Red-hot inflation shows RBA may have cut rates too far

The Reserve Bank is more likely to hike rates next than cut them, traders believe, after a “concerning” inflation reading.

Analysts were blindsided when the Australian Bureau of Statistics revealed on Wednesday consumer prices rose by a higher-than-expected 3.8 per cent in the 12 months to October.

The result shook markets, which up until a few months ago had been expecting the central bank to lower the cash rate once or twice from its current level of 3.6 per cent.

A recent resurgence in price pressures had tempered expectations, but on balance, traders still thought another move down was more likely than a move up.

The rates market had been pricing in about 12 basis points of cuts in 2026 ahead of the “red-hot” inflation data, IG market analyst Tony Sycamore said.

“It goes out pricing in roughly 12bp of rate hikes for 2026,” he said.

That boosted the Aussie dollar against the greenback but spooked equities investors, with the ASX200 retreating about 40 points after the news.

The fact that growth is in an upswing and inflation is rising suggests the cash rate is not slowing the economy down, HSBC chief economist Paul Bloxham said.

“For the RBA, today’s figures should be concerning,” he wrote in a research note on Wednesday.

“A debate can be had about whether the RBA has already cut its cash rate too far.

“Our central case sees the RBA on hold through 2026, with the rate hikes beginning in early 2027. Today’s print adds to the risk that rate rises could be needed earlier than that.”

Analysts at investment banks Barrenjoey and UBS tipped the Reserve Bank to raise rates in 2026 following the print, but economists at ANZ and Westpac were still holding onto their predictions for at least one more cut in 2026.

JP Morgan analyst Tom Kennedy said while the upside surprise meant there was clearly a risk that inflation could overshoot the Reserve Bank’s forecasts, he did not think it was “sufficient for rate hikes to creep into the RBA’s internal discussion”.

“We continue to see the RBA on hold through 2026, with hikes likely from early 2027,” he said.

D-day for deal on contentious environmental law reforms

Labor is expected to strike a deal on its historic overhaul of environmental laws as negotiations reach a pointy end.

Greens leader Larissa Waters and environment spokeswoman Sarah Hanson-Young met with Prime Minister Anthony Albanese after the Greens were provided with amendments to the laws, drafted to secure their support.

Labor has remained optimistic an agreement will be struck with either the Greens or the coalition to pass the laws by the end of the year.

An agreement must be struck by Thursday if the 1500-page package of bills is to be tabled in the Senate.

The bill aims to ensure better protections for the environment while tackling a backlog of critical infrastructure, energy and housing projects by streamlining approvals processes.

Amendments for the Greens were aimed at removing fossil fuel projects from fast-track approvals pathways and ensuring they could not be subject to a new “national interest” exemption from environment laws.

Another change included keeping the “water trigger” in the hands of the federal government, which requires any impacts on water resources to be considered when approving a project.

For the coalition, Labor offered five changes, including imposing a 14-day stop work order imposed by a federal Environment Protection Authority.

The coalition has also raised concerns about the powers of a proposed national environment protection agency, and in response, Labor has agreed to somewhat limit the powers of the department’s boss.

Negotiations are firming in favour of the Greens, with Opposition Leader Sussan Ley yet to meet the prime minister face-to-face on the reforms.

Parliament is scheduled to rise on Thursday evening, but politicians have been told to stay until Friday in case negotiations drag on until the last minute.

Vatican reports first surplus after years of deficits

The Vatican closed 2024 with a budget surplus, it says, signalling a turnaround after years of deficits that had frustrated church leaders, including the late Pope Francis.

In its first budget report since 2022, the Vatican said it had registered a “significant recovery” in its accounts last year, achieving a surplus of 1.6 million euro ($A2.8 million), thanks mainly to higher donations and strong investment gains.

It said it had managed to cut the structural deficit – the gap between ordinary revenues and ordinary expenses – by 50 per cent but acknowledged that this still amounted to 44 million euros, underscoring the long-term financial challenges facing Pope Leo.

“The report highlights a clear improvement and, while prudently recognising that full financial sustainability is a long-term goal, a clearly positive direction can be observed,” a press statement said.

