Australia hopes for a final hour backdown over COP role

Energy Minister Chris Bowen says he’ll stand his ground and won’t back down over the right to host the world’s most important climate meeting, despite rival bidder Turkey’s determination to do the same.

The two nations have been locked in a months-long stand-off, even though Australia has secured “overwhelming support” to bring COP31 Down Under.

Prime Minister Anthony Albanese wrote to Turkish President Tayyip Erdogan earlier in November in a bid to resolve the tussle.

The United Nations’ annual Conference of the Parties lacks provisions to break deadlocks over such disputes, with the scenario relying on one side or the other voluntarily withdrawing.

However, Mr Bowen said Australia remained committed.

“We have the overwhelming support of the world to host” the 2026 conference, he told reporters at Sydney Airport on Saturday on his way to join this year’s summit being held in the Amazonian city of Belem.

Australia wanted to co-host with Pacific island nations for the first time and demonstrate how to work together to fight the “existential threat” of climate change, he said.

“Our nation has a lot at stake when it comes to climate change but every effort we make now will help avert the worst impacts,” he said.

“It’s not a matter of fighting on for months afterwards – it gets decided at this conference.

“It’s not a ballot process. That means we need to reach an agreement with Turkey – that’s difficult.”

Mr Bowen said he would continue to converse with Turkish counterparts during the week, while a regional diplomatic bloc of 18 countries, the Pacific Islands Forum, is backing Australia’s bid.

Yet it has been overshadowed by domestic climate policy after the Liberal Party dropped its net-zero emissions target in a decision to be rubber-stamped on Sunday.

Opposition MP Leon Rebello maintains the party’s choice was “driven by what’s right for Australia”, despite the majority of Australians believing the government should adhere to net zero by 2050 in some way.

“We don’t support net zero by 2050 and the reason is … because we have the licence to step away from it and put our own way forward,” he told Sky News on Saturday.

With the United States absent from COP for the first time in three decades, China is stepping into the limelight as a leader in the fight against global warming.

Unlike previous years, when it had a modest pavilion with just a handful of seats available for mostly technical and academic panels, its display in Belem occupies prime space near the entrance next to host country Brazil.

China is also playing a more subtle role in filling the US void behind the scenes, with efforts to rally governments toward agreement.

Pothole ahead: AI, the new eyes on US roads

As America’s aging roads fall further behind on much-needed repairs, cities and states are turning to artificial intelligence to spot the worst hazards and decide which fixes should come first.

Hawaii officials are giving away 1000 dashboard cameras as they try to reverse a recent spike in traffic fatalities.

The cameras will use AI to automate inspections of guardrails, road signs and pavement markings, instantly discerning between minor problems and emergencies that warrant sending a maintenance crew.

“This is not something where it’s looked at once a month and then they sit down and figure out where they’re going to put their vans,” said Richard Browning, chief commercial officer at Nextbase.

Hawaii drivers over the next few weeks will be able to sign up for a free dashcam valued at $US499 ($A766) under the Eyes on the Road campaign, which was piloted on service vehicles in 2021 before being paused due to wildfires.

Roger Chen, a University of Hawaii associate professor of engineering who is helping facilitate the program, said the state faces unique challenges in maintaining its outdated roadway infrastructure.

“Equipment has to be shipped to the island,” Chen said.

“There’s a space constraint and a topography constraint they have to deal with, so it’s not an easy problem.”

Although the program also monitors such things as street debris and faded paint on lane lines, the companies behind the technology particularly tout its ability to detect damaged guardrails.

“They’re analysing all guardrails in their state, every single day,” said Mark Pittman, CEO of Blyncsy, which combines the dashboard feeds with mapping software to analyse road conditions.

Hawaii transportation officials are well aware of the risks that can stem from broken guardrails.

Last year, the state reached a $US3.9 million ($A6.0 million) settlement with the family of a driver who was killed in 2020 after slamming into a guardrail that had been damaged in a crash 18 months earlier but never repaired.

