BHP liable for 2015 Brazil dam collapse, UK court rules

BHP can be held liable over the 2015 collapse of a dam in southeastern Brazil, London’s High Court has ruled, in a lawsuit the claimants’ lawyers previously valued at up to $48.32 billion.

Hundreds of thousands of Brazilians, dozens of local governments and around 2000 businesses sued BHP over the collapse of the Fundao dam in Mariana, southeastern Brazil, which was owned and operated by BHP and Vale’s Samarco joint venture.

Brazil’s worst environmental disaster unleashed a wave of toxic sludge that killed 19 people, left thousands homeless, flooded forests and polluted the length of the Doce River.

Judge Finola O’Farrell said in her ruling that continuing to raise the height of the dam when it was not safe to do so was the “direct and immediate cause” of the dam’s collapse, meaning BHP was liable under Brazilian law.

BHP said it would appeal against the ruling and continue to fight the lawsuit.

BHP’s president minerals Americas Brandon Craig said in a statement that 240,000 claimants in the London lawsuit “have already been paid compensation in Brazil”.

“We believe this will significantly reduce the size and value of claims in the UK group action,” he added.

Hamas reasserts Gaza control, post-war talks grind on

From regulating the price of chicken to levying fees on cigarettes, Hamas is seeking to widen control over Gaza as US plans for its future slowly take shape, Gazans say, adding to rivals’ doubts over whether it will cede authority as promised.

After a ceasefire began last month, Hamas swiftly re-established its hold over areas from which Israel withdrew, killing dozens of Palestinians it accused of collaborating with Israel, theft or other crimes.

Foreign powers demand the group disarm and leave government, but have yet to agree on who will replace them.

Now, a dozen Gazans say they are increasingly feeling Hamas’ control in other ways.

Authorities monitor everything coming into areas of Gaza held by Hamas, levying fees on some privately imported goods, including fuel as well as cigarettes and fining merchants seen to be overcharging for goods, according to 10 of the Gazans, three of them merchants with direct knowledge.

Ismail Al-Thawabta, head of the media office of the Hamas government, said accounts of Hamas taxing cigarettes and fuel were inaccurate, denying that the government was raising any taxes.

The authorities were only carrying out urgent humanitarian and administrative tasks whilst making “strenuous efforts” to control prices, Thawabta said.

He reiterated Hamas’ readiness to hand over to a new technocratic administration, saying it aimed to avoid chaos in Gaza: “Our goal is for the transition to proceed smoothly”.

Hatem Abu Dalal, owner of a Gaza mall, said prices were high because not enough goods were coming into Gaza.

Government representatives were trying to bring order to the economy – touring around, checking goods and setting prices, he said.

Mohammed Khalifa, shopping in central Gaza’s Nuseirat area, said prices were constantly changing despite attempts to regulate them.

“It’s like a stock exchange,” he said.

“The prices are high. There’s no income, circumstances are difficult, life is hard, and winter is coming,” he said.

US President Donald Trump’s Gaza plan secured a ceasefire on October 10 and the release of the last living hostages seized during the Hamas-led October 7, 2023, attacks on Israel.

The plan calls for the establishment of a transitional authority, the deployment of a multinational security force, Hamas’ disarmament, and the start of reconstruction.

But Reuters, citing multiple sources, reported this week that Gaza’s de facto partition appeared increasingly likely, with Israeli forces still deployed in more than half the territory and efforts to advance the plan faltering.

Nearly all of Gaza’s two million people live in areas controlled by Hamas, which seized control of the territory from President Mahmoud Abbas’ Palestinian Authority and his Fatah Movement in 2007.

Ghaith al-Omari, a senior fellow at the Washington Institute think-tank, said Hamas’ actions aimed to show Gazans and foreign powers alike that it cannot be bypassed.

“The longer that the international community waits, the more entrenched Hamas becomes,” Omari said.

Asked for comment on Gazans’ accounts of Hamas levying fees on some goods, among other reported activities, a US State Department spokesperson said: “This is why Hamas cannot and will not govern in Gaza”.

A new Gaza government can be formed once the United Nations approves Trump’s plan, the spokesperson said, adding that progress has been made towards forming the multinational force.

The Palestinian Authority is pressing for a say in Gaza’s new government, though Israel rejects the idea of it running Gaza again.

Fatah and Hamas are at odds over how the new governing body should be formed.