Francis, who died in April, had long struggled to get the Vatican’s budget under control.

He was battling firm resistance from his own cardinals in his last months as he sought to plug the gap in the Vatican’s finances, and slashed cardinals’ salaries three times from 2021 to 2024.

Although the Vatican had not published its accounts in three years, the last set of accounts, approved in mid-2024, included an 83-million-euro shortfall, two sources told Reuters at the time.

Reuters was not able to verify the previous deficit figure independently.

The Vatican, a microstate within Rome, has limited fiscal options.

It does not issue debt, sell bonds or levy taxes.

The Vatican has three main income streams: it takes donations, it has an investment portfolio and it makes money from admissions to the Vatican Museums.

It also owns the Bambino Gesu Pediatric Hospital in Rome, which is a source of revenue.

The Holy See said revenues rose by 79 million euros last year, driven by external donations and income from its hospital in Rome, while expenses increased by 40 million euros.

Financial management delivered 46 million euros in “positive results,” boosted by capital gains from the sale of historical investments following the launch of a new investment committee.

“This performance … (played) a key role in covering the operating deficit,” the statement said.

It said “2024 could be a turning point if, after years of stable or growing operating deficit, the Holy See (continues) the reduction of its operating deficit in the coming years”.

“It is important to underline that this improvement is mainly due to an increase in donations,” it said.

“It will be necessary to confirm this progress in the coming years.”

The new report does not include data about the growing liabilities within the Vatican’s pension fund, which were estimated to total 631 million euros by the Vatican’s finance chief in a 2022 media interview.

The liabilities are believed by insiders to have ballooned since.

UK announces new tax on expensive homes from 2028

The United Kingdom has announced a new annual tax on the most expensive homes.

The surcharge will apply to residential properties worth more than two million pounds ($A4.1 million) and is expected to raise 400 million pounds in 2029-30, according to estimates from the country’s budget watchdog published on Wednesday ahead of the finance minister’s budget statement.

The new tax will come into force in April 2028.

The fiscal watchdog, the Office for Budget Responsibility, said owners of homes valued at more than two million pounds by the Valuation Office, in 2026 prices, will be liable for a recurring annual charge which will be additional to existing local tax liability.

Under the changes, there will be four price local tax bands with the surcharge rising from 2500 pounds for a home valued in the lowest two million to 2.5 million band, rising to 7500 pounds for a property valued in the highest band of five million or more.

The values will be uprated in line with consumer price inflation every year, the document showed.

UK finance minister Rachel Reeves on Wednesday also said there would be changes to commercial property taxes, or business rates, to increase rates for high value properties.

“I will introduce permanently lower tax rates for over 750,000 retail, hospitality and leisure properties – the lowest tax rates since 1991 – paid for through higher rates on properties worth 500,000 pounds or more, like the warehouses used by online giants,” Reeves said in her budget speech to parliament.

The UK’s major supermarket groups, including industry leader Tesco and number-two player Sainsbury’s, had urged the government not to charge higher rates on high value properties, arguing the move would add to high food inflation.

UK government delivers budget after unprecedented leak

The United Kingdom’s Treasury chief Rachel Reeves has stood up to deliver a crucial tax-raising budget statement to MPs following an unprecedented leak from the government’s independent forecaster that basically laid out her measures.

The biggest change in terms of money raised, according to the leak from the Office for Budget Responsibility, is freezing the levels at which earners pay the UK’s different tax levels, meaning as wages rise, more people fall into higher tax brackets.

Other measures include a mansion tax on high-valued properties, changes to the capital tax regime and a cut to tax-free provisions for private pensions.

According to the leaked documents from the OBR, which it has apologised for, the government will raise 26 billion pounds ($A53 billion) in 2029-30.

The OBR blamed a “technical error” for the leak, saying it went “live on our website too early this morning”.

It said it will report to all relevant authorities, including the Treasury, as to what happened.

The leak is a further embarrassment for the UK’s Labour government following weeks of weeks of speculation and mixed signals that unsettled the markets.

The budget, Reeves’ second since Labour returned to power after 14 years with a landslide election victory in July 2024, could prove pivotal in the fortunes of both Reeves and her boss, Prime Minister Keir Starmer.

