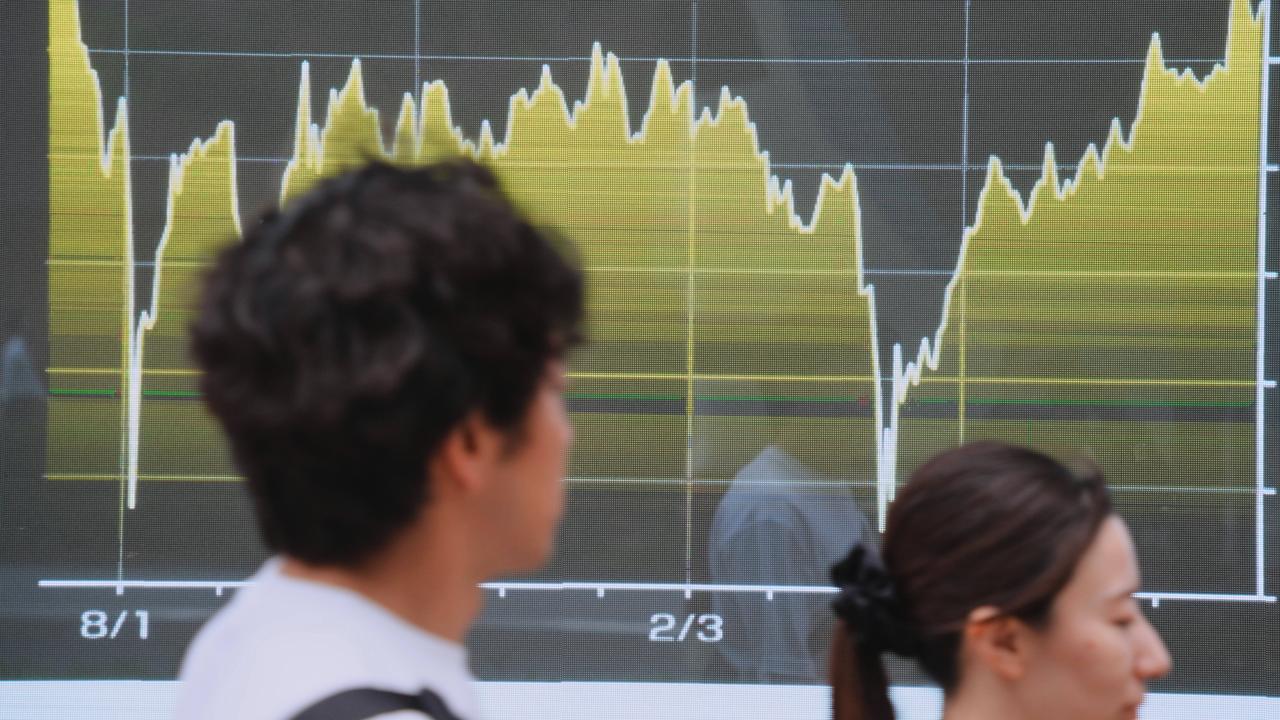

Shares in Asia rose for a second consecutive session and the US dollar held most of its losses on Tuesday as investors increased bets the Federal Reserve will act to prop up the world’s largest economy.

US shares rallied on Monday on generally positive earnings reports and increasing bets for a September rate cut from the Fed after disappointing jobs data on Friday.

Oil remained lower after output increases by OPEC+ and threats by US President Donald Trump to raise tariffs on India over its Russian petroleum purchases. Japan’s Nikkei rallied, with data showing a jump in the nation’s service sector activity in July.

“There are signs of weakness in parts of the US economy, that plays to the view that maybe not in September, but certainly this year that the Fed’s still on course to ease potentially twice,” said Rodrigo Catril, senior currency strategist at National Australia Bank.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.6 per cent in early trade. The Nikkei climbed 0.5 per cent after falling by the most in two months on Monday.

The dollar dropped 0.1 per cent to 146.96 yen. The euro was unchanged at $US1.1572 ($A1.7904), while the dollar index, which tracks the greenback against a basket of major peers, edged up 0.1 per cent after a two-day slide.

Odds for a September rate cut now stand at about 94 per cent, according to CME Fedwatch, from a 63 per cent chance seen on July 28. Market participants see at least two quarter-point cuts by the end of this year.

The disappointing nonfarm payrolls data on Friday added to the case for a cut by the Fed, and took on another layer of drama with Trump’s decision to fire the head of labour statistics responsible for the figures.

News that Trump would get to fill a governorship position at the Fed early also added to worries about politicisation of interest rate policy.

Trump again threatened to raise tariffs on goods from India from the 25 per cent level announced last month, over its Russian oil purchases, while New Delhi called his attack “unjustified” and vowed to protect its economic interests.

Second-quarter US earnings season is winding down, but investors are still looking forward to reports this week from companies including Walt Disney and Caterpillar.

Tech heavyweights Nvidia, Alphabet and Meta surged overnight, and Palantir Technologies raised its revenue forecast for the second time this year on expectations of sustained demand for its artificial intelligence services.

“Company earnings announcements continue to spur market moves,” Moomoo Australia market strategist Michael McCarthy said in a note.

In Japan, the S&P Global final services purchasing managers’ index climbed to 53.6 in July from 51.7 in June, marking the strongest expansion since February.

Oil prices were little changed after three days of declines on mounting oversupply concerns, with the potential for more Russian supply disruptions providing support.

Brent crude futures were flat at $US68.76 ($A106.38) per barrel, while US crude futures dipped 0.02 per cent to $US66.28 ($A102.55) a barrel. Spot gold was slightly higher at $US3,381.4 ($A5,231.6) per ounce.

The pan-region Euro Stoxx 50 futures were up 0.2 per cent, while German DAX futures were up 0.3 per cent and FTSE futures rose 0.4 per cent. US stock futures, the S&P 500 e-minis , were up 0.2 per cent.

Bitcoin was little changed at $US114,866.06 ($A177,716.35) after a two-day rally.

Australian Associated Press is the beating heart of Australian news. AAP is Australia’s only independent national newswire and has been delivering accurate, reliable and fast news content to the media industry, government and corporate sector for 85 years. We keep Australia informed.