It’s been a golden era for Google Australia, Netflix Australia and Facebook Australia. Bunkered in pandemic lockdowns, Australians spent record time on their screens. How then did the digital giants rake in so much cash but pay so little tax? Michael West looks at the tall tales the multinational tax dodgers tell the Australian Tax Office.

Coinciding with the drama of the election, a slew of the world’s biggest companies have just quietly dropped their financial reports, a once-a-year affair which affords us a glimpse into how they, with their plotting advisers from EY, KPMG, Deloitte and PwC, are robbing Australia on the tax front.

We say “quietly” because they don’t post this important stuff on their websites. They hide it their statutory reports, furtively filed to the corporate regulator ASIC.

When it comes to multinational tax dodging the art is telling a story, spinning a good yarn to the Tax Office. They spin various yarns, like “we had to borrow $11bn from our other companies overseas” (Exxon), or “that $7bn in revenue is not really revenue like you think it is, duh” (Google), or “this is not really Australian income, though we made it from selling to Australians in Australia to watch on their Aussie TVs, it really belongs in a tax haven” (Netflix).

If it’s Big Pharma they have their armies of highly paid advisers and lawyers backing them on transfer pricing myths, that is, how their Australian companies had to pay high prices for those drugs to their other companies overseas – and that’s why profits are not very high here and we can’t afford to pay much tax.

The unifying factor in in these tall tales and untrue, is that their stories are designed to explain how they wiped out profits in Australia deliberately, and funnelled the money offshore. Where would you rather book a profit? In Bermuda, where the corporate tax rate is zero, or Australia, where it is 30%?

Google’s Elf Revenue, a Californian fairytale

Take Google Australia for instance, which has just reported its results for the year to December 2021. Its tax people over in Mountainview California have concocted a ripping yarn about Google’s revenue in Australia not really being like, er, revenue anyway, and its auditors EY have agreed it’s a great story and signed off on the Californian fairytale as “true and fair”.

The pandemic has been a golden era for the monsters of the digital economy, billions of people in lockdowns around the world, billions captive to their screens. You would think then that Google, Facebook, Netflix et al would have paid a lot of tax. Not so.

Take Netflix for example, the world’s number one streaming service. It is a true story that all they do is stream content from offshore into Australian homes but they take the “it’s not really an Australian business so we won’t pay tax here” fable to the realms of fantasy.

Netflix and the Magical Vanishing Tax

What a story this is. They probably make more than a billion dollars selling their entertainment packages to Australians who live in Australia and watch the shows in Australia, but the corporate Aesops at Netflix have decided to spin the Tax Office the story that the revenue at Netflix Australia only rose from $20m in 2020 to $30m in 2021.

Customers in Australia are estimated at 6 million, and its two lowest packages are priced $10.99 a month and $16.99 a month so it’s fair to take a punt and say the cashflow from selling this product to Australians – and Australian content offshore – is in the vicinity of $1bn.

So how did they get it down to $30m? They invoice their customers from offshore. Their Australian accounts have negligible disclosure, nothing on where the money actually goes, only the hint that a Netherlands parent is involved. So it is that during the lockdowns of the past two years they claim to have made virtually no profit and therefore paid virtually no tax.

They admit to just $2.4m profit in Australia in 2021 and paid income tax of $574,000. Pocket fluff.

Excuses excuses

Google has something of a partial excuse for paying a pittance in tax. The government’s bizarre Media Bargaining Code “reform” – means it can write off the payments it has made to Murdoch, Nine, Seven and other old media and claim them as tax deductions.

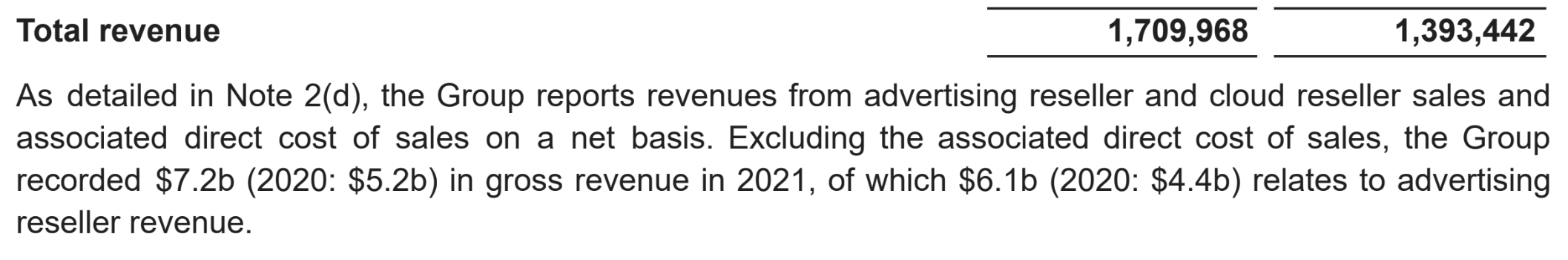

Google’s real story is buried in the revenue note to the accounts, and of course “related party transactions”. Although, if you thumb through its Profit and Loss statement Google claims to have made revenue of just $1.7bn (it was higher than this years ago before they dreamt up their new revenue story), the actual cash through the door was a monumental $7.2bn last year.