The overall message in the budget is much the same at it was in her first budget a little more than a year ago.

She insisted at the time that it would be the one and only big tax-raising budget in this parliamentary term, which is due to run to 2029.

Unfortunately for Reeves, the the UK economy, the world’s sixth-largest, is not doing as well as she hoped, with many critics blaming her decision last year to slap taxes on business.

Although there were signs that the economy was improving in the first half of the year, when it was the fastest-growing among the G7 leading industrialised countries, it has faltered again.

The budget is a high-stakes moment for Reeves and Starmer, who is facing mounting concern from Labour MPs over his dire poll ratings.

Opinion polls consistently put Labour well behind the populist Reform UK party led by Nigel Farage.

The next election does not have to be held until 2029, and the government continues to hope that its economic measures will spur higher growth and ease financial pressures.

But speculation is swirling about a potential challenge to Starmer’s leadership from within his party and analysts say a misfiring budget could add to the sense of crisis within the government.

Man dies under falling tree as storms take their toll

A man has been killed by a falling tree during surging storms that have left tens of thousands of people without power.

The 76-year-old died on Wednesday afternoon after being struck by the tree at Glenworth Valley on the NSW Central Coast.

More than 1000 calls for help have been made in NSW alone after wild weather left multiple roofs torn from buildings in the state’s central west.

The town of Nevertire, west of Dubbo, felt some of the worst of the major storms blasting eastern Australia, with lightning causing wall collapses on one property and six others losing their roof.

At least 120,000 homes in NSW are without power after gusts of up to 119 kilometres per hour were felt on Wednesday afternoon, according to the Bureau of Meteorology.

Tens of thousands are also without power in Queensland as two consecutive days of superstorms were declared a catastrophic event.

The damage bill from the storms is expected to surge into the millions, as the Insurance Council of Australia confirmed claims have reached 27,800 and continue to climb.

Crews are working around the clock to repair the damage but almost 29,000 people are still without power, with the worst-affected areas including Moreton Bay, Noosa and the Sunshine Coast north of Brisbane.

Brisbane bore the brunt of Tuesday night’s second wave of damage from a storm system stretching as far south as up to 110mm of rain was dumped on some areas.

Large parts of Queensland also continue to swelter under heatwave conditions, with temperatures six to 10 degrees above the November average.

By 3.30pm on Wednesday, 1145 calls for help had been made to the NSW State Emergency Service, with 622 in metropolitan Sydney alone.

“These incidents relate mainly to trees down, taking down power lines and also damaging roofs,” NSW SES Assistant Commissioner Sean Kearns said.

“We’re asking people as they leave work this afternoon to avoid any unnecessary travel and to drive to the conditions.”

Paramedics and SES workers also worked to free a man in his twenties with head and leg injuries after a tree collapsed on him at a park in Ophir, north of Orange, also in central-west NSW.

Humidity combined with warm temperatures and troughs to produce storms right across the east coast with the threat of further storms lingering.

“There’s also a risk of high-end storms bringing giant-sized hail and destructive gusts,” bureau meteorologist Sarah Scully said.

Meanwhile, a cold front moving across southern areas of the country is expected to trigger stormy conditions and damaging winds across parts of South Australia and Victoria.

“That’s catching the southeastern parts of South Australia, possibly reaching some of those southern Adelaide suburbs and then pushing across most of Victoria, including Melbourne,” Ms Scully said

Ex-tropical cyclone Fina was downgraded overnight and is impacting the northern parts of Western Australia’s Kimberley region with heavy rainfall and the risk of flash flooding.

“We’re going to continue to see the impact of this ex-tropical cyclone over the next day or two, even though it’s lost that cyclonic category,” the Bureau of Meteorology’s Miriam Bradbury said.

The clean-up continues in the Northern Territory after Fina felled trees, caused power outages and damaged buildings as it swept through on the weekend as a category three system.

UK’s treasury chief to unveil another tax-heavy budget

British finance minister Rachel Reeves is likely to announce tens of billions of pounds of new tax increases in a budget that puts her credibility on the line with financial markets and MPs demanding more welfare spending.