Munther al-Hayek, a Fatah spokesperson in Gaza, said Hamas actions “give a clear indication that Hamas wants to continue to govern”.

Hamas’ Gaza government employed up to 50,000 people, including policemen, before the war.

Hamas authorities continued paying them salaries during the war, though it cut the highest, standardising wages to 1,500 shekels ($A720) a month, Hamas sources and economists familiar with the matter said.

with EFE and AP

China warns Japan against Taiwan intervention

Japan will suffer a “crushing defeat” by the Chinese military if it tries to use force to intervene over Taiwan, China’s defence ministry warns, ramping up the rhetoric over Japanese Prime Minister Sanae Takaichi’s remarks about the island.

Takaichi sparked a diplomatic row with Beijing with comments in parliament last week that a Chinese attack on Taiwan could amount to a “survival-threatening situation” and trigger a military response from Tokyo.

China’s top diplomat in Osaka shared a news article about Takaichi’s remarks about Taiwan on X and commented, “the dirty neck that sticks itself in must be cut off”, prompting a protest from Japan’s embassy in Beijing to Chinese Vice Foreign Minister Sun Weidong.

Chinese Defence Ministry spokesperson Jiang Bin said that Takaichi’s words were extremely irresponsible and dangerous.

“Should the Japanese side fail to draw lessons from history and dare to take a risk, or even use force to interfere in the Taiwan question, it will only suffer a crushing defeat against the steel-willed People’s Liberation Army and pay a heavy price,” Jiang said in a statement.

Chinese state media has also weighed in with a series of vitriolic editorials and commentaries lambasting Takaichi, given lingering grievances about Japan’s wartime past and China’s extreme sensitivity over anything Taiwan-related.

Takaichi’s remarks were by no means an “isolated political rant,” the Communist Party’s People’s Daily said earlier on Friday in a commentary.

Japan’s right wing has been trying to break free from the constraints of their post-World War Two constitution and pursue the status of a military power, said the commentary published under the pen name “Zhong Sheng”, meaning “Voice of China” and often used to give views on foreign policy.

“In recent years, Japan has been racing headlong down the path of military buildup,” the paper added.

“From frequent visits to the Yasukuni Shrine, to denying the Nanjing Massacre, to vigorously hyping the ‘China threat theory,’ Takaichi’s every step follows the old footprints of historical guilt, attempting to whitewash a history of aggression and revive militarism.”

World War Two, and the Japanese invasion of China which preceded it in 1931, remain a source of ongoing tension between Beijing and Tokyo.

Beijing claims democratically governed Taiwan as its own and has not ruled out using force to take control of the island.

Taiwan’s government rejects Beijing’s claims and says only its people can decide the island’s future.

Taiwan sits just over 110 km from Japanese territory and the waters around the island provide a vital sea route for trade that Tokyo depends on.

Japan also hosts the largest contingent of US military overseas.

Meanwhile, Japanese broadcaster NTV reported on Friday the Chinese embassy in Tokyo had instructed its staff to avoid going out due to concerns about rising anti-China sentiment.

In a regular news conference, Japan’s top government spokesperson Minoru Kihara reiterated the country’s position on Taiwan, telling reporters that Tokyo hopes for a peaceful resolution of the issue through dialogue.

China has also cranked up its rhetoric against what it calls “diehard” Taiwan independence separatists.

On Friday, the State Council’s Taiwan Affairs Office criticised Taiwan’s ruling Democratic Progressive Party politician Puma Shen, who visited Berlin earlier this week.

Shen said China was threatening to try to get him arrested while abroad, but that he was not frightened.

“Taiwan independence advocates are already at the dusk of their days and at a dead end,” the office’s spokesperson Chen Binhua said, according to state broadcaster CCTV.

A day earlier, Chinese police issued a wanted notice and offered a $35,000 reward for two Taiwanese social media influencers they accused of “separatism”.

The two influencers took to social media to poke fun at the wanted notice.

One of them, the rapper Mannam PYC, posted a video on Friday where he tried to turn himself in to police in Taiwan.

“Why won’t the Taiwan police arrest me? Does that mean everyone supports Taiwan independence?” he wrote, sarcastically.

China’s legal system has no authority or jurisdiction in Taiwan.

Lendlease has secured $3b in new construction work

Lendlease has secured $3 billion in new construction work in recent months, its chief executive says.

