Tobacco black market sending billions up in smoke

Illegal tobacco is burning a $4 billion hole in Australia’s hip pocket, with skyrocketing tobacco tax blamed for fuelling the underground trade and escalating violence.

Reports from the Australian Criminal Intelligence Commission and Australian Institute of Criminology lay bare the national scale and cost of serious and organised crime.

The direct and indirect cost of organised crime to Australia jumped to $82.3 billion in the 2023/24 financial year, up from $68.7 billion in 12 months.

Illicit tobacco’s cost of the Australian economy was estimated to be $4 billion, a four-fold increase over the past three years.

Of that figure, $3.3 billion was as a result of lost tax revenue from the tobacco excise, with the rest from associated healthcare costs and reduced productivity.

Organised crime groups’ efforts to control the illicit tobacco and vape market has led to 200 fire bombings, at least three murders and countless acts of intimidation and extortion, the commission’s chief executive Heather Cook said.

“Legitimate businesses have been forced to close their doors,” she said in a speech at Canberra’s National Security College on Thursday evening.

“Billions of dollars in lost tax revenue means less money for hospitals, schools and essential services.

“Organised crime syndicates then recycle these illicit proceeds into a range of other criminal activities, further impacting community safety, security and the broader social fabric.”

The violence was not contained, spilling into streets and impacting bystanders and entire neighbourhoods, Ms Cook added.

Tobacco sales across Ritchies IGA’s 156 shops in Victoria, NSW and Queensland have cratered from $300 million to $60 million in four years.

Woolworths’ tobacco sales in the September quarter were down 51 per cent on the same period last year, while Coles had a 30 per cent drop over the past financial year.

It follows sharp increases in the federal tax on tobacco to $1.50 per stick, pushing the average cost of a legal over-the-counter pack of 20 cigarettes in Australia past $40.

Australian Association of Convenience Stores chief executive Theo Foukkare said legal tobacco contributed to about 40 per cent of all non-fuel sales at service stations and corner stores as recently as four years ago.

That has dwindled to about 15 per cent, with Mr Foukkare pointing the finger at the federal government’s decision in 2019 to lift the tobacco tax by 55 per cent over three years on public health grounds.

“The crime groups are … in a smugglers paradise,” he told ABC Radio.

“We have the highest excise in the world. We up until very recently have had very limited enforcement with meaningless fines and effectively next to no prosecutions.”

The federal government unveiled a multi-agency national tobacco disruption task force in October after the collapse of tobacco excise revenue.

Two shops in Sydney’s north were the first to be shut down for selling illicit vape and tobacco products under new NSW health powers.

While issuing closure orders in raids on Tuesday, NSW Health inspectors seized 3860 illicit cigarettes and 224 illegal vapes at both shops.

US flights slashed during government shutdown order

US airlines have cancelled hundreds of flights around the country due to a federal order to reduce traffic at the country’s busiest airports, as the government shutdown continues.

Nearly 500 flights scheduled for Friday were already cut nationwide, and the number of cancellations climbed throughout Thursday afternoon, according to FlightAware, a website that tracks flight disruptions.

The Federal Aviation Administration has ordered airlines to phase in a 10 per cent reduction in their flight schedules across more than two dozen states.

Airlines were scrambling to figure out where to cut, and travellers with plans for the weekend and beyond waited nervously to see if their flights would take off as scheduled.

The affected airports include busy connecting hubs and those in popular tourist destinations, including Atlanta, Denver, Orlando, Miami, and San Francisco. In some of the biggest cities — such as New York, Houston and Chicago — multiple airports will be affected.

“This is going to have a noticeable impact across the US air transportation system,” industry analyst Henry Harteveldt said.

The FAA said Wednesday it would reduce air traffic by 10 per cent across “high-volume” markets to maintain travel safety as air traffic controllers exhibit signs of strain during the shutdown.

The controllers have been working unpaid since the shutdown began on October 1, with many calling in sick.

The cuts could affect as many as 1,800 flights, or upward of 268,000 passengers, per day, according to an estimate by aviation analytics firm Cirium.

Package deliveries could also be disrupted because two airports with major distribution centres are on the list — FedEx operates at the airport in Memphis, Tennessee, and UPS in Louisville, Kentucky, the site of this week’s deadly cargo plane crash.

Meanwhile, a federal judge has ordered the Trump administration to find the money to fully fund November’s SNAP food-aid benefits, which had been suspended after the shutdown.

