Woolworths has badly disappointed investors, just a day after its biggest rival delighted them.

Woolworths shares were on track for their worst performance in more than six years on Wednesday, plunging 13.9 per cent to a five-month low of $28.76 in early trading after Australia’s biggest private employer posted a big decline in full-year profit.

Coles shares, in contrast, were up 2.8 per cent to a fresh all-time high of $23.13, building on its stellar 8.5 per cent gains on Tuesday after the supermarket and liquor group beat earnings expectations almost across the board.

Woolworths’ losses on Wednesday came after it announced it would cut its dividend by 21.1 per cent after its net profit fell 17.1 per cent to $1.39 billion.

Sales were up 3.6 per cent to $69.1 billion, but earnings before interest, tax, depreciation and amortisation fell 3.5 per cent to $5.7 billion on a normalised basis.

Chief executive Amanda Bardwell said Woolworths’ financial performance was well below its expectations and those of shareholders, and it was taking action to reposition itself.

“You’re clearly lagging your major competitor by a fairly large margin, probably the largest margin we’ve seen in quite some time,” Jefferies deputy head of equity research Michael Simotas commented on an analyst call.

Woolworths said the drop in profit reflected higher finance costs and lower earnings, which were hit by a number of issues.

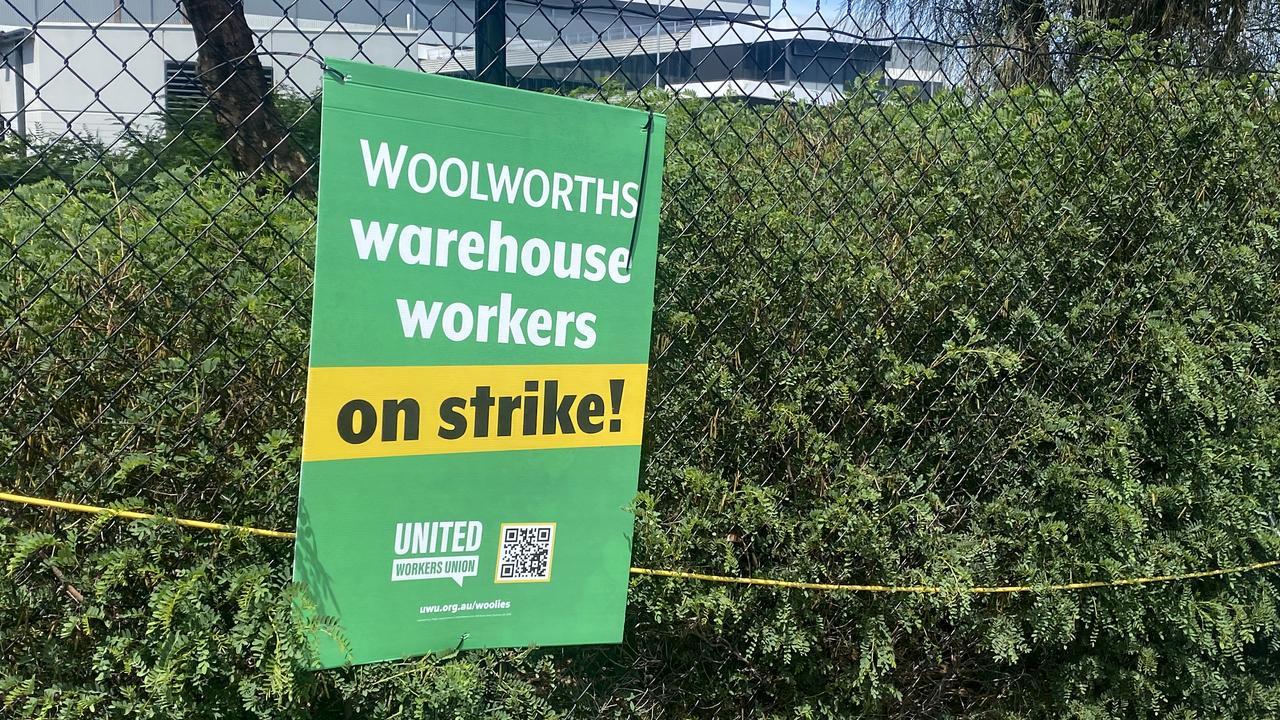

Industrial action in the first half cost the group $95 million, and it spent $73 million in dual-running costs as new high-tech warehouses get up and running.

Woolworths’ cost of doing business also rose, mostly because of a 4.25 per cent wage increase for Australian retail team members.

In addition, it posted $569 million in impairments, including writing off $346 million from the value of Big W after a financial performance below expectations.

A Disney Discs collectibles campaign had underperformed and theft and acts of aggression against Woolworths team members had increased during the second half, something the company has been taking steps to address.

Woolworths said that for the first eight weeks of 2025/26, Australian supermarket sales excluding tobacco were up four per cent compared with the same time last year.

RBC Capital Markets analyst Michael Toner pointed out that Coles on Tuesday reported supermarket sales excluding tobacco products were up 7.0 per cent over the same period.

That was a big difference, he said, adding Woolworths “appears to be losing market share to Coles”.

Woolworths will pay a 45c final dividend, down from last year’s 57c payout.

Australian Associated Press is the beating heart of Australian news. AAP is Australia’s only independent national newswire and has been delivering accurate, reliable and fast news content to the media industry, government and corporate sector for 85 years. We keep Australia informed.