About two-thirds of that external construction work is on behalf of government clients in areas such as defence and social infrastructure, chief executive Tony Lombardo told investors on Friday.

“Business momentum continues to build,” he said.

Lendlease was also bidding on $25 billion in development opportunities and aimed to secure $10 billion of these projects in 2025/26, Mr Lombardo said.

Opportunities include Lendlease’s RNA Showgrounds, which is the preferred site for the Olympic athlete’s village in Brisbane, and a harbourside residential land development in the Sydney suburb of Rozelle.

Lendlease is also nearing completion of its Victoria Cross commercial office tower in North Sydney, which is built on top a metro station that opened in 2024.

Lendlease expects to finish its One Circular Quay residential skyscraper project in Sydney in 2026/27, as well as its Victoria Harbour waterfront development in Melbourne.

The construction and property giant has been under pressure from investors to prove that it can rebound from a decade of underperformance.

A slimmed-down Lendlease returned to profitability in August, posting a $225 million gain for 2024/25 compared with a $1.5 billion loss the year before, after it shed thousands of roles and abandoned its international ambitions.

“We are very focused on further capital recycling to strengthen our balance sheet,” chairman John Gillam told shareholders.

“Our business is clearly simplified and that has sharpened our attention to our core markets where we see the greatest potential for growth and long-term value creation.”

All the resolutions put to the meeting passed with 97 per cent to 99 per cent support.

Lendlease shares on Friday afternoon were down 0.2 per cent to $5.41, on a day of sharp losses for most of the market.

Asbestos fears prompt state, territory school closures

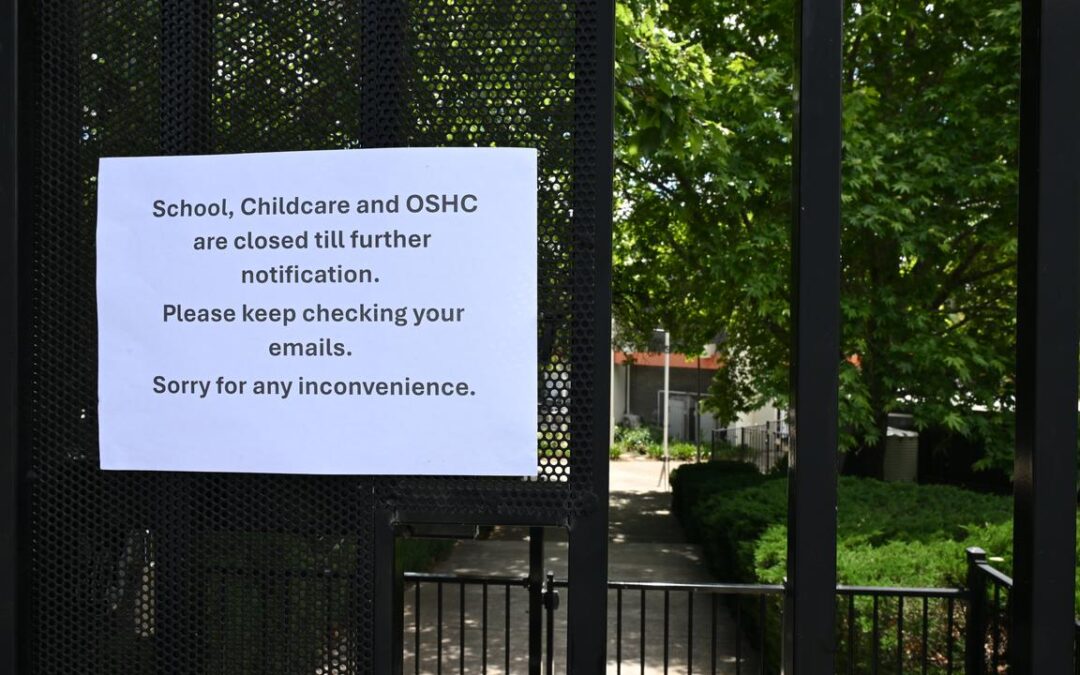

Fears students may have been exposed to asbestos have triggered the sudden closure of schools and preschools across Australia.