The ruling gave the government until Friday to make the payments through the Supplemental Nutrition Assistance Program, though it’s unlikely the 42 million Americans — about 1 in 8 — will see the money on the debit cards they use for groceries that quickly.

The order was in response to a challenge from cities and non-profits complaining that the administration was only offering to cover 65 per cent of the maximum benefit, a decision that would leave some recipients getting nothing for this month.

US District Judge John J McConnell Jr was one of two judges who ruled last week that the administration could not skip November’s benefits entirely because of the federal shutdown.

‘Can’t keep being negative’: ex-leader lashes Ley, Libs

Sussan Ley has been savaged by a former Liberal leader for lacking strategy and leadership, as the party grapples with infighting and demoralising polling.

The opposition leader has been accused of failing to articulate a way forward for the Liberals, who are edging closer to a final position on their energy and climate change policy.

After a fortnight of damaging infighting and wild leadership speculation, Ms Ley has called a series of party room meetings to bed down a new approach to energy and emissions reduction.

As the party prepares to negotiate its final policy, former Liberal leader John Hewson has delivered a withering assessment of Ms Ley and the party she leads.

“She hasn’t shown any clear strategy, or any strong capacity in terms of leadership,” he told AAP.

Mr Hewson, who let his membership lapse in 2019 because of concerns about the party’s record on climate change, said the opposition was devoid of serious policies because its members had little experience outside politics.

“They haven’t got people with significant business experience … I don’t think that they’ve got people who are policy wonks in economic policy,” he said.

“You can’t just keep being negative and hoping to win on criticism, as (Tony) Abbott did.”

As opposition leader, Mr Hewson took a highly detailed promise of economic reform to the 1993 federal election, which the coalition roundly lost to Paul Keating’s Labor government.

“I’d really like to see Sussan be given a fair run with everyone pitching in and doing a proper policy job,” he said.

Mr Hewson was also highly critical of West Australian MP Andrew Hastie, who is widely considered a potential leadership contender.

“He’s been sold a bit of a dump by the right of the party,” the former Liberal leader said, arguing Mr Hastie’s criticism of Australia’s immigration program was unlikely to be popular in the broader electorate.

Mr Hastie is a vocal critic of Australia’s climate targets, an issue the Liberals appear to be a step closer to resolving their differences over.

After weeks of internal brawling, a party room meetings have been called for next week to finalise the coalition’s energy and emissions reduction policies.

Liberal members will discuss their energy and emissions-reduction policy at a party room meeting on Wednesday.

Shadow ministers will meet to formalise their position the following day.

But even if the Liberals land a cohesive plan amid fierce internal divisions, they will still need to strike an agreement with the Nationals.

A six-person committee – three Liberals and three Nationals – will attempt to reach a compromise on the issue ahead of an online hook-up of both party rooms on November 16.

Interest rate cuts might have less impact than thought

Changes to interest rates could have less of an impact on household spending than traditionally thought, which means the Reserve Bank might have to hike or cut harder to achieve its aims.

Despite the RBA hiking interest rates in one of its sharpest tightening cycles in decades after the COVID-19 pandemic, Australians only trimmed their spending by a relatively small amount, the e61 Institute found in a research paper released on Friday.

That is because mortgage-holders were able to use offset accounts as a buffer to smooth out spending.

The findings challenge the conventional wisdom that, because Australia has a relatively high amount of variable-rate home loans, the mortgage market is an especially sensitive transmission pathway for monetary policy to influence inflation.

“Household spending barely flinched,” report co-author Gianni La Cava said.

“Australia’s experience shows that when mortgage flexibility and large savings buffers are in play, the transmission of monetary policy may become weaker and slower.”

There was little change in spending between variable-rate borrowers, whose repayments rose by about $14,000 on average over 18 months, and fixed-rate borrowers.

Australia’s mortgage market is unusually flexible, with around 90 per cent of variable-rate mortgagors saving through redraw facilities, providing borrowers with a liquidity buffer when repayments shot up.

“During the rate-hike cycle, only about seven per cent of variable-rate borrowers were liquidity-constrained according to household survey data,” Dr La Cava said.

“With savings plentiful, the RBA’s tightening took longer to bite.”

The same effect could work in the inverse and dampen the RBA’s ability to boost economic activity by cutting rates, with borrowers opting to rebuild buffers instead of increasing spending.