In October, Hawaii recorded its 106th traffic fatality of 2025 — more than all of 2024.

It’s unclear how many of the deaths were related to road problems, but Chen said the grim trend underscores the timeliness of the dashboard program.

After San Jose, California, started mounting cameras on street sweepers, city staff confirmed the system correctly identified potholes 97 per cent of the time.

Now they’re expanding the effort to parking enforcement vehicles.

But Mayor Matt Mahan said the effort will be much more effective if cities contribute their images to a shared AI database.

The system can recognise a road problem that it has seen before — even if it happened somewhere else, Mahan said.

“It sees, ‘Oh, that actually is a cardboard box wedged between those two parked vehicles, and that counts as debris on a roadway,'” Mahan said.

“We could wait five years for that to happen here, or maybe we have it at our fingertips.”

San Jose officials helped establish the GovAI Coalition, which went public in March 2024 for governments to share best practices and eventually data.

Other local governments in California, Minnesota, Oregon, Texas and Washington, as well as the state of Colorado, are members.

Not all AI approaches to improving road safety require cameras.

Massachusetts-based Cambridge Mobile Telematics launched a system called StreetVision that uses mobile phone data to identify risky driving behaviour.

The company works with state transportation departments to pinpoint where specific road conditions are fuelling those dangers.

Ryan McMahon, the company’s senior vice president of strategy and corporate development, was attending a conference in Washington, DC, when he noticed the StreetVision software was showing a massive number of vehicles braking aggressively on a nearby road.

The reason: a bush was obstructing a stop sign, which drivers weren’t seeing until the last second.

“What we’re looking at is the accumulation of events,” McMahon said.

“That brought me to an infrastructure problem, and the solution to the infrastructure problem was a pair of garden shears.”

Texas officials have been using StreetVision and various other AI tools to address safety concerns.

The approach was particularly helpful recently when they scanned 402,000 kilometres of roads to identify old street signs long overdue for replacement.

“If something was installed 10 or 15 years ago and the work order was on paper, God help you trying to find that,” said Jim Markham, who deals with crash data for the Texas Department of Transportation.

“Having AI that can go through and screen for that is a force multiplier that basically allows us to look wider and further much faster than we could just driving stuff around.”

Experts in AI-based road safety techniques say what’s being done now is largely just a stepping stone for a time when a large proportion of vehicles on the road will be driverless.

Pittman, the Blyncsy CEO who has worked on the Hawaii dashcam program, predicts that within eight years almost every new vehicle — with or without a driver — will come with a camera.

“How do we see our roadways today from the perspective of grandma in a Buick, but also Elon and his Tesla?” Pittman said.

“This is a really important nuance for departments of transportation and city agencies. They’re now building infrastructure for humans and automated drivers alike, and they need to start bridging that divide.”

Climate protesters march on UN climate talks

Some wore black dresses to signify a funeral for fossil fuels, while hundreds wore red shirts, symbolising the blood of those fighting to protect the environment.

Saturday was the biggest day of protest at the halfway point of the United Nations climate talks being held in Belem, Brazil.

Organisers with booming sound systems on trucks with raised platforms directed protesters from a wide range of environmental and social movements.

Marisol Garcia, a Kichwa woman from Peru marching at the head of one group, said protesters are there to put pressure on world leaders to make “more humanised decisions”.

The demonstrators planned to walk about four kilometres on a route that will take them near the main venue for the talks, known as COP30.

Protesters earlier this week twice disrupted the talks by surrounding the venue, including an incident on Tuesday where two security guards suffered minor injuries.

Many of the protesters revelled in a freedom to demonstrate more openly than at recent climate talks held in more authoritarian countries, including Azerbaijan, the United Arab Emirates and Egypt.

Youth leader Ana Heloisa Alves, 27, said it was the biggest climate march she has been part of.

“This is incredible,” she said.

“You can’t ignore all these people.”

Alves was at the march to fight for the Tapajos River, which the Brazilian government wants to develop commercially.