How did they shift all that out the door? Again, this is the money they make selling advertising services in Australia to Australians. Shimmy down to the back of the accounts and you will find their Australian company was charged “service fees” of $5.4bn ($3.8bn in the prior year) in “related party transactions”.

We don’t know where this actually went but we can assume it was a tax haven.

Yes, three times the Google Australia stated revenue piped offshore in service fees. Now, if the Google tax people were explaining this over a cognac around the log fire they would claim that their technology is legally owned in Bermuda or somewhere, the intellectual property that is, and so they were rightfully paying another Google company for this IP.

True story too, but they are gilding the lily to the very outer limits here for yes, while there are values placed on IP, Google has been making the vast bulk of its income for a long time from selling its AdWords product to advertisers on its search engine.

To call it a one trick pony would be cheeky but its global monopoly status as a search engine is Google’s overwhelming market value and power now, not its IP any more. Drug company patents don’t last forever. Should Google forever send billions to tax havens on account of IP created decades ago?

This is getting off course a bit, Google is telling the yarn that the $7.2b it got last year from selling advertising services to Australian customers in Australia didn’t really belong in Australia. So it didn’t recognise it as revenue, rather it came up with a “net revenue” descriptor which recognised just a fraction of the actual payments which Australian customers made to it.

This means it can create its profit from one quarter of its actual cashflow – that profit was winnowed down to $329m – and its tax paid down to $86m. The good news is that $86m is a lot bigger than the $22m tax *benefit* it recorded the year before, and it sounds big too, though it’s tiny for a company this profitable. at less than 2% of total income.

Good old EY the auditor thought it was a great story, signed the accounts for a fee. That helps for the audience to suspend disbelief.

Facebook’s fable a mother Zucker

Let’s not forget the Facebook story. Facebook Australia even spun the yarn to Nine newspapers the other day it paid more than the 30% tax rate it as required to pay:

“During the last financial years, we paid income taxes in Australia at effective tax rates well above 30 per cent and in accordance with local taxation laws,” a Meta spokesperson told the SMH.

Why the blazes would they pay above 30%, more than the rate at which they were legally obliged to pay? Their revenue is a myth, that’s why. In telling the SMH how great they were paying so much tax they were concealing the fact that the figure on which they were actually paying tax was a fable.

In its income statement Facebook Australia recorded its revenues rising from $155m to $194m last year but in its Cashflow Statement, it showed cash jumping from $746m to $1b. By creating its own, lower, revenue number, Facebook made its paltry tax payment (rising from $15m to $32m) seem a lot shinier.

How did it rake the money out of the country? “Purchases of services (ad inventory)” rose from $559m to $949m. The more money they made the more they raked out buying ad space from themselves, literally space (thin air with an IP value for the idea Mark Zuckerberg had at Harvard 20 years ago).

That IP is sitting in a Facebook entity overseas somewhere and that’s where the bulk of the value still goes, despite Facebook selling its advertising service to Australians advertising Australian products to Australian buyers on Australian computers.

Is it not time this ageing idea came “off patent” and Facebook was taxed for the money it made selling ad space to Australian buyers?

Oily stuff from Exxon

The multinational tax dodgers spin their different yarns for different sectors. Perhaps the most pressing for the new government of Anthony Albanese to address are the fossil fuel giants who are now reaping stratospheric profits.

Even last year, before Putin’s war on Ukraine, the oil majors enjoyed a huge spike in cash thanks to rising oil and gas prices.

The yarn they spin to the ATO is a different yarn than the digital players. It’s more about debt loading and transfer pricing than IP. PwC signs off on ExxonMobil Australia’s accounts year after year, agreeing that it really needs that $11bn in loans from its associates offshore which helps send a lot of profit offshore too in the form of interest payments.

True believer in fees, PwC, must have been happy with last year’s Exxon story because revenue shot up from $9.7b to $12b, profits in the sector are astronomical and that means the Big 4 can charge more for their services, which are auditing and helping multinationals cheat governments around the world.

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.