“Even though interest payments have fallen for variable-rate borrowers, many have not automatically lowered their scheduled payments,” Dr La Cava said.

“That means rate cuts may deliver less of an immediate boost to spending than textbook models would predict.”

After its record tightening cycle, the RBA started lowering rates in February, with inflation apparently under control and unemployment slowly rising.

But inflation has since shot up above the central bank’s forecasts.

Household spending has also picked up quicker than expected, rising 0.9 per cent in the June quarter, compared with the RBA’s prediction of 0.6 per cent.

The Reserve Bank is now expected to leave the cash rate steady until at least mid-2026.

Some economists even predict the next move will be up, not down, following Tuesday’s rate hold.

France calls for EU probe into Shein sex dolls, weapons

The European Union must take action against Shein, say French government officials, claiming the Chinese online retailer is in breach of the bloc’s regulations due to the sale of child-like sex dolls and banned weapons on its marketplace.

France moved to ban Shein over the illicit products on Wednesday, prompting the company to suspend its marketplace in the country as it reviewed how third-party sellers operate on it. It had already halted the sale of all sex dolls worldwide.

“The platform is evidently in breach of European rules,” French Foreign Minister Jean-Noel Barrot said in an interview with radio station Franceinfo.

“The European Commission must take action. It cannot wait any longer.”

Shein’s website in France was still viewable on Thursday. But it showed only its own-brand clothing, for which it is best known, rather than the vast array of toys, homeware and gadgets normally available on its marketplace, which has been a growing source of revenue for the company.

Shein did not immediately respond to a Reuters request for comment on Thursday.

As part of the crackdown on Shein, France’s budget and small business ministers visited Paris’ Charles de Gaulle airport on Thursday, where millions of packages arrive via air freight. They said they’d blocked 200,000 parcels, which would be examined by customs officials and France’s consumer watchdog.

Finance Minister Roland Lescure and Anne le Henanff, France’s digital minister, meanwhile wrote to EU tech chief Henna Virkkunen late Wednesday, calling for the European Commission to investigate Shein “without delay”.

“France alerts the European Commission and all member states to these serious breaches within its borders, and expects there are similar risks associated with this platform’s activities in other European Union countries,” they wrote.

A Commission spokesperson said the 27-nation bloc’s executive arm was in touch with Shein following the French complaint. Violating EU law could lead to further steps by the Commission, the spokesperson said, but added that the EU did not intend to suspend any platforms EU-wide.

Gunther Oettinger, a former European Commissioner and German state prime minister who advises Shein, said the company should “be as transparent as possible and, if needed, correct course.”

“I am sure Shein takes this seriously. You can see they have already delisted the products,” he told Reuters.

German retail industry group HDE also called on the German government and EU authorities to take a tougher stance against Shein.

“Violations of laws and regulations must have consequences,” HDE’s managing director Stefan Genth told Reuters on Thursday.

Germany’s state-backed products testing group Stiftung Warentest said last week that 110 out of 162 items it tested from Shein and rival online platform Temu did not meet EU standards, citing unsafe toys and toxic metals in jewellery.

The Commission has powers to investigate large online platforms for breaches of the EU’s Digital Services Act, which requires they collect and verify information on third-party sellers and check their marketplaces for non-compliant products.

It can impose fines of up to six per cent of a company’s global annual turnover for confirmed breaches.

Shein had global revenues of $US37 billion ($A57 billion) in 2024, according to parent company Roadget Business Pte Ltd’s most recent filing in Singapore.

Fast track urged for intercity high-speed rail project

Commuters will hop onto Australia’s first high-speed trains in just 12 years if the latest proposal for the nation’s rail network leaves the station.

