Fresh figures have allayed fears of a tightening in Australia’s labour market, which should rule out the Reserve Bank returning to a major rate-hiking cycle.

Australia’s economy added an estimated 21,000 jobs in January, while wages grew by 0.8 per cent over the quarter, according to Commonwealth Bank data drawn on de-identified salary payments from about 400,000 CBA accounts.

The CBA data provides an early indicator of official Australian Bureau of Statistics figures.

While it shows the jobs market remains in a good position, the sharp fall in unemployment in official figures for December was more noise than signal, CBA economist Harry Ottley said.

ABS figures showed the jobless rate fell to 4.1 per cent in December, well below the RBA’s estimate of the natural, non-inflationary rate of unemployment.

If that was indicative of a sustained tightening trend in the labour market, the central bank could see it as evidence inflationary pressures were getting worse.

“But we’re not seeing in our data yet any evidence of a material re-tightening that was hinted at in the (ABS) labour force survey,” Mr Ottley told AAP.

“It gives us confidence that we’re still in a bit of a fine-tuning phase in terms of monetary policy, rather than a big risk of a massive (tightening) cycle.”

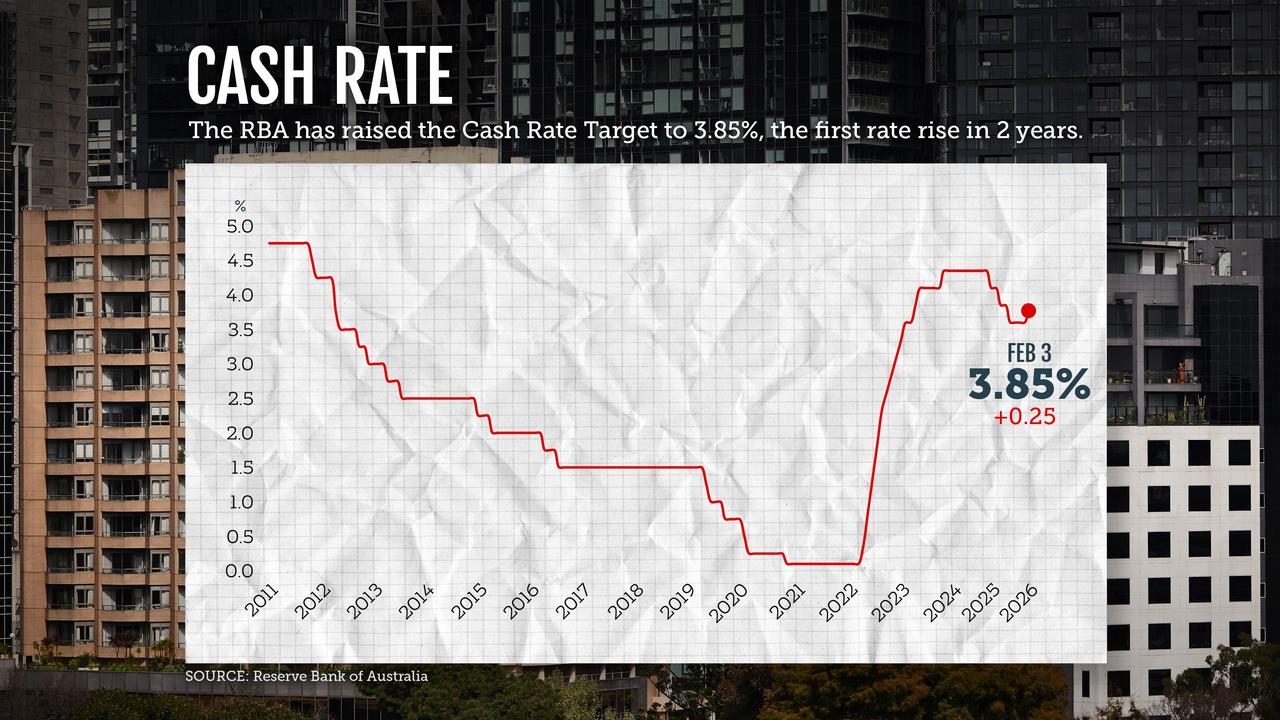

CBA economists expect the central bank to lift the cash rate once more in May to 4.1 per cent.

But from then, they see the bank sitting on hold, with other indicators also showing the economy finely balanced.

Consumer confidence fell further on Tuesday, with the Westpac-Melbourne Institute consumer sentiment index declining 2.6 per cent to 90.5, following the RBA’s rate hike a week prior.

Confidence levels have plummeted since November, when the index was in positive territory at 103.8, and markets were still relatively bullish about the chance of more rate cuts.

While the continuing strength of the jobs market and wages growth will support consumption, weakening sentiment, the high Australian dollar and the impact of higher interest rates should slow the economy and bring it back towards balance, Mr Ottley said.

A NAB survey released on Tuesday showed business conditions also softened, driven by declines in trading conditions and profitability, while capacity utilisation eased 0.6 percentage points.

AMP economist My Bui said the combination of data pointed to the economy in a roughly balanced position, with business and consumer sentiment softer than usual and capacity utilisation slightly tighter than historical averages.

“With the consumer sector still very price conscious, evident in their concentration of purchases in promotional periods, we think that the softer sentiment readings point to some slowing in discretionary spending ahead as well as a moderation in underlying inflation pressures,” Ms Bui said.

Australian Associated Press is the beating heart of Australian news. AAP is Australia’s only independent national newswire and has been delivering accurate, reliable and fast news content to the media industry, government and corporate sector for 85 years. We keep Australia informed.