Sir Paul McCartney blasts COP30 for serving meat

Sir Paul McCartney has urged COP30 organisers not to serve meat at the climate change conference.

The Beatles legend – a prominent vegetarian and animal rights activist – has written an open letter on behalf of animal rights group PETA to COP30 President Andre Correa do Lago about the decision to serve meat to guests at the event, which begins next week in Belem, Brazil.

McCartney penned: “I’m writing on behalf of my friends at PETA to ask you to align COP30’s menu with its mission by making it all vegetarian. This would greatly reduce its carbon footprint and overall environmental impact, setting a positive example for the world to follow.”

The 83-year-old musician was shocked by the lack of vegetarian options for guests, particularly with the grave threat that climate change poses to Brazil and the Amazon Rainforest.

The Let It Be artist said: “It is fitting that COP30 will be held in Belem, the gateway to the Amazon, whose rainforest is often called ‘the lungs of the Earth’ because it absorbs and stores massive amounts of carbon dioxide while releasing oxygen.

“Protecting the life-sustaining Amazon must be a top priority for environmentalists of all nationalities, so I was shocked to learn that only 40 per cent of the food served at COP30 is currently slated to be vegetarian.”

Paul couldn’t help but point out the irony of serving meat at an event designed to help the environment.

He quipped: “Serving meat at a climate summit is like handing out cigarettes at a cancer-prevention conference! The animal agriculture industry is a top driver of deforestation and the climate catastrophe that is wreaking havoc on the planet.”

McCartney concluded: “COP30’s own website confirms that plant-based meals have a substantially lower carbon footprint, so I urge you to lead by example and make the conference all vegetarian.”

Paul and his late wife Linda McCartney became vegetarians in 1975 and the music icon is proud to have been a pioneer of a diet that is now adopted by millions of people worldwide.

He said: “It was a joint decision, definitely. We were both quite happy eating meat, because she was a great cook, and we didn’t really think about it until we were on the farm one day eating a lamb dinner and both realised that the lambs outside were what we were eating. We didn’t like that.

“We said, ‘Shall we try going vegetarian?’ And actually, it was a very exciting point in our lives, trying to think of what we would have to fill the hole in the middle of the plate.

“Now of course, it’s really not difficult at all. You just go down the shops and most places will have great veggie options. It was a joint decision and we never looked back. It was a great thing to do, and it turned out we became part of a vegetarian revolution.”

Brazen lies, ballot box bullies among election antics

Misinformation during Australia’s election is being spurred by right-wing trolls, raising concerns about integrity.

Prominent accounts with a high number of followers “constantly, shamelessly post nonsense about preferential voting”, election analyst Kevin Bonham said.

“They’re usually not bots, it’s particularly right-wing accounts that are outside the Liberal Party mainstream, the sort of Sky News-oriented types, some of the supporters of minor right parties,” he told an inquiry into the 2025 federal election.

Greens deputy convenor Jonathan Parry attributed more brazen misinformation to a lack of consequences without laws on truth in political advertising.

Mr Parry called for big money to be removed from politics and donation bans on sectors seeking political influence including gambling, fossil fuels, banking, pharmaceuticals, defence, alcohol and property development.

“The perception of trading money for favours or clientelism is really ripe and it needs to essentially be cut off at any possible opportunity,” he said.

The Greens deputy convenor spoke of intimidation tactics at polling booths, with a volunteer from another party coming and standing over him at the federal election in May.

Independent MP Helen Haines also expressed concerns about violence, saying one booth required a police presence.

“It was dangerous and our volunteers did not wish to return to that polling booth because they felt so threatened,” she said.

Independent colleague Nicolette Boele, who won the Sydney seat of Bradfield from the Liberals, said she had to hire private security.

The inquiry is also reviewing whether to expand the federal parliament as Australia’s population grows and MPs are responsible for more constituents.

Independent ACT senator David Pocock said Senate seats for territories should be a ratio close to half the number of seats states have.

