonesia, Malaysia, Nigeria and Brazil.

“It’s going to be a renaissance for mega-regional, so-called plurilateral, deals. But the world is going to be more complicated. There are going to be more suboptimal, not necessarily cost-effective solutions. There is going to be more friendshoring,” he said.