“The river is for the people,” her group’s signs read.

Pablo Neri, coordinator in the Brazilian state of Pará for the Movimento dos Trabajadores Rurais Sem Terra, an organisation for rural workers, said organisers of the talks should involve more people to reflect a climate movement that is shifting toward popular participation.

The United States, where President Donald Trump has ridiculed climate change as a scam and withdrawn from the landmark 2015 Paris Agreement that sought to limit the earth’s warming, is skipping the talks.

One demonstrator, Flavio Pinto of Pará state, took aim at the US.

Wearing a brown suit and an oversized American flag top hat, he shifted his weight back and forth on stilts and fanned himself with fake hundred-dollar bills with Trump’s face on them.

“Imperialism produces wars and environmental crises,” his sign read.

The marchers formed a sea of red, white and green flags as they progressed up a hill.

A crowd of onlookers gathered outside a corner supermarket to watch them approach, leaning over a railing and taking mobile phone photos.

“Beautiful,” said a man passing by, carrying grocery bags.

The climate talks are scheduled to run until Friday.

Analysts and some participants have said they don’t expect any major new agreements to emerge from the talks, but are hoping for progress on some past promises, including money to help poor countries adapt to climate change.

Foodies fret as Trump moves to make pasta great again

Steel and copper 50 per cent, cars up to 25 per cent, but an even bigger Trump-era levy looms – 107 per cent on Italian pasta.

Mamma mia.

It started with the US Commerce Department launching what it says was a routine anti-dumping review, based on allegations Italian pasta makers sold product into the US at below-market prices and undercut local competitors.

That has led to a threat of 92 per cent duties, which would come on top of the 15 per cent tariff President Donald Trump’s administration imposed on European exports generally.

The news sent shockwaves through Italy, where 13 producers would be subject to the double whammy. They say sales in their second-biggest export market would shrivel if prices to American consumers more than doubled.

While the measure would hardly prompt pasta shortages, it has perplexed importers such as Sal Auriemma, whose shop in Philadelphia’s Italian market, Claudio Specialty Food, has been operating for more than 60 years.

“Pasta is a pretty small sector to pick on. I mean, there’s a lot bigger things to pick on,” said Auriemma, pointing to luxury items as an alternative.

But pasta?

“It’s basic food,” he said. “Something’s got to be sacred.”

Italy is a nation of avid pasta eaters. Less known is that most of the tortellini, spaghetti and rigatoni its factories churn out is sent abroad. The US accounts for about 15 per cent of its $A7.12 billion in exports, making it Italy’s largest market after Germany, data from farmers’ association Coldiretti show.

The punitive pasta premium has become a cause celebre for Italy’s politicians, executives and economists. Agriculture Minister Francesco Lollobrigida told MPs in mid-October the government was working with the European Commission and engaging in diplomatic efforts, while supporting the companies’ legal actions to oppose US sanctions.

EU Trade Commissioner Maros Sefcovic addressed reporters in Rome in October, stressing the lack of evidence backing the US decision and calling the combined 107 per cent levy “unacceptable”.

Margherita Mastromauro, president of the pasta makers sector of Unione Italiana Food, said prices for Italian pasta in the US remained high, and certainly higher than American-made rivals – undermining any dumping claim.

She said the measures could deal a fatal blow to small- and medium-sized producers.

Lucio Miranda, president of consultancy group Export USA, agreed.

“A duty rate of 107 per cent would definitely kill this flow of export,” Miranda, who is Italian, said by phone from New York. “It’s not going to be something that you can just dump on the consumer and move on. Life continues. It will definitely be a deal killer.”

The Commerce Department’s investigation started in 2024 after complaints from Missouri-based 8th Avenue Food and Provisions, which owns pasta brand Ronzoni, and Illinois-based Winland Foods, whose multiple brands include Prince, Mueller’s and Wacky Mac.