This would give the territories about six seats, with half going up at each election for six-year terms, similar to the states.

Dr Bonham said if territories received four seats, which is what Labor has pledged, they should all be up for election at the same time and not staggered as states are.

“They’re still voting in these impoverished two-seat elections,” he said.

Dr Bonham flagged a potential expansion to 14 or 16 senators per state, up from 12, which would necessitate dozens of new House seats because of proportions required by the constitution between the upper and lower houses.

More MPs would be better for community engagement, the inquiry was told by electoral analyst Ben Raue who runs The Tally Room website.

It would also widen the talent pool, he said.

“There’s a limited relationship between the talent of the individual and whether they get elected,” he said, pointing to parties doing poorly or candidates pre-selected in tight seats.

The priority should be to better resource MPs, Senator Pocock said, as crossbenchers called for staff allocations to be depoliticised with it now at the behest of the prime minister.

A three-year cycle was an international anomaly and cost the economy because of uncertainty, the inquiry was told.

Public and private sectors paused big investments and decisions until after an election, stymieing economic growth, 4 Year Terms Australia founder Marty Gray said.

A change to four-year fixed terms could add $60 billion in productivity benefits over two decades, he calculated.

Media giant wants compo if gambling ads are punted

Australian taxpayers should compensate the costs of a gambling advertising ban to media companies’ bottom lines, Nine’s chair says.

Nine Entertainment operated gambling ads in a heavily regulated environment and had been in talks with government over the issue, Catherine West told shareholders at the group’s annual meeting.

“If we are banned from having gambling advertising, there’s two things we would ask for,” she said.

“Yes, some type of compensation, some type of some other reduction somewhere else, but most importantly, that the gambling ban is fair across all sectors.”

A ban that excluded tech companies would only divert advertising revenue offshore, she said.

“Our biggest plea is is make it fair across the board, and don’t disadvantage responsible Australian media companies and allow a gambling free-for-all in terms of the ad tech platforms,” Ms West said.

Gambling advertising income was in the low single digits as a percentage of the group’s revenues and had been slipping for the past three years, the chair said.

Polling shows about three in four Australians support a total ban on gambling ads, but more two years after a landmark inquiry into gambling harm, the Albanese government is still mulling its response to its 31 recommendations.

A shelved proposal from Labor included a ban on gambling ads during live sports broadcasts and an hour on either side, and a limit of two an hour outside of this.

Frustrated with ongoing uncertainty, the gambling lobby is reportedly pushing for age-based restrictions for gambling ads on social media accounts and reduced blackout periods in an effort to avoid a blanket ban.

Nine would comply with whatever advertising rules were handed down, Ms West said.

“We believe that gambling across the society is a collective responsibility for all stakeholders,” she said.

“It’s government, it’s the wager inspector, it’s sports organisations, media and also the broader community.”

SBS has has taken matters into its own hands, offering streaming service viewers the ability to opt-out of certain advertising categories, including gambling.

Nine had not considered following suit.

“That wouldn’t work for our main broadcast service, but we will continue to work with the government and work towards implementing wherever they come to a landing on the gambling regulations,” Ms West said.

Nine avoided a second shareholder strike against its remuneration report on Friday, after its owners sent a message in 2024 over bullying and harassment allegations.

Its executive pay plan won the blessing of more than four in five shareholders, who also voted overwhelmingly to re-elect Peter Tonagh as a director.

Mr Tonagh is set replace Ms West as chair, who will step down after 18 months in the role.

Multiple shareholders lauded Nine’s financial performance relative to its traditional media peers, bolstered by growth in its streaming platform Stan and the $3 billion sale of real estate platform Domain to US company CoStar Group.

Lawsuits claim ChatGPT drove people to suicide

Tech company OpenAI has been accused of ignoring warnings that ChatGPT was psychologically manipulative, in lawsuits claiming some people were driven to suicide and harmful delusions.

Seven lawsuits filed in California allege wrongful death, assisted suicide, involuntary manslaughter and negligence, on behalf of six adults and one teenager.

