Xero shares sink to 15-month low despite revenue growth

Xero shares have hit their lowest level in more than a year even as the New Zealand-based cloud accounting platform posts double-digit revenue growth and $NZ321.1 million ($278 million) in free cash flow.

The Kiwi cloud accounting platform grew operating revenue by 20 per cent to $NZ1.19 billion in the six months to September 30, with its adjusted earnings climbing 12 per cent to $NZ350.9 million.

“We have demonstrated strong momentum, with our portfolio of large markets and our products contributing to our macro-resilient growth,” chief executive Sukhinder Singh Cassidy said.

In Australia and New Zealand, Xero’s revenue rose 17 per cent to $NZ663.7 million, and subscribers grew to 2.7 million.

Investors had apparently expected more, with Xero shares changing hands at $134.61 just before midday on Thursday, their lowest level since August 2024.

XRO shares are down 3.8 per cent from Wednesday’s close, down nearly 20 per cent year-to-date and about 30 per cent lower than their June 24 peak, which is when Xero announced it was acquiring US payments group Melio in a $US2.5 billion ($3.9 billion) cash and scrip deal.

Xero plans to use Melio’s features to roll out bill payment capabilities in the US in December.

The result showed a company “quietly shifting gears” and delivering “solid numbers that show the core business ticking along nicely”, eToro analyst Farhan Badami said.

He said the market has been sceptical about Xero’s Melio acquisition, but it showed long-term strategic logic.

RBC Capital Markets analyst Garry Sherriff called the results solid, with better-than-expected average revenue per user and in-line subscriber growth.

Xero also that in October it upgraded its artificial intelligent agent named JAX – “Just Ask Xero” – to offer automated bank reconciliation and advanced financial insights through Xero’s partnership with OpenAI.

Global expat tells Australia to lift its economic game

Company taxes and regulation must be cut to boost productivity, Australia has been told by an expat head of a leading global economic body.

Matthias Cormann, the first Australian to lead the Organisation for Economic Co-operation and Development and a former federal finance minister, said the nation trails other member countries in attracting investment and this led to poorer productivity growth.

“Australia needs to reassess the international competitiveness of its regulatory and of its tax policy settings,” he told the ASIC annual forum in Melbourne on Thursday.

While productivity challenges were common across developed countries, Australia’s labour productivity grew at just 0.5 per cent annually between 2010 and 2024, well below the OECD average of 0.9 per cent, Mr Cormann said.

“Australia can and must do better,” he warned.

Labor has made reinvigorating productivity growth one of its key policy priorities since its re-election in May.

Productivity growth is the main driver of improving living standards over the long term. Essentially, it means doing more with less and allows the economy to increase its capacity without contributing to inflation.

At an economic roundtable in August, Treasurer Jim Chalmers vowed to simplify overly complex regulation.

He also signalled further work on tax reform but plans to cut the corporate tax rate appear unlikely to succeed after the Productivity Commission’s proposal involving a novel net cashflow tax was met with broad opposition.

Mr Cormann urged Australia not to give up on lowering its corporate tax rate.

“In order to boost investment, enhance productivity and growth, Australia should have and needs to have another look at its business taxation arrangements and how they compare with other, more productive economies like the United States and the United Kingdom.”

Mr Cormann also said compliance burdens for companies looking to list on the stock exchange were too high.

He commended corporate regulator ASIC for its efforts to make it easier for companies to list on the ASX by shortening the initial public offering process, but encouraged further relaxing of prospectus requirements and reducing fees for small firms.

Corporate watchdog sues after super millions risked

Australia’s corporate regulator is accusing a financial planning company of engaging in “industrial-scale misconduct” for exposing nearly 7000 investors to dodgy super funds.

InterPrac is accused of failing to ensure representatives they authorised were complying with the law when they recommended 6843 clients invest around $677 million in two now-collapsed funds.

