With Medicare shaping up as a key election issue, we examine optometry retailing and how your friendly optometrist is ‘incentivised’ to put glasses on your nose. Zach Szumer reports.

Have you ever walked into an outlet like OPSM, Specsavers, Bailey Nelson, or Laubman & Pank for an eye test and left feeling like you’d been gently pressured into spending $500 on a pair of glasses?

Well, firstly – you probably shouldn’t be too surprised. You did, after all, go to a retail outlet. Still, you might be wondering why the places Australians so often go for their eye tests – often paid for through Medicare – are the same places that want to sell you eye-wateringly expensive products.

I mean, why don’t we also have podiatrists at Foot Locker? Or dermatologists at Aesop?

Your correspondent has recently been granted a glimpse into this highly commercialised corner of healthcare, in which bosses impose onto optometrists a variety of targets – whether its “converting” eye tests into sales or increasing rates of certain types of tests.

This type of pressure is reportedly causing many optometrists “significant moral distress” and some are starting to fight back.

“Failure to improve” punished

MWM has seen an email sent from a state director for both OPSM and Laubman & Pank, reminding optometrists that “individual optometry performance goals across the state are: conversion: 50 percent, eyecare $70 and UWDRS: 35 percent.”

“Conversion” means the rate at which an eye test is converted into a sale of glasses and “eyecare” is the average fee for an eye test. “UWDRS” stands for ultrawide digital retinal scan – a type of test that Medicare doesn’t pay for – and is thus more profitable for the company.

The email from the state manager goes on:

“Please take immediate action to improve conversion over the coming weeks”.

Failure to improve your individual KPIs to an acceptable level will lead to reduction or discontinuation of future bookings.

OPSM and Laubman & Pank are both owned by the international optical retail giant Luxottica, which also owns Sunglass Hut, Ray-Ban, Oakley and Vogue Eyewear, and Oliver Peoples – among approx. 150 other eyewear brands.

MWM reached out to ask if OPSM and Laubman & Pank believe that such performance targets and the threat of punitive action have any negative effect on the delivery of quality health care.

We received no reply.

“They’ll give you a talk”

MWM has also seen screenshots from what an optometrist said was an official Specsavers document in which optometrists are told they must “consistently achieve a 60-65% plus conversion rate.” We were told that the screenshot referencing the conversion rate was from several years ago.

A Specsavers spokesperson acknowledged the company “measures all elements of clinical care and customer service, of which conversion is one, to ensure there is an unrelenting focus on enhancing patient experiences and visual outcomes.”

“The Specsavers brand, however, does not mandate conversion rates or sales targets for our professionals.”

Specsavers has a joint venture partnership (JVP) model, which means that outlets are part-owned and managed by franchise owners.

MWM has sighted recent communication by one optometrist who said Specsavers does still have conversion targets – “but it really depends on the directors” of these JVPs. If your numbers are really bad, they’ll give you a talk,” the optometrist wrote.

In another screenshot – sent by a person MWM was told was likely a franchise director – optometrists are informed that the stores just “couldn’t afford” it if people didn’t also buy glasses when coming in for a test.

(To protect the optometrist’s privacy, MWM has chosen not to quote the entire message.)

Specsavers would only tell MWM that this message wasn’t sent from corporate HQ. They didn’t clarify whether the company put any pressure on joint venture partners by, for instance, offering bonuses to stores that met budgets, which would directly lead to JVPs imposing such targets themselves.

Ramping up rebates

MWM was also supplied with screenshots sent by Bailey Nelson state clinical leads and eyecare directors in which optometrists’ Medicare claiming patterns are compared with company averages.

In these emails, optometrists are praised for above-average billing of certain Medicare items, recommended to look for other billing “opportunities”, and given advice to reduce billing items that can only be claimed every three years.

One optometrist who fell below average was reminded that “there may be missed opportunities” to make certain Medicare claims and is asked to “please really look for these new signs/symptoms… or progressive disease opportunities where possible.”

The email explicitly states that one of the reasons for doing this is to raise “clinical revenue”.

One optometrist told MWM this type of pressure was leading optometrists to make invalid Medicare claims, referring to it as “corporate optometry rorting Medicare”.

He said he had made multiple reports to the Medicare Integrity Taskforce that patients are, without valid clinical basis, being pushed to undergo tests that attract certain Medicare rebates. He said he has seen no evidence these claims have yet been investigated by the taskforce.

A Bailey Nelson spokesperson told MWM that the company was “committed to delivering high-quality eye care while ensuring our optometrists practice with integrity and in full compliance with regulatory requirements.”

“We have established Medicare guidelines to ensure our optometry team is fully aware of their rights and obligations when it comes to Medicare billing and claims. Additionally, we work closely with a Medicare consultant to support our optometrists in maintaining compliance with all claiming requirements.”