The action, by the Social Media Victims Law Centre and Tech Justice Law Project, claim that OpenAI knowingly released GPT-4o prematurely, despite internal warnings that it was dangerously sycophantic and psychologically manipulative.

17-year-old Amaurie Lacey, began using ChatGPT for help, according to the lawsuit filed in San Francisco Superior Court. But instead of helping, “the defective and inherently dangerous ChatGPT product caused addiction, depression, and, eventually, counselled him on the most effective way to tie a noose and how long he would be able to “live without breathing.'”

“Amaurie’s death was neither an accident nor a coincidence but rather the foreseeable consequence of OpenAI and Samuel Altman’s intentional decision to curtail safety testing and rush ChatGPT onto the market,” the lawsuit says.

OpenAI called the situations “incredibly heartbreaking” and said it was reviewing the court filings to understand the details.

Another lawsuit, filed by Alan Brooks, a 48-year-old in Ontario, Canada, claims that for more than two years ChatGPT worked as a “resource tool” for Brooks. Then, without warning, it changed, preying on his vulnerabilities and “manipulating, and inducing him to experience delusions. As a result, Allan was pulled into a mental health crisis that resulted in devastating financial, reputational, and emotional harm.”

“These lawsuits are about accountability for a product that was designed to blur the line between tool and companion all in the name of increasing user engagement and market share,” said Matthew P Bergman, founding attorney of the Social Media Victims Law Centre, in a statement.

OpenAI, he added, “designed GPT-4o to emotionally entangle users, regardless of age, gender, or background, and released it without the safeguards needed to protect them.” By rushing its product to market without adequate safeguards in order to dominate the market and boost engagement, he said, OpenAI compromised safety and prioritised “emotional manipulation over ethical design.”

In August, parents of 16-year-old Adam Raine sued OpenAI and its CEO Sam Altman, alleging that ChatGPT coached the California boy in planning and taking his own life earlier this year.

“The lawsuits filed against OpenAI reveal what happens when tech companies rush products to market without proper safeguards for young people,” said Daniel Weiss, chief advocacy officer at Common Sense Media, which was not part of the complaints. “These tragic cases show real people whose lives were upended or lost when they used technology designed to keep them engaged rather than keep them safe.”