The office’s review focused on La Molisana and Garofalo, chosen as primary respondents because they are Italy’s two largest exporters, the Commerce Department said in an emailed statement. Any sale price below either producer’s costs or the price they charge in the Italian market would be considered dumping, in line with numerous other reviews of Italian pasta since 1996, it said.

The two companies presented information incorrectly or withheld it, significantly impeding analysis, according to the Commerce Department. And in the face of these alleged deficiencies, the office presented its 92 per cent duty estimate, which it extended to 11 other companies based on an assumption the two companies’ behaviour was representative.

“After they screwed up their initial responses, the Commerce Department explained to them what the problems were and asked them to fix those problems; they didn’t,” White House spokesperson Kush Desai said in an emailed response to the AP’s questions.

“And then Commerce communicated the requirements again, and they didn’t answer for a third time.”

La Molisana declined to comment. Garofalo didn’t respond to a request for comment.

The sanctions would be applied not only to future imports but also to the 12 months through to June 2024, according to the Commerce Department. It added that only 16 per cent of total Italian pasta imports could be affected.

Its final decision is scheduled for January 2, which could be extended by 60 days.

A little over an hour’s drive northeast from Naples is Benevento, a sleepy hilltop town of 55,000 people famed for its ancient Roman theatre and Aglianico red wine. It’s also home to Pasta Rummo, founded in 1846, which prides itself on its seven-phase, “slow work” production method.

CEO Cosimo Rummo is outraged by the threat to his company’s annual 20 million euros ($A36 million) in exports to the US

“These tariffs are completely senseless,” Rummo said in a phone interview. “These are fast-moving consumer goods … Who would ever buy a pack of pasta that costs $10 ($A15) – the same price as a bottle of wine?”

He said he had no intention of starting to produce pasta stateside, as some companies have done, and so would be spared the prospective levy. That includes Barilla, which for decades has been the main Italian pasta brand in the US and now has large-scale production facilities there.

When the transatlantic imbroglio started simmering, Robert Tramonte of Arlington, Virginia, sought assurances. The owner of The Italian Store called his supplier, who told him there’s enough pasta inventory stocked in the warehouse to keep prices steady until Easter.

Tramonte’s clients count on him for top-shelf product and he was relieved that, at least for the time being, they won’t have to shell out for the real deal. Or worse – perish the thought – purchase made-in-America pasta.

“They’ve tried to make Italian products and use the same ingredients, but the source wasn’t Italy,” he said.

“And they just didn’t taste the same.”

Trump removes tariffs on Australian beef exports

Donald Trump has removed tariffs on one of Australia’s biggest exports to the US.

The US president revealed on Saturday morning Australian time he would lift reciprocal tariffs on some agricultural goods including a plethora of beef goods.

Though Australian products already had the lowest tariff rate of any US trading partner, removing that baseline 10 per cent levy on beef will be a significant boon for farmers.

“As an incredibly important market for Australian beef, we greatly value our relationship with the American industry and consumers,” Cattle Australia chief executive Will Evans said.

“The decision to remove tariffs will further strengthen that relationship.”

Meat is Australia’s second largest export to America behind non-monetary gold according to the Australian Bureau of Statistics.

In 2024, the US accounted for 30 per cent of Australia’s beef exports, the United States Studies Centre found.

394,000 tonnes of beef worth $4.16 billion was sent to the states, according to Meat and Livestock Australia.

Even when the tariffs were in place, trade continued to flow.

Australia has exported more than 370,000 tonnes of beef since the beginning of the year, up 17 per cent compared to the first 10 months of 2024, Meat and Livestock Australia found.

The Albanese government in July wound back biosecurity restrictions on US beef imports as tariff concerns reached their zenith.

Ms Collins at the time insisted the decision had followed a decade-long science-based review.

But the US had previously complained to Australia about non-tariff trade barriers, including longstanding restrictions on beef following a prior outbreak of mad cow disease, and their removal was hailed by Mr Trump as a victory.