“No competent financial adviser could have recommended investment in Shield or First Guardian (Master Funds),” the Australian Securities and Investments Commission (ASIC) said in Federal Court documents lodged on Wednesday.

Both funds allegedly had exorbitant fees, opaque investments and delivered millions of dollars in payments to Venture Egg and its boss Ferras Merhi, one of InterPrac’s former authorised representatives.

The court documents say Mr Merhi told InterPrac in June 2024 companies he controlled received nearly $20 million from the two funds.

“Despite this, InterPrac permitted Venture Egg and Merhi to remain as its authorised representatives until 31 May 2025,” ASIC said.

InterPrac allegedly relied exclusively on external research before approving Shield and First Guardian for advisers and even when it did institute a temporary hold on new investments, they failed to maintain it.

Investors may not have even agreed to having their super savings transferred into the dodgy funds after InterPrac allowed Venture Egg to use “negative consent” to alter portfolios.

The practice allows advisers to adjust their client’s investments by issuing a statement saying the client would consent unless they explicitly said otherwise.

InterPrac was contacted for comment.

The collapse of Shield and First Guardian has been one of ASIC’s most complex cases, with the regulator saying more than 40 investigators are working full-time to bring those responsible for the losses to justice.

“What we are talking about here is an industrial-scale misconduct that involved a range of players,” ASIC deputy chair Sarah Court said on Wednesday.

“We are very methodically working through them in order to make sure … we hold those companies and individuals involved to account.”

The regulator is also initiating legal action against fellow advice licensee MWL and research house SQM for their roles in duping unsuspecting customers.

ASIC has launched a separate legal case against Mr Merhi alleging he engaged in unconscionable conduct and failed to act in the best interests of clients while receiving millions of dollars.

People who invested in Shield or First Guardian should contact the respective liquidators for updates on recovering investments and may be entitled to lodge a complaint with the Australian Financial Complaints Authority.

The case against InterPrac will return to the Federal Court at a later date.

The roles expected to be in hot demand from AI boom

Artificial intelligence will result in fewer jobs in the short term, but workers in some occupations may benefit from increased demand for their skills, employers predict.

Despite considerable debate about the extent of disruption AI is likely to bring to the workforce, it was still too soon to tell what the overall impact would be, the Reserve Bank of Australia said in a report released on Thursday.

Of more than 100 firms surveyed by the RBA, just over half expected that increased use of AI would result in a reduction in headcount over the next three years.

But those responses do not take into account other factors that could boost employment.

If AI increased productivity and led to faster business expansion it could drive up demand for labour, for instance.

“In the Australian context, long-run modelling suggests that AI adoption may result in a net increase in employment,” said report authors Joel Fernando, Kate McLoughlin and Ravi Ratnayake.

Because of its potential to replace non-routine cognitive tasks, AI posed a greater threat to higher-skilled jobs that were less susceptible to displacement from previous technological advancements.

Surveyed firms said jobs like bookkeeping, clerical support, contact centres, legacy IT support, junior professionals and manual roles in manufacturing and logistics were at risk of being displaced.

Conversely, demand was likely to increase for jobs in AI engineering, data engineering, cybersecurity, robotics, business analysis and process orchestration and customer experience and design.

“Many surveyed firms reported difficulties finding skilled workers (e.g. data engineers and scientists) to drive their adoption of AI,” the paper said.

“This issue is expected to become more challenging over coming years as more firms compete for these skills, potentially constraining the pace of investment in the future.”

Australia’s uptake of AI has so far lagged behind other advanced economies, with adoption of AI at an enterprise level still at a very early stage, firms reported.

While the technology is expected to save labour and boost productivity over the long term, firms said governments could make a much bigger impact by slashing onerous red tape.

“Many surveyed firms noted that the volume and complexity of regulation has diverted staff away from core business activities and has been a key factor weighing on their labour productivity growth over the past five years.”

Assistant Productivity Minister Andrew Leigh has previously called for light touch regulation to encourage the uptake of AI, citing studies that suggested early adopters hired more workers rather than shedding staff.