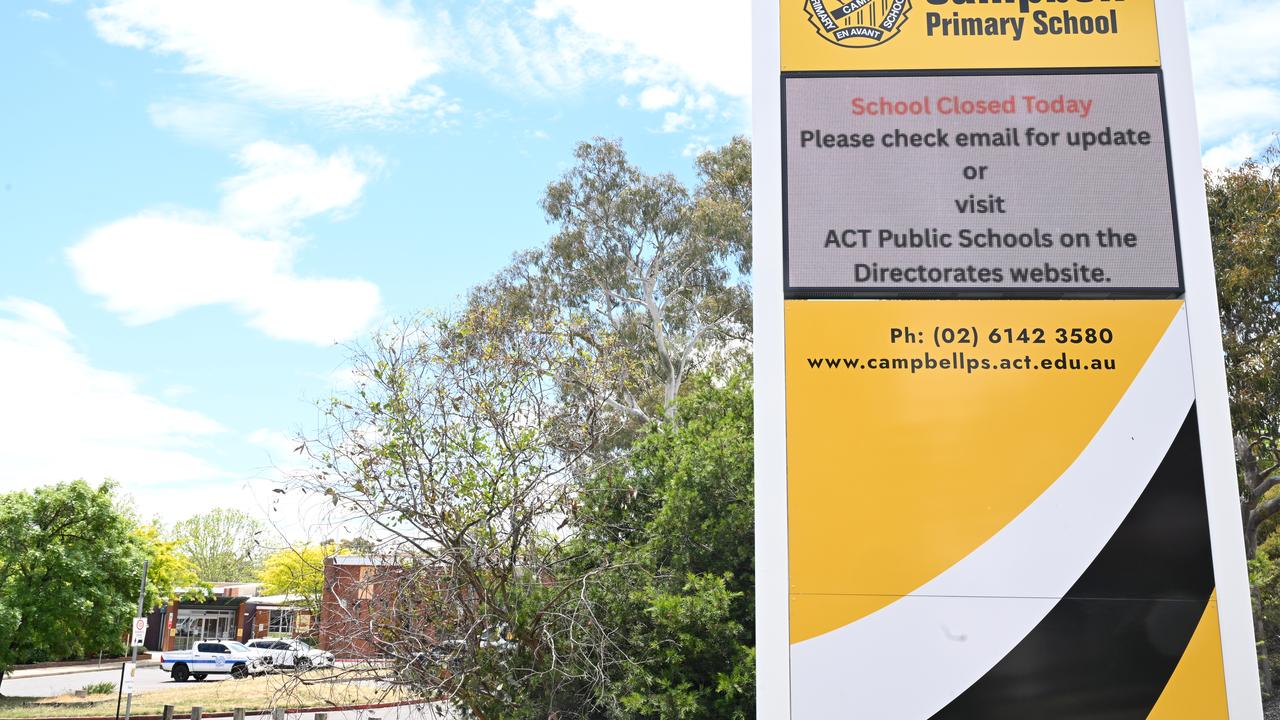

Some 23 schools and preschools were shut or partially shut in the ACT on Friday, while one Brisbane school closed for the day after the consumer watchdog warned a coloured sand may contain asbestos traces.

Health risks to children are low after initial air tests at eight ACT schools came back negative for asbestos but results of other forms of testing are not yet known, the territory’s WorkSafe commissioner Jacqueline Agius said.

ACT authorities want all schools to re-open on Monday and parents will be notified of a decision on Sunday afternoon or evening, ACT Education Minister Yvette Berry said.

“Our first priority is the safety of our schools and students, and it is a workplace as well, so we need to make sure that all school staff are safe and protected,” she told reporters in Canberra.

Ms Berry said authorities did not want children or staff to see asbestos workers in biohazard suits conducting tests, and revealed some parents were not aware of closures until school drop-off.

Mancel College in Brisbane was initially open on Friday morning but quickly shut after the product was discovered at its junior and senior schools.

Parents were urged to pick up their children immediately and told students would be kept away from the sand.

“While the advice is low risk and there are only minor traces, we are acting with an abundance of caution,” the college said on social media.

“We are therefore advising parents that with immediate effect we are closing the entire College today.”

A safety alert has been issued to all NSW public schools to remove recalled sand products.

A Victorian Department of Education spokesperson said it received advice the risk to health was low and had no indication of a need to close schools or early childhood services.

The coloured sand product found at ACT schools was imported from China and is sold as Kadink Decorative Sand in tubes weighing 10 grams, Worksafe ACT said.

It comes after a national recall of children’s sand products sold at retailers including Officeworks, Educating Kids, Modern Teaching Aids and Zart Art.