Little more than a year after ordering Stg40 billion ($A81 billion) of tax hikes – the biggest since the 1990s and which she promised would be a one-off – Reeves has been forced to look at further revenue-raising measures due to an expected downgrade of Britain’s economic prospects and higher debt costs.

Reeves said she was taking “fair and necessary choices” to improve the country and speed up economic growth but she recognised the unhappiness among voters.

“I know that people feel frustrated at the pace of change or angry at the unfairness in our economy,” she said.

“I have to be honest that the damage done from austerity, a chaotic Brexit and the pandemic were worse than we thought.”

Reeves said she would help families with the cost of living, cut hospital waiting lists and reduce debt.

“I will not return Britain back to austerity, nor will I lose control of public spending with reckless borrowing,” she said.

Economists expect between Stg20 billion to Stg30 billion of tax hikes when she addresses parliament on Wednesday.

But that might not be enough to put the public finances on an even keel, given Britain’s slow economic growth and mounting demands for public spending, ranging from rising defence costs to the toll of an ageing population.

An inconclusive budget might fuel speculation about the future of Prime Minister Keir Starmer, who is floundering in opinion polls despite the centre-left Labour Party’s big election victory in 2024.

Reeves said in her first budget in 2024 that she was returning stability to the public finances after the shocks delivered by Brexit, the coronavirus pandemic and the “mini-budget” crisis of former Conservative prime minister Liz Truss.

But those plans are likely to be holed by a downgrade of Britain’s economic outlook from the government’s fiscal forecasters, who have been overly optimistic for years about productivity growth.

She is expected to drag more workers into the income tax net and make more of them pay higher rates by extending a freeze on threshold levels, something she had said she would not do because of the hit it would deliver to households.

Owners of expensive homes and gamblers are likely to pay more in tax, drivers of electric cars reportedly face a new mileage charge and the generosity of pension incentives looks set to be scaled back, among other measures.

Investors say Reeves must come up with a convincing set of tax increases that boost revenues sooner rather than later.

Adding to the headache for Reeves are calls from Labour MPs for an end to a two-child cap on welfare benefits paid to families, which could add about Stg3 billion a year to government spending.

Retail supremo dangles ‘game-changing’ mystery tech

The figurehead of one of Australia’s leading electronic retailers has had a go at his rivals, joked about punishing shoplifters and hailed the arrival of game-changing consumer technology.

While he’s not ready to say what the mystery tech is, Harvey Norman executive chairman Gerry Harvey told AAP he believes it will do more to change people’s lives in the next 10 years than anything that’s happened in the past 30.

“There’s quite a lot of this new product just around the corner. I’m not going to tell you what it is, but I know,” Mr Norman said.

“So this product is coming out, and it will be game-changer stuff.”

Earlier in an interview after the conclusion of Harvey Norman’s annual general meeting on Wednesday, Mr Harvey mentioned the “AI influence” over products ranging from fridges to televisions, and also talked about robots.

“If you said to me, will I be selling robots in the showroom in 18 months, I’d say ‘yeah, probably’.

“Can it load the washing machine? Can it load the fridge? Can it get you some butter out of the fridge and put it on the toaster? I don’t know – but that robot’s going to be a part of our lives.”

Mr Harvey noted CEO Katie Page, who is also his wife, meets regularly with executives from Harvey Norman’s top suppliers, although those meetings are now occurring every three or four months rather than every six months.

“The world’s moving too quickly, with people like Nvidia and Microsoft and others,” he said.

Mr Harvey said Harvey Norman was trying to prepare for a high-tech future by spending money on fit-outs and salespeople.

“We’ve got the best showrooms in the country by a mile,” he said.

“You go into a JB Hi-Fi, and you don’t think, ‘what a beautiful fit-out’.

“You go into a Good Guys, and it’s maybe a little bit better.”

Harvey Norman boasts a better quality showroom, quality salespeople and excellent lighting, Mr Harvey said.

“If you’ve got a big name manufacturer that’s produced a brand new product, then he wants to launch it with you, not with the others.”

During Wednesday’s meeting, the 86-year-old entrepreneur gave shareholders a tongue-in-cheek solution to retail crime, suggesting staff should hit thieves “as hard as you can” to discourage them.