He urged miners to adopt new technologies like automated drilling and self-driving trucks to boost productivity.

“Research shows that young, fast-growing firms are central to job creation and innovation,” he said in a speech to the Energy and Minerals Tax Conference in Brisbane.

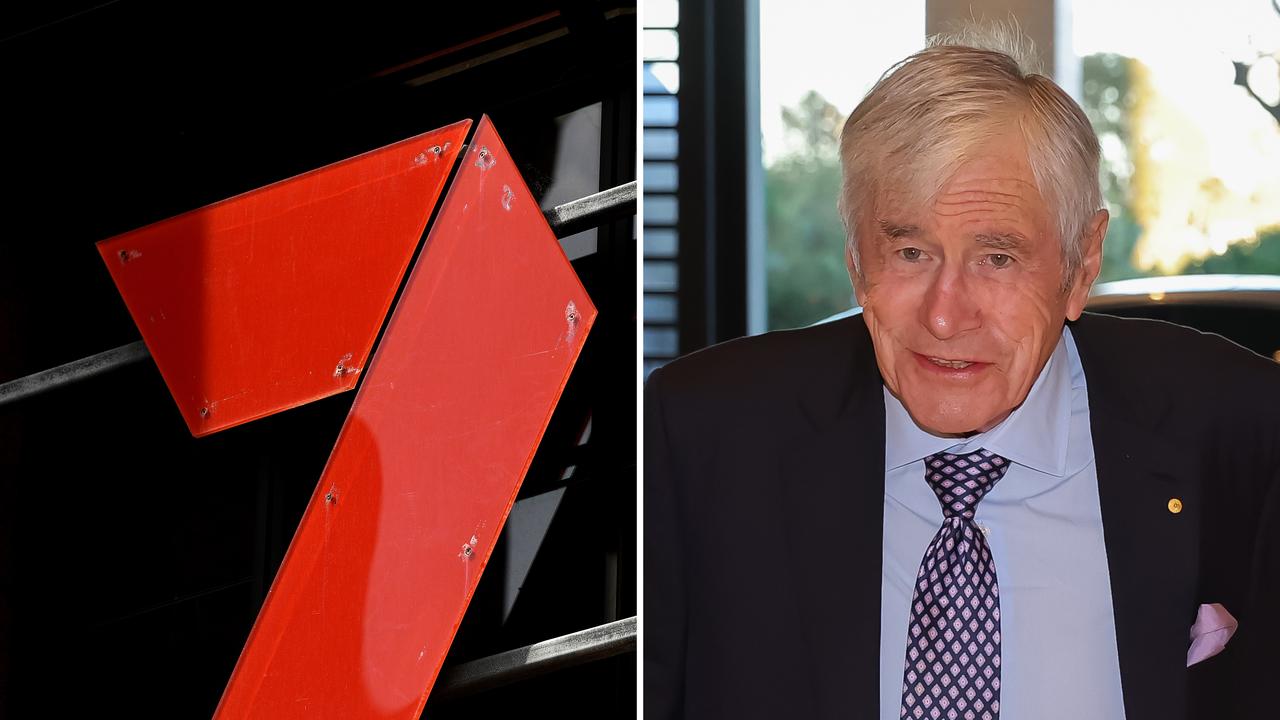

Seven merger with Southern Cross moves a step closer

Australia’s competition watchdog has helped Kerry Stokes closer to retirement, clearing Southern Cross Media to take over his Seven West Media.

The Australian Competition and Consumer Commission has opted not to oppose the media tie-up, with deputy chair saying Mick Keogh saying the companies were different enough not to significantly impact advertising or content markets.

Southern Cross is a radio and podcast business, led by the Triple M and Hit networks, while Mr Stokes’ company operates national broadcaster Seven and newspapers in Western Australia.

“Southern Cross and Seven are not close enough competitors for content,” Mr Keogh said in a statement on Thursday.