The Australian Competition and Consumer Commission issued alerts after asbestos traces were detected in laboratory testing.

Products affected are labelled as Kadink Decorative sand 10g 6 pack, Kadink Sand (1.3kg), Educational Colours Rainbow Sand (1.3kg) and Creatistics Coloured Sand (1kg).

The sand has been on sale in Australia since 2020 and is used for crafts or sensory play.

Worksafe ACT urged anyone with the sand at home to dispose of it immediately but do everything they can to prevent fibres from becoming airborne.

That includes wearing disposable gloves, a P2-rated face mask and protective eyewear when disposing of it.

“Do not disturb or use it, and isolate the product,” the authority said.

“Carefully double wrap the sand, its container, and any related materials in 200-micron plastic bags, seal securely with tape, and clearly label the package as asbestos waste.”

Asbestos cannot be disposed of in general waste and must be taken to resource management facilities.

Officeworks said the safety risk was “negligible” after commissioning an independent health and safety risk assessment, but it recalled products as a precaution.

Asbestos-contaminated mulch prompted the closure of schools, hospitals and parks in Sydney in 2024 while historic dumping and legacy contamination was blamed for traces found at parks in Melbourne’s west.

Some 1000 ACT homes were found to be riddled with loose-fill asbestos installed by insulation company Mr Fluffy up until the 1970s.

Stocks crumble as hopes fade for imminent Fed rate cut

Asian shares joined a global selloff on Friday as hawkish comments from Federal Reserve officials doused hopes for a US rate cut next month, while a still messy data calendar added to the angst, hitting bonds, the dollar and even gold.

Japan’s Nikkei tumbled 1.8 per cent on Friday, Australia’s resources-heavy shares slid 1.5 per cent, while South Korea plunged 2.3 per cent.

China will report its monthly activity figures later in the day, after weak lending data flagged concerns from households and businesses to take on more debt amid economic uncertainties.

Overnight, Wall Street tumbled with steep losses in Nvidia and other AI heavyweights on valuation concerns, while Treasuries retreated as investors scaled back expectations of a rate cut from the Fed in December to just 51 per cent, down from 63 per cent a day earlier.

The dollar failed to get a lift on higher yields, losing ground to the likes of the yen and Swiss franc.

“The drawdown seen across assets was pronounced, and looking across the suite of investable markets there were few places to hide,” said Chris Weston, head of research at Pepperstone.

“With the US government open for business, traders now await the Bureau of Labor Statistics (BLS) schedule for key economic data… So far, positioning has been set largely on Tier 2 data, and that will need to be reconciled against the headline data that truly drives the Fed’s decision-making process.”

The White House, however, dashed hopes for a clearer view of the US economy any time soon, saying that the US unemployment rate for October may never be available. Adding to the downbeat mood and pointing to worries about high inflation, a growing number of Fed officials overnight signaled caution about further rate cuts.

Alberto Musalem, who runs the St. Louis Fed Bank, said there was limited room to ease further without becoming overly accommodative, while Cleveland Fed President Beth Hammack said interest rate policy should remain restrictive in order to put downward pressure on inflation.

Minneapolis Fed President Neel Kashkari told Bloomberg that he opposed a rate cut last month and is on the fence about December.

Treasuries fell overnight as investors pared back bets for a Fed cut next month. Two-year Treasury yields held at 3.597 per cent, having risen 3 basis points overnight, while the 10-year yield rose 1 bp to 4.125 per cent, after gaining 3 bps overnight.

The rise in yields, however, failed to support the US dollar, which was down 0.2 per cent against its major peers overnight and was at 99.254, close to the lowest level in two weeks.

The yen got some much-needed respite and last traded at 154.7 per dollar, just a touch above a nine-month low of 155.05 per dollar. The Swiss franc jumped 0.6 per cent on the dollar.

Sterling, however, lost 0.3 per cent to $US1.3153 ($A2.0155) on Friday after the Financial Times reported Prime Minister Keir Starmer and finance minister Rachel Reeves have ditched their manifesto-busting plan to increase income tax rates.

Oil prices rose in early trade but were set for the third straight week of declines. US West Texas Intermediate crude gained 0.4 per cent to $US58.91 ($A90.27), but were down 1.4 per cent this week.

Spot gold prices rose 0.3 per cent to $US4,183 ($A6,410) per ounce, having lost 0.6 per cent overnight to snap a four-day winning streak. It remained well off its record top of $US4,381 ($A6,713).