Lifeline 13 11 14

beyondblue 1300 22 4636

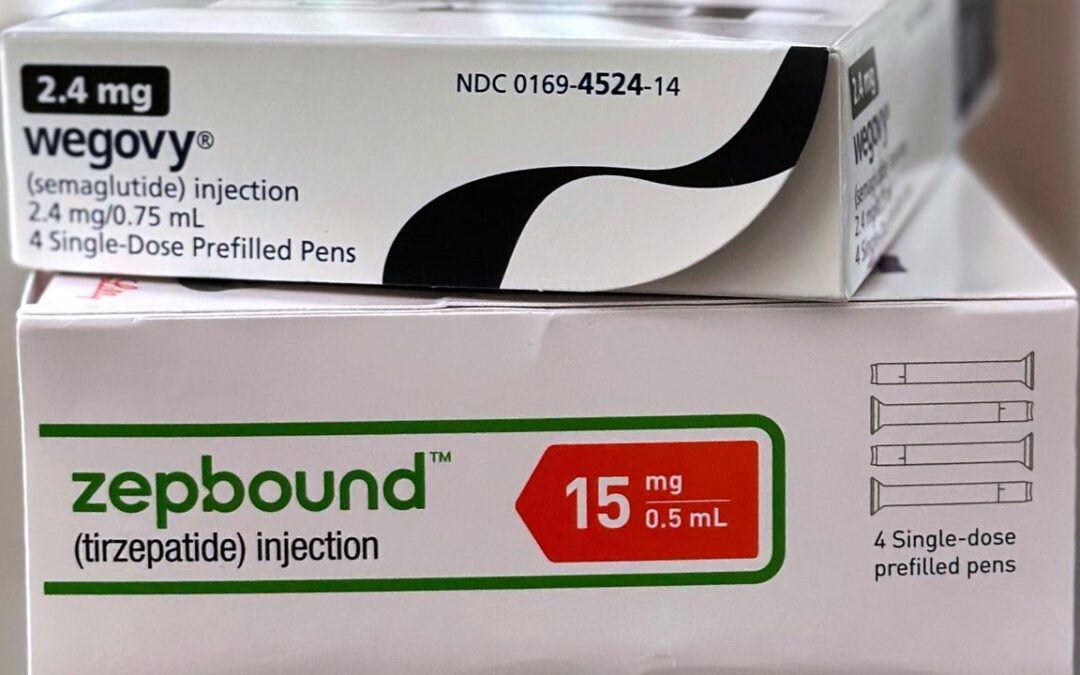

Trump broadens access to weight-loss drugs

Americans will have better access to popular weight-loss drugs Zepbound and Wegovy, after US President Donald Trump unveiled a deal with drugmakers Eli Lilly and Novo Nordisk.

Known as GLP-1 receptor agonists, the drugs have soared in popularity in recent years, but patient access has been a consistent problem because of their cost — around $500 a month for higher doses — and insurance coverage has been spotty. More than 100 million American adults are obese, according to federal estimates.

Coverage of the drugs will expand to Medicare patients starting next year, according to the administration, which said some lower prices will also be phased in for patients without coverage.

Starting doses of new, pill versions of the treatments also will cost $149 a month if they are approved.

“(It) will save lives and improve the health of millions and millions of Americans,” said Trump, in an Oval Office announcement in which he referred to GLP-1s as a “fat drug.”

Thursday’s announcement is the latest attempt by the Trump administration to rein in soaring drug prices in its efforts to address cost-of-living concerns among voters.

Pfizer and AstraZeneca recently agreed to lower the cost of prescription drugs for Medicaid after an executive order in May set a deadline for drugmakers to electively lower prices or face new limits on what the government will pay.

The obesity drugs work by targeting hormones in the gut and brain that affect appetite and feelings of fullness. In clinical trials, they helped people shed 15 per cent to 22 per cent of their body weight.

“Trump is the friend of the forgotten American,” said Health and Human Services Secretary Robert F Kennedy Jr at Thursday’s announcement. “Obesity is a disease of poverty. And overwhelmingly, these drugs have only been available for people who have wealth.”

(Obesity rates actually are slightly higher for middle-income Americans than they are for those with the lowest and highest incomes, according to 2017-2020 data collected by the US Centres for Disease Control and Prevention.)

Kennedy had previously expressed scepticism about GLP-1s, but he was full of praise for Trump for pushing to help a broader segment of Americans have access to the drug.

The drug-pricing announcement came days after Democrats swept elections in races across the country. Economic worries were the dominant concern for those casting their ballots, according to findings from the AP voter poll.

The White House sought to diminish price-reduction efforts by the previous Democratic administration as a gift to the pharmaceutical industry.

Trump, instead, consummated a deal that ensures Americans aren’t unfairly financing the pharmaceutical industry’s innovation, claimed a senior administration official, who briefed reporters ahead of Thursday’s Oval Office announcement.

Doctors who treat patients for obesity say help is needed to improve access. Dr. Leslie Golden says she has roughly 600 patients taking one of these treatments, and at least 75 per cent struggle to afford them.

Bank manager ‘gatekeeper’ of $200m fraud syndicate

Dodgy mortgage brokers, real estate agents and solicitors are all being targeted by investigators after the latest arrest linked to a $200 million fraud syndicate.

A NAB insider was charged over allegedly using his position at the bank to deliver shonky business loans worth about $10 million.

The Sydney man’s arrest is the most recent in a string of busts targeting a group that allegedly used stolen personal information to apply for loans to buy non-existent luxury “ghost cars”.