The president’s latest tariff retreat also lifts levies on coffee, tropical goods, and a swathe of other goods as his administration faces mounting pressure to lower the cost of living.

Australia to make eleventh-hour bid to seal COP31 deal

Australia will make a last-ditch attempt to host the world’s biggest climate conference and bring a years-long deadlock to an end.

Climate Change Minister Chris Bowen set off on Saturday for the United Nations Climate Change Conference, also known as COP30, in the Amazonian city of Belem to represent Australia and try to seal the deal on hosting rights for the 2026 event.

The federal government first revealed it would make a tilt at co-hosting COP31 with Australia’s Pacific neighbours, in 2022.

But in the years since, Turkey has doubled down on its own bid for the event, setting up a stalemate that has to be resolved before the 2025 conference ends on Friday.

“It’s not a matter of fighting on for months afterwards – it gets decided at this conference,” Mr Bowen told reporters before his flight from Sydney Airport.

“Australia has the overwhelming support of the world to host COP31 but that’s not how the system works.

“It’s not a ballot process … that means we need to reach an agreement with Turkey – that’s difficult.”

He said he would continue to have conversations with Turkish counterparts over the upcoming week.

But the bid has been overshadowed by domestic climate policy after the Liberal party dropped its net-zero emissions target in a decision to be rubber-stamped on Sunday.

Liberal MP Leon Rebello maintained the party’s choice was “driven by what’s right for Australia”, despite the majority of Australians believing the government should adhere to net zero by 2050 in some way, according to the Resolve Political Monitor.

“We don’t support net zero by 2050 and the reason is … because we have the licence to step away from it and put our own way forward,” he told Sky News on Saturday.

He claimed Labor’s plan was failing on reducing emissions and driving up energy prices – though experts like those at the Australian Energy Market Operator continue to find that wind and solar backed by storage and transmission are the lowest-cost new-build electricity generation technologies.

The opposition’s emissions target stoush has allowed Labor to position itself as being stronger on climate.

However the Labor government has also made a number of controversial decisions that have drawn the ire of environmental groups and now the United Nations has also begun to take notice.

Astrid Puentes Riano, the UN Special Rapporteur on the human right to a clean, healthy and sustainable environment, filed an application on Friday to intervene in three Federal Court challenges over the controversial extension to Woodside’s North West Shelf gas project.

The move would allow her to intervene as an amicus curiae or “friend of the court” in cases against the environment minister by the Australian Conservation Foundation and the Friends of Australian Rock Art, meaning she would be able to offer information or expertise on the case without being a party.

According to the foundation, her lawyer has told the court she wants the opportunity to address Australia’s international legal obligations and how international law should be considered when interpreting the country’s main environment law.

Environment Minister Murray Watt said he was aware of the proceedings but maintained approving the North West Shelf project to 2070 was “consistent with Australian law and our international obligations”.

The carbon emissions emitted across its lifetime would be 13 times greater than Australia’s total annual emissions, the conservation foundation says.

But Mr Watt has insisted the project would be required to reduce its emissions every year and reach net-zero greenhouse gas emissions by 2050.

Switzerland wins US tariff reduction to 15 per cent

The United States and Switzerland have announced a framework trade agreement that includes the US slashing its tariffs on imported Swiss products to 15 per cent from 39 per cent and a pledge by Swiss companies to invest billion of dollars in the US by the end of 2028.

The United States and Switzerland, joined by Liechtenstein, aim to conclude negotiations to finalise their trade deal by the first quarter of 2026, the White House said in a statement.

US Trade Representative Jamieson Greer said the agreement tears down longstanding trade barriers and opens new markets for US goods.

He welcomed “massive Swiss investment to help reduce our deficit in pharmaceuticals and other key sectors” that will generate thousands of jobs across the US.

Of the $US200 billion ($A307 billion) in pledged Swiss investments in the United States, at least $US67 billion will come in 2026, the White House said.

They will target sectors including pharmaceuticals, medical devices, aerospace and gold manufacturing, it said.

