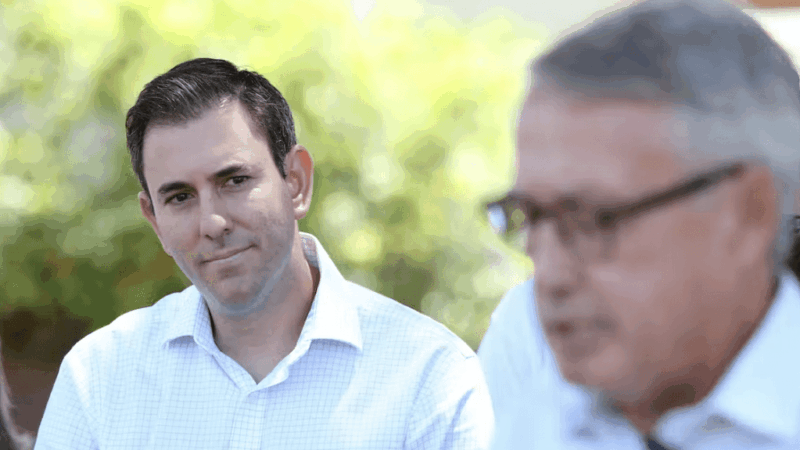

Treasurer Jim Chalmers is talking tax reform, and a public debate is long overdue. A key component should be to stop corporate tax dodging. Rex Patrick puts forward one way to address it.

When Ken Henry, then Treasury Secretary, handed his 2009 report into Australia’s future tax system to then Treasurer Wayne Swan, one of the people who would have studied it in detail was Swan’s deputy chief of staff, Jim Chalmers.

The ‘Henry Review‘ proposed bold changes. In summary, it recommended that a wide range of taxes be abolished for simplicity’s sake and that only four robust and efficient taxes remain:

- Personal income tax, assessed on a more comprehensive basis

- Business income tax, designed to support economic growth

- Rents on natural resources and land, and

- Private consumption tax (GST).

Many taxes and levies would go altogether; such as the Medicare levy, payroll tax, and land taxes; those taxes would be combined into the four. Yes, there would still be complexities, but fewer of them.

Business income tax not working

The focus of this article is business income; getting businesses to pay their fair share for society, educating their workforce, keeping their workforce healthy, keeping the law and order in and around their factories, providing them with a justice system and for national security that ultimately protects their assets.

The problem is that they don’t. MWM has long been keeping its readers abreast of how many companies operating in Australia are here without regard to their social obligations to contribute.

Corporate tax avoidance. Who helps fund Australia, and who doesn’t?

I was always perplexed as a senator in the 45th and 46th Parliaments when Liberal Party ministers lobbied me to support lower corporate tax rates. Tax transparency data released by the Tax Office every year shows that there’s little relationship between revenues generated by companies and the taxes they pay.

Companies are taxed on profit, not revenue, at a marginal rate of 25% (for companies with a turnover of less than $50m) and 30% (for companies with a turnover of more).

But it doesn’t matter if the rate is 30%, 25%, 15% or 10%. Expensive company accountants can ‘enhance’ the books to ‘reduce’ the profit to zero so that no tax is paid.

Digital tax

It is for this reason that a lot of countries have or are moving to a digital tax for the big data companies, who rake in billions but use it to pay for expensive ‘marketing’ or ‘intellectual property’ charges to related entities in a low-cost tax jurisdiction.

That’s been happening in Australia and also been reported by MWM for a long time.

Californian Fairytales: what Google, Facebook and Netflix told the Australian Tax Office

Other countries have been imposing a digital tax of typically between 3% and 5% of revenue on the large digital players. With that, it doesn’t matter how good the big accounting consultant firms are that have been assisting digital platforms to rob Governments of revenue (whilst at the same time offering their services to the same Governments for a king’s ransom).

Fixed tax rate

Watching this as a senator, I asked the Parliamentary Budget Office (PBO) to produce a confidential analysis of what would happen to Australian Government revenue if a fixed tax on revenue scheme were adopted.

I did not release the analysis (until now) because nobody was talking much about tax changes. But now we are.

As a starting point, I asked the PBO for a calculation of the average tax-to-revenue income for the (then) last three financial years. They calculated figures as follows.

Tax to revenue %

| Financial Year | Company and Sole Trader Revenue | Taxes Paid | % Tax to Revenue | % Tax to Revenue rounded |

|---|---|---|---|---|

| 2015-16 | $2,950B | $71.7B | 2.43% | 2.5% |

| 2016-17 | $3,050B | $79.2B | 2.59% | 3% |

| 2017-18 | $3,290B | $94.7B | 2.88% | 3% |

Across the years, the average tax-to-revenue percentage was less than 3%. Some entities were clearly paying more than that (bless their souls), and others were paying none.

The key takeaway from the PBO analysis was that a 3% tax-to-revenue ratio is about the right number.

I also asked the PBO to tell me what would happen if the tax-to-revenue ratio were raised to various other percentages. The answer for 3.5% was as follows.

| Financial Year | Taxes Paid at 3.5% | Additional taxes raised |

|---|---|---|

| 2015-16 | $107B | $16.8B |

| 2016-17 | $103B | $27.7B |

| 2017-18 | $115B | $20.5B |

A tax on revenue could make great sense, perhaps tiered by size based on aggregated turnover.

- Micro businesses (under $2M in revenue) – 2.4%

- Small through medium businesses ($2M to $50M in revenue) – 2.7%

- Large and very large businesses ($50M to $250M in revenue) – 3.0 %

Beware the accountant

Whilst it is true that progress has been made internationally through the work of the Organisation for Economic Co-operation and Development (OECD) on Base Erosion and Profit Shifting (BEPS 2.0) to try to ensure tax is paid where money is earned, the the big accounting firms still look for and offer advice on how to avoid paying tax.

Company directors do not owe their duty to the public; they owe it to their shareholders. They are motivated personally by financial reward to minimise how much of a company’s money makes its way into Government’s coffers. Whilst ever there is a return on investment in bringing lawyers and accountants into the boardrooms to minimise tax, they will do so.

Hence, Ken Henry described the need for taxes to be simple and robust. They need to be without loopholes. A revenue tax is a simple and robust solution. There will be some winners (who will pay less tax) and some losers (who will have to pay some or more), but the point is that everyone will have to contribute along consistent lines; everyone.

And that ticks off another goal for our tax system overall; it has to be fair.

The Big Four accountants and the $480 billion global tax evasion industry

Rex Patrick is a former Senator for South Australia and, earlier, a submariner in the armed forces. Best known as an anti-corruption and transparency crusader, Rex is also known as the "Transparency Warrior."