Mr Norman later clarified the comments were not to be taken literally.

Harvey Norman also announced on Wednesday that sales revenue for the period July 1 to November 20 was up 9.1 per cent, compared to the same time in 2024.

Same-store sales in Harvey Norman’s Australian franchises were up 6.4 per cent during that time, the company said.

Harvey Norman shares were down about two per cent on Wednesday afternoon to $7.24.

Mining giant ends bitter legal fight with former staff

Fortescue has ended a long and public battle with former employees accused of stealing the iron ore miner’s data for their green iron startup.

The mining behemoth’s lawyers had claimed ex-chief scientist Bart Kolodziejczyk and technology development lead Bjorn Winther-Jensen used green-iron technology they helped develop while working for the miner, to form rival startup Element Zero.

Element Zero’s chief executive Michael Masterman, another former Fortescue employee, was also taken to court over the issue.

But after numerous court appearances and months of dispute, the Andrew “Twiggy” Forrest-controlled mining giant and the startup confirmed on Wednesday the legal stoush had come to an end.

Mr Masterman welcomed the outcome and said it would end almost two years of uncertainty for Element Zero.

“We are delighted to put this episode behind us,” he said in a statement.

“We can now focus all of our deep and capable technical resources on rapidly advancing our iron-ore-to-iron technology and developing our manufacturing sites in the Pilbara heartland of Port Hedland and in the US.”

Each side will pay for their own expenses, according to Element Zero.

Fortescue, one-third owned by billionaire and company chairman Mr Forrest, also confirmed the outcome on Wednesday.

It had earlier been seeking damages or compensation, which could have included any profits gained by Element Zero from the allegedly stolen invention.

“We have reached a settlement with the parties, the terms of which are confidential,” a Fortescue spokesman said in a statement.

During the spat, Element Zero accused Fortescue of using “unprecedented surveillance” and private investigators to go after its former workers.

In 2024, Element Zero’s offices and Dr Kolodziejczyk and Dr Winther-Jensen’s homes were searched under a Federal Court order and four terabytes of material was seized.

Mr Masterman and Mr Forrest had previously been close, with the ex-employee telling the court he maintained relatively regular contact after leaving Fortescue, including attending parties and the funeral of the billionaire’s father.

In the lawsuit, Element Zero and the executives were accused of breach of contract, copyright infringement, breach of corporations and consumer law, and breach of their fiduciary duties.