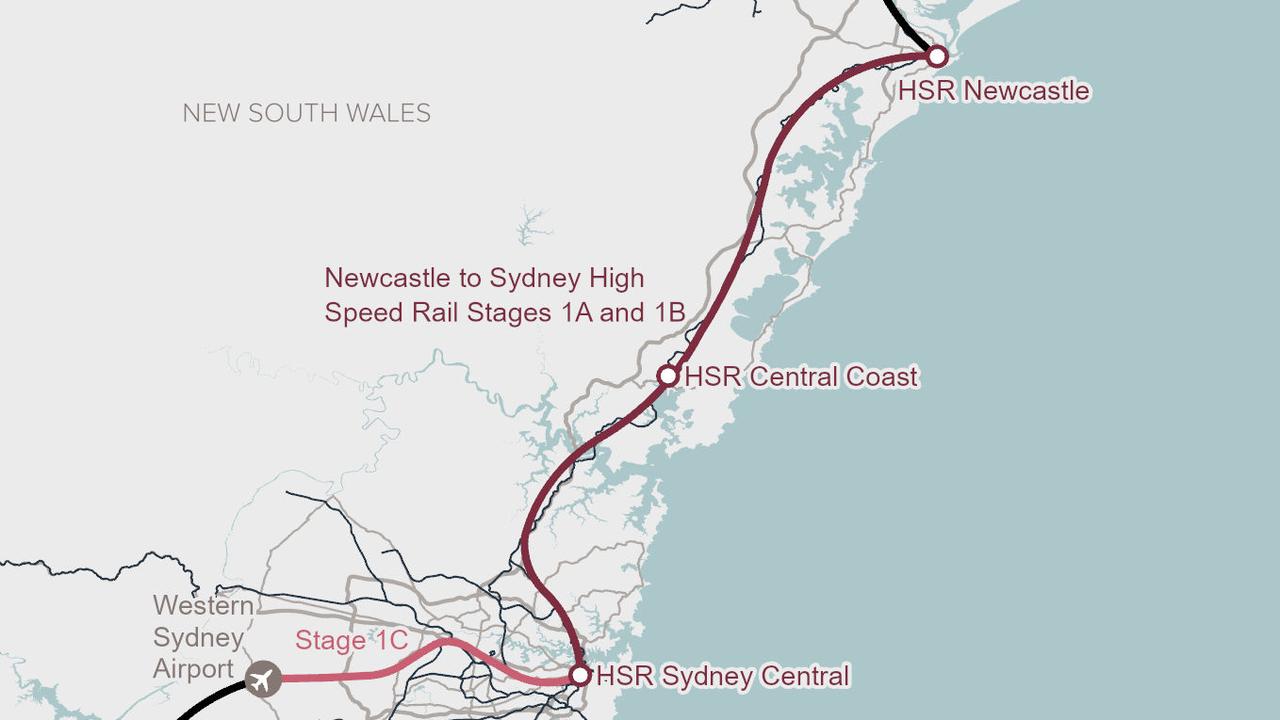

Stretching almost 200km from Newcastle to Sydney, newly released details have the long-touted line being built in three in stages with the final section opening in 2042.

Infrastructure Australia recommended pushing ahead with the plan in its evaluation of a business case, which the Albanese government has been sitting on since the High Speed Rail Authority finished it in 2024.

The nation-building project would ultimately allow passengers to travel between the two most populous NSW cities at up to 320km/h, cutting the travel time from Newcastle to Sydney more than two-and-a-half hours to one hour.

Six stations would be built in total. The first stage, encompassing Newcastle, Lake Macquarie and the Central Coast, would be delivered in 2037, while the second stage, between Central Coast and Sydney Central, would be finished in 2039.

A third section, linking Central to Parramatta and the soon-to-be-opened Western Sydney Airport, would open in 2042.

Most of the route – almost 60 per cent or about 115km – would be tunnelled, making slower speeds necessary.

“Given the large amount of tunnelling and the new rail systems, we expect costs to vary considerably as design maturity improves,” the evaluation report said, noting it was not yet possible to make a confident assessment on the proposal’s cost-benefit ratio.

The former NSW coalition government began developing a high-speed rail proposal from Newcastle to Sydney before dropping the plans ahead of the 2023 election, after spending $100 million on feasibility studies.

NSW Premier Chris Minns was not enthusiastic when asked on Thursday about the project’s feasibility without federal backing.

“The federal government’s got way, way deeper pockets than NSW. If it’s an initiative they want to pursue, it’s great for NSW, I’m not going to stand in their way,” he told reporters.

But federal Transport and Infrastructure Minister Catherine King welcomed the plan, describing it as a “nation-shaping investment”.

“It will unlock housing, create employment opportunities in the regions and enable our ambitious carbon reduction targets to be achieved,” a spokesperson for Ms King said in a statement.

“The government is committed to progressing high speed rail, which has proven its ability overseas to bring people and places closer together.”

The High Speed Rail Authority seeks Commonwealth funding to progress the design work, secure planning approvals and refine cost estimates for the first two stages.

The Albanese government has already committed $500 million to planning work for the project. More work is needed to determine a final cost but it is likely to run into at least tens of billions of dollars.

