Big banks claiming to be ‘carbon neutral’ are anything but. The big four banks in Australia only account for a fraction of their emissions, with CBA offsetting just 4%. Callum Foote investigates.

Since 2015, the Australian government-sponsored Climate Active program has been certifying organisations and products as carbon neutral. However, tricky carbon accounting has brought certified companies and the program as a whole into question.

The loopholes and carve-outs embedded within the Climate Active program have allowed fossil fuel companies or their products to be labelled “carbon neutral”. These include gas explorer Cooper Energy, petroleum giant Ampol and Australia’s biggest corporate emitter AGL.

The Department of Industry and Science Climate Active website states that “Climate Active certification is awarded to businesses and organisations that have credibly reached a state of carbon neutrality.”

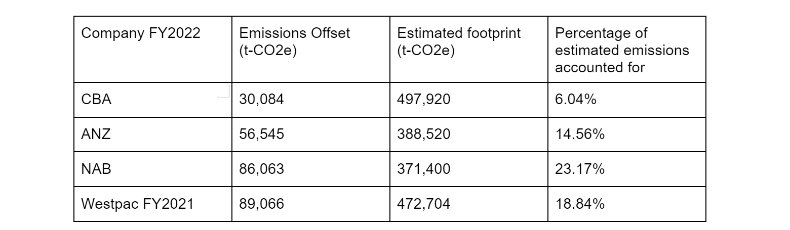

Each of the big four banks has been certified under the program for quite some time, with as little as 4% of Commonwealth Bank’s (CBA) actual emissions being offset.

According to Audrey van Herwaarden, a corporate environmental performance analyst at the Australian Conservation Foundation (ACF),

the government’s climate active plan does not provide real certainty of carbon neutrality. This is because the scheme does not strictly require banks to calculate and subsequently offset emissions from their entire value chain.

According to van Herwaarden, “When it comes to banks, emissions from their financing activities account for the majority of their total emissions, however often only emissions from their operations are reported.”

Commonwealth Bank excludes any emissions arising from employee commuting, base building retail sites, capital expenditure or financed emissions from its carbon accounting.

Estimated actual emissions can be calculated using input/output tables provided by the Department of Industry and Science Climate Active Program.

These tables provide the estimated tons of Co2 equivalent (t-CO2e) emitted per dollar by specific industry sectors.

Using the Professional Services/Banking category provided by Climate Active and applying it to CBA’s $30.16 billion in revenue in 2021, we get a carbon footprint calculation of 690,399 tonnes of CO2e.

According to its Climate Active public disclosure statements, CBA has only offset 27,512 tonnes of CO2e or just over 6% of its total estimated emissions.

The look was even worse in 2021, where CBA only offset 27,512 tonnes of CO2e from the 690,399 tonnes it emitted that same year. An offset rate of less than 4%.

Using the same methodology for the other big banks we see that Westpac offset 18.84% of its 472,704 tonnes of CO2e of estimated actual emissions, NAB 19.63% of its 395,102 t-CO2e and ANZ in front with 23.29% of its 421,198 t-CO2e.

According to Director at NoCO2 (Carbon Reduction Institute), Robert Cawthorne, “these estimates are on the conservative side. The reason why is that the input/output tables don’t have as much coverage as a carbon-neutral claim should do. It really only covers the consumption of the organisation.”

Things such as staff travel to and from the office are not captured in the input/output. More importantly, they should include their financed emissions.

Finance emissions cover everything from the equity portion of something a financial institution has invested in, or emissions from anything that they’ve lent money to.

Network of influence: is the carbon credits elite prolonging fossil fuels?

Operational emissions only

According to Jacqueline Fox, NAB’s Chief Climate Officer, NAB’s carbon neutrality certification is for its operational emissions.

“Our priority is to reduce our operational emissions, before offsetting emissions we are yet to eliminate” Fox says, “NAB’s scope 1 & 2 emissions are down 74%, or 112,208 tCO2-e, from 2015 levels (as at 2022), driven by energy efficiency initiatives and the purchase of renewable energy.”

“Away from reducing operational emissions, we recognise the most significant impact NAB can have on emissions reduction is through the finance we provide. We are transparent on our climate strategy, which prioritises supporting customers to decarbonise and build climate resilience, and our performance against it. NAB aims to align its operational and financed emissions with pathways to net zero by 2050, consistent with a maximum temperature rise of 1.5°C.”

According to NAB, their financed emissions in 2021 almost hit 11 million tCO2e, or 26.5 times higher than their estimated emissions.

Additional exclusions the banks have claimed range from international offices, refrigerants, capital goods and works, business travel, international operations, and product transportation.

Each of the big four makes the carbon neutral claim without any qualification of the extensive exclusions they have laid claim to.

In the ACCC’s sights

This year, NAB got in hot water after a complaint made by the Australian Institute to the ACCC, and a number of articles from the ABC specifically highlighted the excluded emissions in the bank’s carbon neutral claim.

Following this, NAB released a new Climate Active public disclosure statement. In the new statement, NAB simply removed much of the information from its previous disclosure, which according to Cawthorne “provided just enough information for an experienced carbon auditor to interrogate and determine the deficiencies of the banks’ claim.”

NAB’s new disclosure statement only shows three exclusions, employee commuting, food and catering, and cleaning services. This has not altered how NAB calculates its carbon border for its Climate Active certification.

The removal of this information in the FY2022 Climate Active PDS shows, in my opinion a deliberate action by NAB to hide the truth from consumers and avoid criticism from the media.

Robert Cawthorne

Misleading and deceptive claims

According to Van Herwaarden, “the Climate Active scheme is misleading consumers and investors to support organisations or products which do not guarantee genuine emissions reduction in line with a science-based pathway and diverts attention away from climate leaders. This contributes to a broader societal harm by moving Australia further away from our emission reduction targets.”

Former ACCC boss Professor Allan Fels told a Senate inquiry on greenwashing that “on the face of it” the government’s Climate Active program was guilty of “misleading and deceptive conduct”.

Robert Cawthorne says that “one thing Climate Active promotes is that the logo provides at a glance assurance for consumers. I’m not sure how you say at a glance assurance when you’ve got to go to a public disclosure statement, do an investigation through their finances and then probably a Freedom of Information request. That’s a long way away from at a glance assurance.”

Callum Foote was a reporter for Michael West Media for four years.