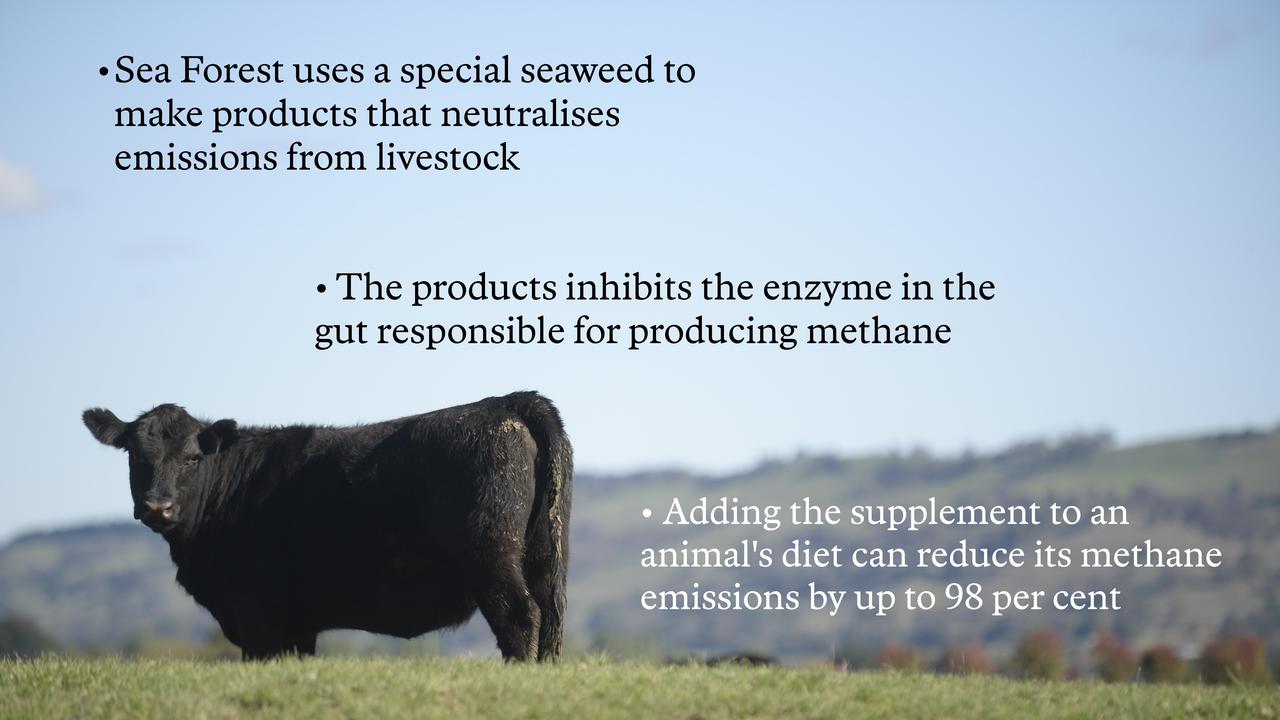

Strong lift off for seaweed firm with unique business

An Australian company working to curb the livestock industry’s impact on climate change has won a warm reception as investors feasted at the trough of the stock exchange’s latest debut.

Shares in Sea Forest, an Australian livestock feed additive manufacturer using seaweed to cuts methane emissions, traded 20 per cent above its offer price after listing on the Australian Securities Exchange on Wednesday.

The organisation’s SeaFeed supplement, made from the native Tasmanian seaweed asparagopsis, has been shown to reduce methane released from livestock burps by up to 80 per cent.

Recent studies also discovered benefits at the feedlot, finding the additive also helped livestock grow faster.

The initial public offering was oversubscribed, raising $20.5 million and valued the company at $112.1 million at the $2 per share offer price.

At $2.42 per share by Wednesday afternoon as pent-up demand uncoiled in persistent sales, the company’s market capitalisation swelled to roughly $135 million.

After securing a European distribution deal and partnerships with Belterra and Oisix to launch the product in Brazil and Japan, the public offering will fund Sea Forest’s path to profitability after years of costly research investment, founder and managing director Sam Elsom said.

“Listing on the ASX gives us a platform to scale production, expand internationally and support farmers across Australia, and in time internationally to reduce methane emissions by up to 80 per cent,” Mr Elsom told investors at the stock exchange in Sydney.

“As we step into life as a public company, our commitment is simple: We will lead with transparency, with discipline and with the same purpose that brought us here.”

Proceeds from the offer will include funding blending and distribution facilities in Queensland, NSW, Western Australia and South Africa, as well as navigating foreign regulatory hurdles.

Sea Forest already has supply agreements with livestock producers and global brands including Teys Australia, Ashgrove Cheese, Uniqlo parent company Fast Retailing, Grill’d, Orffa, Olsson’s, Chadwick Consolidated Group and Morrisons UK.

Beef and dairy cattle are livestock agriculture’s biggest source of methane, which has more than 80 times the warming capacity of carbon dioxide.

While seaweed feed additives have so-far been excluded from the Australian government’s carbon credit scheme, other jurisdictions are implementing measures such as methane credits or sustainability subsidies for farmers.

Voluntary frameworks such as Verra allow producers to generate carbon credits from anywhere in the world.

When it came to global decarbonisation efforts, Sea Forest offered one of the few tools that actually delivered a return on investment, Mr Elsom said.

“They often have an extraordinary cost on the economy,” he said.

“Not to say that they’re any less important, just that the work we’re doing, in many ways, is low-hanging fruit.”

The organisation’s independent chair and agribusiness leader John McKillop said the product was a game-changer for livestock producers, even before the environmental benefits were considered.

“When you can look at something that gives you a 6 per cent improvement in net feed efficiency, there was big opportunity here to to not only improve the outcomes for the planet, but also improve outcomes for feedlotters, and will eventually flow on to … other livestock producers as well,” he told AAP.