Police estimate the syndicate is worth more than $200 million, saying the total figure “could get to at least a quarter of a billion”.

“In my time investigating corporate corruption matters of this magnitude, it would have to be in the top three that I’ve ever seen,” Financial Crimes Squad commander Gordon Arbinja told reporters on Friday.

The 36-year-old was hit with 19 charges after being arrested in the city’s southwest on Thursday.

He was “gatekeeper of funds” in the group, Detective Superintendent Arbinja alleged.

“Without this person, the fraud cannot be facilitated,” he said.

The man had been working with NAB since 2008 and had contributed to the syndicate for at least three years, Det Supt Arbinja said.

He left the bank for an 18-month period to work as a mortgage broker before returning as a business bank manager in 2018.

In 2022, he was promoted to a more senior role.

NAB, whose staff worked with NSW Police on the matter, confirmed the man’s employment had been terminated, adding the bank had zero tolerance for criminal conduct.

No customers had been impacted by the alleged fraud, it said.

He was the 16th person charged by a NSW Police strike force targeting the same syndicate, which has had $60 million in assets seized by the state’s crime commission.

Detectives initially focused on the syndicate’s use of stolen personal data to get loans to buy luxury cars that didn’t exist.

But plumbing the depths of the fraud has allegedly uncovered pools of funds derived from large-scale personal, business and home loan fraud against multiple lenders.

Police would now focus on professional facilitators including bankers, mortgage brokers, real estate agents and solicitors, Det Supt Arbinja said.

NAB’s group investigations executive Chris Sheehan said the bank acted swiftly to investigate and sack its employee.

“NAB has worked in partnership with NSW Police on this matter and continues to provide significant support to aid the investigation and attempted recovery of any funds lost to criminal activity,” he said.

“There is absolutely no place for financial crime in our community.

“We recognise the important role we play in the monitoring and reporting of suspicious activity, working closely with police as well as regulators and government agencies as necessary.”

The man was charged with nine counts of dishonestly obtaining financial advantage by deception.

He was also charged with participating in a criminal group, dealing proceeds of crime charges and possessing anabolic steroids.

He was due to appear in Fairfield Local Court on Friday afternoon.

Souring mood on tech weighing on Asian markets

Tech-heavy stock markets are bracing for their heaviest weekly falls in seven months with investors uneasy about how far the rally in artificial intelligence stocks has run, while safer assets such as bonds and the yen went higher.

S&P 500 futures and Nasdaq 100 futures were a touch firmer in the Asia morning, but overnight the Nasdaq dropped 1.9 per cent.

For the week so far the world’s biggest tech index is down 2.8 per cent, which if sustained would mark its largest one-week drop since March and a jolt for a juggernaut that has gained more than 50 per cent from lows touched when tariffs were announced in April.

Japan’s Nikkei fell 1.8 per cent in morning trade to head for a weekly loss of 4.7 per cent, the largest since late March, while in Seoul the Kospi fell 1.4 per cent for a 3.3 per cent weekly fall, its worst since late March.

Chip and cable makers were among the biggest losers, with tech investor Softbank Group Corp down more than 20 per cent this week. Bitcoin, sometimes a bellwether for tech sentiment, is down 8 per cent on the week to $101,092.

There has been no obvious trigger for the pullback in AI-related share prices but the market reaction to recent results shows how some of the fears about a bubble in the sector and questions about profitability are starting to surface.

Late last month Meta stock dived after the company outlined big capital expenses as it builds data centres in an AI push. Shares in data and AI firm Palantir Technologies have also tumbled in spite of beating earnings forecasts.

“Sometimes it’s a gradual shift in markets whereby an increasing number of people say: ‘Well, I’m well positioned … maybe I’ll take some money off the table,'” said Herald van der Linde, head of equity strategy for Asia Pacific at HSBC.

“And a second one says so. And a third one. And a fourth one says, hey, these three are selling. I might maybe be selling as well, right? So it’s a shift in the market sentiment that has its own sort of dynamic. That might well be unfolding a little bit now.”