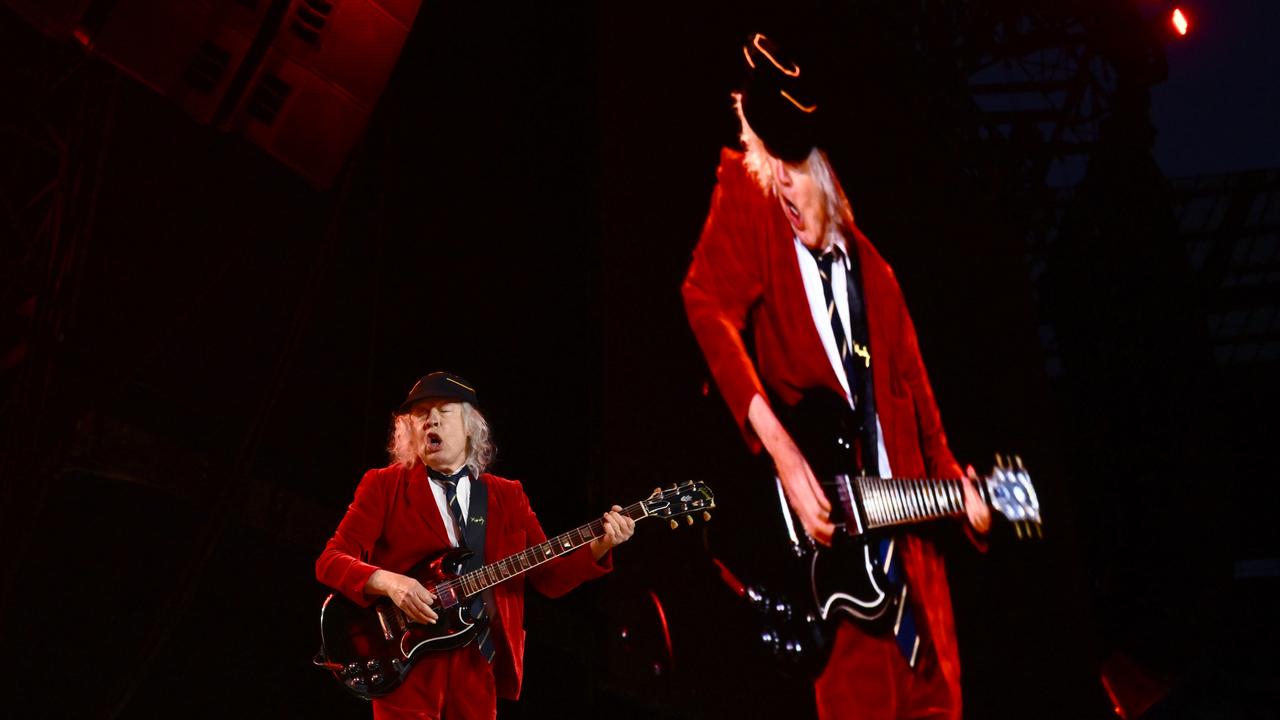

Businesses thunderstruck as AC/DC shows boost spending

AC/DC, Metallica and other major music powerhouses are set to rock Australian businesses and help put them back in the black.

Australians are expected to spend an extra $424 million on merch, accommodation, pubs, and food when Metallica and AC/DC roll into Sydney in the next fortnight, one bank says.

The 10 days between Metallica’s Saturday performance and AC/DC’s November 25 show will be one of the city’s busiest periods of 2025, with more than 210,000 people expected at their shows.

During a normal 10-day period, consumers usually spend about $334 million in the central business district, inner suburbs and the Stadium Australia precinct.

But that is set to grow by 26 per cent.

“Big events are really vital to bring in that extra spend and create real buzz in the city,” NAB executive manager of small business Krissie Jones told AAP.

“Concerts like this aren’t just cultural highlights – they’re economic powerhouses.”

Spending on general merchandise is set to more than double, increasing by up to 131 per cent.

Consumers are also expected to splurge on accommodation, which could grow by up to 81 per cent, and bars and pubs, where spending is expected to increase by 49 per cent.

Fast food spending is set to grow by 34 per cent, while restaurant spending is expected to increase by up to 24 per cent.

Melbourne experienced a similar economic boost after the four-day Melbourne Cup Carnival and Oasis and Metallica’s concerts, with consumers forking out about $250 million.