“We take compliance seriously and have measures in place to educate and support our optometrists in making clinically appropriate decisions.”

Significant moral distress

In February, industry peak body Optometry Australia (OA) – released a position statement on KPIs – Key Performance Indicators for those not used to corporate jargon.

It said “KPIs that incentivise optometrists to breach the Code or relevant laws, whether directly or indirectly, should not be used”.”

In a statement recently given to MWM, OA CEO Skye Cappuccio said “many (optometrists) feel highly pressured in their workplace and revenue-driven targets are a central part of creating that pressure.” However, she also pointed MWM to the preliminary results from a study currently being conducted at Flinders University, partly funded by the group.

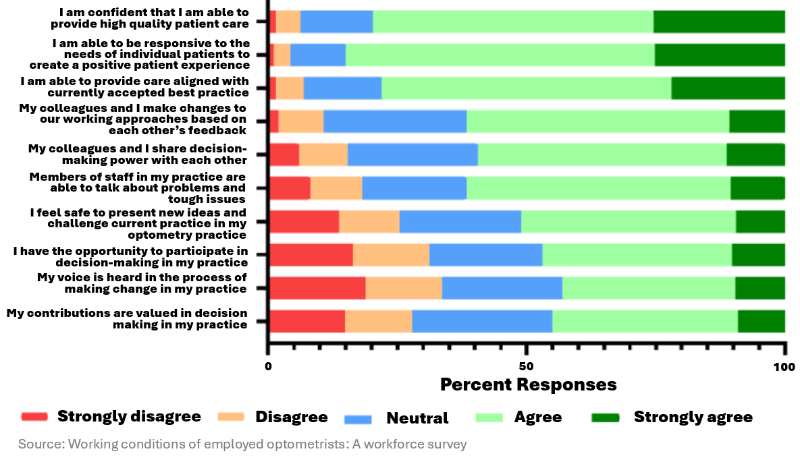

The anonymous survey found that “over 75 percent of optometrists agreed or strongly agreed that they were able to provide high quality patient care, aligned with current evidence-based practice and responsive to the individual needs of their patients.”

Flinders University Optometrist workforce survey

However, it also noted

there is significant moral distress among optometrists at work, e.g. KPIs causing role conflicts.

OA told MWM it had sent the survey results to many large retail optometrist employers. “We are calling on them to work with us to realise change, now,” Cappuccio said.

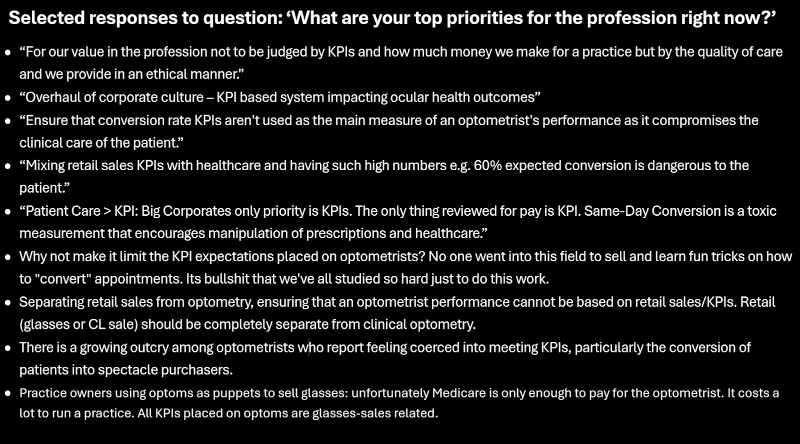

Some optometrists feel that OA – which represents both employers and employees – has insufficiently protected their interests and they’ve launched a unionisation drive. Some of these optometrists have also set up a Facebook group that has around 1,600 members.

Presuming all members are registered optometrists, that’s over 20 percent of the industry in Australia.

The admins of this group conducted their own internal survey, which received over 150 responses, many of which mention KPIs:

Making money

MWM asked OA if it was aware of any other area of healthcare provision in which qualified practitioners are required to meet targets and KPIs like those mentioned above, and were told “KPIs are commonly used across healthcare settings and various industries to evaluate professional performance.”

We put the same question to various experts. Dr Karinna Saxby, a research Fellow Melbourne Institute of Applied Economic and Social Research, said some hospitals implemented KPIs to access “performance-funding payments”. She continued:

This can lead to too much emphasis placed on attaining (or even manipulating) ‘target numbers’, and too little on actual quality of patient care.

However, in reference to retail optometry, she said “Broadly speaking, this seems more like a case of supplier induced demand; the optometrist owners get money from hitting targets – just more about making money.”

Editor’s note: Story updated March 28.

Zacharias Szumer is a freelance writer from Melbourne. In addition to Michael West Media, he has written for The Monthly, Overland, Jacobin, The Quietus, The South China Morning Post and other outlets.

He was also responsible for our War Power Reforms series.