Coles Group has begun the new financial year strongly after posting stellar earning results for the previous 12 months that sent its stock flying.

The grocery and liquor company’s shares on Tuesday soared 8.5 per cent to an all-time high of $22.50, in its best single-day performance since the extreme volatility at the start of the COVID-19 pandemic.

The gains came after the supermarket giant reported sales of $44.3 billion for the 52 weeks to June 29, up 3.6 per cent from Coles’ prior financial year after adjusting for the fact it was a week longer.

Supermarket sales grew 4.3 per cent to $40 billion – a 5.7 per cent increase when excluding tobacco products – while sales from its Liquorland stores were up 1.1 per cent to $3.7 billion.

Coles turned a $1.1 billion profit, up 2.4 per cent from 2024/25.

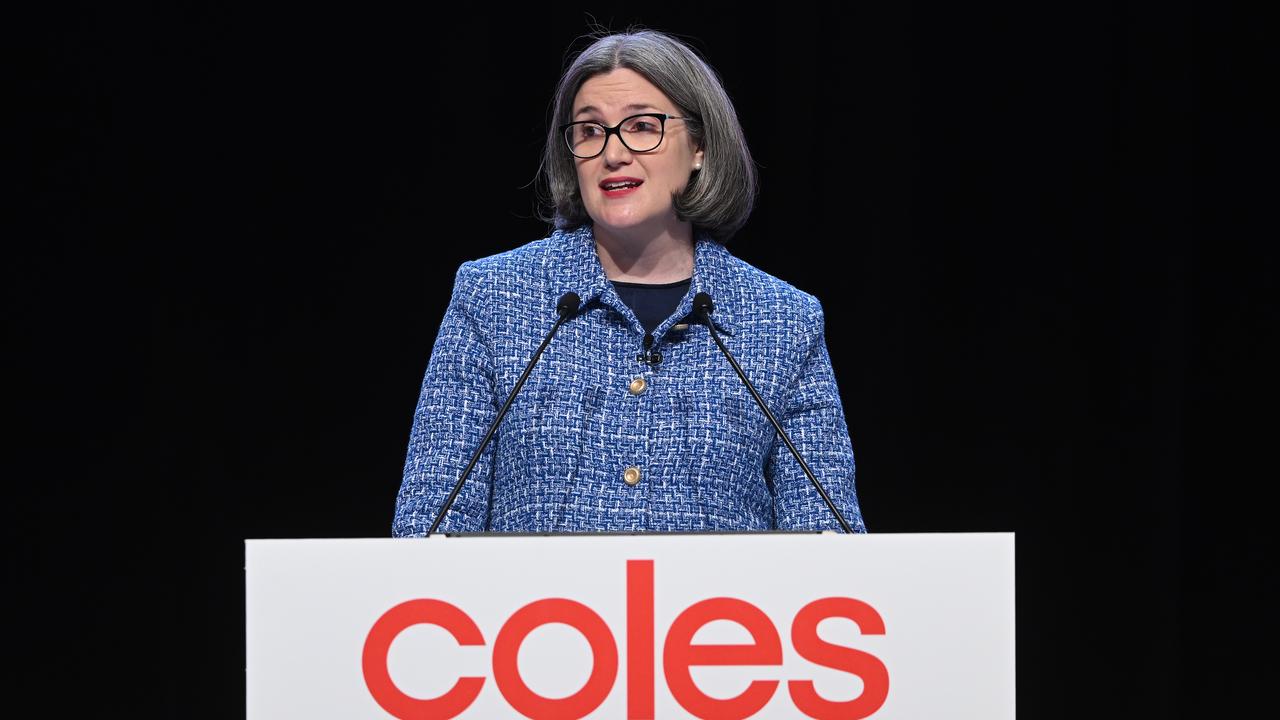

The company had maintained a consistent focus on its strategic priorities during the financial year, chief executive Leah Weckert said.

“There is no doubt that value has remained front of mind for our customers, and we have continued to work hard on providing a compelling offer with quality products across all price points,” she told analysts.

The “Great Value, Hands Down” seasonal value campaigns focused on fewer, deeper promotions with an expanded range of products, Coles said.

Customers had also responded favourably to its Curtis Stone Glassware and Harry Potter Magical Discs campaign.

Coles’ investment in its new state-of-the-art customer fulfilment centres in Sydney and Melbourne and an automated distribution centre in western Sydney were paying dividends, although Coles incurred $103 million in dual-running costs in 2024/25 as those warehouses got up and running.

Coles isn’t burdened with those costs this year and says its investment in the $400 million customer fulfilment centres are already paying off.

The high-tech warehouses allow it to offer next-day delivery to all customers in Sydney and Melbourne, while offering a third more products than the average Coles store stocks.

Coles said its e-commerce supermarket sales rose 24.4 per cent to make up 11.2 per cent of all grocery sales, with customer satisfaction surveys indicating shoppers love the freshness of products like berries delivered by refrigerated trucks, Ms Weckert said.

Coles’ momentum has continued in the new financial year, with supermarket sales excluding tobacco products rising 7.0 per cent in the first eight weeks of 2025/26.

Ms Weckert described Coles’ sales growth as “green shoots”, prompting one analyst to scoff and say it was more than that.

“Look, it’s been a pleasing start for the year,” she replied.

“It’s our job to be cautious about that and be thinking ahead of what the customer is going to want, particularly as we head into the really important trading period for Christmas.”

Coles posted a final dividend of 32 cents, taking the total for the year to 69 cents, up from 68 cents last year.

Australian Associated Press is the beating heart of Australian news. AAP is Australia’s only independent national newswire and has been delivering accurate, reliable and fast news content to the media industry, government and corporate sector for 85 years. We keep Australia informed.