“This agreement puts Switzerland on an equal footing with the European Union and brings the tariff level down from 39 per cent to 15 per cent,” Swiss Economy Minister Guy Parmelin said in announcing the deal, which affects about 40 per cent of Switzerland’s exports.

“Of course, we would prefer (the $US200 billion) to be invested in Switzerland,” Parmelin added.

“And that’s why the Federal Council in parallel is doing everything to see how we can reduce costs for our businesses.”

The lower tariff rate is likely to be activated within “days, weeks,” as soon as the US customs processing systems can be adjusted, said Helene Budliger Artieda, director of Switzerland’s State Secretariat for Economic Affairs.

She added that a large portion of Swiss investments in US production would come from the pharmaceuticals and life sciences sectors but declined to provide specifics.

Pharmaceuticals is by far the largest export sector from Switzerland to the US.

The deal guarantees a 15 per cent tariff ceiling for Swiss drug makers, including Roche and Novartis, from US President Donald Trump’s forthcoming Section 232 national security duties for the sector, which could reach 100 per cent for certain patented drugs.

Parmelin said the 15 per cent cap would also apply to other future Section 232 duties, including semiconductors, putting it on the same footing as the EU.

“The risk of much higher sector-specific tariffs is therefore ruled out,” Parmelin added.

A Swiss government statement said the tariff agreement, which includes neighbouring Liechtenstein, will reduce Swiss import duties on US industrial products, fish and seafood and agricultural products “that Switzerland considers non-sensitive”.

Switzerland will grant the US duty-free bilateral tariff quotas on 500 tons of beef, 1000 tons of bison meat and 1500 tons of poultry meat, the government said.

Secret report on cronyism comes back to bite Labor

A review of political cronyism kept secret for more than two years has put Labor on the back foot, with its leaked advice revealing why.

The review, commissioned by Finance Minister Katy Gallagher, has called for an end to politicised public sector appointments and a move to an independent, merit-based process.

But Labor has also installed a slate of former MPs, ministers and political allies to public sector boards and government bodies, as did the coalition when it was in government.

Current and past board appointments were not included in the review, nor was the process related to a specific person.

The recommendations cover appointments to boards and bodies across all commonwealth portfolios, although the government has indicated privately that not all will recommendations be accepted.

Senator Gallagher, who doubles as the public service minister, accused the former government of overseeing a “jobs for mates” culture when she announced the review to strengthen the integrity of appointments.

The claim pointed to alleged cronyism and nepotism on public boards as ministers used their discretion to install political allies to plum positions.

Senator Gallagher has been sitting on the findings of the review since August 2023, saying they cannot be made public because they are being considered by cabinet, even though it’s not uncommon for reports to be released without a government response.

Reviews, for example, conducted by both the government’s Islamophobia and anti-Semitism envoys were released in 2025 and await formal replies.

Former Australian Public Service commissioner Lynelle Briggs has called for merit-based public sector board appointments rather than political ones, according to public sector sources familiar with the report but unable to speak publicly due to the sensitivities involved.

Senator Gallagher’s office declined to comment.

The report has created a political headache for Labor, which promised an end to a culture of cronyism when it came to power in 2022.

Senator Gallagher declared soon after that she looked forward to Ms Briggs providing “robust recommendations” on restoring integrity to public sector appointments.

Centre for Public Integrity executive director Catherine Williams said it was unclear why the government had not publicly released the report two years later.

“If indeed robust recommendations have been made by Ms Briggs, we look forward to government taking up their implementation as a matter of priority so that Australians can trust that public appointments aren’t just jobs for mates,” she told AAP.

One method floated publicly by another former public service commissioner, Andrew Podger, and championed by independent MP Sophie Scamps, is an advisory committee that puts forward a shortlist to the minister.

The minister would have to choose from this list.

Senator Gallagher has been forced to release the report by the end of 2025 under a Senate order following a push from all non-government upper house members to punish Labor for keeping it under wraps.