The city’s night-time mayor, James Young, even penned a letter to the Gallagher brothers’ band after his rock’n’roll dive bar collected a week’s takings in a day during their biggest weekend on record.

He said he event had been one gigantic group hug “and it’s saving the bars and pubs of Melbourne”.

After the COVID-19 pandemic shutdowns and years of growing cost pressures, these kinds of events have helped businesses bounce back.

Business conditions rose two points in October, hitting its highest level since March 2024, according to NAB’s monthly business survey, but confidence fell 2 points.

“Of course, there are particular businesses that are doing it tough, but generally we’re seeing some good momentum,” Ms Jones said.

Lady Gaga’s upcoming performances are also expected to push consumers into a spending spree.

Tide turning on Reserve Bank rate cut expectations

The mood has turned against further interest rate cuts, with jobs data convincing more forecasters the Reserve Bank’s easing cycle is at an end.

NAB on Thursday became the latest big bank to abandon its call for a rate cut in 2026, after the Australian Bureau of Statistics reported employment jumped by a larger-than-expected 42,000 jobs in October.

The unemployment rate fell from 4.5 per cent to 4.3 per cent, also wrong-footing economists, who had predicted the rate to edge down to 4.4 per cent.

On top of a still tight jobs market, underlying inflation is on track to print above the Reserve Bank’s two to three per cent target band for the next six months, activity is accelerating, and the economy is showing signs of being at full capacity, NAB economists say.

The assessment follows comments earlier this week from Reserve Bank deputy governor Andrew Hauser, who revealed the central bank estimated the economy was at its strongest starting point to an economic recovery in more than 40 years.

“If an acceleration in growth starts from an elevated level of capacity utilisation and a labour market with close to full employment, there can be little or no tolerance for above trend growth,” NAB economists Sally Auld, Gareth Spence and Taylor Nugent said.

“Against this backdrop, the RBA will have an enhanced sensitivity to upside surprises in growth and/or inflation.”

NAB’s call brings it in line with the Commonwealth Bank, making them the first two big banks to forecast that the rate-cutting cycle is over.

Nomura economists Andrew Ticehurst and David Seif predicted more forecasters would adopt that perspective, with the consensus shifting to no more cuts.

“We sometimes joke that forecasting data (and markets) can be hard, but ‘forecasting forecasters’ is easier, and we would not be surprised to see others shift to our ‘RBA is done’ view, over coming days and weeks, following this release,” the pair said.

Commonwealth Bank economist Harry Ottley said leading indicators suggested the labour market was not due for any dramatic softening that would give the Reserve Bank second thoughts about staying put.

Job vacancy data and business responses to employment surveys suggested employers were still struggling to find suitable labour, while internal Commonwealth Bank data was also holding up, providing further confidence that jobs growth would remain solid into the future, Mr Ottley said.

“The labour market is a lagging indicator and so the improvements we are seeing in economic conditions should flow through to better employment growth – especially in the market sector.”

However, Westpac economist Ryan Wells said a deeper dive into the data showed the unemployment rate was still steadily rising.

“After smoothing for some of this monthly volatility with a three-month average, the overall unemployment rate is still clearly tracking a gradual uptrend,” Mr Wells said.

ANZ economists Aaron Luk and Adelaide Timbrell affirmed their view for one more rate cut in February, while Westpac predicts the Reserve Bank will cut rates in May and August.

Labor makes hay as coalition abandon net zero pledge

Opposition Leader Sussan Ley insists her party’s decision to ditch Australia’s climate targets won’t affect its popularity in city seats, as progressive campaigners fundraise off the controversial move.

The coalition plans to finalise its official climate policy in coming days, with the Liberals now committed to abandoning net zero by 2050 and other interim emissions-reduction goals if they win government.

Labor and Climate 200, which gives financial support to “teal” independent candidates, have already sent out fundraising emails off the back of the policy change more than two years out from the next federal election.

New and existing coal and gas plants would receive taxpayer subsidies under the plan put forward by the Liberals on Thursday, which the party claims will bring down power prices while still reducing carbon emissions over the long run.

Ms Ley said her proposal would would keep Australia in the Paris climate accord, a landmark agreement which the government signed when the coalition was last in power.

The agreement prohibits countries from watering down their commitments to reduce emissions, but Ms Ley appeared to not be concerned if her plan put Australia in breach of the deal.