Stokes blames ‘marauders’ as owners reject pay report

Kerry Stokes has used his last annual general meeting as Seven West Media chair to blast “foreign marauders” and an unfair tax system for the group’s fading revenues.

Seven West’s total revenue slipped four per cent in the latest financial year, while group net profit after tax shrunk from $67 million in the 2024 financial year to $30 million in 2025.

“The past year has been a typically eventful one, unpredictable and undeniably challenging for an industry facing persistent pressures, regulatory uncertainty, and ongoing threats from foreign marauders intent on snapping at our heels and snatching away our heartland,” Mr Stokes told shareholders in Sydney.

“It’s pretty public challenges that we’ve faced, particularly from the platforms that come in and steal our businesses.”

Shareholders were unimpressed with the result and more than 35 per cent voted against the group’s remuneration report, despite a lack of bonuses for executives who failed to meet targets.

Investors were also frustrated they hadn’t received a dividend in eight years, with one noting the group’s share price had tanked from $5 with a five per cent dividend at the time of purchase to 13.5 cents and no cash back today.

“I believe that Seven West media is treating minority shareholders such as my wife and I with contempt, belittling us,” he said.

The lack of dividends was something to which the 85-year-old billionaire chair could relate.

“I’ve had no dividends either, so I am sympathetic to shareholders and dividends,” Mr Stokes told the meeting.

“When you get one, I will get one. Promise.”

Streaming giants such as Netflix and YouTube had captured $6 billion in revenue that otherwise would have gone to Australian legacy media, Mr Stokes said.

“It’s gone to external parties which paid no tax,” he told shareholders.

“This year, we’ll probably pay less than $100,000 (in tax) because we’ve lost our profits, because it’s being taken offshore by people who don’t have any accountability and don’t pay tax in our country.”

The group’s planned merger with Southern Cross Media, a sore point with shareholders who weren’t allowed to vote on the deal, would deliver greater revenue streams, chief executive Jeff Howard assured shareholders.

“Our financial ambition is to grow the combined revenue base and find even more efficient ways of operating, in ways we can’t do on our own,” he said.

“Each will help drive earnings and cashflow for shareholders.”

Regarding the “foreign marauders”, the group was in talks with the federal government on the media bargaining code and news bargaining incentive to ensure digital platforms contributed to Australian media sustainability.

“While discussions with the government have been constructive, we encourage them to accelerate these and other initiatives to ensure the Australian media sector operates on a level playing field with the international platforms that dominate the landscape and control many parts of the value chain,” Mr Howard said.

The Albanese government on Tuesday announced a bill to make streamers with more than a million subscribers invest a set proportion of expenditure or revenue on new Australian content.

NAB profits stable as bad business debts creep higher

NAB has delivered a small drop in earnings as bad debts ticked up with some businesses defaulting on their loans.

The business-focused bank on Thursday reported $7.09 billion in cash earnings in the year to September 30, down 0.2 per cent on the year before.

Statutory net profit was down 2.9 per cent to $6.76 billion, while underlying profit rose one per cent.

NAB took a $833 million charge on debt it considers unlikely to be repaid, up 14.4 per cent from $728 million the year before.

The big-four bank said deterioration in the group’s business lending portfolio includes a small number of customers in its corporate and business banking division and its New Zealand operations.

“While single loan exposures are lumpy and they’re hard to predict, it’s not unusual to see some increases in impairments towards the end of an asset quality cycle,” chief executive Andrew Irvine told analysts.

Australian mortgage arrears were stable over the year, the bank said.

Overall, 1.55 per cent of NAB’s lending portfolio was considered “non-performing,” up from 1.39 per cent a year ago.

Conditions improved over the second half of the 2024/25 financial year as inflation moderated and interest rate pressures eased, the company said.

NAB was committed to working with its customers through their business difficulties, Mr Irvine added.

“Whilst this can take time, in our experience, this achieves the best overall result for our customers and our shareholders.”

NAB declared a final dividend of 85 cents per share, taking its dividends for the year to $1.70 per share, up from $1.69 a year ago.

NYC mayor-elect Mamdani announces transition team

Fresh off winning New York City’s mayoral election, Zohran Mamdani has announced that a team including former city and federal officials – all women – will steer his transition to City Hall.

Mamdani vowed on Wednesday to “work every day to honour the trust that I now hold”.