The watchdog also found the rise of streaming services and online advertising mean the merger would not substantially lessen competition in any market.

“Owners of traditional media platforms such as radio, free-to-air television and newspapers will continue to face strong competition from digital media,” Mr Keogh said.

“Southern Cross will be no exception, even after the acquisition.”

Mr Stokes announced the takeover in September, along with his plan to retire in February after chairing the combined board to that point.

The billionaire recently presided over his last annual general meeting as Seven West chair, releasing a worsened set of books with revenue down four per cent and profit halving to $30 million.

Seven West last traded at 13.5 cents a share and has not paid a dividend for eight years.

Under the deal, Seven shareholders will own 49.9 per cent of of the combined entity with Southern Cross retaining 50.1 per cent.

The last remaining hurdle is clearance by the Australian Communications and Media Authority.

Locked-out owners left in dark by social media giants

Vy Tran feels completely helpless as she tries to navigate her next steps after her business social media accounts were disabled without notice.

It’s been a stressful week for the entrepreneur, who has become trapped in a battle with Meta to regain access to her accounts, which had been disabled over the weekend for breaching community guidelines.

It’s unclear why her accounts have been flagged but it’s had a devastating impact on her three businesses.

“These are my full-time jobs and I speak to all my clients and get all my orders through Instagram, that’s the main platform,” Ms Tran told AAP.

“We have no platform to promote … we have three events this weekend and we contact vendors through there, too.”

It’s been nearly a week since the accounts have been flagged, and Ms Tran is running out of ideas on what to do after her attempts to reach Meta failed.

She is disappointed with Meta’s response, adding the complaint process was done online with generic responses.

“It’s just a really difficult situation,” she said.

The Telecommunications Industry Ombudsman’s report released on Thursday spotlights the ongoing issues facing users who are contacting the regulator for help.

Ombudsman Cynthia Gebert told AAP it’s becoming increasingly common to hear from people locked out of their social media, with no one available to help.

“Small businesses (are) being locked out of their accounts often with no explanation and no avenue to appeal. They’re losing money in sales and it’s damaging reputations,” Ms Gebert says.

“It is hitting people’s livelihood when they can’t navigate the opaque systems to get your complaints addressed through the platforms themselves.”

Ms Gebert says laws do not allow the ombudsman to help users resolve disputes and is calling for powers to be expanded to close a key consumer protection gap.

“It’s really challenging when you hear people telling you heart-wrenching stories around the impact it’s had on their lives and they have nowhere to go,” she said.

“We are really calling on the government to deliver on this because it’s consumers that are getting hurt through the process.”

The call is backed by business owner Miranda Richards.

The entrepreneur runs Envy Beauty in Brisbane and only recently regained access to her social media accounts after being banned for breaching guidelines two months ago.

She also felt confused when her personal account along with her business account was taken down, with efforts to speak with someone at Meta unsuccessful.

She even contemplated heading to Instagram Meta HQ in Sydney to take action, with at least $6000 of sales lost during those months.

“It was just really disappointing that there was no one to get in touch with… (so) you’re just left in limbo essentially,” Ms Richards told AAP.

The Australian Competition and Consumer Commission has criticised tech companies over their handling of disputes, recommending an external dispute resolution body to help small businesses.

Meta has been approached for comment.

Worker shortages dampen surge in green energy, housing

Public investment in green energy and social housing has surged but worker shortages and sluggish productivity growth are holding projects back.

Tens of billions of dollars were added to Australia’s major infrastructure pipeline in the past year, federal advisory body Infrastructure Australia found in a report released on Thursday.

As federal and state governments lift their ambitions to tackle housing affordability and the energy transition, an extra $29 billion was added to the five-year pipeline of major public projects, lifting it to $242 billion.

That is the highest the outlook has been since the agency began tracking nationwide government infrastructure investment in 2020.

Transport investment still accounts for the majority of the pipeline at $129 billion, which is two per cent higher than the previous year’s outlook.