“If there are reasons why people in Paris or in some United Nations organisation don’t like it, I can deal with that,” she said.

Asked how her new energy policy would help the coalition win back the capital-city seats it lost to teal independents at the last two elections, Ms Ley said power prices were a major concern for all voters.

“Let’s not misunderstand what climate action is,” she said.

“If people think that this government’s approach to so-called climate action is working, then they should have a really good look at it, because it’s actually not bringing emissions down.”

Progressive political campaigners wasted no time in blasting out fundraising emails off the back of the policy shift.

“If the Libs want to make fringe views their official policy, community independents will continue to rise and relegate them to the fringes,” Climate 200 executive director Byron Fay wrote.

Energy Minister Chris Bowen accused the Liberals of abandoning action on climate change in an email subject-lined “this is what we’re up against”, with options to join Labor or donate at the bottom of the message.

While, former Liberal MP and moderate Fiona Martin said it was a “sad day” for the Liberal party.

“Just because you don’t think you can’t reach a target doesn’t mean you abandon it. The Liberals once led for the future, today they took us backwards,” Ms Martin told AAP.

Now the Liberals have landed on an official policy, they need to negotiate with the Nationals, who unanimously agreed to ditch net zero earlier in November.

Three representatives from each party will meet in coming days to formulate a joint coalition policy, which is expected to be rubber-stamped at a virtual meeting on Sunday.

Stocks firm as US government shutdown set to lift

Stocks and gold paused for breath on Thursday as the US Congress voted to end the longest government shutdown on record, with markets waiting for the resumption of US economic data to gauge the rates outlook.

US stock futures traded either side of flat.

Japan’s Nikkei was 0.5 per cent firmer but the broad Topix index climbed nearly 1.0 per cent to a record high as investors shifted portfolios from the frothiest artificial intelligence firms to buy exposure to other parts of the economy.

Similar moves had been afoot overnight, along with a jump in the gold price above $US4,200 ($A6,419) an ounce and a modest rally for bonds that has the US 10-year yield at 4.067 per cent.

US President Donald Trump, who was expected to host Wall Street executives for dinner on Wednesday, would sign a bill to end the government’s shutdown at 9:45pm, the White House said.

Delayed economic data will likely trickle out next week, economists expect, and the focus is on whether it will back up private surveys that have shown softness in the job market.

“One of the arguments now is with reopening, we should get a lot of data coming through that will give more clarity for (Federal Reserve Chair Jerome) Powell to say: ‘I’m cutting rates because of this,'” said Damian Rooney, director of institutional sales at Perth-based stockbroker Argonaut.

In the Aussie market volumes were a little light but there was a bid for lithium and gold miners, he said, as lower interest rates tend to drive buyers for gold.

“It means these guys are making a lot of lolly in Aussie dollar terms. I think we’ve got a bit more legs there,” Rooney said. Most other sectors fell in Australia and the index was 1.0 per cent lower.

Hong Kong’s Hang Seng retreated slightly from a one-month high and the Shanghai Composite rose 0.1 per cent.

On Wall Street the Dow Jones index notched a record high overnight while the tech-heavy Nasdaq retreated.

In London the mining-heavy FTSE 100 closed at a record high. Bank stocks also pushed the pan-European STOXX 600 to record peaks while Italy’s FTSE MIB has hit its highest in almost a quarter of a century.

Japan’s yen has come under renewed pressure as the country’s new premier has been pushing the central bank to go slow on further rate rises. It hit a record low of 179.49 per euro and was near a nine-month trough on the dollar at 154.94.

The yen touched 155.05 against the dollar on Wednesday, prompting the finance minister to remind traders the government was watching closely in a prelude to possible intervention in the market.

Bank of Japan Governor Kazuo Ueda appeared before parliament on Thursday and said underlying inflation was gradually accelerating toward the bank’s target.

Elsewhere in foreign exchange trade the Australian dollar ticked higher after data showed a surge in employment in October, bolstering a view that the easing cycle there may have run its course.

The Aussie was last up about 0.2 per cent at $US0.6552 ($A1.0014) and expectations of a cut in May dropped from nearly 70 per cent to 32 per cent.

US Treasuries were steady. Brent crude futures inched down to a three-week low of $US62.48 ($A95.49) a barrel after OPEC shifted its projection to forecast a small surplus to oil demand for 2026.