The finance minister previously argued it could not be released because it could prejudice cabinet deliberations.

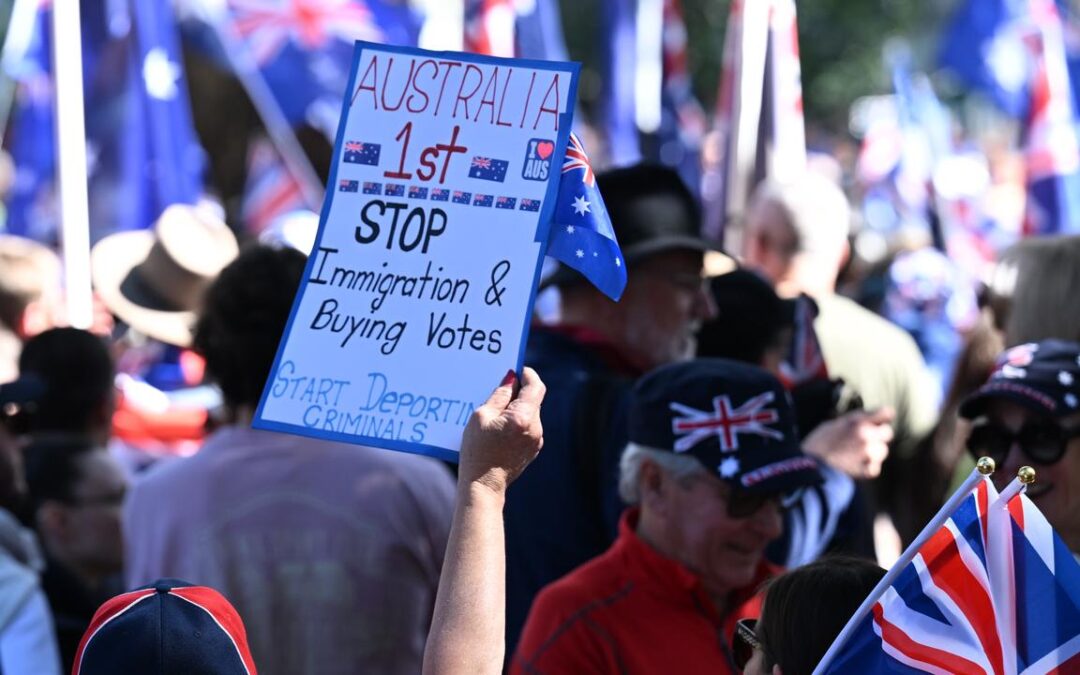

Conservatives zero in on migration after climate coup

Fresh from winning the fight to water down the Liberals’ climate commitments, the party’s right wing plans to wield its influence in an equally bitter battle over immigration policy.

The Liberals and Nationals are preparing for a meeting on Sunday to rubber-stamp a joint plan to abandon Australia’s net-zero-by-2050 target, a move moderates warn will hurt the party’s popularity in inner-city areas.

The policy shift is a major victory for the right faction, which has been strengthened by two consecutive elections where moderate MPs have been wiped out, and further emboldened by Opposition Leader Sussan Ley’s capitulation on net zero.

One conservative suggested the next debate over immigration would be a “rinse and repeat” of the climate fight and that there were no immediate plans to challenge Ms Ley as leader because the conservatives had won their policy demands.

Despondent moderate Liberals fear the Nationals will front-run the coalition’s migration policy, mirroring how the climate negotiations unfolded.

But Nationals sources denied those claims, insisting they would pursue their goals through the official party room process.

The immigration debate is more nuanced in the Nationals’ party room because its regional base relies on migrants to fill crucial roles such as farm labourers.

One option being discussed by MPs would tie Australia’s migration rate to the number of available homes as a way to ensure the intake of new arrivals does not make it harder to find somewhere to live.

Ms Ley conceded immigration would be the next big policy issue for the Liberals to thrash out and said the party would do so in a respectful manner.