But transport projects are falling as a proportion of total investment due to the growth in housing and electricity transmission infrastructure.

State and territory governments are responsible for the majority of the $44 billion invested in social and affordable housing projects, which is more than 12 per cent higher than in 2024.

But the increased investment in the sector has also been driven by the federal government, with its $2 billion social housing accelerator and the $10 billion Housing Australia Future Fund underwriting funding for tens of thousands of homes.

According to Infrastructure Australia estimates, social and affordable housing makes up eight per cent of the total $540 billion residential construction pipeline.

“The lion’s share of that is developers and mums and dads,” Infrastructure Australia chief executive Adam Copp told AAP.

“But governments are investing significantly more than they have in recent times into housing.”

All that investment is immaterial if the construction sector does not have the skills and resources to turn it into new homes.

With about 204,000 workers in construction, Infrastructure Australia projects the industry is about 141,000 workers short.

Builders have called on the federal government to change migration settings to bring in more skilled construction workers from overseas.

But Infrastructure Australia called on the industry to do more to attract and retain more domestic workers as young people’s preferences change.

“It’s quite a difficult sector to work in; very long hours, quite a lot of conflict,” Mr Copp said.

“So we think that there’s definitely a lot of work to do in attracting people into the sector, but we need to focus on the culture in the sector more broadly.

“Having more diversity, having more women and making it a great place to work.”

Lacklustre productivity growth is also holding back construction of new homes.

The average construction worker builds about half as many dwellings a year as they did in the 1970s, the Committee for Economic Development of Australia found in a recent study.

“We need to do more with less, and that’s why one of our key recommendations is to incentivise the market to trial productivity enhancing innovations such as modern methods of construction,” Mr Copp said.

Signs labour market outlook gloomier than RBA thinks

Economists and the Reserve Bank predict the unemployment rate to edge lower, but worrying signs suggest the jobs market could weaken down the track.

After a shock jump in joblessness to 4.5 per cent in September, the unemployment rate is expected to unwind slightly and settle at 4.4 per cent in fresh labour force figures set to be released by the Australian Bureau of Statistics on Thursday.

The trend line has been steadily moving upwards since the start of 2025.

But in their latest economic forecasts released in November, RBA economists predicted the unemployment rate would remain stable at 4.4 per cent for the foreseeable future.

Several indicators, such as low underemployment, an above-average share of firms struggling to find workers, a high ratio of vacancies to unemployed workers and strong growth in unit labour costs suggested the labour market remained tight, the bank said.

However, two surveys gauging consumer and business sentiment this week painted a gloomier picture.

Unemployment expectations shot up to their highest level since the pandemic in the Westpac-Melbourne Institute consumer sentiment index on Tuesday.

“This is consistent with softening jobs growth in recent months and suggests that households are increasingly nervous about the labour market outlook,” AMP economist My Bui said.

NAB’s monthly business survey, also released on Tuesday, showed employment conditions have stagnated in recent months.

Future hiring in the market sector would not be enough to make up for an expected slowdown in government-related hiring, which meant slower jobs growth and higher unemployment, she said.

AMP analysts forecast the unemployment rate to tick up to 4.6 per cent in 2026.

That would give the RBA room to deliver another one or two cuts in 2026, Ms Bui said.

Despite financial conditions easing following the central bank’s three rate cuts in 2025, many Australians were still doing it tough.

More than one in four Australians earn money through a side hustle, while another 28 per cent are considering launching one in the next 12 months, Westpac research found.

According to the survey, earning extra income to provide financial relief was the main driver for picking up a side hustle, Westpac national general manager Anthony Mathews said.

D-Day for Liberal climate policy after marathon meeting

The Liberals are preparing to unveil their new climate change and energy policy after a marathon meeting of MPs and senators in the nation’s capital.

The party’s shadow cabinet will convene in Canberra on Thursday morning to finalise its approach to reducing carbon emissions, with an announcement expected shortly after.