The S&P 500 closed 1.1 per cent lower overnight and the Philadelphia SE Semiconductor index dropped 2.4 per cent.

Bond markets rallied on a clamour for safety and also as some second-tier US employment data pointed to a wave of layoffs that could support further US rate cuts.

Benchmark 10-year US Treasury yields fell 6.4 basis points overnight to 4.09 per cent after outplacement firm Challenger, Gray & Christmas said there had been a surge in announced job cuts in October.

Such private surveys have gained attention in the market while a prolonged US government shutdown has halted official US data publication.

The move lower in yields pulled down the dollar, which slipped nearly 0.5 per cent overnight to $1.1546 per euro.

Losses were a little bit larger on safe-haven currencies such as the yen and Swiss franc, with the dollar last at 153.17 yen and 0.8069 francs.

Sterling jumped after the Bank of England left interest rates on hold, though the likelihood of a cut in December capped gains and it traded a fraction lower at $1.3128 in Asia.

Gold was firm just below $4,000 an ounce. Brent crude held at $63.64 a barrel.

Glimpse of Qantas long-haul jet to New York and London

Qantas has offered a first glimpse of its first, specially configured plane that will fly Australians non-stop to London and New York in 2027.

The A350-1000ULR is on the Airbus assembly line in Toulouse, France with its fuselage sections, wings and landing gear now attached, the airline said on Friday.

The aircraft will shortly be transferred to a new hangar where its engines and instruments will be installed for test flights in 2026.

Qantas has ordered a dozen of the planes for “Project Sunrise”, its plan to connect Australia’s east coast with London and New York via non-stop flights for the first time.

The 22-hour flights will cut up to four hours off total travel time compared to the current one-stop services.

The airline released the imagery ahead of its annual general meeting later on Friday in Brisbane.

“This is an aircraft that will change what’s possible when it comes to international point-to-point air travel,” chief executive Vanessa Hudson is set to tell shareholders, according to a copy of her speech lodged with the ASX.

“Our teams are incredibly excited for the arrival of the first aircraft late next year, a landmark moment for international aviation.”

There was also less positive news for the nation’s largest carrier.

Qantas said it expected its domestic revenue to grow by about three per cent in the first half, which is at the lower end of the guidance range it provided in August.

While demand for leisure travel remained strong, businesses outside the resource sector were flying less than it had expected, the company said.

Its forecast for international revenue remains unchanged at two to three per cent growth, and its Qantas Loyalty program’s growth remains strong and on track.

Qantas also said Friday it would introduce a new cabin product on domestic and short-haul flights that will offer passengers extra leg-room, priority boarding and priority access to overhead baggage space.

Qantas Economy Plus will be available for purchase beginning in February, with high-level frequent flyers receiving complimentary access.

Uni chief slams ‘unfair’ $51k degrees as jobs in peril

A major university boss has lambasted the tertiary sector for becoming too bloated, failing students and losing sight of its purpose to serve the public good.

The sector had become a two-track system, with record profits for some and large deficits and job losses elsewhere, Western Sydney University vice-chancellor George Williams said.

WSU is among six of NSW’s 10 universities undergoing restructures the union estimates puts 1500 jobs on the line.

“There’s a misalignment on what universities should be delivering and management structures,” Professor Williams told ABC Radio on Friday.

“We should be judged on what we deliver to our students first and foremost.”

The constitutional lawyer who was a pivotal figure in the failed voice referendum defended the use of hiring a trio of consultants for $3000 a day, saying it ultimately defrayed some job redundancies.

Prof Williams noted satisfaction among his institution’s 47,000 students was low, with many reporting they went hungry.

“The $51,000 arts degree is just so unfair and wrong for a group that often earns the lowest salaries,” he said.

“Then we’re loading them with debt and then they can’t afford a house. They’re not getting a fair go.”

A NSW parliamentary probe began on Friday to examine the sector, including a reliance on external consultants.