“I and my team will build a City Hall capable of delivering on the promises of this campaign,” the mayor-elect said at a news conference, vowing that his administration would be both compassionate and capable.

He named political strategist Elana Leopold as executive director of the transition team.

She will work with United Way of New York City president Grace Bonilla; former deputy mayor Melanie Hartzog, who was also a city budget official; former Federal Trade Commission chair Lina Khan; and former first deputy mayor Maria Torres-Springer.

With his win over former governor Andrew Cuomo and Republican Curtis Sliwa, the 34-year-old democratic socialist will soon become the city’s youngest mayor in more than a century.

“I’m confident in delivering these same policies that we ran on for the last year,” he said.

Mamdani said he had not heard from Cuomo or the city’s outgoing mayor, Eric Adams.

He did speak with Republican candidate Curtis Sliwa.

More than two million New Yorkers cast ballots in the contest, the largest turnout in a mayoral race in more than 50 years, according to the city’s board of elections.

With roughly 90 per cent of the votes counted, Mamdani held an approximately nine percentage point lead over Cuomo – with 50.4 per cent to 41.6 per cent – while Sliwa received 7.1 per cent.

Mamdani, who was criticised throughout the campaign for his thin resume, will have to begin staffing his incoming administration and planning how to accomplish the ambitious but polarising agenda that drove him to victory.

“The directive here has to be one of ensuring that it is excellence that characterises the people I surround myself with, both in the appointments in the team and in the general expectation that is being set for my City Hall,” Mamdani said.

Among the campaign’s promises are free child care, free city bus service, city-run grocery stores and a new Department of Community Safety that would send mental health care workers to handle certain emergency calls rather than police officers.

It is unclear how Mamdani will pay for such initiatives, given Democratic governor Kathy Hochul’s steadfast opposition to his calls to raise taxes on wealthy people.

On Wednesday, he touted his support from Hochul and other state leaders as “endorsements of an agenda of affordability”.

His decisions around the leadership of the New York Police Department will also be closely watched.

Mamdani was a fierce critic of the department in 2020, calling for “this rogue agency” to be defunded and criticising it as “racist, anti-queer & a major threat to public safety”.

He has since apologised for those comments and has said he will ask the current NYPD commissioner to stay on the job.

US President Donald Trump on Wednesday admitted that the results of a slate of elections, in which Democrats swept major races including New York City, was bad for his Republican Party.

“Last night, it was, you know, not expected to be a victory, it was very Democrat areas, but I don’t think it was good for Republicans,” he said during a meeting at the White House with senators from the party.

“I’m not sure it was good for anybody,” Trump said.

“But we had an interesting evening and we learned a lot, and we’re going to talk about that.”

with DPA

‘Women are watching’ treatment of Sussan Ley by party

Toppling the first woman to lead the Liberal Party would be a “terrible look” for female voters, as Sussan Ley’s leadership faces renewed pressure over climate policy.

Ms Ley has been forced to talk down speculation she could face a challenge to her fledgling leadership after two of her main rivals Liberals Angus Taylor and Andrew Hastie, were seen having dinner together in Canberra.

The pair have both voiced their support for dumping the coalition’s commitment to net-zero emissions by 2050.

Infighting over the key climate target has heightened following the decision by the Nationals to scrap the policy.

Monash University politics lecturer Blair Williams said it would be a “terrible look” for the Liberal Party’s first female leader to be dumped by a bunch of men.

“Women are watching,” she told AAP.

“By choosing a woman leader in Ley, they sent a message to Australia to say, ‘We are paying attention to what you said to us at the election’.

“Which is, you need more women and more focus on women’s issues.”

Recent polling has revealed support for the Liberals has plummeted to historic lows, further heaping pressure on the opposition leader.

Ms Ley played down the meeting between the two conservatives in her party and said she was completely confident in her position.

Asked if she was prepared to ditch net zero to save her leadership, Ms Ley said “there are a lot of different opinions in our party room”.

The growing speculation prompted former Nationals leader Michael McCormack to call for his leader to be given clear air and a chance to do the job.

Dr Williams said anyone taking on the reins of the coalition post the disastrous May 3 election defeat would have faced trouble leading the party, but Ms Ley’s position was “made even worse by the fact that she’s a woman”.

Mr Taylor told Sky News that the opposition leader’s position was safe and he believed she was going to take the party to the next election.

A decision on the coalition’s climate policy is expected to be made by the end of 2025.