The decision follows hours-long talks between all 51 Liberal MPs and senators, where a majority of party members spoke in favour of ditching Australia’s goal of net zero emissions by 2050, according to people in the room.

Opposition energy spokesman Dan Tehan wouldn’t be drawn on the details of party room discussions but said all members were given the chance to have their say.

“There was very, very passionate discussions in the room, because energy and emissions reduction is an issue that everyone cares deeply about,” he told reporters on Wednesday.

Opposition Leader Sussan Ley, whose position has come under significant pressure as the party thrashes out its policy, said the meeting was “excellent”, but didn’t answer questions about whether her colleagues were united on the issue.

Mr Tehan unveiled a list of 10 principles which will inform Thursday’s decision, including the two “foundational principles” of keeping the nation’s power supply stable and affordable, while also taking some action to reduce emissions.

The list also includes a promise to extend the life of ageing coal power plants for as long as possible, lift the ban on nuclear power and scrap a series of Labor policies which Liberal MPs say amount to “sneaky carbon taxes”.

The Liberals are widely tipped to retain an aspiration to reach net zero emissions at some point, but not by 2050 as currently legislated.

Once the party announces its policy, it still needs to negotiate a shared position with its coalition partner the Nationals.

A joint party room meeting has been scheduled for Sunday, where the political allies are expected to announce a final deal on the issue.

Former prime minister Tony Abbott, who signed Australia up to the Paris climate agreement in 2015 but urged later governments to leave the accord, said he was encouraged by the Liberals’ approach.

“You should never put cutting emissions ahead of saving jobs, keeping industries and trying to make people’s cost of living affordable,” he told Sky News.

Western Sydney Liberal Melissa McIntosh said the meeting was positive and she hoped her colleagues would abandon net zero.

“It felt like in the room there was more people in agreement (with dumping net zero) than against,” she told ABC TV.

Bounce in US travel keeps Flight Centre looking up

Australians prioritising short-haul travel has impacted Flight Centre profits but optimism persists that rebounding interest in Asia and the US is just around the corner.

The 2024/25 financial year may have been disappointing, with the online travel agency posting a less than expected $289.1 million before-tax profit, but early results have executives and analysts confident of greener grass ahead.

“Our fundamentals remain strong – arguably stronger than ever – and we expect to return to profit growth this year,” managing director and company founder Graham Turner said at the company’s annual general meeting on Wednesday.

With the largest share of business taking place between March and June each year, fears of US border turnbacks and rising tensions in the Middle East in the first half of 2025 had a big impact on Flight Centre’s success.

Australians in particular started to look for shorter international flights with Japan overtaking the US and UK to become the second-most popular overseas destination behind New Zealand.

But analysts are seeing signs travellers are returning stateside as October outbound travel to the US from Australia grew for the first time since the March quarter.

“With the stock an under-performer relative to travel peers we expect today’s update to be taken positively,” RBC Capital Markets analyst Wei-Weng Chen said.

Corporate clients are of ever-increasing importance to Flight Centre and losses in Asia were a significant contributor to the lacklustre profit showing in 2024-25.

In the first quarter of the current financial year, Mr Turner reported Asia was providing “modest profitability” and the total transaction value of corporate business rose seven per cent.

The sunnier outlook led to target profit before tax between $305 million and $340 million in the next earnings report, a rise of up to 17 per cent.

Embracing artificial intelligence is a step the travel company is approaching cautiously, noting both its potential to streamline customer service but also the threat of AI-powered competitors in travel planning online.

Corporate Traveller, a subsidiary of Flight Centre, has introduced an AI assistant called “Mel” to “deliver a smarter, more personalised experience -while keeping human service at the core”.

When questioned by a shareholder what the adoption of AI would mean for the future of the 12,400 full-time employees of Flight Centre, the company’s chief financial officer said AI was not intended to replace staff.

“We are very much a people-oriented company,” Adam Campbell said.

“We will always be a people-first organisation, but we will use AI as an enabler of our strategies.”