It runs parallel to a Senate inquiry due to report in December on university governance, including compliance with workplace health and safety laws.

The workplace safety regulator in September took the unprecedented step of forcing the University of Technology Sydney to pause plans to cut 400 jobs in the hope of saving about $100 million.

About $66.9 million in federal funding will be used to set up study hubs for aspiring students from regions and outer suburbs of major cities.

They will have a chance at going university through an extra 9500 places.

The additional places will be allocated for 2026 by the Australian Tertiary Education Commission and will mark 4.1 per cent growth on 2025 numbers.

Nine in every 10 new jobs will require post-secondary qualifications over the next decade, with almost half through vocational education pathways.

Education Minister Jason Clare noted that half of people in their 20s and 30s in Australia have a degree, but numbers were lower in the outer suburbs and regions.

“Opening the doors of our universities wider to more people from the suburbs and the regions isn’t just the right thing to do, it’s what we have to do,” he said.

The hubs provide computers, internet and study spaces, along with in-person academic skills support for students.

Another seven of the hubs will be opened before the end of the year in Fairfield and Liverpool in NSW, Northam in WA, Beenleigh in Queensland, Kangaroo Island in SA, Sorrell in Tasmania, and Norfolk Island.

The government is also funding free TAFE places, committing to at least 100,000 spots every year from 2027.

Elon Musk’s $878 billion Tesla pay plan wins approval

Tesla CEO Elon Musk has scored a resounding victory with shareholders approving a pay package of as much as $US878 billion over the next decade, endorsing his vision of morphing the EV maker into an AI and robotics juggernaut.

Shares of Tesla rose about 1 per cent in after-hours trading. The proposal was approved with over 75 per cent support.

The vote, analysts have said, is a positive for Tesla’s stock, the valuation of which hangs on Musk’s vision of making vehicles drive themselves, expanding robotaxis across the US and selling humanoid robots, even though his far-right political rhetoric has hurt the Tesla brand this year.

Musk took to the stage in Austin, Texas, along with dancing robots. “What we are about to embark upon is not merely a new chapter of the future of Tesla, but a whole new book,” he said. “This really is going to be quite the story.” Shareholders also re-elected three directors on Tesla’s board and voted in favour of holding annual elections for all board members and a replacement pay plan for Musk’s services because a legal challenge has held up a previous package.

“Other shareholder meetings are like snoozefests, but ours are bangers,” Musk said. “I mean, look at this. This is sick.”

Shareholders voted in favour of Tesla investing in Musk’s artificial intelligence startup, xAI, though there were many abstentions.

Although conflict-of-interest concerns have arisen over Tesla’s possible investment in xAI, the move is seen as widely benefiting both companies as the EV maker’s self-driving ambitions hinge on critical AI prowess and xAI would gain from a major customer like Tesla.

A win for Musk was widely expected as the billionaire was allowed to exercise the full voting rights of his roughly 15 per cent stake after the automaker moved to Texas from Delaware. Some major investors had opposed the plan, including Norway’s sovereign wealth fund and proxy firms Glass Lewis and Institutional Shareholder Services, saying the pay could decrease shareholder value.

Tesla’s board had said Musk could quit if the pay package was not approved.

Under the new package, Musk could earn as much as $878 billion in Tesla stock over 10 years. He could be given as much as $1 trillion in stock but will have to make some payments back to Tesla.

The vote allays investor concern that Musk’s focus has been diluted with his work in politics as well as in running his other companies, including rocket maker SpaceX and xAI. The board and many investors who lent their endorsement have said the nearly $1 trillion package benefits shareholders in the longer run as Musk must ensure Tesla achieves a series of milestones to get paid.

Goals for Musk over the next decade include the company delivering 20 million vehicles, having 1 million robotaxis in operation, selling 1 million robots and earning as much as $400 billion in core profit. But in order for him to get paid, Tesla’s stock value has to rise in tandem, first to $2 trillion from the current $1.5 trillion, and all the way to $8.5 trillion.