“The problems we’re facing are not the fault of any migrant or migrant community. They are failings of infrastructure,” she said.

Pollster and former Liberal staffer Tony Barry warned migration posed a political risk to both Labor and the coalition as it had the potential to mobilise soft voters.

“Both sides will need to communicate their position with precision,” he told AAP.

“Often in politics, it’s not just what you say, but it’s also how you say it.

“If the coalition are framed by Labor as being insular and anti-migrants, it will be a massive problem.”

Opposition immigration spokesman Paul Scarr is a more moderate Liberal voice on the issue and has strong ties to multicultural communities.

He’s wary of not pushing migrants further away from the party after a slew of disparaging comments against them by colleagues.

WA-based Liberal leadership aspirant Andrew Hastie resigned from his post as opposition home affairs spokesman in March because of a disagreement over immigration policy.

He’s been outspoken on the issue, calling for a reduced migrant intake and controversially suggesting Australians felt like “strangers in our own home”.

Ms Ley sacked fellow former frontbencher Jacinta Nampijinpa Price from her veterans affairs portfolio after the Northern Territory senator refused to apologise for suggesting Labor prioritised Indian migrants to win votes.

Spanner thrown as retail giant battles worker abuse

Australia’s biggest hardware retailer has poured millions into tactical security across stores in a state lagging others in hammering out retail worker abuse.

States and territories across the country have passed laws to toughen penalties for assaults on retail workers and other frontline staff.

Victoria moved to follow on Friday with legislation to create an offence for people who assault or threaten to assault workers in shops, restaurants, bars, cafes, shopping centres, taxis and Ubers.

The indictable offence will carry a maximum sentence of five years’ jail.

Further legislation will be introduced to parliament in April 2026 to ban troublemakers under workplace protection orders.

Bunnings managing director Mike Schneider is hopeful it can be a “circuit breaker” to a problem plaguing the hardware giant’s Victorian stores.

“We’re getting there in the end,” he told AAP.

“It’s in SA, it’s in NSW, it’s in Western Australia – there’s (workplace protection orders) in the ACT.

“We’re spending half a million dollars a month on tactical security guards in Victoria, $6 million a year that we are not spending in those states.”

Violent and aggressive incidents at Bunnings stores doubled nationally from 2023/24 to last financial year but tripled in Victoria.

One individual committed 30 offences in Bunnings, using an extendable baton to threaten staff and customers each time.

Mr Schneider attributed the larger rise in Victoria to a combination of pronounced anti-authority sentiment following the COVID-19 pandemic and a legislative framework that favoured offenders over victims.

“It’s been building for a while,” he said.

“There’s been a shift from just sticking a screwdriver up the back of your jumper and walking out of the store to bringing a weapon, using a weapon, threatening our team.”

Big W worker Tammy, who did not wish to have her last name published, said she and her colleagues had noticed the “massive” uptick in abuse and violence in the past few years.

Workers at her Melbourne store were subjected to sexism, racism, ageism or another form of abuse every day.

“I have been kicked, I have been spat at, I have been punched in the past,” the retail worker of 25 years said.

“It’s a constant and we’re one of the quieter stores.

“It’s just snowballing this violence, particularly coming up to the Christmas period now.”

Supermarket worker Ruth, who has been in retail for more than 50 years, blamed inflation for emboldening bad behaviour.

“It’s been a big escalation in the last few years of people thinking they could tell us where to go because they don’t like prices,” the Coles staffer said.

The COVID-19 pandemic was no picnic but people came out of the crisis angrier, she said.

“It should have calmed down by now,” Ruth said.

“What was once in a blue moon of somebody going off tap is a weekly, sometimes daily occurrence.”

The Victorian measures have been a long time coming, with Premier Jacinta Allan calling worker abuse “unacceptable” when committing to a crackdown in mid-2024.

The Victorian Shop, Distributive and Allied Employees Association was “unhappy” with the speed of Victoria’s changes and called for MPs to push through the laws so they can be enacted before Christmas.